XTB 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive xtb review evaluates one of the most established and regulated forex brokers in the industry. XTB stands out as a trusted financial services provider with over 20 years of market experience. The broker offers a robust trading environment suitable for both new and experienced traders. XTB's most compelling features include zero minimum deposit requirements and an extensive selection of over 4,500 financial instruments spanning forex, CFDs, stocks, ETFs, and cryptocurrencies.

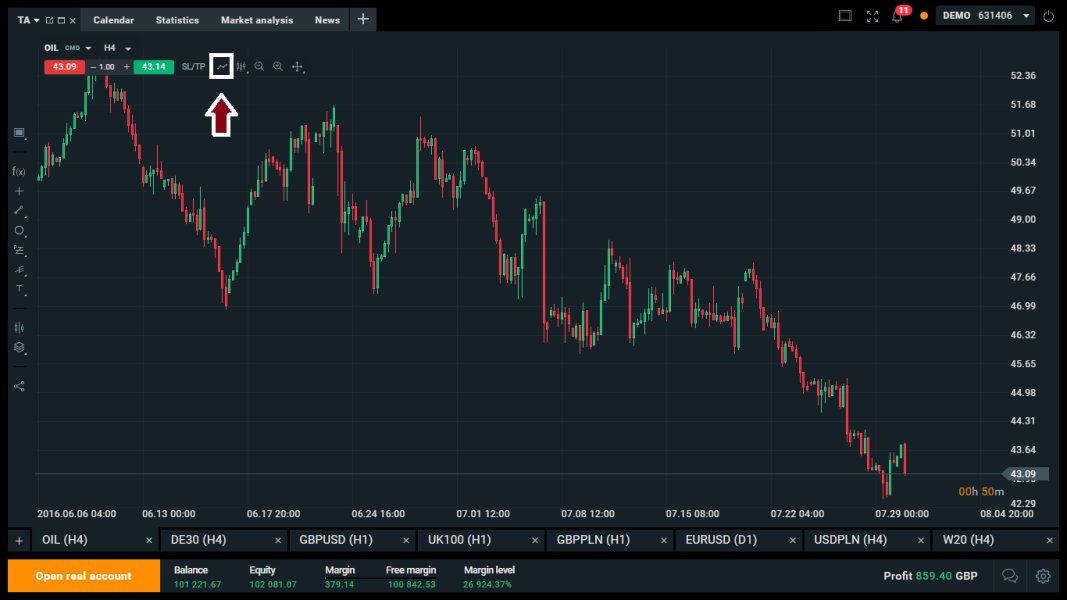

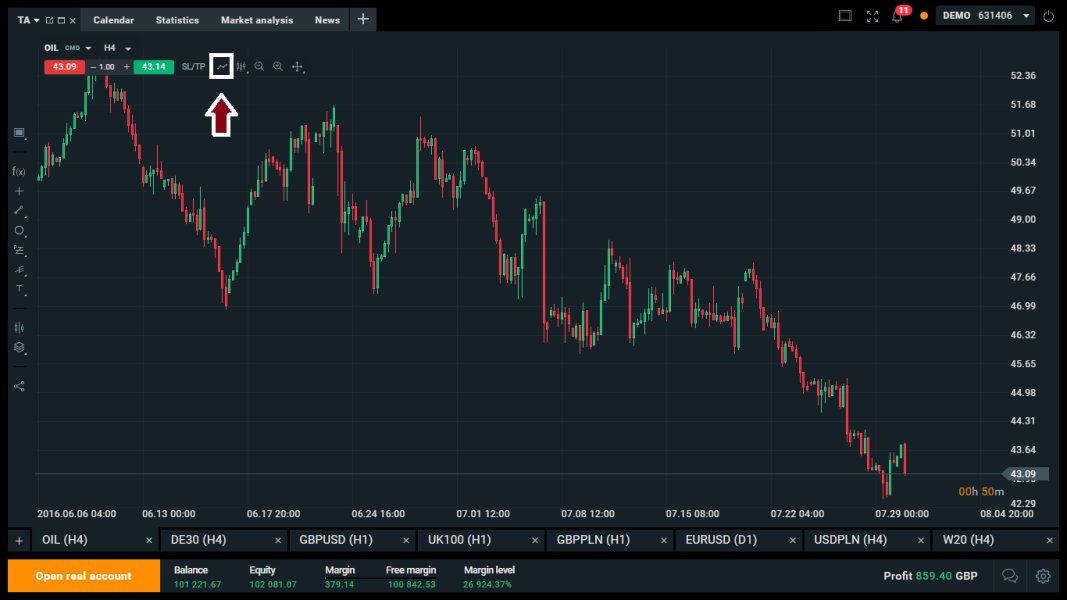

XTB distinguishes itself in the competitive brokerage landscape through its commitment to regulatory compliance across multiple jurisdictions. The broker also maintains sophisticated trading infrastructure. The broker operates through three primary platforms: the proprietary xStation 5, the mobile-optimized xStation Mobile, and the industry-standard MetaTrader 4. This ensures traders have access to professional-grade tools regardless of their experience level.

XTB particularly appeals to traders seeking a reliable, well-regulated broker without the barrier of minimum deposit requirements. The broker's global presence across 15 countries demonstrates its commitment to serving diverse international markets. This presence also shows the broker maintains consistent service standards. According to various industry reports, XTB consistently ranks among the most trusted and regulated brokers. This makes it an attractive option for traders prioritizing security and regulatory oversight in their broker selection process.

Important Notice

XTB operates as a global financial services provider with offices in 15 countries. Regulatory conditions may vary significantly across different jurisdictions. Traders should verify the specific regulatory status and available services in their region before opening an account. Offerings and protections may differ based on local regulatory requirements.

This evaluation is based on publicly available market data, user feedback from platforms like Trustpilot, and industry analysis current as of 2025. The assessment aims to provide objective analysis while acknowledging that individual trading experiences may vary. These variations depend on account type, region, and trading strategy. Potential clients should conduct their own research and consider their specific trading needs before making any decisions.

