Doo Prime 2025 Review: What You Need to Know About Doo Prime

Executive Summary

Doo Prime is a forex broker that started in 2014. This broker offers many trading platforms and different types of investments to both regular people and professional traders. This complete doo prime review shows a broker with good points in platform choices and rules, but it also has problems with user trust and steady service.

The broker follows rules from ASIC, FCA, and FINTRAC. It gives traders high leverage up to 1:1000, protects against negative balances, and has programs to protect investors. Doo Prime works with MetaTrader 4, MetaTrader 5, and their own InTrade platform. You can trade forex, indices, stocks, goods, futures, and precious metals.

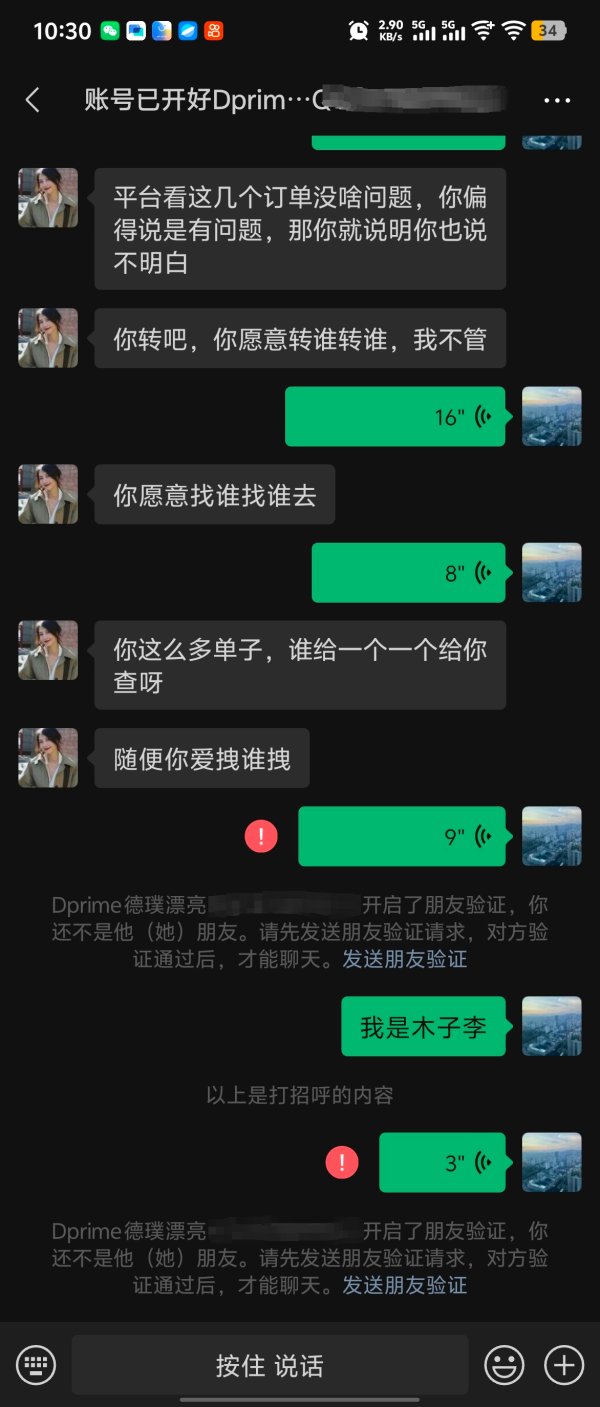

But user reviews tell a mixed story. Some traders like how the platform works and its good conditions. Others worry about slow customer service and trust problems. Trustpilot reviews show some users question if the broker is reliable, with complaints about slow support and serious concerns about trading practices.

The broker targets traders who want high leverage and access to many different investments. These traders should be okay with medium risk levels. You need at least $100 to start, and commission begins at $0. Doo Prime tries to work for both new and experienced traders, but people should look carefully at the mixed user feedback before putting in money.

Important Notice

Doo Prime works through different companies in various countries because of different rules. The legal protection and services you get may change based on where you live and which company you trade with. We strongly tell potential clients to check which rules apply to their account and understand what protections they have.

This review uses public information, user feedback, and official broker materials from 2025. The review tries to give a complete evaluation while knowing that individual trading experiences can be very different based on personal situations and trading strategies.

Rating Framework

Broker Overview

Doo Prime started in 2014 as an international online broker based in Hong Kong. The company focuses on giving regular and professional investors access to global financial markets. The broker uses ECN and STP business models and sees itself as a technology-focused broker that wants to give competitive trading conditions and complete market access.

TradingBrokers reports say Doo Prime built its reputation by offering different trading solutions with competitive costs and easy deposit and withdrawal methods. The broker says it provides 24/7 multilingual professional services, but user feedback shows this service quality changes a lot in practice.

