Kot4x Broker 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

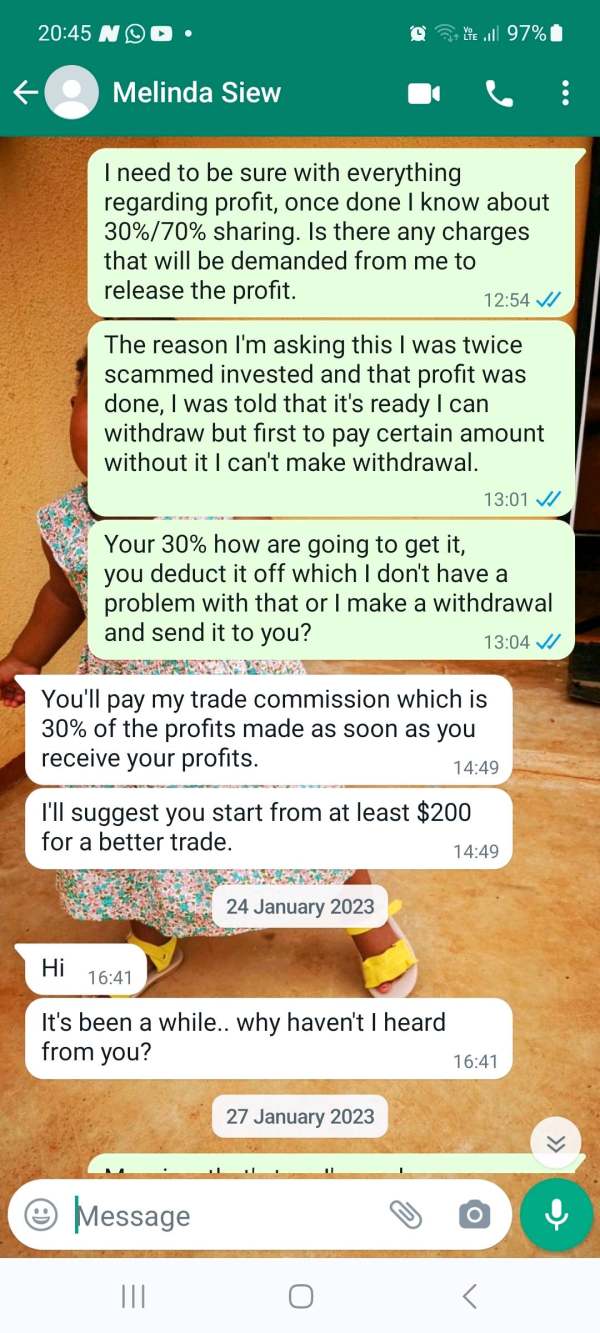

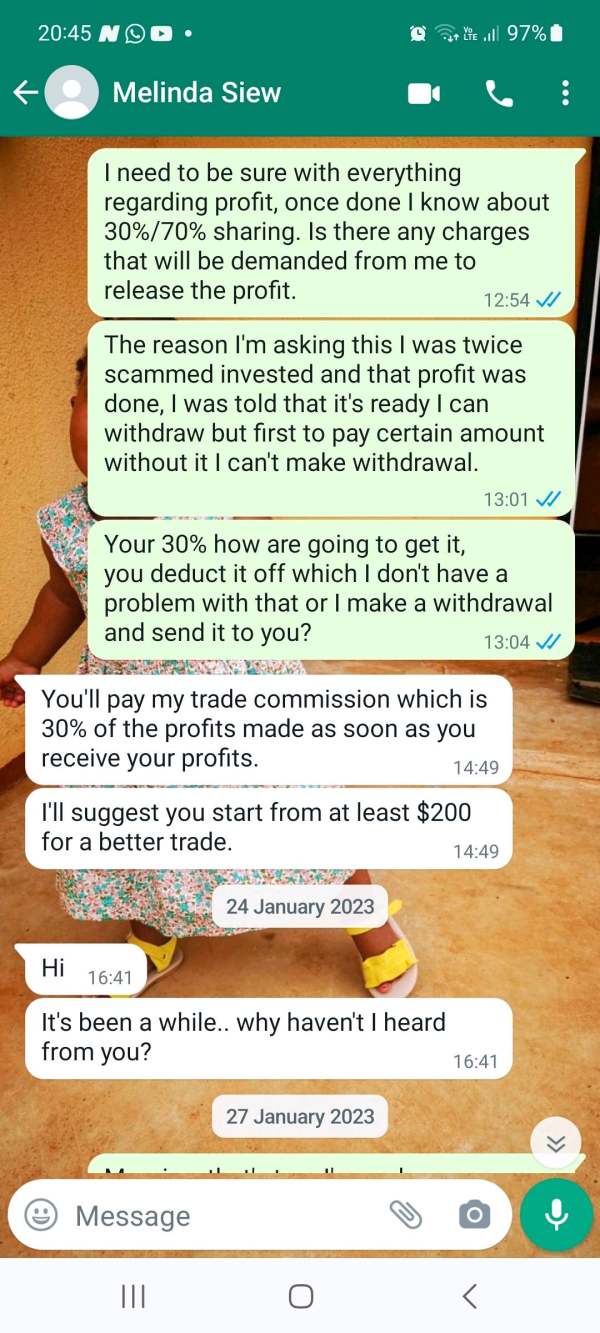

In the fast-paced world of online trading, Kot4x has emerged as a broker promoting attractive features such as a low minimum deposit and high leverage ratios. While these elements may appeal to traders looking for flexible trading conditions, a closer inspection reveals deeper concerns. Kot4x operates as an unregulated offshore broker situated in Saint Vincent and the Grenadines. The lack of robust regulatory oversight raises significant questions regarding the safety of client funds and withdrawal reliability. Furthermore, feedback from users has highlighted serious operational issues, particularly around the withdrawal process, indicating risks that may outweigh the potential benefits.

Potential users should be particularly cautious. This review will delve into both the advantages and drawbacks of Kot4x, and discuss the importance of thorough due diligence when considering partnerships with such unregulated brokers.

⚠️ Important Risk Advisory & Verification Steps

Warning: The lack of regulation and oversight at Kot4x represents significant risks. Potential clients should consider the following:

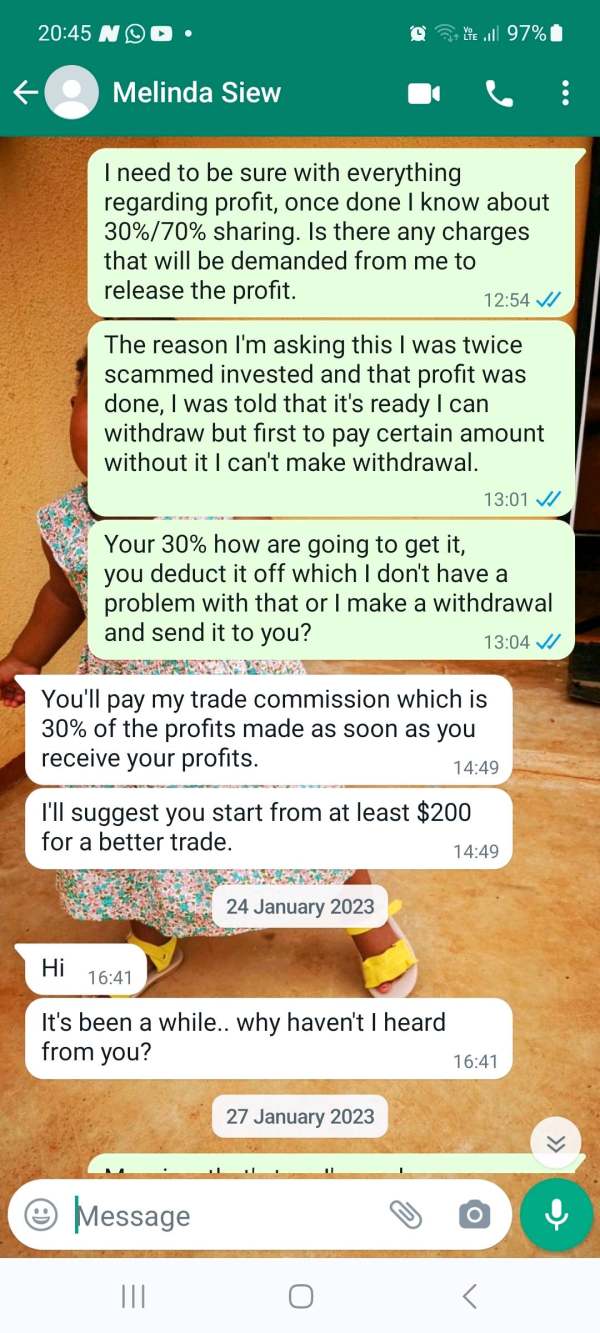

- Regulatory Oversight: Kot4x is unregulated, increasing the risk of fund mismanagement and potential fraud.