Rating Framework

Broker Overview

XTB has established itself as a prominent player in the global financial services sector with more than two decades of operational experience. Founded in the early 2000s, the company has evolved from a regional broker into a multinational financial services provider. The broker maintains a significant international footprint. The broker's expansion across 15 countries demonstrates its commitment to serving diverse global markets while maintaining consistent service standards and regulatory compliance.

The company operates on a comprehensive business model that encompasses multiple asset classes and trading instruments. XTB's primary focus extends beyond traditional forex trading. The broker includes contracts for difference (CFDs), individual stocks, exchange-traded funds (ETFs), commodities, indices, and cryptocurrency instruments. This diversified approach positions XTB as a one-stop solution for traders seeking exposure to various financial markets through a single platform.

XTB's technological infrastructure centers around three primary trading platforms designed to meet different user preferences and trading styles. The flagship xStation 5 represents the broker's proprietary web-based platform. This platform offers advanced charting capabilities and comprehensive market analysis tools. The xStation Mobile application extends this functionality to mobile devices, ensuring traders maintain market access regardless of location. Additionally, the integration of MetaTrader 4 provides access to the industry's most widely recognized trading platform. This platform comes complete with automated trading capabilities and extensive third-party tool compatibility. According to industry analysis, this xtb review confirms that the broker's multi-platform approach successfully addresses the diverse needs of modern traders while maintaining consistent execution standards across all offerings.

Regulatory Framework: While specific regulatory details require verification based on regional operations, XTB is recognized as one of the most regulated brokers in the industry. The broker operates across multiple jurisdictions with appropriate licensing.

