ATFX 2025 Review: Everything You Need to Know

Executive Summary

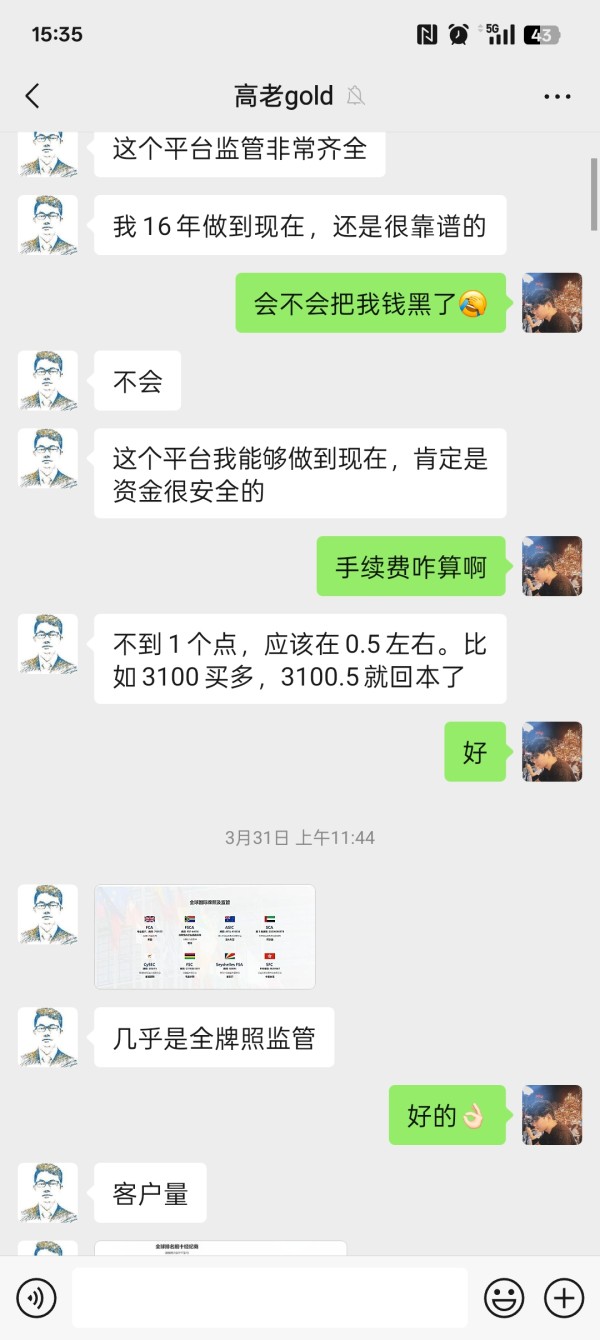

This comprehensive ATFX review evaluates one of the most talked-about forex brokers in the current market landscape. ATFX has built itself as a trustworthy forex broker with multiple regulatory frameworks and generally positive user feedback across various trading communities. The broker operates under the oversight of several prestigious regulatory bodies including the FCA, FSCA, ASIC, SCA, CySEC, FSC, FSA, and Hong Kong authorities. This significantly enhances its credibility in the competitive forex market.

Two key highlights distinguish ATFX from its competitors. First, the broker has an impressive trust score of 89 out of 99, reflecting strong market confidence. Second, ATFX offers a diversified portfolio of trading asset classes spanning forex, precious metals, crude oil, and indices. However, according to user feedback, the platform notably lacks MT5 integration. Some traders consider this a significant limitation in today's trading environment.

The broker primarily targets intermediate to advanced traders seeking comprehensive market access. It also serves novice traders who prioritize educational resources and structured learning programs. According to available data, 2,158 new traders chose ATFX in the last 90 days. This indicates sustained market appeal and growing user confidence in the platform's services.

Important Disclaimers

ATFX operates through different regulatory entities across various jurisdictions. Traders must understand that regulatory frameworks, applicable laws, and policy implementations may vary significantly depending on their geographical location. The regulatory differences between FCA oversight in the UK, ASIC regulation in Australia, and other jurisdictional frameworks mean that trading conditions, investor protections, and dispute resolution mechanisms may differ substantially.

This evaluation is based on comprehensive analysis of publicly available information, user feedback from multiple sources, and regulatory filings. The assessment methodology incorporates data from official regulatory databases, user review platforms, and industry reports. This provides a balanced perspective on ATFX's services and performance.

