It is essential to conduct thorough research and due diligence before opening an account to ensure that FXTM aligns with your trading needs and risk tolerance.

FXTM, established in 2011 by Andrey Dashin, has its headquarters in Cyprus and operates under multiple regulatory entities, including the FCA in the UK and CySEC in Cyprus. The broker's strong emphasis on providing accessible trading solutions has enabled it to attract over three million clients globally. FXTM's operational strategy focuses on meeting the demands of emerging markets, particularly in Africa and Asia, where it has experienced rapid growth and expansion.

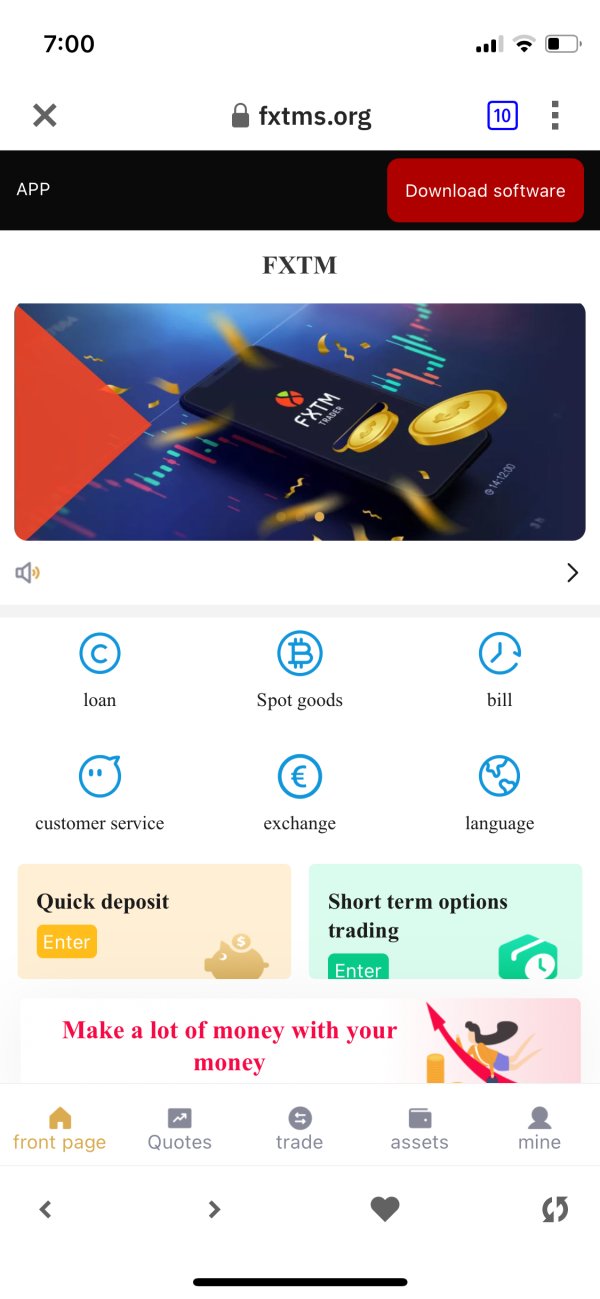

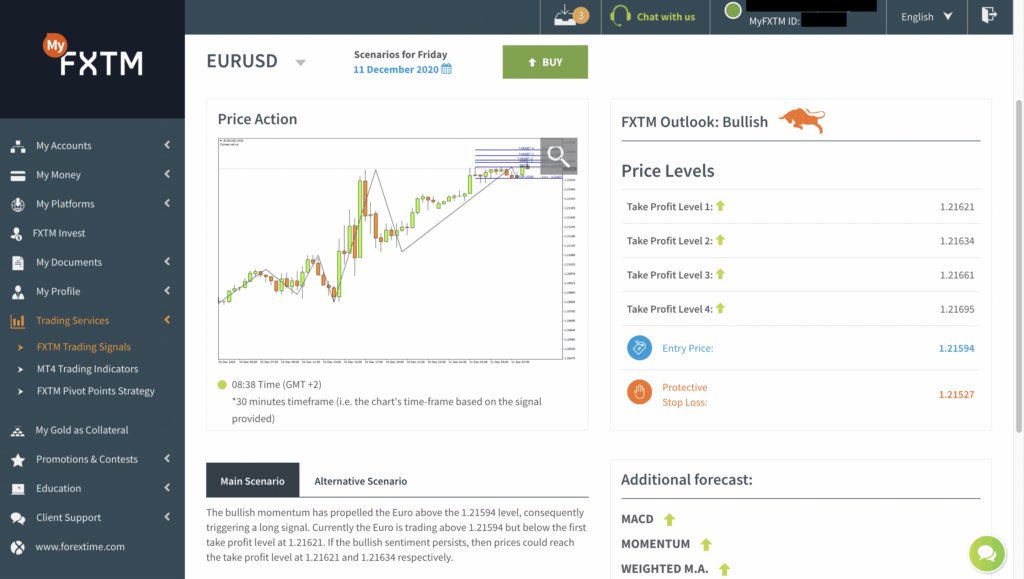

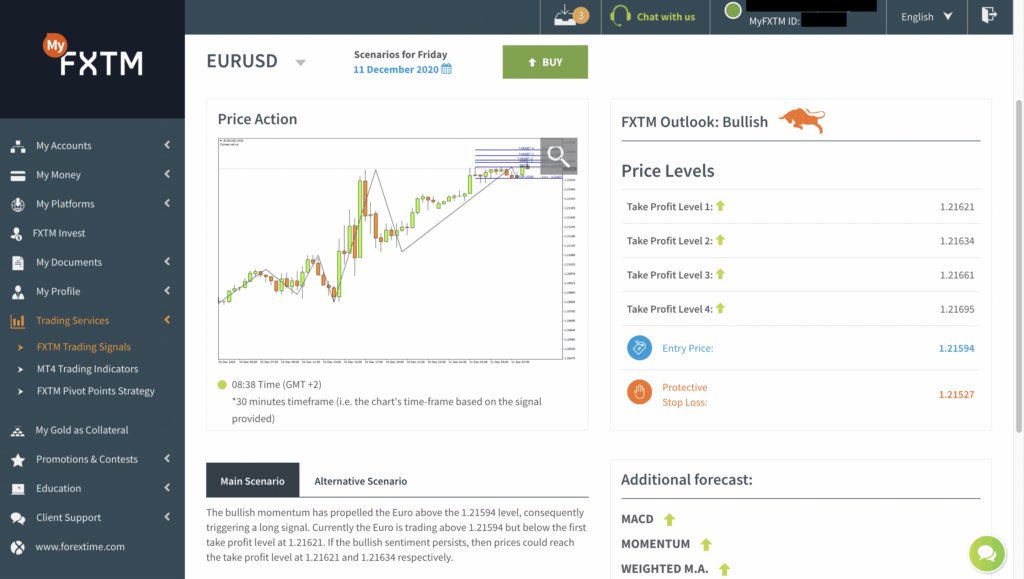

FXTM offers a wide variety of trading instruments, with a strong focus on forex and CFDs. Clients can trade over 60 currency pairs and gain access to commodities, stock indices, and cryptocurrencies. The broker supports trading through well-regarded platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), catering to both beginner and advanced traders. FXTM is committed to protecting traders through strong regulatory compliance, but clients must remain cautious about the potential risks associated with trading in less regulated jurisdictions.

