Regarding the legitimacy of XTB forex brokers, it provides CYSEC, FCA, ICDX, BAPPEBTI and WikiBit, (also has a graphic survey regarding security).

Is XTB safe?

Pros

Cons

Is XTB markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 17

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

XTB Ltd

Effective Date:

2012-04-18Email Address of Licensed Institution:

office.cy@xtb.comSharing Status:

No SharingWebsite of Licensed Institution:

www.xtb.com/cyExpiration Time:

--Address of Licensed Institution:

Pikioni, 10 HIGHSIGHT RENTALS LTD, 3075, LimassolPhone Number of Licensed Institution:

+357 25 724350Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

XTB Limited

Effective Date:

2011-01-17Email Address of Licensed Institution:

compliance@xtb.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://www.xtb.com/enExpiration Time:

--Address of Licensed Institution:

Level 9, Office 9.14 One Canada Square Canary Wharf London E14 5AA UNITED KINGDOMPhone Number of Licensed Institution:

+44 2036953085Licensed Institution Certified Documents:

ICDX Derivatives Trading License (EP)

Indonesia Commodity and Derivatives Exchange

Indonesia Commodity and Derivatives Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

XTB Indonesia Berjangka, PT

Effective Date: Change Record

--Email Address of Licensed Institution:

info@xtb.idSharing Status:

No SharingWebsite of Licensed Institution:

www.xtb.com/idExpiration Time:

--Address of Licensed Institution:

Treasury Tower Lantai 09 Unit N, District 8 SCBD Lot 28, Jl. Jend. Sudirman Kav. 52-53, Jakarta Selatan 12190Phone Number of Licensed Institution:

(+62) 222 0582 219Licensed Institution Certified Documents:

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT XTB INDONESIA BERJANGKA

Effective Date: Change Record

--Email Address of Licensed Institution:

info@xtb.idSharing Status:

No SharingWebsite of Licensed Institution:

www.xtb.com/idExpiration Time:

--Address of Licensed Institution:

Treasury Tower, Lantai 09 N, District 8, SCBD Lot 28, Jalan Jenderal Sudirman Kavling 52-53 Senayan, Kec. Kebayoran Baru, Jakarta Selatan - DKI Jakarta 12190Phone Number of Licensed Institution:

021 - 50152888Licensed Institution Certified Documents:

Is XTB A Scam?

Introduction

XTB, also known as X-Trade Brokers, is a prominent player in the forex and CFD trading markets, founded in 2002 and headquartered in Poland. With over 1 million clients globally, XTB positions itself as a reliable broker offering a wide range of trading instruments, including forex, stocks, commodities, and cryptocurrencies. However, the online trading landscape is riddled with potential risks and scams, making it essential for traders to carefully evaluate brokers before committing their funds. This article aims to provide a comprehensive analysis of XTB, assessing its legitimacy, regulatory standing, trading conditions, and overall safety for traders. Our investigation is based on a thorough review of various sources, including regulatory databases, user reviews, and expert analyses, to present a balanced perspective on whether XTB is a trustworthy broker or a potential scam.

Regulation and Legitimacy

Regulation is a crucial aspect when evaluating the safety and legitimacy of a forex broker. XTB operates under multiple regulatory authorities, which adds a layer of trust and security for its clients. The primary regulatory bodies overseeing XTB include the Financial Conduct Authority (FCA) in the UK, the Polish Financial Supervision Authority (KNF), and the Cyprus Securities and Exchange Commission (CySEC). These regulators are recognized for their stringent requirements and investor protection measures.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | 522157 | UK | Verified |

| KNF | 6884980 | Poland | Verified |

| CySEC | 169/12 | Cyprus | Verified |

| FSC | 000302/11 | Belize | Verified |

The presence of these reputable regulators indicates that XTB adheres to high standards of conduct and operational transparency. Furthermore, XTB is a publicly traded company listed on the Warsaw Stock Exchange, which subjects it to additional scrutiny and reporting requirements. This level of oversight is vital for ensuring that client funds are handled responsibly and that the broker remains accountable to its clients.

