CBCX 2025 Review: Everything You Need to Know

Executive Summary

CBCX is a forex broker that started in 2011. It offers trading services across many different types of investments. While some users have given positive feedback about the broker, this cbcx review shows major concerns about whether we can trust it and how clear it is about following rules. CBCX gives high leverage up to 1:500, supports both MetaTrader 4 and MetaTrader 5 platforms, and lets you trade over 500 different instruments including forex, precious metals, commodities, and indices.

The broker focuses on experienced traders who want high leverage and many trading options. But potential clients should know that CBCX has faced serious problems, including customer data breaches and questions about whether it's legitimate. With a trust score of 46 and mixed user reviews, CBCX creates a complicated picture for traders who might want to use it. The broker offers good trading conditions with spreads starting from zero and 24/7 customer support, but the unclear regulations and security problems make it a risky choice that needs careful thought.

Important Notice

CBCX works through several regional offices in the UK, South Africa, Singapore, and Mauritius. However, it doesn't clearly show specific regulatory license numbers in available documents, which may hurt user trust in different areas. This cbcx review is based on detailed analysis of user feedback, regulatory information, and market data available when we wrote this. Potential clients should do their own research and check current regulatory status before making any investment decisions.

Rating Framework

Broker Overview

CBCX was founded in 2011 and has become a multi-asset broker with headquarters in the United Kingdom. The company runs additional offices in South Africa, Singapore, and Mauritius, positioning itself as a global trading services provider. CBCX's business model focuses on giving access to international financial markets through advanced trading platforms, serving mainly retail and institutional clients who want diverse investment opportunities.

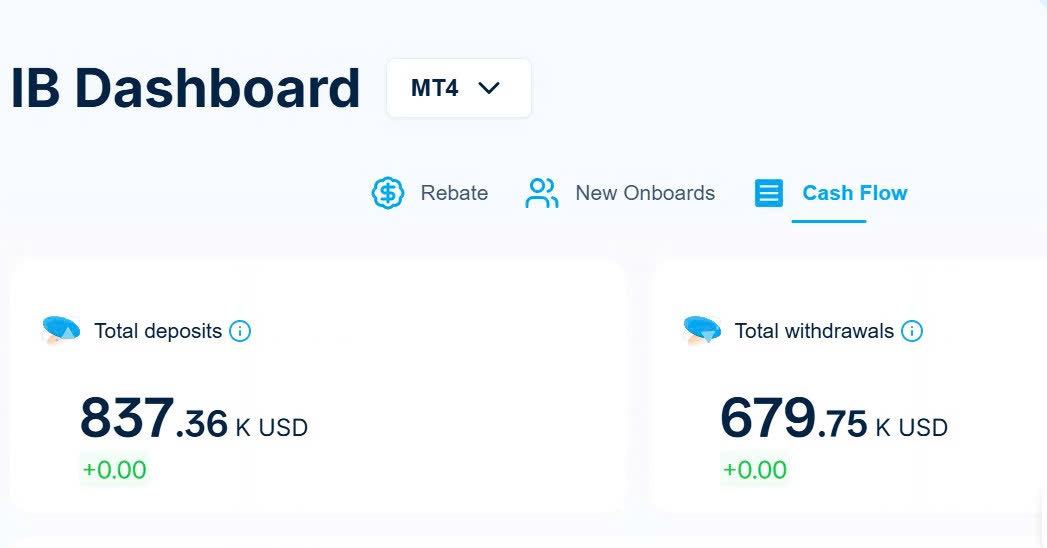

The broker's main business centers on offering trading services across major asset classes including foreign exchange, precious metals, commodities, stock indices, and individual stocks. CBCX emphasizes its liquidity provision services and has been recognized by BrokersView as the 2025 Best Liquidity Provider, showing some level of industry recognition for its market-making abilities.

CBCX supports both MetaTrader 4 and MetaTrader 5 platforms, giving traders familiar and strong trading environments. The broker offers access to over 500 trading instruments, making it attractive to traders who prefer portfolio diversification. According to available information, CBCX claims regulatory oversight from FCA and FSCA, though specific license numbers and detailed regulatory information remain unclear in public documentation.

