SpreadCo 2025 Review: Everything You Need to Know

Executive Summary

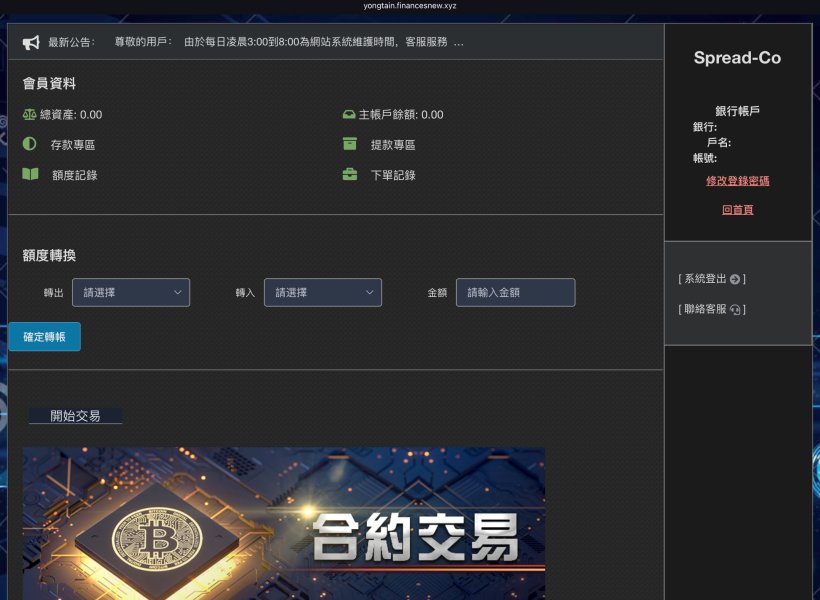

SpreadCo is a UK-based CFD and spread betting broker operating under FCA regulation with license number 446677. This spreadco review shows a broker that has built a solid reputation for excellent customer service, with many long-term clients praising their professional support team. The company focuses on CFD trading and spread betting across multiple asset classes including forex, shares, commodities, and indices.

