Regarding the legitimacy of TRADING 212 forex brokers, it provides ASIC, FCA, CYSEC, FSC, VFSC, CYSEC and WikiBit, (also has a graphic survey regarding security).

Is TRADING 212 safe?

Pros

Cons

Is TRADING 212 markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Trading 212 AU PTY LTD

Effective Date: Change Record

2023-08-17Email Address of Licensed Institution:

alvin.kim@trading212.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SE 102 135-151 CLARENCE ST SYDNEY NSW 2000 AUSTRALIAPhone Number of Licensed Institution:

0414145388Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Trading 212 UK Limited

Effective Date:

2014-10-01Email Address of Licensed Institution:

info@trading212.com, complaints@trading212.comSharing Status:

No SharingWebsite of Licensed Institution:

www.trading212.comExpiration Time:

--Address of Licensed Institution:

Aldermary House 10-15 Queen Street London EC4N 1TX UNITED KINGDOMPhone Number of Licensed Institution:

+4402038571320Licensed Institution Certified Documents:

CYSEC Derivatives Trading License (MM) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Trading 212 Markets Ltd

Effective Date:

2021-03-01Email Address of Licensed Institution:

compliance.cy@trading212.comSharing Status:

No SharingWebsite of Licensed Institution:

www.trading212.comExpiration Time:

--Address of Licensed Institution:

Agias Fylaxeos, 1, Floor 2, Flat/Office 1, 3025, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 343222Licensed Institution Certified Documents:

FSC Derivatives Trading License (EP)

Financial Supervision Commission

Financial Supervision Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

TRADING 212 EOOD

Effective Date:

--Email Address of Licensed Institution:

info@trading212.comSharing Status:

No SharingWebsite of Licensed Institution:

www.trading212.comExpiration Time:

--Address of Licensed Institution:

BULGARIA, 1756 Sofia, 3 Lachezar Stanchev Str., Litex Tower, fl.10Phone Number of Licensed Institution:

+ 359 2/448 48 50, + 359 2/448 48 51, +359 2 448 48 60Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Trading 212 Global Ltd

Effective Date:

2019-03-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Gobaba FX Cy Ltd

Effective Date:

2016-01-20Email Address of Licensed Institution:

kd@gobabafx.comSharing Status:

No SharingWebsite of Licensed Institution:

www.trading212.com.cyExpiration Time:

--Address of Licensed Institution:

11, Grigori Afxentiou Street, Centro Imperio, Office 102, Mesa Geitonia CY-4003 LimassolPhone Number of Licensed Institution:

+357 25 013 610Licensed Institution Certified Documents:

Is Trading 212 a Scam?

Introduction

Trading 212 is a well-known online brokerage that has gained recognition in the forex and CFD trading markets. Established in 2004, it has positioned itself as a pioneer in commission-free trading, particularly in Europe and the UK. The platform caters to a diverse range of traders, from beginners to experienced investors, offering access to various financial instruments, including stocks, ETFs, and CFDs. However, as the online trading landscape continues to evolve, it becomes crucial for traders to carefully evaluate the trustworthiness of their chosen brokers. This is especially true in an industry marked by rapid growth and occasional scandals.

In this article, we will conduct a thorough investigation into Trading 212's legitimacy, focusing on its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and potential risks. Our evaluation will draw from multiple sources, including regulatory filings, customer reviews, and industry reports, to provide a comprehensive analysis of whether Trading 212 is a safe and reliable broker or a potential scam.

Regulation and Legitimacy

Regulation is a pivotal factor in assessing a brokerage's credibility. Trading 212 is regulated by several reputable authorities, which adds a layer of confidence for potential traders. The primary regulatory bodies overseeing Trading 212 include the UK's Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). These regulators enforce strict guidelines to protect traders and ensure fair practices in the financial markets.

Regulatory Information Table

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| FCA | 609146 | United Kingdom | Verified |

| CySEC | 398/21 | Cyprus | Verified |

| FSC | RG-03-0237 | Bulgaria | Verified |

The FCA is known for its stringent regulatory framework, which requires brokers to maintain client funds in segregated accounts and provide negative balance protection. This means that clients cannot lose more money than they have deposited, even in volatile market conditions. CySEC also offers similar protections, covering up to €20,000 in case of broker insolvency. However, it is worth noting that the FSC in Bulgaria, while a regulatory authority, is considered less stringent compared to the FCA and CySEC.

Trading 212's compliance with these regulatory bodies indicates a commitment to maintaining high operational standards. The broker has not reported any significant regulatory breaches or compliance issues, further supporting its legitimacy in the market.

Company Background Investigation

Trading 212 was founded in 2004 by Borislav Nedialkov and Ivan Ashminov, initially operating under the name Avus Capital. The company has since evolved, expanding its services and geographical reach. With its headquarters located in London, Trading 212 has established a strong presence in Europe, particularly in the UK and Bulgaria.

The management team comprises experienced professionals with backgrounds in finance and technology, which contributes to the broker's operational efficiency and innovation. The company has been transparent about its ownership structure and management, providing information on its website about key personnel and their qualifications.

In terms of transparency, Trading 212 has made significant strides. It provides detailed information about its services, fees, and trading conditions on its website. The broker also maintains an active presence on social media and trading forums, where it engages with its users and addresses their concerns. This level of transparency is essential in building trust and credibility among traders.

