Executive Summary

This comprehensive Capital.com review looks at a popular online trading platform in the forex and CFD space. Capital.com works as a regulated forex broker under the Securities Commission Board (SCB), but we give it a neutral rating because it lacks clear information about spreads, fees, and customer feedback.

The platform stands out with two main features that make it different from other trading sites. First, Capital.com offers its own web-based trading platform plus MetaTrader 4 access (not available for UK clients), winning awards as the "Best Overall Trading Platform 2024" and "Best Trading App 2023." Second, the broker uses AI-driven trading services, which appeals to traders who want modern tech solutions.

This Capital.com review targets traders who want current trading tools and mobile access. The platform works best for people who want easy-to-use interfaces with advanced tech features, but users should think carefully about the limited pricing information and account details before choosing this platform.

Important Disclaimer

Traders should know that Capital.com works through different regional companies, which may change trading conditions, regulatory protections, and available services based on where you live. The monitoring and regulatory rules can vary a lot between countries, possibly affecting leverage limits, asset availability, and dispute resolution procedures.

This review uses publicly available information and user feedback from various sources. The assessment doesn't cover all possible trading conditions, promotional offers, or regional differences that individual traders might experience. Future users should verify current terms, conditions, and regulatory status directly with Capital.com before opening any trading account.

Rating Framework

Broker Overview

Capital.com presents itself as a modern CFD and forex trading provider, though specific founding details are unclear in available documents. The company has its headquarters in Dubai, United Arab Emirates, focusing mainly on Contract for Difference (CFD) trading across various financial markets. The broker's business model centers on providing easy trading solutions through tech innovation, especially emphasizing mobile trading capabilities and AI-enhanced trading tools.

The platform works with a clear focus on user experience and technological advancement, making it different from traditional forex brokers through its emphasis on contemporary trading solutions. Capital.com's approach targets both new and experienced traders seeking streamlined access to financial markets without the complexity often found with traditional trading platforms.