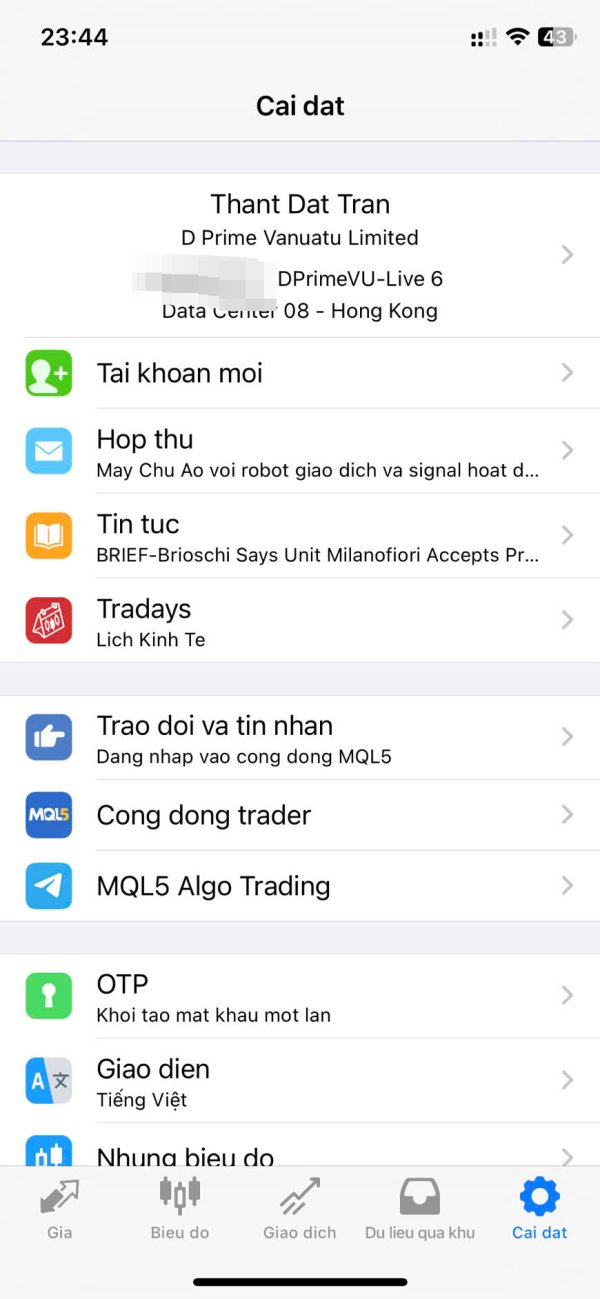

The broker supports MetaTrader 4, MetaTrader 5, their own InTrade platform, and TradingView integration. You can trade forex, indices, stocks, commodities, futures, precious metals, and securities, giving traders many market opportunities. This complete doo prime review shows the broker follows rules across multiple areas including FCA, ASIC, SEC, and VU FSC oversight, but how well this regulatory framework protects user interests is still debated by users.

Regulatory Jurisdictions: Doo Prime follows rules from ASIC (Australia), FCA (United Kingdom), FINTRAC (Canada), SEC, and VU FSC. This multi-area approach gives different levels of investor protection depending on where the client lives and which entity they choose.