FXTM operates under multiple regulatory jurisdictions, including the FCA in the UK and CySEC in Cyprus, providing a background of trust and reliability. However, issues arise in less regulated regions, such as those covered by offshore entities. This creates varying degrees of protection for the clientele depending on their location, raising questions about user safety when dealing with FXTM's offshore branches.

- Visit the Regulatory Websites: Make sure the broker you are considering holds licenses from recognized authorities like FCA and CySEC.

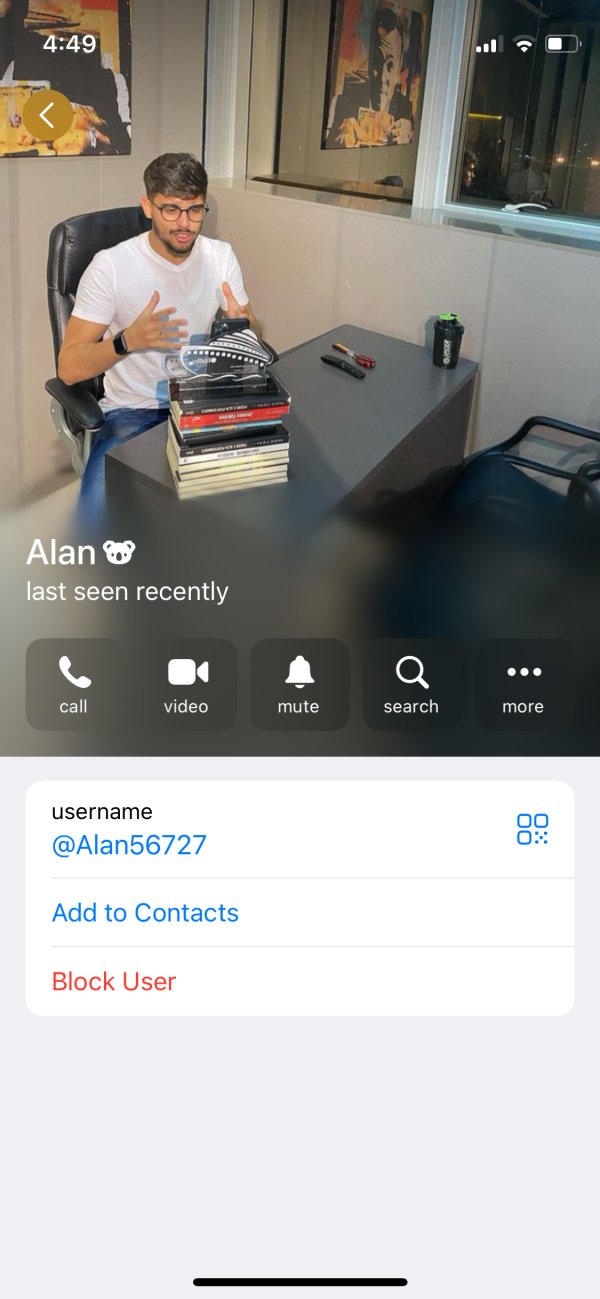

- Read Client Reviews: Check platforms such as Trustpilot or Forex Peace Army for user experiences and complaints related to the broker.

- Assess Risk Factors: Evaluate if your trading goals and risk tolerance align with the broker's operational structure and client protection policies.

Industry Reputation and Summary

"While FXTM has received accolades for its trading conditions and customer service, complaints about withdrawal delays and fees suggest necessary caution for new traders.

Trading Costs Analysis

Advantages in Commissions

FXTM boasts a competitive trading fee structure, especially on its Advantage accounts, which feature spreads that can be as low as 0 pips. Various account types allow traders to select conditions best suited to their trading styles, helping to minimize costs, particularly for high-frequency traders.

