Ox Securities 2025 Review: Everything You Need to Know

Summary

Ox Securities is a new forex broker that started in 2020. This company offers many different trading tools that work well for both new traders and those with lots of experience. The broker is based in Saint Vincent and the Grenadines and uses an STP and ECN business model. They give traders access to multiple types of investments including forex, indices, commodities, and cryptocurrencies. Two big features make this broker stand out: no minimum deposit needed and leverage up to 1:500.

This ox securities review shows that the broker works with multiple trading platforms like MT4, MT5, and IRESS. These platforms help different types of traders with various skill levels. The company focuses on retail traders who want easy access and good trading conditions. They especially target people looking for cheap ways to start trading forex. Ox Securities has rules and oversight from ASIC and SVGFSA, and they try to create a complete trading space for many different strategies and risk levels.

Important Notice

Ox Securities works in different countries and follows different rules depending on where you live. Traders need to know that laws and rules change based on their location and which company they trade with. The rules from ASIC and SVGFSA give different amounts of protection and standards.

This review looks at lots of public information and feedback from users to give you a fair assessment. But readers should know that some parts of this review include opinions based on industry standards and comparing different brokers. Market conditions and what brokers offer can change, so traders should check current information directly with the broker before they decide to trade.

Rating Framework

Overall Rating: 6.7/10

The score shows that Ox Securities has strong account conditions with no minimum deposit and good leverage. However, some areas need more detailed information, especially about customer service quality and complete user feedback.

Broker Overview

Ox Securities started in 2020 and has its main office in Kingstown, Saint Vincent and the Grenadines. The company works as an STP (Straight Through Processing) and ECN (Electronic Communication Network) broker. This means they give direct market access for forex and CFD trading. Reports show that the broker focuses on giving good trading conditions while staying easy to use for traders with different experience levels. Their business model focuses on clear execution and cost-effective trading solutions.

The broker works with multiple trading platforms like MetaTrader 4, MetaTrader 5, and IRESS. These platforms give traders complete charting tools and analysis capabilities. Ox Securities lets you access over 80 forex pairs plus indices, commodities, and cryptocurrency CFDs. The company follows rules from both the Australian Securities and Investments Commission (ASIC) and the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). This gives them regulatory coverage in different countries.

Regulatory Jurisdictions: Ox Securities follows rules from ASIC and SVGFSA, which gives them compliance coverage in multiple countries. ASIC regulation gives better consumer protection for eligible clients, while SVGFSA oversight covers international operations.

