novatech 2025 Review: Everything You Need to Know

1. Abstract

The novatech review shows a broker that clients rate well. NovaTech has an overall customer satisfaction rating of 8 and a quality score of 9. Over 61,148 customer comments were used to create these ratings. NovaTech gets praise for using the MT5 trading platform and offering many different assets to trade, including Forex, cryptocurrencies, and stocks. This wide range of options appeals to traders who want to spread their investments across different types of assets. However, users have reported some serious problems like high deposit fees and trouble withdrawing money. The novatech review shows that many traders like the strong platform and wide product range, but people should be careful because of ongoing operational problems. This broker works best for investors who want to trade Forex and cryptocurrency and who value good platform features, even if fund management has some issues.

2. Notice

NovaTech's business structure changes depending on the region. The company has its headquarters in Saint Vincent and the Grenadines. Different areas have different rules and investor protection levels. This novatech review looks at client feedback, platform features, and how easy the service is to use, among other things. However, the available information did not include specific regulatory details. The review also looks at many different areas, from account conditions to overall user experience, to give a complete picture of both good and bad points. Readers should know that some important details, like exact regulatory registration numbers and specific deposit and withdrawal methods, are not included in the available data. This review focuses on the parts that can be judged confidently based on existing user reports and platform analysis.

3. Rating Framework

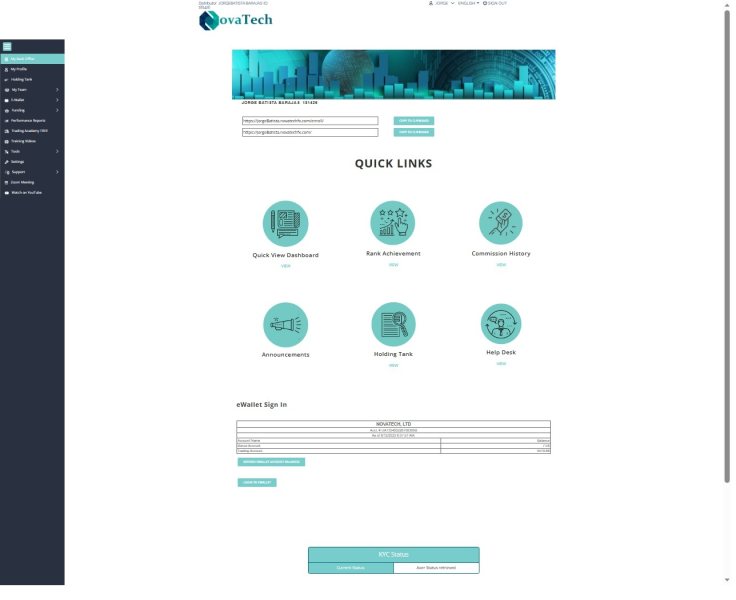

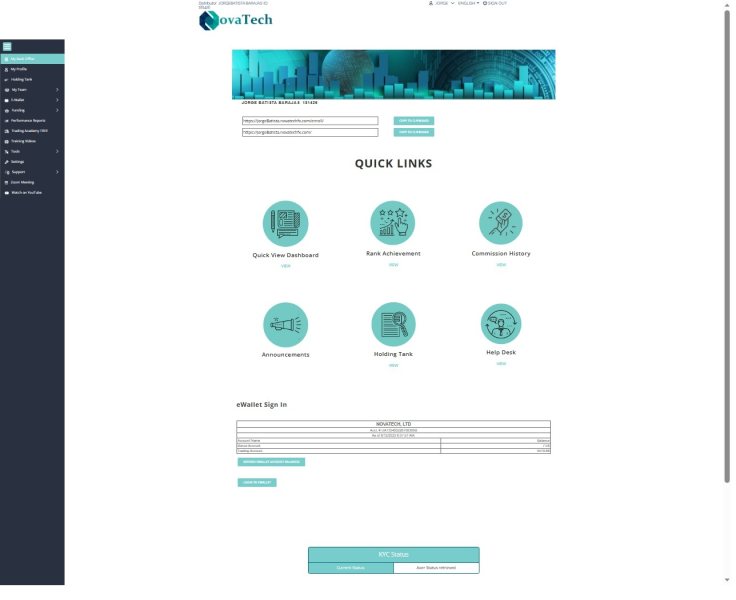

4. Broker Overview

NovaTech started in 2019 as a registered hedge fund company. The company says it provides investment solutions that focus on Forex and cryptocurrency markets. The company's background creates some controversy because its founder was involved in a Ponzi scheme, which makes people worry about the firm's long-term reliability and honesty. Despite this problem, NovaTech has built a client base that likes its diverse investment options and advanced technology. The broker has collected over 61,148 customer comments, and users rate customer satisfaction at 8 and quality at 9. Some services get good reviews, but problems like high deposit fees and withdrawal challenges have been reported, which hurts what could have been an excellent service record.

NovaTech gives traders access to many different assets, including Forex, cryptocurrencies, and stocks, making it attractive for people who want to diversify. The broker uses the popular MT5 trading platform to provide a strong trading experience, but no additional company-made platforms are available. Regulatory oversight details beyond the fact that headquarters are in Saint Vincent and the Grenadines remain unclear, leaving certain investor protections uncertain. This novatech review aims to give potential users a clear understanding of both the benefits and concerns related to the broker's services.

Several key points need careful examination when looking at NovaTech from multiple operational angles.

- Regulatory Regions: The available information did not provide specific regulatory bodies or registration numbers, leaving details unclear.