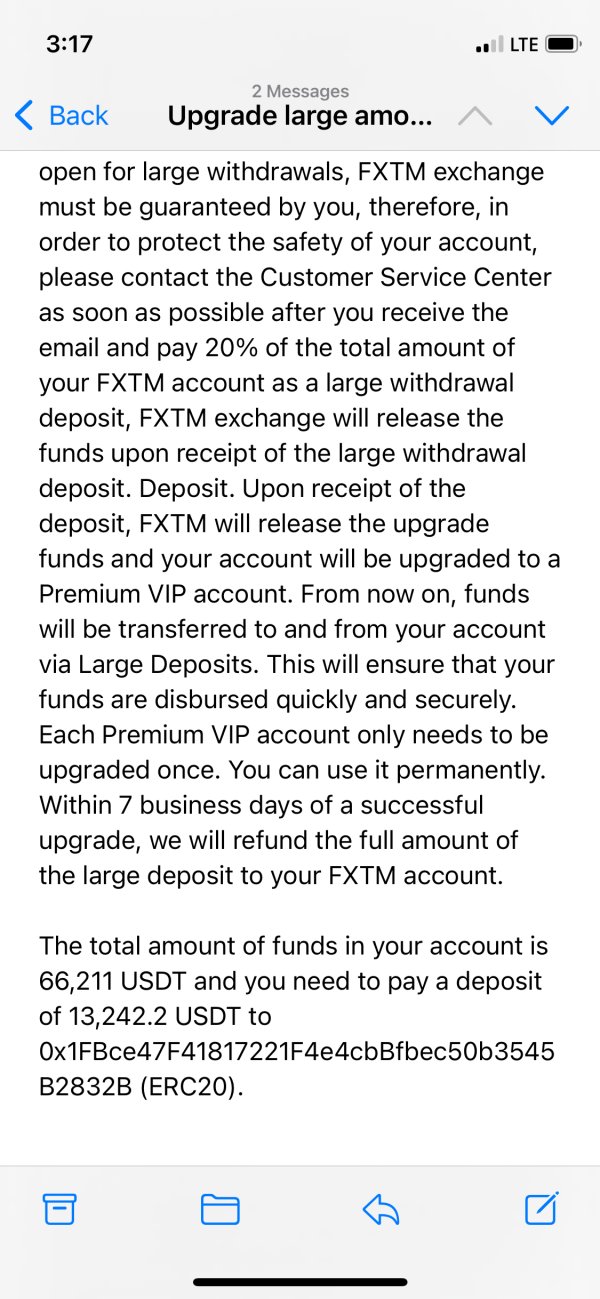

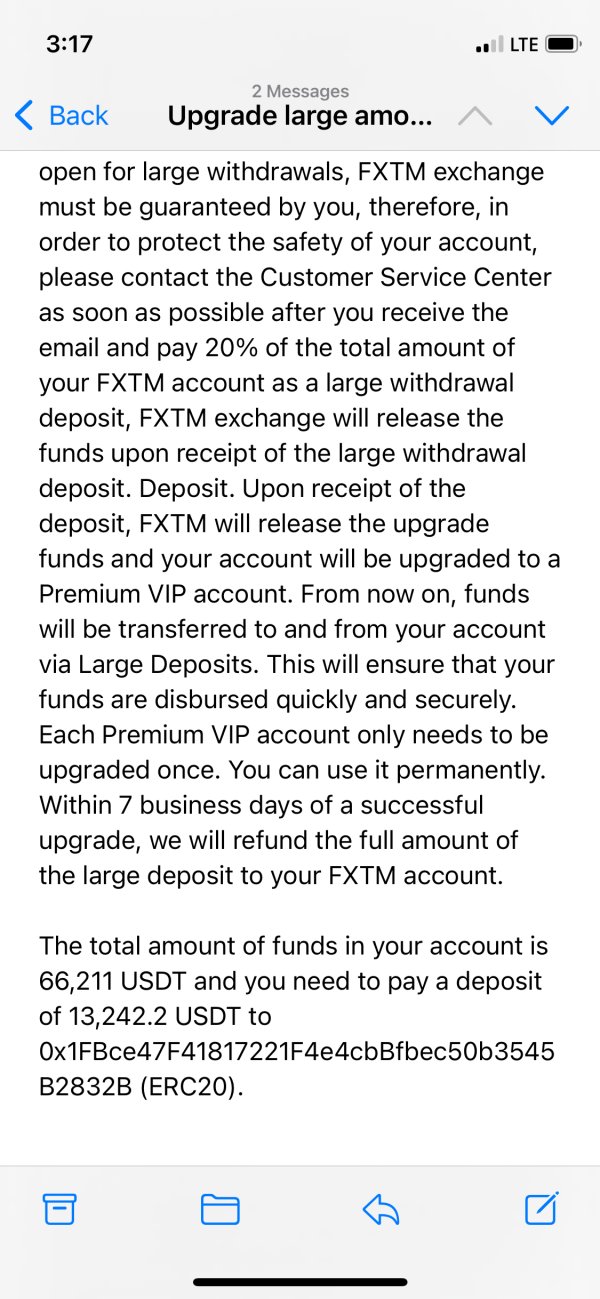

The "Traps" of Non-Trading Fees

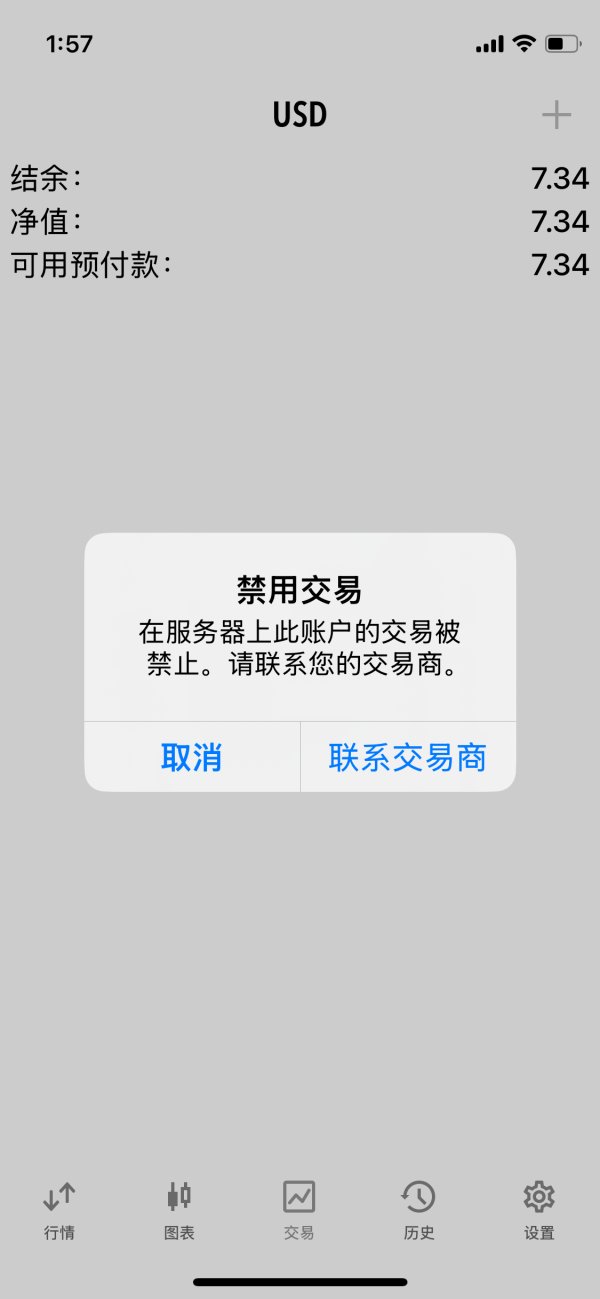

