RoboForex 2025 Review: Everything You Need to Know

Executive Summary

RoboForex is a well-known forex broker that has served traders since 2009. In this detailed roboforex review, we look at a broker that shows moderate performance with a 3.7 out of 5-star rating from 634 real customer reviews. REVIEWS.io data shows that 68% of users recommend RoboForex, which means most clients have positive experiences with the company.

The broker stands out through several important features. Most notably, it offers negative balance protection and complete multilingual customer support in 12 different languages. These features show RoboForex's focus on risk management and helping traders worldwide. The company works as a market maker, giving access to eight different types of assets including forex and CFDs through popular platforms like MetaTrader 4 and MetaTrader 5.

RoboForex mainly targets traders who want diverse trading products with reliable customer service. The broker especially appeals to international traders who need multilingual support and those who want account protection features. While the broker has solid basics, our analysis shows areas where transparency and clear information could be better to help potential clients.

Important Disclaimers

Traders should know that RoboForex operates through different regional companies, which may create different rules and services depending on where you live. The terms, conditions, and features discussed in this review may be different based on your country and the specific RoboForex company that serves your area.

This review uses publicly available information and user feedback from sources like REVIEWS.io and industry publications. Our goal is to provide an objective analysis based on available data, though individual trading experiences may vary. We recommend that potential clients check current terms and conditions directly with RoboForex before making trading decisions, as broker policies and offerings can change over time.

Rating Framework

Based on our complete analysis, here are our ratings for RoboForex across six key areas:

Broker Overview

RoboForex Ltd started in the forex market in 2009, building itself as a market maker that specializes in foreign exchange trading and various financial tools. The company has built its reputation over more than ten years of operation, focusing on providing complete trading solutions to retail and institutional clients worldwide. According to Trader Magazine, RoboForex operates as a market maker, which means they provide liquidity to their clients and may take the opposite side of trades.

The broker's operational framework centers on offering multiple investment products across diverse asset classes. RoboForex has positioned itself as a technology-forward broker, supporting advanced trading platforms and keeping a strong focus on customer service excellence. The company's commitment to serving global clients is clear through its extensive language support system, which helps traders from various linguistic backgrounds.

From a regulatory standpoint, RoboForex Ltd operates under the supervision of the Financial Services Commission (FSC), though specific license numbers are not clearly shown in available public information. The broker supports multiple trading platforms, with MetaTrader 4 and MetaTrader 5 being the main offerings, alongside access to eight different asset categories including forex pairs and contracts for difference (CFDs). This roboforex review shows a broker that emphasizes platform diversity and asset variety as core competitive advantages.

Regulatory Framework

RoboForex Ltd operates under regulation from the Financial Services Commission (FSC), which provides a basic level of regulatory oversight. However, specific license numbers and detailed regulatory information are not extensively detailed in publicly available materials, which may concern traders seeking complete transparency about regulatory status.

