Regarding the legitimacy of eightcap forex brokers, it provides ASIC, FCA, CYSEC and WikiBit, (also has a graphic survey regarding security).

Is eightcap safe?

Pros

Cons

Is eightcap markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

EIGHTCAP PTY LTD

Effective Date: Change Record

2011-04-29Email Address of Licensed Institution:

compliance@eightcap.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

EIGHTCAP PTY LTD 'RIALTO SOUTH TOWER' L 35 525 COLLINS ST MELBOURNE VIC 3000Phone Number of Licensed Institution:

0383734800Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Eightcap Group Ltd

Effective Date:

2020-12-23Email Address of Licensed Institution:

customerservice-uk@eightcap.com, complianceuk@eightcap.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.eightcap.com/uk/Expiration Time:

--Address of Licensed Institution:

40 Gracechurch Street London EC3V 0BT UNITED KINGDOMPhone Number of Licensed Institution:

+443331503027Licensed Institution Certified Documents:

CYSEC Forex Execution License (STP) 21

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Eightcap EU Ltd

Effective Date:

2014-07-30Email Address of Licensed Institution:

compliance@eightcap.euSharing Status:

No SharingWebsite of Licensed Institution:

www.eightcap.euExpiration Time:

--Address of Licensed Institution:

Anexartisias 187, 1st floor, 3040 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 060 006Licensed Institution Certified Documents:

Is Eightcap A Scam?

Introduction

Eightcap is an online forex and CFD broker founded in 2009 and headquartered in Melbourne, Australia. Over the years, it has positioned itself as a reputable player in the trading industry, offering a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. As traders increasingly turn to online platforms for investment opportunities, it becomes crucial to assess the credibility and reliability of these brokers. With the rise of scams in the financial sector, traders must conduct thorough due diligence before committing their funds to any broker.

This article aims to provide an objective analysis of Eightcap's legitimacy and safety for potential traders. Our investigation will incorporate a comprehensive evaluation framework, including regulatory compliance, company background, trading conditions, client fund security, user experiences, and risk assessments. By synthesizing data from multiple credible sources, we aim to present a balanced view of whether Eightcap is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulation of a broker is paramount in ensuring its legitimacy and the safety of client funds. Eightcap is regulated by several reputable authorities, which enhances its credibility in the trading community. The following table summarizes the core regulatory information for Eightcap:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 391441 | Australia | Verified |

| FCA | 921296 | United Kingdom | Verified |

| CySEC | 246/14 | Cyprus | Verified |

| SCB | SIA-F 220 | Bahamas | Verified |

Eightcap is regulated by the Australian Securities and Investments Commission (ASIC), the UK's Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Securities Commission of the Bahamas (SCB). The presence of multiple tier-1 regulators indicates a high level of oversight and adherence to strict financial standards. ASIC and FCA, in particular, are known for their rigorous compliance requirements, including maintaining adequate capital reserves and providing client fund protection through segregated accounts.

Historically, Eightcap has maintained a clean regulatory record, with no significant compliance breaches reported. This regulatory framework not only ensures that the broker operates transparently but also provides a safety net for traders in case of insolvency, as client funds are protected under various investor compensation schemes.

Company Background Investigation

Eightcap has been operational since 2009, establishing itself as a reliable broker in the highly competitive forex market. The company has expanded its reach globally, serving clients across numerous countries while maintaining a strong presence in Australia and Europe. Ownership of Eightcap is structured as Eightcap Pty Ltd, with its headquarters located in Melbourne, Australia, and additional offices in the UK, Cyprus, and the Bahamas.

The management team at Eightcap is comprised of experienced professionals with backgrounds in finance and trading. The company's founder, Joel Murphy, has been instrumental in its growth and development. Under his leadership, Eightcap has received multiple awards for its services, including recognition for its customer support and innovative trading solutions. The management's expertise in the financial sector contributes to the broker's reputation for reliability and client-centric services.

In terms of transparency, Eightcap provides ample information about its operations, including its regulatory licenses and contact details. However, some users have noted a lack of detailed financial disclosures, which could enhance trust among potential clients. Overall, Eightcap's solid foundation and experienced management team bolster its credibility in the trading industry.

Trading Conditions Analysis

The trading conditions offered by a broker significantly impact a trader's overall experience and profitability. Eightcap provides a competitive fee structure, which varies depending on the type of account chosen. The following table compares the core trading costs associated with Eightcap and the industry average:

| Fee Type | Eightcap | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 0.0 pips | From 0.6 pips |

| Commission Model | $3.50 per lot | $5.00 per lot |

| Overnight Interest Range | Variable | Variable |

Eightcap offers two primary account types: the Standard account and the Raw account. The Standard account features spreads starting from 1 pip with no commission, making it suitable for beginners. In contrast, the Raw account provides access to tighter spreads, starting from 0.0 pips, but charges a commission of $3.50 per standard lot traded. This structure allows traders to choose an account type that aligns with their trading strategies and preferences.

While Eightcap's spreads and commission rates are competitive, it is essential to note that traders should be cautious of any unusual fees that may arise. For instance, while there are no deposit or withdrawal fees, traders should be aware of potential bank charges when transferring funds. Furthermore, Eightcap imposes an inactivity fee of $50 after six months of no trading activity, which could affect less active traders.