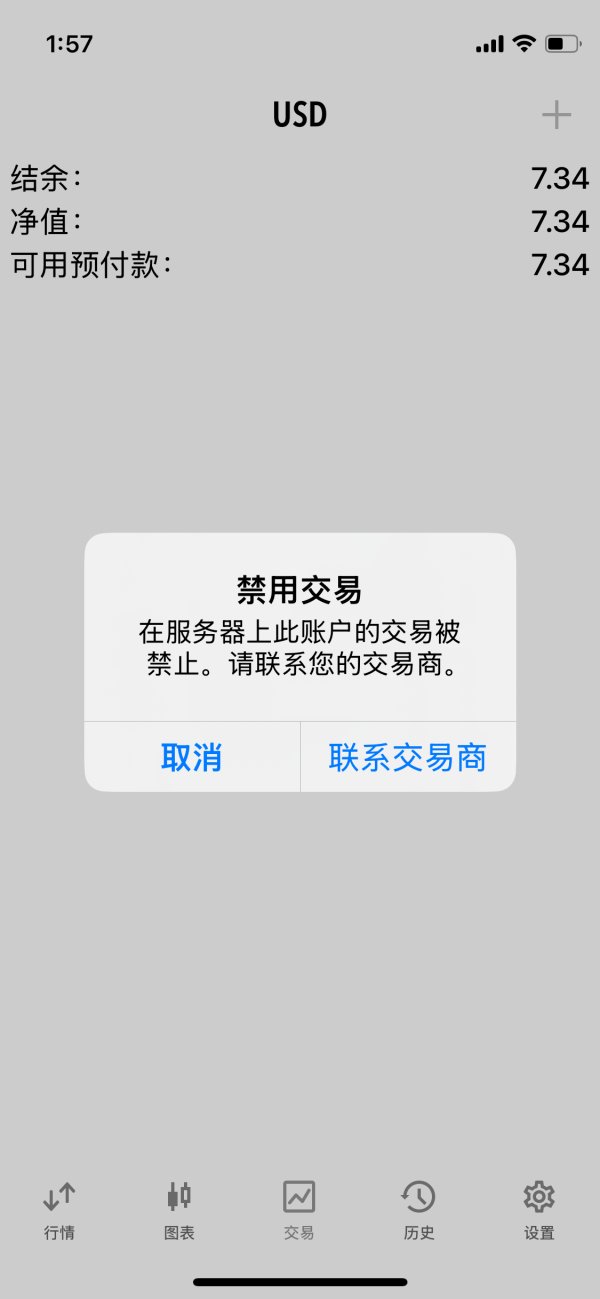

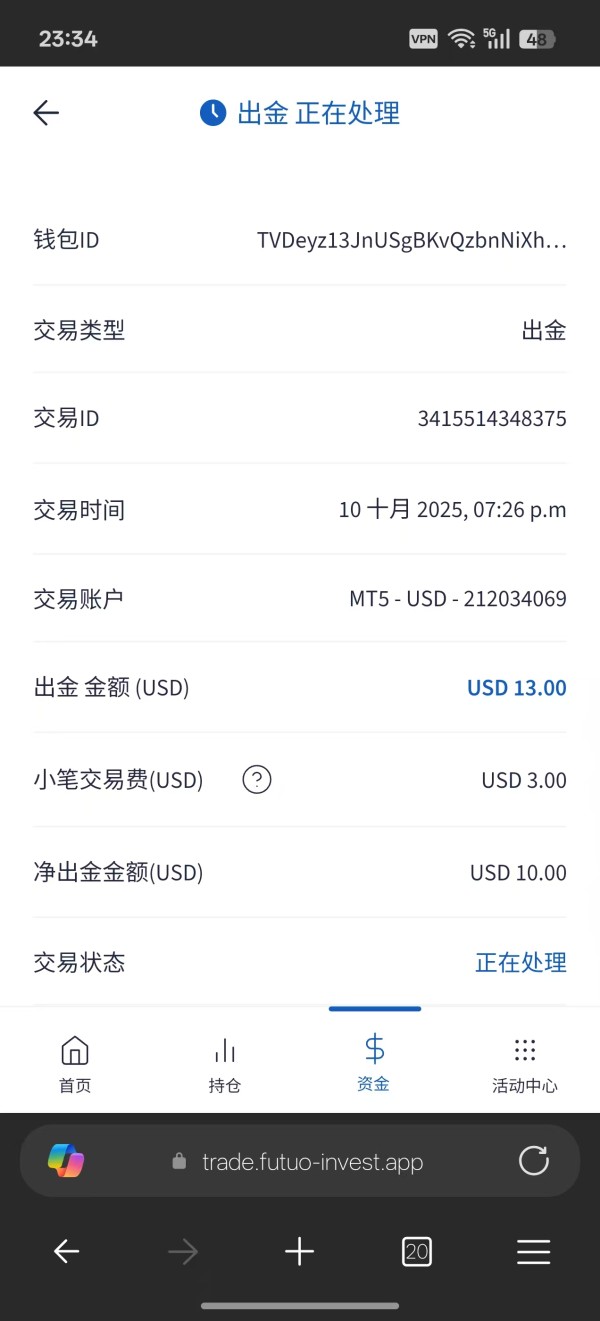

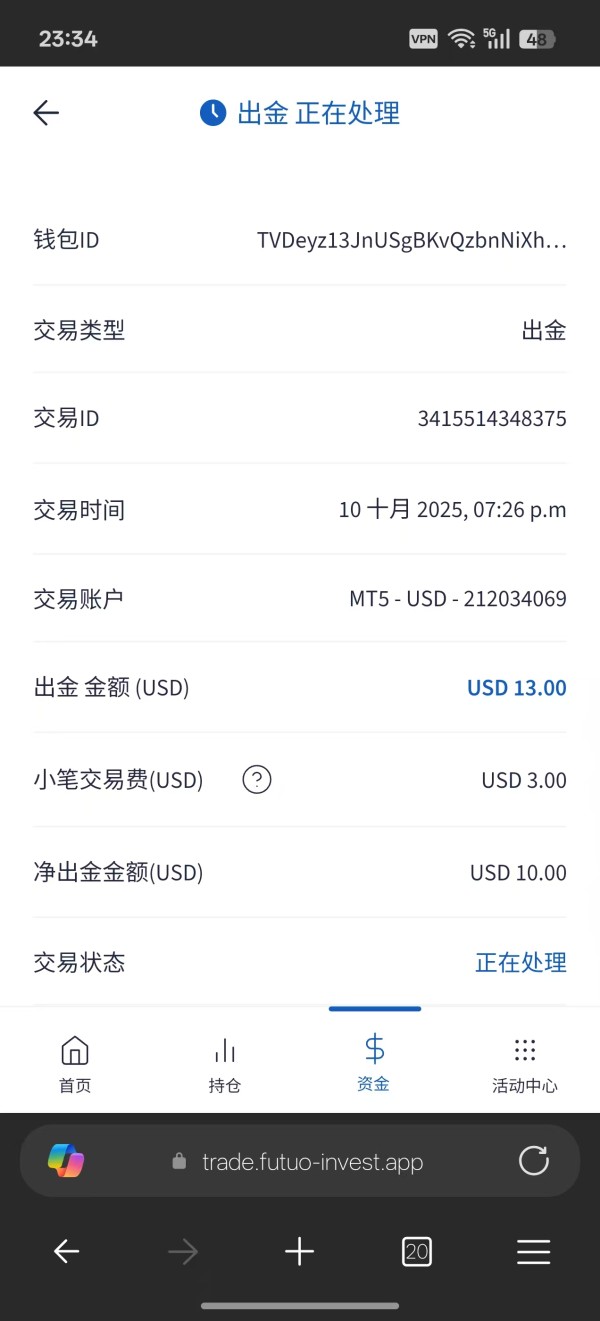

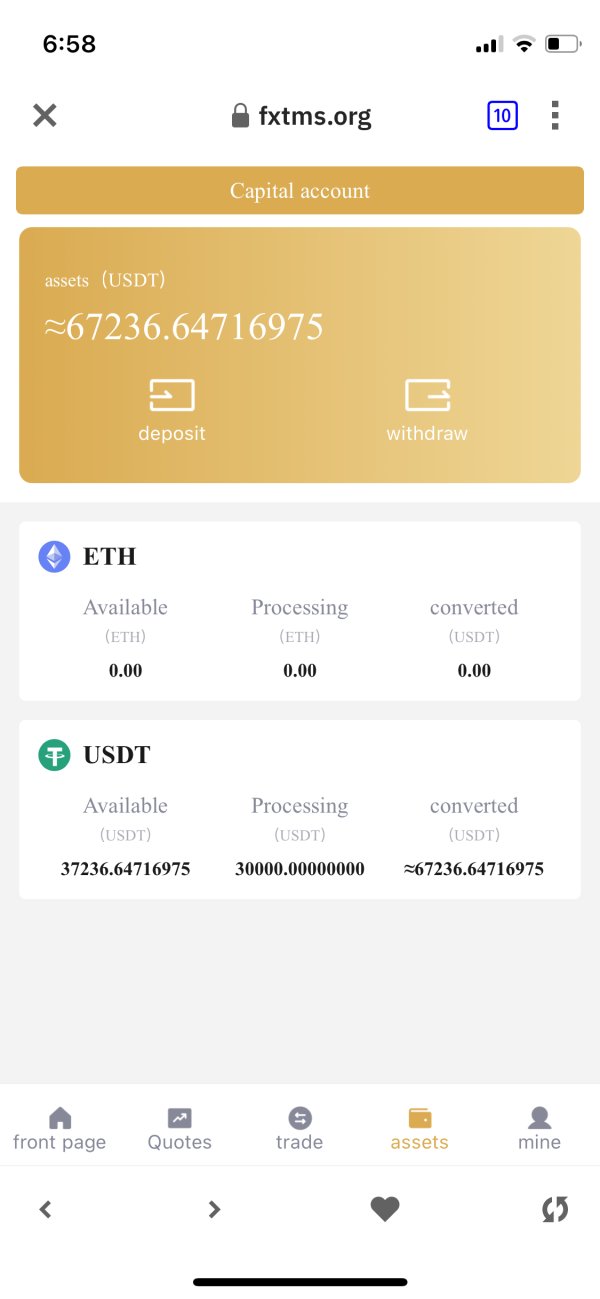

