eToro 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive eToro review looks at one of the world's top social trading and multi-asset brokerage platforms. eToro has changed the investment world since it started in 2007, making trading more social and accessible for everyone. The platform stands out because it lets users copy trades from successful investors while giving them access to many different financial tools like stocks, ETFs, cryptocurrencies, and forex pairs.

Over 30 million people around the world have signed up with eToro. This makes it a major player in online trading, especially for regular investors who want both manual trading and automated social investment features. The platform's main selling point is its community approach, where being open and social interaction are at the heart of the trading experience.

Key highlights include an easy-to-use interface made for beginners, lots of educational materials, and over 3,000 financial instruments to choose from. The platform works on both web browsers and mobile apps, so you can trade on many different devices and systems. This makes it easy to access your account anywhere.

Target audience: eToro mainly serves new and intermediate investors who like community insights and social trading features. However, it also works well for experienced traders who want access to different assets and new trading tools.

Keywords: etoro review

Important Disclaimers

Regional Regulatory Variations: eToro works through different legal companies in various countries, including the United States, United Kingdom, Cyprus, and Australia. Each company may have different rules, fees, and features available to users. You should check which eToro company serves your area and understand the rules that apply to you.

Review Methodology: This review uses public information, user feedback from many sources, and platform analysis done in 2025. Rules and specific features may be different depending on where you live and can change over time. Potential users should do their own research and check current offerings directly with eToro before making investment decisions.

Risk Warning: All trading involves risk, and past results don't guarantee future success. Social trading and copy trading have extra risks because they depend on how other traders perform.

Rating Framework

Broker Overview

Company Background and History

eToro started in 2007 when brothers Yoni and Ronen Assia teamed up with David Ring. The company has its main office in Tel Aviv, Israel, and they created the idea of social trading, which changed how people traditionally invest by adding transparency and community interaction to financial markets. Since it began, eToro has grown around the world and now has regulated companies in major financial centers like London, Sydney, and Limassol.

The platform began as a simple forex trading site but grew into a complete multi-asset investment system. eToro's goal is to open financial markets to everyone by making investing easier through technology and social interaction. The company has received significant funding from major financial institutions, which shows that their new approach to retail investing is working.

Business Model and Platform Architecture

eToro makes money through spreads, overnight fees, and withdrawal charges. The platform lets users trade manually or use automated copy trading through their CopyTrader system. Users can either make their own trades or automatically copy the strategies of successful investors called "Popular Investors."

The eToro review shows a platform built to be easy to use, with web and mobile apps that work for traders at all skill levels. The company focuses on social interaction, which makes it different from traditional brokers by creating a place where sharing knowledge and being transparent drive investment decisions.

Keywords: etoro review

Regulatory Status and Compliance

eToro follows multiple regulatory rules around the world. In Europe, eToro (Europe) Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC), while eToro (UK) Ltd is authorized by the Financial Conduct Authority (FCA). In Australia, eToro Australia Pty Ltd works under an Australian Financial Services License, and in the United States, eToro USA Securities Inc. is registered with the Securities and Exchange Commission.