Rating Framework

Broker Overview

Company Background and Foundation

ATFX was established in 2014. The company operates from its headquarters in Cyprus, positioning itself as a global online forex and CFD broker committed to delivering efficient trading services to clients worldwide. The company has built its reputation on providing comprehensive access to international financial markets while maintaining strict adherence to regulatory standards across multiple jurisdictions. Since its inception, ATFX has focused on creating a trading environment that balances accessibility for newcomers with sophisticated tools for experienced traders.

The broker's business model centers on providing trading access to forex, precious metals, crude oil, indices, and other financial instruments through a unified platform experience. ATFX emphasizes educational programs designed to help clients succeed in online trading. This reflects their commitment to trader development rather than simply transaction volume generation.

Regulatory Framework and Asset Classes

According to available regulatory information, ATFX maintains authorization and oversight from multiple prestigious regulatory bodies. These include the Financial Conduct Authority (FCA), Financial Sector Conduct Authority (FSCA), Australian Securities and Investments Commission (ASIC), and several other international regulatory entities. This multi-jurisdictional approach ensures compliance with diverse international trading standards while providing clients with appropriate investor protections based on their location.

The platform's asset coverage includes foreign exchange pairs, precious metals trading, crude oil contracts, and various market indices. This provides traders with diversified exposure across major asset classes. However, user feedback indicates that the platform lacks MT5 integration. Some traders consider this essential for advanced trading strategies and automated trading systems.

Regulatory Coverage and Compliance

ATFX operates under comprehensive regulatory oversight from FCA, FSCA, ASIC, and other international regulatory authorities. This ensures robust fund safety measures and adherence to international trading standards. The multi-regulatory approach provides traders with confidence in fund security and dispute resolution mechanisms.

Deposit and Withdrawal Infrastructure

The minimum deposit requirement is set at $500. This positions ATFX in the mid-range category compared to industry standards. Specific deposit and withdrawal methods are not detailed in available information. Prospective traders need to contact the broker directly for comprehensive payment option details.

Promotional Offerings and Incentives

Available information does not specify particular bonus programs or promotional activities currently offered by ATFX. Traders interested in promotional opportunities should inquire directly with the broker about any available incentive programs.

Trading Assets and Market Access

ATFX provides access to forex, precious metals, crude oil, and indices. This offers traders diversified exposure across major asset classes. The comprehensive asset selection enables portfolio diversification and various trading strategy implementations across different market sectors.

Cost Structure and Pricing

The broker offers spreads starting from 0. This is competitive within the industry standard range. However, specific commission structures and additional fees are not detailed in available information. Direct inquiry is required for comprehensive cost analysis.

Leverage Parameters

Maximum leverage reaches 1:30. This aligns with European regulatory standards and provides reasonable risk management parameters for most trading strategies. The leverage level balances trading opportunity with prudent risk management requirements.

Platform Technology

Available information does not specify the exact trading platforms offered. User feedback indicates the absence of MT5 functionality. Some traders consider this a significant limitation for advanced trading requirements.

Geographic Restrictions

Specific geographic restrictions are not detailed in available information. The broker's multi-jurisdictional regulatory structure suggests broad international availability with location-specific regulatory compliance.

Customer Support Languages

The range of customer support languages is not specified in available information. Direct inquiry is required to determine multilingual support availability.

Comprehensive Rating Analysis

Account Conditions Analysis (Score: 7/10)

ATFX's account structure reflects a balanced approach to serving diverse trader needs. Specific account type varieties are not detailed in available information. The $500 minimum deposit requirement represents a moderate entry barrier that effectively filters serious traders while remaining accessible to committed newcomers. User feedback generally supports this deposit level as reasonable, though it positions ATFX above some competitors offering lower entry points.

The account opening process appears streamlined based on positive user experience feedback, though specific details are not available. The overall user response suggests efficient verification and setup procedures. Islamic account options and other specialized account features are not mentioned in available documentation.

When compared to industry standards, the $500 minimum deposit places ATFX in the intermediate category. This is higher than some competitors but justified by the broker's regulatory standing and service quality. This ATFX review indicates that the deposit requirement aligns well with the broker's positioning as a serious trading platform rather than a casual trading environment.

The leverage limitation of 1:30 reflects compliance with European regulatory standards while providing sufficient trading opportunity for most strategies. This conservative approach to leverage demonstrates responsible risk management practices. It protects both traders and the broker's operational stability.

The trading tools and resources category reveals both strengths and limitations in ATFX's offering. User feedback specifically highlights the absence of MT5 platform integration. This represents a significant gap for traders requiring advanced charting capabilities, expert advisors, and sophisticated automated trading systems. The limitation affects the broker's appeal to algorithmic traders and those requiring comprehensive technical analysis tools.