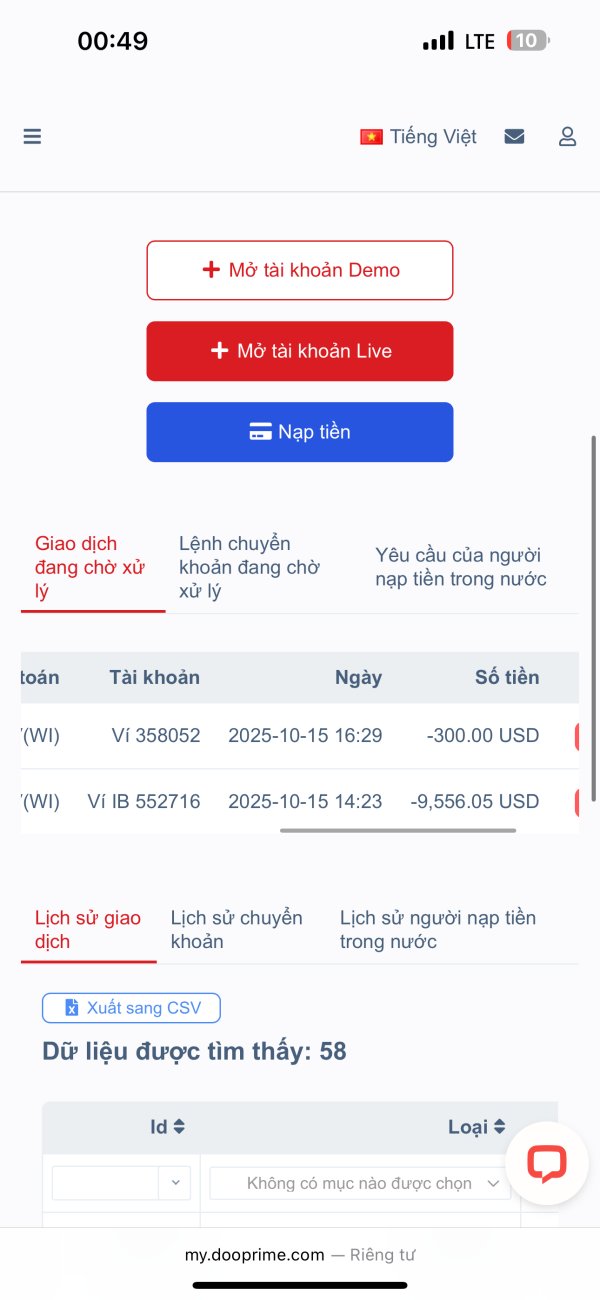

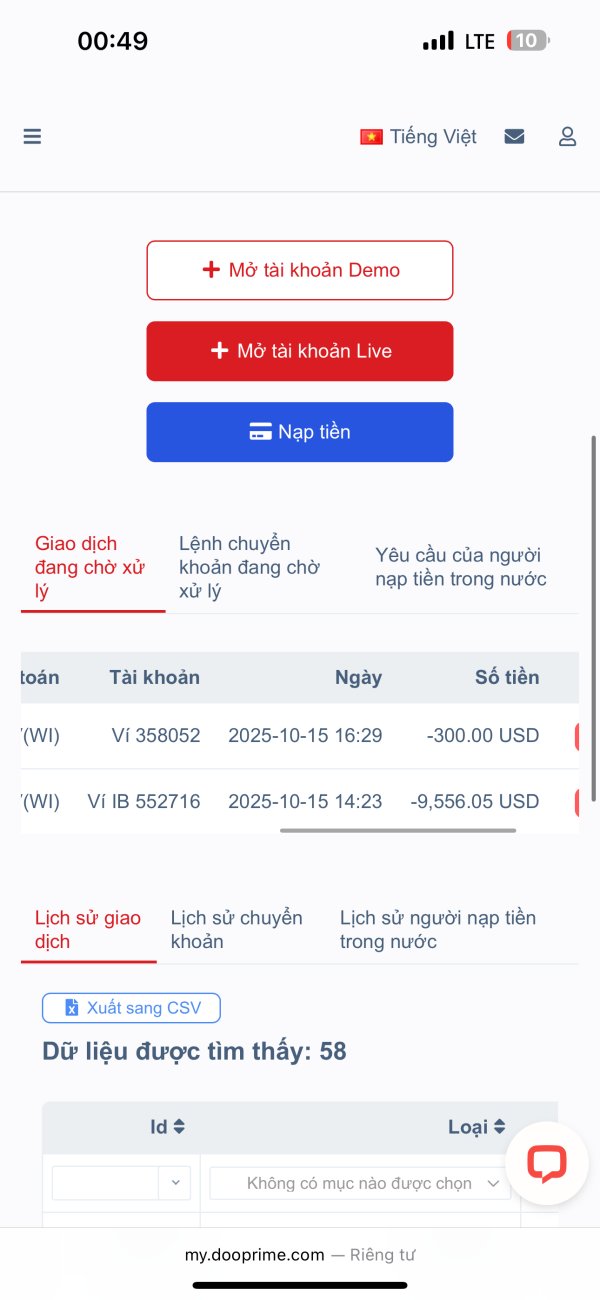

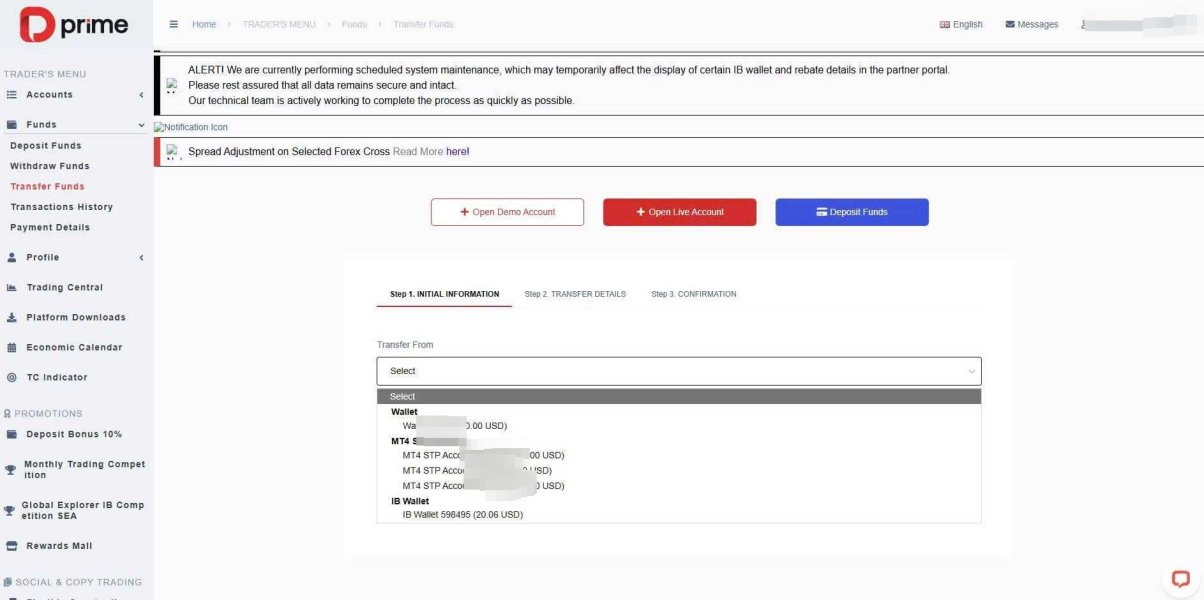

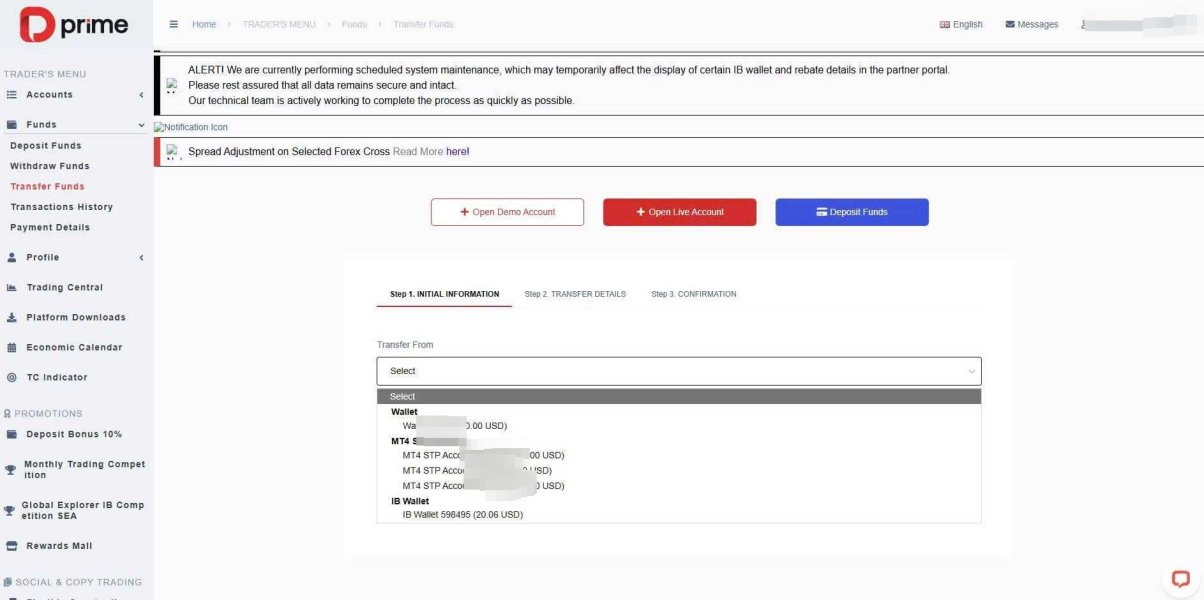

Deposit and Withdrawal Methods: The broker accepts bank transfers, credit/debit cards, e-wallets, and cryptocurrency funding options. However, specific processing times and fees are not detailed in available documentation.

Minimum Deposit Requirements: You need at least $100 to start. This makes the platform accessible to traders with limited starting money.

Bonus and Promotions: Doo Prime regularly holds various trading incentives and rewards campaigns to thank clients for their continued support. However, specific bonus terms and conditions need direct verification with the broker.

Tradeable Assets: The platform gives access to forex, indices, stocks, commodities, futures, and precious metals. This provides complete market coverage for different trading strategies.

Cost Structure: The broker works with both fixed and variable spreads, with commission starting from $0. Specific cost details change by trading instrument and account type, requiring individual assessment based on trading preferences.

Leverage Ratios: Maximum leverage reaches 1:1000. This puts Doo Prime among high-leverage brokers, though traders should carefully consider the risks involved.