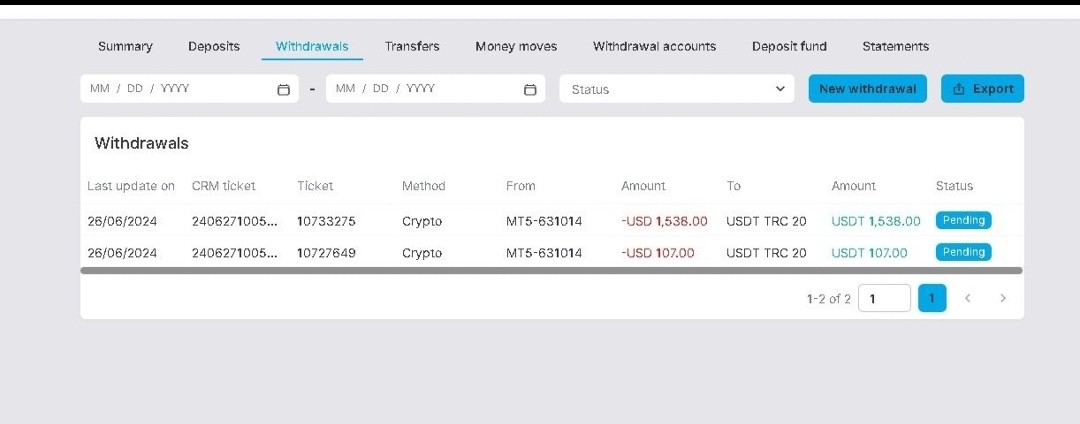

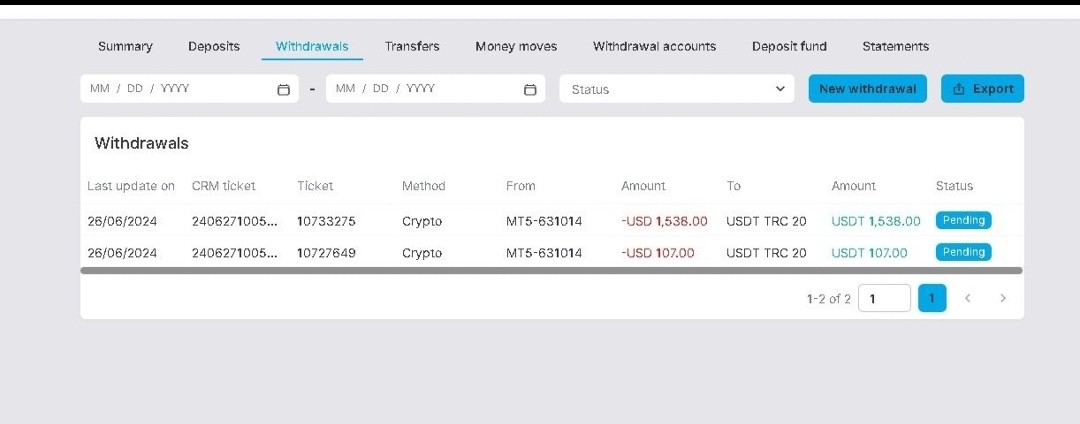

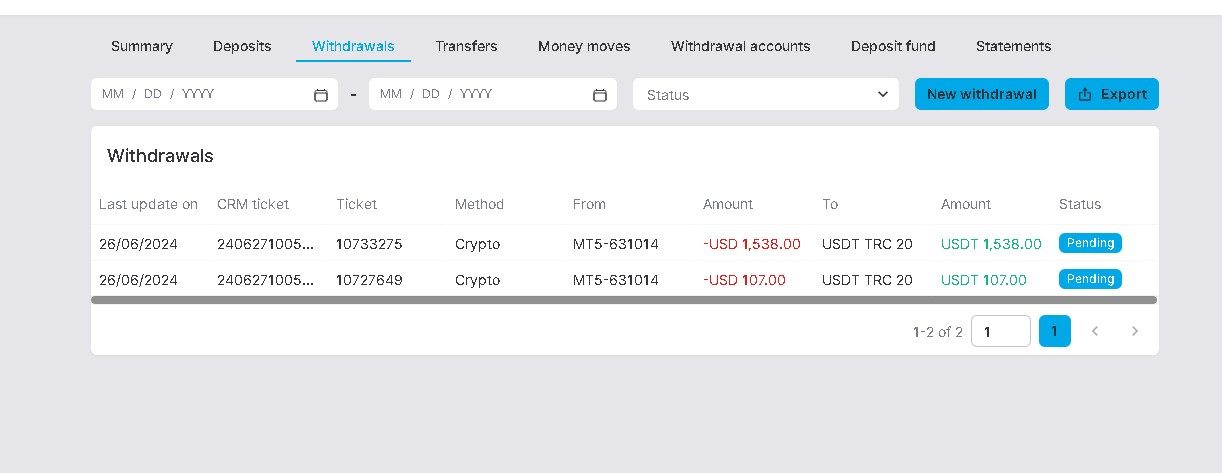

Deposit and Withdrawal Methods: The broker accepts credit card deposits based on available information. Specific withdrawal methods and how long they take are not detailed in current resources, so you need to check directly with the broker.

Minimum Deposit Requirements: Ox Securities has no minimum deposit requirement, making it easy for beginners and traders with limited starting money. Some sources say deposits can start from as low as 1 USD, which gives exceptional accessibility.

Bonuses and Promotions: Current promotional offers are not listed in available information sources. This means traders should contact the broker directly for any available incentives or promotional programs.

Tradeable Assets: The platform gives access to over 80 forex pairs along with other financial instruments including indices, commodities, and cryptocurrency CFDs. The exact number and variety of instruments across all asset classes need direct confirmation.

Cost Structure: Ox Securities offers spreads starting from 0.0 pips according to available data, with no funding fees reported. However, detailed commission structures and complete fee schedules are not well documented in current sources.

Leverage Ratios: Maximum leverage reaches 1:500, which works well for traders who want higher exposure with smaller capital requirements. This leverage level matches industry standards for retail forex trading.

Platform Options: The broker supports MT4, MT5, and IRESS platforms. These provide different trading experiences and analysis capabilities to suit different trader preferences and strategies.