ATFX does provide educational programs designed to support client success in online trading. This indicates commitment to trader development. However, specific details about research tools, market analysis resources, and educational content depth are not comprehensively detailed in available information.

The absence of detailed information about automated trading support, signal services, or expert advisor compatibility further limits the assessment of ATFX's technological capabilities. Some users express disappointment regarding the MT5 limitation. This suggests the gap represents a meaningful issue in the platform's competitive positioning.

Despite these limitations, users who don't require MT5 functionality report satisfaction with available tools. This suggests that the platform adequately serves traders with standard requirements. The educational focus appears to resonate well with newer traders seeking structured learning opportunities.

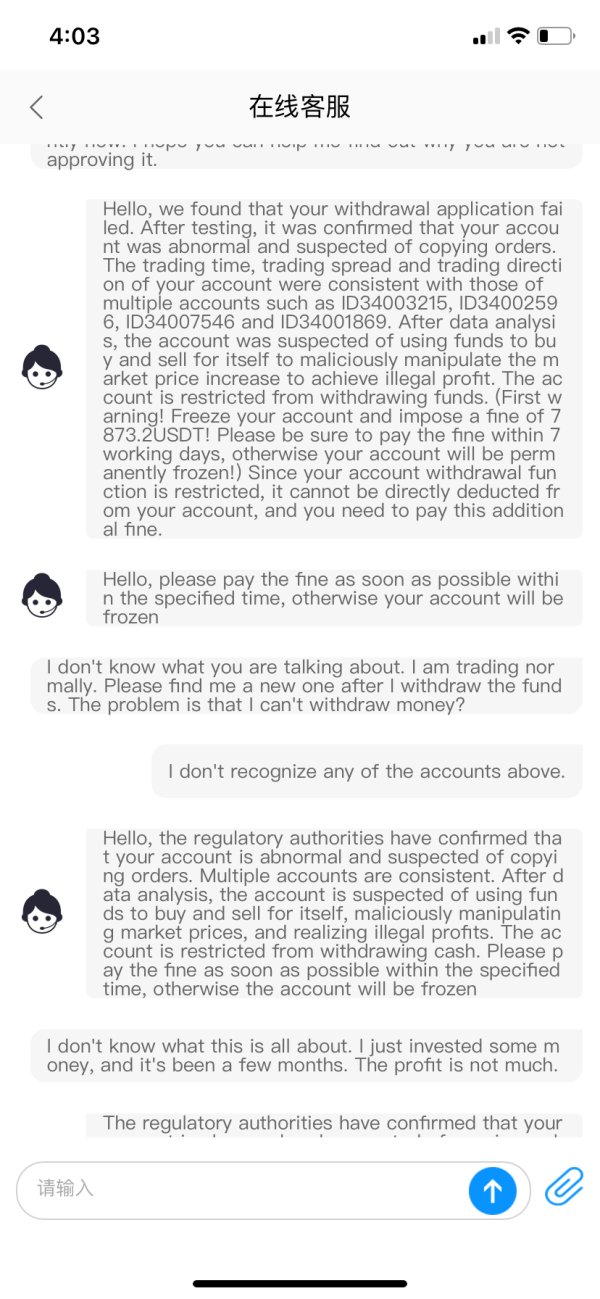

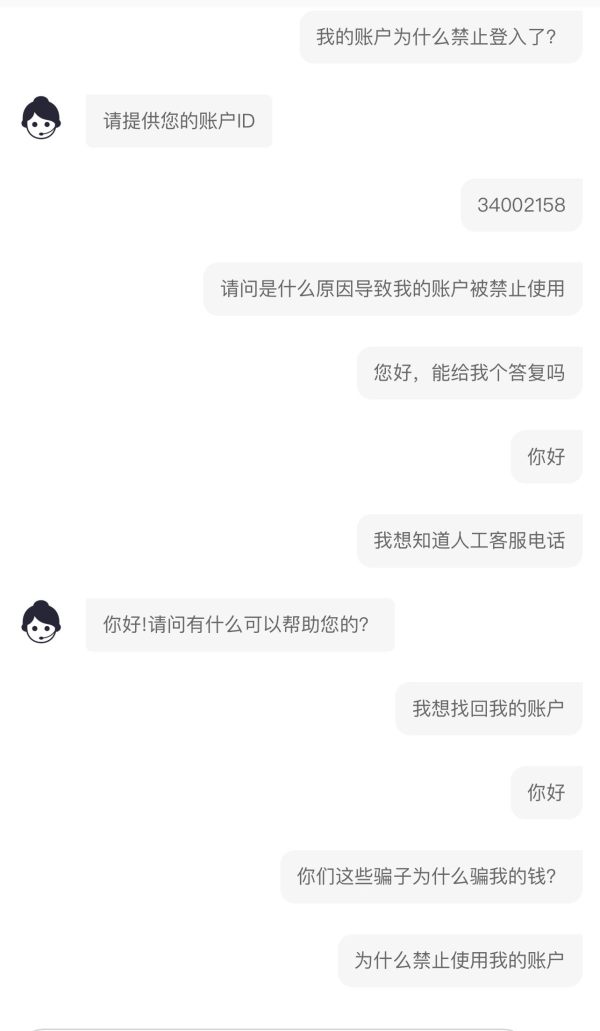

Customer Service and Support Analysis (Score: 8/10)

Customer service represents one of ATFX's stronger performance areas. User feedback consistently indicates positive experiences with support quality. While specific customer service channels, response times, and availability hours are not detailed in available information, the overall user sentiment suggests effective problem resolution and helpful support interactions.