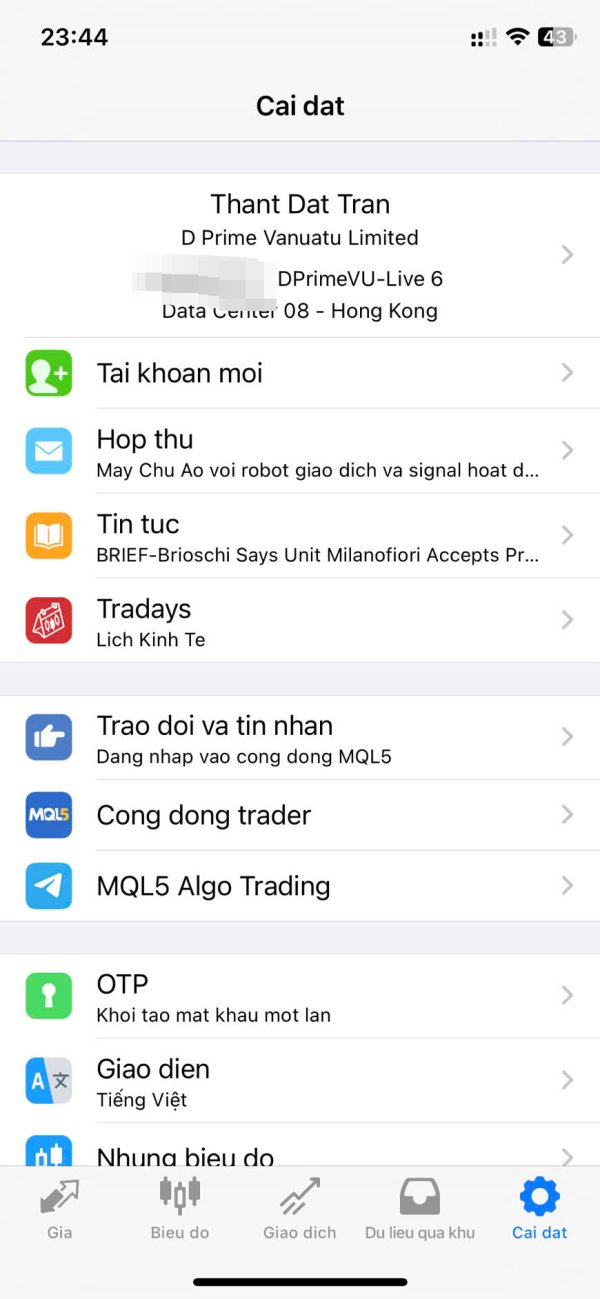

Platform Options: Available platforms include MetaTrader 4, MetaTrader 5, InTrade proprietary platform, and mobile trading applications for iOS and Android devices.

Geographic Restrictions: The broker tells residents of certain regions to consult legal counsel to ensure compliance with local laws and regulations. However, specific restricted countries are not clearly listed in available materials.

Customer Support Languages: While the broker advertises multilingual support, specific supported languages are not completely detailed in this doo prime review based on available information.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

Doo Prime offers multiple account types designed to work for different trader profiles, from beginners to professional investors. The $100 minimum deposit requirement makes the broker competitive in the market, making it accessible to traders with limited starting money. TradingBrokers analysis shows this relatively low barrier appeals particularly to new traders exploring forex markets.

The account opening process seems straightforward based on user feedback. However, some clients have reported inconsistencies in verification procedures. The broker provides negative balance protection and investor protection programs, adding security layers for client funds. But the effectiveness of these protections changes by regulatory area, requiring careful consideration of which entity oversees individual accounts.

Account features include high leverage options up to 1:1000. This appeals to traders seeking significant position sizing capabilities. Commission structures starting from $0 provide cost-effective trading for high-frequency strategies, though traders should verify specific costs for their preferred instruments. The availability of both fixed and variable spread options allows strategy customization based on market conditions and trading preferences.

User feedback shows generally positive experiences with account functionality. However, some traders have noted limitations in advanced account features compared to specialized institutional brokers. This doo prime review suggests the broker successfully balances accessibility with functionality, though improvements in account customization options could enhance overall value proposition.

Doo Prime shows strong performance in trading tools and platform variety. It offers MetaTrader 4, MetaTrader 5, and their own InTrade platform. This multi-platform approach works for different trader preferences and technical analysis requirements. The inclusion of TradingView integration further enhances charting capabilities and market analysis tools.

The broker supports automated trading through Expert Advisors (EAs) and signal services. This appeals to algorithmic traders and those preferring systematic trading approaches. Technical analysis tools appear complete across platforms, with standard indicators and drawing tools available for market analysis. However, specific details about proprietary research tools or advanced analytics are not extensively documented in available materials.

Asset diversity represents a significant strength. You get access to forex, indices, stocks, commodities, futures, and precious metals. This complete market coverage enables portfolio diversification and multiple trading opportunities within a single account. The range of available instruments competes well with larger international brokers.

User feedback generally supports the platform's technical capabilities. Traders appreciate the familiar MT4/MT5 environments and additional InTrade features. However, some users have noted limitations in advanced order types and risk management tools compared to specialized professional platforms. Educational resources and market analysis materials are not extensively detailed in available documentation, representing a potential area for improvement.

Customer Service and Support Analysis (Score: 6/10)

