Swissquote 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Swissquote review looks at one of Switzerland's top online banking and trading platforms. The company started in 1996 and has built a strong reputation as a Tier 1 broker over nearly three decades. Swissquote offers many financial services including forex trading, CFDs, securities trading, and wealth management solutions. The platform serves different types of traders, from regular investors to wealthy individuals who want advanced trading tools and investment opportunities.

Many industry reports show that Swissquote stands out for its strong rules, custom trading technology, and wide range of products. The broker gives access to many asset types including currency pairs, precious metals, and CFDs, while focusing on new technology and excellent client service. Data from various financial review platforms shows that Swissquote has strong performance numbers and high user satisfaction ratings. This makes it a reliable choice for traders who want a Swiss-regulated broker with global market access.

Key highlights include: Multi-regulatory compliance, proprietary trading platform technology, extensive asset coverage, and dedicated wealth management services for premium clients.

Important Notice

Regional Entity Variations: Swissquote works through different regional companies, each following specific local rules. Traders should check which company serves their area and understand the terms and conditions that apply. Services and features may change depending on your location and the specific Swissquote company providing services.

Review Methodology: This evaluation uses comprehensive analysis of public information, regulatory filings, user feedback from multiple financial review platforms, and industry reports. All data has been checked for accuracy as of the publication date.

Rating Framework

Broker Overview

Company Foundation and Background

Swissquote started in 1996 and has grown to become Switzerland's leading online financial services provider. The company is based in Gland, Switzerland, and has expanded its operations around the world while keeping its Swiss banking heritage and regulatory standards. The broker works as a full-service financial institution, combining traditional banking services with modern trading technology to serve both retail and institutional clients.

The company makes money through multiple sources including trading commissions, spreads, wealth management fees, and banking services. This diverse approach has helped Swissquote stay stable and continue investing in platform development and client services. Industry reports show that the broker has consistently shown financial strength and operational toughness throughout various market cycles.