The generally positive user feedback regarding customer service indicates that ATFX has invested appropriately in support infrastructure and staff training. Users appear satisfied with the quality of assistance received. Specific examples of problem resolution or support excellence are not detailed in available information.

Multilingual support capabilities are not specified in available documentation. This may be relevant for international traders seeking assistance in their native languages. The broker's multi-jurisdictional operation suggests likely multilingual capabilities, though confirmation would require direct inquiry.

The customer service evaluation benefits from consistently positive user feedback. This indicates that ATFX has successfully prioritized support quality as a competitive differentiator. The focus on service quality appears to contribute significantly to overall user satisfaction and retention.

Trading Experience Analysis (Score: 7/10)

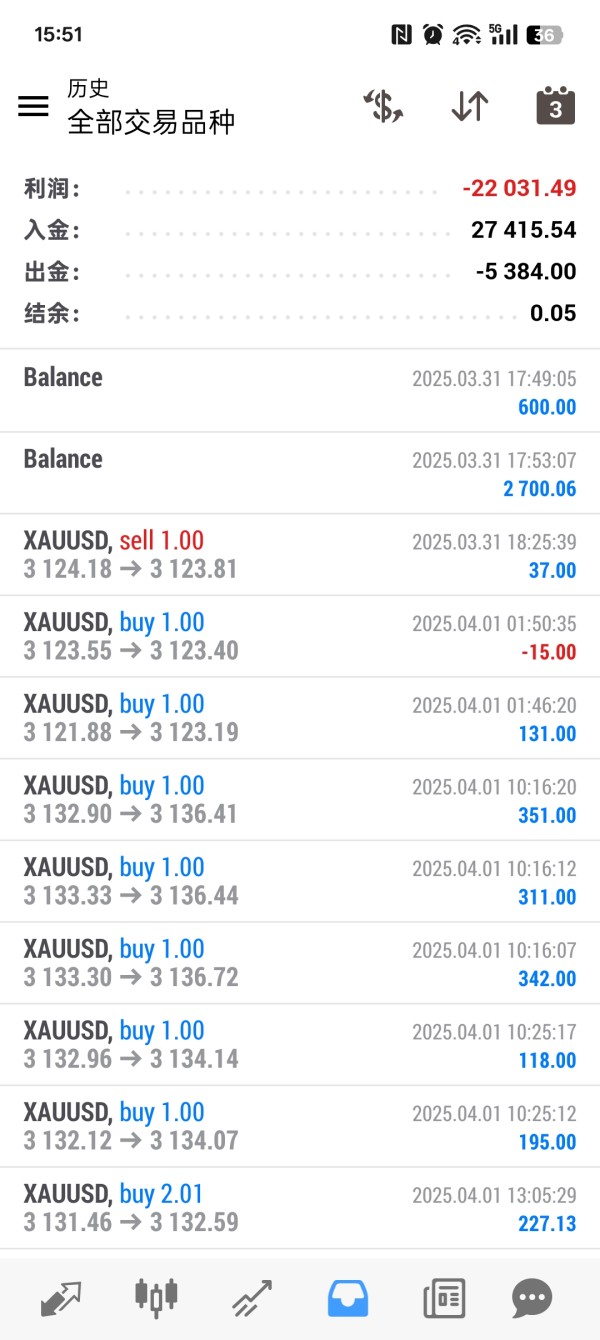

The trading experience evaluation reveals a generally satisfactory environment with competitive pricing and stable execution. Spreads starting from 0 provide cost-effective trading opportunities, particularly for high-frequency traders and those implementing scalping strategies. User feedback does not indicate significant slippage issues. This suggests reliable order execution under normal market conditions.

