Regarding the legitimacy of VT Markets forex brokers, it provides ASIC, FSCA and WikiBit, (also has a graphic survey regarding security).

Is VT Markets safe?

Pros

Cons

Is VT Markets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

VANTAGE GLOBAL PRIME PTY LTD

Effective Date: Change Record

2012-12-21Email Address of Licensed Institution:

compliance@vantagemarkets.com.auSharing Status:

Website of Licensed Institution:

https://www.vantagemarkets.com/en-au/Expiration Time:

--Address of Licensed Institution:

L 12 15 CASTLEREAGH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

+6594567234Licensed Institution Certified Documents:

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

VT MARKETS (PTY) LTD

Effective Date:

2020-09-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

18 CAVENDISH ROADCLAREMONTCAPE TOWN7708Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is VT Markets A Scam?

Introduction

VT Markets, established in 2015 and headquartered in Sydney, Australia, positions itself as a multi-asset broker offering a wide range of trading instruments, including forex, commodities, indices, and CFDs. With a focus on providing competitive trading conditions and a user-friendly experience, VT Markets has attracted a global clientele, boasting over 400,000 active traders. However, in an industry fraught with potential scams and unreliable brokers, it is crucial for traders to conduct thorough evaluations before committing their funds. This article aims to assess the credibility of VT Markets by examining its regulatory status, company background, trading conditions, customer experience, and risk factors. The evaluation is based on a comprehensive analysis of available data, including regulatory filings, customer feedback, and market comparisons.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety and legitimacy of any forex broker. VT Markets operates under multiple regulatory authorities, which adds a layer of credibility to its operations. The primary regulator is the Australian Securities and Investments Commission (ASIC), known for its stringent regulatory standards. Additionally, VT Markets is also regulated by the Financial Sector Conduct Authority (FSCA) in South Africa and the Financial Services Commission (FSC) in Mauritius.

| Regulatory Body | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| ASIC | 516246 | Australia | Verified |

| FSCA | 50865 | South Africa | Verified |

| FSC | GB23202269 | Mauritius | Verified |

The presence of ASIC as a tier-1 regulator is particularly significant, as it imposes strict compliance requirements on brokers, including the segregation of client funds and regular audits. However, it is worth noting that VT Markets also operates an offshore entity in Saint Vincent and the Grenadines, which has less regulatory oversight. This aspect raises concerns, as offshore entities often lack the same level of investor protection as those regulated by tier-1 authorities. Overall, while VT Markets holds legitimate licenses, potential clients should be cautious about the implications of its offshore operations.

Company Background Investigation

VT Markets is a subsidiary of the Vantage Group, which has a long-standing presence in the financial services industry. The broker was founded with the mission of making trading accessible and straightforward for all traders. Over the years, VT Markets has expanded its offerings and improved its technology to cater to a diverse range of trading needs.

The management team behind VT Markets comprises individuals with extensive experience in finance and trading, which is a positive indicator of the broker's operational integrity. The company's transparency is somewhat commendable, as it provides information about its history, regulatory compliance, and trading conditions on its official website. However, more detailed disclosures regarding its ownership structure and management team could enhance its credibility further.

Trading Conditions Analysis

VT Markets offers a competitive trading environment with a variety of accounts tailored to different trading strategies. The broker provides two primary account types: the Standard STP account, which features no commissions but higher spreads, and the Raw ECN account, which offers lower spreads at the cost of a commission per trade.

| Fee Type | VT Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | $6 per round turn | Varies |

| Overnight Interest Range | Varies | Varies |

While the spreads on the Standard account are slightly higher than the industry average, the Raw ECN account offers competitive pricing for active traders. It is essential to note that VT Markets does not charge deposit fees, which is a common practice among reputable brokers. However, the commission structure may deter less active traders who prefer a commission-free environment.