Regulatory Regions: CBCX claims regulatory supervision from the Financial Conduct Authority (FCA) and Financial Sector Conduct Authority (FSCA). However, specific license numbers are not clearly shown in available materials.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available documentation.

Minimum Deposit Requirements: The minimum deposit requirements are not specified in current available information.

Bonuses and Promotions: Details about current bonus offerings and promotional programs are not mentioned in accessible materials.

Tradeable Assets: CBCX provides access to over 500 trading products across multiple asset classes including forex pairs, precious metals, commodities, stock indices, and individual stocks.

Cost Structure: The broker offers competitive spreads starting from zero, with trading costs rated as "C" level. Average slippage is reported at 3 points, which is considered reasonable for most trading strategies.

Leverage Ratios: CBCX offers high leverage up to 1:500. This makes it attractive to traders seeking significant market exposure with limited capital.

Platform Options: The broker supports MetaTrader 4 and MetaTrader 5 platforms, providing comprehensive charting tools and automated trading capabilities.

Regional Restrictions: Specific information about regional restrictions is not detailed in available documentation.

Customer Service Languages: Available customer service languages are not specified in current materials.

This cbcx review reveals that while the broker offers competitive trading conditions, significant information gaps exist regarding operational details.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

CBCX offers competitive account conditions that appeal to experienced traders seeking high leverage opportunities. The broker's standout feature is its maximum leverage of 1:500, which significantly exceeds many competitors and allows traders to amplify their market exposure. The spreads starting from zero represent a competitive advantage, particularly for scalping strategies and high-frequency trading approaches.

However, specific information about different account types, their respective features, and minimum deposit requirements remains unclear in available documentation. This lack of transparency regarding account structure details represents a significant concern for potential clients who need to understand the full cost structure before committing funds.

The account opening process details are not well-documented. This makes it difficult to assess how easy it is to get started with CBCX. Additionally, information about special account features such as Islamic accounts for Muslim traders is not available in current materials. While the basic trading conditions appear competitive, the lack of detailed account information prevents a higher rating in this category.

The cbcx review of account conditions suggests that while the broker offers attractive leverage and spread conditions, the transparency issues regarding account details limit its overall appeal to cautious traders.

CBCX demonstrates strength in its trading tools and resources offering, primarily through its support for both MetaTrader 4 and MetaTrader 5 platforms. These industry-standard platforms provide traders with comprehensive charting capabilities, technical analysis tools, and automated trading functionality through Expert Advisors (EAs).

The broker's access to over 500 trading instruments across multiple asset classes represents a significant resource for traders seeking portfolio diversification. This extensive product range includes major and minor forex pairs, precious metals, commodities, and stock indices, providing ample opportunities for various trading strategies.

CBCX also offers MAM/PAMM account management services, which can be valuable for both money managers and investors seeking professional account management. This feature demonstrates the broker's commitment to serving both retail and institutional clients with sophisticated trading needs.

However, specific information about research and analysis resources, educational materials, and market insights is limited in available documentation. While the broker mentions market news and educational content on its platform, detailed information about the quality and depth of these resources is not readily available, preventing a perfect score in this category.

Customer Service and Support Analysis (Score: 6/10)

CBCX advertises 24/7 customer support availability, which is essential for forex trading given the global nature of currency markets. This round-the-clock support commitment suggests the broker understands the needs of international traders operating across different time zones.

However, user feedback regarding service quality appears mixed based on available information. While some users have provided positive reviews, others have expressed concerns about the overall service experience. The lack of specific information about response times, available communication channels, and multilingual support capabilities limits the ability to fully assess the customer service quality.

The broker's customer support infrastructure details, including whether support is available via phone, live chat, email, or other channels, are not clearly specified in available materials. Additionally, information about the expertise level of support staff and their ability to handle complex trading-related inquiries is not documented.

Given the mixed user feedback and limited transparency about support infrastructure, CBCX's customer service receives a moderate rating that reflects both the 24/7 availability commitment and the concerns raised by some users about service quality consistency.