Platform stability and speed appear adequate based on user feedback. There are no widespread complaints about system downtime or execution delays. However, the absence of MT5 functionality limits the trading experience for users requiring advanced platform features and sophisticated analytical tools.

Users have provided suggestions for platform functionality improvements. This indicates engagement with the trading environment while suggesting areas for enhancement. The specific nature of these suggestions is not detailed in available information. The feedback suggests constructive user engagement rather than fundamental dissatisfaction.

Mobile trading experience details are not specified in available information. The competitive landscape typically requires robust mobile functionality for modern trading requirements. The overall trading environment appears stable and cost-effective, contributing to positive user experiences for those whose requirements align with available platform capabilities.

This ATFX review indicates that the trading experience meets standard industry expectations while leaving room for technological advancement. This is particularly true in platform variety and advanced trading tools.

Trust and Security Analysis (Score: 9/10)

ATFX excels in trust and security metrics, primarily due to its comprehensive regulatory oversight and exceptional trust score. The broker's regulation by FCA, FSCA, ASIC, and other prestigious regulatory bodies provides multiple layers of oversight and investor protection. This significantly enhances trader confidence in fund safety and operational integrity.

The impressive 89/99 trust score reflects strong market confidence and positive industry reputation. This positions ATFX among the more trustworthy brokers in the competitive forex market. The high trust rating suggests consistent operational performance and effective risk management practices that protect both trader interests and regulatory compliance.

While specific fund safety measures such as segregated accounts, insurance coverage, or compensation schemes are not detailed in available information, the multiple regulatory framework implies adherence to strict fund protection standards. Each regulatory jurisdiction requires these standards.

Company transparency regarding financial reporting, management structure, and operational policies is not comprehensively detailed in available information. However, the regulatory oversight provides inherent transparency requirements. The absence of mentioned negative events or regulatory actions suggests clean operational history and effective compliance management.

The combination of multi-jurisdictional regulation and high trust scores creates a strong foundation for trader confidence. This makes ATFX particularly appealing to risk-conscious traders prioritizing fund safety over aggressive promotional offerings.

User Experience Analysis (Score: 7/10)

Overall user satisfaction with ATFX appears strong. Feedback consistently indicates positive experiences across various aspects of the trading relationship. Users appreciate the broker's reliability and service quality, though some express desires for additional platform options and enhanced functionality.

Interface design and usability details are not specifically described in available information. However, the generally positive user feedback suggests adequate design and navigation. The registration and verification process appears efficient based on user experience reports. Specific timeline and requirement details are not provided.

The primary user complaint centers on the absence of MT5 platform availability. This affects traders requiring advanced analytical tools and automated trading capabilities. The limitation represents the most significant user experience gap identified in available feedback.

ATFX appears well-suited for intermediate to advanced traders seeking reliable execution and regulatory security. It also serves novice traders prioritizing educational resources and structured support. The user profile analysis suggests the broker successfully serves traders who value stability and regulation over cutting-edge technological features.

User recommendations for improvement focus on expanding platform options and enhancing tool availability. This suggests constructive engagement rather than fundamental dissatisfaction. The feedback pattern indicates that ATFX has established a solid foundation for user experience while maintaining clear areas for technological advancement.

Conclusion

This comprehensive ATFX review reveals a trustworthy forex broker that effectively balances regulatory compliance, service quality, and competitive trading conditions. ATFX demonstrates particular strength in trust and security metrics, with multiple regulatory oversight and an exceptional 89/99 trust score. This provides a strong foundation for trader confidence.

The broker is well-suited for intermediate to advanced traders who prioritize regulatory security and reliable execution. It also serves novice traders seeking educational resources and structured support programs. The educational focus and multi-jurisdictional regulatory framework make ATFX particularly appealing to risk-conscious traders who value stability over aggressive promotional offerings.

Key advantages include comprehensive regulatory oversight, competitive spreads starting from 0, strong customer service feedback, and high industry trust ratings. The primary limitation involves the absence of MT5 platform integration. This may disappoint traders requiring advanced analytical tools and automated trading capabilities. Overall, ATFX represents a solid choice for traders whose requirements align with the broker's current technological capabilities and regulatory focus.