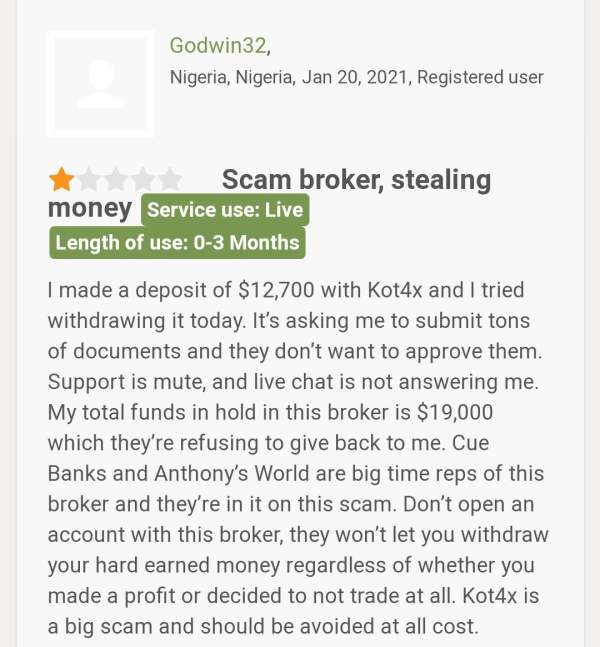

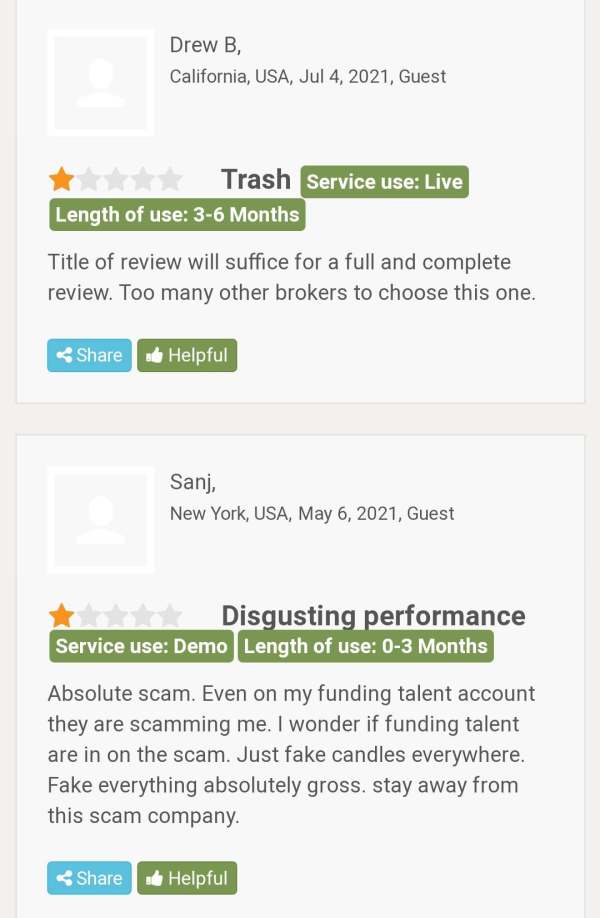

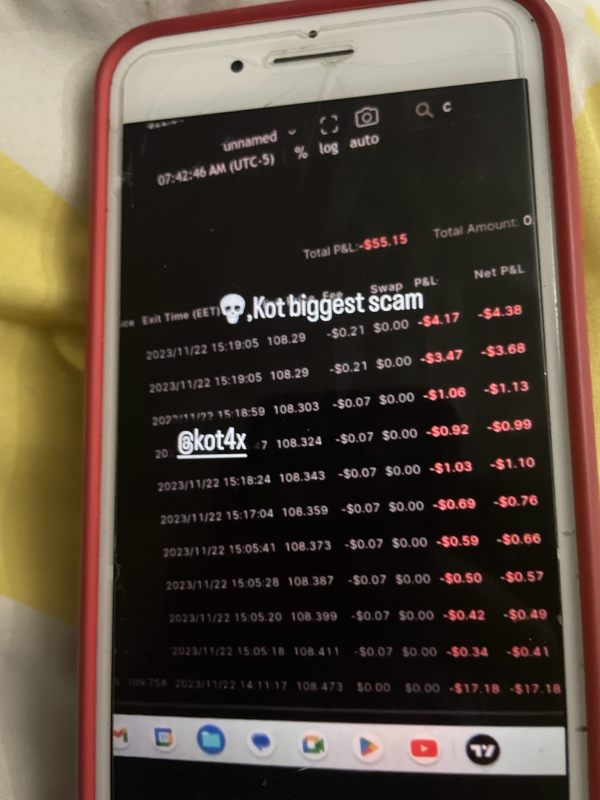

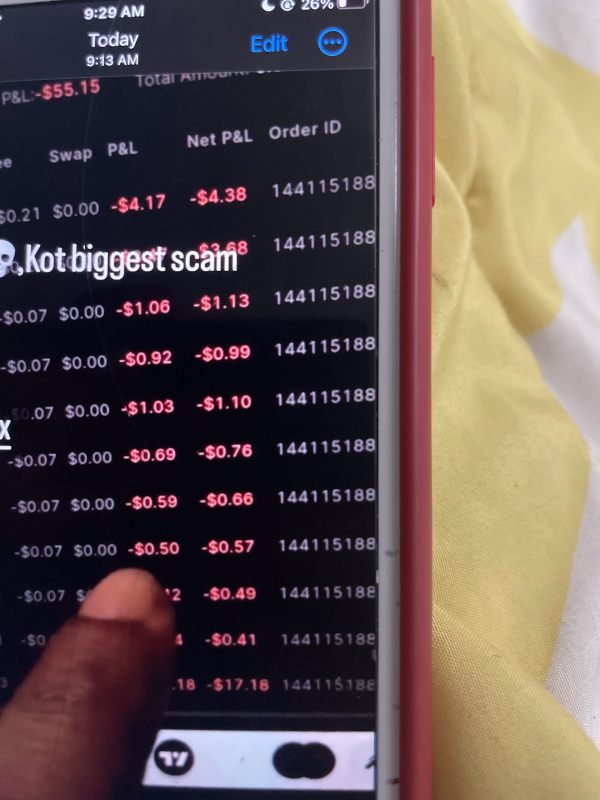

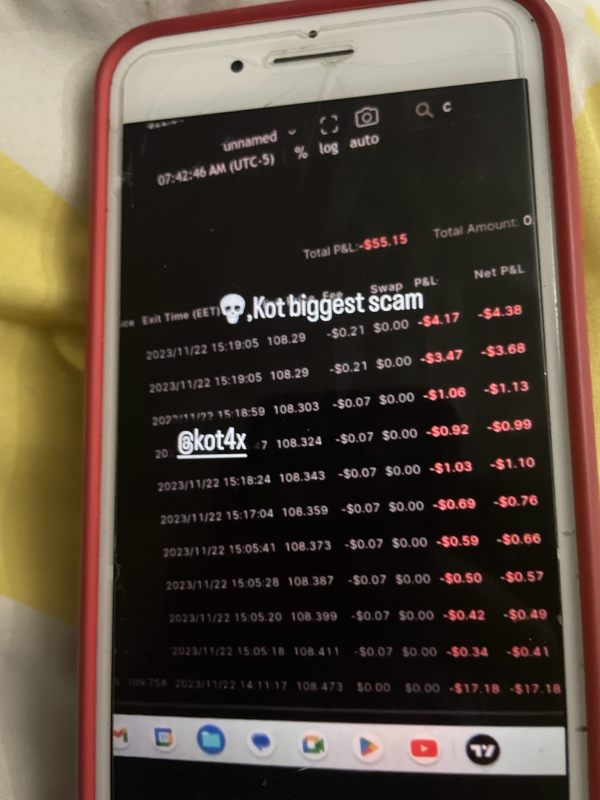

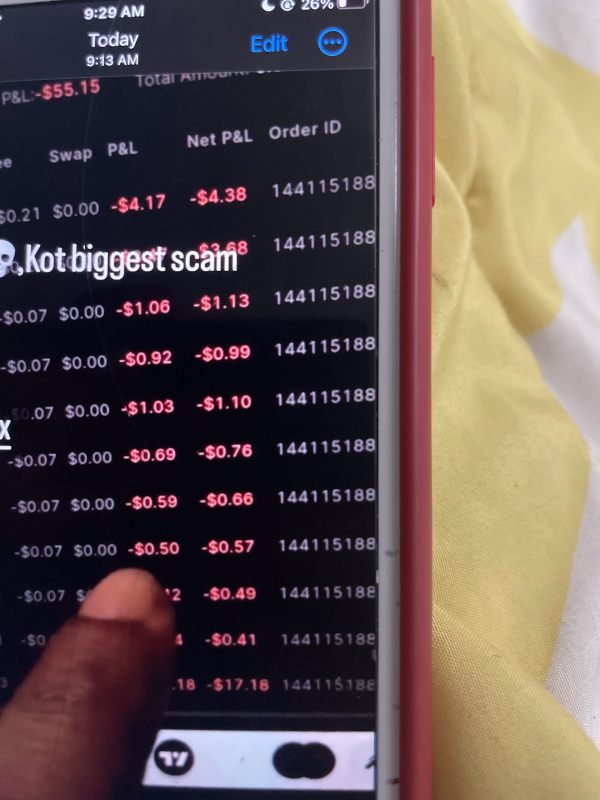

- User Reviews: Numerous complaints regarding withdrawals and fund safety have been reported.

- Education and Support Deficiency: Limited customer support and educational resources can lead to poor trading decisions.

Verification Steps:

- Check Official Regulations: Visit the financial regulatory authority's website to confirm broker registration.

- User Reviews and Forums: Research feedback from current and past traders on forums and review sites.

- Contact Customer Service: Engage with customer service to assess responsiveness before opening an account.