Regarding the legitimacy of Libertex forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is Libertex safe?

Pros

Cons

Is Libertex markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 18

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Indication Investments Ltd

Effective Date:

2012-01-31Email Address of Licensed Institution:

support@help.libertex.comSharing Status:

No SharingWebsite of Licensed Institution:

https://libertex.com, www.libertex.deExpiration Time:

--Address of Licensed Institution:

116 Gladstonos Street, Michael Kyprianou building, 1st Floor, 3032, Limassol, Cyprus, 10 Agiou Athanasiou, Ksenos building,6th and 7th floor, 4105, Limassol, CyprusPhone Number of Licensed Institution:

+357 22 025 100Licensed Institution Certified Documents:

Is Libertex A Scam?

Introduction

Libertex is an online trading platform that has established itself as a significant player in the forex and CFD (Contracts for Difference) markets since its inception in 1997. Operating under the umbrella of Indication Investments Ltd., Libertex has garnered a reputation for offering a user-friendly trading experience, particularly appealing to both novice and experienced traders. Given the complexities and risks associated with forex trading, it is crucial for traders to carefully evaluate the reliability and safety of their chosen brokers. This article aims to provide a comprehensive analysis of Libertex, assessing its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk profile. The investigation is based on a thorough review of available online resources, expert opinions, and user feedback.

Regulation and Legitimacy

The regulatory framework governing a brokerage is a critical factor in determining its legitimacy and trustworthiness. Libertex is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is known for enforcing stringent regulatory standards. This oversight is essential for ensuring the protection of traders' interests and maintaining market integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 164/12 | Cyprus | Verified |

Being regulated by CySEC means that Libertex is required to adhere to various operational standards, including maintaining sufficient capital reserves, ensuring client funds are held in segregated accounts, and implementing measures to protect against negative balances. The company must also comply with the Markets in Financial Instruments Directive (MiFID II), which provides additional safeguards for clients across the European Economic Area (EEA).

Historically, Libertex has maintained a clean compliance record, with no significant regulatory breaches reported. This regulatory oversight not only enhances the broker's credibility but also provides traders with a layer of security, knowing that their investments are protected under the regulatory framework.

Company Background Investigation

Libertex's history dates back to 1997 when it was founded as part of the Forex Club group, a well-known entity in the online trading space. The company has expanded its operations over the years and now serves millions of clients across more than 120 countries. The ownership structure of Libertex is transparent, with Indication Investments Ltd. as its parent company, headquartered in Limassol, Cyprus.

The management team at Libertex is composed of experienced professionals with extensive backgrounds in finance and trading. This expertise is crucial in guiding the company through the dynamic and often volatile trading environment. Additionally, the company has received numerous awards for its trading platform and services, further solidifying its reputation in the industry.

In terms of transparency, Libertex provides clear information about its services, fees, and regulatory status on its website. This level of openness is essential for building trust with clients and ensuring that traders are well-informed before engaging in trading activities.

Trading Conditions Analysis

Libertex offers a range of trading conditions that are generally favorable for both retail and professional traders. The broker employs a commission-based pricing model, which means that instead of spreads, traders pay a fixed commission on each trade. This can be advantageous for traders who prefer clarity in their trading costs.

| Fee Type | Libertex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips (commission applies) | 1.0 pips |

| Commission Structure | 0.011% on major pairs | 0.10% - 0.50% |

| Overnight Interest Range | Varies by asset | Varies by asset |

The absence of spreads can make trading more straightforward, as traders know exactly how much they will be charged upfront. However, it is essential to note that the commission fees can vary depending on the asset class, with some instruments attracting higher fees than others. This variability in costs may be a concern for traders who engage in high-frequency trading strategies.

While the commission structure is competitive, some users have reported confusion regarding the exact fees associated with specific trades. This lack of clarity could potentially lead to unexpected costs, particularly for novice traders who may not be familiar with commission-based trading.

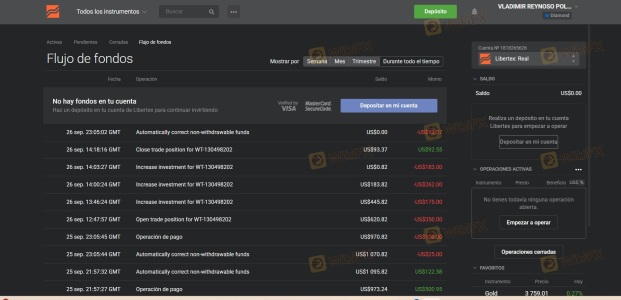

Customer Fund Security

The security of customer funds is a paramount concern for any trader. Libertex implements several measures to ensure the safety of client funds. As part of its regulatory obligations, the broker segregates client funds from its operational capital. This means that in the event of financial difficulties, client funds remain protected and are not at risk.

