Webull 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive webull review looks at one of America's top commission-free brokerages. Webull has gained popularity among technical traders and investors who want to save money. The broker operates in the US under proper regulations and offers zero-commission trading across many types of investments, plus advanced technical analysis tools for experienced traders.

The platform uses a simple design that focuses on easy trading while providing strong futures trading features and advanced tools to screen the market. User feedback shows that Webull has become a trusted choice for investors who want professional-level analysis without paying traditional commission fees. New investors can use the robo-advisor feature, while experienced traders benefit from extensive charting tools and technical indicators.

Key features that make Webull stand out include commission-free trading, a strong technical analysis suite, and access through both mobile and desktop apps. The broker supports trading in stocks, ETFs, options, and futures, making it useful for diverse portfolios. Users consistently praise the platform's easy-to-use interface and powerful analytical tools, though some say customer service and educational resources need improvement.

Important Notice

Webull operates under strict oversight from the SEC and maintains membership with FINRA. However, users should know that regulatory requirements and service availability may differ across regions. This review uses publicly available information and user feedback from 2025.

The analysis here reflects the broker's US operations and may not apply to international branches or related companies. Potential clients should verify current terms, conditions, and regulatory compliance in their area before opening an account. Investment decisions should always be made after careful consideration of personal financial situations and risk tolerance.

Rating Framework

Broker Overview

Webull has become a major player in the discount brokerage sector. The company positions itself as a technology-focused alternative to traditional investment platforms. They operate as a multi-platform discount brokerage with headquarters in the United States, focusing on commission-free trading services for retail investors.

Their business model centers on providing low-cost access to financial markets while maintaining advanced analytical tools usually reserved for institutional traders. The broker emphasizes technological innovation and user-focused design, creating a trading environment that appeals to both new investors through robo-advisor services and experienced traders through comprehensive technical analysis tools. Webull's commitment to transparent pricing and execution has helped it gain market share among cost-conscious investors seeking professional-grade trading infrastructure.

Webull provides both mobile apps and desktop platforms, ensuring traders can access markets and manage positions across multiple devices. The supported asset classes include stocks, ETFs, options, and futures trading, offering clients diverse investment opportunities within a single platform. This webull review confirms that the broker maintains full regulatory compliance through SEC oversight and FINRA membership, providing clients with security and protection from established US financial regulations.

Regulatory Jurisdiction: Webull operates under SEC supervision and maintains active FINRA membership. This ensures compliance with US financial regulations and investor protection standards.