Trading Conditions Analysis

Trading conditions play a crucial role in a trader's overall experience with a broker. Trading 212 is known for its commission-free trading model, which has attracted a significant number of users. However, it is important to understand the overall cost structure, including spreads and other fees.

Trading Costs Comparison Table

| Cost Type | Trading 212 | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 0.8 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Medium-High | Varies |

Trading 212's spreads are competitive for major currency pairs, though they may be higher than some industry averages. The absence of commissions on trades is a significant advantage, particularly for high-frequency traders. However, traders should be aware of the potential for wider spreads during periods of low liquidity.

The broker charges a currency conversion fee of 0.15% on its invest account, which can add to trading costs if users frequently trade in different currencies. Furthermore, while Trading 212 does not impose inactivity fees, it does charge overnight financing fees for leveraged positions, which can accumulate quickly if positions are held for extended periods.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a broker. Trading 212 employs several measures to ensure the security of its clients' investments. Client funds are held in segregated accounts, meaning they are kept separate from the company's operational funds. This segregation protects client money in the event of the broker's insolvency.

Moreover, Trading 212 is a participant in the Financial Services Compensation Scheme (FSCS) in the UK, which provides coverage of up to £85,000 per person in case the broker becomes insolvent. Similarly, clients of the CySEC-regulated entity are protected under the Investor Compensation Fund (ICF), which covers up to €20,000.

Trading 212 also implements negative balance protection, ensuring that clients cannot lose more than their deposited amount. This feature is particularly crucial for traders using leverage, as it mitigates the risk of significant financial losses.

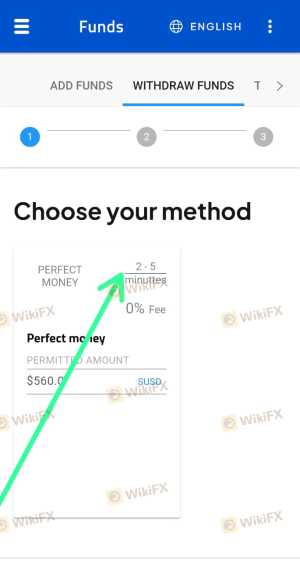

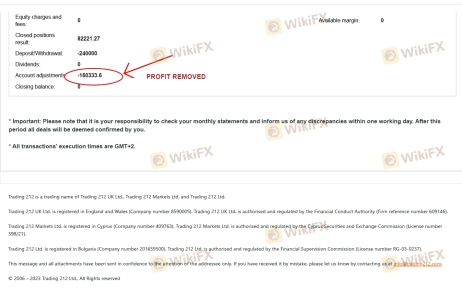

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's performance and reliability. Overall, Trading 212 has garnered a mix of positive and negative reviews from users. Many customers appreciate the user-friendly platform, commission-free trading, and the availability of a demo account. However, some common complaints have emerged.

Complaint Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Moderate |

| Customer Support Availability | High | Slow |

| Platform Stability | Medium | Responsive |

Users have reported experiencing delays in withdrawal processing times, which can be a source of frustration. Additionally, while customer support is available 24/7, some traders have noted that response times can be slow, particularly during peak periods. Despite these complaints, Trading 212 has generally been responsive in addressing user issues and concerns.

A notable case involved a trader who faced difficulties withdrawing funds after a period of inactivity. While the broker eventually resolved the issue, it highlighted the importance of maintaining clear communication and timely responses to customer inquiries.

Platform and Trade Execution

The trading platform is a critical aspect of a trader's experience. Trading 212 offers a proprietary platform that is designed to be intuitive and user-friendly. The platform provides access to various trading tools, charting features, and market analysis resources.

However, some traders have reported issues related to order execution, including slippage and instances of order rejections. While these issues are not uncommon in the trading industry, they can impact the overall trading experience. The broker has not shown any significant signs of platform manipulation, but traders should remain vigilant and monitor their trade executions closely.

Risk Assessment

Using Trading 212 involves certain risks that traders should be aware of. While the broker is regulated and offers several safety measures, the inherent risks of trading in volatile markets cannot be overlooked.

Risk Rating Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by reputable authorities. |

| Financial Risk | Medium | Potential for losses in trading activities, especially with leverage. |

| Customer Support Risk | Medium | Complaints about response times and withdrawal delays. |

| Platform Risk | Medium | Occasional issues with order execution and stability. |

To mitigate these risks, traders should conduct thorough research, develop a solid trading plan, and consider using risk management tools such as stop-loss orders. Additionally, starting with a demo account can help traders familiarize themselves with the platform and its features before committing real funds.

Conclusion and Recommendations

In conclusion, Trading 212 is not a scam. It is a legitimate broker regulated by reputable authorities, offering a range of trading services with a focus on commission-free trading. While it has received some negative feedback regarding withdrawal delays and customer support responsiveness, the overall regulatory framework and safety measures in place provide a solid foundation for traders.

For beginners and casual traders, Trading 212 can be a suitable choice due to its user-friendly platform and educational resources. However, more experienced traders seeking advanced tools and features may find the platform lacking in depth.

If you are considering using Trading 212, it is advisable to start with a small investment and take advantage of the demo account to gain experience. For those looking for alternatives, brokers like eToro and Interactive Brokers offer comprehensive trading solutions with additional features that may better suit advanced trading needs.

Is TRADING 212 a scam, or is it legit?

The latest exposure and evaluation content of TRADING 212 brokers.

TRADING 212 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRADING 212 latest industry rating score is 8.75, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.75 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.