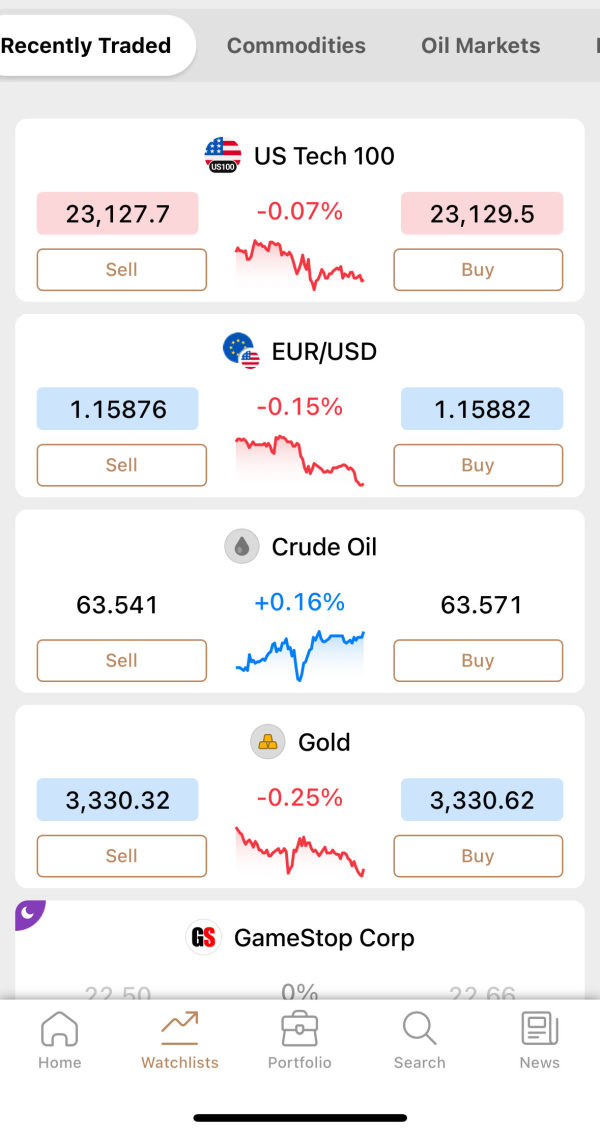

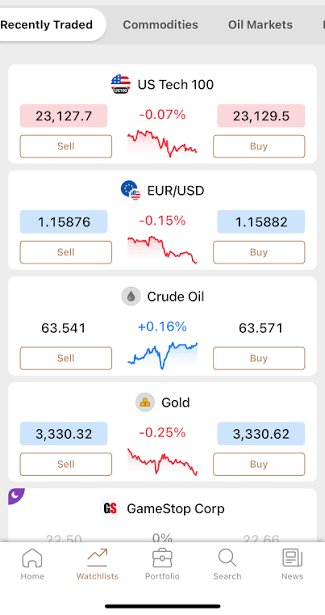

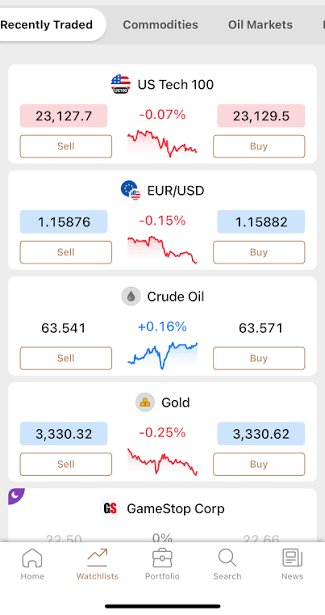

For trading infrastructure, Capital.com offers multiple platform options including its own web-based trading interface, MetaTrader 4 access for non-UK clients, and dedicated mobile trading applications. The broker maintains regulatory compliance through Securities Commission Board (SCB) oversight, though specific asset classes and trading instruments available through the platform need direct verification with the provider. This Capital.com review notes that the platform's regulatory framework provides a foundation for secure trading, though traders should verify specific protections applicable to their jurisdiction.

Regulatory Jurisdiction: Capital.com operates under Securities Commission Board (SCB) regulation, providing basic trading safety protections and regulatory oversight for client activities and fund management.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal options is not detailed in current available documentation, requiring direct inquiry with the broker for comprehensive payment method details.

Minimum Deposit Requirements: Current available resources do not specify minimum deposit amounts for account opening, suggesting potential variation based on account type and regional regulations.

Bonus and Promotional Offers: Available documentation does not detail specific promotional campaigns, welcome bonuses, or ongoing trading incentives currently offered by the platform.

Tradeable Assets: Comprehensive information about specific financial instruments, currency pairs, commodities, indices, and other tradeable assets requires direct verification with Capital.com representatives.

Cost Structure Analysis: Critical information about spreads, commission rates, overnight financing charges, and other trading costs is not specified in current available documentation, representing a significant transparency gap for potential traders.

Leverage Ratios: Specific leverage offerings and maximum leverage limits are not detailed in available resources, likely varying based on regulatory jurisdiction and account classification.

Platform Selection: The broker supports proprietary web-based trading platforms and MetaTrader 4 access, though UK clients cannot access MetaTrader 4 functionality due to regional restrictions.

Geographic Restrictions: Detailed information about country-specific limitations and restricted territories is not comprehensively covered in available documentation.

Customer Support Languages: Available resources do not specify the range of languages supported by customer service representatives or platform interfaces.

This Capital.com review emphasizes that future traders should directly contact the broker to get current, comprehensive information about these essential trading parameters.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions evaluation for Capital.com gets a moderate rating mainly due to insufficient transparency about specific account structures and requirements. Available documentation does not clearly outline distinct account types, their respective features, or targeted user demographics for each offering. This lack of clarity creates uncertainty for potential traders trying to assess whether the platform meets their specific trading requirements and experience levels.

Minimum deposit requirements remain unspecified in current available resources, preventing accurate assessment of accessibility for traders with varying capital levels. The absence of detailed information about account opening procedures, verification requirements, and timeline expectations further complicates the evaluation process for future users.