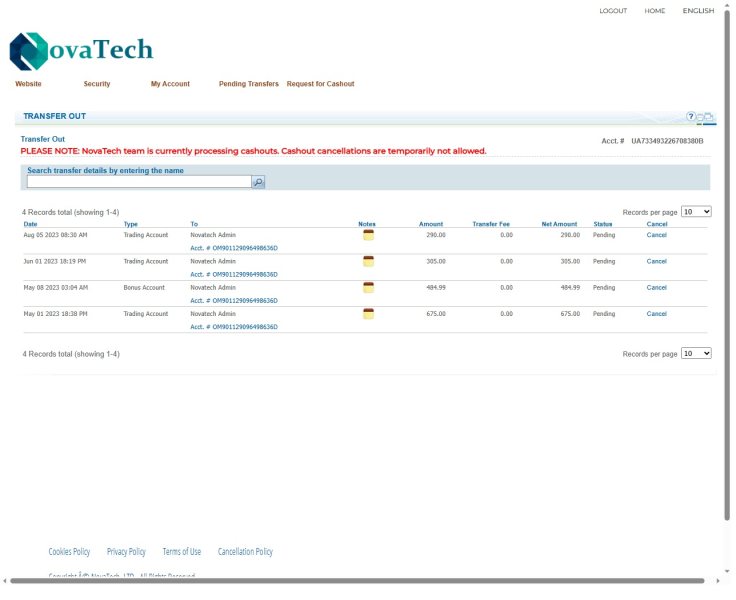

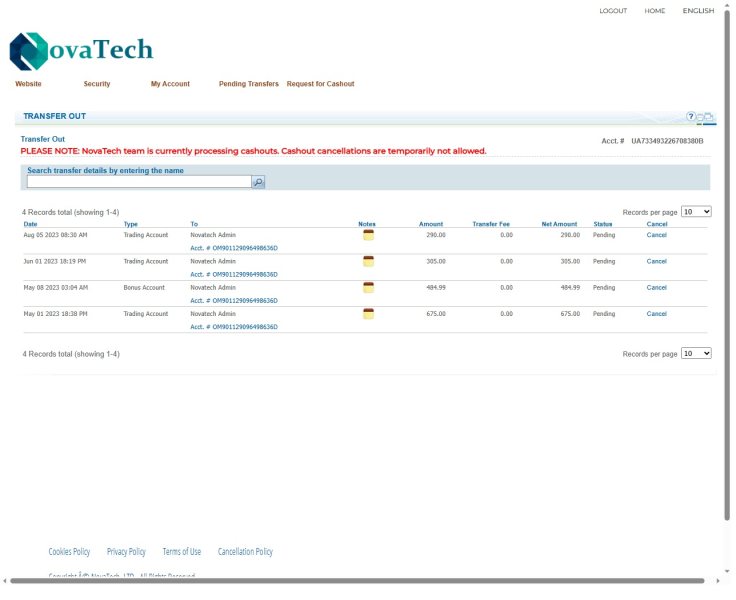

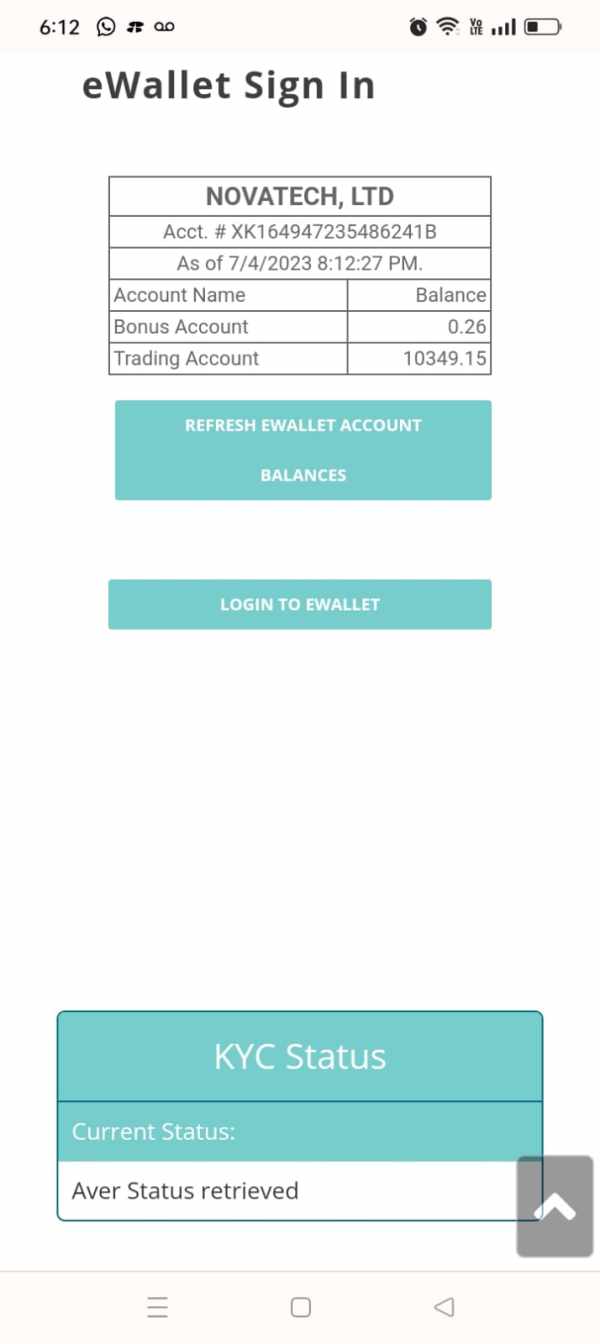

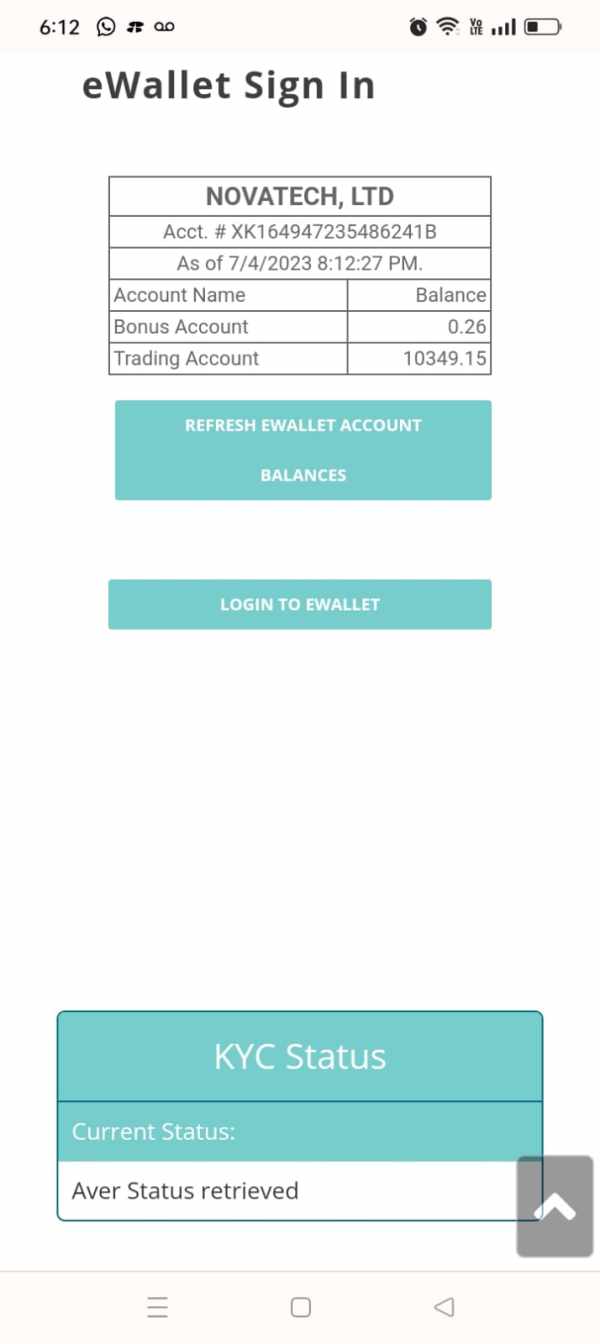

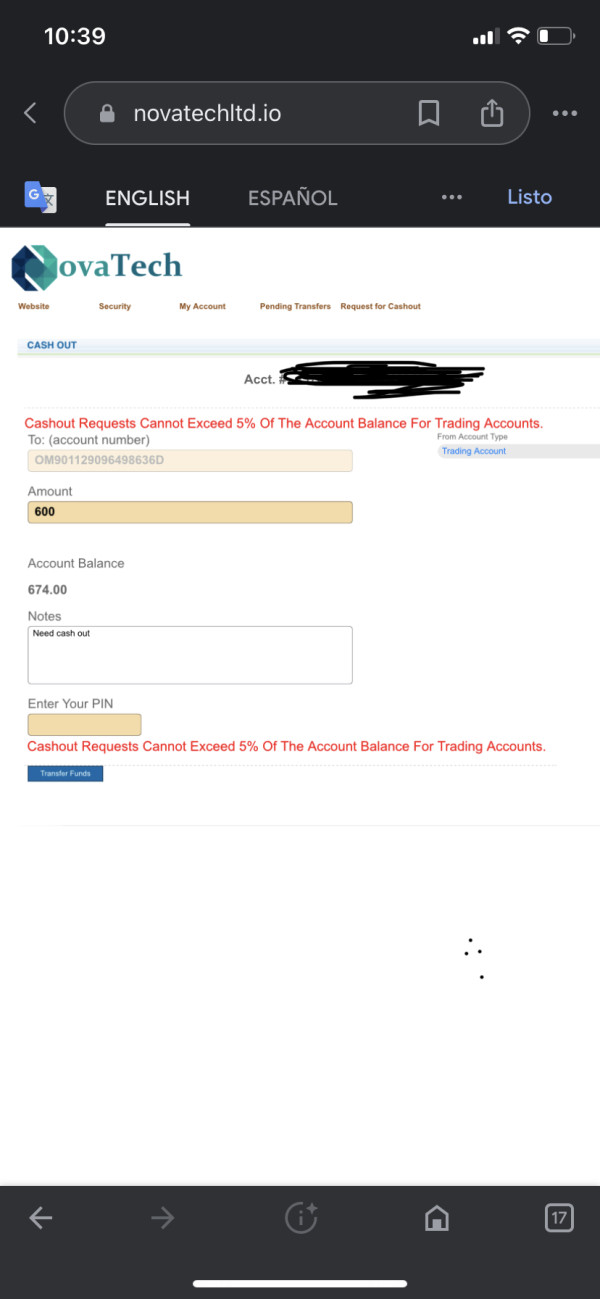

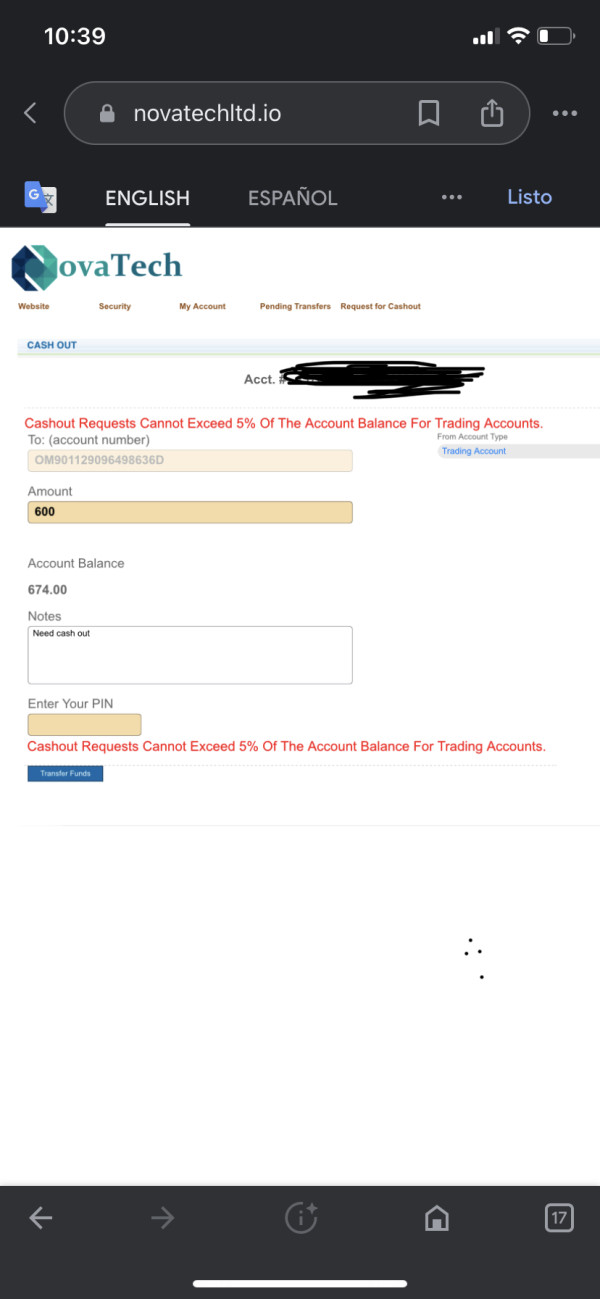

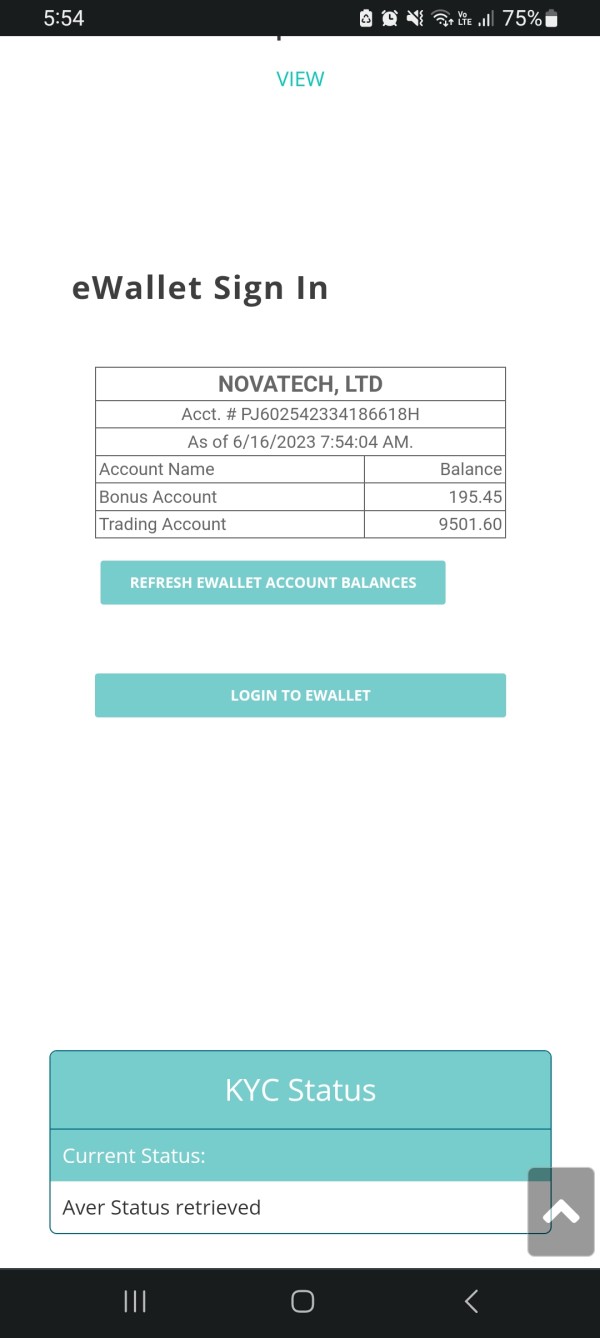

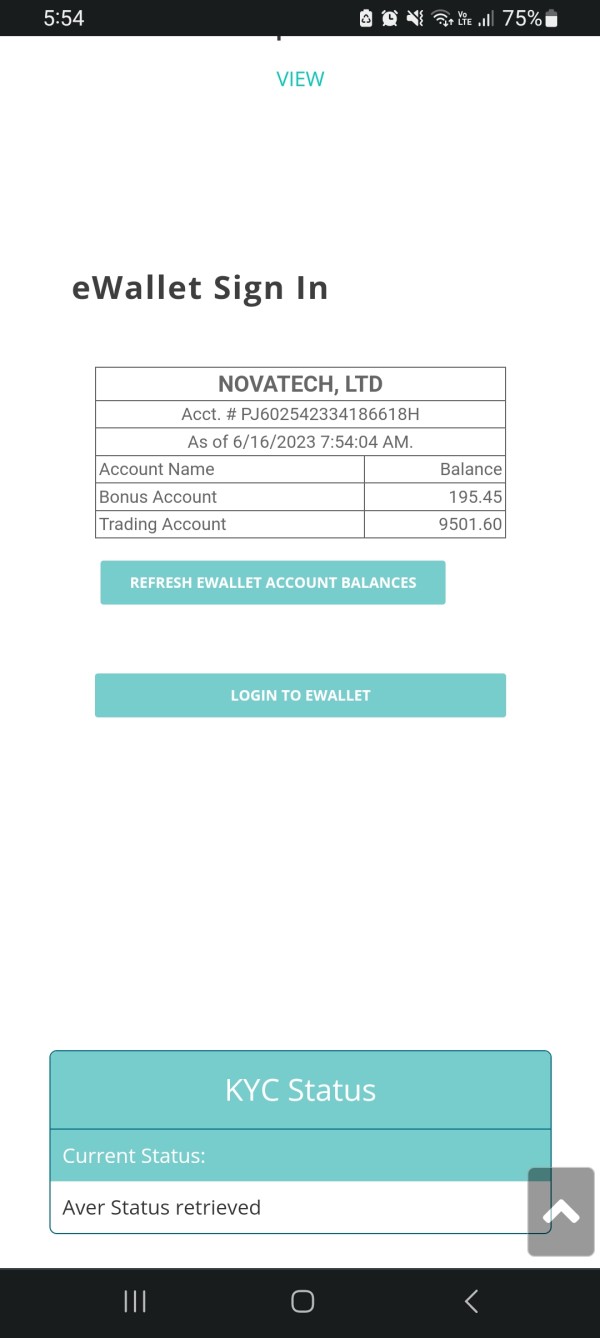

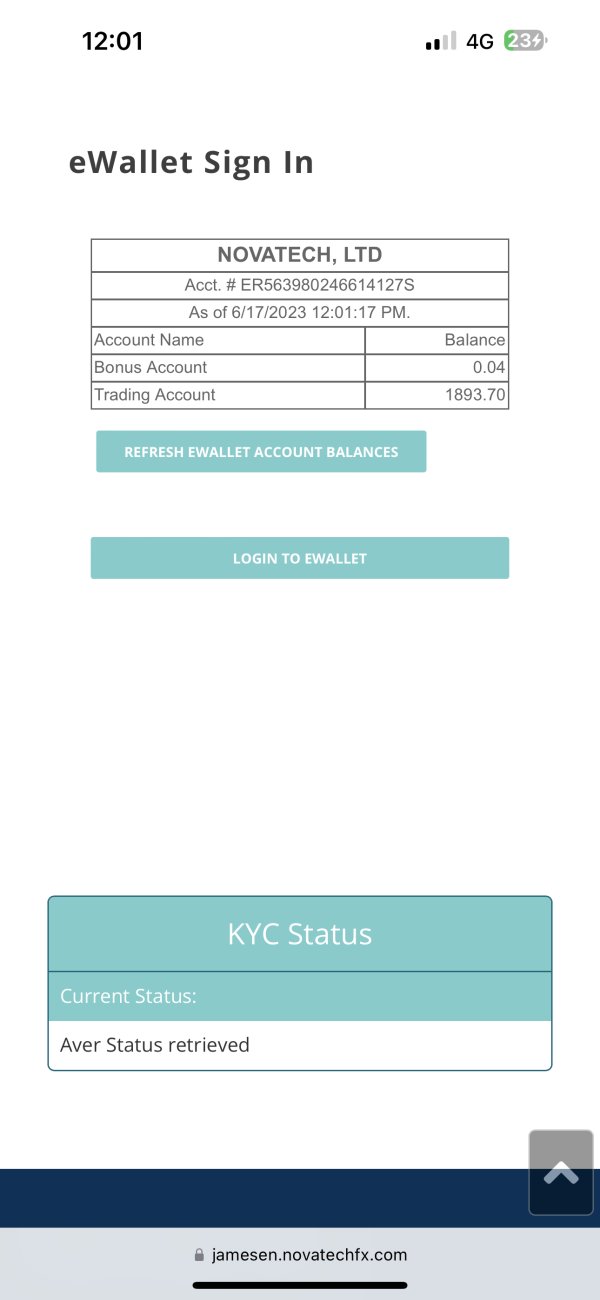

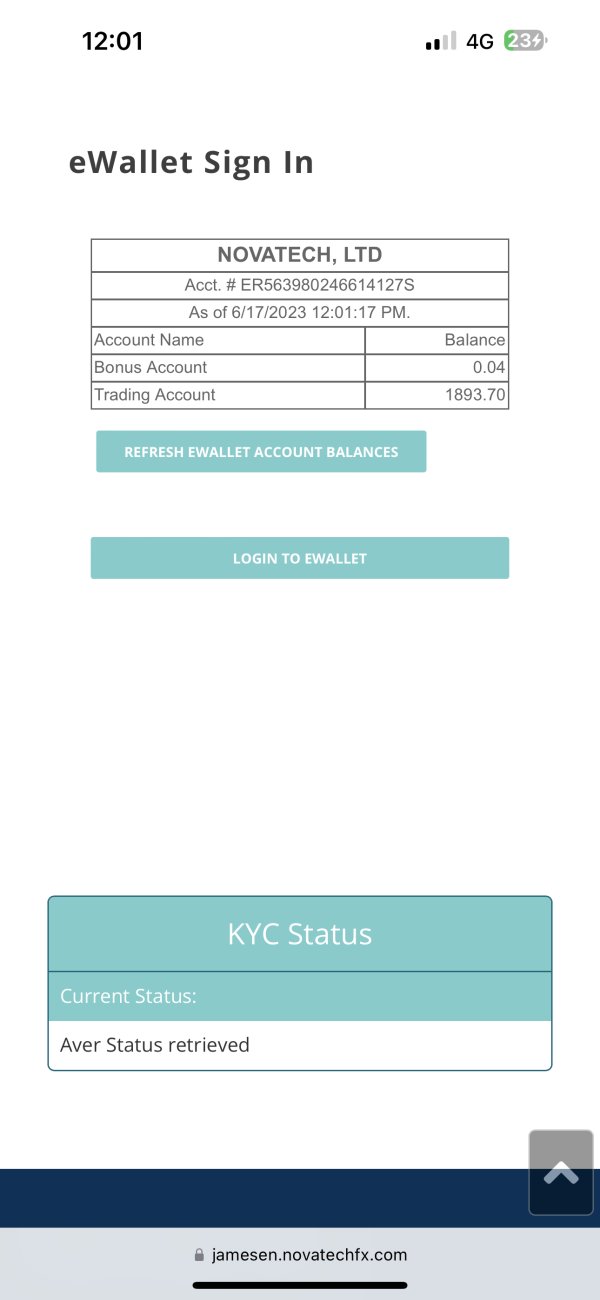

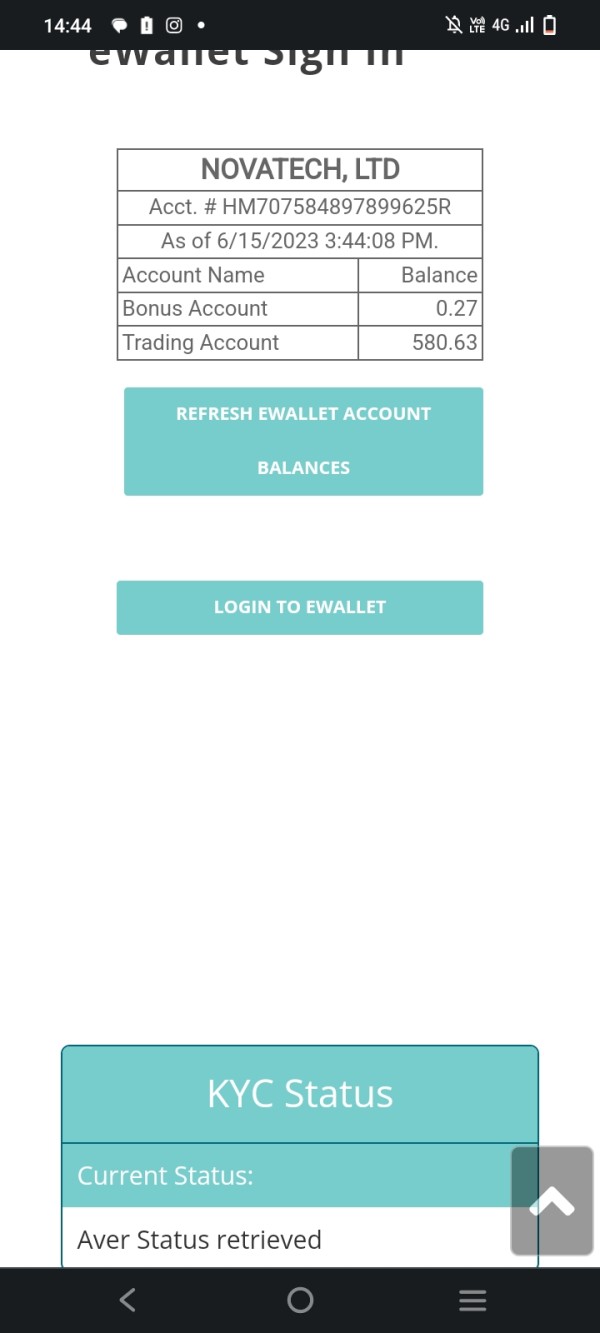

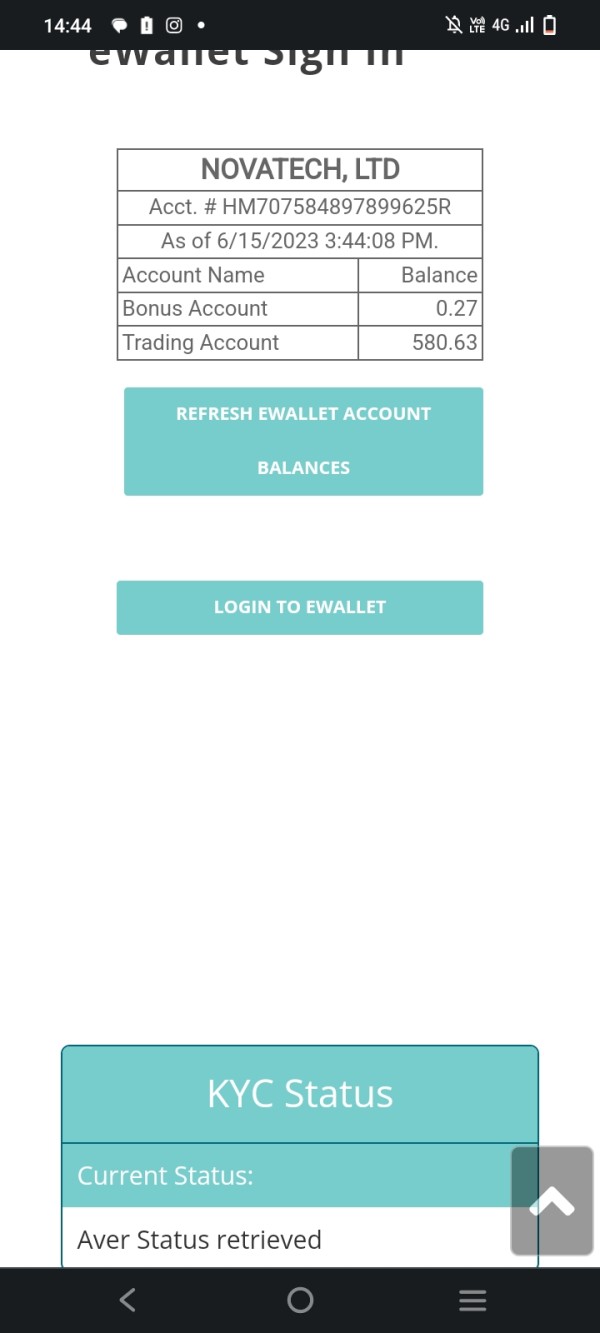

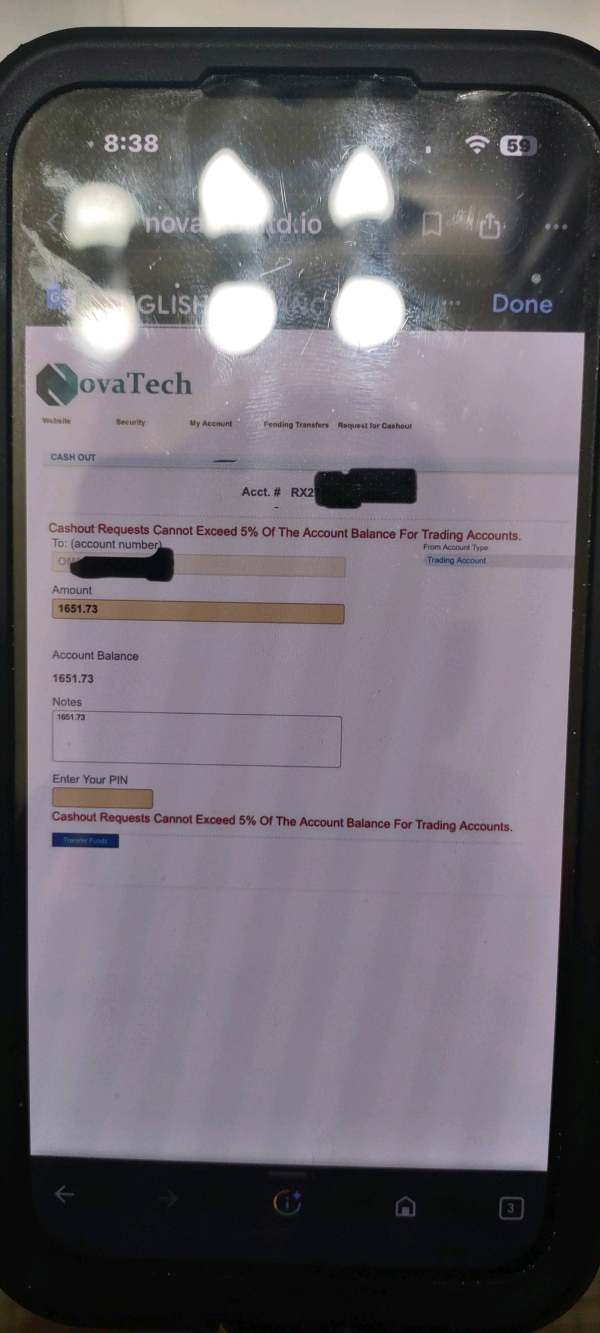

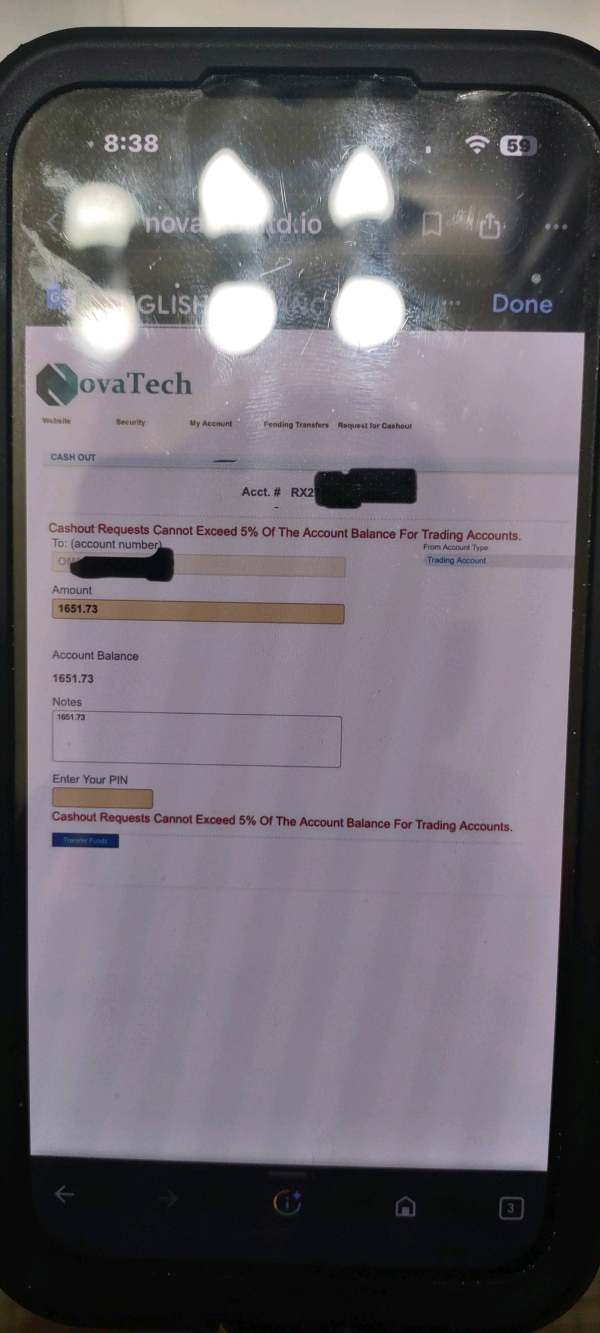

- Deposit and Withdrawal Methods: Details about specific deposit and withdrawal methods are not mentioned, but users have reported withdrawal difficulties.

