Questrade Review 12

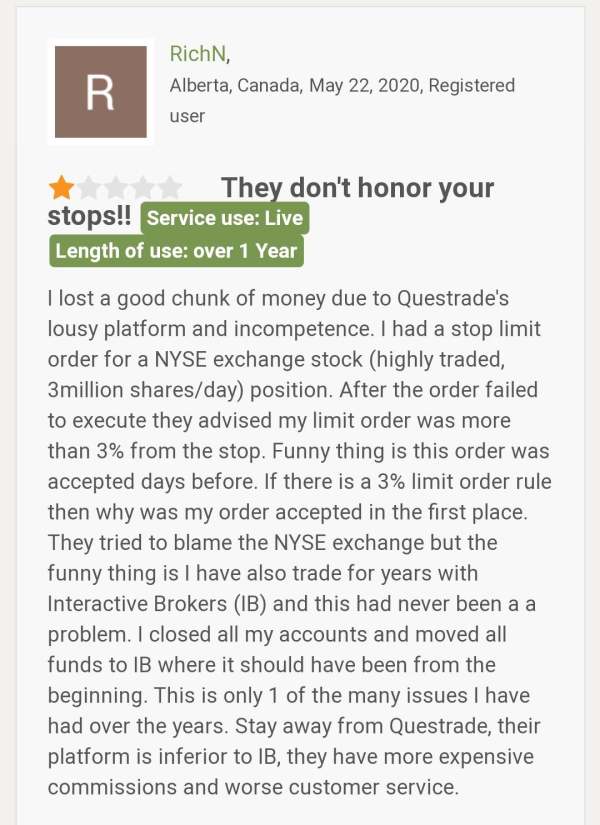

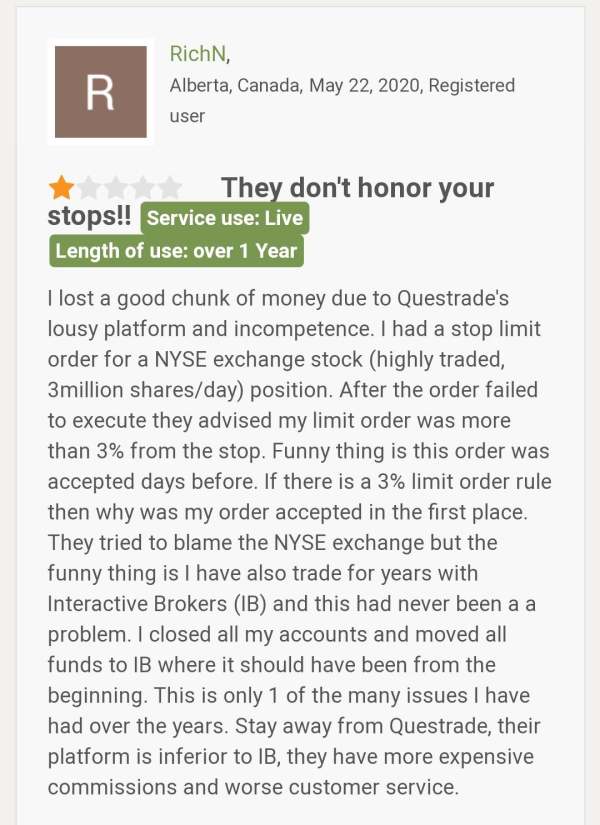

A client has complained that he had to lose a lot of money due to the lousy and incompetent behaviour of this broker. He also complained about the poor customer service of this broker and advised others not to invest in this broker. Many other clients also complained about this broker.

Most users agree that their web version is suitable for portfolio management. It also offers commission-free trading in stocks and ETFs.

