Regarding the legitimacy of INFINOX forex brokers, it provides FCA, SCB and WikiBit, (also has a graphic survey regarding security).

Is INFINOX safe?

Pros

Cons

Is INFINOX markets regulated?

The regulatory license is the strongest proof.

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Inst Market Making (MM)

Licensed Entity:

Infinox Capital Limited

Effective Date:

2009-09-15Email Address of Licensed Institution:

compliance@infinox.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://infinox.co.uk/enExpiration Time:

--Address of Licensed Institution:

90 Bartholomew Close London EC1A 7BN UNITED KINGDOMPhone Number of Licensed Institution:

+4402045151797Licensed Institution Certified Documents:

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

IX Capital Group Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

201 Church Street, Sandyport, West Bay StreetPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Infinox A Scam?

Introduction

Infinox, established in 2009, positions itself as a reputable forex and CFD broker operating on a global scale. With its headquarters in London and regulatory oversight from multiple jurisdictions, it aims to provide traders with access to various financial markets, including forex, commodities, indices, and cryptocurrencies. However, the rise of online trading has also led to an increase in fraudulent activities, making it essential for traders to carefully evaluate the legitimacy and reliability of their brokers. This article will investigate whether Infinox is a trustworthy trading partner or a potential scam. Our evaluation will be based on a comprehensive analysis of its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

Regulation is a critical factor in assessing the safety and reliability of a forex broker. Infinox is regulated by multiple financial authorities, which is a positive indicator of its legitimacy. Here is a summary of Infinox's regulatory information:

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| FCA | 501057 | United Kingdom | Verified |

| SCB | SIA F-188 | Bahamas | Verified |

| FSC | GB20025832 | Mauritius | Verified |

| FSCA | 50506 | South Africa | Verified |

Infinox's primary regulation comes from the Financial Conduct Authority (FCA) in the UK, which is known for its stringent regulatory standards that protect traders' interests. The FCA mandates that brokers maintain segregated accounts for client funds, ensuring that traders' capital is not misused. Additionally, the FCA provides a compensation scheme that safeguards deposits up to £85,000 in the event of broker insolvency. The presence of other regulatory licenses, including those from the Securities Commission of the Bahamas (SCB) and the Financial Services Commission of Mauritius (FSC), adds a layer of credibility, although it is essential to note that these jurisdictions may not offer the same level of protection as the FCA.

Historically, Infinox has maintained compliance with regulatory requirements, and there have been no significant legal issues reported against it. This regulatory framework provides a solid foundation for traders to trust Infinox as a legitimate broker.

Company Background Investigation

Infinox's history dates back to 2009, when it was founded with the goal of providing innovative trading solutions to a global audience. The company has expanded its presence across multiple countries, establishing a reputation for reliability and customer service. Infinox operates under the ownership of IX Capital Group Limited, which further enhances its credibility as a regulated entity.

The management team at Infinox boasts extensive experience in the financial services industry, with members having backgrounds in trading, technology, and customer service. This expertise is crucial in navigating the complexities of the forex market and ensuring that the broker remains competitive. The company's transparency regarding its ownership structure and management team is commendable, as it allows traders to assess the qualifications of those overseeing their investments.

In terms of information disclosure, Infinox provides comprehensive details about its services, regulatory status, and trading conditions on its website. This level of transparency is essential for fostering trust among potential clients.

Trading Conditions Analysis

Infinox offers a competitive trading environment, with various account types and trading conditions designed to cater to different trader profiles. The broker operates on both STP (Straight Through Processing) and ECN (Electronic Communication Network) models, which provide direct access to liquidity providers and competitive spreads.

The overall fee structure at Infinox is as follows:

| Fee Type | Infinox | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 1.5 pips |

| Commission Model | None (STP) / $7.50 (ECN) | Varies |

| Overnight Interest Range | Varies | Varies |

Infinox's spreads for major currency pairs are competitive, starting from 1.3 pips, which is below the industry average. The ECN account offers lower spreads starting from 0.2 pips but incurs a commission, which is standard practice among brokers offering such accounts. However, traders should be cautious of any hidden fees or unusual policies that could impact their trading costs.