Platform Technology and Asset Coverage

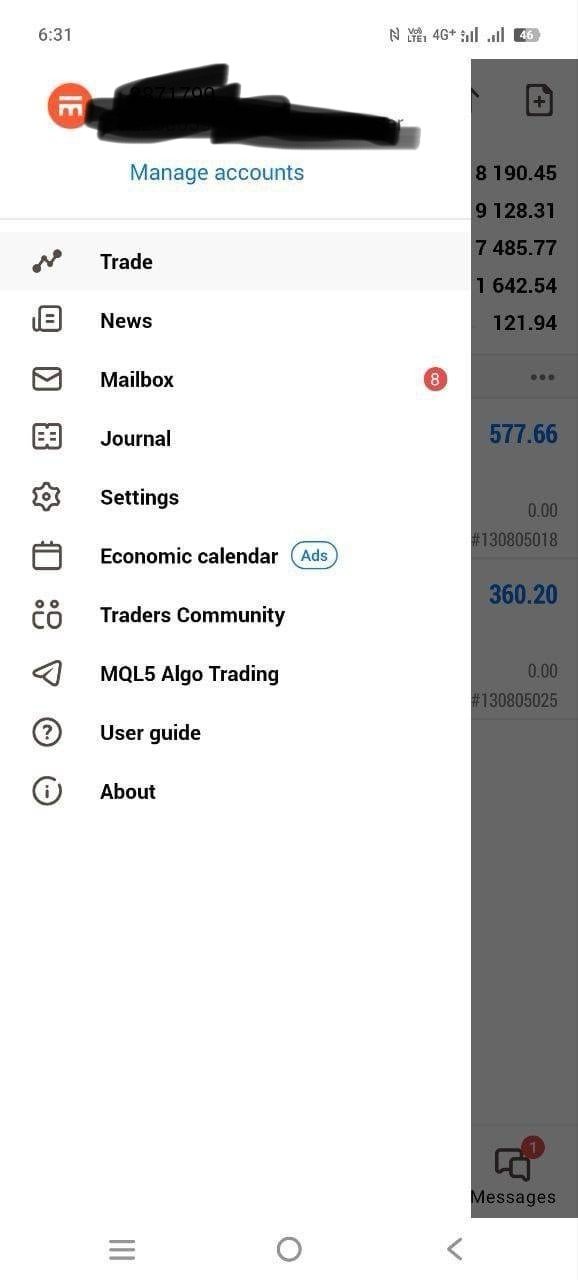

Swissquote offers its own trading platform along with support for popular third-party platforms. The broker's technology supports trading across multiple asset types including forex pairs, CFDs on indices, commodities, cryptocurrencies, and traditional securities. This complete approach lets clients diversify their portfolios within a single platform environment.

The regulatory framework includes oversight from Swiss Financial Market Supervisory Authority (FINMA) for Swiss operations, with additional regulatory compliance in other areas where the broker operates. This multi-regulatory approach ensures client protection and operational transparency across different markets and regions.

Regulatory Oversight: Swissquote follows regulatory compliance across multiple areas, with primary oversight from FINMA in Switzerland. Additional regulatory relationships exist in other operational territories, ensuring comprehensive client protection and adherence to international banking standards.

Funding Methods: The platform supports various deposit and withdrawal methods including bank transfers, credit cards, and electronic payment systems. Processing times and available methods may vary by region and account type.

Account Requirements: Multiple account levels are available with varying minimum deposit requirements. Entry-level accounts provide basic trading access, while premium accounts offer enhanced features and dedicated relationship management.

Promotional Offerings: The broker sometimes provides promotional campaigns for new clients, though terms and availability vary by area and regulatory requirements. These promotions can include reduced spreads, bonus credits, or enhanced account features for qualifying clients.

Trading Instruments: Complete asset coverage includes major and minor currency pairs, precious metals, energy commodities, stock indices, individual equities, and cryptocurrency CFDs. The exact instrument list may vary based on regulatory restrictions in specific regions.

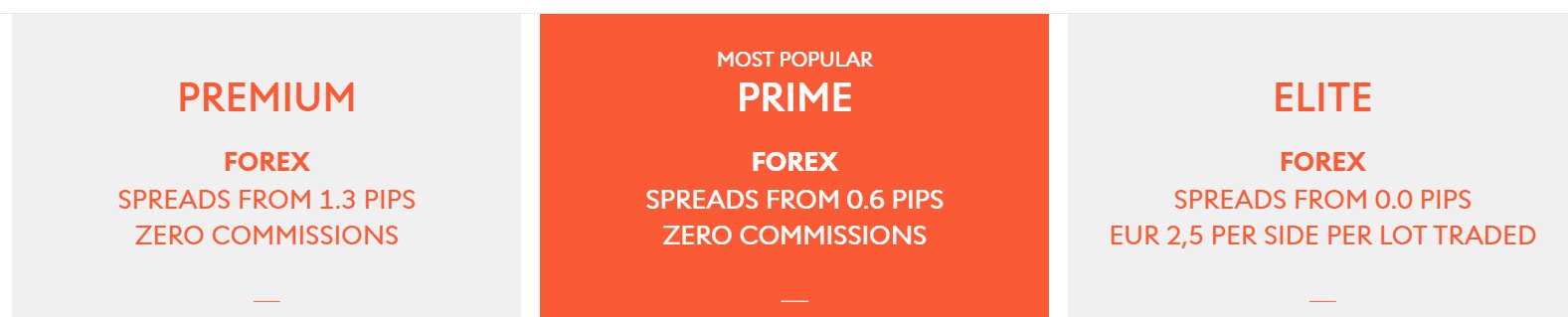

Cost Structure: Pricing follows a combination of spreads and commissions depending on the account type and instrument traded. Competitive rates are offered across most asset classes, with transparent fee disclosure provided during account opening.