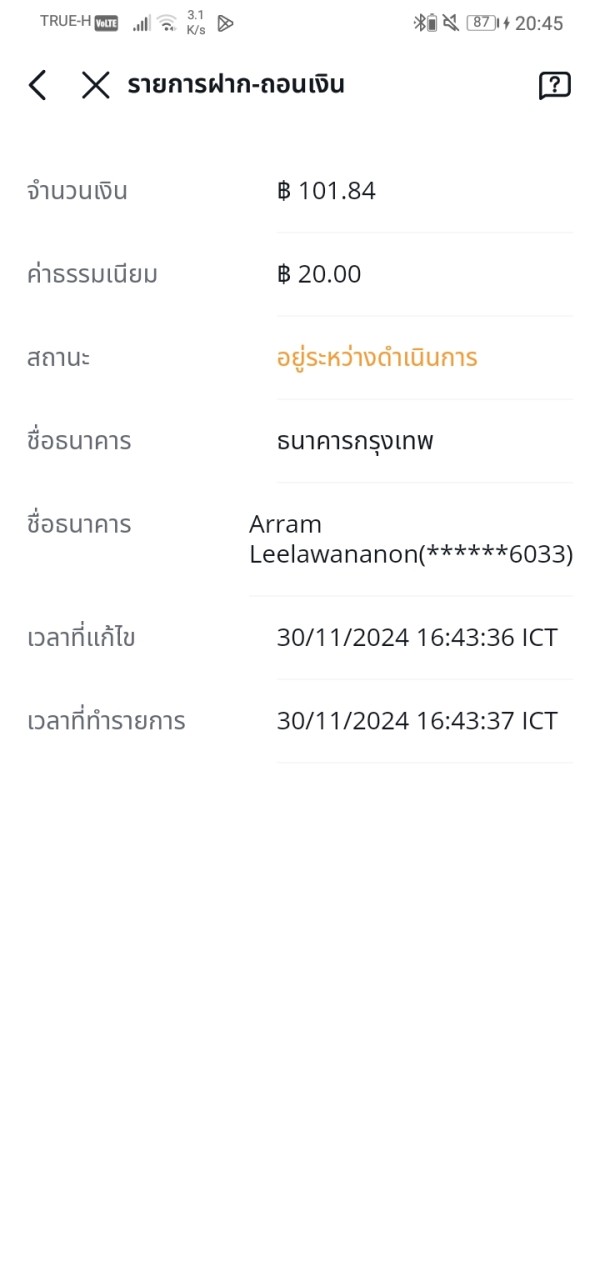

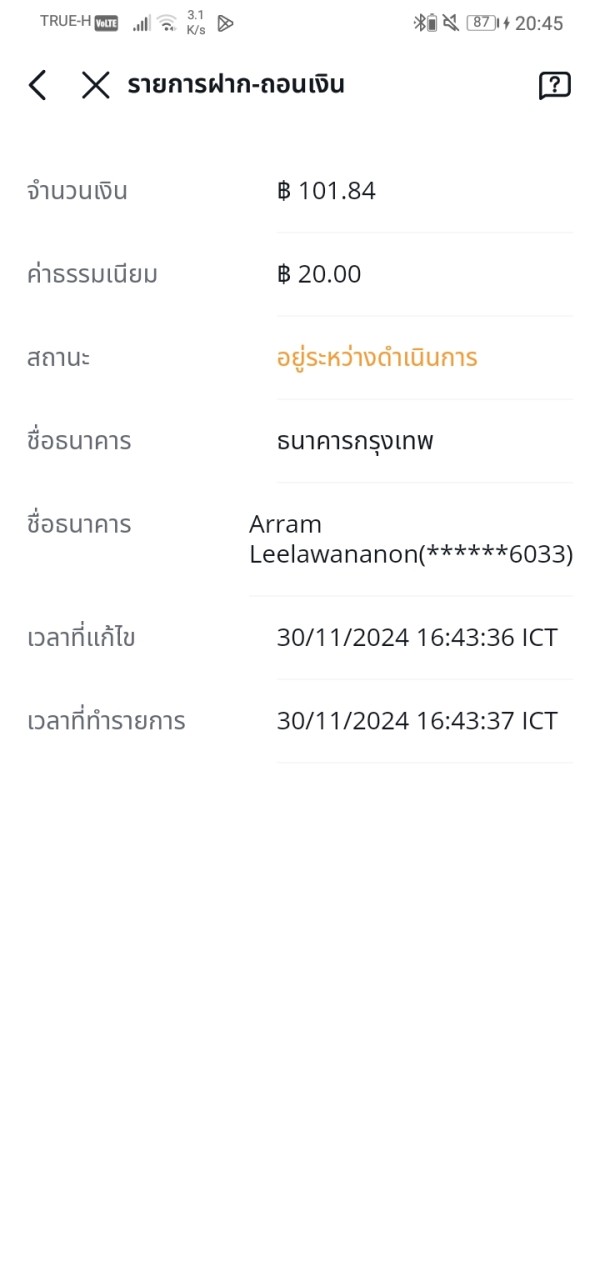

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options was not detailed in available materials. However, standard ACH transfers and wire transfers are typically supported by US brokerages.

Minimum Deposit Requirements: Exact minimum deposit amounts were not specified in available documentation. Many commission-free brokers have eliminated or significantly reduced minimum deposit requirements.

Bonus and Promotional Offers: Current promotional offerings were not detailed in the source materials. New account incentives may be available depending on market conditions and regulatory approval.

Tradeable Assets: The platform supports comprehensive trading in stocks, ETFs, options contracts, and futures markets. This provides clients with access to diverse investment opportunities across major asset classes.

Cost Structure: Webull operates on a commission-free model for stock and ETF trading. Options trading may incur a $0.50 per contract fee for certain index option trades. Additional fees may be applied by regulatory agencies and passed through to clients as transaction costs.

