Regarding the legitimacy of FxPro forex brokers, it provides CYSEC, FCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is FxPro safe?

Pros

Cons

Is FxPro markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 21

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

FXPRO Financial Services Ltd

Effective Date:

2007-03-05Email Address of Licensed Institution:

compliance@fxpro.comSharing Status:

No SharingWebsite of Licensed Institution:

www.fxpro.com, www.fxpro.co.uk, www.fxpro.es, www.fxpro.fr, www.fxpro.ru, www.fxpro.pl, www.fxpro.hu, www.fxpro.de, www.fxpro.it, www.fxpro-vn.com, www.fxpro.vn, www.fxpro.ae, www.fxpro.cn, www.fxpro-thailand.com, www.fxpro.cz, www.fxpro.com.my, fxpro.com.au, fxpro.org.cn, www.fxpro.dk, www.fxpro.no, www.fxpro.ee, www.fxpro.ro, www.fxpro.hr, www.fxpro.seExpiration Time:

--Address of Licensed Institution:

5 Dimokratias, Ergates, Nicosia, 2643, CyprusPhone Number of Licensed Institution:

+357 25 969 200Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

FXPRO UK Limited

Effective Date:

2010-09-10Email Address of Licensed Institution:

compliance@fxpro.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.fxpro.comExpiration Time:

--Address of Licensed Institution:

13-14 Basinghall Street City Of London EC2V 5BQ UNITED KINGDOMPhone Number of Licensed Institution:

+442077769720Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Invemonde Trading Ltd

Effective Date:

--Email Address of Licensed Institution:

support@fxpro.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.fxpro.comExpiration Time:

--Address of Licensed Institution:

Room 2, Attic Suites, 3rd Floor, Oliver Maradan Building, Victoria, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4224337Licensed Institution Certified Documents:

Is FxPro A Scam?

Introduction

FxPro is a well-known online forex and CFD broker that has established itself as a significant player in the global financial markets since its inception in 2006. Headquartered in London, the broker operates under multiple regulatory authorities, including the UK's Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). As the forex market continues to grow, traders are increasingly cautious about selecting a reliable broker, given the prevalence of scams and unethical practices in the industry. Therefore, it is essential for traders to conduct thorough due diligence before committing their funds to any trading platform. This article aims to evaluate the legitimacy and safety of FxPro by examining its regulatory status, company background, trading conditions, client fund security, user experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory framework within which a broker operates is crucial for ensuring the safety and security of client funds. FxPro is regulated by several reputable authorities, which enhances its credibility in the forex market. The following table summarizes FxPro's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 509956 | United Kingdom | Verified |

| CySEC | 078/07 | Cyprus | Verified |

| FSCA | 45052 | South Africa | Verified |

| SCB | SIA-F 184 | Bahamas | Verified |

FxPro's regulation by the FCA and CySEC, both of which are considered tier-1 regulators, provides a high level of investor protection. The FCA, for instance, offers a compensation scheme that protects clients up to £85,000 in the event of broker insolvency. Additionally, FxPro's compliance with the stringent requirements set forth by these regulatory bodies indicates a commitment to maintaining high operational standards. The broker has a history of compliance with regulatory mandates, which is essential for establishing trust with its clients.

Company Background Investigation

FxPro was founded in 2006 with the vision of becoming a leading online trading platform. Over the years, it has expanded its services globally, catering to both retail and institutional clients in over 170 countries. The company is owned by FxPro Group Ltd., which comprises several subsidiaries that operate under different regulatory jurisdictions. The management team at FxPro consists of experienced professionals with extensive backgrounds in finance, trading, and technology. This expertise is reflected in the broker's innovative trading solutions and commitment to client education.

Transparency is another critical aspect of FxPro's operations. The broker maintains an informative website that provides detailed information about its services, trading conditions, and regulatory status. Additionally, FxPro has received numerous awards for its service quality, further solidifying its reputation in the industry. The broker's long-standing presence in the market and its commitment to ethical trading practices contribute to its credibility as a reliable trading partner.