Additionally, Libertex offers negative balance protection, which ensures that traders cannot lose more money than they have deposited in their accounts. This feature is particularly important in volatile markets, where rapid price movements can lead to significant losses.

Historically, there have been no major incidents involving the loss of customer funds at Libertex, which speaks to the broker's commitment to maintaining a secure trading environment. However, traders should always remain vigilant and conduct their due diligence to ensure their chosen broker maintains high-security standards.

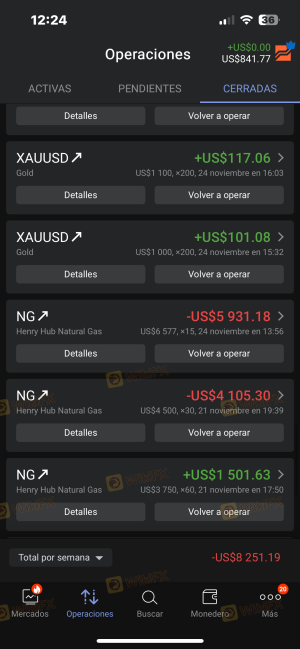

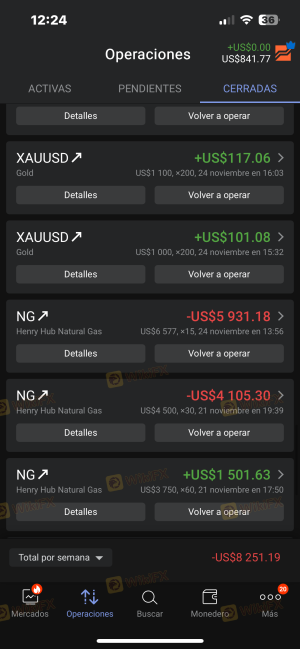

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the quality of services offered by a broker. Overall, Libertex has received mixed reviews from users. Many traders appreciate the user-friendly interface of the trading platform and the variety of assets available for trading. However, common complaints include issues with customer support response times and the clarity of fee structures.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Slow customer support | Medium | Acknowledged but needs improvement |

| Confusion over fees | High | Ongoing efforts to enhance transparency |

One notable case involved a trader who experienced delays in fund withdrawals, leading to frustration and dissatisfaction. While the company addressed the issue, it highlighted the need for Libertex to improve its customer support responsiveness to enhance user experience further.

Platform and Trade Execution

The performance of a trading platform is crucial for a trader's success. Libertex offers a proprietary platform that is generally well-regarded for its ease of use and functionality. The platform provides various technical analysis tools and features that cater to both novice and experienced traders.

However, there have been reports of slippage and order rejections during high volatility periods, which can be detrimental to traders executing time-sensitive strategies. While the platform's overall performance is solid, traders should remain aware of these potential issues, particularly during major market events.

Risk Assessment

Trading with any broker involves inherent risks. When evaluating Libertex, several key risk areas emerge:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by CySEC |

| Operational Risk | Medium | Occasional platform issues reported |

| Customer Support Risk | Medium | Mixed feedback on response times |

To mitigate these risks, traders are advised to start with a demo account to familiarize themselves with the platform and trading conditions. Additionally, maintaining a clear understanding of the fee structure and trading costs can help avoid unexpected expenses.

Conclusion and Recommendations

In conclusion, Libertex is a regulated broker with a solid reputation in the forex and CFD trading industry. While it does not exhibit signs of being a scam, traders should be cautious and aware of certain areas that may require improvement, particularly regarding customer support and fee transparency.

For novice traders, Libertex offers a user-friendly platform and a competitive commission structure, making it a viable option for those looking to enter the trading world. However, advanced traders may find the lack of educational resources and complex fee structures a drawback.

For those seeking alternatives, brokers such as XM, eToro, and IG Markets offer robust educational resources and comprehensive customer support, making them suitable options for traders at all levels. Overall, while Libertex is a legitimate broker, potential clients should weigh their options carefully and consider their trading needs before committing.

Is Libertex a scam, or is it legit?

The latest exposure and evaluation content of Libertex brokers.

Libertex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Libertex latest industry rating score is 6.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.