Geographic Restrictions: Specific regional limitations are not detailed in available information. You need to ask directly about jurisdiction-specific availability.

Customer Service Languages: Supported languages for customer service are not listed in current information sources.

Detailed Rating Analysis

Account Conditions Analysis (Score: 8/10)

Ox Securities does really well with account accessibility because they have no minimum deposit requirement. This sets them apart from many competitors in the forex brokerage space. This approach makes trading access fair for everyone, especially helping new traders who want to start with very little money. The broker offers multiple account types designed to work with different trading styles and experience levels. However, specific account tier details need direct verification.

The leverage offering of up to 1:500 gives significant flexibility for traders who want enhanced market exposure. This high leverage ratio increases potential returns but also makes risk bigger, making it suitable for experienced traders who understand how leverage works. The account opening process seems simple based on available information. However, specific requirements and verification procedures are not well detailed in current sources.

According to this ox securities review, the combination of zero minimum deposits and competitive leverage puts the broker in a good position against industry peers. But complete account features like Islamic account availability, account protection measures, and specific terms for different account tiers would benefit from more detailed documentation. This would provide complete transparency for potential clients.

The broker supports multiple professional trading platforms including MetaTrader 4, MetaTrader 5, and IRESS. These platforms provide complete charting capabilities and technical analysis tools. These platforms offer extensive indicator libraries, automated trading support, and customizable interfaces suitable for various trading strategies. The multi-platform approach lets traders choose their preferred environment based on experience and specific requirements.

Trading instruments span multiple asset classes including over 80 forex pairs, indices, commodities, and cryptocurrency CFDs. This provides diversification opportunities within a single account. The range of available instruments appears competitive for a broker of this size and establishment date. However, detailed specifications for each asset class would enhance trader decision-making capabilities.

Research and educational resources are not well detailed in available information sources. This represents a potential area for enhancement. Modern traders increasingly value complete market analysis, economic calendars, and educational content to support their trading development. The availability and quality of such resources would significantly impact the overall value proposition for traders seeking complete broker support.

Customer Service and Support Analysis (Score: 6/10)