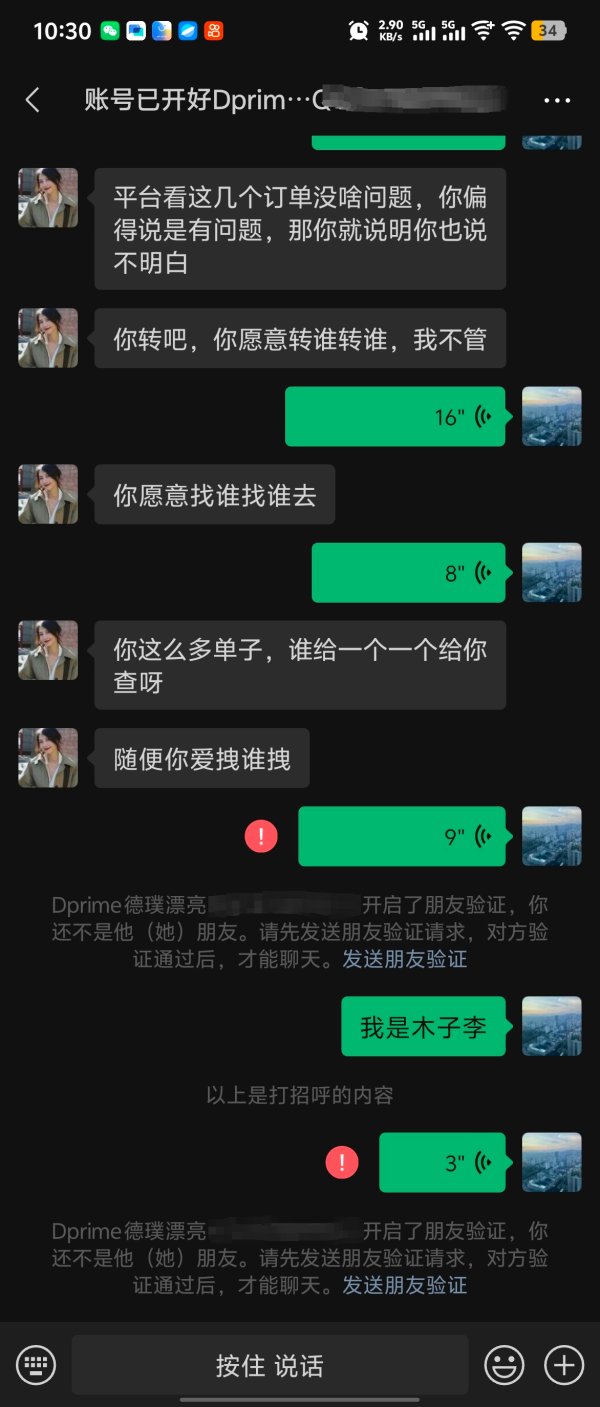

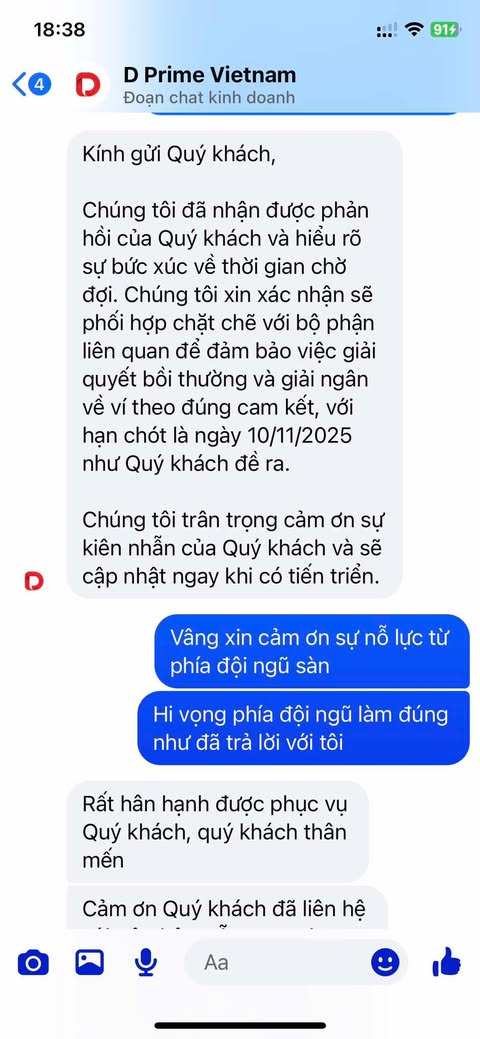

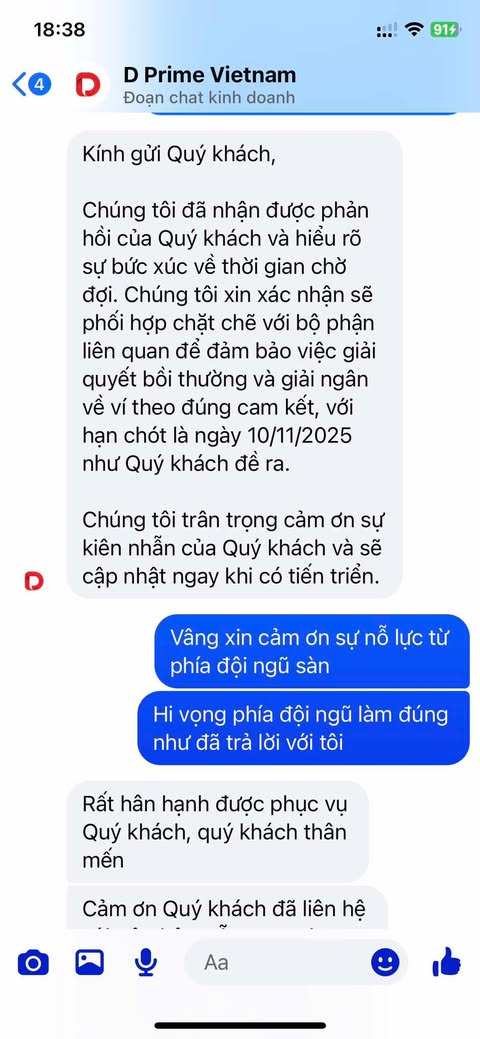

Customer service represents a significant challenge area for Doo Prime based on available user feedback. The broker advertises 24/7 multilingual support, but actual service quality appears inconsistent according to user reports on various review platforms. Response times have been criticized by some users, with complaints about delayed responses to urgent trading-related inquiries.

Service quality varies significantly across different communication channels and regions. This suggests inconsistent training or resource allocation across support teams. Some users report satisfactory experiences with knowledgeable representatives, while others describe frustrating interactions with inadequately trained staff. This inconsistency undermines confidence in the broker's commitment to customer service excellence.