Leverage Ratios: Specific leverage information was not provided in available materials. Standard margin requirements typically apply for eligible accounts.

Platform Options: Clients can access trading through dedicated mobile apps and desktop platforms. Both are designed with easy-to-use interfaces and comprehensive analytical tools.

Geographic Restrictions: Specific regional limitations were not detailed in available documentation.

Customer Service Languages: Language support information was not specified in the source materials.

This webull review indicates that while core trading features are well-documented, some operational details may require direct contact with the broker for complete specifications.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

Webull's account structure reflects the modern trend toward accessible, low-barrier entry trading platforms. While specific account types were not detailed in available materials, user feedback suggests that the account opening process is streamlined and user-friendly. The absence of commission fees on stock and ETF trades represents a significant advantage for frequent traders and long-term investors alike.

The platform's approach to account conditions appears designed to accommodate various investor profiles. This ranges from beginners using the robo-advisor functionality to experienced traders requiring advanced analytical tools. However, the lack of detailed information about minimum deposit requirements and specific account tier benefits represents an area where greater transparency would benefit potential clients.

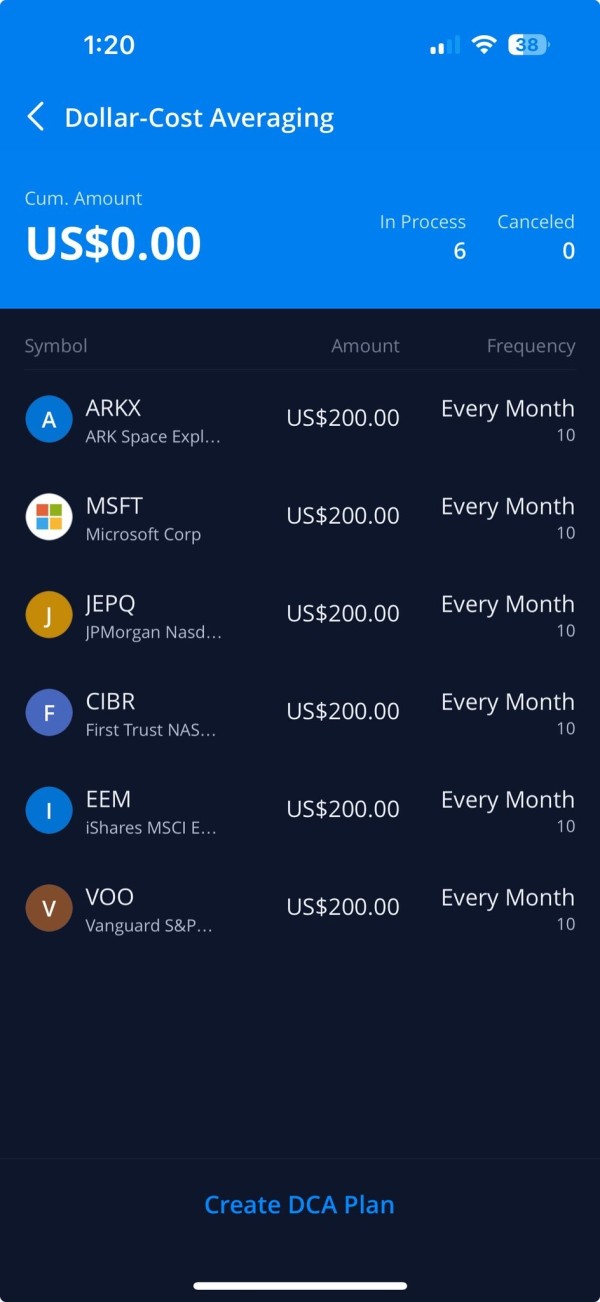

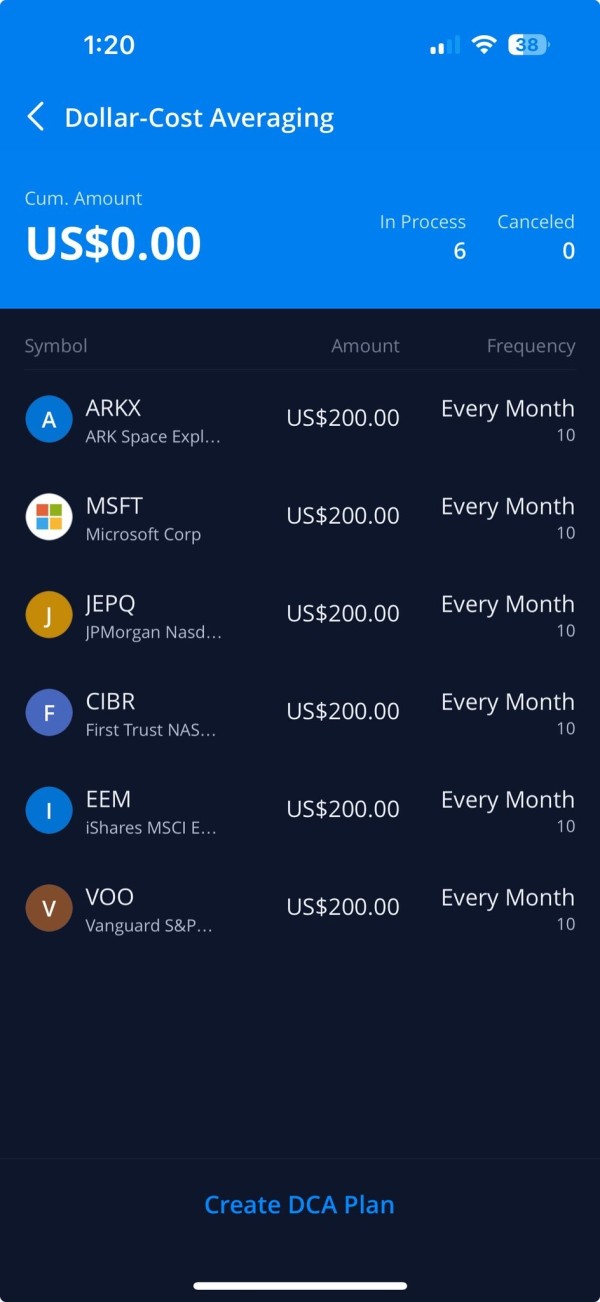

User evaluations indicate that account conditions are relatively flexible compared to traditional brokerages. The absence of comprehensive account type information limits the ability to fully assess the broker's offerings. The commission-free structure provides clear cost advantages, particularly for investors implementing dollar-cost averaging strategies or engaging in frequent trading activities.