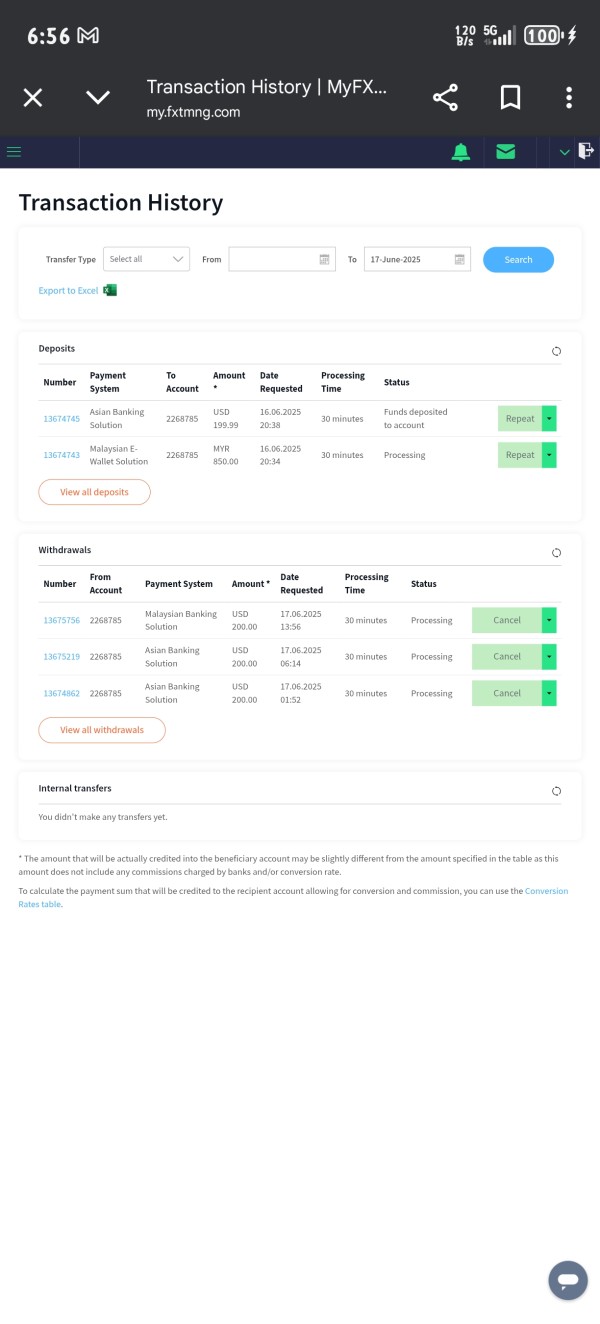

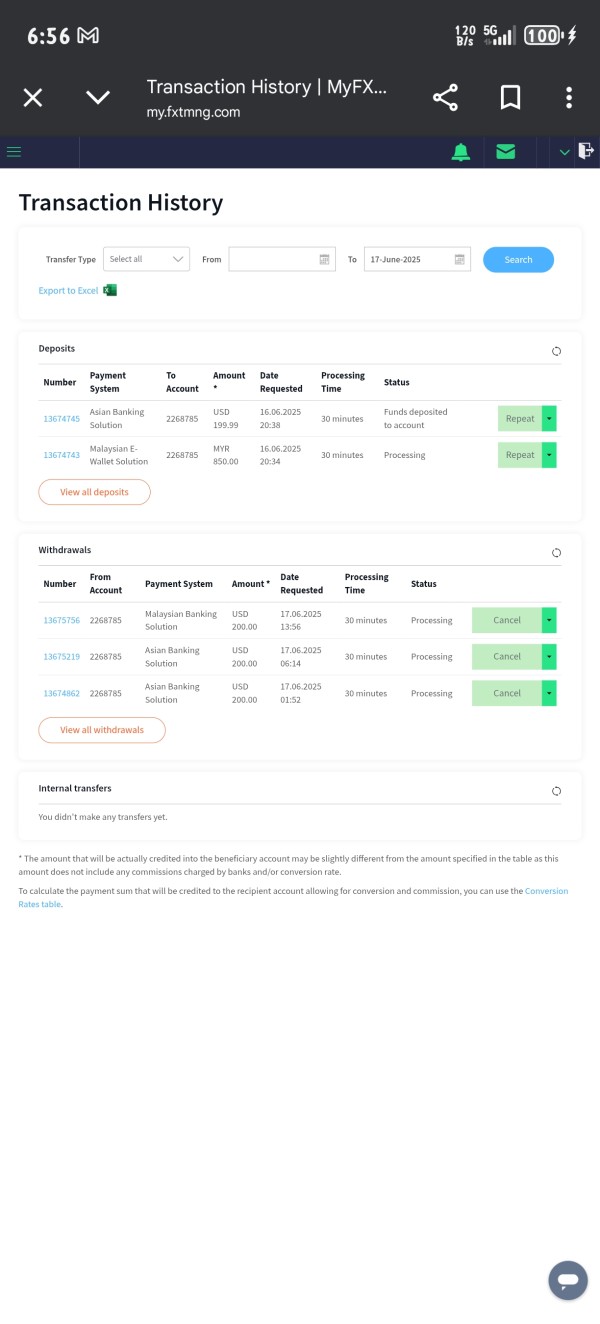

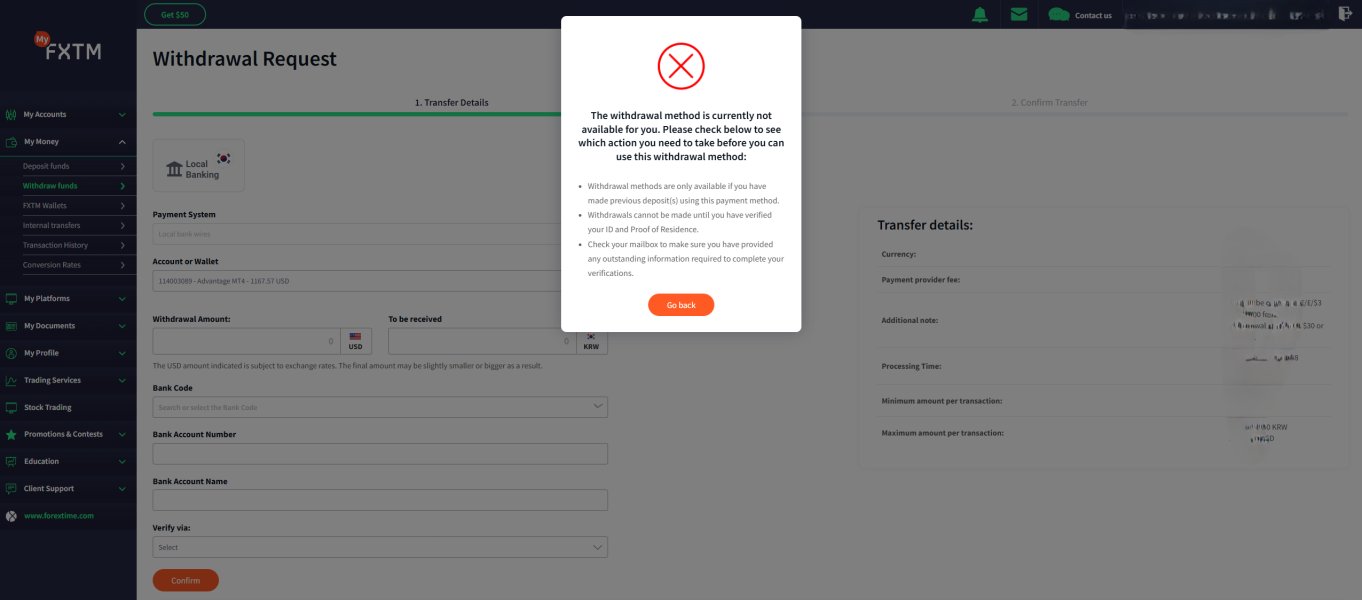

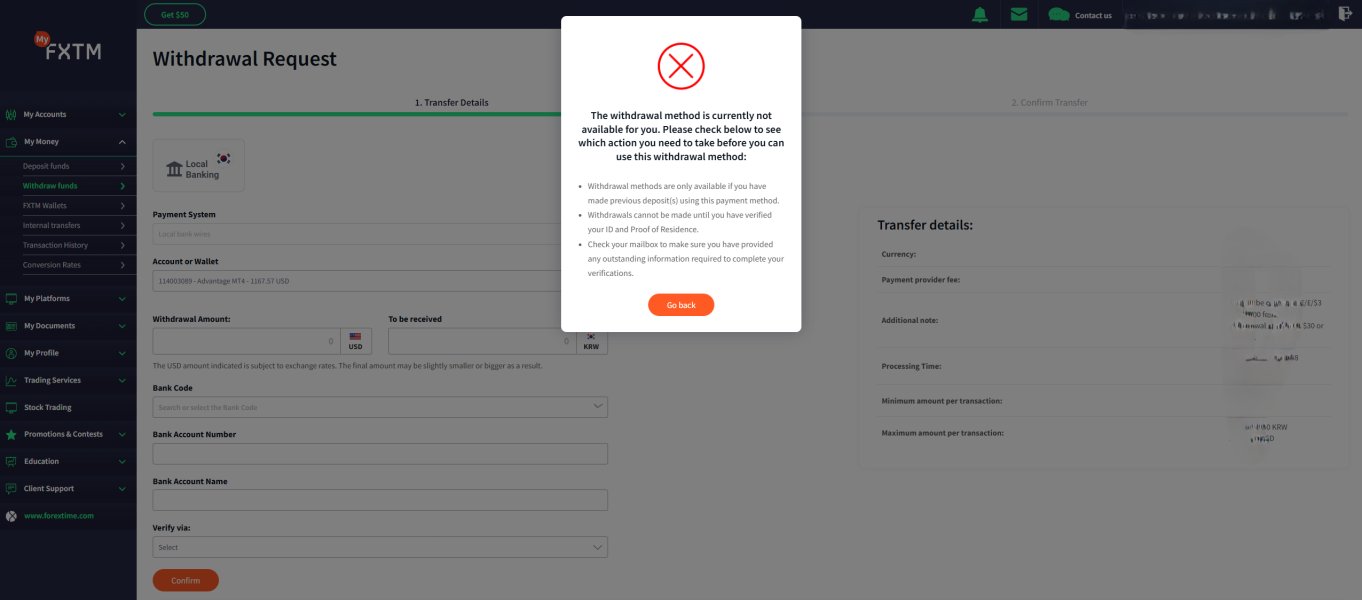

Despite the attractive trading costs, FXTM has a reputation for levying relatively high withdrawal fees, which can significantly affect the overall profitability for traders. Users have reported instances where the withdrawal processes have been slow and expensive, raising red flags about cost-effectiveness.