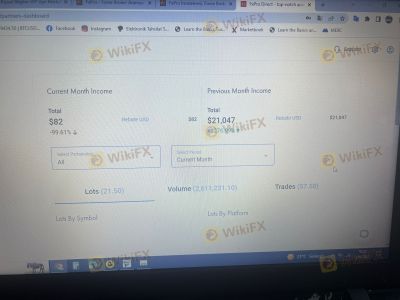

Trading Conditions Analysis

FxPro offers a range of trading accounts tailored to different trading styles, including standard, raw+, and elite accounts. The overall fee structure is competitive, but it is essential to understand the costs associated with trading on the platform. The following table compares core trading costs at FxPro with industry averages:

| Fee Type | FxPro | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 1.4 pips | From 1.0 pips |

| Commission Structure | $3.50 per lot (raw+) | $3.00 per lot |

| Overnight Interest Range | Average for the industry | Average for the industry |

While FxPro's spreads are competitive, they may not be the lowest in the market, especially for standard accounts. The raw+ account offers tighter spreads but incurs a commission, which may not be ideal for all traders. Additionally, traders should be aware of overnight swap fees, which can vary depending on the asset class. The transparency regarding fees is commendable, as FxPro clearly outlines its pricing structure on its website.

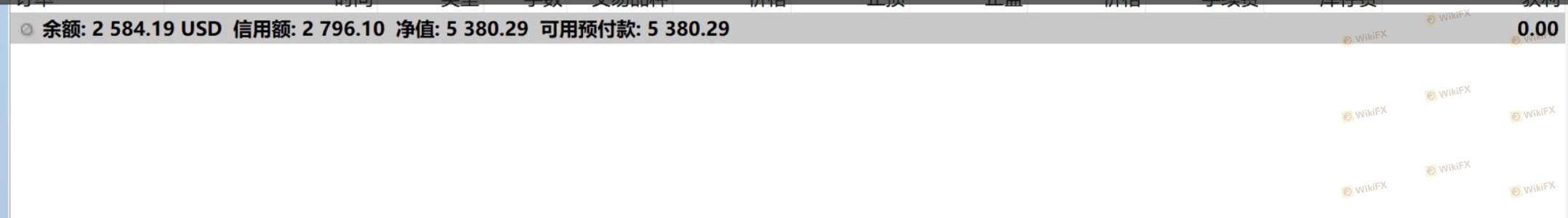

Client Fund Security

The safety of client funds is paramount when selecting a broker. FxPro employs several measures to ensure the security of client deposits. Client funds are kept in segregated accounts at major international banks, which means that they are not used for operational expenses or speculative investments. This segregation of funds is a regulatory requirement that adds an extra layer of protection for traders.

Moreover, FxPro offers negative balance protection, ensuring that clients cannot lose more than their deposited amount. This feature is particularly important in the volatile forex market, where sudden price movements can lead to significant losses. Additionally, FxPro is a member of the Financial Services Compensation Scheme (FSCS) in the UK, providing further assurance that client funds are protected. Historically, FxPro has maintained a clean record regarding fund security, with no major incidents reported.

