Regarding the legitimacy of FXCM forex brokers, it provides ASIC, FCA, CYSEC, ISA and WikiBit, (also has a graphic survey regarding security).

Is FXCM safe?

Pros

Cons

Is FXCM markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

STRATOS TRADING PTY. LIMITED

Effective Date: Change Record

2007-05-15Email Address of Licensed Institution:

compliance@fxcm.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.fxcm.com/au/Expiration Time:

--Address of Licensed Institution:

STRATOS TRADING PTY. LIMITED 'PART' SE 2 L 12 530 COLLINS ST MELBOURNE VIC 3000Phone Number of Licensed Institution:

1800109751Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Stratos Markets Limited

Effective Date:

2003-05-27Email Address of Licensed Institution:

compliance@fxcm.comSharing Status:

Website of Licensed Institution:

www.fxcm.com/uk/, www.tradu.com/ukExpiration Time:

--Address of Licensed Institution:

125 Old Broad Street Ninth Floor London EC2N 1AR UNITED KINGDOMPhone Number of Licensed Institution:

+44 02073984050Licensed Institution Certified Documents:

CYSEC Market Making License (MM) 20

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Stratos Europe Ltd

Effective Date:

2020-11-23Email Address of Licensed Institution:

info@fxcm.euSharing Status:

Website of Licensed Institution:

http://fxcm.com/eu, http://fxcm.com/fr, http://fxcm.com/it, http://fxcm.com/gr, http://fxcm.com/espana, http://www.fxcm.com/de, https://www.fxcm.com/pl/, https://www.fxcm.com/nl/, https://www.fxcm.com/se, https://www.tradu.com/eu, https://www.fxcm.com/pro/Expiration Time:

--Address of Licensed Institution:

Neas Engomis 33, Units 310, 312 and 315, the Doms Assets Business Centre, Engomi, 2409, Nicosia, CyprusPhone Number of Licensed Institution:

+357 22 022 619Licensed Institution Certified Documents:

ISA Securities Trading License (AGN)

The Israel Securities Authority

The Israel Securities Authority

Current Status:

RegulatedLicense Type:

Securities Trading License (AGN)

Licensed Entity:

STRATOS LIGHT LTD

Effective Date:

2016-10-31Email Address of Licensed Institution:

info@fxcm.co.ilSharing Status:

No SharingWebsite of Licensed Institution:

www.fxcm.com/ilExpiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

03-5101317Licensed Institution Certified Documents:

Is FXCM A Scam?

Introduction

FXCM, or Forex Capital Markets, is a prominent player in the online forex trading landscape, established in 1999. With its headquarters in London, UK, FXCM has positioned itself as a global broker offering various trading services, including forex, CFDs, and commodities. Given the vast array of forex brokers available, traders must exercise caution when selecting a platform, as the industry has seen its fair share of fraudulent activities and untrustworthy entities. This article aims to provide a comprehensive assessment of FXCM, evaluating its safety, legitimacy, and overall reputation in the forex market. The investigation draws on multiple sources, including regulatory filings, customer reviews, and expert analyses, utilizing a structured framework to ensure an objective evaluation.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its trustworthiness. FXCM is regulated by several top-tier authorities, including the UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). This multi-regulatory oversight provides a robust framework for ensuring compliance and protecting traders' interests.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 217689 | UK | Verified |

| ASIC | 309763 | Australia | Verified |

| CySEC | 392/20 | Cyprus | Verified |

| FSCA | 46534 | South Africa | Verified |

FXCM's adherence to regulations from these authorities indicates a commitment to maintaining high standards of conduct and transparency. However, it is important to note that FXCM has faced regulatory scrutiny in the past. In 2017, the firm was penalized by the Commodity Futures Trading Commission (CFTC) for fraudulent activities, leading to its exit from the U.S. market. Despite this troubled history, FXCM has made significant strides to rebuild its reputation, implementing stricter compliance measures and enhancing its regulatory framework.

Company Background Investigation

FXCM was founded in 1999 in New York and quickly became a leader in the retail forex trading space. The company expanded internationally, establishing a strong presence in various markets. However, it faced significant challenges in 2017 when its former parent company, Global Brokerage, Inc., filed for bankruptcy following a series of regulatory issues. FXCM is now owned by Jefferies Financial Group, a reputable investment bank, which has contributed to its stability and growth.

The management team at FXCM comprises experienced professionals from the finance industry, with a focus on regulatory compliance and customer service. This expertise is essential in navigating the complex landscape of forex trading and ensuring that the company adheres to the highest standards.

In terms of transparency, FXCM provides detailed information about its operations, including its regulatory status, trading conditions, and customer support. This level of openness is a positive indicator of the company's commitment to building trust with its clients.

Trading Conditions Analysis

FXCM offers a variety of trading accounts, including standard and active trader accounts, with a low minimum deposit requirement of $50. The broker operates on a spread-based pricing model, which means that traders pay the difference between the buying and selling price rather than a separate commission.

| Fee Type | FXCM | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.3 pips | 1.0 - 1.5 pips |

| Commission Model | None (standard) | Varies (0.1 - 0.5% per trade) |

| Overnight Interest Range | Varies | Varies |

While FXCM's spreads are competitive, they can be higher than some industry peers, particularly for standard accounts. The absence of a raw spread or ECN account option may limit transparency regarding trading costs. Additionally, FXCM imposes a $50 inactivity fee for accounts that remain dormant for over a year, which is a common practice in the industry but can be seen as a drawback for long-term traders.