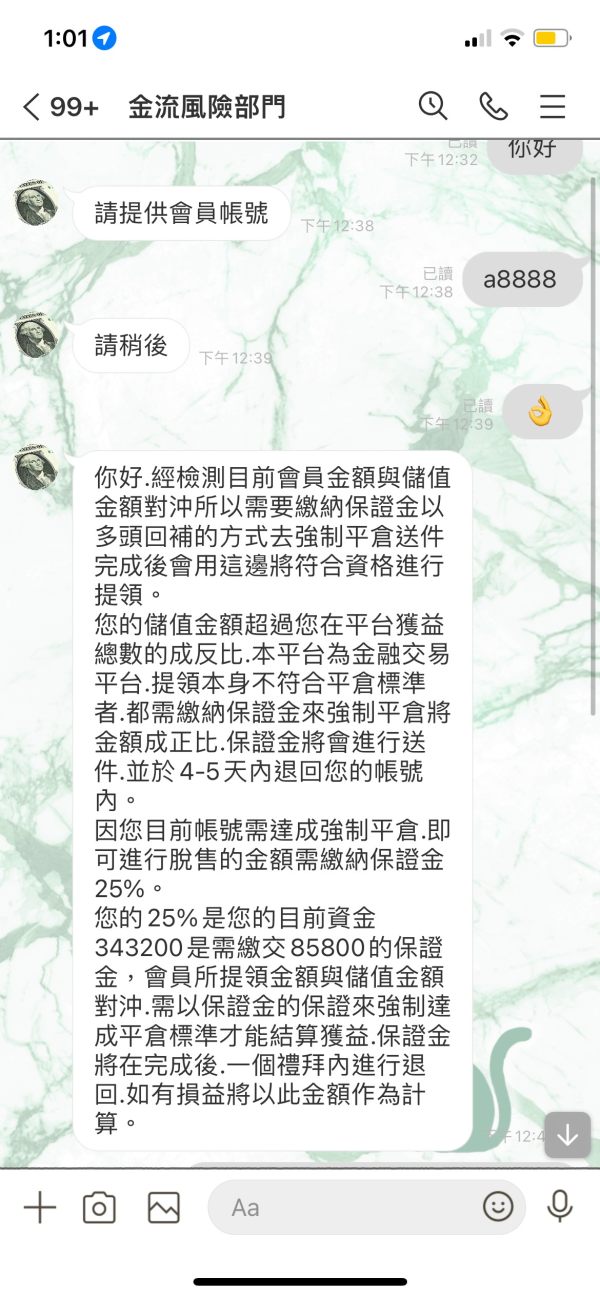

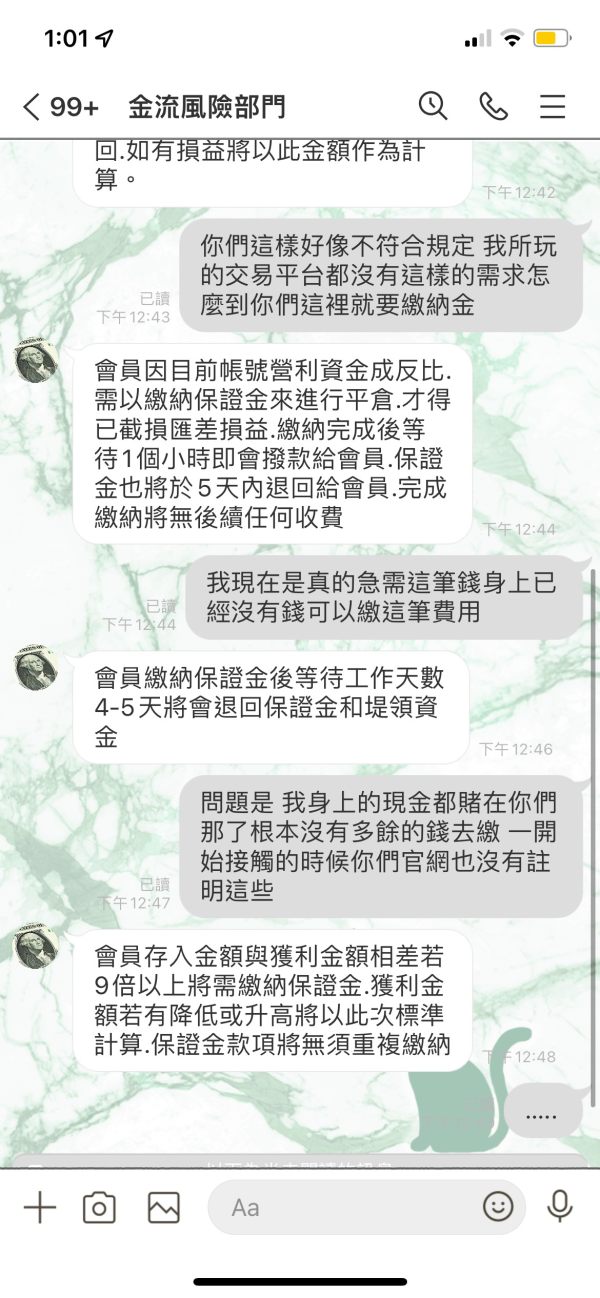

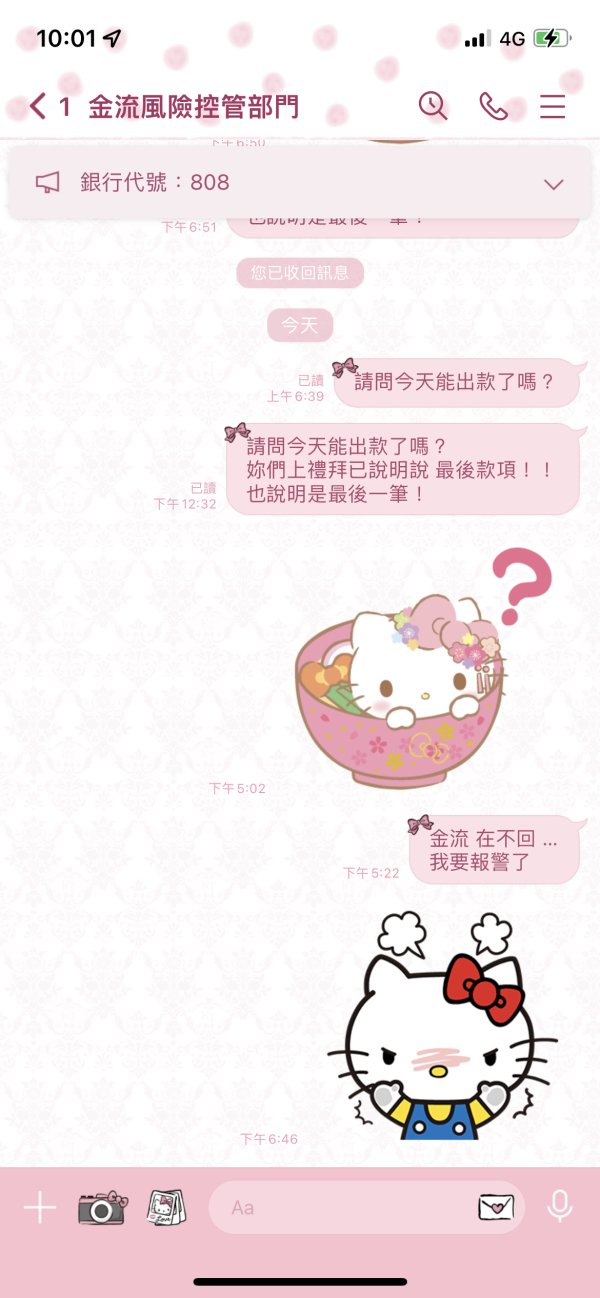

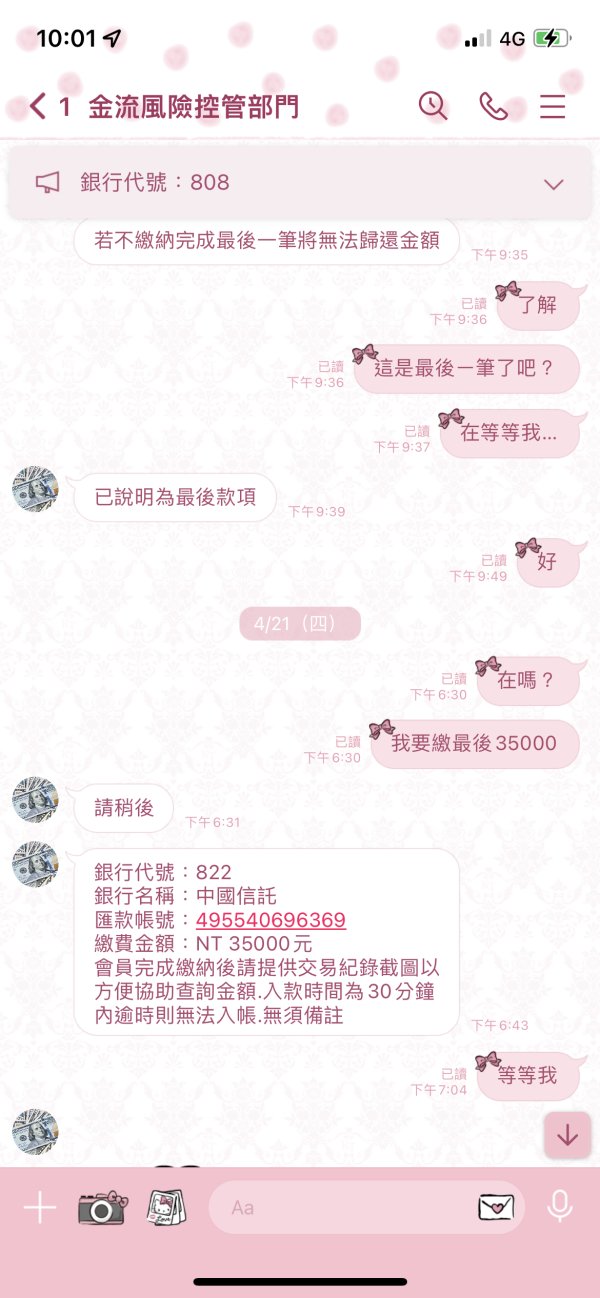

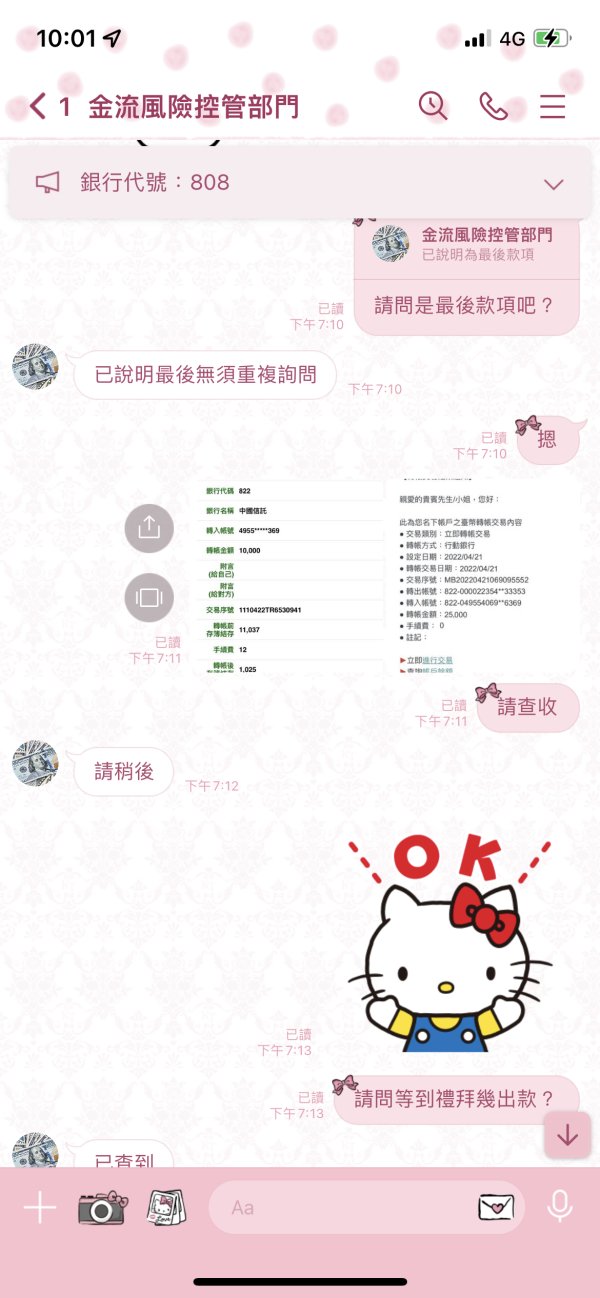

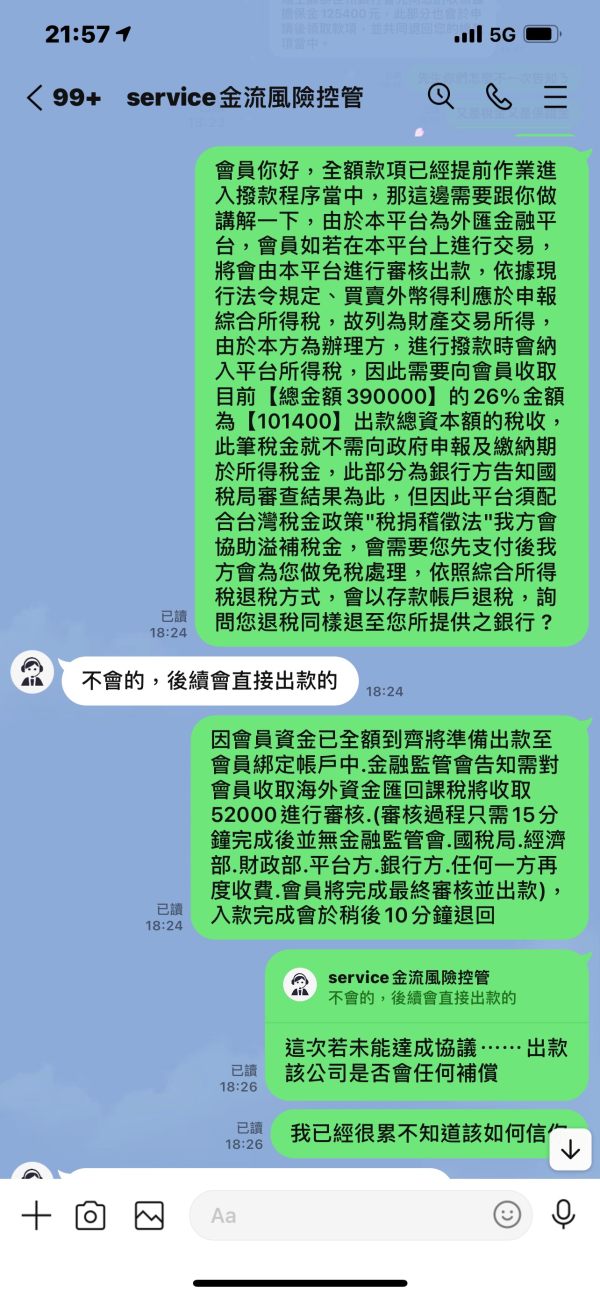

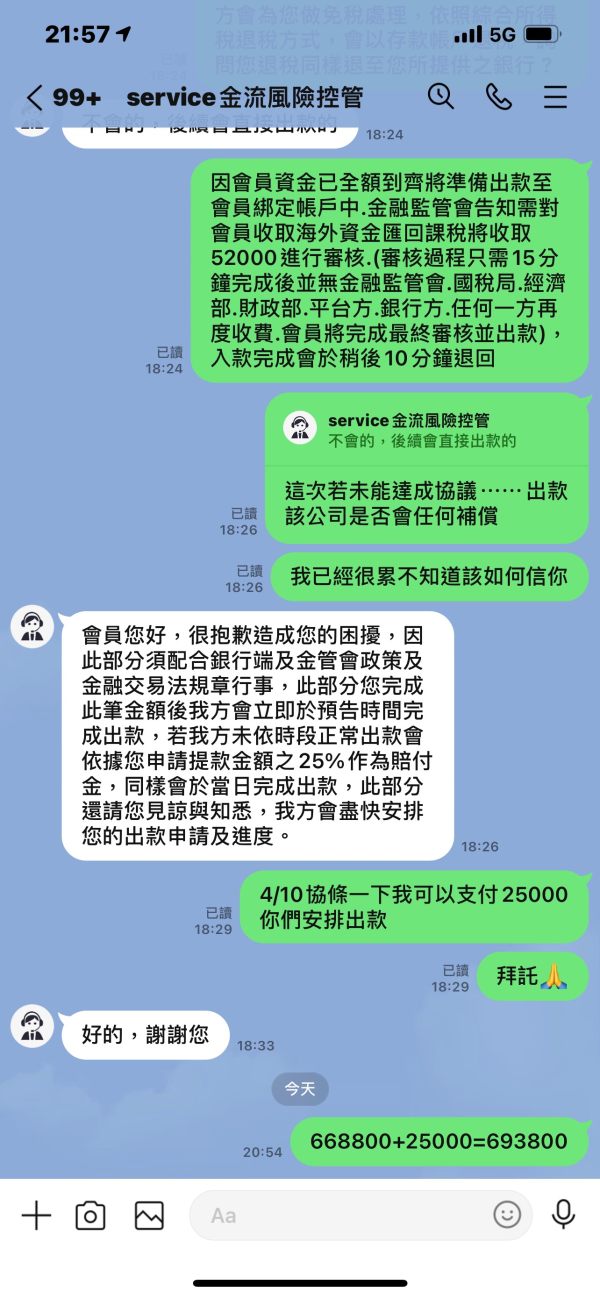

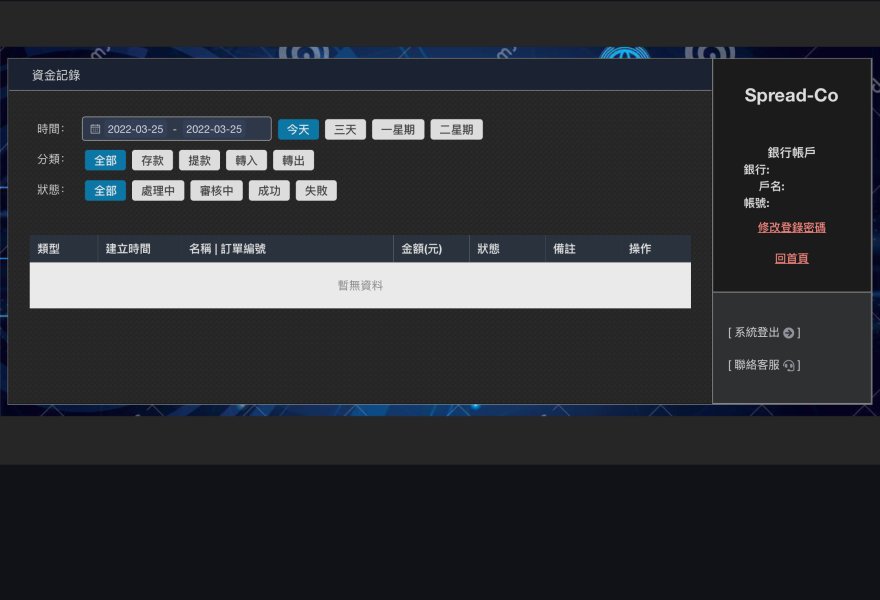

Our analysis finds some concerning issues about deposit processing. User complaints mention transferred funds not reaching their destination. SpreadCo still appeals to traders who want responsive customer support and diverse trading opportunities despite these challenges. The broker requires a minimum deposit of $250, making it accessible to retail traders.