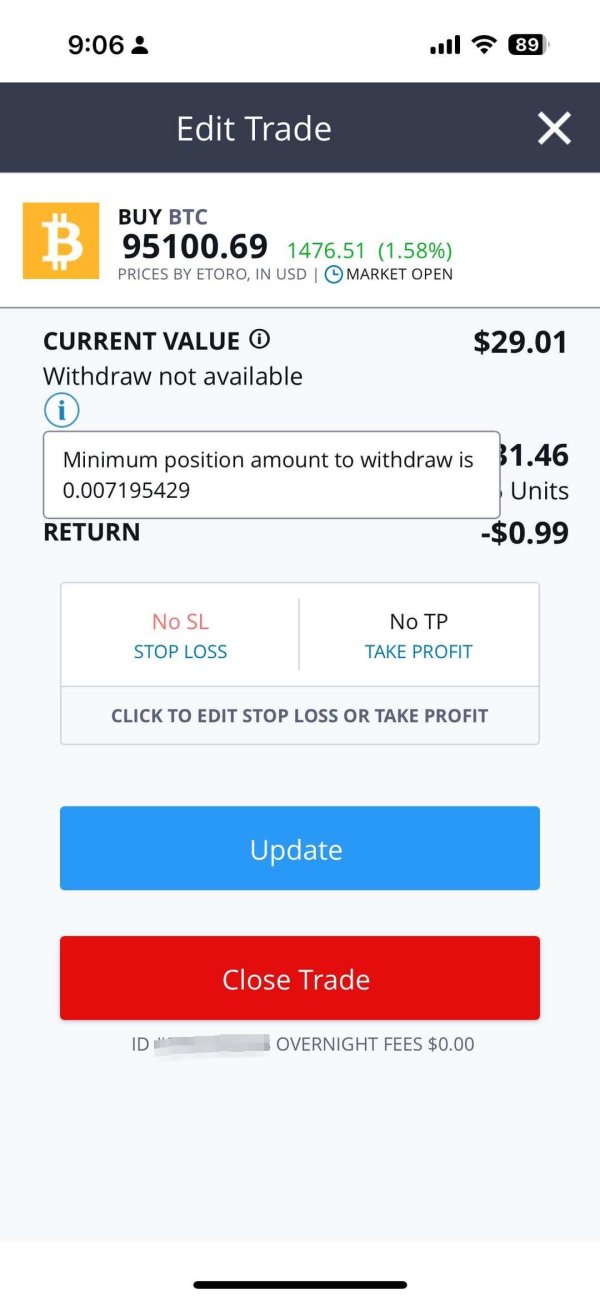

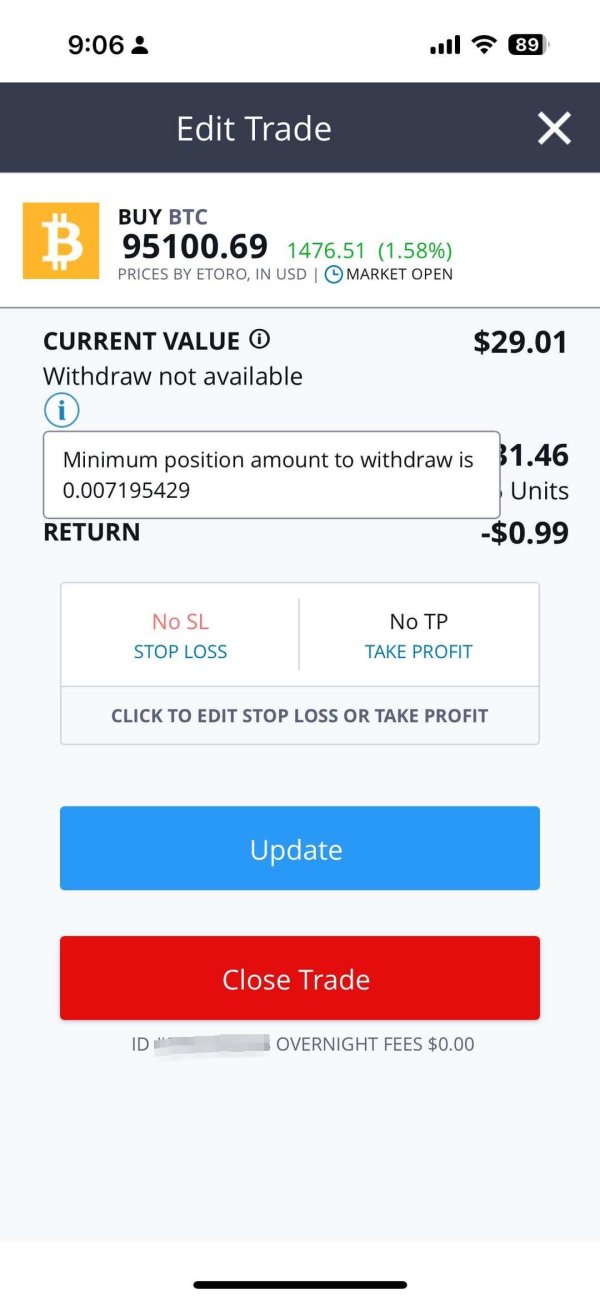

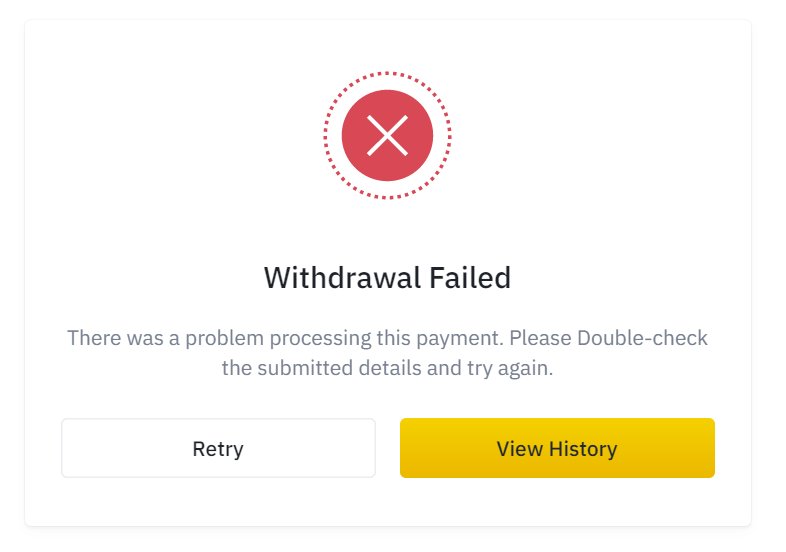

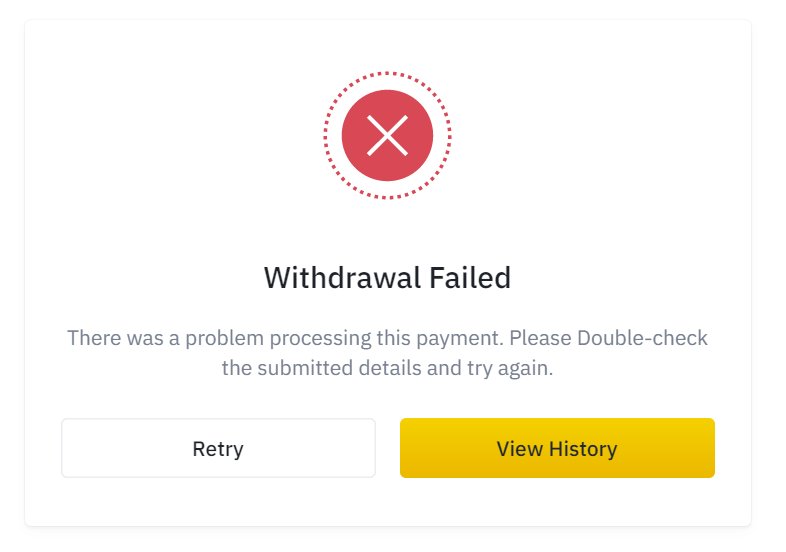

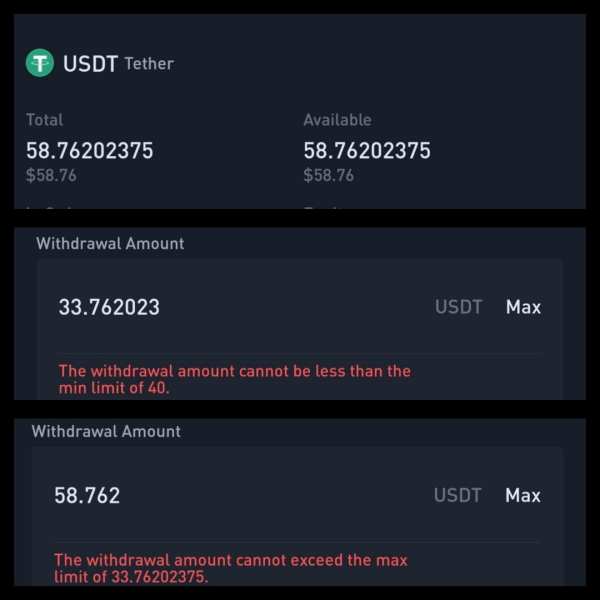

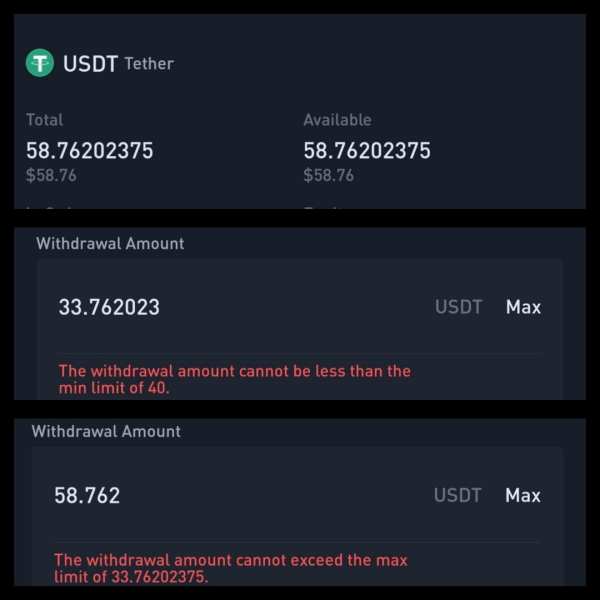

Deposit and Withdrawal Methods

The platform accepts various payment methods including credit and debit cards (Visa, Mastercard), bank transfers, PayPal, Skrill, Neteller, and other regional payment options. How long it takes to process depends on the method you choose, with card deposits usually instant and bank transfers taking 1-3 business days. Withdrawals usually take 1-8 business days depending on which method you pick.

Minimum Deposit Requirements

The minimum amount you need to deposit varies by region and payment method, usually ranging from $50 to $200 for most areas. US users need to deposit at least $100, while European and other international users often have lower requirements to get started.