Cost Structure Summary

Overall, FXTM's fee structure offers advantages for various trader profiles, but potential hidden costs, particularly regarding withdrawals, could serve as a deterrent for those seeking low-cost trading solutions.

FXTM supports both the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms provide solid functionality, including advanced charting tools and automated trading capabilities. The inclusion of both platforms allows them to cater effectively to both beginner and experienced traders.

FXTM provides a host of tools and educational resources, empowering traders with methods and insights to enhance their market understanding. This encompasses market news, technical analysis, trading signals, and educational articles that cater to various trader levels.

"While FXTM provides robust trading platforms, some users report that the learning curve associated with the advanced features can be steep for new traders."

User Experience Analysis

Navigation and Usability

FXTM's platforms offer a user-friendly interface with an organized layout that users typically find easy to navigate. However, user experiences vary, and there are reports of inconsistent customer service when seeking help with platform functionality.

Feedback on Experience

User reviews indicate that while many find the platforms intuitive, issues with service responsiveness can create frustration, particularly in urgent situations.

Customer Support Analysis

Availability and Quality of Support

Customer support at FXTM operates predominantly through multilingual channels including live chat, email, and phone. However, users have expressed dissatisfaction regarding the timeliness and effectiveness of support, particularly noting that response times can exceed acceptable limits during critical trading moments.

Summary of Support Experiences

Many users appreciate the educational resources but often feel neglected when it comes to immediate customer support needs."

Account Conditions Analysis

Overview of Account Types

FXTM offers various account types tailored to traders' needs, including micro, advantage, and advantage plus accounts. This ensures versatility and choice for different trading strategies.

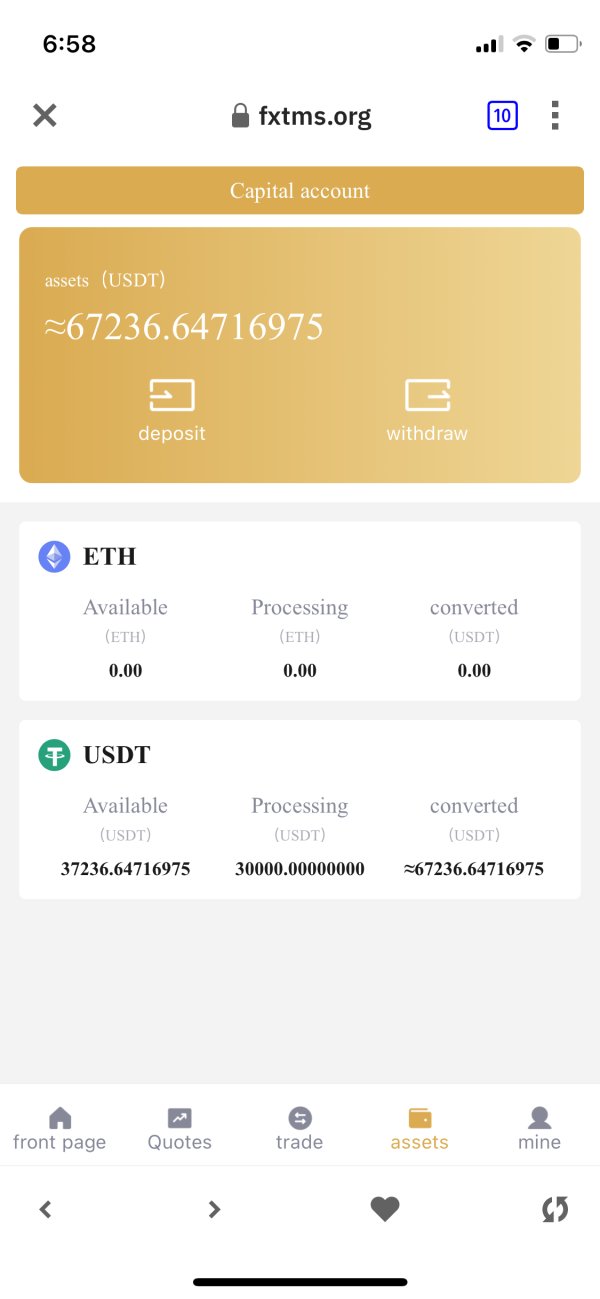

Minimum Deposit and Fees

The broker's minimum deposit is attractive to new traders, especially with options available for as little as $10 in specific accounts. Nevertheless, the additional fees, including withdrawal fees after inactivity, may catch users off-guard.

Conclusion

FXTM presents a solid trading option for beginner and intermediate traders thanks to its wide range of instruments, competitive fee structure, and extensive educational resources. However, potential users should approach with caution, particularly regarding withdrawal fees and customer service experiences. Thorough research and understanding of associated risks are paramount for any trading endeavor with this broker. As with any investments, especially in leveraged products like forex and CFDs, it is essential to ensure that the broker aligns with ones trading goals and financial safety needs.