Information about spreads and commission structures stays limited in public documentation. SpreadCo appears most suitable for intermediate traders who value established regulatory oversight and comprehensive customer service, particularly those interested in spread betting products. The FCA regulation provides a solid foundation for trust, but potential clients should be aware of reported deposit-related issues when considering this platform.

Important Notice

SpreadCo operates under FCA regulation in the United Kingdom. Services may vary depending on your geographical location and local regulatory requirements. This review is based on publicly available information, user feedback from platforms like Trustpilot, and industry reports available as of 2025.

Our evaluation method uses multiple data sources including regulatory filings, user testimonials, and comparative industry analysis to provide a comprehensive assessment of SpreadCo's services and reliability.

Rating Framework

Broker Overview

SpreadCo operates as a specialized CFD and spread betting broker based in the United Kingdom. The company has established itself in the competitive UK financial services market by focusing on providing comprehensive trading solutions across multiple asset classes. Available information shows SpreadCo has built a loyal client base, with some users reporting relationships spanning many years, indicating a level of service consistency that retains long-term customers.

The broker's business model centers on CFD trading and spread betting. It offers access to forex markets, individual shares, commodities, and various indices. This spreadco review finds that the company operates under the regulatory oversight of the Financial Conduct Authority with license number 446677, which provides clients with standard UK investor protections.

SpreadCo's approach appears to target retail traders seeking diversified trading opportunities within a regulated environment. Specific details about their proprietary technology or unique trading features remain limited in public documentation.

Regulatory Status: SpreadCo operates under FCA regulation with license number 446677. This ensures compliance with UK financial services standards and provides client fund protection under established regulatory frameworks.