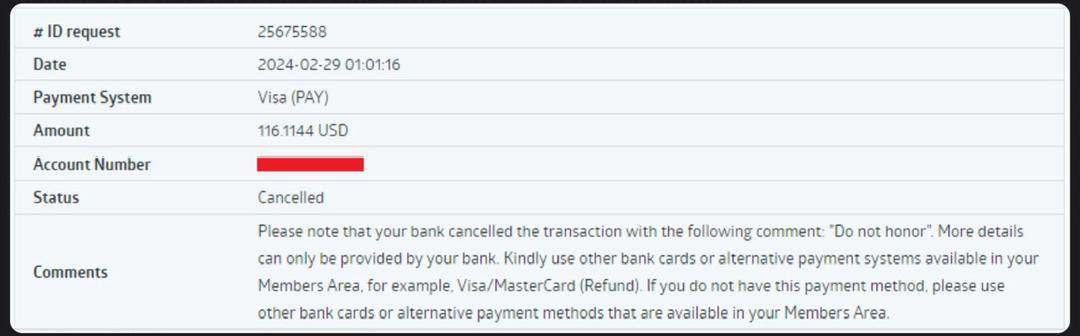

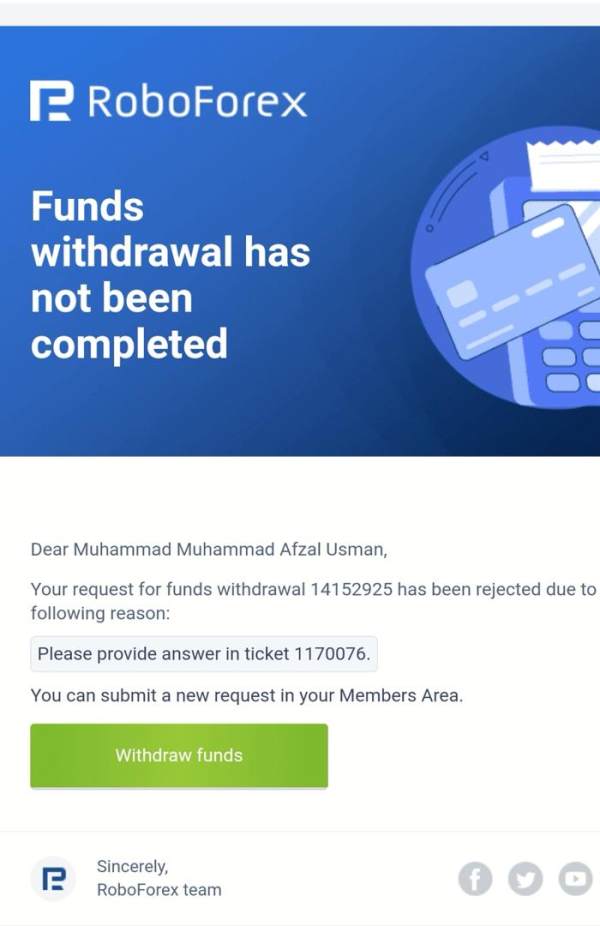

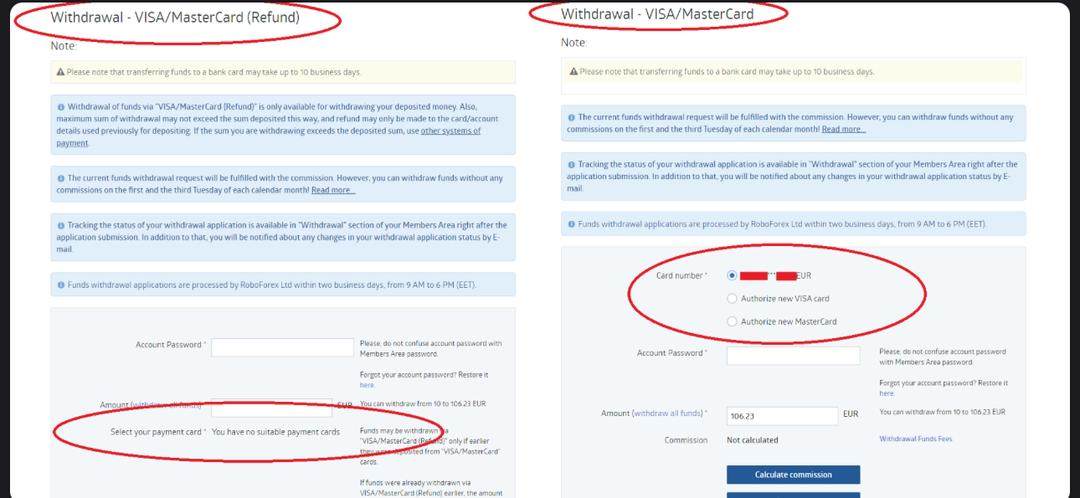

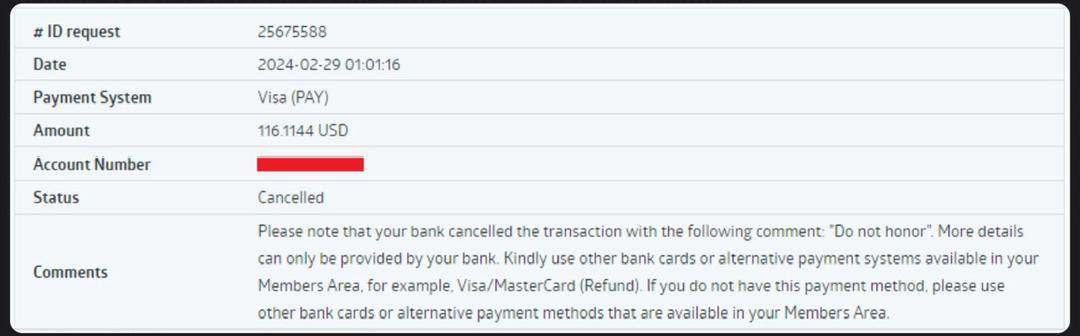

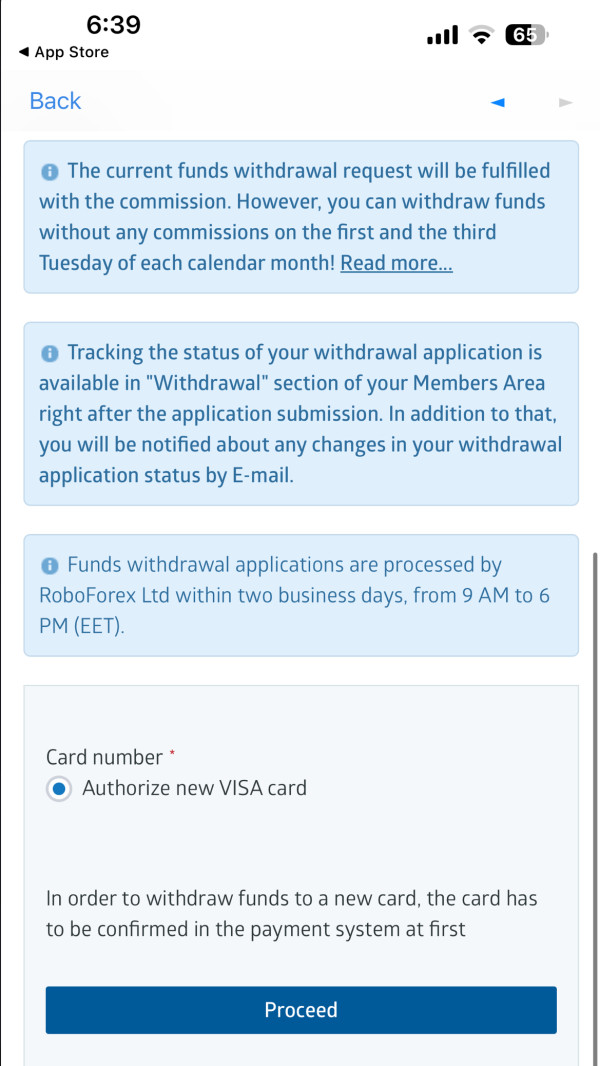

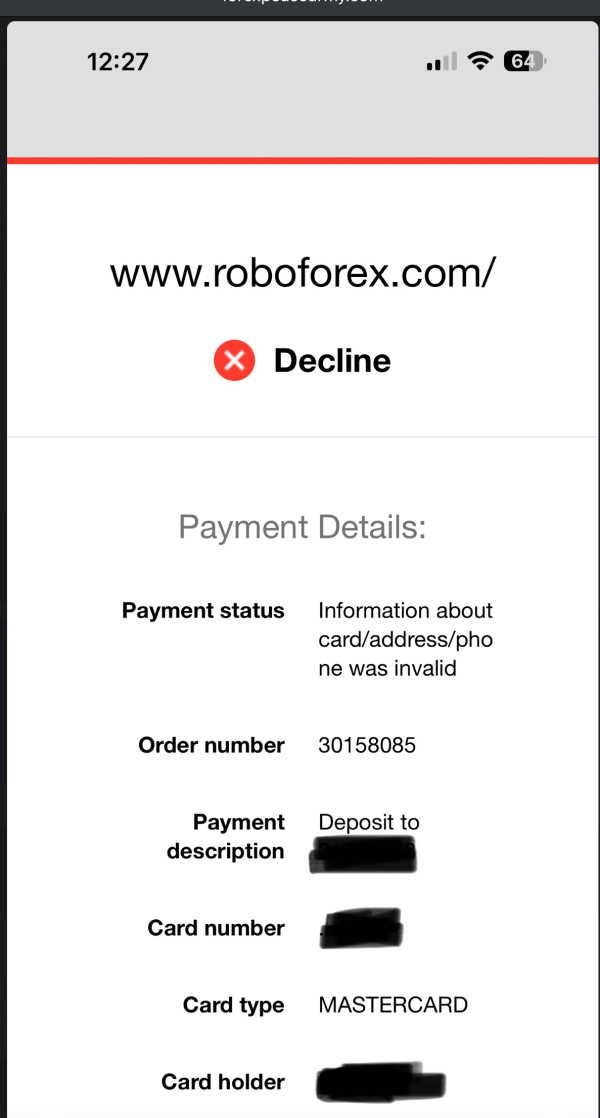

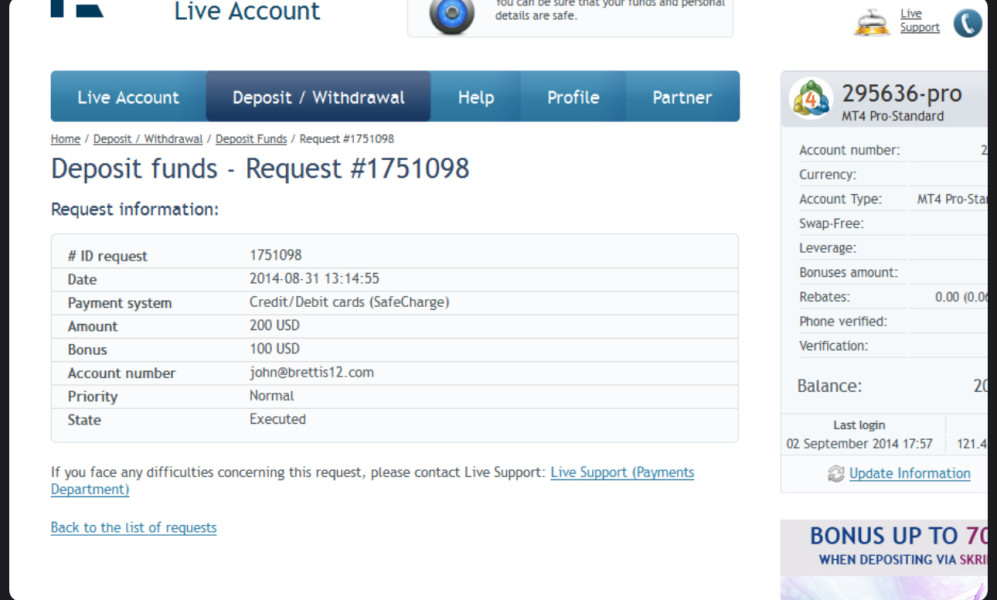

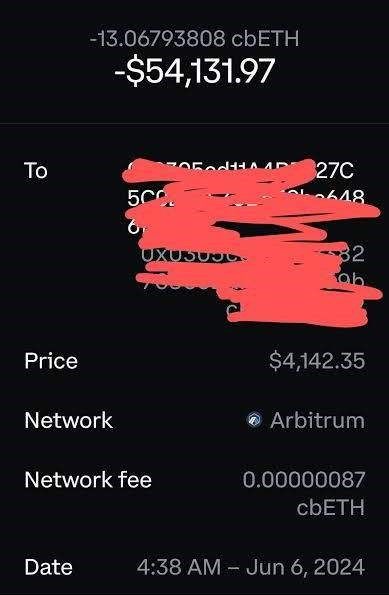

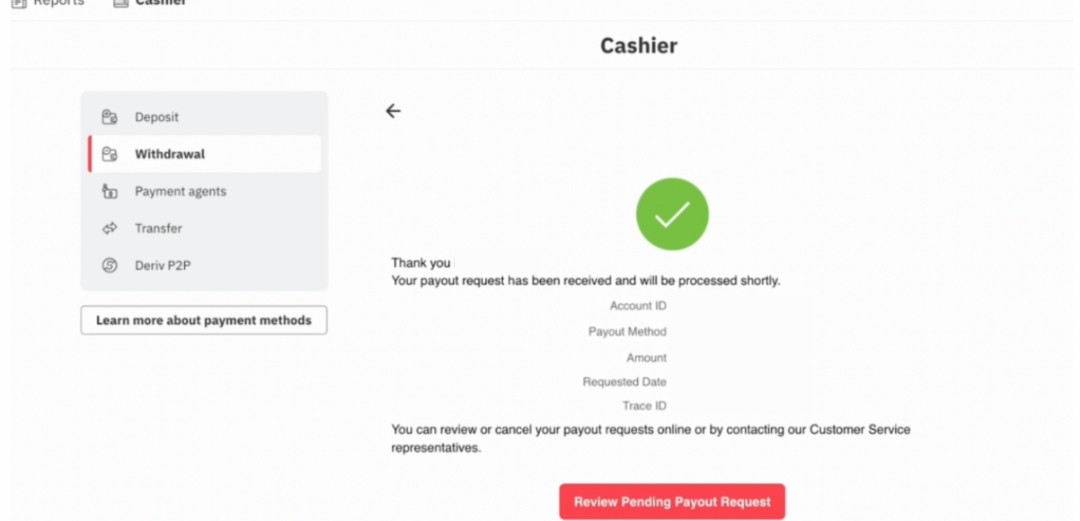

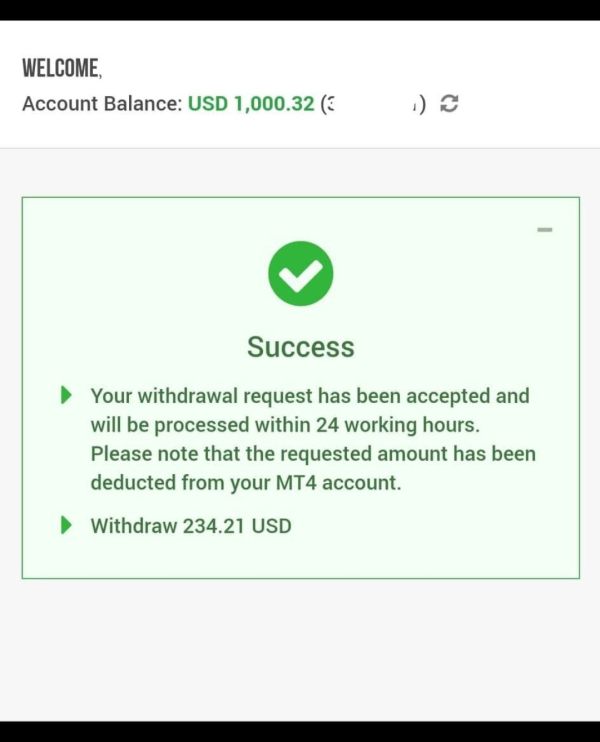

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods is not fully detailed in available sources. This represents a significant information gap that potential clients should address by contacting the broker directly for current payment processing options and associated timeframes.

Minimum Deposit Requirements

The minimum deposit requirements for different account types are not specified in the available information sources. Prospective traders should verify current minimum deposit thresholds directly with RoboForex, as these requirements can vary by account type and regional regulations.

Current bonus and promotional activities are not detailed in the source materials reviewed. Traders interested in promotional offers should check directly with RoboForex for any ongoing campaigns or welcome bonuses that may be available.

Trading Assets

RoboForex provides access to eight distinct asset classes, prominently featuring forex currency pairs and contracts for difference (CFDs). This diversity allows traders to build varied portfolios and implement different trading strategies across multiple markets.

Cost Structure

Detailed information about spreads, commissions, and other trading costs is not available in the reviewed sources. This lack of transparent pricing information represents a notable gap that requires direct inquiry with the broker for accurate cost assessment.

Leverage Options

Specific leverage ratios offered by RoboForex are not detailed in available public information. Leverage availability typically varies by asset class and regulatory jurisdiction, requiring direct consultation with the broker.