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2019, Kot4x operates from Saint Vincent and the Grenadines. Positioned as a broker that appeals to forex and cryptocurrency traders, it markets itself as providing a "king of transparency" trading environment. However, the lack of regulatory oversight significantly undermines this positioning, suggesting that traders may face greater risks than benefits.

Core Business Overview

Kot4x is primarily a trading platform facilitating access to a wide range of financial instruments, including forex, indices, commodities, stocks, and cryptocurrencies. While the broker claims to operate with transparency and efficiency, it is essential to recognize the absence of regulatory endorsement, which can leave traders vulnerable to misconduct and fraud.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

-

Regulatory Information Conflicts: Kot4x does not hold a license from any major regulatory body. This lack of regulation raises substantial risks regarding client fund safety. According to various user complaints, many are skeptical about whether Kot4x can be trusted with their investments.

User Self-Verification Guide: Traders should ensure the credibility of the broker by verifying its regulatory status through recognized sources such as the FCA or ASIC. Additionally, users should read independent reviews from multiple platforms.

Industry Reputation and Summary: Kot4x has garnered a poor reputation in trader reviews, with users citing withdrawal issues and lack of accessibility to customer support. "They have no way to contact their support live, and responses are slow," stated a disgruntled trader.

Trading Costs Analysis

-

Advantages in Commissions: Kot4x offers a competitive edge for active traders through its low minimum deposit and high leverage options. The broker markets spreads starting from 0.4 pips for specific accounts, making it attractive for forex traders.

