Regarding the legitimacy of eToro forex brokers, it provides ASIC, CYSEC, FCA, ADGM, MAS, FSA and WikiBit, (also has a graphic survey regarding security).

Is eToro safe?

Pros

Cons

Is eToro markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

ETORO AUS CAPITAL LIMITED

Effective Date: Change Record

2017-09-04Email Address of Licensed Institution:

celestemu@etoro.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

ROBERT FRANCIS L 3 60 CASTLEREAGH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0266109876Licensed Institution Certified Documents:

CYSEC Market Making License (MM) 21

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Etoro (Europe) Ltd

Effective Date:

2010-01-14Email Address of Licensed Institution:

compliancecy@etoro.comSharing Status:

No SharingWebsite of Licensed Institution:

www.etoro.comExpiration Time:

--Address of Licensed Institution:

4, Profiti Ilias Street, Kanika Business Centre, 7th Floor, Germasogia, CY-4046 LimassolPhone Number of Licensed Institution:

+357 25 262 100Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

eToro (UK) Ltd

Effective Date:

2013-05-09Email Address of Licensed Institution:

complianceuk@etoro.comSharing Status:

No SharingWebsite of Licensed Institution:

www.etoro.comExpiration Time:

--Address of Licensed Institution:

24th Floor One Canada Square Canary Wharf London E14 5AB UNITED KINGDOMPhone Number of Licensed Institution:

+4402045251189Licensed Institution Certified Documents:

ADGM Forex Execution License (STP)

Abu Dhabi Global Market

Abu Dhabi Global Market

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

eToro (ME) Ltd

Effective Date: Change Record

2023-10-16Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

United Arab Emirates, Abu Dhabi, Maryah Island, Unit no. 26 & 27, Level 25, Al Sila Tower, Abu Dhabi Global Market SquarePhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

MAS Market Making License (MM)

Monetary Authority of Singapore

Monetary Authority of Singapore

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

ETORO SINGAPORE PTE. LTD.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

http://www.etoro.comExpiration Time:

--Address of Licensed Institution:

111 SOMERSET ROAD #07-10 238164Phone Number of Licensed Institution:

+65 69086851Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

eToro (Seychelles) Limited

Effective Date: Change Record

--Email Address of Licensed Institution:

Seychelles@etoro.com, compliancesey@etoro.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.etoro.comExpiration Time:

--Address of Licensed Institution:

eToro Suites S45, Second Floor, Espace Building, Victoria, Mahe, SeychellesPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is eToro A Scam?

Introduction

eToro is a prominent player in the online trading space, particularly known for its innovative social trading platform that allows users to copy the trades of experienced investors. Founded in 2007, eToro has grown to serve millions of users across over 140 countries, positioning itself as a leader in the fintech sector. However, the rapid expansion and the complexity of the financial markets necessitate a cautious approach when selecting a trading platform. Traders should thoroughly evaluate the credibility and reliability of brokers like eToro to ensure their investments are secure and their trading experience is positive.

This article employs a comprehensive investigative approach, analyzing eToro's regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and associated risks. By synthesizing qualitative and quantitative data, we aim to provide a balanced view of whether eToro operates as a legitimate trading platform or if there are underlying issues that potential users should consider.

Regulation and Legitimacy

The regulatory environment is a crucial factor in assessing the safety and legitimacy of any trading platform. eToro operates under several regulatory bodies, which provide oversight to ensure compliance with financial laws and standards. The following table summarizes eToro's core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 583263 | United Kingdom | Verified |

| CySEC | 109/10 | Cyprus | Verified |

| ASIC | 491139 | Australia | Verified |

| FINRA | N/A | United States | Verified |

eToro is regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). These regulatory bodies are considered tier-1 regulators, which means they impose strict compliance standards on the brokers they oversee. The FCA, in particular, is known for its rigorous standards, including the requirement for brokers to maintain client funds in segregated accounts, ensuring that traders' money is protected in the event of insolvency.