While the trading conditions appear favorable, it is essential for traders to read the fine print and understand the fee structure fully. Transparency in this area is crucial, as unexpected costs can quickly erode trading profits.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. Infinox implements several measures to ensure the security of its clients' investments. The broker segregates client funds from its operational capital, which means that in the event of financial difficulties, client funds remain protected.

In addition to fund segregation, Infinox provides negative balance protection, ensuring that traders cannot lose more than their initial investment. This feature is particularly important for traders using leverage, as it mitigates the risk of significant losses.

Furthermore, Infinox has obtained additional insurance coverage for client funds, providing up to $500,000 in protection per claimant in case of insolvency. This insurance policy adds an extra layer of security, reassuring clients that their funds are safeguarded against unforeseen circumstances.

Despite these robust security measures, it is essential for traders to remain vigilant. Any historical issues or controversies related to fund security should be thoroughly researched before committing to a broker.

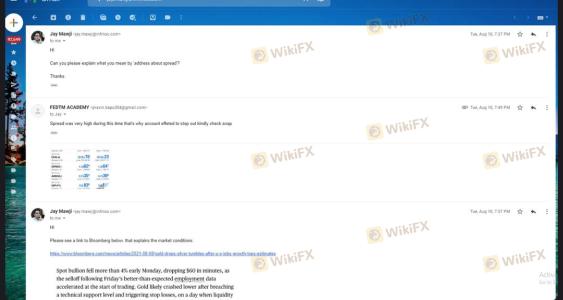

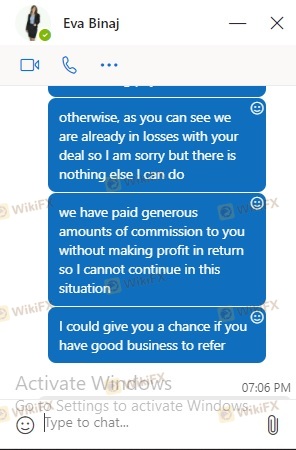

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability. Infinox has received mixed reviews from clients, with many praising its customer service and trading conditions, while others have reported issues.

Common complaints include delays in withdrawal processing and difficulties in accessing customer support. Here is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Slow response times |

| Customer Support Availability | High | Limited hours |

| Account Verification Issues | Medium | Prompt resolution |

For instance, some users have reported that their withdrawal requests took longer than expected, leading to frustration. However, others have noted that the company eventually processed their requests without issue. This inconsistency highlights the importance of managing expectations and being aware of potential delays.

Overall, while Infinox has garnered positive feedback for its trading conditions and customer service, the presence of complaints should prompt potential clients to exercise caution.

Platform and Trade Execution

Infinox provides access to well-known trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are favored by many traders for their user-friendly interfaces and advanced trading features. The platforms are known for their stability and performance, allowing users to execute trades efficiently.

The quality of order execution at Infinox is generally regarded as satisfactory, with minimal slippage reported. However, traders should remain vigilant for any signs of platform manipulation or issues that could affect their trading experience.

Risk Assessment

Using Infinox as a trading platform comes with inherent risks, as with any forex broker. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risks | Low | Strong regulatory oversight |

| Fund Security Risks | Low | Segregated funds and insurance |

| Withdrawal Risks | Medium | Occasional delays reported |

| Platform Risks | Low | Stable platforms with low slippage |

To mitigate these risks, traders are advised to conduct thorough due diligence, understand the fee structure, and maintain realistic expectations regarding withdrawal times and customer support availability.

Conclusion and Recommendations

In conclusion, Infinox is not a scam but a regulated broker with a solid reputation in the forex and CFD trading space. Its regulatory status, particularly with the FCA, provides a strong foundation for trust and security. However, potential clients should remain aware of the mixed customer feedback regarding withdrawal processes and support availability.

For traders looking for a reliable broker, Infinox offers competitive trading conditions and a user-friendly platform. Nevertheless, it is crucial for all traders, especially beginners, to conduct their research and be aware of the potential challenges that may arise.

If you are considering alternatives, brokers like FP Markets and AvaTrade are also well-regarded in the industry and may offer similar services with different trading conditions. Overall, while Infinox presents itself as a trustworthy option, traders should always prioritize their due diligence and risk management strategies.

Is INFINOX a scam, or is it legit?

The latest exposure and evaluation content of INFINOX brokers.

INFINOX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INFINOX latest industry rating score is 6.06, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.06 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.