The availability of multiple contact methods appears standard. However, specific channels and their effectiveness are not completely documented. Language support, while advertised as multilingual, has received mixed reviews regarding actual fluency and technical knowledge of support staff in various languages.

Problem resolution effectiveness varies considerably based on user reports. Some clients express satisfaction with issue handling while others report prolonged resolution times for account-related problems. The lack of complete public documentation about service level agreements and escalation procedures further complicates assessment of support quality standards.

Trading Experience Analysis (Score: 7/10)

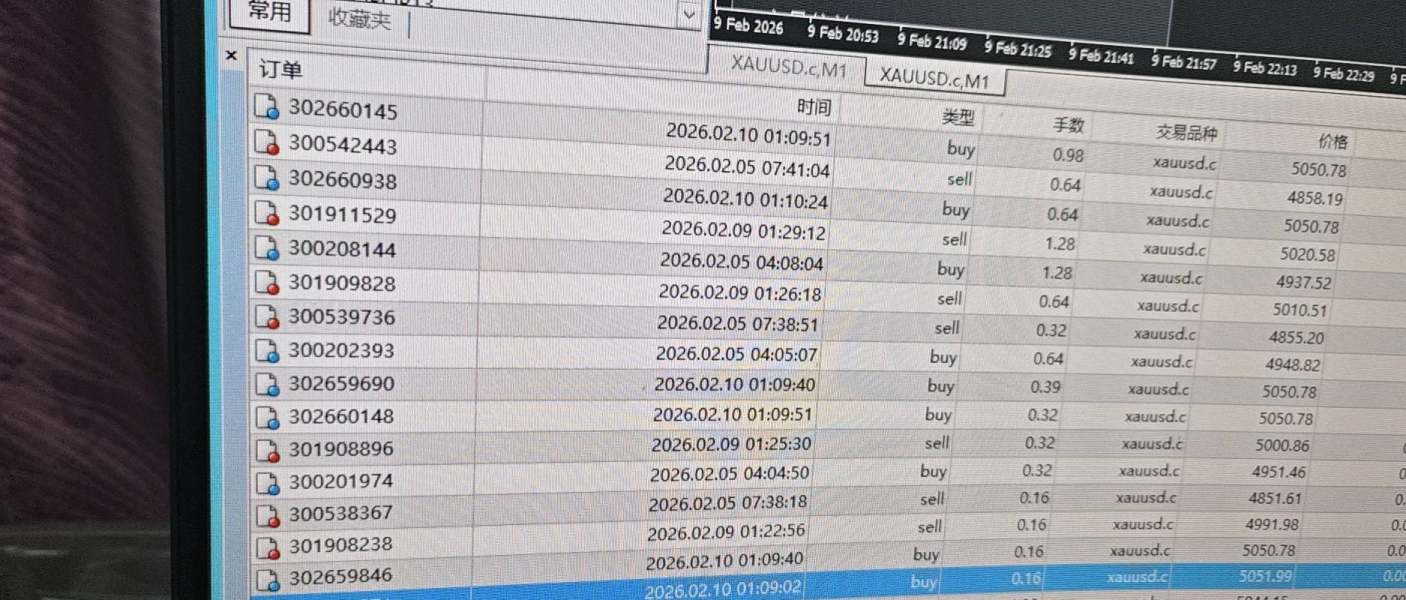

Trading experience with Doo Prime generally receives positive feedback regarding platform stability and execution reliability. Users report satisfactory performance across MetaTrader platforms, with standard functionality operating as expected. The proprietary InTrade platform offers additional features, though complete user feedback on its performance remains limited.