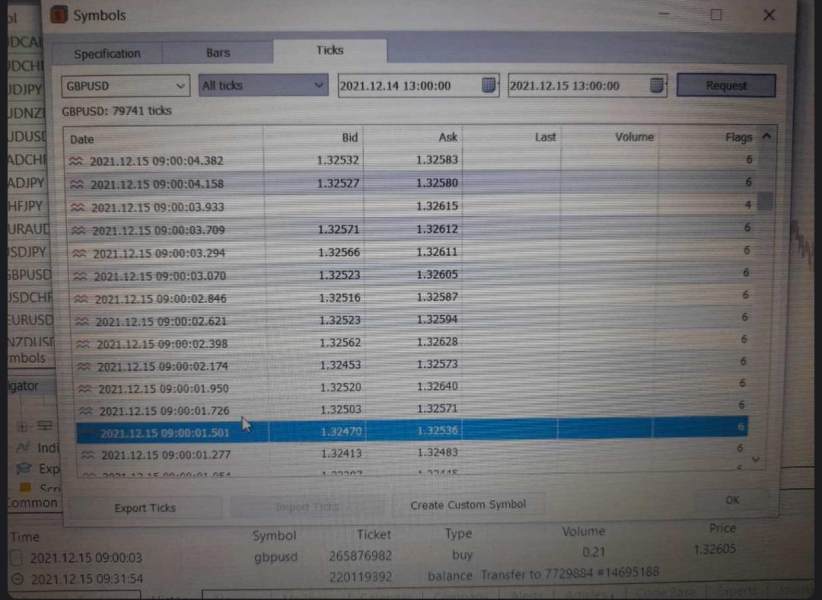

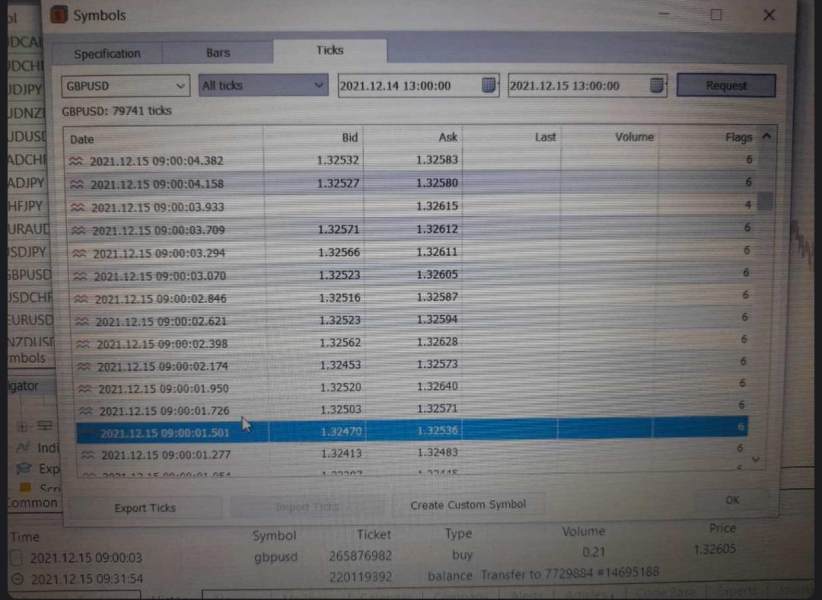

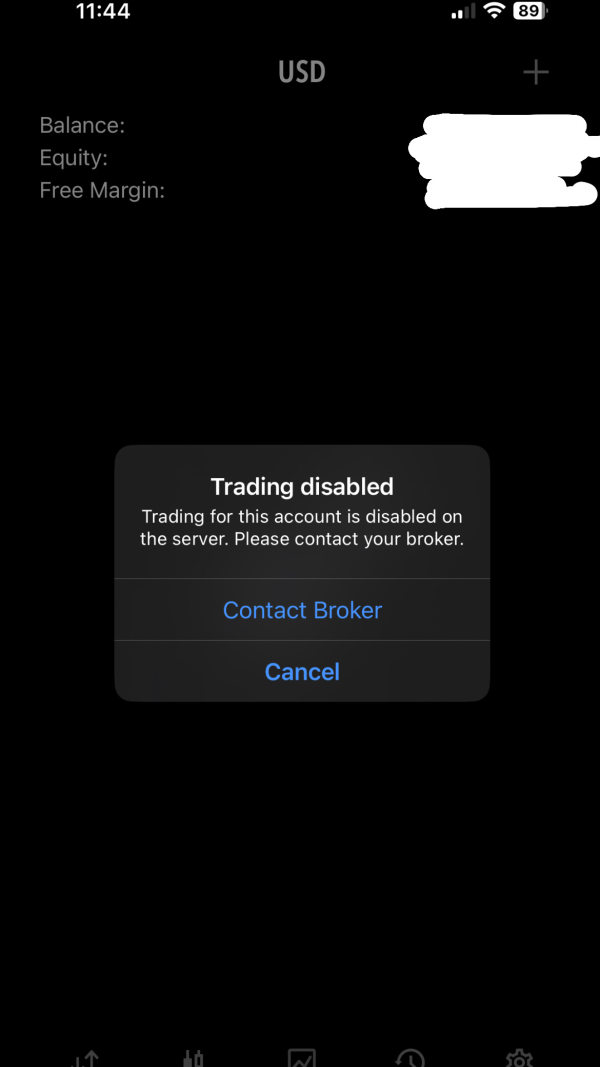

The broker supports MetaTrader 4 and MetaTrader 5 platforms, which are industry-standard solutions offering complete charting tools, technical indicators, and automated trading capabilities.

Regional Restrictions

Specific geographical restrictions are not detailed in available sources, though regulatory compliance typically requires certain limitations based on local laws and licensing agreements.

Customer Support Languages

RoboForex demonstrates strong international commitment by offering customer support in 12 different languages, making communication easier for a diverse global client base.

This roboforex review highlights the need for potential clients to seek additional clarification on several key operational details directly from the broker.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

RoboForex's account conditions get an average rating due to limited transparency in publicly available information. While the broker operates as an established market maker with over ten years of experience, specific details about account types, their distinctive features, and associated benefits are not fully outlined in accessible sources. This lack of detailed information makes it challenging for potential clients to make informed decisions about which account type might best suit their trading needs.

The absence of clearly stated minimum deposit requirements across different account tiers represents a significant transparency gap. Most competitive brokers provide this information prominently to help traders understand entry barriers. Additionally, specific account opening procedures and required documentation are not detailed in available materials, which could potentially slow the onboarding process for new clients.

User feedback suggests that while account functionality generally meets expectations, the lack of upfront clarity about account conditions creates some friction in the initial evaluation process. Traders have noted that getting complete account information requires direct contact with customer service, which, while ultimately helpful, adds an extra step to the decision-making process. The broker would benefit from providing more detailed account comparison information on their public-facing materials.

Despite these transparency challenges, RoboForex does offer negative balance protection, which represents a significant positive feature for risk management. This roboforex review indicates that while basic account functionality appears adequate, enhanced information transparency would significantly improve the overall account conditions rating.