Tradeable Assets and Instruments

eToro gives you access to over 3,000 financial instruments across many different asset types. Stock options include shares from major exchanges like NYSE, NASDAQ, LSE, and other international markets. The cryptocurrency selection has over 70 digital assets including Bitcoin, Ethereum, and various altcoins. ETF options cover major index funds and sector-specific products, while forex trading includes major, minor, and exotic currency pairs.

Fee Structure and Costs

The platform uses a spread-based model for most instruments, with spreads changing based on asset type and market conditions. Cryptocurrency spreads usually range from 0.75% to 5%, while forex spreads start from 1 pip for major pairs. Stock and ETF trading has no commission, though overnight and weekend fees apply to leveraged positions. All withdrawal requests have a $5 fee.

Leverage and Margin Requirements

How much leverage you can use depends on regulatory rules in your area and what type of asset you're trading. European users face ESMA restrictions with maximum leverage of 1:30 for major forex pairs and 1:2 for cryptocurrencies. Professional traders may get higher leverage if they qualify. US users have different leverage limits based on SEC and FINRA rules.

Platform Options and Technology

eToro's own platform works through web browsers and mobile apps for iOS and Android devices. The platform has advanced charting tools, technical indicators, and social trading features. There's no MetaTrader integration because eToro focuses on their own technology designed specifically for social trading.

