Regarding the legitimacy of SPREAD CO forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is SPREAD CO safe?

Pros

Cons

Is SPREAD CO markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Spread Co Limited

Effective Date:

2006-10-06Email Address of Licensed Institution:

ajay.pabari@spreadco.comSharing Status:

No SharingWebsite of Licensed Institution:

www.spreadco.comExpiration Time:

--Address of Licensed Institution:

1st Floor North Argyle House Joel Street Northwood Hills Middlesex HA6 1NW UNITED KINGDOMPhone Number of Licensed Institution:

+4401923832600Licensed Institution Certified Documents:

Is SpreadCo Safe or a Scam?

Introduction

SpreadCo, founded in 2006 and headquartered in London, is a broker that provides access to a variety of trading instruments, including forex, contracts for difference (CFDs), and spread betting. As a market player, SpreadCo positions itself as a provider of competitive spreads and low trading costs, appealing to both novice and experienced traders. However, the increasing number of online brokers in the forex market necessitates that traders exercise caution when selecting a broker. The potential for scams and unethical practices in this space is high, making it crucial for traders to thoroughly evaluate their options. This article aims to assess whether SpreadCo is a safe trading platform or a potential scam by analyzing its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

One of the first indicators of a broker's trustworthiness is its regulatory status. SpreadCo is regulated by the Financial Conduct Authority (FCA) in the United Kingdom, which is known for its stringent regulatory framework and consumer protection measures. Regulation by the FCA means that SpreadCo is required to adhere to strict operational guidelines, including maintaining client funds in segregated accounts and providing transparency in its operations.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FCA | 446677 | United Kingdom | Verified |

The FCA's oversight adds a layer of security for traders, as it ensures that the broker operates within legal boundaries and adheres to high standards of conduct. Historical compliance with FCA regulations is generally favorable, indicating that SpreadCo has maintained a good standing within the regulatory framework. However, traders should remain vigilant and conduct their due diligence to ensure that the broker continues to comply with regulatory requirements.

Company Background Investigation

SpreadCo has a relatively short history in the financial industry, having been established in 2006. The company is owned and operated by Spread Co Limited, which is registered in England and Wales. The management team consists of experienced professionals with backgrounds in finance and trading, contributing to the broker's credibility. Transparency in the company's operations is crucial, and SpreadCo provides adequate information about its services, trading conditions, and contact details on its website.

The broker's commitment to transparency is reflected in its clear communication regarding fees, account types, and trading conditions. However, the absence of detailed profiles for its management team raises some questions about the level of transparency. Overall, SpreadCo appears to operate with a reasonable degree of openness, which is a positive sign for potential clients.

Trading Conditions Analysis

When evaluating whether SpreadCo is safe, it is essential to consider its trading conditions, including fees and spreads. SpreadCo offers a competitive fee structure, with fixed spreads that start at 0.8 pips for major currency pairs. This pricing model can be advantageous for traders looking to minimize costs. However, it is important to note that the broker may impose additional fees, such as withdrawal fees, which can impact overall trading costs.

| Fee Type | SpreadCo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.8 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

Traders should be aware of any unusual fees that may apply, particularly withdrawal fees, which can be a red flag in assessing the overall cost of trading with SpreadCo. While the spreads are competitive, the presence of additional fees warrants careful consideration.

Customer Funds Safety

The safety of customer funds is a critical aspect of evaluating whether SpreadCo is safe for trading. The broker employs several measures to ensure the security of client funds, including holding them in segregated accounts at top-tier banks. This practice helps protect traders' capital in the event of financial difficulties faced by the broker. Additionally, SpreadCo offers negative balance protection, which means that clients cannot lose more than their deposited funds.

Despite these safety measures, potential clients should remain aware of any historical issues related to fund security. There have been no significant reports of fund mismanagement or security breaches associated with SpreadCo, which is a positive indicator of its operational integrity.

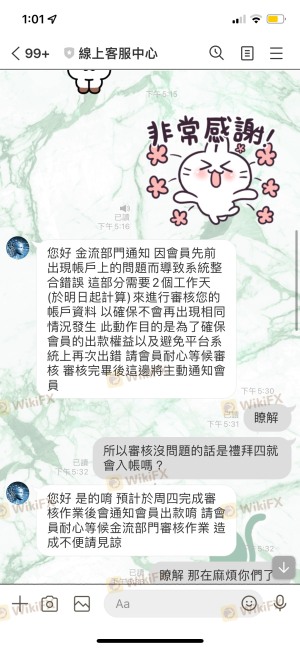

Customer Experience and Complaints

Analyzing customer feedback is essential in determining whether SpreadCo is safe to trade with. Reviews from users reveal a mixed bag of experiences. While some traders report satisfaction with the platform's performance and customer service, others express frustration over withdrawal processes and the quality of support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Platform Stability | Medium | Generally Positive |

| Customer Support Quality | Medium | Mixed |

One common complaint involves delays in processing withdrawals, which can be a significant concern for traders. While SpreadCo's customer support team generally responds to inquiries, the quality and speed of these responses can vary, leading to dissatisfaction among some users. A couple of notable cases highlight these issues, with traders reporting prolonged waiting times for their funds to be released.

Platform and Trade Execution

The performance of a trading platform is another crucial factor in assessing whether SpreadCo is a safe choice. SpreadCo offers a proprietary trading platform that is designed to be user-friendly and efficient. However, some users have reported issues with platform stability, including occasional disconnections and execution delays.

The quality of order execution is also a vital consideration. Traders expect quick and reliable execution of their trades, and any signs of slippage or rejected orders can raise concerns about the broker's integrity. While SpreadCo generally performs well in this regard, there are isolated reports of execution problems that warrant attention.

Risk Assessment

When determining whether SpreadCo is safe, it is important to evaluate the overall risk associated with using the broker. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | FCA regulation provides oversight. |

| Financial Risk | Medium | Withdrawal issues reported by users. |

| Operational Risk | Medium | Platform stability concerns noted. |

To mitigate risks, traders are advised to start with smaller investments and utilize the demo account feature to familiarize themselves with the platform before committing significant capital.

Conclusion and Recommendations

In conclusion, while SpreadCo is regulated by the FCA and offers several measures to protect client funds, potential traders should remain cautious. The mixed reviews regarding customer experience, particularly concerning withdrawals and platform stability, suggest that while SpreadCo is not a scam, there are areas for improvement.

Traders should consider their individual needs and risk tolerance when deciding whether to use SpreadCo. For those who prioritize regulatory oversight and competitive spreads, SpreadCo may be a suitable option. However, traders seeking a more robust customer support experience and greater platform stability may want to explore alternative brokers that offer similar services.

Ultimately, conducting thorough research and considering personal trading goals is essential for anyone looking to engage with SpreadCo or any other broker in the forex market.

Is SPREAD CO a scam, or is it legit?

The latest exposure and evaluation content of SPREAD CO brokers.

SPREAD CO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SPREAD CO latest industry rating score is 6.88, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.88 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.