Customer Funds Security

The security of client funds is a paramount concern for any trader. FXCM implements several measures to ensure the safety of its clients' assets. Client funds are held in segregated accounts, separate from the company's operational funds, which protects them in the event of financial difficulties.

Furthermore, FXCM is a member of the Financial Services Compensation Scheme (FSCS) in the UK, which provides coverage of up to £85,000 for eligible clients in the event of broker insolvency. The broker also offers negative balance protection, ensuring that clients cannot lose more than their account balance.

Despite these safeguards, FXCM has faced scrutiny in the past regarding its handling of client funds. The 2017 regulatory issues raised concerns about the company's practices, but since then, FXCM has made significant improvements in its compliance and fund management practices.

Customer Experience and Complaints

Customer feedback is a critical indicator of a brokers reliability. FXCM generally receives positive reviews for its customer service and trading platforms. However, there are common complaints regarding high spreads, particularly during volatile market conditions, and the lack of certain advanced trading features.

| Complaint Type | Severity | Company Response |

|---|---|---|

| High Spreads | Medium | Acknowledged; improvements made |

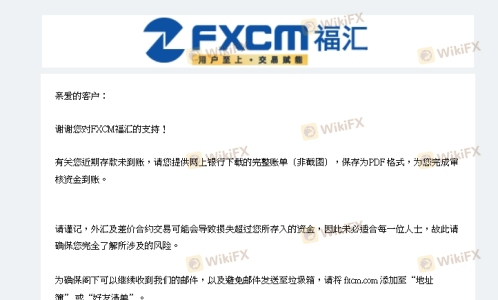

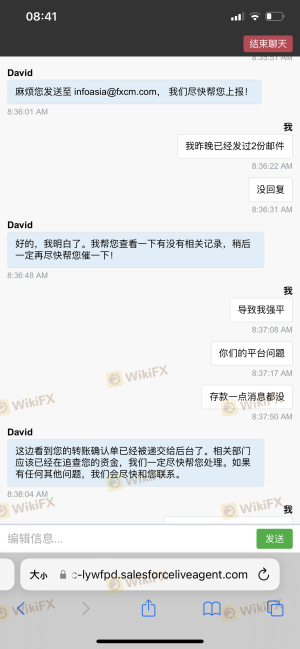

| Withdrawal Delays | High | Addressed; faster processing times implemented |

| Limited Asset Variety | Medium | Ongoing discussions about expanding offerings |

One notable case involved a trader who reported significant delays in withdrawals, which raised concerns about the broker's processing efficiency. FXCM responded by enhancing its withdrawal processes, leading to improved turnaround times. Overall, while some complaints exist, the company's responsiveness and commitment to addressing issues are commendable.

Platform and Trade Execution

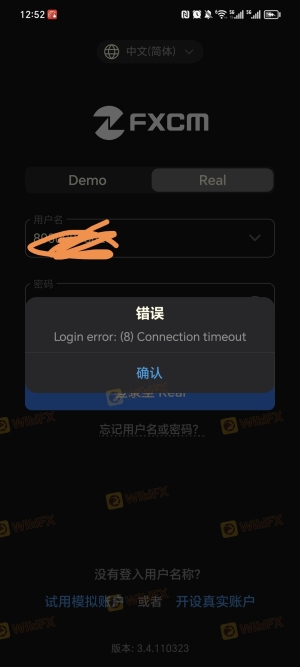

FXCM offers multiple trading platforms, including its proprietary Trading Station and MetaTrader 4 (MT4). The Trading Station is known for its user-friendly interface, advanced charting tools, and real-time market data. However, some users have reported occasional stability issues and a lack of customization options.

The quality of order execution is another critical aspect of trading. FXCM claims to provide fast execution speeds, with an average of 0.019 seconds. The broker also publishes slippage statistics, indicating that a majority of orders are executed with little to no slippage. However, traders should remain vigilant, as reports of rejected orders or significant slippage during high volatility periods have been noted.

Risk Assessment

Using FXCM involves several risks that traders should be aware of. The broker's history of regulatory issues and the potential for high spreads during volatile market conditions are key concerns.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Past issues raise concerns but improvements noted |

| Trading Costs | Medium | Higher spreads can impact profitability |

| Platform Stability | Medium | Occasional stability issues reported |

To mitigate these risks, traders should conduct thorough research and consider using demo accounts to familiarize themselves with the platform. Additionally, understanding the fee structure and potential trading costs is essential for effective risk management.

Conclusion and Recommendations

In conclusion, FXCM is a well-established broker with a long history in the forex market. While it has faced significant challenges in the past, the company has made substantial efforts to rebuild its reputation and enhance its regulatory compliance. FXCM operates under stringent regulations, providing a level of security and protection for client funds.

However, potential clients should remain cautious and consider the broker's higher spreads and limited asset offerings. For beginners and intermediate traders, FXCM offers a solid platform with extensive educational resources. Advanced traders seeking a wider selection of instruments and lower trading costs may want to explore alternative brokers.

Overall, FXCM is not a scam; it is a legitimate broker with a commitment to improving its services and ensuring client safety. Traders should assess their individual needs and risk tolerance before deciding to engage with FXCM or any other broker in the forex market.

Is FXCM a scam, or is it legit?

The latest exposure and evaluation content of FXCM brokers.

FXCM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXCM latest industry rating score is 9.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 9.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.