Regarding the legitimacy of Questrade forex brokers, it provides CIRO and WikiBit, (also has a graphic survey regarding security).

Is Questrade safe?

Pros

Cons

Is Questrade markets regulated?

The regulatory license is the strongest proof.

CIRO Derivatives Trading License (EP)

Canadian Investment Regulatory Organization

Canadian Investment Regulatory Organization

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Questrade, Inc.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

www.questrade.comExpiration Time:

--Address of Licensed Institution:

5700 Yonge Street Suite 1900 Toronto ON M2M 4K2Phone Number of Licensed Institution:

416-227-9876Licensed Institution Certified Documents:

Is Questrade A Scam?

Introduction

Questrade is a Canadian online brokerage that has carved a niche for itself in the financial services industry since its inception in 1999. With over $30 billion in assets under management, Questrade positions itself as a cost-effective alternative to traditional banks for Canadian investors, particularly in trading stocks, options, ETFs, and forex. However, as the popularity of online trading grows, so does the necessity for traders to evaluate the legitimacy and safety of their chosen broker. The forex market, known for its volatility and complexity, demands that traders exercise due diligence before committing their funds. This article will investigate whether Questrade is a safe and reliable broker or if there are potential red flags that warrant caution. Our analysis will rely on multiple sources, including regulatory information, customer feedback, and the company's operational history.

Regulation and Legitimacy

Regulation is a cornerstone of a broker's credibility, serving as a safety net for investors. Questrade is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and is a member of the Canadian Investor Protection Fund (CIPF). These regulatory bodies ensure that brokers adhere to strict operational guidelines designed to protect investors. Below is a summary of Questrade's regulatory status:

| Regulatory Body | License Number | Regulating Region | Verification Status |

|---|---|---|---|

| IIROC | N/A | Canada | Verified |

| CIPF | N/A | Canada | Verified |

The IIROC oversees all investment dealers in Canada, ensuring compliance with high standards of financial operations and ethics. The CIPF provides protection for investors in the event of a brokerage's insolvency, covering up to $1 million per eligible account. Questrade goes a step further by offering additional private insurance coverage of up to $10 million per account. This dual-layered protection enhances Questrade's credibility and indicates a commitment to safeguarding client assets.

Company Background Investigation

Founded in 1999 by Edward Kholodenko, Questrade has grown to become Canada's largest independent online brokerage. The company has consistently been recognized as one of Canada's best-managed companies, a testament to its operational excellence and customer service. The management team comprises seasoned professionals with extensive backgrounds in finance and investment, lending credibility to the firm. Questrade operates transparently, providing detailed information about its services, fees, and operational policies on its website. Such transparency is crucial for building trust with clients and ensuring that they are well-informed about their investments.

Trading Conditions Analysis

When evaluating whether Questrade is safe, it's essential to consider the overall trading conditions it offers. Questrade employs a transparent fee structure, with stock trades costing $0.01 per share, a minimum fee of $4.95, and a maximum of $9.95. Notably, Questrade offers commission-free ETF purchases, which is a significant draw for many investors. However, when selling ETFs, the standard commission applies. Below is a comparison of core trading costs:

| Cost Type | Questrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.7 pips | 1.5 pips |

| Commission Model | $4.95 - $9.95 | $9.99 |

| Overnight Interest Range | Varies | Varies |

While Questrade's fees are competitive, traders should be aware of additional costs, such as wire transfer fees and potential inactivity fees for accounts below a certain balance. These fees can add up, particularly for less active traders, making it crucial for potential clients to understand the complete cost structure before opening an account.

Client Fund Security

Client fund security is a critical factor in determining whether Questrade is safe for trading. Questrade employs several measures to protect client funds, including segregating client assets from the company's operational funds. This segregation ensures that client funds are not at risk in the event of company insolvency. Additionally, Questrade's membership in the CIPF provides an extra layer of protection, covering up to $1 million per account. The firm also offers a 100% reimbursement guarantee for unauthorized transactions, further enhancing its commitment to client security. However, it is important to note that Questrade does not provide negative balance protection, which could expose traders to additional risks, particularly in volatile markets.

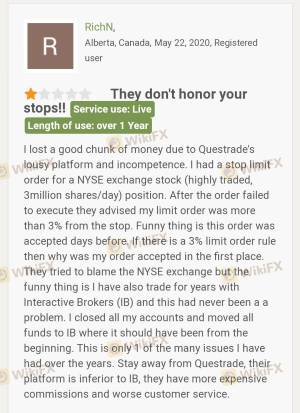

Customer Experience and Complaints

Customer feedback plays a vital role in assessing whether Questrade is a scam or a legitimate broker. While many users praise Questrade for its low fees and user-friendly platforms, there are also numerous complaints regarding customer service and platform stability. Common complaints include long wait times for customer support and issues with order execution. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Customer Service Delays | High | Slow response times |

| Order Execution Issues | Medium | Addressed but frequent |

| Platform Stability | High | Ongoing improvements |

One notable case involves a user who experienced significant delays in order execution during a market downturn, leading to financial losses. While Questrade did respond to the complaint, the recurring nature of such issues raises concerns about the platform's reliability, especially for active traders.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial in determining whether Questrade is safe for trading. Questrade offers multiple platforms, including Questrade Trading and Questrade Edge, each designed for different user needs. While the platforms are generally user-friendly, some users have reported issues with platform stability and execution quality, particularly during periods of high market volatility.

Risk Assessment

Using Questrade does come with its risks, which can be summarized in the following risk scorecard:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by IIROC |

| Fund Security Risk | Medium | No negative balance protection |

| Platform Reliability Risk | High | Reports of execution issues |

| Customer Service Risk | Medium | Complaints about response times |

To mitigate these risks, it is advisable for traders to utilize demo accounts to familiarize themselves with the platform before committing real funds. Additionally, maintaining a diversified investment portfolio can help cushion against potential losses.

Conclusion and Recommendations

In conclusion, Questrade is a well-established broker with robust regulatory oversight and a transparent fee structure. However, potential clients should be aware of the risks associated with trading, including platform reliability and customer service issues. While there are no definitive signs of Questrade being a scam, traders should exercise caution and conduct thorough research before opening an account. For those seeking alternatives, brokers such as Qtrade or Wealthsimple may offer similar services with potentially better customer support and more user-friendly platforms. Ultimately, whether Questrade is the right choice will depend on individual trading needs and risk tolerance.

Is Questrade a scam, or is it legit?

The latest exposure and evaluation content of Questrade brokers.

Questrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Questrade latest industry rating score is 6.72, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.72 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.