Special account features, including Islamic account availability for traders requiring Sharia-compliant trading conditions, are not addressed in available documentation. This represents a significant information gap for traders with specific religious or cultural trading requirements. Additionally, the lack of information about account maintenance fees, inactivity charges, or minimum trading volume requirements prevents comprehensive cost assessment.

The platform's approach to account management, including available account management tools, portfolio analytics, and performance tracking features, requires direct inquiry with Capital.com representatives. This Capital.com review notes that the limited transparency about account conditions significantly impacts the platform's accessibility assessment, suggesting potential users should prioritize direct communication with the broker before account opening decisions.

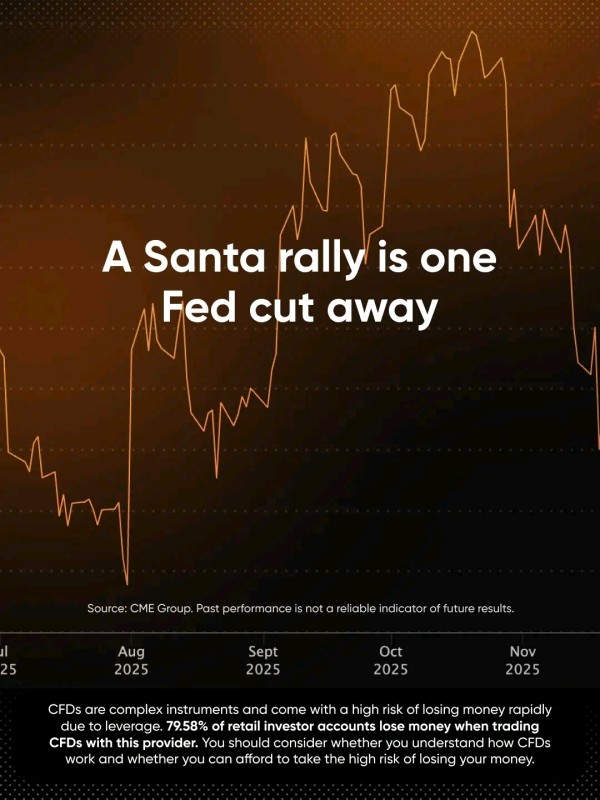

Capital.com shows strong performance in trading tools and resources, earning recognition as the "Best Overall Trading Platform 2024" and "Best Trading App 2023." The broker's proprietary trading platform represents a significant technological achievement, offering modern interface design and comprehensive trading functionality. MetaTrader 4 availability for non-UK clients expands platform options, accommodating traders familiar with this industry-standard software.

The integration of AI-driven trading services makes Capital.com different from traditional forex brokers, providing algorithmic assistance and market analysis capabilities. This technological advancement appeals to traders seeking data-driven decision support and automated trading elements. The platform's emphasis on mobile trading accessibility addresses the growing demand for on-the-go trading capabilities among contemporary traders.

However, specific information about research and analysis resources remains limited in available documentation. Details about market commentary, economic calendars, technical analysis tools, and fundamental analysis resources require direct verification with the platform. Educational resources, including trading guides, webinars, video tutorials, and market education materials, are not comprehensively detailed in current available information.

Automated trading support capabilities, expert advisor functionality, and third-party tool integration possibilities need clarification through direct platform inquiry. Despite these information gaps, the platform's industry recognition and technological focus suggest robust tool offerings that merit the positive rating in this category.

Customer Service and Support Analysis (6/10)

Customer service evaluation for Capital.com yields a moderate rating based on Trustpilot reviews indicating "average to good" user experiences, though specific support infrastructure details remain unclear. The absence of detailed information about available customer service channels, including live chat availability, telephone support hours, email response systems, and help desk functionality, limits comprehensive service assessment.

Response time expectations and service level agreements are not specified in available documentation, preventing accurate evaluation of support efficiency and reliability. The quality of customer service interactions, based on available user feedback, appears satisfactory but lacks specific examples or detailed user testimonials that would provide deeper insight into service capabilities.