Client Fund Security

The safety of client funds is a critical consideration when evaluating a broker's reliability. Eightcap implements several measures to ensure the security of its clients' investments. Client funds are held in segregated accounts, separate from the broker's operating funds. This practice is crucial in protecting clients' money in the event of the broker's insolvency.

Additionally, Eightcap offers negative balance protection, which ensures that clients cannot lose more than their deposited amount. This feature is particularly beneficial for traders utilizing high leverage, as it mitigates the risk of significant losses.

Despite these safeguards, it is essential to remain vigilant and informed about any potential security concerns. While Eightcap has not faced any significant controversies regarding fund security, traders should always conduct regular checks and stay updated on the broker's policies and practices.

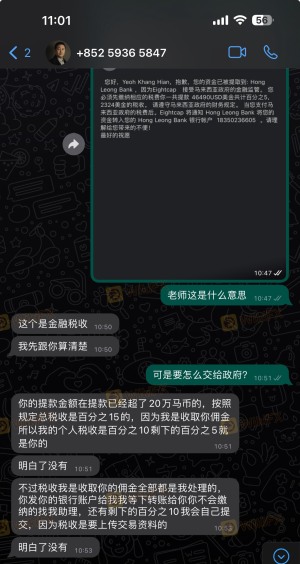

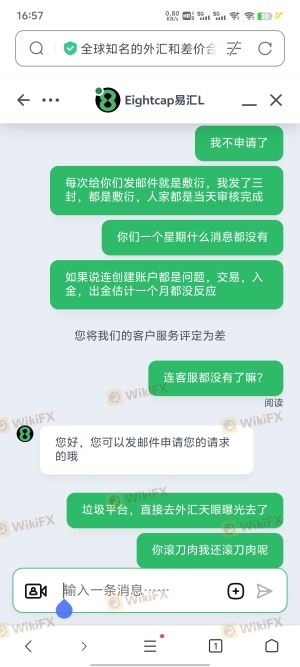

Client Experience and Complaints

Customer feedback plays a vital role in understanding a broker's performance and reliability. Eightcap generally receives positive reviews regarding its trading conditions, platform performance, and customer support. However, some users have reported issues related to withdrawals and customer service responsiveness.

The following table summarizes the primary complaint types and their severity assessments for Eightcap:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Customer Support Availability | Medium | Generally Positive |

| Platform Performance Issues | Low | Responsive |

Typical complaints include delays in processing withdrawal requests, with some users expressing frustration over the time it takes to receive funds. While many traders report satisfactory experiences with the withdrawal process, a few have encountered challenges that suggest a need for improvement in this area.

One notable case involved a trader who experienced significant delays in withdrawing profits, leading to concerns about the broker's reliability. However, it is crucial to consider that user experiences can vary widely, and many traders have successfully withdrawn funds without issue.

Platform and Trade Execution

The performance of a trading platform is a key factor in a trader's success. Eightcap offers access to the popular MetaTrader 4 and MetaTrader 5 platforms, known for their user-friendly interfaces and robust features. Additionally, Eightcap integrates with TradingView, providing traders with advanced charting tools and market analysis capabilities.

In terms of order execution, Eightcap generally maintains a high level of reliability. However, some users have reported occasional issues with slippage and order rejections, particularly during volatile market conditions. It is essential for traders to be aware of these potential challenges and to implement effective risk management strategies to mitigate their impact.

Overall, Eightcap's platform performance is regarded as solid, with a focus on providing users with a seamless trading experience. The broker's commitment to technological advancements and integration with popular platforms contributes to its reputation in the industry.

Risk Assessment

Engaging with any broker comes with inherent risks, and Eightcap is no exception. The following table summarizes the key risk areas associated with trading through Eightcap:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Regulated by multiple tier-1 authorities. |

| Fund Security Risk | Low | Segregated accounts and negative balance protection. |

| Withdrawal Risk | Medium | Some reports of delays in processing withdrawals. |

| Platform Performance Risk | Medium | Occasional slippage and execution issues. |

To mitigate these risks, traders should conduct thorough research, maintain a diversified portfolio, and implement robust risk management strategies. Additionally, it is advisable to start with a demo account to familiarize oneself with the platform and trading conditions before committing significant capital.

Conclusion and Recommendations

In conclusion, Eightcap appears to be a legitimate broker with a solid regulatory framework, competitive trading conditions, and a commitment to client security. While there are some concerns regarding withdrawal delays and occasional platform performance issues, these do not necessarily indicate that Eightcap is a scam. Instead, they highlight areas where the broker could improve its services.

For traders considering Eightcap, it is essential to weigh the benefits against the potential risks. Novice traders may find the educational resources and user-friendly platforms to be advantageous, while experienced traders may appreciate the competitive spreads and advanced tools available.

However, those who prioritize a broker with a flawless withdrawal process and extensive educational materials may want to explore alternative options. Brokers like IG Group or OANDA, which are also regulated and offer robust educational resources, could be suitable alternatives.

Overall, Eightcap is a credible choice for traders seeking a reliable and regulated broker, but due diligence and careful consideration of individual trading needs are crucial before making any commitments.

Is eightcap a scam, or is it legit?

The latest exposure and evaluation content of eightcap brokers.

eightcap Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

eightcap latest industry rating score is 7.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.