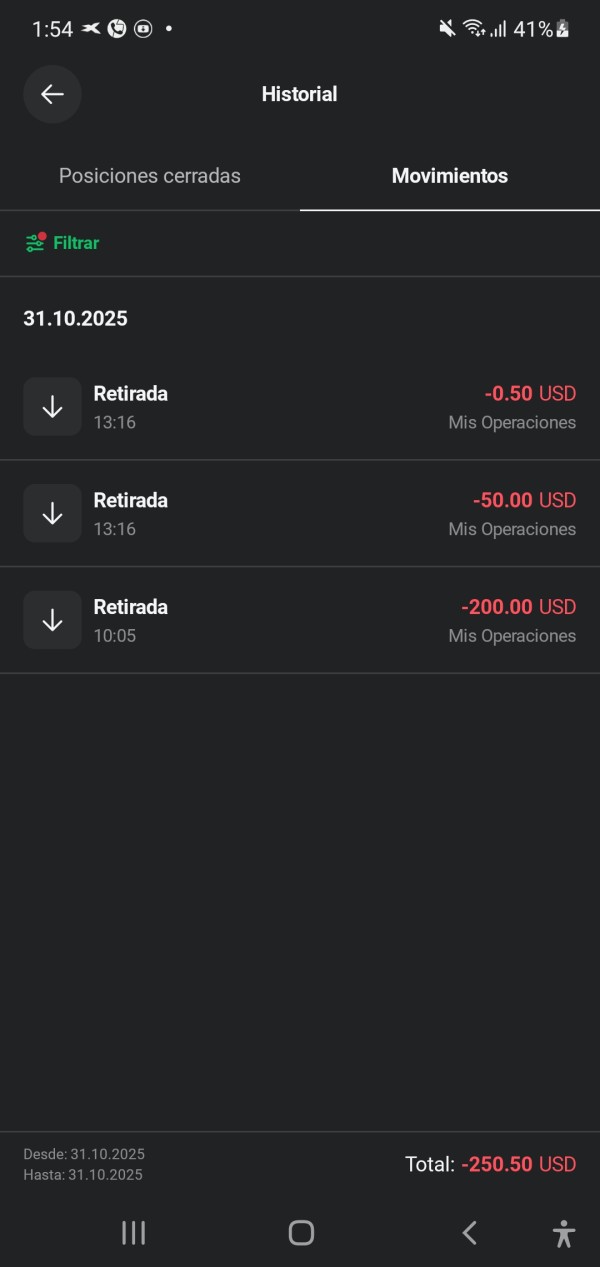

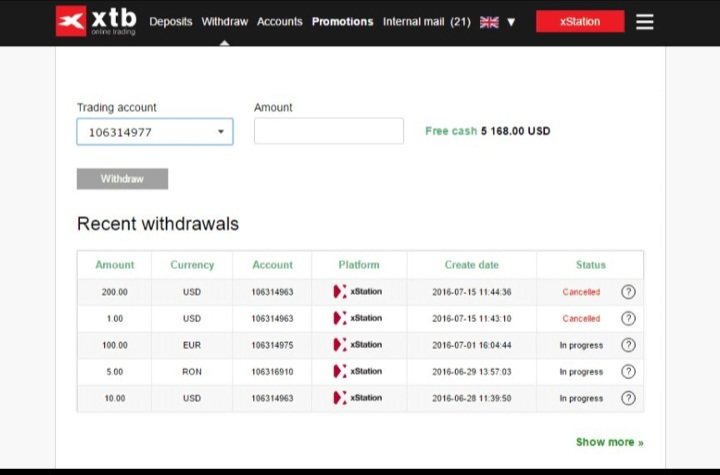

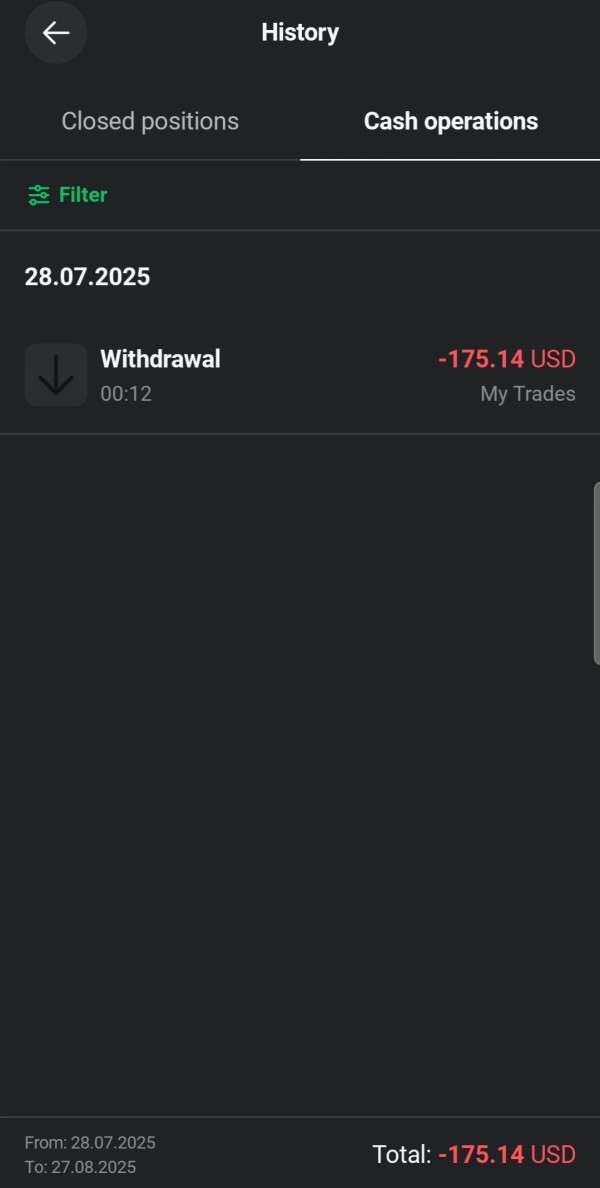

Deposit and Withdrawal Methods: Specific payment methods and processing times are not detailed in available materials. This information requires direct verification with the broker for current options and procedures.

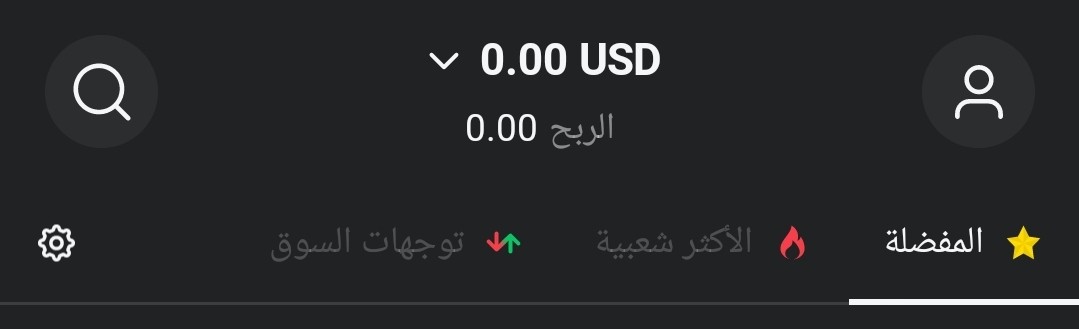

Minimum Deposit Requirements: XTB distinguishes itself with zero minimum deposit requirements. This makes the platform accessible to traders with varying capital levels and removes traditional barriers to entry.

Promotional Offers: Current bonus and promotional structures are not specified in available documentation. These details would need direct confirmation from the broker's official channels.

Tradeable Assets: The broker offers an extensive range of over 4,500 financial instruments. These include major and minor forex pairs, CFDs on various underlying assets, individual stocks from global exchanges, ETFs, commodities, major indices, and cryptocurrency instruments.

Cost Structure: Specific information regarding spreads, commissions, and fee structures requires direct verification with the broker. Detailed pricing information is not available in current materials.

Leverage Ratios: Leverage specifications are not detailed in available materials. These would vary based on regulatory jurisdiction and account type.