RoboForex shows solid performance in the tools and resources category, mainly through its support of industry-standard trading platforms. The broker's commitment to MetaTrader 4 and MetaTrader 5 provides traders with access to complete charting capabilities, technical analysis tools, and automated trading functions that are essential for modern forex trading. These platforms offer extensive customization options and support for expert advisors, which appeals to both novice and experienced traders.

The availability of eight different asset classes expands trading opportunities beyond traditional forex pairs, allowing for portfolio diversification and various trading strategies. This asset variety demonstrates the broker's understanding of modern traders' needs for multi-market access. However, specific details about proprietary trading tools, market analysis resources, or educational materials are not extensively documented in available sources.

User feedback indicates general satisfaction with platform functionality and tool accessibility. Traders appreciate the familiar interface of MetaTrader platforms and the stability of trading execution. The automated trading support allows for algorithmic strategies, which is particularly valuable for traders seeking to implement systematic approaches to market participation.

Areas for potential improvement include more detailed information about research resources, market analysis tools, and educational content. While the core trading infrastructure appears robust, additional proprietary tools or enhanced market insights could elevate the overall offering and better compete with brokers providing comprehensive research departments.

Customer Service and Support Analysis (8/10)

Customer service represents one of RoboForex's strongest performance areas, earning recognition for both accessibility and quality. The broker's commitment to supporting 12 different languages demonstrates a genuine dedication to serving an international client base effectively. This multilingual approach removes significant communication barriers that often frustrate traders when seeking assistance with technical or account-related issues.

According to user reviews compiled by REVIEWS.io, customer service quality receives consistently positive feedback, with users highlighting responsive support and professional handling of inquiries. The availability of multiple communication channels, including phone, email, and live chat options, provides flexibility for clients to choose their preferred method of contact based on urgency and complexity of their needs.

Response times appear to meet industry standards, with users reporting satisfactory resolution timeframes for most common issues. The support team demonstrates technical competency in addressing platform-related questions and account management concerns. This level of service quality contributes significantly to the overall user experience and helps maintain client satisfaction even when other areas may present challenges.

The primary area for potential enhancement involves expanding the availability of detailed self-service resources, which could reduce the need for direct contact while maintaining the high-quality personal support that currently distinguishes RoboForex in this category. The strong customer service performance significantly contributes to the broker's overall appeal and user retention.

Trading Experience Analysis (7/10)

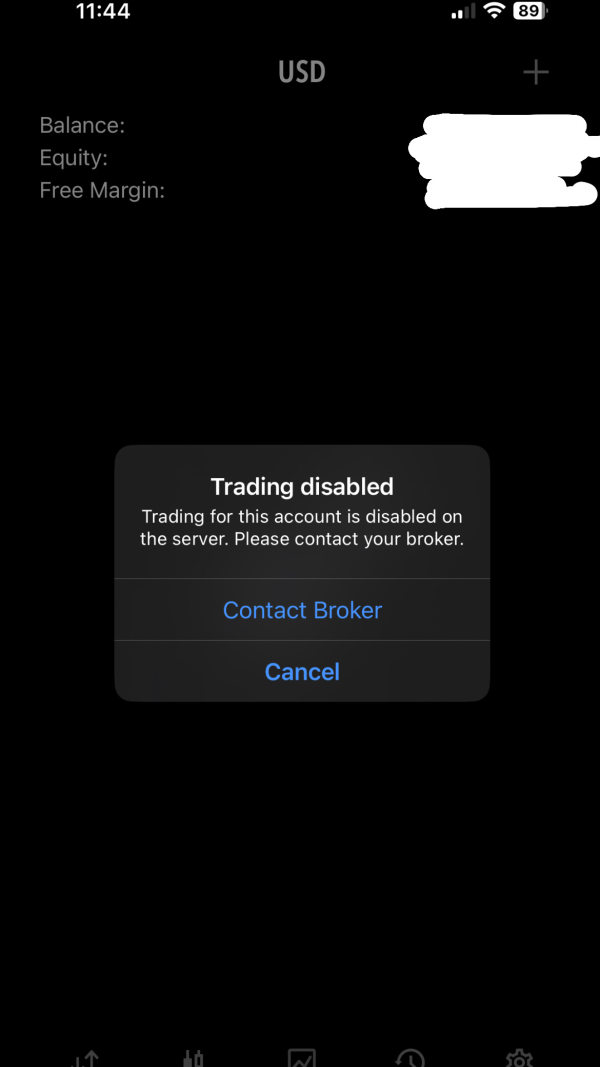

The trading experience with RoboForex receives positive evaluation based on user feedback indicating generally smooth platform operation and reliable trade execution. The broker's use of MetaTrader platforms provides traders with familiar, stable environments that support various trading styles and strategies. Platform stability appears consistent, with users reporting minimal disruptions during normal market hours and acceptable performance during high-volatility periods.

