Regarding the legitimacy of City Index forex brokers, it provides ASIC, FCA and WikiBit, .

Is City Index safe?

Business

License

Is City Index markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

STONEX FINANCIAL PTY LTD

Effective Date: Change Record

2010-05-31Email Address of Licensed Institution:

John.Blundell@StoneX.comSharing Status:

No SharingWebsite of Licensed Institution:

www.cityindex.com.auExpiration Time:

--Address of Licensed Institution:

'01' SE 42 264-278 GEORGE ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0280305011Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

StoneX Financial Ltd

Effective Date:

2006-03-24Email Address of Licensed Institution:

sfladvisorycompliance@stonex.com, retailcomplianceuk@stonex.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.stonex.comExpiration Time:

--Address of Licensed Institution:

Stonex Financial Ltd First Floor, Moor House 120 London Wall London City Of London EC2Y 5ET UNITED KINGDOMPhone Number of Licensed Institution:

+442035806000Licensed Institution Certified Documents:

Is City Index A Scam?

Introduction

City Index, established in 1983, is a well-known broker operating primarily in the forex and CFD markets. As a part of the Stonex Group, which is publicly traded on the NASDAQ, City Index positions itself as a reliable trading partner for both retail and institutional clients. The broker offers a wide range of trading products, including forex, indices, commodities, and shares, across various platforms, including its proprietary web trader and the popular MetaTrader 4.

However, the forex market is notorious for its potential risks and the existence of unscrupulous brokers. Traders must exercise caution and conduct thorough evaluations of any broker before entrusting them with their funds. In this article, we will investigate City Index's regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment. Our analysis is based on a review of credible sources, user feedback, and industry standards.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety and reliability of a forex broker. City Index is regulated by several top-tier financial authorities, which enhances its credibility in the trading community. The following table summarizes the core regulatory information for City Index:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 113942 | United Kingdom | Verified |

| Australian Securities and Investments Commission (ASIC) | 345646 | Australia | Verified |

| Monetary Authority of Singapore (MAS) | 200400922K | Singapore | Verified |

The FCA, ASIC, and MAS are recognized as stringent regulators that enforce strict compliance standards to protect traders. City Index's adherence to these regulations ensures that client funds are kept in segregated accounts, reducing the risk of misappropriation. Additionally, the Financial Services Compensation Scheme (FSCS) in the UK provides up to £85,000 in compensation for eligible clients in case of broker insolvency. This regulatory framework significantly diminishes the likelihood of City Index being a scam.

Historically, City Index has maintained a good standing with regulators, with no major compliance violations reported. This solid regulatory background provides a strong foundation for traders considering City Index as their broker.

Company Background Investigation

City Index has a long-standing history in the financial services industry, having been founded in 1983 by Chris Hales and Jonathan Sparke. The company pioneered spread betting and later expanded into CFD trading in 2001. Its acquisition by Gain Capital in 2014 further strengthened its market position, allowing it to leverage Gain Capital's extensive resources and expertise.

The ownership structure of City Index is transparent, as it operates under the Stonex Group, a publicly traded company listed on the NASDAQ. This affiliation with a larger, financially stable parent company provides additional assurance regarding the broker's reliability. The management team at City Index is composed of experienced professionals with extensive backgrounds in finance and trading, further enhancing the broker's credibility.

City Index also emphasizes transparency and information disclosure. The company provides detailed information about its services, fees, and trading conditions on its website, allowing potential clients to make informed decisions. This level of transparency is essential for building trust with clients and is a positive indicator of the broker's legitimacy.

Trading Conditions Analysis

City Index offers a variety of trading conditions that cater to different types of traders. The broker employs a competitive pricing model, with spreads that are generally in line with industry averages. However, it is crucial for traders to understand the fee structure to avoid unexpected costs.

The following table compares the core trading costs at City Index with industry averages:

| Cost Type | City Index | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.7 pips (EUR/USD) | 0.6 pips |

| Commission Model | No commission on forex; commissions apply to stock CFDs | Varies by broker |

| Overnight Interest Range | Varies by position size and market conditions | Varies by broker |

While City Index does not charge commissions on forex trades, it does impose commissions on stock CFDs, which can be higher than average. This fee structure may be a concern for traders focusing on equity trading, as they could incur additional costs that may not be immediately apparent.

Moreover, City Index charges an inactivity fee of £12 per month after 12 months of inactivity. This policy can be off-putting for traders who may not trade frequently. Overall, while City Index provides competitive pricing, potential clients should carefully review the fee structure to ensure it aligns with their trading strategies.

Client Fund Security

The security of client funds is paramount when choosing a broker. City Index employs several measures to ensure the safety of client funds, including the segregation of client accounts from the company's operational funds. This practice ensures that client money is protected even in the event of financial difficulties faced by the broker.

In addition to segregated accounts, City Index offers negative balance protection, which prevents clients from losing more money than they have deposited. This feature is particularly important in the volatile forex market, where sudden price movements can lead to significant losses.

The broker's compliance with regulatory standards further enhances fund security. For instance, the FCA mandates strict rules regarding the handling of client funds, including regular audits and financial reporting. City Index's participation in the FSCS adds an additional layer of security, providing compensation to eligible clients in the event of broker insolvency.

Despite these robust measures, it is essential for traders to remain vigilant and aware of any historical issues related to fund security. To date, there have been no major incidents reported regarding City Index's handling of client funds, reinforcing its reputation as a secure trading platform.

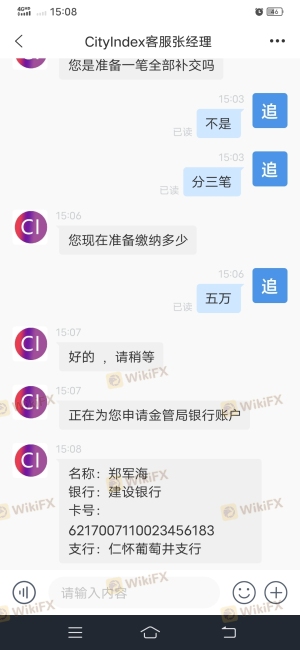

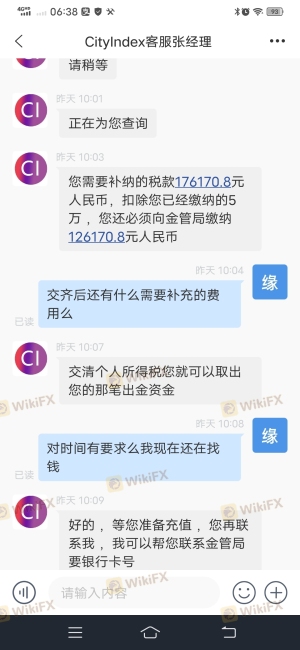

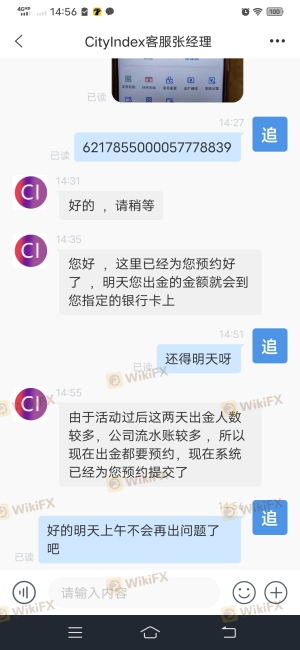

Customer Experience and

Is City Index a scam, or is it legit?

The latest exposure and evaluation content of City Index brokers.

City Index Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

City Index latest industry rating score is 1.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.