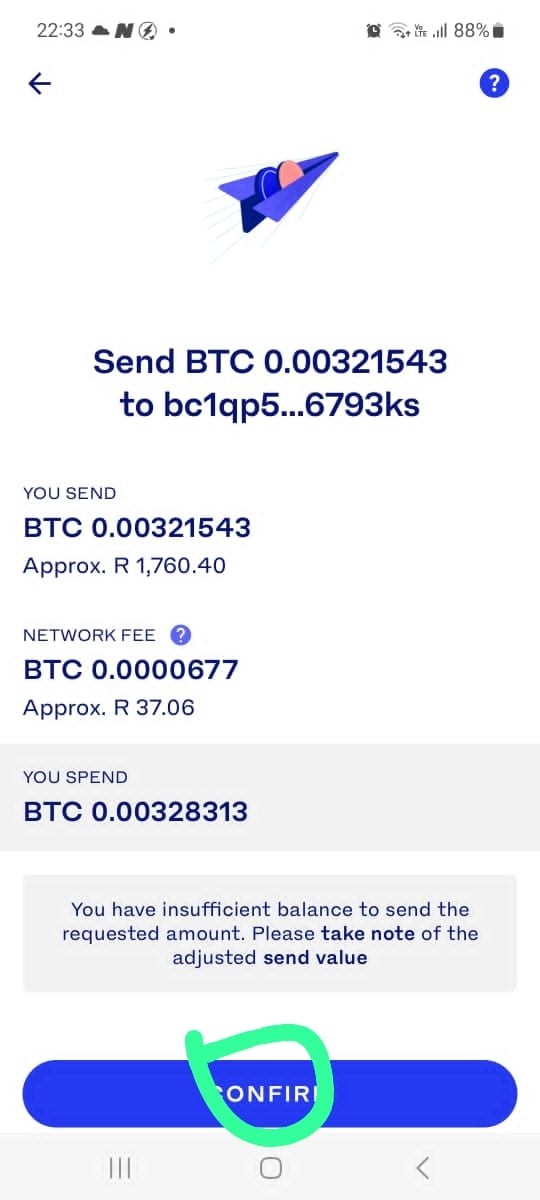

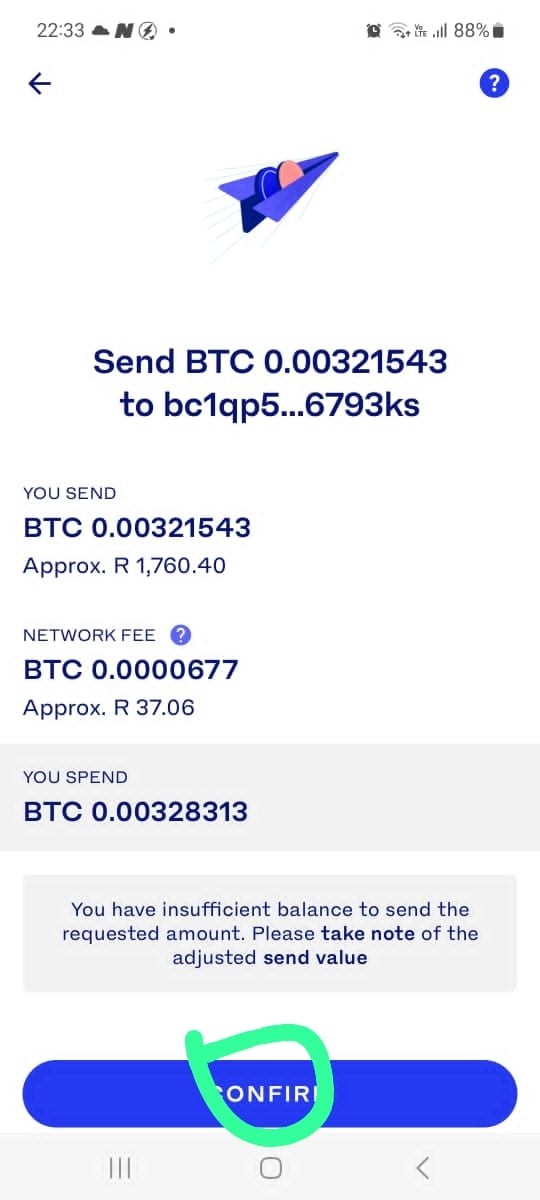

The "Traps" of Non-Trading Fees: Despite the competitive pricing, many users have reported hidden costs tied to trading commissions and withdrawal operations creating a less transparent environment. One user highlighted that "while there are no withdrawal fees, delays on the processing of requests add frustration."