Multi-language support availability remains unspecified, potentially limiting accessibility for international traders requiring assistance in their native languages. Customer service operating hours, timezone coverage, and weekend support availability require direct verification with Capital.com representatives.

The platform's approach to issue resolution, escalation procedures, and customer complaint handling processes are not detailed in current available resources. Additionally, self-service options, including FAQ sections, knowledge bases, and troubleshooting guides, need direct platform assessment to evaluate comprehensiveness and utility.

This moderate rating reflects the uncertainty surrounding customer support infrastructure while acknowledging generally positive user feedback about service quality when accessed.

Trading Experience Analysis (7/10)

The trading experience evaluation for Capital.com receives a positive rating based on platform stability features and service status tracking functionality, contributing to generally favorable user feedback about execution quality. The platform's technological infrastructure appears robust, supporting consistent trading operations and reliable order processing capabilities.

However, specific information about order execution quality, including average execution speeds, slippage statistics, and fill rate performance, is not detailed in available documentation. Platform functionality comprehensiveness, including advanced order types, risk management tools, and trading automation features, requires direct platform assessment for accurate evaluation.

Mobile trading experience quality, despite the platform's recognition as "Best Trading App 2023," lacks specific user feedback about interface responsiveness, feature completeness, and cross-device synchronization capabilities. The mobile application's performance during high-volatility market periods and its reliability during critical trading moments need verification through direct user experience.

Trading environment assessment, including spread stability, liquidity provision, and market depth information, is not specified in current available resources. Price feed quality, market data accuracy, and real-time information reliability require direct platform evaluation to assess trading environment quality comprehensively.

The positive rating reflects the platform's technological recognition and generally favorable user feedback while acknowledging the need for more detailed performance metrics. This Capital.com review suggests that the platform's technological focus likely supports quality trading experiences, though specific performance data would strengthen this assessment.

Trust and Security Analysis (6/10)

Capital.com's trust and security evaluation receives a moderate rating based on Securities Commission Board (SCB) regulatory oversight, though specific license numbers and detailed regulatory compliance information are not provided in available documentation. The regulatory framework provides fundamental protection for trading activities and client fund management, establishing basic security infrastructure for platform operations.

Fund safety measures, including client money segregation, deposit protection schemes, and bankruptcy protection procedures, are not detailed in current available resources. This information gap prevents comprehensive assessment of client asset security and protection levels available through the platform. Additionally, operational transparency about financial reporting, management structure, and corporate governance practices requires direct verification.

The platform's industry recognition as "Best Overall Trading Platform 2024" indicates positive industry perception and professional acknowledgment of service quality. This recognition suggests adherence to industry standards and operational excellence, contributing positively to the trust assessment despite limited transparency in specific security measures.

Negative event handling, including past regulatory actions, customer complaints resolution, and crisis management procedures, is not addressed in available documentation. The absence of detailed information about data security measures, cybersecurity protocols, and privacy protection policies represents additional transparency gaps affecting the overall trust evaluation.

The moderate rating reflects the basic regulatory protection provided while acknowledging the need for enhanced transparency about specific security measures and operational safeguards that would strengthen user confidence in the platform's trustworthiness.

User Experience Analysis (6/10)

User experience assessment for Capital.com indicates moderate satisfaction levels based on Trustpilot reviews showing "average to good" ratings, though detailed user feedback analysis is limited in available documentation. The platform's recognition as "Best Trading App 2023" suggests positive mobile user experience design and functionality, appealing to traders prioritizing mobile trading accessibility.

Interface design and usability information is not comprehensively detailed in current available resources, preventing thorough assessment of platform navigation, feature accessibility, and overall user interface quality. Registration and verification process details, including required documentation, timeline expectations, and approval procedures, require direct platform inquiry for accurate evaluation.