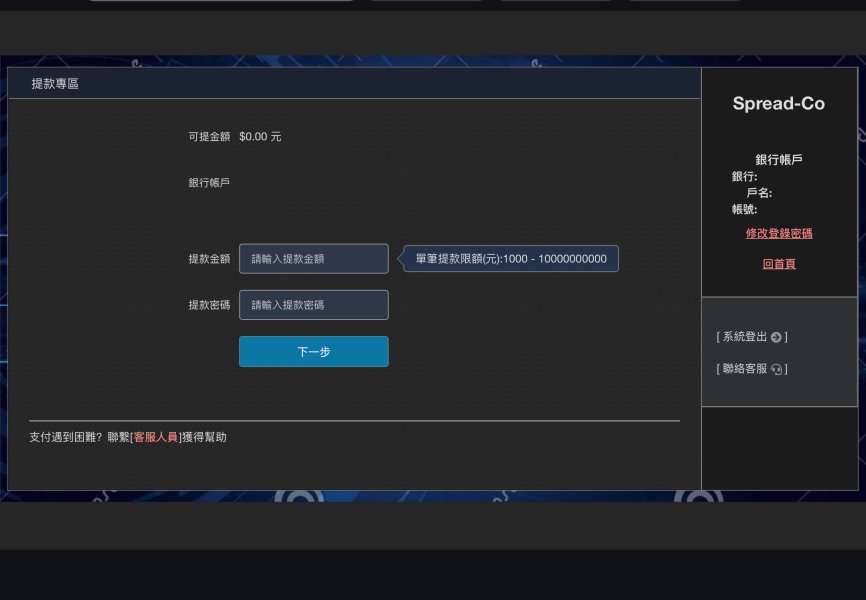

Minimum Deposit Requirements: The broker requires a minimum deposit of $250 for real trading accounts. This positions itself as accessible to retail traders without imposing prohibitively high entry barriers.

Available Assets: SpreadCo provides trading access across multiple asset classes including forex pairs, individual company shares, commodities markets, and stock indices. This offers diversification opportunities for various trading strategies.

Business Model: The company specializes in CFD trading and spread betting products. It caters to traders interested in leveraged positions across different markets without owning underlying assets.

Promotional Offers: Specific information about current bonus structures or promotional campaigns was not detailed in available sources. This may require direct inquiry with the broker.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not comprehensively available in reviewed sources. This represents an area requiring further investigation by prospective clients.

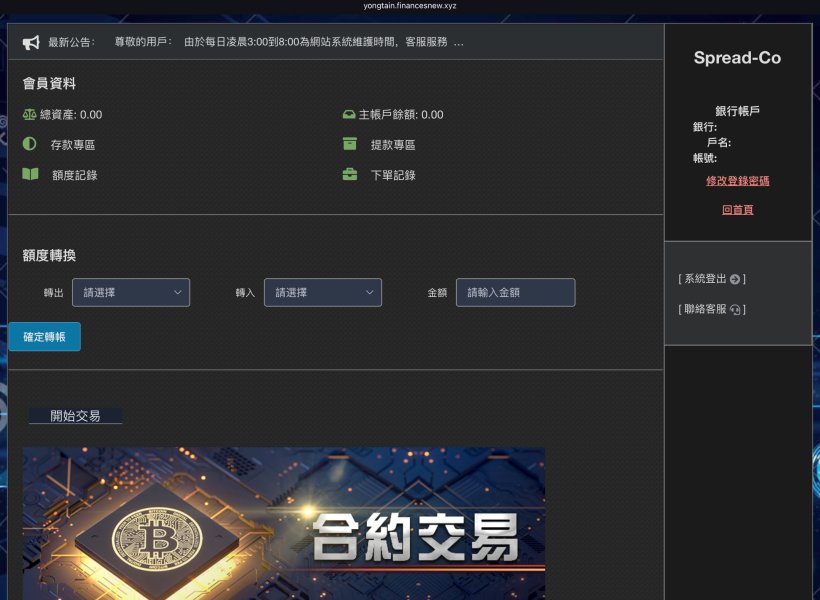

Platform Technology: Specific details about trading platforms, mobile applications, or proprietary technology features were not extensively documented in available materials.

Geographic Restrictions: Information about regional service limitations or restricted territories was not specified in reviewed sources.

This spreadco review notes that several operational details require direct verification with the broker. Limited public disclosure of specific terms and conditions creates this need.

Account Conditions Analysis

SpreadCo's account structure centers around a $250 minimum deposit requirement. This positions the broker competitively within the retail trading market. Available information shows this entry threshold makes the platform accessible to individual traders without imposing the higher barriers seen with some institutional-focused brokers.

Our spreadco review identifies significant gaps in publicly available information regarding account types, features, and specific conditions. The broker appears to operate a straightforward account model, though details about different tier structures, Islamic accounts, or specialized trading conditions remain unclear from available sources. User feedback suggests that the account opening process involves guidance from customer service representatives, with specific mentions of staff members like Sufyaan who assist new clients through initial setup procedures.