Platform Options: XTB provides three primary trading platforms: xStation 5 (web-based), xStation Mobile (mobile application), and MetaTrader 4. These platforms cater to different trading preferences and technical requirements.

Regional Restrictions: Specific geographical limitations are not detailed in available materials. These would depend on local regulatory requirements and licensing agreements.

Customer Support Languages: The specific range of supported languages for customer service is not detailed in current materials. This comprehensive xtb review indicates that support availability likely varies by region and regulatory jurisdiction.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

XTB's account structure demonstrates a commitment to accessibility and user-friendly conditions. This is particularly evident in their zero minimum deposit policy. This approach eliminates one of the most significant barriers that prevent new traders from entering the forex and CFD markets. Unlike many competitors who require substantial initial deposits, XTB allows traders to begin with any amount they feel comfortable investing. This makes it particularly attractive for beginners who want to start with smaller capital allocations.

The absence of minimum deposit requirements reflects XTB's confidence in their service quality. It also shows their understanding that trader retention depends on platform performance rather than artificial barriers. This policy also allows experienced traders to test the platform's capabilities without committing significant capital initially. However, specific details regarding account types, tier structures, and any potential differences in service levels based on account size are not clearly outlined in available materials.

While the zero minimum deposit policy represents a significant advantage, the overall account conditions evaluation is limited by the lack of detailed information. This includes specific account features, Islamic account availability, and any special account categories that might be available. The scoring reflects the positive impact of accessible entry requirements while acknowledging the need for more comprehensive information about the complete account structure and associated benefits.

This xtb review recognizes that account conditions extend beyond deposit requirements. These include factors such as account opening procedures, verification processes, and ongoing account maintenance requirements. These are areas where additional transparency would strengthen the overall offering.

XTB's tools and resources offering represents one of the broker's strongest competitive advantages. The broker provides over 4,500 financial instruments available for trading across multiple asset classes. This extensive selection positions XTB among the most comprehensive brokers in terms of market access. It allows traders to diversify their portfolios and explore various trading opportunities within a single platform environment.

The breadth of available instruments spans traditional forex pairs, contracts for difference on various underlying assets, individual stocks from major global exchanges, exchange-traded funds, commodities, indices, and cryptocurrency instruments. This diversity enables traders to implement sophisticated trading strategies. It also allows them to hedge positions across different markets and respond to various market conditions with appropriate instruments.

The quality of trading tools is further enhanced by XTB's multi-platform approach. The broker offers xStation 5 with its advanced charting capabilities, xStation Mobile for on-the-go trading, and MetaTrader 4 for traders preferring industry-standard functionality. Each platform provides access to the full range of available instruments while maintaining consistent execution standards and market data quality.

However, the evaluation is somewhat limited by the lack of specific information about research resources, educational materials, market analysis tools, and automated trading capabilities. While the instrument selection is impressive, comprehensive trading success often depends on the quality of supporting resources. These include economic calendars, news feeds, technical analysis tools, and educational content for skill development.