Trading Experience Analysis (Score: 7/10)

The trading experience with CBCX shows several positive aspects based on available performance data. The average trading speed of 480 milliseconds is competitive and should satisfy most trading strategies, including those requiring quick order execution. This execution speed is particularly important for scalping and day trading approaches where timing is critical.

The reported average slippage of 3 points is reasonable and within acceptable ranges for most trading conditions. Combined with spreads starting from zero, this creates a favorable trading environment for cost-conscious traders. The broker's recognition as the 2025 Best Liquidity Provider by BrokersView suggests adequate liquidity provision, which should contribute to smooth order execution.

The support for both MT4 and MT5 platforms ensures traders have access to familiar and robust trading environments with comprehensive functionality. These platforms offer advanced charting, technical analysis tools, and automated trading capabilities that enhance the overall trading experience.

However, specific information about platform stability, mobile trading experience, and advanced trading features is limited in available documentation. Additionally, user feedback about the overall trading experience varies, with some expressing satisfaction while others have raised concerns about the broker's reliability.

This cbcx review of trading experience indicates that while the technical performance metrics are competitive, the mixed user feedback prevents a higher rating.

Trust and Safety Analysis (Score: 4/10)

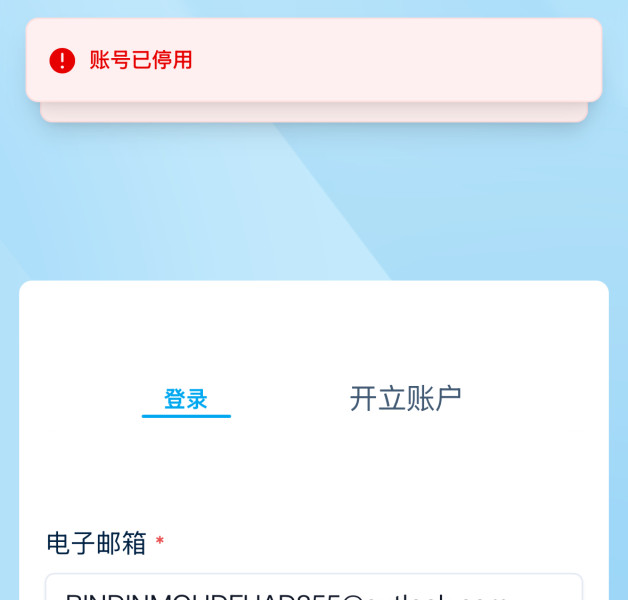

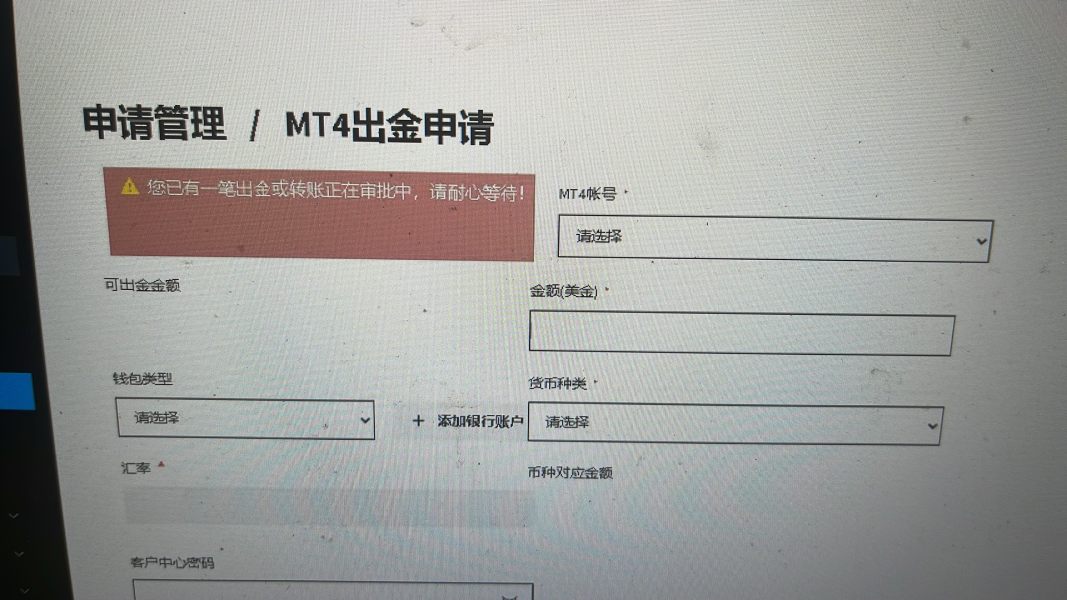

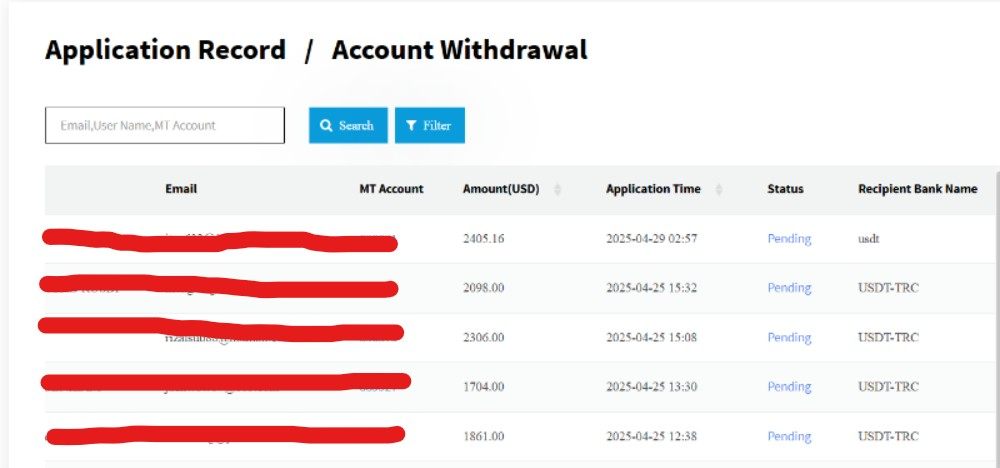

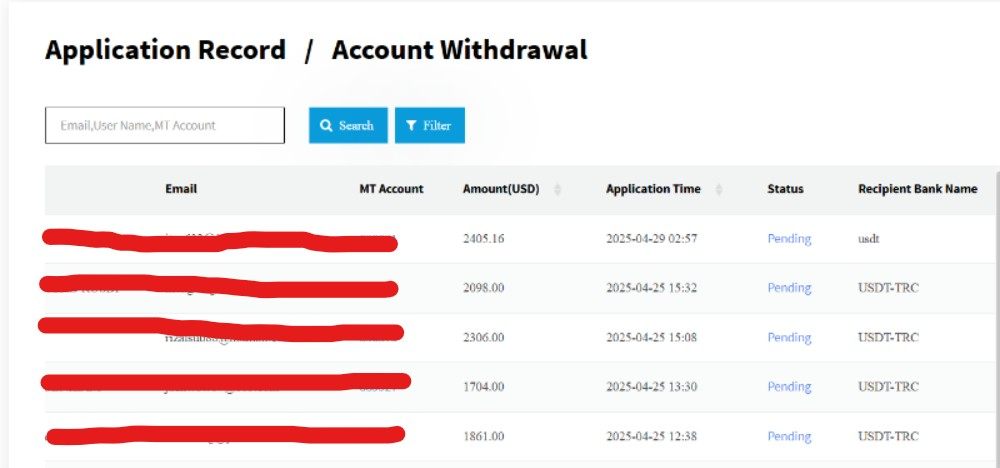

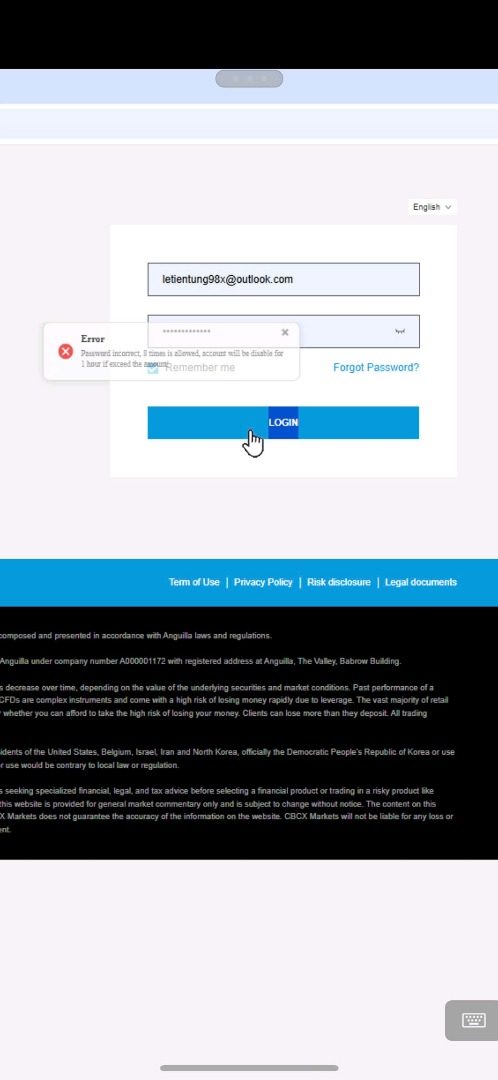

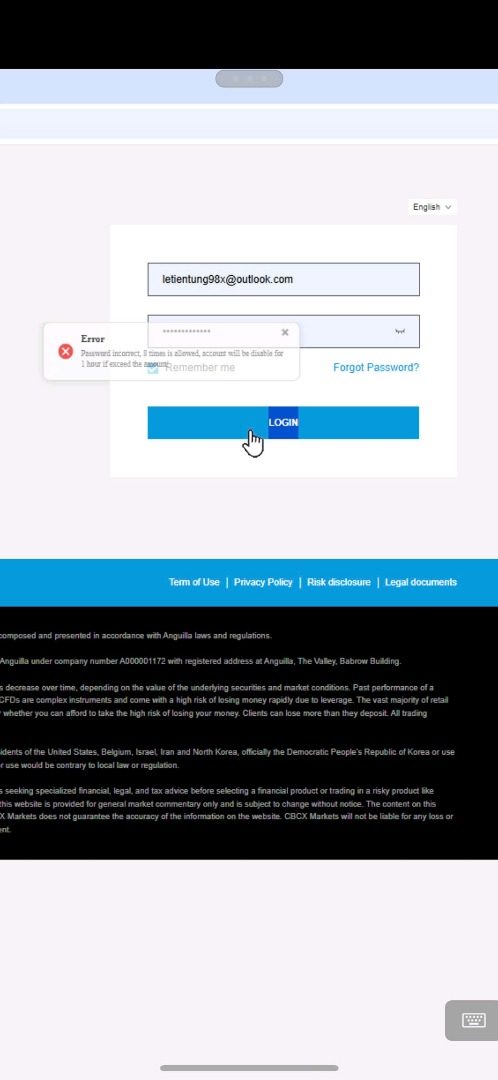

Trust and safety represent the most concerning aspects of CBCX's operations based on available information. The broker has experienced significant security issues, including a reported data breach that exposed customer information including personal data, phone numbers, emails, and contact addresses. This incident raises serious questions about the broker's data security practices and customer protection measures.

Regulatory transparency is another major concern. While CBCX claims oversight from FCA and FSCA, specific license numbers and detailed regulatory information are not clearly disclosed. This lack of regulatory transparency makes it difficult for potential clients to verify the broker's legitimate status and regulatory compliance.

User feedback regarding the broker's legitimacy shows mixed opinions, with some expressing concerns about CBCX's safety and authenticity. The trust score of 46 reflects these concerns and suggests that a significant portion of the trading community has reservations about the broker's reliability.