Keywords: etoro review

Detailed Rating Analysis

Account Conditions Analysis (7/10)

eToro offers multiple account types designed to work for different trader profiles and regulatory requirements. The standard retail account gives you access to all platform features including social trading, copy trading, and manual trading capabilities. Professional accounts are available for qualified users in certain areas, offering better leverage and fewer regulatory restrictions.

Account opening procedures are simple and usually completed within 24-48 hours, depending on document verification requirements. The Know Your Customer (KYC) process needs standard ID documents including passport or driver's license, proof of address, and sometimes proof of income for higher deposit limits.

Based on user feedback from various sources, the account verification process usually works well, though some users report delays during busy periods or when extra documentation is needed. The platform's minimum deposit requirements are considered reasonable within industry standards, making it accessible to new investors while following regulatory rules.

Islamic accounts are available in certain areas, meeting religious trading requirements by removing overnight fees and ensuring Sharia-compliant trading conditions. However, availability varies by region and regulatory framework.

The score reflects the platform's complete account options and reasonable entry requirements, though some limits exist regarding leverage restrictions in certain areas and occasional verification delays reported by users.

Keywords: etoro review

eToro's tool system represents one of its strongest competitive advantages, especially in social trading functionality. The CopyTrader system lets users automatically copy trades from successful investors, with detailed performance stats and risk information available for each Popular Investor. This feature makes professional trading strategies available to everyone and provides transparency rarely seen in traditional investment platforms.

Research and analysis capabilities include complete market analysis, economic calendars, and real-time news feeds built right into the trading platform. The platform provides detailed asset information, including fundamental analysis for stocks and cryptocurrencies, helping users make smart investment decisions.

Educational resources are extensive, featuring eToro Academy with courses covering basic investing principles, technical analysis, and advanced trading strategies. Webinars, video tutorials, and written guides work for different learning styles and experience levels. The quality of educational content gets positive feedback from users, especially beginners trying to understand market dynamics.

Portfolio management tools include performance tracking, risk assessment features, and detailed transaction history. The platform's social features go beyond copying trades to include discussion forums, investor profiles, and market sentiment indicators based on community activity.

However, some advanced traders note limits in technical analysis tools compared to specialized trading platforms, and the lack of automated trading beyond copy trading may disappoint algorithmic trading enthusiasts.

Customer Service and Support Analysis (6/10)

eToro provides customer support through multiple channels including email ticketing systems, live chat functionality, and complete FAQ sections. Response times vary a lot based on inquiry type and regional support teams, with live chat usually providing faster solutions for general questions while complex account issues may need email communication.

Service quality gets mixed reviews from users, with many praising how helpful support representatives are while others report inconsistent response quality and occasional language barriers. The platform offers support in multiple languages including English, Spanish, German, French, and Italian, though availability varies by region and time zone.

Support availability works during business hours for most regions, with extended hours for major markets. However, 24/7 support is not available, which may be inconvenient for traders in certain time zones or during weekend market events affecting cryptocurrency positions.

User feedback shows that common issues include account verification delays, withdrawal processing questions, and technical platform difficulties. While most issues are solved well, some users report long resolution times for complex problems that need escalation to specialized departments.

The platform's help center provides complete self-service options, but navigation can be challenging for users looking for specific information about regulatory differences or advanced trading features.

Trading Experience Analysis (8/10)

eToro's trading experience focuses on its new approach to social investing combined with traditional trading capabilities. Platform stability gets generally positive feedback, with users reporting reliable order execution and minimal downtime during normal market conditions. However, some users note occasional performance issues during high volatility periods or major market events.

Order execution quality varies by asset class and market conditions. Stock and ETF trades usually execute at displayed prices with minimal slippage, while cryptocurrency trades may experience wider spreads during volatile periods. The platform's market making model for certain assets means that eToro acts as the counterparty, which can affect execution during extreme market conditions.

User interface design is consistently praised for its easy layout and accessibility for beginners. The social trading integration feels natural rather than forced, with copy trading controls smoothly built into the standard trading interface. Mobile application functionality mirrors the web platform well, allowing full trading and portfolio management capabilities on smartphones and tablets.

