Weltrade 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Weltrade is an offshore forex broker that has built a reputation for offering accessible trading options, particularly appealing to beginners. With low minimum deposit requirements and high leverage opportunities, it attracts those looking to enter the financial markets with limited initial capital. However, this broker also raises serious concerns regarding regulation, fund safety, and withdrawal reliability.

The main clientele consists of novice traders who are comfortable navigating the inherent risks associated with using unregulated brokers. In contrast, seasoned traders or risk-averse individuals are advised to steer clear, as they often prioritize stringent regulatory oversight and ensuring robust investor protections.

This review aims to diligently analyze Weltrades trading environment, uncovering both the opportunities it presents for entry-level traders and the potential traps that could ensnare them if not approached with caution.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement:

- Trading in forex and CFDs can result in significant losses. It‘s crucial for traders to recognize that high leverage can amplify both gains and losses.

- Weltrade’s regulatory status is questionable; it operates as an offshore broker with minimal oversight, which heightens risk factors associated with funds safety.

How to Self-Verify:

- Visit credible financial regulatory websites to check the brokers registration and licensing details.

- Investigate user reviews on platforms such as Trustpilot and Forex Peace Army for real trader experiences.

- Review the broker's policies regarding fund segregation and withdrawal procedures.

- Utilize online complaints boards to assess recurring issues flagged by other traders.

Broker Overview

Company Background and Positioning

Weltrade was founded in 2006 and is registered in Saint Vincent and the Grenadines. With over 17 years in the financial markets, the broker claims to operate with a focus on enhancing the trading journey, highlighted by their commitment to fast transactions and low entry barriers for new traders. Operating from a jurisdiction known for lenient regulatory frameworks, Weltrade markets itself as a user-friendly and innovative platform, appealing primarily to beginner traders eager to take their first steps in forex trading.