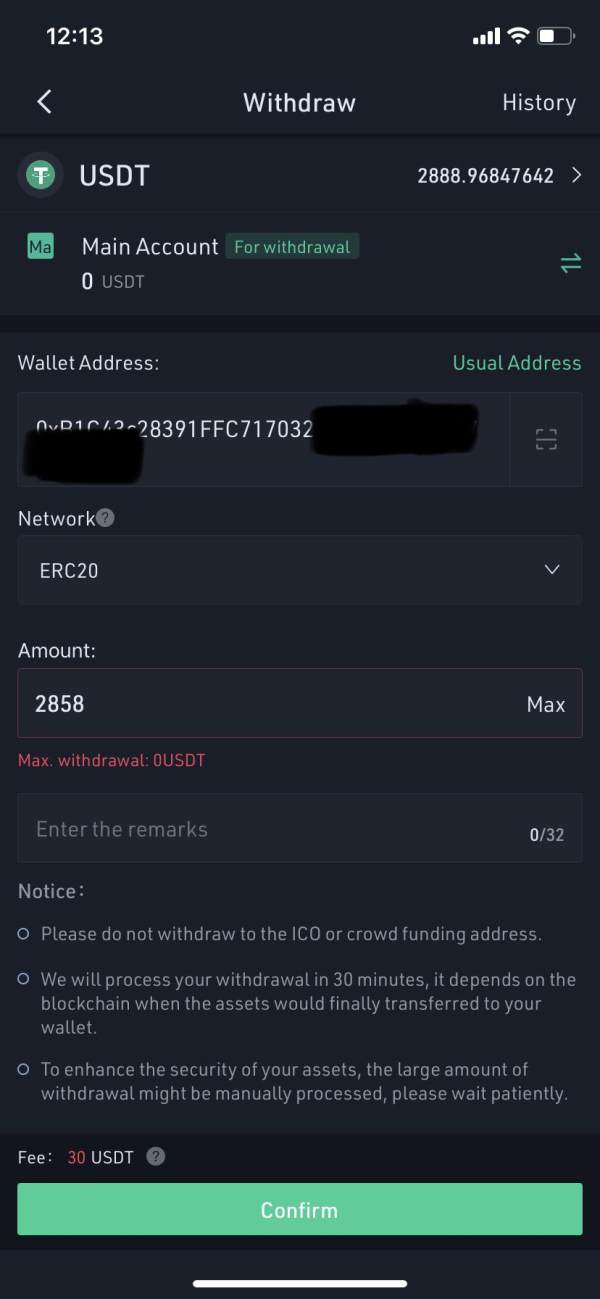

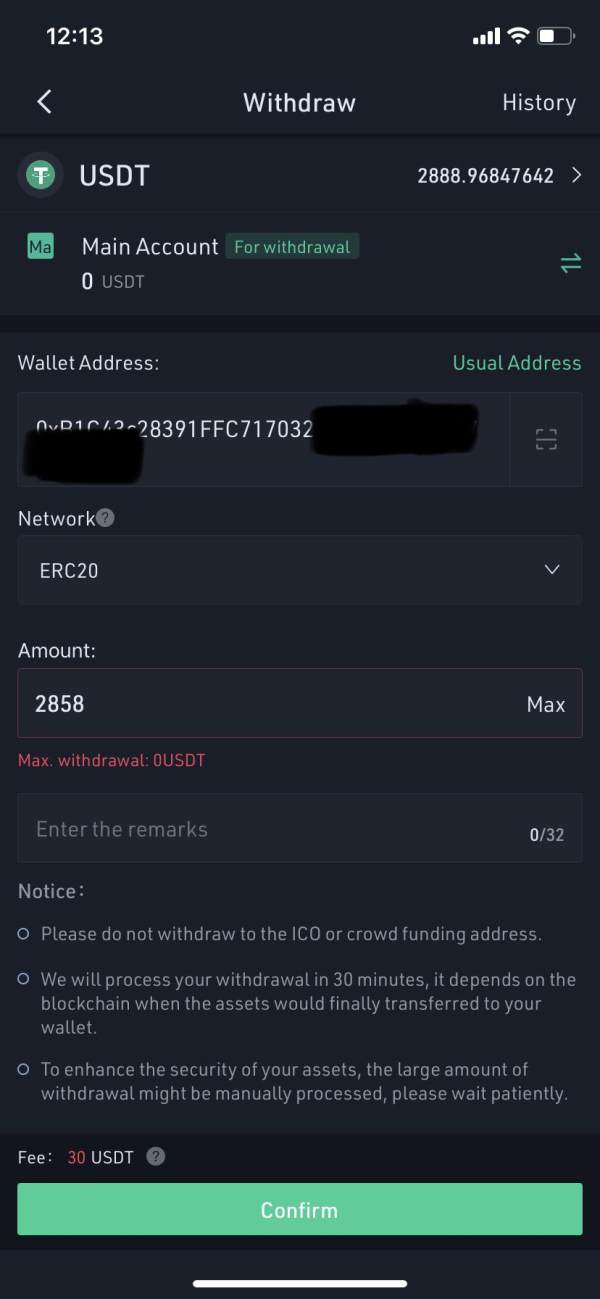

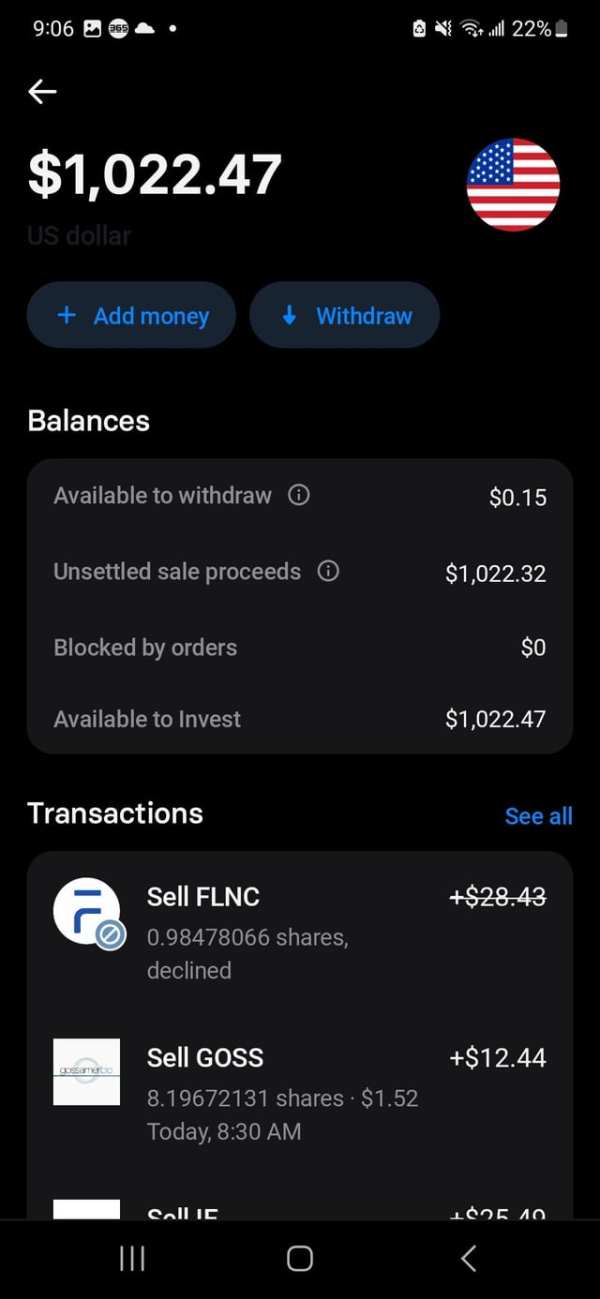

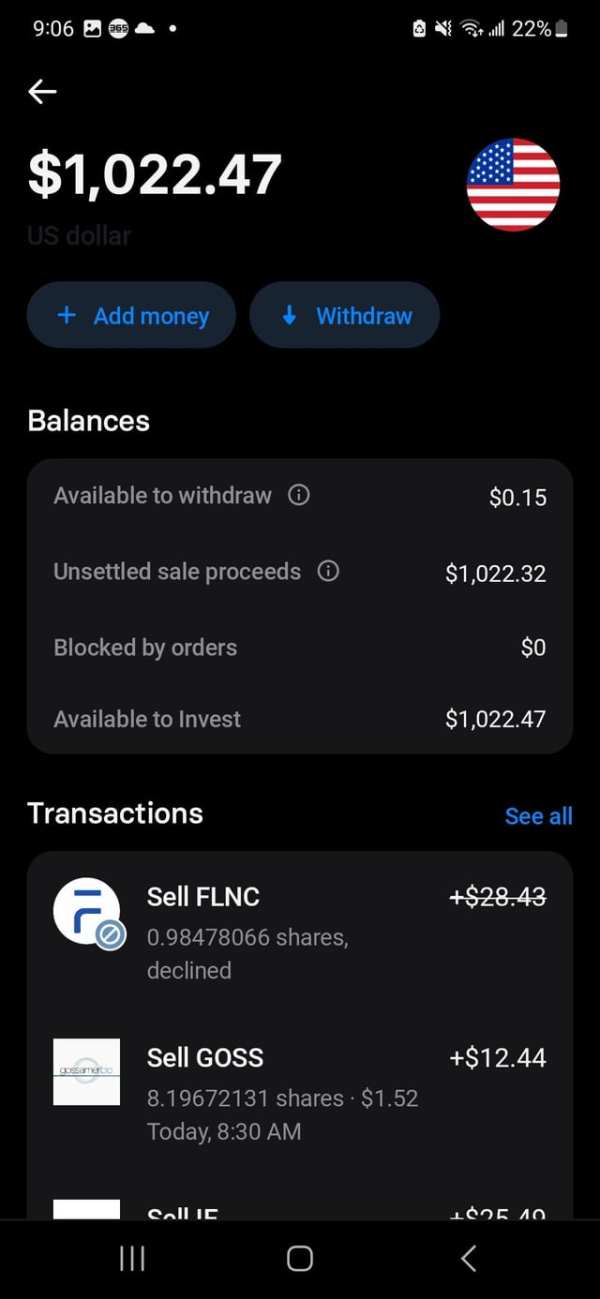

Fund operation experience, including deposit processing times, withdrawal procedures, and payment method efficiency, is not specified in available documentation. This represents a significant information gap for users seeking to understand the practical aspects of account funding and profit withdrawal processes.

Common user complaints and recurring issues are not detailed in current available resources, limiting understanding of potential platform limitations or user frustration points. The absence of specific positive and negative feedback examples prevents comprehensive user satisfaction assessment.

The platform appears most suitable for traders seeking modern trading tools and mobile accessibility, based on its technological focus and industry recognition. However, the moderate rating reflects limited detailed user feedback and the need for enhanced transparency about user experience elements that would provide clearer guidance for potential platform users.

Conclusion

This comprehensive Capital.com review reveals a forex broker with mixed characteristics, earning an overall neutral evaluation due to limited transparency in critical trading parameters. Capital.com operates under SCB regulatory oversight, providing basic trading security while maintaining a technological focus that has earned industry recognition for platform excellence and mobile trading capabilities.

The platform appears most suitable for traders prioritizing modern trading tools, mobile accessibility, and AI-enhanced trading features. Users seeking cutting-edge technology integration and contemporary trading interfaces may find Capital.com's offerings appealing, particularly given its industry awards and technological innovation focus.

However, significant drawbacks include limited transparency about account conditions, cost structures, and customer support infrastructure. The absence of detailed information about spreads, commissions, minimum deposits, and specific trading terms creates uncertainty for potential users trying to assess platform suitability. Future traders should prioritize direct communication with Capital.com representatives to get comprehensive information before making account opening decisions, ensuring the platform meets their specific trading requirements and expectations.