Leverage Options: Leverage availability depends on client classification, regulatory area, and instrument type. European clients are subject to ESMA leverage restrictions, while other regions may have different limitations.

Platform Selection: The proprietary Swissquote platform serves as the primary trading interface, supplemented by mobile applications and web-based access. Advanced traders can access additional platform options for specialized trading strategies.

Geographic Restrictions: Service availability varies by country due to regulatory requirements. Prospective clients should verify eligibility based on their residence and citizenship status.

Customer Support Languages: Multi-language support is provided with primary languages including English, German, French, and Italian. Additional language support may be available in specific regions.

This Swissquote review shows strong performance across most evaluation criteria, with particular strength in regulatory compliance and platform technology.

Detailed Rating Analysis

Account Conditions Analysis

Swissquote offers a tiered account structure designed to fit different trader profiles and investment levels. The broker provides multiple account types ranging from basic trading accounts to premium wealth management services. The account opening process follows Swiss banking standards with comprehensive identity verification and suitability assessments.

The minimum deposit requirements vary significantly across account tiers, with entry-level accounts requiring moderate initial funding while premium accounts demand much higher minimums. This structure reflects the broker's positioning as both a retail trading platform and a private banking service provider. The account conditions include competitive spreads on major currency pairs, though exact figures may change based on market conditions and account type.

Special account features include Islamic-compliant trading options for eligible clients, corporate accounts for institutional traders, and managed account services for clients preferring professional portfolio management. The broker's Swiss banking heritage ensures strong account security measures and client fund separation according to regulatory requirements.

User feedback about account conditions generally emphasizes the professional service standards and clear fee structures, though some clients note that the minimum deposits may be higher than purely retail-focused competitors. This Swissquote review finds that the account conditions align well with the broker's premium positioning and regulatory standards.

The platform's technology infrastructure represents a significant strength, featuring custom trading software developed specifically for Swissquote's client base. The trading tools include advanced charting capabilities, technical analysis indicators, and automated trading features that support various trading strategies from scalping to long-term position trading.

Research resources include daily market analysis, economic calendar integration, and expert commentary from the broker's internal research team. The platform provides real-time news feeds, earnings calendars, and market sentiment indicators to support informed trading decisions. Educational resources include webinars, trading guides, and market tutorials designed for different experience levels.

The mobile trading application extends platform functionality to smartphones and tablets, maintaining full trading capabilities and account management features. Cross-platform synchronization ensures consistent user experience across devices, with real-time data and order management available regardless of access method.

Advanced traders benefit from API access for algorithmic trading strategies, while institutional clients receive dedicated tools for portfolio management and risk assessment. The platform's integration with traditional banking services allows seamless fund management and multi-currency account operations within the same interface.

Customer Service and Support Analysis

Swissquote's customer service infrastructure reflects its Swiss banking heritage with emphasis on professional, personalized client relationships. The support structure includes multiple contact channels ranging from phone and email support to live chat functionality during trading hours. Response times are generally competitive with industry standards, though availability may vary based on the client's account tier and geographic location.

The broker provides dedicated relationship managers for premium account holders, offering personalized service and direct access to trading specialists. This tiered support approach ensures that high-value clients receive enhanced attention while maintaining adequate service levels for all account types.

Multi-language support accommodates the broker's international client base, with native-speaking representatives available in major European languages. The support team shows strong technical knowledge of the platform's features and can assist with both basic account inquiries and complex trading strategies.

Client feedback indicates satisfaction with the professionalism and competence of the support staff, though some users note that response times during peak market periods may extend beyond optimal levels. The broker's commitment to service quality includes ongoing staff training and service level monitoring to maintain consistent support standards.

Trading Experience Analysis

Platform stability and execution quality represent core strengths of the Swissquote trading environment. The custom technology infrastructure supports fast order execution with minimal slippage under normal market conditions. The platform architecture includes backup systems and backup procedures to ensure continuous availability during critical trading periods.

