Is 24option safe?

Pros

Cons

Is 24option Safe or Scam?

Introduction

24option is a trading platform that has garnered significant attention in the Forex market since its inception in 2010. Originally established as a binary options broker, it has since transitioned to focus on Forex and Contract for Difference (CFD) trading. This shift reflects broader regulatory changes in the industry, particularly concerning the legality and safety of binary options trading. As traders navigate the complex landscape of Forex trading, it's crucial to assess the safety and reliability of their chosen brokers. Evaluating brokers like 24option is essential to avoid potential scams and ensure a secure trading environment.

This article aims to provide a comprehensive analysis of 24option's safety, regulatory compliance, company background, trading conditions, customer experiences, and overall risk assessment. Our investigation is based on a thorough review of available online resources, user feedback, and regulatory information to present a balanced view of whether 24option is a safe platform for trading or if it exhibits characteristics of a scam.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety of a trading platform. 24option operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC) and the International Financial Services Commission (IFSC) of Belize. The presence of these regulatory bodies provides a level of assurance regarding the broker's operations and the protection of clients' funds.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| CySEC | 207/13 | Cyprus | Active |

| IFSC | 000319/38 | Belize | Active |

The regulation by CySEC means that 24option is required to adhere to strict guidelines, including maintaining client funds in segregated accounts and providing negative balance protection. However, it's important to note that the quality of regulation can vary significantly between jurisdictions. While CySEC is generally regarded as a reputable regulatory authority within the EU, the IFSC's standards may not be as stringent, raising concerns about the broker's overall compliance history.

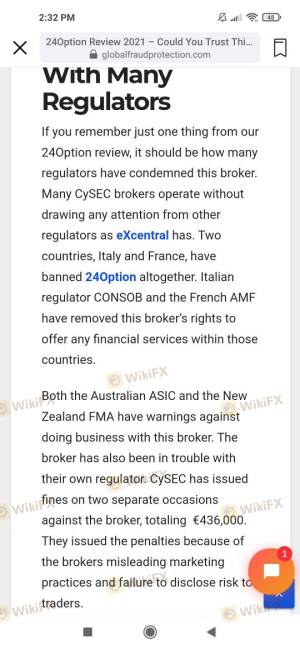

Historically, 24option has faced regulatory scrutiny, including fines for misleading advertising and non-compliance with operational standards. In 2021, the broker voluntarily renounced its CySEC license, which raises red flags regarding its commitment to regulatory compliance.

Company Background Investigation

24option was established in 2010 by Rodeler Limited, a Cyprus-based investment firm. The company initially focused on binary options trading, which was a popular but controversial financial product. As regulatory pressures increased, particularly against binary options, 24option pivoted to offer Forex and CFD trading, aiming to align with more acceptable trading practices.

Despite its relatively short history, 24option has experienced significant growth and has become one of the more recognized names in the Forex trading space. However, the lack of transparency regarding the company's ownership structure and management team is concerning. Limited information is available about the individuals behind the firm, which can complicate efforts to assess its credibility.

In terms of transparency, 24option's website lacks detailed disclosures about its operational history, management team, and financial standing. This absence of information can be a warning sign for potential traders, as reputable brokers typically provide comprehensive details about their operations and leadership.

Trading Conditions Analysis

When considering whether 24option is safe, it's essential to evaluate its trading conditions, including fees, spreads, and overall cost structure. 24option employs a commission-free model, primarily generating revenue through the spread on trades. However, the broker's fee structure has raised concerns among traders.

| Fee Type | 24option | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.3 - 3.0 pips | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% - 3.5% | 0.1% - 0.5% |

One of the most notable aspects of 24option's fee structure is the high maintenance and withdrawal fees. The broker charges a monthly maintenance fee of €10 and imposes withdrawal fees that can reach up to 3.5% after the first withdrawal. Additionally, there are inactivity fees that can escalate to €200 after six months of no trading activity. These fees are considerably higher than what is typically seen in the industry, which may deter potential clients from trading with 24option.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. 24option claims to implement various security measures to protect client funds, including segregated accounts and negative balance protection. Segregated accounts ensure that clients' funds are kept separate from the broker's operating capital, providing a layer of protection in the event of insolvency.

