Regarding the legitimacy of CBCX forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is CBCX safe?

Pros

Cons

Is CBCX markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

CBCX MARKETS (PTY) LTD

Effective Date:

2019-05-07Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

CRADDOCK SQUARE ROSEBANK 169 OXFORD ROAD ROSEBANK JOHANNESBURG GAUTENG 2196Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is CBCX Safe or Scam?

Introduction

CBCX is a forex broker that has established itself in the global trading landscape since its inception in 2010. With headquarters in London and operational offices in South Africa and Singapore, CBCX markets itself as a liquidity provider, offering a wide range of trading instruments including forex, commodities, and precious metals. Given the competitive nature of the forex market, it is crucial for traders to carefully evaluate the legitimacy and reliability of their chosen broker. The potential for fraud and mismanagement in the forex industry necessitates a thorough investigation into brokers' regulatory compliance, financial practices, and overall reputation. This article aims to provide an objective assessment of CBCX, utilizing a combination of narrative analysis and structured information derived from various online sources.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors influencing its credibility. CBCX claims to be regulated by several reputable authorities, including the Financial Conduct Authority (FCA) in the UK and the Financial Sector Conduct Authority (FSCA) in South Africa. These regulatory bodies are known for enforcing strict compliance measures, which enhance investor protection. Below is a summary of CBCX's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Verified |

| FSCA | N/A | South Africa | Verified |

| FSC | N/A | Mauritius | Verified |

Despite being regulated by these authorities, there are mixed reviews regarding the quality and extent of compliance by CBCX. Some sources indicate that while it holds licenses, the broker has been flagged for "medium potential risk" due to concerns about its operational practices and transparency. This suggests that while CBCX operates within a regulated framework, traders should remain vigilant and conduct due diligence before engaging in trading activities.

Company Background Investigation

CBCX was founded in 2010, positioning itself as a provider of liquidity solutions for forex and CFD trading. The ownership structure of the company remains somewhat opaque, with limited publicly available information regarding its stakeholders. However, the management team is reported to consist of experienced professionals with backgrounds in finance and trading, which could lend credibility to the firm's operations.

The companys transparency in terms of its operations and financial disclosures appears to be inconsistent. While it offers some information on its website, the lack of detailed reports or insights into its financial health may raise concerns for potential investors. A broker's willingness to disclose operational metrics and financial data is often a good indicator of its reliability.

Trading Conditions Analysis

When evaluating a broker, understanding the cost structure is paramount. CBCX offers various trading accounts, with competitive spreads and commission structures. However, the broker does not provide clear information regarding its fees, leading to potential confusion among traders. Below is a summary of the core trading costs associated with CBCX:

| Fee Type | CBCX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | Spread-only | Varies |

| Overnight Interest Range | N/A | Varies |

CBCX's spreads are notably tight compared to industry averages, which can be appealing to traders looking to minimize costs. However, the absence of a clear commission structure may indicate that costs are embedded within the spreads, potentially leading to higher effective trading costs for certain strategies. Traders should carefully assess their trading style and calculate potential costs before committing to this broker.

Client Fund Safety

The safety of client funds is a critical aspect of any brokerage. CBCX claims to implement several measures to protect client capital, including segregated accounts and adherence to regulatory requirements. These measures are designed to ensure that client funds are kept separate from the broker's operational funds, reducing the risk of misappropriation.

However, the absence of specific information regarding investor protection schemes, such as negative balance protection, may be a concern for traders. Historical disputes or issues surrounding fund safety can also impact a broker's reputation. While CBCX has not been prominently associated with significant safety scandals, the lack of transparency in this area warrants cautious consideration.

Customer Experience and Complaints

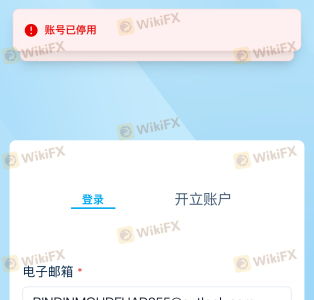

Customer feedback is an essential indicator of a broker's reliability. CBCX has received a mix of reviews from users, with some praising its trading conditions and customer support, while others have expressed concerns regarding withdrawal processes and account management. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

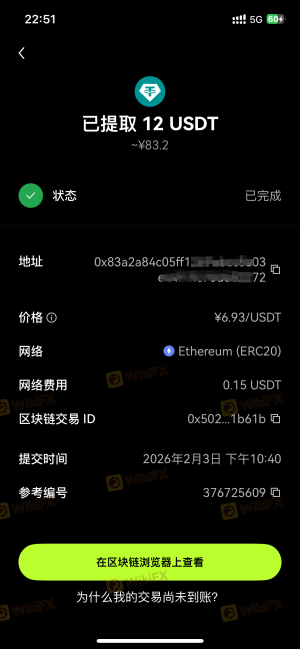

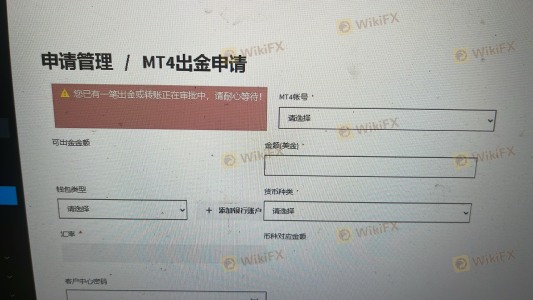

| Withdrawal Delays | High | Mixed responses |

| Account Management Issues | Medium | Generally responsive |

| Lack of Transparency | Medium | Limited information |

One notable case involved a trader who reported delays in withdrawing funds, leading to frustration and a loss of trust in the broker. While CBCX's customer support is reported to be responsive, the handling of withdrawal requests appears inconsistent, which could be a red flag for potential clients.

Platform and Trade Execution

The trading platform offered by CBCX, primarily MetaTrader 4 (MT4) and MetaTrader 5 (MT5), is widely regarded for its reliability and user-friendliness. Traders benefit from advanced charting tools and automated trading capabilities, which can enhance their trading experience. However, the quality of order execution is a critical aspect that can significantly impact trading outcomes.

Reports indicate that CBCX generally provides good order execution with minimal slippage; however, there are isolated instances of rejected orders, which could be concerning for high-frequency traders. Overall, the platform's performance appears to be satisfactory, but traders should remain vigilant for any signs of manipulation or execution issues.

Risk Assessment

Engaging with any broker involves inherent risks, and CBCX is no exception. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Mixed reviews on adherence to regulations |

| Fund Safety | Medium | Segregated accounts, but lack of investor protection details |

| Customer Service Reliability | Medium | Varied feedback on responsiveness and issue resolution |

To mitigate these risks, traders are advised to conduct thorough research, maintain realistic expectations, and consider using risk management tools such as stop-loss orders.

Conclusion and Recommendations

In conclusion, CBCX presents itself as a legitimate forex broker with several appealing features, including tight spreads and a reputable trading platform. However, potential clients should exercise caution, given the mixed reviews regarding its regulatory compliance, customer service, and transparency. While there are no overt signs of a scam, the inconsistencies and lack of detailed information could pose risks for traders.

For those considering CBCX, it may be prudent to start with a demo account to evaluate the platform and customer service before committing real funds. Additionally, traders may want to explore other well-regarded brokers that offer robust regulatory oversight and a proven track record, such as IG Group or OANDA, as safer alternatives. Always remember that thorough research and due diligence are key to successful trading in the forex market.

Is CBCX a scam, or is it legit?

The latest exposure and evaluation content of CBCX brokers.

CBCX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CBCX latest industry rating score is 6.95, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.95 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.