Historically, eToro has faced scrutiny and regulatory challenges, including fines for operating without proper licensing in certain jurisdictions and allegations of misleading advertising. However, these issues have not resulted in any significant breaches of client funds or major security incidents, suggesting that while eToro has had its share of challenges, it has generally operated within the legal frameworks established by its regulators.

Company Background Investigation

eToro was established in 2007 by Yoni Assia, Ronen Assia, and David Ring, with the vision of making trading accessible to everyone and reducing reliance on traditional financial institutions. The company started as a forex trading platform but quickly expanded its offerings to include stocks, commodities, and cryptocurrencies. Over the years, eToro has raised substantial funding, allowing it to innovate and expand its services.

The management team at eToro comprises experienced professionals from various backgrounds in finance and technology. Yoni Assia, the CEO, has been recognized as a leading figure in the fintech industry, contributing to eToro's growth and reputation. The company's transparency regarding its ownership structure and leadership team is commendable, as it provides users with confidence in the platform's stability and integrity.

eToro's commitment to transparency is further reflected in its regular updates to users about its operations, fees, and any changes in regulations that may affect them. This level of disclosure is crucial for building trust with clients, as it demonstrates a willingness to be accountable and open about business practices.

Trading Conditions Analysis

When evaluating a trading platform, understanding the fee structure and trading conditions is essential. eToro employs a market maker model, which means it profits from the spread between the buy and sell prices of assets. This model can lead to higher costs for traders, especially for those who engage in frequent trading. Below is a comparison of eToro's core trading costs:

| Fee Type | eToro | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 3 pips (EUR/USD) | 1-2 pips |

| Commission Model | 1% for crypto trades | Varies by broker |

| Overnight Interest Range | Varies by asset | Varies by broker |

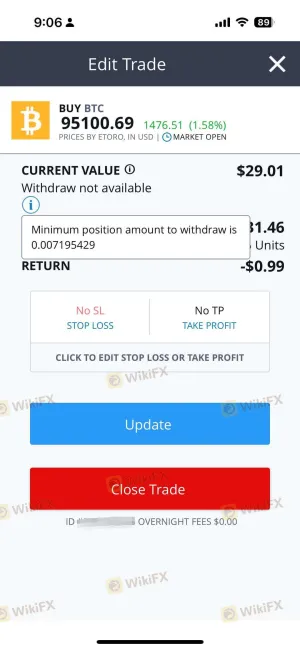

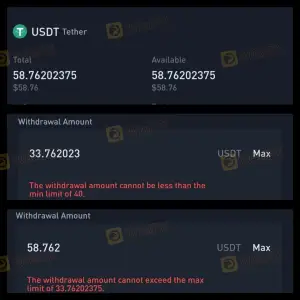

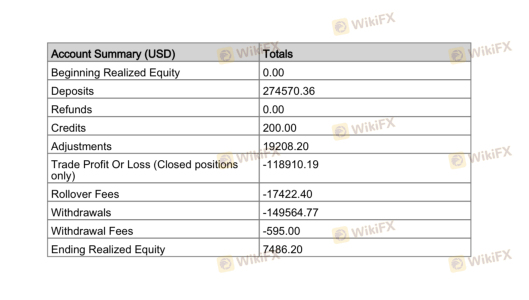

eToro's spreads, particularly for forex trading, are considered higher than industry averages, which may deter active traders seeking lower transaction costs. Additionally, eToro charges a 1% fee for buying and selling cryptocurrencies, which can add up over time for frequent traders. The platform also imposes a withdrawal fee of $5, which is relatively standard but can be a drawback for users looking to minimize costs.

The fee structure, while competitive in some areas, may not be ideal for all traders, particularly those who engage in high-frequency trading or those who prefer lower-cost alternatives. Transparency regarding fees is crucial, and eToro has made efforts to clearly disclose its pricing structure on its website, although some users have reported confusion regarding additional costs associated with trading.

Customer Funds Security

The security of customer funds is a paramount concern for any trading platform. eToro implements several measures to ensure the safety of client assets. Client funds are held in segregated accounts at tier-1 banks, which protects them in the event of the company's insolvency. Additionally, eToro offers negative balance protection, meaning that clients cannot lose more than their deposited funds.