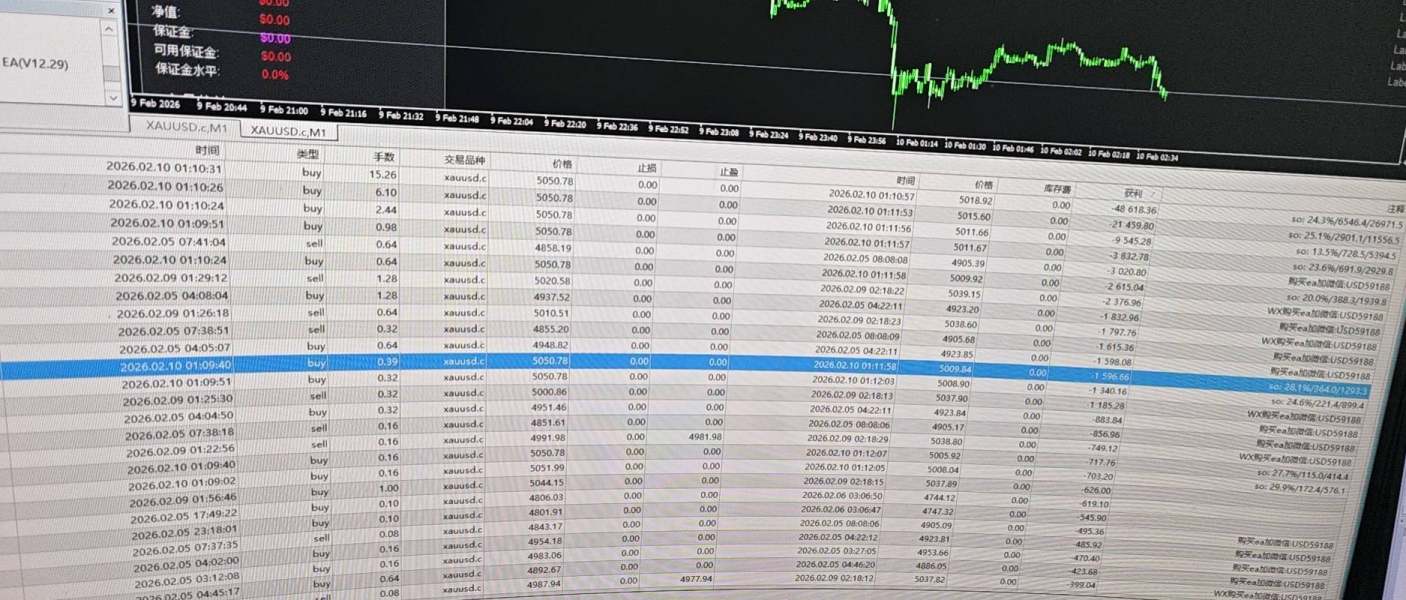

Order execution quality appears adequate for most trading strategies. However, some users have reported occasional slippage during high volatility periods. Requote instances exist but don't appear excessive compared to similar brokers operating in competitive market conditions. The broker's ECN and STP models theoretically support fair execution practices, though independent verification of execution quality metrics is not publicly available.

Platform functionality supports various trading strategies including scalping, day trading, and longer-term position trading. The availability of automated trading tools and Expert Advisors enables systematic trading approaches. Mobile platform performance receives generally positive feedback, allowing effective trading management across devices.

Trading environment stability appears satisfactory during normal market conditions. Users report reliable platform access and order processing. However, performance during extreme market volatility periods requires careful monitoring, as some users have noted connectivity issues during major news events. This doo prime review indicates overall trading experience meets standard industry expectations, though improvements in execution transparency and performance reporting could enhance trader confidence.

Trust and Reliability Analysis (Score: 5/10)

Trust and reliability represent the most challenging aspects of Doo Prime's overall assessment. The broker maintains multiple regulatory licenses including ASIC, FCA, and FINTRAC oversight, but user feedback raises significant concerns about overall trustworthiness and business practices. Trustpilot reviews include serious allegations about fraudulent activities, though these claims require independent verification.

Regulatory compliance across multiple jurisdictions provides theoretical protection for client funds and trading practices. The presence of negative balance protection and investor compensation schemes adds security layers, though the effectiveness of these protections depends on specific regulatory frameworks governing individual accounts.

Company transparency regarding ownership structure, financial statements, and business operations remains limited in publicly available materials. This lack of complete disclosure contributes to user uncertainty about the broker's long-term stability and commitment to client interests.

Industry reputation suffers from negative user feedback and allegations posted on review platforms. While some positive user experiences exist, the volume and severity of negative reviews significantly impact overall trust assessment. The broker's handling of negative publicity and complaint resolution appears inadequate based on publicly available responses to user concerns.

User Experience Analysis (Score: 6/10)

Overall user satisfaction with Doo Prime presents a mixed picture. Experiences vary significantly across different service areas and user types. Account registration and verification processes generally receive positive feedback for simplicity and speed, making initial platform access relatively straightforward for new users.

Interface design across trading platforms receives adequate ratings. Familiar MetaTrader environments provide standard functionality expected by experienced traders. The proprietary InTrade platform offers additional features, though user adoption and satisfaction metrics are not completely documented in available materials.

Navigation and platform usability appear satisfactory for basic trading operations. However, advanced features may require additional learning for traders transitioning from other brokers. Mobile platform functionality supports essential trading activities, enabling effective account management across devices.

Common user complaints center on customer service responsiveness and occasional technical issues during high-volume trading periods. Some users also report frustrations with withdrawal processing times and verification requirements, though specific timelines and procedures are not consistently documented across user reports.

User demographics appear diverse. They range from novice traders attracted by low minimum deposits to more experienced traders seeking high leverage opportunities. However, the broker's ability to consistently meet expectations across this diverse user base remains questionable based on available feedback patterns.

Conclusion

This complete doo prime review reveals a broker with notable strengths in platform variety and regulatory coverage. However, it has significant weaknesses in user trust and service consistency. Doo Prime successfully provides access to diverse markets with competitive basic conditions, making it potentially suitable for traders prioritizing platform functionality and market access over premium service quality.

The broker best serves traders comfortable with moderate risk levels who prioritize high leverage opportunities and diverse asset exposure. However, potential clients should carefully weigh the mixed user feedback and trust concerns against the platform's technical capabilities and market access benefits.

Primary advantages include complete platform options, competitive account conditions, and extensive regulatory oversight across multiple jurisdictions. Key disadvantages center on inconsistent customer service quality, trust concerns raised by user feedback, and limited transparency regarding business operations and complaint resolution procedures.