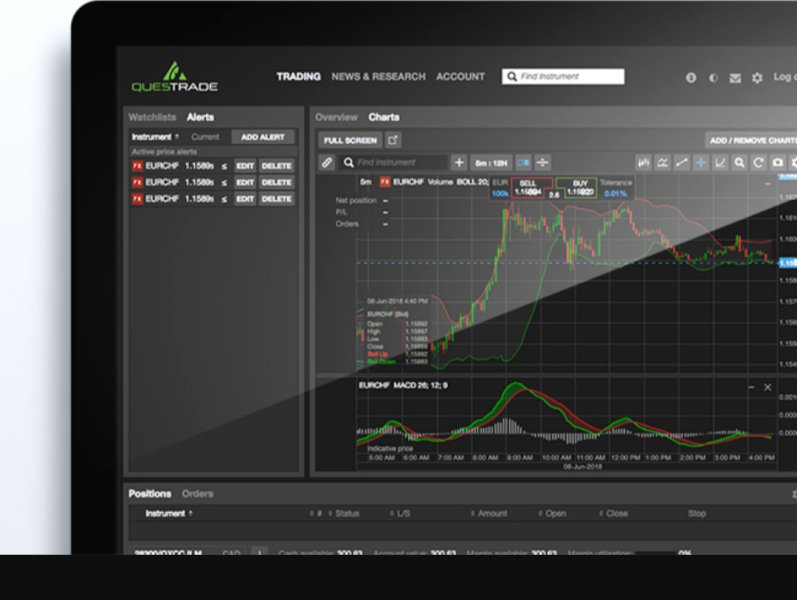

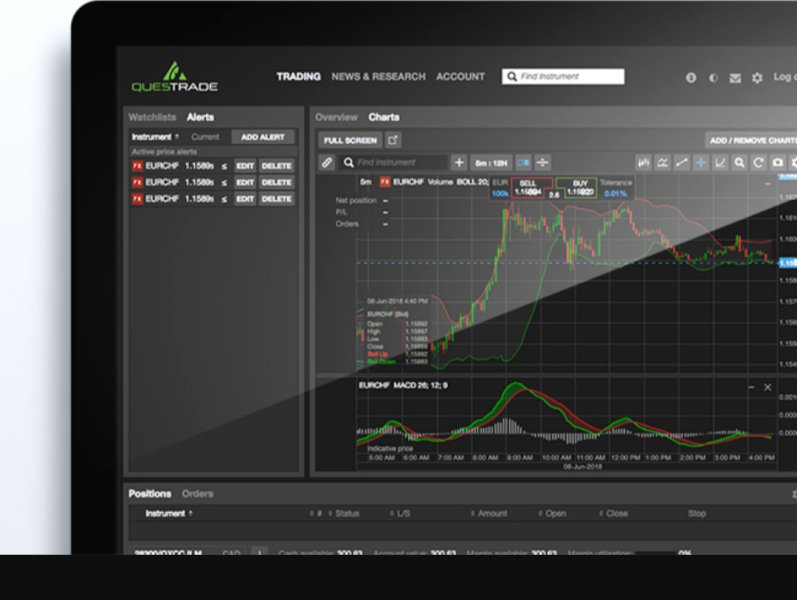

A few weeks ago, after trying a demo account for a month, I opened a mini live account. Compared to other brokers, QuestradeFX requires a large amount of documents to open an account. I don't like their web-based Java trading platform, it's too slow to start. It also doesn't support hedging and doesn't display swap rates, which is annoying for carry trades. The charts and customer service are acceptable. I chose QuestradeFX because I can easily transfer funds from my stock trading accounts, which are also with Questrade. Once I gain more experience, if the aforementioned issues are not resolved and no automated system (such as Metatrader) is added, I will consider switching to another platform.

A few years ago, I traded through this company and closed my account easily and smoothly. Trading in the autumn season was difficult, and I felt that continuing forex trading was not worthwhile, so I closed it. The staff was good, but the waiting time was sometimes long. Now I use the Interactive Broker platform, which is faster and more reliable.

I have a TFSA account at Questrade, where I deposit money every year but don't make any trades. As long as I remember that market orders are charged double the price of limit orders, it's not a problem. I was originally considering opening a regular trading account, but the comments here have changed my mind. I hope Questrade pays attention to these comments and improves their service.

In the past two years of trading with Questrade FX, it is not top-notch but also not encountered fraud. Insufficient under pressure, there are occasional re-quotes, occasional disconnections, and slow customer service, but it is still acceptable for small forex traders. Previous posts mostly complained about stock trading issues, and this forum seems to focus on forex broker evaluations. It is worth noting that profits can be withdrawn by mailing a check and there are no transaction fees, which is commendable.

I am quite satisfied with Questrade. It took about one to two weeks to open an account in August 2008, and it took roughly the same amount of time to transfer funds from my TD US dollar account to Questrade. After logging in, Questrade displays the balances of my Canadian dollars and US dollars. There are two login steps, one for trading and another to access the trading details from the Montreal-based trading processor, Penson. Their online chat customer service responds promptly and can quickly and effectively answer any questions, no matter how simple. Compared to the high fees charged by banks, their trading fees are more reasonable: $4.95 CAD for stocks and $11.95 USD for US stock options.

Trading on the Questrade platform for 3 months, I feel stable, with no tricks in the orders. They are executed as requested regardless of when the order is placed or the impact of news. However, the basic charting functionality needs improvement. The customer service is reliable. In conclusion, as a good platform for learning trading fundamentals, I wish you all happy trading and good luck.