- Minimum Deposit Requirement: No detailed information on minimum deposit requirements is available from the summarized data.

- Bonus Promotions: No clear information about bonus or promotional offers is provided, leaving this part of the broker's service poorly described.

- Tradable Assets: NovaTech allows trading in many different assets, including Forex, cryptocurrencies, and stocks, appealing to traders who want variety and flexibility in their investment choices.

- Cost Structure: The broker charges high deposit fees as a major cost factor, but specific details about spreads, commissions, or other transaction fees have not been provided.

- Leverage Ratios: Information about the exact leverage options that NovaTech provides remains unclear.

- Platform Selection: NovaTech only uses the MT5 trading platform, which is known for its strong performance and many trading features.

- Regional Restrictions: No specific information about regional restrictions or limitations was mentioned in the available summary.

- Customer Service Language Support: There is not enough detail about the range of languages that the customer service team supports.

While certain strengths of NovaTech are clear—especially its use of a leading trading platform and its asset diversity—the lack of detailed information in several operational areas remains an important point in this novatech review.

6. Detailed Score Analysis

6.1 Account Conditions Analysis

Account conditions for NovaTech are one of the least clear parts of its service. Specific details about account types offered, minimum deposit requirements, and account opening procedures are completely missing from the available information. This lack of detail leaves potential clients without a clear understanding of what to expect when starting their trading journey, which may add to uncertainty and risk. There is no mention of special account types, like Islamic accounts, or any additional features that could serve different investor needs. Other brokers provide detailed account information that helps people make informed decisions, but NovaTech's lack of such data creates challenges for potential users trying to judge cost-effectiveness and suitability. No customer feedback specifically addresses account conditions, making it hard to compare these factors with industry standards. This absence of detailed data is a major drawback in this novatech review and shows the need for greater transparency when presenting account terms to potential traders.

NovaTech's tool offering mainly depends on the strong MT5 trading platform. This platform is known for its advanced charting abilities, analytical tools, and overall stability. Having this platform available is definitely an advantage, especially for traders dealing with multiple asset classes like Forex, cryptocurrencies, and stocks. However, the depth of additional research or analytical resources—like educational materials or automated trading support—remains unaddressed in the available information. The MT5 platform itself typically comes with many technical indicators and automated systems, but users lack clarity on whether NovaTech adds proprietary research or enhanced customer support services related to trading tools. User feedback does not provide detailed insights into how effective the available tools are beyond confirming that the platform itself performs well. While the quality and variety of trading instruments provided by the platform are good, the absence of additional educational and research resources is a notable gap. This assessment fits with the overall positive yet careful tone of this novatech review, where the natural abilities of the trading platform are balanced against the limited scope of additional support tools.