Cost Structure Summary: For new traders, the promise of low fees and high leverage is appealing, but such promotions come with significant risks, especially when transparency is questioned.

-

Platform Diversity: Kot4x provides access to MT4, a well-respected platform among traders, and its proprietary platform, Trade Locker, which is still in development. However, the lack of a fully functional proprietary platform raises questions regarding the overall trading experience.

Quality of Tools and Resources: Users have reported that while MT4 is a solid trading platform, the lack of additional tools and educational resources may impede new trader development. Specifically, "The training materials are minimal," commented a new trader seeking guidance.

Platform Experience Summary: Overall, the trading experience, while adequate for executing trades, may fall short for those needing extensive resources and robust platform functionalities. "It's adequate but lacks depth," commented an experienced trader in a review.

User Experience Analysis

-

Registration Process: Users find the registration process straightforward, with a low barrier of entry through the minimal deposit requirement.

Trading Experience Overview: The actual trading experience varies significantly from user to user, often depending on prior knowledge and individual trading strategy. Reports of slippage and unfulfilled withdrawal requests mar the otherwise clean usage experience.

User Feedback and Quotes: The general consensus among users is split; while some see potential in the platform due to its low deposit and high leverage, the absence of regulation and poor user reviews lead others to express their dissatisfaction vehemently.