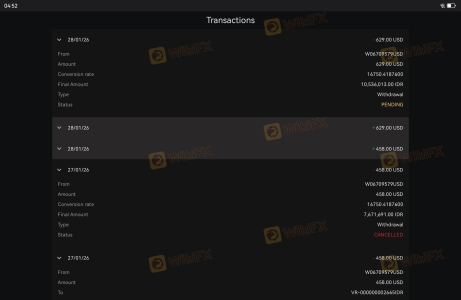

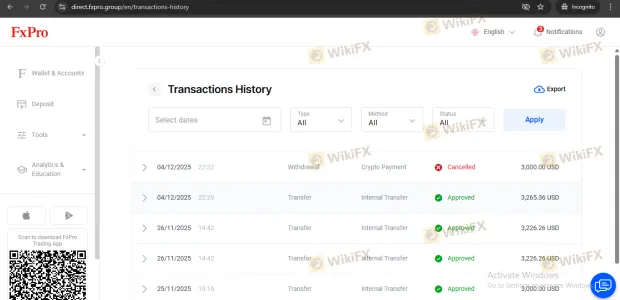

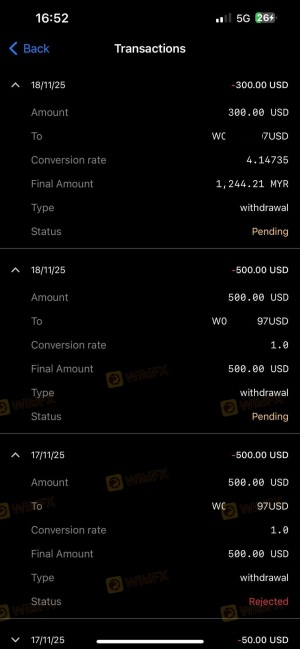

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's performance and reliability. Overall, FxPro has received a mix of positive and negative reviews from its clients. Common complaints include issues related to withdrawal processing times and the clarity of fee structures. The following table summarizes the main complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response time |

| Fee Transparency | Medium | Generally responsive |

| Platform Stability | Medium | Addressed promptly |

A few typical case studies highlight these issues. For instance, some users have reported delays in processing withdrawals, especially when multiple payment methods are involved. However, many clients have praised the broker's customer support for being responsive and helpful in resolving issues.

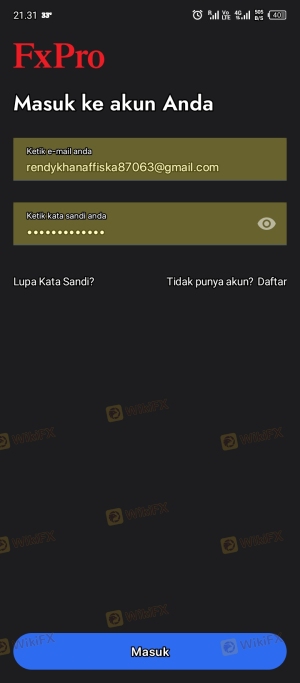

Platform and Trade Execution

FxPro provides access to multiple trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms are known for their robust performance, offering a range of features that cater to different trading styles. The execution quality is generally high, with most trades being executed in under 12 milliseconds. However, there have been reports of slippage and requotes during volatile market conditions, which can affect trading outcomes.

The platforms are user-friendly and provide a seamless trading experience, with advanced charting tools and technical indicators. Traders can also utilize algorithmic trading features, allowing for automated trading strategies. Overall, FxPro's platform performance is competitive, but traders should remain cautious during high-impact news events.

Risk Assessment

Using FxPro as a trading platform comes with a set of risks that traders should be aware of. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by tier-1 authorities. |

| Operational Risk | Medium | Occasional issues with withdrawal processing. |

| Market Risk | High | High leverage can amplify losses. |

| Platform Risk | Medium | Reports of slippage and requotes during volatility. |

To mitigate these risks, traders are advised to utilize proper risk management strategies, including setting stop-loss orders and avoiding excessive leverage. Additionally, maintaining a diversified trading portfolio can help cushion against market volatility.

Conclusion and Recommendations

Based on the evidence presented, FxPro does not appear to be a scam. The broker is well-regulated, has a solid reputation, and offers a range of trading instruments and platforms. However, potential traders should remain cautious and aware of the associated risks, particularly regarding withdrawal processing times and fee transparency.

For beginner traders, FxPro offers a user-friendly platform with excellent educational resources, making it a suitable choice. More experienced traders may find the advanced features and low latency execution appealing, especially for scalping and algorithmic trading.

If you are looking for alternatives, consider brokers like IG or OANDA, which also offer robust regulatory oversight and competitive trading conditions. Overall, FxPro is a legitimate broker, but as with any financial service, due diligence is essential before committing your funds.

Is FxPro a scam, or is it legit?

The latest exposure and evaluation content of FxPro brokers.

FxPro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FxPro latest industry rating score is 6.98, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.98 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.