Historically, XTB has maintained a good compliance record with regulatory authorities, which is an essential factor for traders seeking a reliable broker. The company's commitment to regulatory compliance is further demonstrated by its implementation of negative balance protection, which ensures that clients cannot lose more than their deposited funds, a key feature for risk management in trading.

Company Background Investigation

XTB has a rich history dating back to its inception in 2002. Originally established as X-Trade Brokers, the company rebranded to XTB in 2004 to comply with new regulations in Poland. Over the years, XTB has expanded its operations and now has offices in multiple countries, including the UK, Germany, France, and Spain. This international presence has allowed XTB to cater to a diverse clientele while adapting its services to meet local market demands.

The management team at XTB comprises experienced professionals with backgrounds in finance, trading, and technology. Their expertise is crucial in navigating the complexities of the financial markets and ensuring that the broker remains competitive. Transparency is a core value for XTB, and the company regularly publishes financial reports and updates, allowing clients to access critical information about its operations and performance.

In terms of ownership, XTB is publicly traded, which further enhances its accountability. Shareholders can influence the company's direction, and regulatory bodies closely monitor its activities. This structure promotes a culture of compliance and ethical conduct, which is essential for maintaining trust with clients.

Trading Conditions Analysis

XTB offers competitive trading conditions, which are vital for attracting and retaining clients. The broker provides a transparent fee structure, primarily based on spreads, with no hidden charges. Traders can access a wide range of instruments, including over 2,300 CFDs, stocks, and ETFs, making it a versatile platform for various trading strategies.

The overall cost structure at XTB is competitive, particularly for forex trading. However, it is essential to scrutinize the fee policies to identify any potentially problematic charges. For instance, XTB charges a monthly inactivity fee of €10 after one year of inactivity, which may be a concern for traders who do not trade frequently.

| Fee Type | XTB | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | From 0.2 pips |

| Commission Model | None for standard | Varies by broker |

| Overnight Interest Range | Varies by instrument | Varies by broker |

XTB's spreads start at competitive levels, particularly for major currency pairs, which is attractive for both novice and experienced traders. The absence of commissions on most trades further enhances the appeal of trading with XTB. However, traders should be aware of the potential for wider spreads during periods of high volatility, which could impact trading costs.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. XTB employs several measures to ensure the security of its clients' investments. One of the key features is the segregation of client funds, meaning that traders money is kept in separate accounts from the broker's operational funds. This practice minimizes the risk of losing client funds in case of the broker's insolvency.

Additionally, XTB participates in investor compensation schemes, which provide further protection for clients. For instance, UK clients are protected by the Financial Services Compensation Scheme (FSCS), which covers up to £85,000 in the event of the broker's failure. This level of protection is a significant advantage for traders concerned about the safety of their investments.

XTB's negative balance protection policy also safeguards traders from incurring debts beyond their deposits, a critical feature for managing risk in leveraged trading. While XTB has maintained a good track record regarding fund security, it is essential for traders to remain vigilant and conduct due diligence before investing.