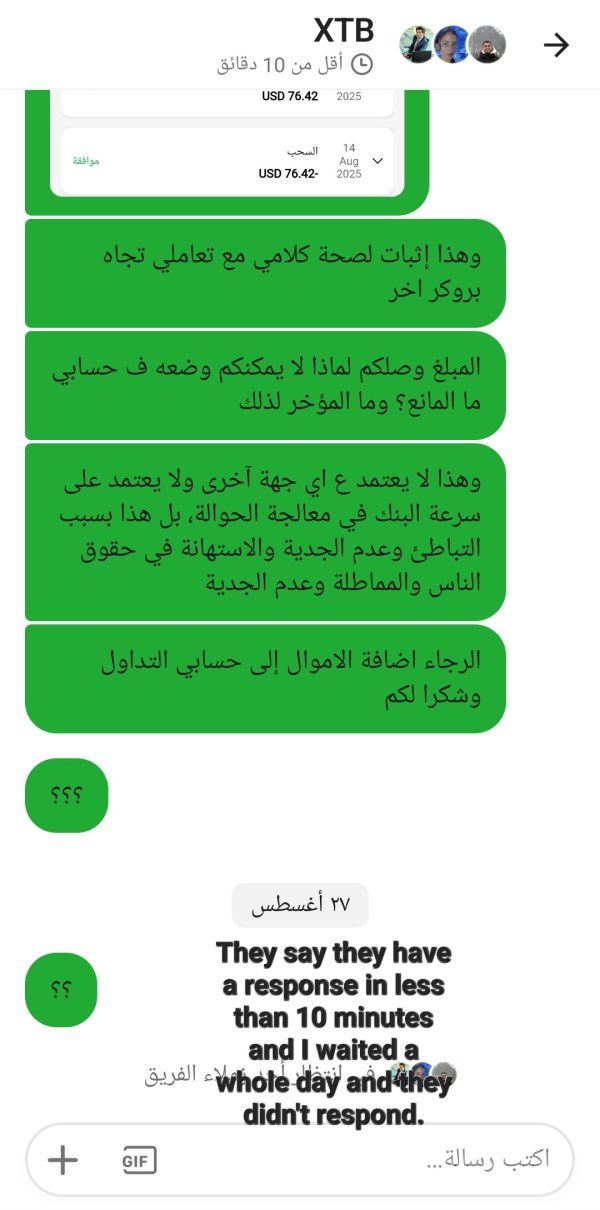

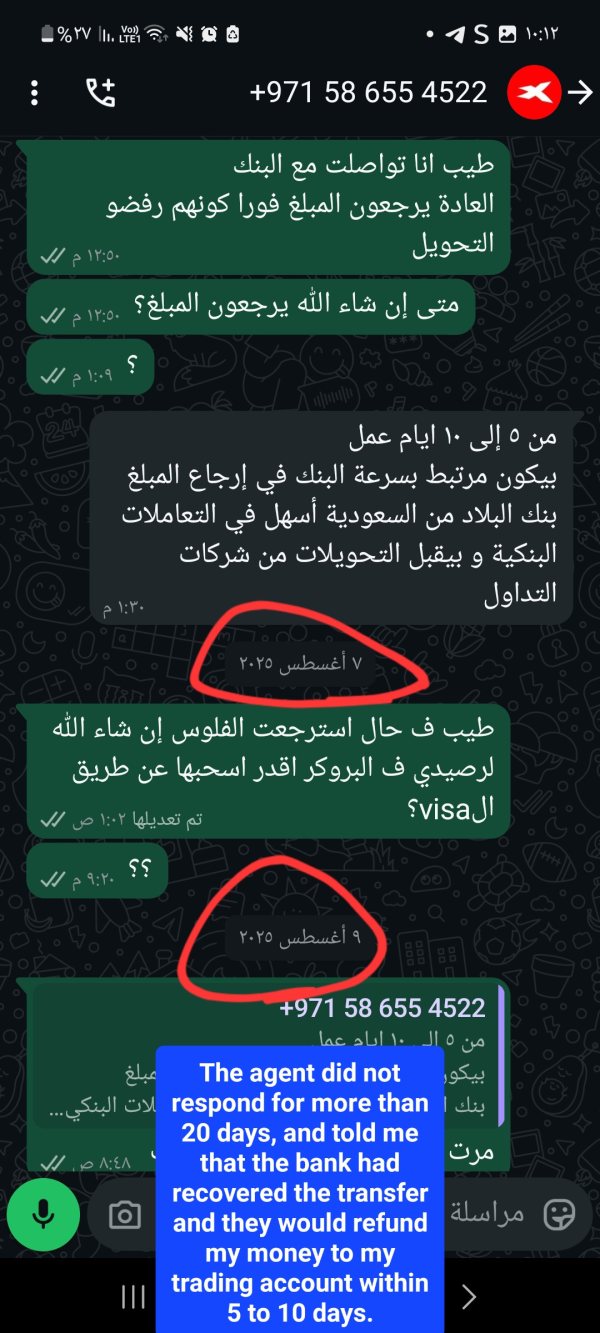

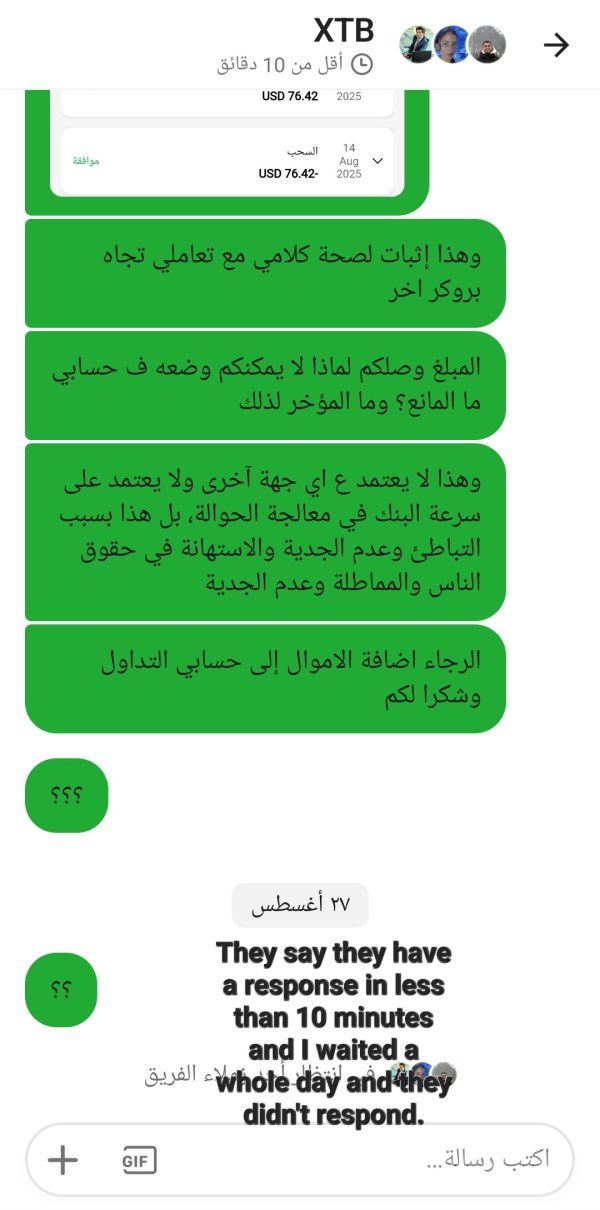

Customer Service and Support Analysis (7/10)

Customer service evaluation for XTB is based primarily on user feedback available through platforms like Trustpilot. The broker maintains a presence on these platforms and receives customer reviews. The available feedback suggests generally positive experiences with customer service interactions. However, specific metrics regarding response times, resolution rates, and service quality depth are not detailed in current materials.

The global nature of XTB's operations across 15 countries suggests a substantial customer service infrastructure capable of supporting diverse international clients. However, specific information about available communication channels, service hours, multilingual support capabilities, and regional service variations requires direct verification with the broker.

Effective customer service in forex and CFD trading encompasses not only problem resolution but also account opening assistance, platform guidance, technical support, and trading-related inquiries. The complexity of financial markets and trading platforms often requires knowledgeable support staff. These staff members must be capable of addressing both technical and trading-specific questions.

The moderate scoring reflects the positive user feedback available while acknowledging the lack of detailed information about service structure, availability, and specific performance metrics. Professional traders often require rapid response times and knowledgeable support. This is particularly important during volatile market conditions when technical issues can significantly impact trading outcomes.

Trading Experience Analysis (8/10)

XTB's trading experience benefits significantly from its multi-platform approach and the variety of available trading instruments. The broker's proprietary xStation platforms are designed to provide intuitive user interfaces while maintaining professional-grade functionality. This appeals to both new traders seeking simplicity and experienced traders requiring advanced features.