When compared to other commission-free brokerages, Webull's account conditions appear competitive. The specific advantages may vary depending on individual trading requirements and investment objectives. This webull review suggests that while the basic account structure is attractive, potential clients may need to contact the broker directly for detailed account specifications.

Webull excels in providing sophisticated technical analysis tools that rival many institutional-grade platforms. The broker offers advanced market screening capabilities and comprehensive charting functionality that appeals particularly to technical traders and data-driven investors. These tools enable users to conduct detailed market analysis and identify trading opportunities across multiple asset classes.

The platform's screening tools allow for complex filtering based on fundamental and technical criteria. This enables users to identify securities that meet specific investment parameters. The charting capabilities include numerous technical indicators, drawing tools, and analytical overlays that support various trading strategies and market approaches.

However, user feedback consistently highlights the relative weakness in educational materials compared to the strength of the analytical tools. While the platform provides powerful resources for market analysis, the lack of comprehensive educational content may limit its appeal to newer investors seeking to develop their trading knowledge and skills. According to user evaluations, "Users generally express satisfaction with the tools but desire more educational resources."

Expert opinions suggest that the platform is particularly well-suited for technical traders who can fully utilize the advanced analytical capabilities without requiring extensive educational support.

Customer Service and Support Analysis (6/10)

Customer service represents an area where Webull shows room for improvement according to user feedback. While specific customer service channels were not detailed in available materials, user evaluations suggest that response times and service quality could be enhanced to better serve the growing client base. User feedback indicates that while the platform's self-service capabilities are strong, direct customer support experiences vary in quality and efficiency.