Client Funds Security

The safety of client funds is paramount when evaluating a broker. VT Markets employs several measures to ensure the security of its clients' funds. Client deposits are held in segregated accounts at reputable financial institutions, such as the Commonwealth Bank of Australia, which is known for its financial stability. Furthermore, VT Markets provides negative balance protection, ensuring that clients cannot lose more than their deposited funds.

Despite these protective measures, it is essential to consider any historical issues related to fund security. While there have been no significant publicized incidents involving VT Markets, the presence of an offshore entity may raise concerns regarding transparency and fund safety.

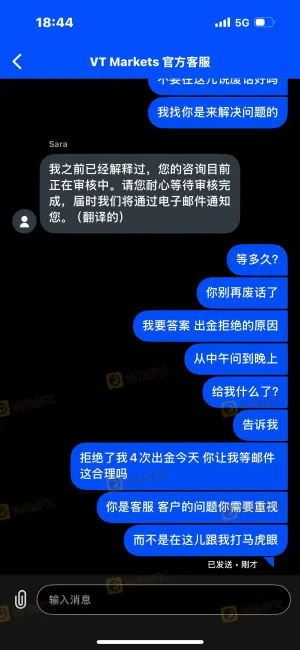

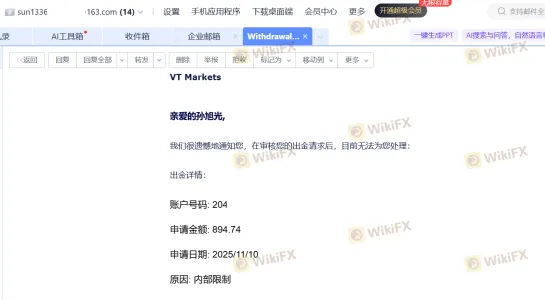

Customer Experience and Complaints

Customer feedback is a vital component of assessing a broker's reliability. Overall, VT Markets has received mixed reviews from users. Many traders appreciate the competitive spreads and the range of trading instruments available. However, common complaints include difficulties with withdrawals and customer support response times.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Mixed |

| Customer Support | Medium | Average |

For instance, some users have reported delays in processing withdrawals, while others have experienced challenges in reaching customer support. These issues can significantly impact the overall trading experience and raise red flags for potential clients.

Platform and Trade Execution

VT Markets primarily operates on the well-regarded MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are known for their reliability and extensive functionalities. The platforms offer a user-friendly interface, advanced charting tools, and automated trading capabilities.

Order execution quality is another critical aspect to consider. VT Markets claims to provide fast execution speeds, but traders should be aware of the potential for slippage, especially during volatile market conditions. While there have been no widespread reports of manipulation or excessive slippage, traders should remain vigilant.

Risk Assessment

When trading with VT Markets, several risks should be considered. The broker's offshore entity, while regulated, may not offer the same level of protection as those governed by stricter authorities. Additionally, the presence of common complaints regarding withdrawals and customer support can pose risks to traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore operations may lack protection. |

| Withdrawal Risk | High | Reports of delays and issues. |

| Customer Support Risk | Medium | Inconsistent response times. |

To mitigate these risks, traders are advised to conduct thorough research, maintain clear communication with the broker, and consider starting with smaller investments.

Conclusion and Recommendations

In conclusion, VT Markets presents itself as a legitimate broker with a range of competitive trading conditions and regulatory oversight. However, potential clients should exercise caution due to the presence of an offshore entity and mixed customer feedback regarding withdrawals and support. While there are no clear indications of fraudulent activity, traders should be aware of the associated risks and conduct their due diligence.

For traders seeking a reliable alternative, consider brokers with strong regulatory frameworks, comprehensive customer support, and transparent operations. Ultimately, the choice of a broker should align with individual trading goals and risk tolerance.

Is VT Markets a scam, or is it legit?

The latest exposure and evaluation content of VT Markets brokers.

VT Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VT Markets latest industry rating score is 8.68, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.68 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.