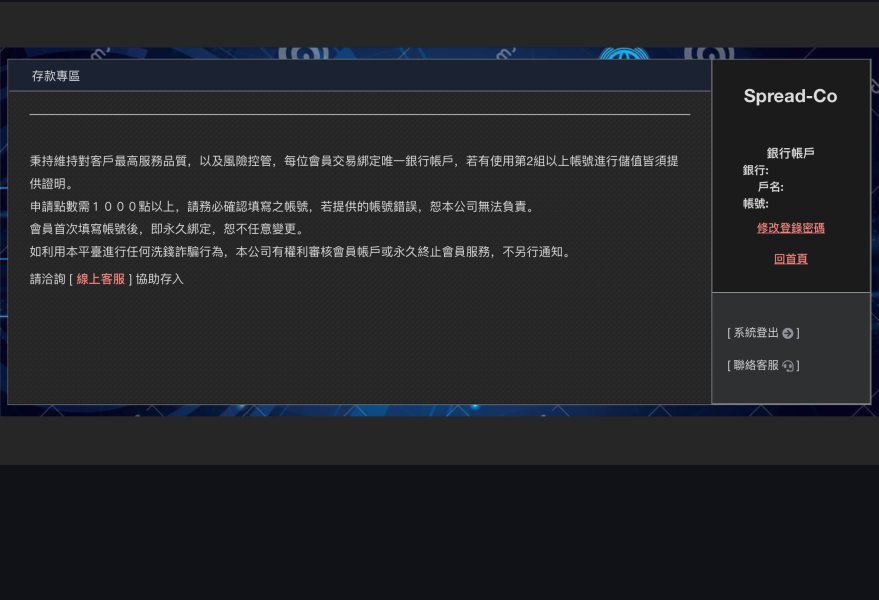

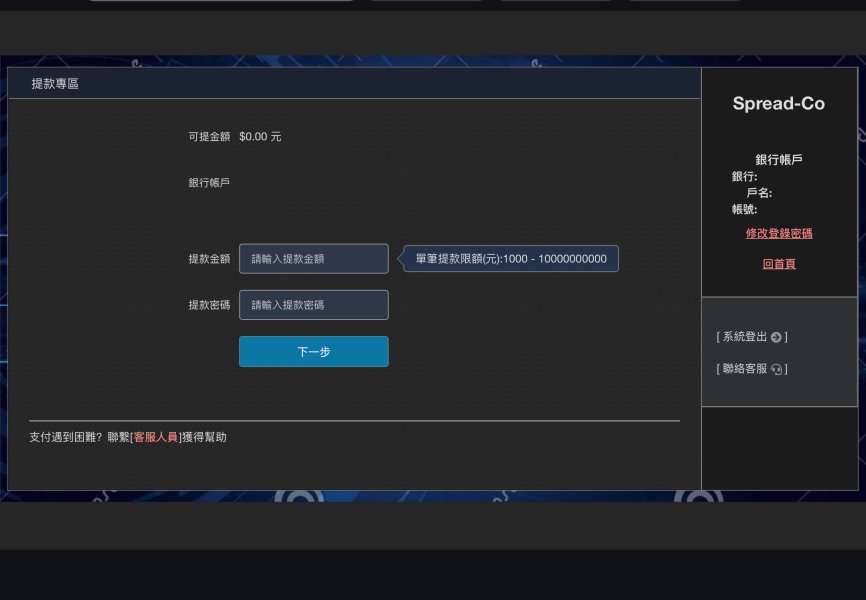

One area of concern emerges from user reports about deposit processing. At least one documented case shows transferred funds failing to reach the intended trading account. This issue potentially affects the overall account experience and represents a significant operational concern that prospective clients should consider when evaluating SpreadCo's services.

The absence of detailed information about account features, withdrawal procedures, and specific terms of service in public documentation suggests that potential clients may need to engage directly with SpreadCo representatives. This engagement becomes necessary to fully understand account conditions before committing funds.

SpreadCo's trading infrastructure focuses on CFD and spread betting products across multiple asset categories. The broker provides access to forex markets, individual company shares, commodities, and indices, offering traders diversification opportunities across different market sectors.

This range of instruments allows for various trading strategies and portfolio approaches. However, this analysis reveals limited publicly available information about specific trading tools, research resources, or educational materials. The absence of detailed platform specifications, charting capabilities, or analytical tools in reviewed sources represents a significant information gap that affects comprehensive evaluation.

User feedback suggests that SpreadCo's strength lies more in customer service and relationship management rather than cutting-edge trading technology or research provision. Long-term clients appear to value the broker's reliability and support quality over advanced technological features. The lack of detailed information about automated trading support, API access, or third-party platform integration limits our ability to assess SpreadCo's technological competitiveness.

Traders prioritizing advanced analytical tools or sophisticated trading platforms may need to verify these capabilities directly with the broker before making account decisions.