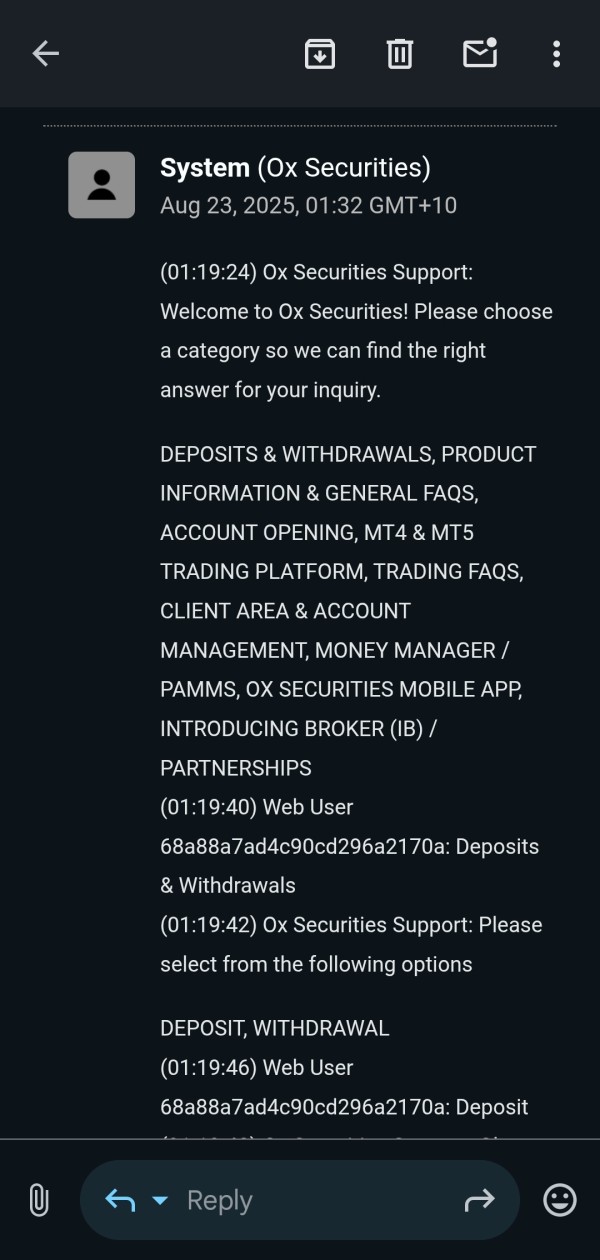

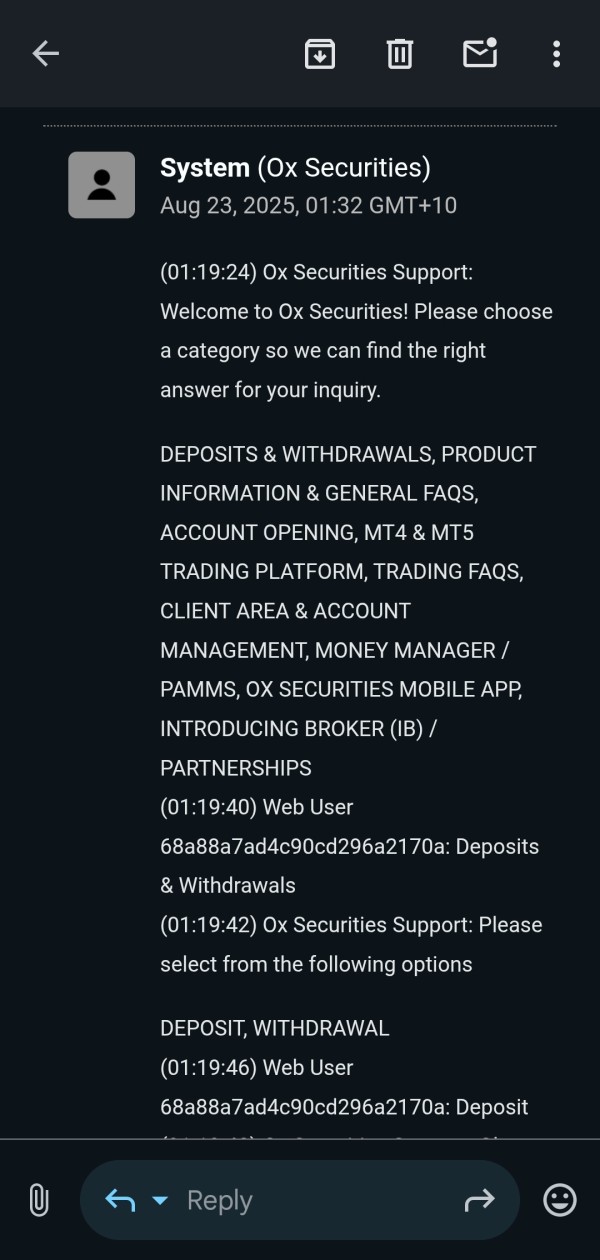

Customer service information remains limited in available sources. This prevents complete evaluation of support quality and availability. The specific customer service channels, response times, and service quality metrics are not detailed in current information. This makes it difficult to assess this crucial aspect of broker operations.

Multi-language support capabilities are not specified. This could impact international trader accessibility and satisfaction. Given the broker's international focus and regulatory presence across multiple jurisdictions, complete language support would be expected but requires verification.

Operating hours for customer support and problem resolution procedures are not detailed in available sources. This information gap represents a significant limitation for traders who require reliable support. This is especially true for those trading across different time zones or requiring urgent assistance during market hours. Direct inquiry with the broker would be necessary to evaluate actual service quality and availability.

Trading Experience Analysis (Score: 7/10)

Platform stability and execution speed are not well documented in available user feedback or technical performance data. The supported platforms (MT4, MT5, IRESS) are industry-standard solutions known for reliability. However, specific performance metrics for Ox Securities' implementation would provide valuable insights for potential clients.

Order execution quality information is limited in current sources. The STP and ECN business model suggests direct market access and transparent execution. Detailed execution statistics, slippage data, and fill rates would enhance trader confidence and decision-making capabilities.

The broker offers spreads starting from 0.0 pips, indicating competitive pricing structures. However, complete spread data across different market conditions, average spreads for major pairs, and execution quality during volatile periods would provide more complete trading environment assessment. Mobile trading capabilities and platform functionality are not well detailed in available information.

This ox securities review indicates that while the fundamental trading infrastructure appears solid, more detailed performance data and user experience feedback would strengthen the evaluation. This would help assess actual trading conditions and platform reliability.