The inclusion of MetaTrader 4 alongside proprietary platforms demonstrates XTB's understanding of trader preferences. It also shows the importance of platform choice in trading success. MT4's widespread adoption in the industry means many traders are already familiar with its functionality. This reduces the learning curve and enables immediate productivity.

User feedback suggests positive experiences with platform stability and functionality. However, specific performance metrics such as execution speeds, slippage rates, and platform uptime are not detailed in available materials. The trading experience encompasses not only platform functionality but also order execution quality, market access during volatile conditions, and the reliability of price feeds.

Mobile trading capability through xStation Mobile addresses the modern requirement for market access regardless of location. This enables traders to monitor positions, execute trades, and respond to market developments while away from their primary trading setup. The effectiveness of mobile platforms often determines trader satisfaction. This is particularly true for those managing positions throughout the trading day.

This xtb review acknowledges that trading experience evaluation would benefit from more detailed information. This includes execution statistics, platform performance metrics, and specific user experience data across different market conditions.

Trust and Safety Analysis (9/10)

XTB's reputation as one of the most regulated and trusted brokers in the industry represents a significant competitive advantage. This is particularly important for traders prioritizing security and regulatory oversight in their broker selection process. The broker's operation across multiple jurisdictions with appropriate regulatory compliance demonstrates a commitment to maintaining high standards and protecting client interests.

The company's longevity in the financial services sector, with over 20 years of operational experience, provides additional credibility. It suggests successful navigation of various market cycles and regulatory changes. Established brokers with extended operational histories often demonstrate greater stability and reliability compared to newer market entrants.

However, the evaluation is limited by the lack of specific information about regulatory bodies, license numbers, client fund protection measures, segregation policies, and compensation schemes. These details are crucial for traders seeking to verify regulatory status. They also help traders understand the specific protections available in their jurisdiction.

The high scoring reflects the industry recognition of XTB's regulatory compliance and trustworthiness. It also acknowledges that complete evaluation would require verification of specific regulatory details, fund protection mechanisms, and any regulatory actions or compliance issues that might affect trader confidence.

User Experience Analysis (8/10)

User experience evaluation for XTB is based on available feedback indicating generally positive platform interactions and user satisfaction. The broker's design philosophy appears to balance functionality with usability. This creates platforms that serve both beginning traders seeking simplicity and experienced traders requiring advanced capabilities.

The multi-platform approach contributes positively to user experience by allowing traders to choose their preferred trading environment. This maintains consistent access to markets and instruments. This flexibility accommodates different trading styles, technical requirements, and personal preferences without compromising functionality.

XTB's positioning as suitable for both beginners and experienced traders suggests successful user interface design that scales with trader development. Effective platforms should support learning and skill development. They should also provide the sophistication required for advanced trading strategies.

However, comprehensive user experience evaluation would benefit from more detailed information about account opening processes, verification procedures, fund management experiences, and common user challenges. The scoring reflects positive available feedback while recognizing the need for more comprehensive user experience data across different account types and usage patterns.

Conclusion

This comprehensive xtb review reveals a well-established and regulated broker that successfully serves diverse trader needs through accessible account conditions and extensive market access. XTB's zero minimum deposit requirement and over 4,500 available trading instruments create an attractive proposition for both new and experienced traders. The broker provides a reliable platform for forex, CFD, and multi-asset trading.

The broker's strengths lie in its regulatory reputation, technological infrastructure offering multiple platform choices, and commitment to accessibility without traditional barriers to entry. XTB appears well-suited for beginners seeking a trustworthy entry point into financial markets. It also serves experienced traders requiring comprehensive instrument selection and professional-grade platforms.

While this evaluation identifies XTB as a competitive option in the brokerage landscape, potential traders should verify specific details about regulatory status in their jurisdiction, current pricing structures, and available services before making account opening decisions. The broker's established market presence and positive industry recognition support its consideration for traders prioritizing reliability and regulatory compliance in their broker selection process.