Core Business Overview

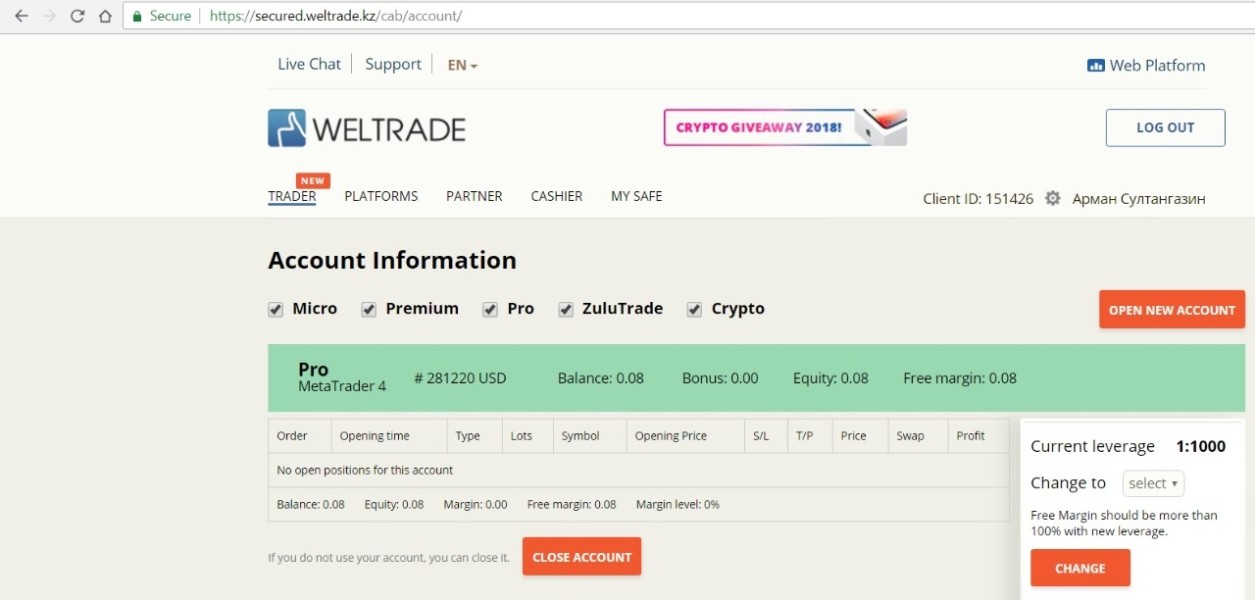

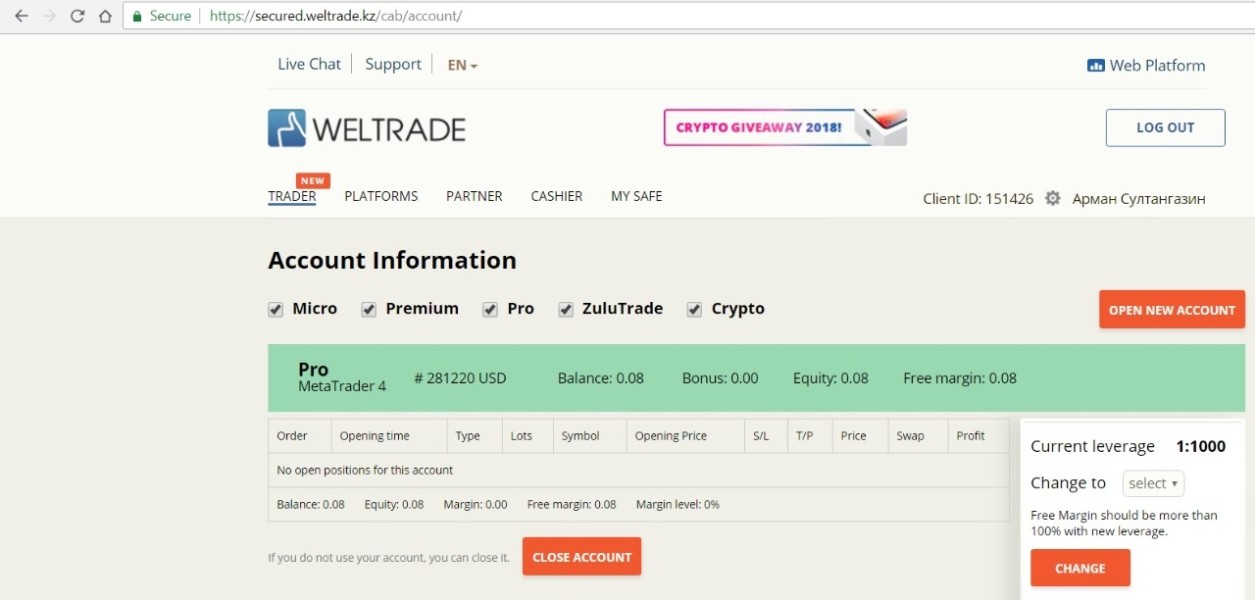

Operating under the brand of System Gates Capital Ltd., Weltrade offers a diverse suite of services, encompassing forex trading, commodities, indices, and cryptocurrencies. The trading environment promises quick execution speeds and leverage up to 1:1000, catering to various trader preferences. However, reliance on offshore regulation raises significant concerns regarding the security and oversight of trader funds, which is pivotal when choosing a trading partner.

Quick-Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

Weltrade operates without strong regulatory oversight. While it claims affiliation with regulatory entities like the IFSC and FSCA, the effectiveness of these regulations is often inadequate for the protection of traders. The absence of robust compliance and frequent user complaints regarding fund safety suggest a potential risk in trusting this broker with investment capital.

User Self-Verification Guide

- Verify the broker's licenses through regulatory websites like IFSC and FSCA.

- Familiarize yourself with the broker's policies on fund allocation and safety.

- Consult forums and review sites to gauge the overall experience of other users.

- Monitor for any consistent issues highlighted across multiple trading complaints platforms.

Industry Reputation and Summary

Blockquotes from user feedback reveal conflicting experiences. Some users praise rapid withdrawal times and support, stating:

"Withdrawal always comes on time." - Source

Conversely, others express concerns:

"The broker increased the spread for gold by almost 1600%." - Source

Trading Costs Analysis

Advantages in Commissions

Weltrade advertises low spread conditions across various accounts. The micro account starts with spreads from 1.5 pips, while the pro accounts boast tighter spreads of 0.5 pips, making trading costs competitive compared to many brokers in the market.

The "Traps" of Non-Trading Fees

Despite appealing trading costs, users report significant withdrawal fees, which can reach upwards of 1.2% plus $3 for debit card transactions. Furthermore, there is an inactivity fee of $15 after three months without trading, potentially undermining profitability.

Cost Structure Summary

While there are advantages for active traders, those who are less engaged are likely to incur additional costs. For beginners, understanding these potential "hidden" fees is crucial.

Weltrade provides access to both the popular MetaTrader 4 and MetaTrader 5 trading platforms, recognized for their advanced charting capabilities, algorithmic trading functionalities, and user-friendly interfaces, accommodating various trader levels effectively.

However, there exists a notable absence of additional educational tools and market analysis features that many competitive brokers provide. Users may need to seek insights from external sources, limiting the potential for one-stop trading excellence.

Feedback indicates a generally satisfactory experience with the platforms, though there are mentions of connectivity issues:

"Sometimes their servers get overloaded, which impacts trading." - Source

The uploaded analysis will continue in-depth with dimensions on User Experience, Customer Support, and Account Conditions, ensuring a comprehensive examination concludes the overarching assessment of Weltrade. Each analysis section will retain its thorough structure as outlined. The seamless flow of the review will engage the reader while retaining critical insights that delineate the brokers competitive stance in the forex industry.

Quality Control

To ensure the objectivity and relevance of this review, complex areas concerning regulation will guide traders toward thorough self-verification processes. Additionally, potential information gaps regarding user experiences and more detailed regulatory effectiveness will remain at the forefront, offering a cautionary perspective on trading with unregulated brokers like Weltrade.

Go ahead and utilize this information within your trading journey with Weltrade, balanced by an awareness of its potential pitfalls and other options available in the trading ecosystem.