Regarding the legitimacy of capital.com forex brokers, it provides ASIC, CYSEC, FCA, CMA, CMA, SCB and WikiBit, (also has a graphic survey regarding security).

Is capital.com safe?

Pros

Cons

Is capital.com markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

CAPITAL COM AUSTRALIA PTY LTD

Effective Date: Change Record

2021-06-16Email Address of Licensed Institution:

compliance.au@capital.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 34 120 COLLINS ST MELBOURNE VIC 3000Phone Number of Licensed Institution:

0383476353Licensed Institution Certified Documents:

CYSEC Market Making License (MM) 20

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Capital Com SV Investments Ltd

Effective Date:

2017-04-07Email Address of Licensed Institution:

compliance@capital.comSharing Status:

No SharingWebsite of Licensed Institution:

https://capital.com/, capital.com/en-eu/, capital.com/de-at/, capital.com/de-de/, capital.com/el-gr, capital.com/es-es/, capital.com/fr-fr/, capital.com/hu-hu/, capital.com/pl-pl/, capital.com/nl-nl/, capital.com/it-it/Expiration Time:

--Address of Licensed Institution:

Vasileiou Makedonos 8, KINNIS BUSINESS CENTER, 2nd floor, 3040 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 024 950Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Capital Com (UK) Limited

Effective Date:

2018-10-26Email Address of Licensed Institution:

compliance.uk@capital.com, complaints.uk@capital.comSharing Status:

No SharingWebsite of Licensed Institution:

www.capital.comExpiration Time:

--Address of Licensed Institution:

4 Orchard Place London SW1H 0BF UNITED KINGDOMPhone Number of Licensed Institution:

+442030978888Licensed Institution Certified Documents:

CMA Forex Trading License (EP)

Capital Market Authority

Capital Market Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

CAPITAL COM MENA SECURITIES TRADING L.L.C

Effective Date:

2023-06-01Email Address of Licensed Institution:

complianceuae@capital.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

١٤a مكتب الشركة المسجل في أبراج جميرا الإمارات، مكاتب أبراج الإمارات، الطابق الوحدة L14 دبي، الامارات العربية المتحدة P.O Box 0000 City DubaiPhone Number of Licensed Institution:

971-553078815Licensed Institution Certified Documents:

CMA Market Making License (MM)

The Capital Markets Authority

The Capital Markets Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

CC Kenya Securities Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://capital.comExpiration Time:

--Address of Licensed Institution:

P.O Box 12189-00100 NairobiPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Capital Com Online Investments Ltd.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

#3 Bayside Executive Park, Blake Road and West Bay StreetPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Capital.com Safe or a Scam?

Introduction

Capital.com is a prominent player in the online trading landscape, having established itself as a reliable broker since its inception in 2016. It specializes in Contracts for Difference (CFDs) across a diverse range of asset classes, including forex, commodities, cryptocurrencies, and stocks. With its user-friendly platform and a strong emphasis on educational resources, Capital.com aims to cater to both novice and experienced traders. However, the forex market is rife with risks, and traders must exercise caution when selecting a broker. This article seeks to provide a comprehensive analysis of Capital.com, evaluating its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a thorough review of multiple sources, ensuring a balanced and factual assessment.

Regulation and Legitimacy

The regulatory framework surrounding a broker is crucial for establishing its legitimacy and ensuring the safety of client funds. Capital.com is regulated by several reputable authorities, which is a positive indicator of its trustworthiness. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 793714 | United Kingdom | Verified |

| ASIC | 513393 | Australia | Verified |

| CySEC | 319/17 | Cyprus | Verified |

| FSA | SD101 | Seychelles | Verified |

| SCB | SIA-F-245 | Bahamas | Verified |

Capital.com holds licenses from top-tier regulators such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC). These regulatory bodies impose strict compliance requirements, ensuring that brokers adhere to high standards of financial conduct. For instance, the FCA mandates that client funds are kept in segregated accounts, providing an additional layer of security. Furthermore, the presence of investor compensation schemes, such as the Financial Services Compensation Scheme (FSCS) in the UK, offers further assurance to traders.

Historically, Capital.com has maintained a clean regulatory record, with no major compliance issues reported. This is an encouraging sign for potential clients, as brokers with a history of regulatory infractions are often seen as higher risk. Overall, the regulatory landscape surrounding Capital.com indicates a strong commitment to safeguarding client interests and maintaining operational transparency.

Company Background Investigation

Capital.com was founded in 2016 and is headquartered in Limassol, Cyprus. The company has rapidly grown to serve over 600,000 clients globally, with a trading volume exceeding $530 billion. The ownership structure of Capital.com is clear, with the broker being operated by Capital.com SV Investments Limited, a company registered in Cyprus. This transparency in ownership is crucial, as it allows clients to understand who is behind the broker they are trading with.

The management team at Capital.com comprises experienced professionals from the finance and technology sectors. Their collective expertise in trading and financial services contributes to the broker's robust operational framework and innovative platform. The company's commitment to transparency is further demonstrated through its detailed disclosures regarding its services, fees, and trading conditions.

In terms of information disclosure, Capital.com provides extensive educational resources and market insights, which are invaluable for traders looking to enhance their skills. The availability of a demo account allows potential clients to familiarize themselves with the platform without any financial risk. Overall, Capital.com presents itself as a transparent and well-structured organization, fostering trust among its clients.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its suitability for traders. Capital.com employs a competitive fee structure, primarily based on spreads rather than commissions. Below is a comparison of its core trading costs:

| Fee Type | Capital.com | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 0.6 pips | 0.7 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Variable | Variable |

Capital.com offers spreads starting from 0.6 pips for major currency pairs, which is competitive compared to the industry average. The absence of commission fees is another attractive feature, as many brokers charge commissions on trades. However, traders should be aware of the overnight interest fees associated with holding positions overnight, which can vary depending on the asset class.