Trust and Reliability Analysis (Score: 6/10)

Ox Securities operates under dual regulatory oversight from ASIC and SVGFSA. This provides regulatory framework coverage across different jurisdictions. ASIC regulation offers enhanced consumer protection standards, including segregated client funds and compensation schemes for eligible clients. SVGFSA oversight provides additional regulatory compliance, though with different protection levels compared to ASIC.

Client fund security measures and company financial transparency are not well detailed in available sources. Modern traders increasingly prioritize fund safety, segregation practices, and broker financial stability information. The lack of detailed information about these crucial trust factors represents a limitation in complete broker evaluation.

Industry reputation and third-party evaluations are limited in current available sources. The broker's relatively recent establishment in 2020 means it has a shorter track record compared to more established competitors. Awards, industry recognition, or independent audits would enhance credibility assessment but are not documented in current information sources.

User Experience Analysis (Score: 6/10)

Overall user satisfaction data is not extensively available in current sources. This limits complete assessment of actual user experiences. User feedback, satisfaction surveys, and detailed testimonials would provide valuable insights into real-world broker performance and client satisfaction levels.

Platform interface design and usability information is limited to the supported platform types (MT4, MT5, IRESS) without specific customization or enhancement details. The registration and account verification process streamlining is not detailed. However, the low entry barriers suggest user-friendly onboarding procedures.

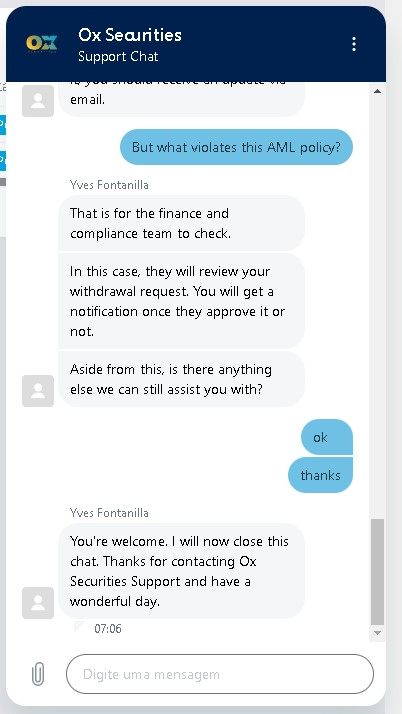

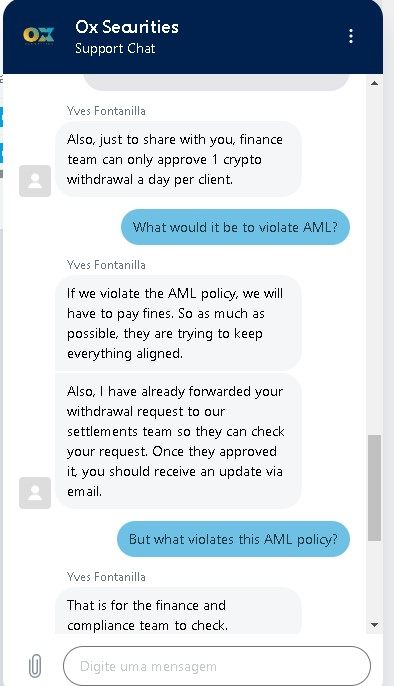

Funding operation convenience and speed are partially addressed through credit card deposit support. But complete payment method availability, processing times, and user experience feedback would enhance evaluation completeness. Common user complaints or satisfaction areas are not documented in available sources. This represents a significant information gap for potential clients seeking peer experiences and feedback.

Conclusion

Ox Securities presents itself as an accessible forex broker with competitive account conditions. It particularly appeals to traders seeking low entry barriers and high leverage options. The broker's no minimum deposit requirement and leverage up to 1:500 create attractive conditions for both beginning and experienced traders looking for flexible trading arrangements.

The broker is most suitable for retail traders prioritizing accessibility, competitive spreads, and multi-platform trading options. The regulatory coverage from ASIC and SVGFSA provides a foundation of oversight. However, traders should verify specific protections based on their jurisdiction and account type.

Key Advantages: No minimum deposit requirements, competitive leverage ratios, multiple trading platforms, and multi-jurisdictional regulatory coverage create a solid foundation for retail forex trading.

Areas for Improvement: Limited detailed information about customer service quality, complete fee structures, educational resources, and user experience feedback represents opportunities for enhanced transparency and client communication.

Potential clients should conduct direct verification of current terms, conditions, and service quality. This ensures alignment with their specific trading requirements and expectations.