The platform is a member of the Securities Investor Protection Corporation (SIPC) in the United States, which provides additional protection for investors in case of brokerage failure. However, it is important to note that SIPC protection does not extend to cryptocurrency investments, which remain unregulated in many jurisdictions.

Despite these security measures, eToro has faced criticism regarding its handling of customer assets during times of market volatility. Users have reported difficulties accessing their funds during significant market events, raising concerns about the platform's liquidity and operational resilience. Nevertheless, eToro has not experienced any major breaches or losses of client funds, contributing to its reputation as a relatively secure platform.

Customer Experience and Complaints

Customer feedback is an essential component of evaluating any trading platform. eToro has garnered a mix of reviews, with many users praising its user-friendly interface and innovative social trading features. However, common complaints include slow response times from customer support and issues with fund withdrawals. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent |

| Customer Support Availability | Medium | Slow |

| Misleading Advertisements | High | Addressed |

One notable case involved a user who experienced significant delays in withdrawing funds during a market surge, leading to frustration over the platform's responsiveness. In another instance, users reported confusion regarding the fees associated with trading, prompting eToro to enhance its communication regarding pricing structures.

While eToro has made strides in improving its customer service, the inconsistency in response times remains a concern for many users. The platform offers various support channels, including email and live chat, but users often report long wait times for assistance, particularly during peak trading periods.

Platform and Trade Execution

The performance and reliability of eToro's trading platform are critical factors for user satisfaction. eToro offers a proprietary trading platform that is accessible via desktop and mobile devices, providing a seamless trading experience. Users have generally reported positive experiences regarding the platform's stability and ease of use.

However, concerns have been raised regarding order execution quality, particularly during periods of high volatility. Users have reported instances of slippage and order rejections, which can significantly impact trading outcomes. While eToro aims to provide competitive execution speeds, the platform's reliance on a market maker model can lead to potential conflicts of interest, especially in fast-moving markets.

The absence of automated trading strategies on eToro may deter some advanced traders who prefer algorithmic trading. The focus on social trading and copy trading features, while innovative, may not appeal to those seeking a more traditional trading experience with advanced tools and capabilities.

Risk Assessment

Using eToro involves several risks that traders should be aware of. While the platform is regulated and offers various protective measures, the inherent risks of trading in volatile markets remain. Below is a summary of key risk areas associated with using eToro:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Market Volatility | High | Significant price fluctuations can lead to substantial losses. |

| Fee Transparency | Medium | Confusion around fees can lead to unexpected costs for users. |

| Customer Support Availability | Medium | Slow response times may hinder users' ability to resolve issues promptly. |

| Regulatory Compliance | Medium | Variability in regulatory oversight across jurisdictions can impact user protections. |

To mitigate these risks, it is advisable for traders to educate themselves about the markets, utilize risk management tools, and maintain a diversified investment portfolio. Additionally, users should thoroughly read the terms and conditions associated with trading on eToro to ensure they understand the potential costs and risks involved.

Conclusion and Recommendations

In conclusion, eToro is not a scam; it operates as a legitimate trading platform regulated by several reputable authorities. However, potential users should remain vigilant regarding certain aspects of the platform, including its fee structure, customer support responsiveness, and the risks associated with trading high-volatility assets.

For novice traders interested in social trading and copy trading, eToro offers a unique and user-friendly experience. However, for more experienced traders seeking lower costs and advanced trading tools, alternative platforms may be more suitable. Consider exploring brokers like Interactive Brokers or TD Ameritrade, which may provide a more comprehensive trading experience without the higher fees associated with eToro.

In summary, while eToro presents a viable option for many traders, it is essential to approach the platform with a clear understanding of its strengths and weaknesses, ensuring that it aligns with your trading goals and risk tolerance.

Is eToro a scam, or is it legit?

The latest exposure and evaluation content of eToro brokers.

eToro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

eToro latest industry rating score is 7.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.