While the fee structure appears favorable, potential clients should remain vigilant regarding any hidden fees or unusual charges. It is essential to thoroughly review the terms and conditions related to trading fees before opening an account. Overall, Capital.coms trading conditions are designed to be transparent and competitive, making it an appealing choice for many traders.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Capital.com implements several measures to ensure the security of its clients' investments. Client funds are held in segregated accounts at reputable banks, which means that they are kept separate from the broker's operational funds. This segregation of funds is a crucial aspect of safeguarding client assets and is a requirement under the regulations imposed by the FCA and CySEC.

Additionally, Capital.com offers negative balance protection, which prevents clients from losing more than their account balance. This feature is particularly important in the volatile forex market, where significant price fluctuations can occur. In the event of adverse market conditions, negative balance protection ensures that traders are not left with debts exceeding their deposits.

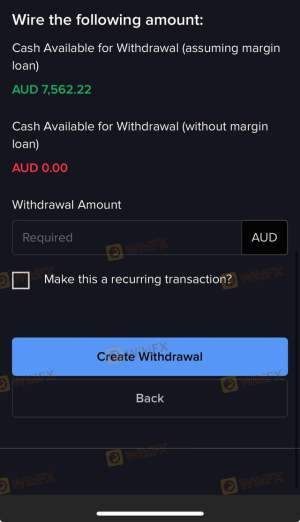

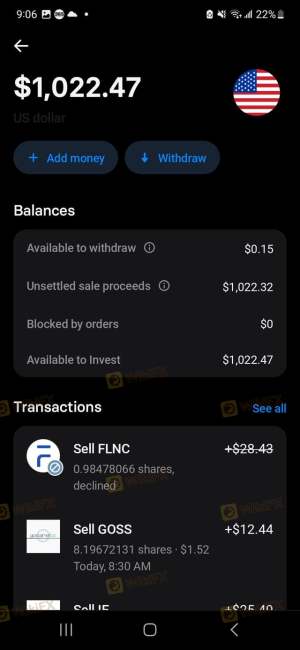

Despite these safety measures, it is worth noting that Capital.com has faced some complaints regarding withdrawal issues. Some users have reported delays or complications when attempting to withdraw funds. While these instances may not reflect the overall reliability of the broker, they do highlight the importance of understanding the withdrawal process and potential limitations. Overall, Capital.com appears to prioritize fund safety, but prospective clients should remain informed about the withdrawal policies and procedures.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Capital.com has generally received positive reviews from its users, particularly regarding its user-friendly platform and educational resources. However, like any brokerage, it has faced its share of complaints. Common issues reported by clients include withdrawal delays and difficulties in account verification.

The following table summarizes some of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Mixed |

| Account Verification Issues | High | Needs Improvement |

| Platform Performance Issues | Low | Generally Positive |

One notable case involved a trader who experienced significant delays in withdrawing funds after submitting the necessary documentation. While the broker ultimately resolved the issue, the experience left the client frustrated. Another instance involved a user struggling with account verification, which is a common hurdle for many brokers. These complaints suggest that while Capital.com generally provides a satisfactory trading experience, there are areas for improvement, particularly in customer support responsiveness.

Platform and Trade Execution

A broker's trading platform is a critical component of the trading experience. Capital.com offers a proprietary trading platform alongside the widely-used MetaTrader 4 (MT4). The platform is designed to be intuitive and user-friendly, providing traders with essential tools for analysis and execution. Users have reported that the platform performs well, with minimal downtime and fast order execution.

However, some traders have raised concerns about slippage and order rejection rates. While Capital.com aims to provide competitive execution speeds, the nature of the forex market can lead to occasional slippage during volatile trading periods. This is a common issue across many brokers and should be taken into account when assessing the overall trading experience.

In summary, Capital.coms platform is generally well-received, but traders should remain aware of potential execution issues, particularly in fast-moving markets.

Risk Assessment

Every broker comes with its own set of risks, and it is essential for traders to understand these before committing their funds. The following risk assessment summarizes the key risk areas associated with trading at Capital.com:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by multiple authorities. |

| Fund Safety Risk | Low | Segregated accounts and negative balance protection. |

| Withdrawal Risk | Medium | Some complaints about withdrawal issues. |

| Market Risk | High | Trading CFDs involves high volatility. |

While Capital.com is a regulated and reputable broker, potential clients should be aware of the inherent risks associated with trading CFDs and leverage. It is advisable to employ risk management strategies, such as setting stop-loss orders and limiting exposure to any single trade.

Conclusion and Recommendations

In conclusion, Capital.com is not a scam; it is a legitimate and regulated broker with a solid reputation in the trading community. The broker's strong regulatory framework, transparent fee structure, and commitment to fund safety make it a reliable choice for many traders. However, prospective clients should remain cautious and informed about potential withdrawal issues and the risks associated with leveraged trading.

For beginner traders, Capital.com offers a wealth of educational resources and a user-friendly platform, making it an excellent choice for those new to the forex market. More experienced traders may also find value in the broker's competitive spreads and diverse trading instruments.

If you are considering alternatives, brokers such as IG, eToro, or OANDA may also provide robust trading environments with similar offerings. Ultimately, the choice of broker should align with your individual trading goals and risk tolerance.

Is capital.com a scam, or is it legit?

The latest exposure and evaluation content of capital.com brokers.

capital.com Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

capital.com latest industry rating score is 7.94, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.94 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.