Some users report satisfactory resolution of basic inquiries, while others express frustration with more complex issues requiring specialized assistance. The availability of customer service across different time zones and communication channels was not specified in the source materials, though this information would be valuable for clients requiring support outside standard business hours. The professional competency and problem-solving capabilities of support staff appear to be areas where user expectations are not consistently met.

User feedback summary indicates that "Users rate customer service lower, believing improvements are needed." This suggests that while the platform's technological capabilities are strong, the human support element requires attention to match the overall quality of the trading experience.

Trading Experience Analysis (8/10)

The trading experience on Webull receives positive feedback from users, particularly regarding platform stability and interface design. The minimalist approach to platform design emphasizes functionality and ease of use, creating an environment conducive to focused trading activities. Users report satisfaction with the platform's reliability during market hours and its ability to handle order execution efficiently.

The platform's functionality encompasses comprehensive charting tools and technical indicators that support various trading strategies. The integration of analytical tools within the trading interface allows for seamless transition from analysis to execution, enhancing the overall trading workflow for active participants. Mobile application performance receives particular attention from users, with the app's design emphasizing simplicity while maintaining access to essential trading functions.

However, some users suggest that mobile functionality could be further enhanced to match the full capabilities available on desktop platforms. While specific performance data regarding slippage and requoting was not provided in available materials, user feedback suggests that order execution quality meets expectations for a retail-focused platform. The overall trading environment appears well-suited to both short-term trading activities and longer-term investment management.

This webull review confirms that "Users express overall satisfaction with the trading experience but hope for improved mobile functionality."

Trust and Reliability Analysis (9/10)

Webull demonstrates strong credentials in terms of regulatory compliance and institutional trustworthiness. The broker's oversight by the SEC and membership in FINRA provides clients with the security and protection associated with established US financial regulatory frameworks. This regulatory structure ensures adherence to investor protection standards and operational transparency requirements.

While specific fund safety measures were not detailed in available materials, the regulatory framework implies standard investor protections including SIPC coverage for eligible accounts. The company's compliance with US financial regulations suggests adherence to segregated account requirements and other safety protocols designed to protect client assets. The broker's transparency regarding its regulatory status and compliance obligations contributes to user confidence in the platform's reliability.

However, specific information regarding financial reporting, third-party audits, or industry awards was not available in the source materials. This could provide additional verification of the company's operational standards. User trust feedback consistently indicates confidence in fund safety and platform reliability, with the regulatory oversight serving as a primary factor in user decision-making.

The absence of significant negative events or regulatory actions in available materials supports the positive trust assessment for the platform.

User Experience Analysis (7/10)

Overall user satisfaction with Webull reflects a generally positive experience, particularly among users who value technical analysis capabilities and cost-effective trading. The platform's interface design receives praise for its intuitive layout and straightforward navigation, making it accessible to users with varying levels of trading experience. The registration and verification processes were not specifically detailed in available materials, though user feedback suggests that account opening procedures are streamlined and efficient.

The platform's design philosophy emphasizes user-centric functionality while maintaining professional-grade analytical capabilities. Common user complaints center on the limited educational resources and average customer service quality, areas that could enhance the overall user experience if addressed. The platform appears particularly well-suited to technical traders and experienced investors who can maximize the available analytical tools without requiring extensive educational support.

User demographic analysis suggests that Webull attracts technically-oriented traders and cost-conscious investors seeking sophisticated tools without traditional commission structures. The positive feedback regarding platform design and trading tools is balanced by suggestions for improvement in educational content and customer support quality, indicating areas for future development.

Conclusion

This comprehensive webull review reveals a broker that successfully combines commission-free trading with sophisticated technical analysis tools. This makes it particularly attractive to technical traders and experienced investors. The platform's regulatory compliance through SEC oversight and FINRA membership provides the security and reliability that serious investors require.

Webull's primary strengths lie in its commission-free trading model and powerful analytical capabilities. Areas for improvement include customer service quality and educational resource development. The platform appears ideally suited for technically-oriented traders who value advanced analytical tools and cost-effective execution over extensive educational support and premium customer service features.

For investors seeking a technology-forward broker with institutional-quality tools at retail-friendly prices, Webull presents a compelling option worth serious consideration.