Regarding the legitimacy of OX SECURITIES forex brokers, it provides ASIC and WikiBit, .

Is OX SECURITIES safe?

Pros

Cons

Is OX SECURITIES markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Market Making (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Market Making (MM)

Licensed Entity:

Ox Securities Pty Ltd

Effective Date: Change Record

2013-07-31Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

'ZENITH TOWER' SE 902 B 821 PACIFIC HWY CHATSWOOD NSW 2067 AUSTRALIAPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is OX SECURITIES A Scam?

Introduction

OX Securities, founded in 2013, positions itself as a multi-asset broker offering a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. Operating primarily in Australia and St. Vincent and the Grenadines, OX Securities claims to prioritize integrity, honesty, and transparency in its trading practices. However, with the prevalence of scams in the forex market, traders must exercise caution when evaluating brokers. Understanding whether OX Securities is a trustworthy platform requires careful consideration of its regulatory status, company background, trading conditions, and customer experiences. This article investigates these aspects through a combination of narrative analysis and structured information, providing a comprehensive overview of the broker's reliability.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. OX Securities is regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Services Authority (FSA) of St. Vincent and the Grenadines. ASIC is known for its stringent regulations, which are designed to protect traders and ensure fair trading practices. However, the FSA has a less robust reputation, often associated with lower regulatory standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 438402 | Australia | Verified |

| SVG FSA | 25509 BC 2019 | St. Vincent | Verified |

While OX Securities claims to uphold high standards of client fund protection by segregating client accounts from company funds, the dual regulatory structure raises concerns. ASIC only regulates wholesale clients, leaving retail clients under the less stringent FSA jurisdiction. This discrepancy can lead to varying levels of protection for different types of clients, making it essential for potential traders to understand the implications of these regulations.

The quality of regulation is paramount; ASIC imposes strict requirements on brokers, including maintaining sufficient capital reserves and adhering to transparent operational practices. However, the lack of a compensation scheme for clients under ASIC's regulation means that traders may not have access to the same level of financial protection as those trading with brokers regulated in the EU or UK. This aspect of OX Securities' regulatory framework warrants careful consideration by potential clients.

Company Background Investigation

OX Securities has a history that dates back to its founding in 2013, originally operating under the name Ruizean Markets. The company has since rebranded and expanded its operations internationally. The ownership structure is primarily Australian, which lends it a degree of credibility, yet the presence of an offshore entity in St. Vincent and the Grenadines complicates its regulatory standing.

The management team consists of experienced professionals from the financial services sector, which is a positive indicator for potential clients. However, the transparency of the company's operations and its willingness to disclose relevant information is crucial for building trust. While OX Securities claims to prioritize integrity and transparency, the mixed reviews and complaints from users raise questions about the actual level of disclosure and operational integrity.

The company's commitment to providing clear and accessible information about its services is vital for establishing trust. However, potential traders should scrutinize the available information and consider the extent to which the company adheres to its stated principles. Understanding the company's history, ownership, and management background is essential for assessing its reliability in the highly competitive forex market.

Trading Conditions Analysis

The trading conditions offered by OX Securities are a significant factor in evaluating its overall attractiveness as a broker. The broker provides various account types, including standard, pro, and swap-free accounts, catering to different trading styles and preferences.

The fee structure is relatively straightforward, with competitive spreads and no minimum deposit requirement. However, potential traders should be aware of any unusual fees or conditions that may apply.

| Fee Type | OX Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 1.2 pips |

| Commission Model | $3.50 per lot (Pro Account) | $5.00 per lot |

| Overnight Interest Range | Varies | Varies |

The standard account features spreads starting from 1.0 pips, while the pro account offers spreads from 0.0 pips, accompanied by a commission of $3.50 per 100,000 units traded. This competitive pricing structure positions OX Securities favorably against many industry competitors. However, traders should remain vigilant regarding any hidden fees or additional costs that could impact their overall trading experience.

Additionally, the lack of negative balance protection is a notable concern, particularly for traders utilizing high leverage. OX Securities offers leverage of up to 1:500, which can amplify both potential profits and losses. This high leverage can be attractive to experienced traders but poses significant risks, especially for those new to trading.

Client Fund Safety

The safety of client funds is a paramount concern when assessing any broker. OX Securities claims to prioritize fund security by maintaining segregated accounts with tier-1 banks in Australia. This practice is intended to protect client funds in the event of the company's insolvency.

However, the absence of an investor compensation scheme under ASIC's jurisdiction raises concerns about the level of protection available to retail clients. In the event of financial difficulties, traders may find themselves without adequate recourse to recover their funds.