Order management features include multiple order types, advanced stop-loss and take-profit settings, and partial fill capabilities. The execution model provides transparent pricing with real-time spread information and execution statistics available to clients for performance evaluation.

The user interface design balances functionality with usability, offering customizable layouts and workspace configurations to accommodate different trading styles. Advanced features include one-click trading, hotkey support, and multi-monitor compatibility for professional trading setups.

Mobile trading experience maintains the desktop platform's core functionality while optimizing the interface for touch-screen navigation. Real-time synchronization ensures that positions and orders remain consistent across all access methods, supporting flexible trading approaches for active traders.

Performance metrics indicate reliable platform uptime and consistent execution speeds, though occasional delays may occur during extreme market volatility periods. This Swissquote review finds that the overall trading experience meets professional standards expected from a Tier 1 broker.

Trust and Security Analysis

Regulatory compliance forms the foundation of Swissquote's trust profile, with primary oversight from FINMA providing strong client protection standards. The Swiss regulatory framework includes strict capital requirements, client fund separation, and operational transparency measures that exceed many international standards.

Client fund security measures include separated account structures, bank deposit protection, and comprehensive insurance coverage for operational risks. The broker's financial stability is supported by strong capital ratios and diversified revenue streams that provide strength during market stress periods.

Corporate transparency includes regular financial reporting, regulatory filings, and public disclosure of business developments. The company's stock exchange listing provides additional oversight and accountability measures that enhance overall transparency and governance standards.

Industry reputation reflects the broker's long operational history and consistent regulatory compliance record. Professional recognition includes various industry awards and positive ratings from financial rating agencies, supporting the broker's credibility within the international trading community.

Risk management procedures include comprehensive compliance monitoring, anti-money laundering protocols, and sophisticated fraud detection systems. These measures protect both the broker and its clients from various operational and financial risks inherent in financial services operations.

User Experience Analysis

Overall user satisfaction levels show strong performance across most service categories, with particular strength in platform reliability and professional service standards. Client feedback consistently highlights the platform's stability and comprehensive feature set as key differentiating factors compared to purely retail-focused competitors.

Interface design prioritizes functionality over simplicity, resulting in a learning curve for new users but enhanced capabilities for experienced traders. The platform's extensive customization options allow users to optimize their workspace for specific trading strategies and preferences.

Account registration and verification processes follow Swiss banking standards with comprehensive documentation requirements and identity verification procedures. While this approach ensures security and regulatory compliance, it may result in longer setup times compared to less regulated alternatives.

Funding and withdrawal procedures generally receive positive feedback for reliability and security, though processing times may vary based on the selected method and regulatory requirements in the client's area. The integration with traditional banking services provides additional convenience for clients using multiple financial services.

Common user feedback themes include appreciation for the platform's professional features and regulatory standards, while some users note that the complexity and minimum requirements may not suit casual traders seeking simpler alternatives. The broker's focus on premium service delivery appears to align well with its target client demographic of serious traders and investors.

Conclusion

This comprehensive Swissquote review reveals a well-established broker that successfully combines Swiss banking traditions with modern trading technology. The platform shows particular strength in regulatory compliance, platform stability, and comprehensive service offerings that cater to both retail and institutional clients.

Recommended User Profiles: Swissquote is best suited for serious traders and investors who prioritize regulatory security, platform reliability, and comprehensive service offerings over minimal costs. The broker particularly appeals to high-net-worth individuals seeking integrated banking and trading services, as well as institutional clients requiring professional-grade trading infrastructure.

Key Advantages and Limitations: Primary strengths include strong regulatory oversight, stable platform performance, comprehensive asset coverage, and professional service standards. Potential limitations involve higher minimum deposits compared to retail-focused competitors and a steeper learning curve for casual traders. The broker's premium positioning results in a service model that may not align with price-sensitive traders seeking minimal-cost alternatives.