Moreover, 24option participates in an investor compensation fund, which can provide up to €20,000 in compensation if the broker fails to meet its obligations. While these measures are positive indicators of the broker's commitment to fund safety, past incidents of regulatory fines and customer complaints regarding fund withdrawals have raised concerns about the broker's reliability.

Customer Experience and Complaints

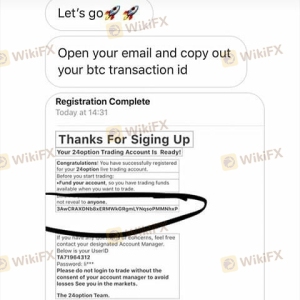

Customer feedback is a vital component in assessing whether 24option is safe. Reviews from users reveal a mixed bag of experiences. While some traders report satisfactory experiences with the platform, others have raised serious complaints regarding withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service Quality | Medium | Average |

| High Fees | Medium | Acknowledged |

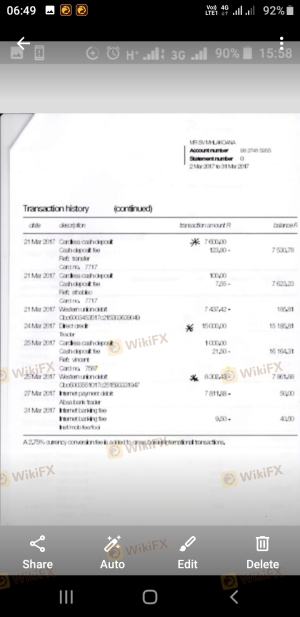

Typical complaints center around difficulties in withdrawing funds, with users reporting long delays and unresponsive customer support. For example, one user described a frustrating experience where their withdrawal requests were met with excuses and delays, leading to a loss of trust in the platform. Such complaints are concerning and suggest that potential traders should exercise caution when considering 24option.

Platform and Trade Execution

The performance of the trading platform is another critical factor in determining the safety of a broker. 24option offers both a proprietary trading platform and the widely used MetaTrader 4 (MT4). The proprietary platform is designed to be user-friendly, allowing traders to execute trades quickly and efficiently. However, some users have reported issues with platform stability and execution speed.

In terms of order execution quality, reports of slippage and order rejections have surfaced, which can significantly impact trading outcomes. Traders should be aware of these potential issues, as they can affect overall trading performance and profitability.

Risk Assessment

Using 24option comes with inherent risks that traders should consider. The broker's history of regulatory scrutiny, high fees, and mixed customer feedback contribute to an overall risk profile that may be concerning for potential clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | History of fines and license renouncement. |

| Withdrawal Issues | High | Frequent complaints regarding withdrawal delays. |

| Fee Structure | Medium | Higher than average maintenance and withdrawal fees. |

To mitigate these risks, potential traders should conduct thorough research and consider starting with a demo account to familiarize themselves with the platform before committing significant capital.

Conclusion and Recommendations

In conclusion, while 24option is regulated by CySEC and IFSC, the broker's history of regulatory issues, high fees, and mixed customer feedback raise significant concerns about its safety. The lack of transparency regarding company ownership and management further complicates the assessment of its legitimacy.

For traders considering whether 24option is safe, it is crucial to weigh the potential risks against the benefits. Those who are new to trading or are risk-averse may want to explore alternative, more established brokers with better reputations for customer service and regulatory compliance.

If you decide to proceed with 24option, ensure that you are fully aware of the fee structures and withdrawal policies. Additionally, consider starting with a smaller investment to gauge the platform's reliability before committing larger sums. For those seeking safer alternatives, brokers such as eToro or IG may provide more favorable trading conditions and a stronger regulatory framework.

Is 24option a scam, or is it legit?

The latest exposure and evaluation content of 24option brokers.

24option Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

24option latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.