Charting and analysis tools provide adequate functionality for most retail traders, including standard technical indicators, drawing tools, and multiple timeframe options. However, professional traders may find the analysis capabilities limited compared to specialized trading platforms or MetaTrader-based solutions.

The social aspects of trading experience get particular praise, with users appreciating the ability to follow successful traders, engage in market discussions, and access collective market sentiment data.

Keywords: etoro review

Trust and Safety Analysis (8/10)

eToro's regulatory compliance across multiple areas provides a strong foundation for user trust. Multi-jurisdictional regulation by respected authorities including CySEC, FCA, ASIC, and SEC registration shows the company's commitment to maintaining high operational standards and user protection measures.

Fund security measures include segregated client accounts, ensuring customer funds stay separate from company operational funds. The platform uses bank-level encryption for data transmission and storage, with two-factor authentication available for enhanced account security. Investor compensation schemes provide additional protection in applicable areas, though coverage amounts vary by regulatory framework.

Company transparency is clear through regular financial reporting, clear fee disclosure, and detailed terms of service. eToro's public listing preparations and institutional investment backing further validate its operational credibility and long-term viability.

Risk management features include negative balance protection for retail clients in regulated areas, real-time risk warnings, and educational content about trading risks. The platform's approach to risk disclosure meets regulatory requirements while staying accessible to new investors.

However, some users express concerns about the market making model for certain instruments, questioning potential conflicts of interest when the broker acts as counterparty. Additionally, the platform's focus on social trading requires users to understand the additional risks associated with copy trading and relying on other traders' decisions.

User Experience Analysis (9/10)

eToro excels in user experience design, particularly for newcomers to financial markets. Interface design focuses on clarity and accessibility, with easy navigation and visual elements that make complex financial concepts more approachable. The platform successfully balances complete functionality with user-friendly design principles.

Registration and verification processes are simple and clearly explained, with progress indicators and helpful guidance throughout the onboarding journey. New users get welcome materials and guided tours of platform features, reducing the learning curve associated with online trading.

Social integration represents eToro's standout user experience feature, smoothly blending social networking concepts with investment functionality. Users can easily discover successful traders, analyze performance metrics, and implement copy trading strategies without technical complexity.

Portfolio management interfaces provide clear visualization of performance, asset allocation, and profit/loss tracking. The ability to switch between traditional portfolio views and social trading dashboards accommodates different user preferences and experience levels.

Mobile experience maintains feature parity with web platforms while optimizing for touch interfaces and smaller screens. Users report satisfaction with mobile app performance and functionality, enabling effective portfolio management and trading on mobile devices.

Community feedback consistently highlights the platform's approachability and educational value, particularly for users new to investing. However, some experienced traders note that the simplified interface occasionally limits access to advanced features or detailed market data.

Conclusion

This comprehensive eToro review reveals a platform that has successfully changed retail investing through innovative social trading features and user-focused design. eToro's strength lies in its ability to make financial markets accessible to everyone while maintaining regulatory compliance across multiple areas.

Ideal user profile: eToro works best for new to intermediate investors seeking educational support, community interaction, and simplified access to diverse financial instruments. The platform particularly appeals to users interested in copy trading and those who value transparency in investment decision-making.

Key advantages include exceptional user experience design, complete educational resources, innovative social trading features, and access to a diverse range of assets including cryptocurrencies. The platform's regulatory compliance and fund protection measures provide reassurance for user safety.

Primary limitations involve higher fees compared to some discount brokers, limited advanced trading tools for professional traders, and potential conflicts of interest inherent in the market-making model for certain instruments.

Overall, eToro represents a solid choice for investors who prioritize community-driven investing, educational support, and innovative trading features. More experienced traders may need to evaluate whether the platform's unique features justify its cost structure compared to traditional brokerage alternatives.