Order execution quality, while not extensively detailed in available performance data, receives generally favorable user reviews. Traders appreciate the straightforward execution process and report satisfaction with fill rates and slippage management. The broker's market maker model provides immediate liquidity for most standard position sizes, contributing to efficient trade processing.

Mobile trading experience gets positive feedback, with users noting that mobile platform functionality adequately supports trading on-the-go requirements. The mobile applications maintain essential features from desktop versions while optimizing for smartphone and tablet interfaces. This mobile accessibility proves particularly valuable for traders who need to monitor positions or react to market developments outside traditional trading hours.

However, this roboforex review notes that specific performance metrics such as average execution speeds, detailed slippage statistics, or comprehensive uptime data are not publicly available. Additionally, information about trading environment specifics like typical spreads and liquidity depth during different market conditions requires direct inquiry with the broker. Enhanced transparency in these areas could further improve the trading experience rating.

Trust and Safety Analysis (7/10)

RoboForex demonstrates reasonable commitment to client protection through several key safety measures, most notably the provision of negative balance protection and client funds insurance. These features provide important safeguards that protect traders from potential account deficits during extreme market volatility and offer additional security for deposited funds. The negative balance protection particularly appeals to retail traders who want to limit their maximum potential losses.

The broker operates under Financial Services Commission (FSC) regulation, which provides a foundational level of regulatory oversight. However, the lack of prominently displayed license numbers or detailed regulatory compliance information creates some transparency concerns. More comprehensive disclosure of regulatory status, including specific license details and regulatory reporting practices, would enhance trust levels among potential clients.

Company transparency presents mixed results in available assessments. While basic operational information is accessible, detailed financial reporting, management team information, and corporate structure details are not extensively available in public sources. This limited transparency may concern traders who prefer comprehensive due diligence capabilities when selecting a broker.

The broker's operational history since 2009 provides some reassurance about stability and longevity in the competitive forex market. However, information about industry recognition, awards, or third-party certifications that might validate the company's standing is not prominently featured. User trust feedback indicates moderate confidence levels, with the 68% recommendation rate suggesting generally positive experiences while highlighting room for improvement in building stronger client confidence through enhanced transparency measures.

User Experience Analysis (6/10)

Overall user satisfaction with RoboForex reflects moderate performance, as evidenced by the 3.7 out of 5-star rating from 634 customer reviews. This rating indicates that while many users find the service acceptable, there are notable areas where improvements could enhance the overall experience. The 68% recommendation rate suggests that more than two-thirds of users would consider recommending the broker to others, though this also indicates that nearly one-third had experiences that fell short of their expectations.

Interface design and platform usability generally receive positive feedback, particularly regarding the familiar MetaTrader environment that most forex traders readily understand. Users appreciate the straightforward navigation and access to essential trading functions. However, some feedback suggests that the overall user experience could benefit from more intuitive account management interfaces and clearer information presentation regarding account conditions and trading costs.

Registration and account verification processes are not extensively detailed in available user feedback, representing an information gap that could affect new client onboarding experiences. Efficient, clearly explained verification procedures significantly impact initial user impressions and overall satisfaction levels.

Common user concerns center around the need for greater transparency in account conditions, trading costs, and service terms. Several reviews indicate that users prefer having comprehensive information readily available rather than requiring direct contact for basic operational details. Additionally, some users express desire for more detailed educational resources and market analysis tools to support their trading development.

The broker appears well-suited for traders who prioritize multilingual support and appreciate negative balance protection features. However, those seeking extensive educational resources or highly detailed cost transparency might find the current offering somewhat limited compared to some competitors in the market.

Conclusion

This comprehensive roboforex review reveals a forex broker with solid fundamentals but notable areas for improvement. RoboForex demonstrates particular strength in customer service quality and multilingual support, making it an attractive option for international traders who value accessible, responsive assistance. The broker's negative balance protection and regulatory oversight provide important safety features that appeal to risk-conscious traders.

However, transparency challenges regarding account conditions, trading costs, and detailed operational information represent significant areas where RoboForex could enhance its offering. The moderate user rating of 3.7/5 reflects these mixed experiences, indicating that while many clients find the service satisfactory, there is clear room for improvement in information clarity and overall user experience.

RoboForex appears most suitable for traders who prioritize customer service quality, appreciate multilingual support, and value basic safety features like negative balance protection. The broker may be less ideal for those seeking extensive educational resources, detailed cost transparency, or comprehensive research tools. Potential clients should plan to engage directly with customer service to obtain detailed information about account conditions and trading costs before making final decisions.