6.3 Customer Service and Support Analysis

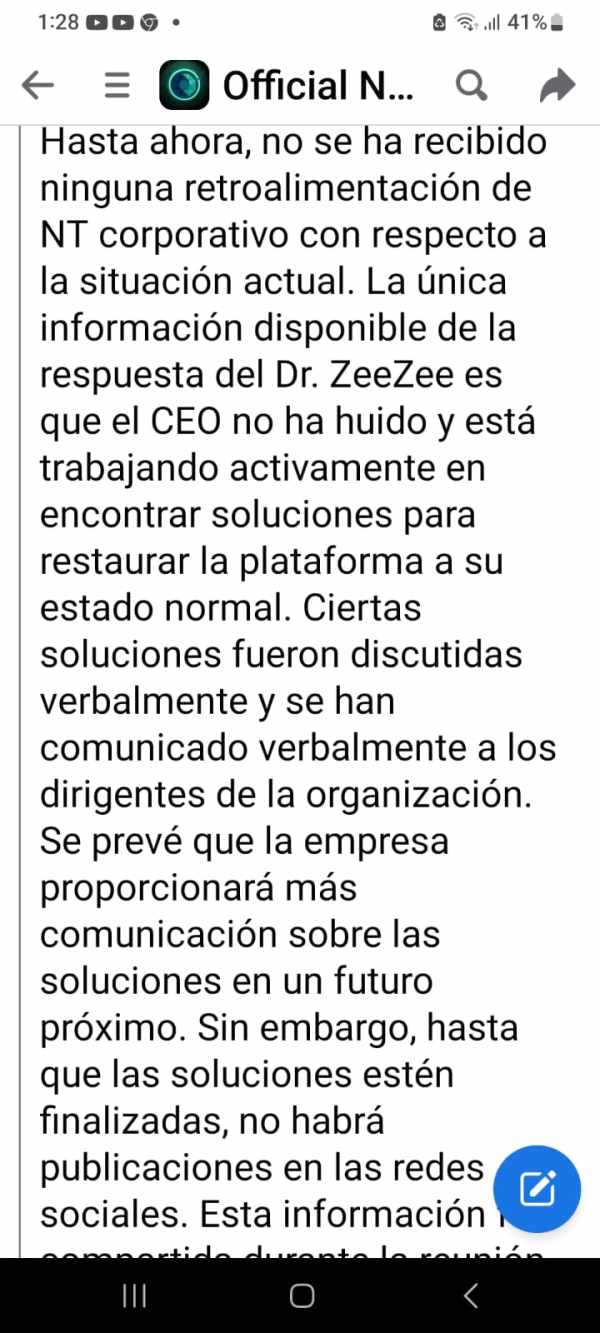

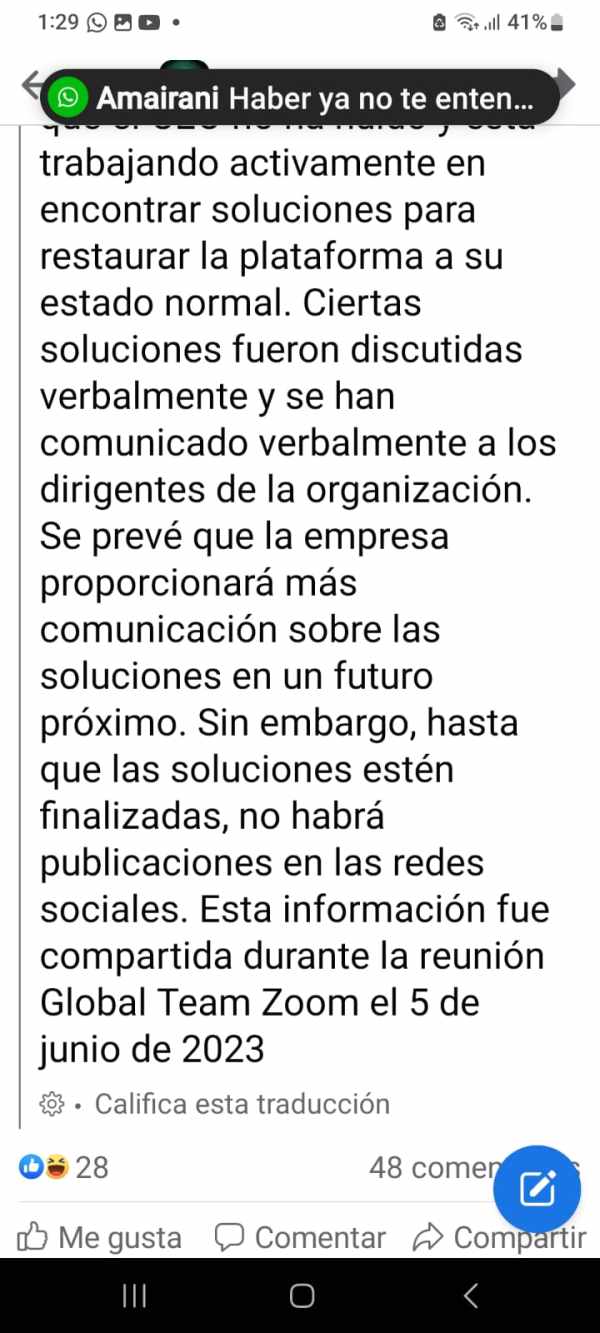

Customer service at NovaTech appears to be mixed based on available user comments. A large number of reviews—about 22,462 on platforms like Trustpilot—suggest that moderate support is in place, but there are repeated reports of operational problems, mainly centered around withdrawal difficulties. The absence of detailed information about communication channels, like live chat, email, or telephone support, makes evaluation harder. There is also no clarification about the range of languages supported or the hours when customer service is available. While the volume of feedback suggests active engagement with users, the quality details indicate that service quality may suffer during high-pressure operations like fund withdrawals. This creates a situation where clients might face delays or poor resolution of issues. Customer service at NovaTech maintains active engagement, but significant room for improvement remains—especially in terms of responsiveness and effective complaint resolution, a factor that is critically highlighted in this aspect of the novatech review.

6.4 Trading Experience Analysis

The trading experience on NovaTech mainly depends on its use of the MT5 trading platform. This platform is known for its stability, extensive toolset, and comprehensive functionality. Users generally report that the platform provides a satisfactory trading environment, with stable order execution and a well-integrated interface that allows for diverse trading activity across Forex, cryptocurrencies, and stocks. However, there are gaps in the available data about specific aspects like slippage occurrence, re-quotes, or the mobile trading experience on any associated apps. Despite these missing details, overall platform usability seems to receive moderate praise from users, reflecting a trading experience that meets industry standards but is hurt by occasional issues like withdrawal complications. The platform supports multiple functions that are important to modern trading environments, but detailed user feedback on the exact mechanics of trade execution is lacking. NovaTech's trading conditions are generally acceptable, but the overall experience is somewhat reduced by reported operational delays and the absence of detailed performance metrics, as noted in this novatech review.

6.5 Trustworthiness Analysis

Trust remains one of the main concerns when evaluating NovaTech. Limited transparency about regulatory oversight is a significant drawback; specific regulatory bodies or compliance numbers are not provided, leaving potential investors unclear about the level of protection they might expect. This problem gets worse because the broker's founder was involved in a Ponzi scheme, a fact that hurts the firm's credibility and trustworthiness. There is little evidence of strong fund safety measures or comprehensive client protection policies. This lack of confirmation from recognized regulatory sources means that investors must be extra careful when considering NovaTech. Without access to independent third-party verification or industry-recognized ratings, the overall trust score remains low at 4/10. The trust issues identified in this analysis are crucial in this novatech review, showing that despite the platform's operational merits, the unresolved transparency and regulatory concerns significantly damage its overall reputation within the competitive broker landscape.

6.6 User Experience Analysis

User experience at NovaTech appears to be a mix of positive outcomes and notable operational challenges. The overall satisfaction rating of 8 suggests that many traders appreciate the interface, platform stability, and the diverse asset options available. The MT5 trading platform is user-friendly, and its strong functionality contributes to a generally satisfying trading experience. However, several user complaints focus on high deposit fees and difficulties experienced during the withdrawal process, which hurt the perception of the broker. The absence of specific details about registration and verification procedures means that first-time users may encounter unexpected challenges. While the interface design and ease-of-use appear to be favorable, the overall user journey is hurt by these operational problems. The trading platform and technology deliver strong performance, but improvements in fund management and customer service responsiveness are necessary to enhance the overall user experience. This balanced view is critical to this novatech review, offering practical insights into areas that require attention and correction.

7. Conclusion

NovaTech displays several attractive features, including a versatile asset offering and the strong MT5 trading platform. These contribute to its overall customer satisfaction rating of 8. However, significant concerns remain, particularly related to high deposit fees, withdrawal difficulties, and serious trust issues stemming from questionable historical practices. This broker may suit traders focused on Forex and cryptocurrency trading who are willing to navigate its operational shortcomings. This novatech review shows that while NovaTech has its merits in providing a broad asset selection and functional trading tools, potential users should exercise caution and ensure they fully understand the risks associated with the broker's current operational practices.