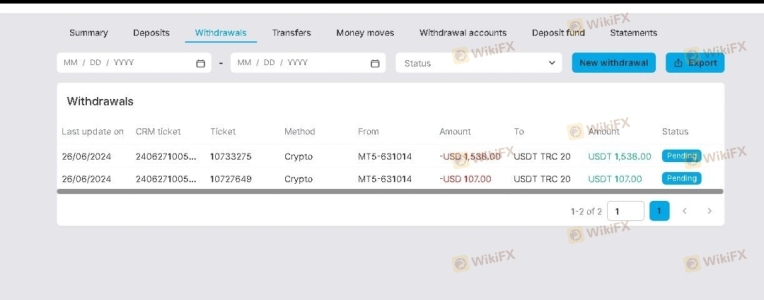

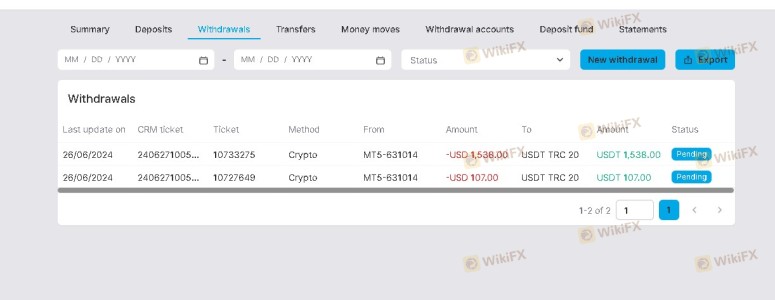

The broker's history regarding fund safety is another critical aspect to consider. There have been reports of withdrawal issues and complaints from clients regarding difficulties in accessing their funds. These issues can significantly undermine trust in the broker and highlight potential vulnerabilities in its operational practices.

Traders should carefully evaluate OX Securities' fund safety measures and consider the implications of the regulatory environment in which the broker operates. Ensuring that funds are securely held and accessible is vital for maintaining a positive trading experience.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. OX Securities has received mixed reviews from clients, with some praising its competitive trading conditions and customer support, while others report significant issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Service | Medium | Inconsistent |

| Lack of Transparency | High | Minimal clarity |

Common complaints include difficulties with fund withdrawals, slow response times from customer support, and concerns regarding transparency in trading conditions. Some users have reported that their withdrawal requests were delayed or canceled without explanation, which raises significant red flags regarding the broker's operational integrity.

For instance, one trader reported turning a modest investment into substantial profits, only to face accusations of arbitrage and difficulties in withdrawing their funds. Such experiences highlight the importance of thorough research and caution when dealing with OX Securities.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. OX Securities offers the widely recognized MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their user-friendly interfaces and robust features.

However, the quality of order execution and potential issues such as slippage and order rejections are crucial factors to consider. Users have reported varying experiences with order execution, with some praising the speed and reliability, while others experienced significant delays and slippage during volatile market conditions.

The broker claims to utilize a straight-through processing (STP) model, which is designed to provide direct access to liquidity providers and minimize dealing desk interference. However, the effectiveness of this model and the broker's claims should be assessed critically, especially in light of the complaints regarding execution quality.

Risk Assessment

Using OX Securities involves several inherent risks that potential traders should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Dual regulation may lead to varying protections. |

| Withdrawal Risk | High | History of withdrawal issues raises concerns. |

| Customer Support Risk | Medium | Complaints about unresponsive support. |

The combination of regulatory concerns, withdrawal difficulties, and customer support issues creates a complex risk landscape for traders. While OX Securities offers competitive trading conditions, the potential for negative experiences cannot be overlooked.

To mitigate these risks, traders should conduct thorough due diligence, consider starting with a small investment, and maintain a clear understanding of the broker's terms and conditions.

Conclusion and Recommendations

In conclusion, while OX Securities presents itself as a legitimate broker with a range of trading options, the evidence suggests that traders should approach with caution. The mixed regulatory environment, customer complaints, and concerns regarding fund safety and withdrawal processes raise significant red flags.

For those considering trading with OX Securities, it is crucial to weigh the potential benefits against the risks. It may be advisable to explore alternative brokers with stronger reputations for transparency, reliability, and comprehensive regulatory oversight.

For traders seeking a more secure trading environment, brokers such as Pepperstone or IC Markets, which are well-regulated and have a track record of positive customer experiences, may be more suitable options. Ultimately, the decision to trade with OX Securities should be based on a careful assessment of individual risk tolerance and trading goals.

Is OX SECURITIES a scam, or is it legit?

The latest exposure and evaluation content of OX SECURITIES brokers.

OX SECURITIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OX SECURITIES latest industry rating score is 2.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.