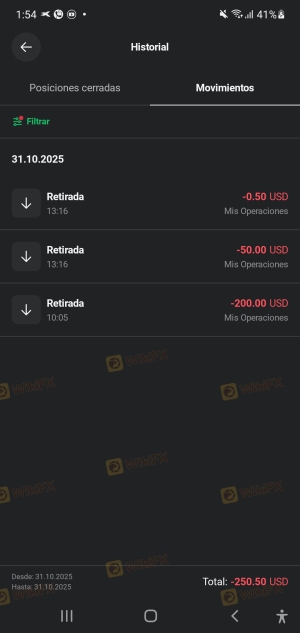

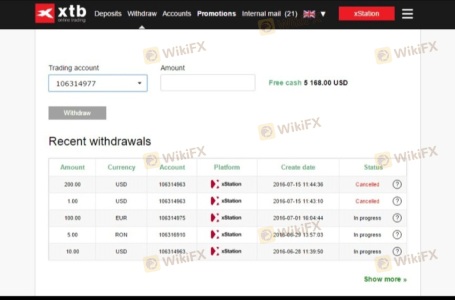

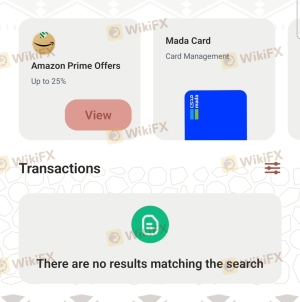

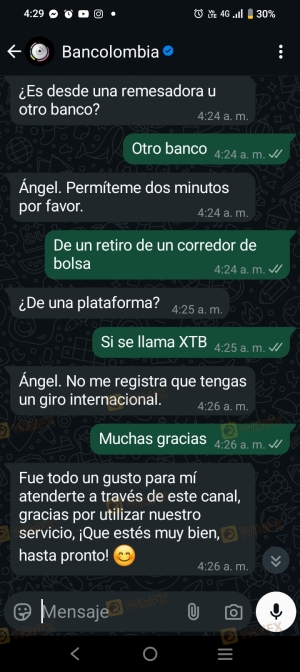

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. XTB generally receives positive reviews for its trading platform, customer support, and educational resources. However, like any broker, it has faced its share of complaints. Common issues reported by clients include withdrawal delays, difficulties in reaching customer support, and concerns over the responsiveness of the service team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Slow response times |

| Support Accessibility | High | Limited availability |

| Fee Transparency | Medium | Clarification needed |

One notable case involved a trader who experienced delays in withdrawing funds, leading to frustration and dissatisfaction. While XTB addressed the issue, the response time was longer than expected, highlighting an area for improvement in customer service. Overall, while many clients report a positive trading experience with XTB, it is essential for potential users to consider these complaints and the broker's response to them.

Platform and Trade Execution

XTB's trading platforms, primarily the proprietary xStation 5 and the widely recognized MetaTrader 4, are designed to cater to both novice and experienced traders. The xStation 5 platform is known for its user-friendly interface, advanced charting tools, and fast execution speeds, which are critical for traders engaging in high-frequency trading or scalping.

The quality of order execution is generally high, with minimal slippage reported during normal market conditions. However, some users have noted instances of slippage during periods of high volatility, which is not uncommon in the forex market. Additionally, the absence of guaranteed stop-loss orders may be a concern for traders looking for additional risk management tools.

Risk Assessment

Using XTB involves several risks that traders should be aware of. While the broker is regulated and has a good reputation, the inherent risks of trading, particularly with leveraged products like CFDs, remain significant. Traders should consider their risk tolerance and the potential for losses when engaging in trading activities.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight from multiple authorities |

| Market Risk | High | High volatility and potential for significant losses |

| Withdrawal Risk | Medium | Some reports of delays in processing withdrawals |

| Customer Support Risk | Medium | Inconsistent response times reported by users |

To mitigate these risks, traders should implement sound risk management strategies, such as setting stop-loss orders, diversifying their portfolios, and only investing funds they can afford to lose.

Conclusion and Recommendations

In conclusion, XTB is a well-regulated broker with a solid reputation in the forex and CFD trading space. The presence of multiple regulatory bodies overseeing its operations, coupled with its commitment to client fund security, positions XTB as a reliable choice for traders. However, potential users should be aware of the inherent risks associated with trading, particularly in volatile markets.

While XTB does not exhibit signs of being a scam, traders should remain vigilant and conduct thorough research before investing. For those seeking alternatives, brokers such as IG Group, CMC Markets, and eToro may offer similar services with varying features and benefits. Ultimately, the choice of broker should align with individual trading goals, risk tolerance, and the specific features that matter most to the trader.

Is XTB a scam, or is it legit?

The latest exposure and evaluation content of XTB brokers.

XTB Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XTB latest industry rating score is 7.04, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.04 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.