Customer Support Analysis

-

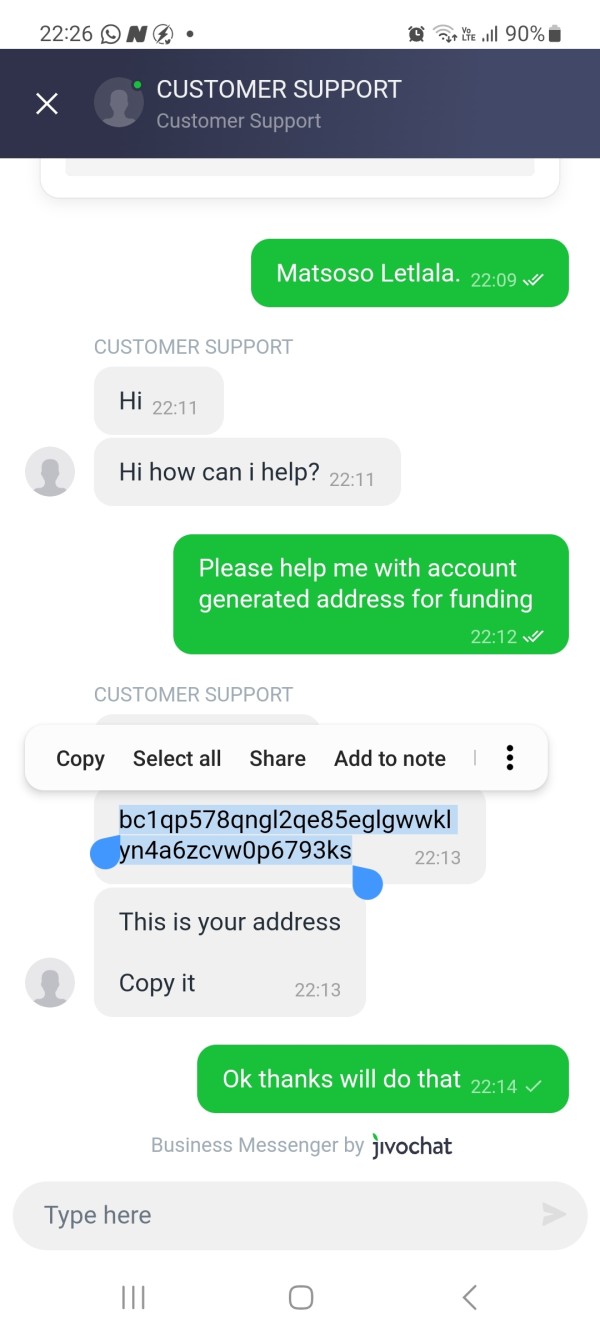

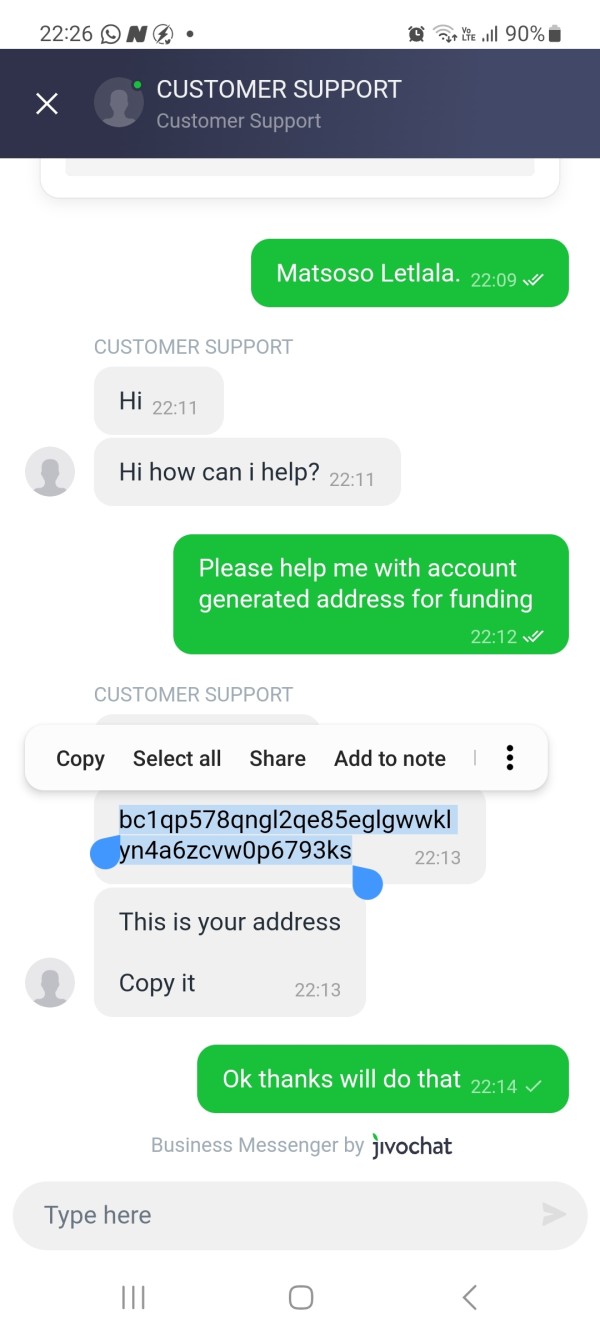

Quality of Customer Support: Kot4xs customer support channels include an email service and a limited chatbot, yet many traders express frustration over slow responses and lack of live support. "Their email responses take days, and I couldn't even get a clear answer from the bot," revealed one user.

Accessibility of Support: The support team is not available 24/7 and responsiveness has been a point of contention. As a trader highlighted: "You can ask all day and get nothing but automated replies."

Overall Support Rating: With reports indicating a lack of effective support systems, the overall experience with customer service remains below expectations, leading to apprehension among existing customers.

Account Conditions Analysis

-

Types of Accounts Offered: Kot4x provides several account types with varying deposit requirements and spreads. While the diversity may cater to different trading styles, many users noted that the differences are minimal.

Trading Account Conditions: Minimum deposits are accessible at $10, appealing especially to new traders. However, the lack of Islamic accounts complicates options for traders adhering to certain financial principles.

Fund Security Concerns: The absence of industry-standard safeguards, such as negative balance protection, raises questions about fund management and safety.

Conclusion

Overall, Kot4x stands at a crossroads, presenting itself as an appealing option through attractive features like low deposit thresholds and high leverage. However, these prospects are overshadowed by serious concerns, primarily concerning regulatory absence, negative user experiences, and questionable withdrawal practices.

Prospective traders should tread carefully, armed with a comprehensive understanding of the risks when engaging with this broker. Its offering may be alluring, but the critical necessity for self-verification and caution cannot be overstated. Thus, it is highly recommended to explore alternative, regulated options that provide both a safer trading environment and proper investor protections.

As the trading landscape continues to evolve, traders must choose wisely to safeguard their capital and ensure a fulfilling trading experience.