Despite being recognized as the 2025 Best Liquidity Provider by BrokersView, which provides some industry credibility, the data security issues and regulatory transparency concerns significantly impact the overall trust rating. The combination of these factors creates a high-risk environment for potential clients.

User Experience Analysis (Score: 5/10)

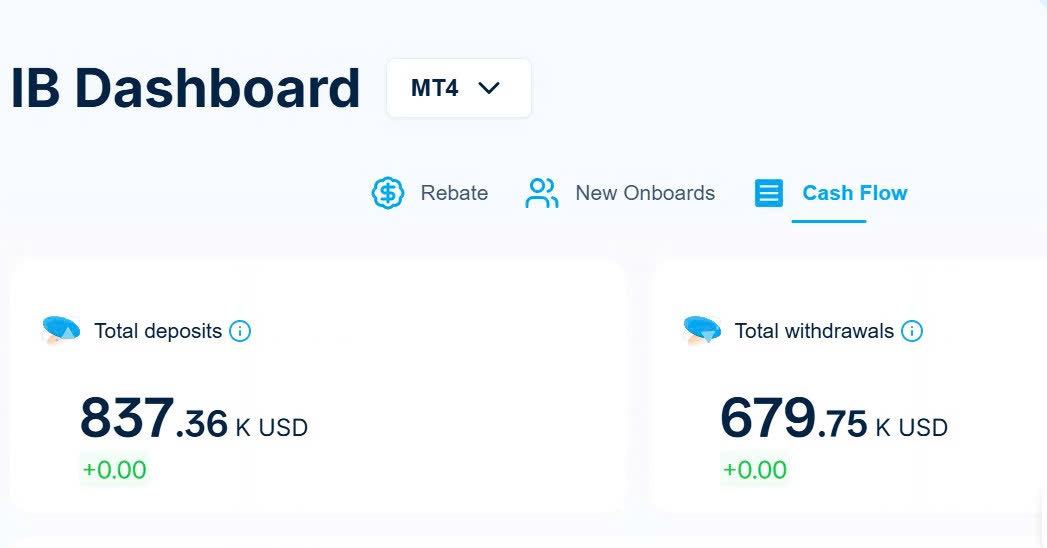

The overall user experience with CBCX presents a mixed picture based on available feedback and information. According to review data, the broker has received 9 positive reviews, 6 neutral reviews, and 7 exposure reviews, indicating a divided user base with varying experiences.

Positive aspects of the user experience include access to professional trading platforms (MT4 and MT5), competitive trading conditions with high leverage options, and a diverse range of trading instruments. These features appeal to experienced traders who value trading flexibility and advanced platform capabilities.

However, significant concerns about the broker's legitimacy and safety have negatively impacted user confidence. The data breach incident and regulatory transparency issues have created uncertainty among users about the security of their funds and personal information. This uncertainty is reflected in the mixed review pattern and moderate trust scores.

The lack of detailed information about the user onboarding process, account verification procedures, and fund management operations makes it difficult to assess the complete user journey. Additionally, specific feedback about platform usability, customer service responsiveness, and problem resolution effectiveness is limited in available documentation.

The user experience rating reflects both the positive aspects of trading conditions and platform access, as well as the significant concerns about security and transparency that affect overall user satisfaction.

Conclusion

CBCX presents a complex profile as a forex broker with both attractive features and significant concerns. While the broker offers competitive trading conditions including high leverage up to 1:500, spreads starting from zero, and access to over 500 trading instruments through professional MT4 and MT5 platforms, serious trust and safety issues overshadow these advantages.

The broker is best suited for experienced traders who understand the risks involved and are attracted to high leverage opportunities and diverse trading products. However, the data security breach, regulatory transparency concerns, and mixed user feedback make CBCX a high-risk choice that requires careful consideration.

The main advantages include competitive trading conditions, professional platform access, and diverse asset offerings. The primary disadvantages center on trust and safety concerns, regulatory transparency issues, and inconsistent user experiences. Potential clients should conduct thorough due diligence and consider alternative brokers with stronger regulatory credentials and better security track records before making investment decisions.