Customer Service and Support Analysis

Customer service emerges as SpreadCo's strongest attribute based on available user feedback. Multiple Trustpilot reviews and user testimonials consistently highlight the quality of customer support, with specific praise for individual representatives who guide clients through various processes.

Users report positive experiences with staff members who provide professional assistance during account setup and ongoing support. The broker appears to maintain a personalized approach to customer service, with representatives like Sufyaan receiving specific recognition for their guidance during initial client onboarding. This personal touch suggests SpreadCo prioritizes relationship-building over purely transactional interactions, which may appeal to traders seeking more individualized support.

Response times and service quality receive consistently positive feedback from users. This indicates that SpreadCo has invested in maintaining effective customer support infrastructure. Long-term clients express satisfaction with ongoing service levels, suggesting consistency in support quality over extended periods.

However, the effectiveness of customer service in resolving operational issues, particularly regarding deposit processing problems, remains a concern. While users praise the quality of interactions, the persistence of deposit-related complaints suggests potential limitations in the support team's ability to resolve certain operational challenges.

Trading Experience Analysis

The trading experience evaluation for SpreadCo faces significant limitations due to sparse publicly available information about platform functionality, execution quality, and user interface design. This spreadco review cannot provide comprehensive assessment of crucial factors like platform stability, order execution speed, or trading environment quality due to insufficient data in reviewed sources.

Available information confirms that SpreadCo offers CFD and spread betting services across multiple asset classes. Specific details about platform features, mobile trading capabilities, or execution methodologies remain unclear. The absence of user feedback specifically addressing trading experience aspects like slippage, requotes, or platform reliability limits objective evaluation.

Users who have maintained long-term relationships with SpreadCo suggest satisfaction with overall service. These testimonials focus more on customer service quality rather than specific trading platform performance. The lack of detailed platform specifications or performance metrics in public documentation represents a significant evaluation challenge.

Prospective traders requiring specific information about trading conditions, platform capabilities, or execution quality would need to engage directly with SpreadCo representatives. They could also utilize demo accounts to assess whether the trading environment meets their requirements.

Trust and Safety Analysis

SpreadCo's regulatory status under FCA license number 446677 provides the fundamental framework for client protection and operational oversight. The Financial Conduct Authority's supervision ensures compliance with UK financial services standards, including client money protection rules and operational requirements that enhance overall safety for traders.

User reports of deposit processing issues raise concerns about operational reliability. Documented cases of transferred funds not reaching intended destinations represent significant trust challenges that affect the broker's overall reliability rating. Regulatory oversight provides structural protection, but operational execution problems can impact client confidence regardless of regulatory status.

The company's establishment as a UK-based entity under FCA regulation generally indicates commitment to maintaining regulatory compliance and industry standards. The persistence of deposit-related complaints suggests potential operational vulnerabilities that could affect client trust over time. SpreadCo's long-term client relationships indicate that many users maintain confidence in the broker despite operational challenges, possibly due to eventual resolution of issues or compensation for problems.

Nevertheless, prospective clients should carefully consider these reported operational concerns when evaluating the broker's overall trustworthiness.

User Experience Analysis

User experience with SpreadCo presents a mixed picture combining excellent customer service with concerning operational challenges. Long-term clients consistently praise the broker's customer support quality, indicating satisfaction with relationship management and ongoing service provision.

Multiple users report multi-year relationships with SpreadCo, suggesting adequate overall experience quality for client retention. The personalized approach to customer service appears to create positive user experiences, with specific staff members receiving recognition for their professional guidance and support. This personal touch may particularly appeal to traders who value relationship-based service over purely technology-driven platforms.

Operational issues, particularly regarding deposit processing, create negative user experiences that affect overall satisfaction. Reports of funds not reaching intended destinations represent serious user experience failures that can overshadow positive customer service interactions. The absence of detailed information about user interface design, platform usability, or account management features limits comprehensive user experience evaluation.

Users considering SpreadCo should weigh the reported excellence in customer service against documented operational challenges when assessing whether the platform meets their trading needs and risk tolerance.

Conclusion

This spreadco review reveals a broker with distinct strengths in customer service and regulatory compliance, balanced against concerning operational challenges. SpreadCo's FCA regulation and positive user feedback regarding customer support create a foundation for trader confidence, while reported deposit processing issues raise important operational concerns.

The broker appears most suitable for traders who prioritize personalized customer service and regulatory oversight over cutting-edge technology or comprehensive platform features. Long-term client relationships suggest that SpreadCo can provide satisfactory service for traders whose needs align with the broker's strengths. Prospective clients should carefully consider the reported operational challenges and limited public information about trading conditions before committing funds.

Direct engagement with SpreadCo representatives may be necessary to fully evaluate whether their services match individual trading requirements and risk tolerance levels.