Regarding the legitimacy of FXTM forex brokers, it provides FCA, FSCA, CMA, FSC and WikiBit, (also has a graphic survey regarding security).

Is FXTM safe?

Pros

Cons

Is FXTM markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Exinity UK Ltd

Effective Date:

2018-02-01Email Address of Licensed Institution:

info@forextime.co.uk, complaints@forextime.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://www.forextime.com/ukExpiration Time:

--Address of Licensed Institution:

8 - 10 Old Jewry London EC2R 8DN UNITED KINGDOMPhone Number of Licensed Institution:

+442035141251Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

EXINITY LIMITED

Effective Date:

2020-09-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

173 OXFORD RD ROSEBANK JOHANNESBURG SOUTH AFRICA 2196Phone Number of Licensed Institution:

00230 6595000Licensed Institution Certified Documents:

CMA Forex Execution License (STP)

The Capital Markets Authority

The Capital Markets Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Exinity Capital East Africa Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://group.exinity.com/exinity-group-receives-cma-license-from-kenyaExpiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

EXINITY LIMITED

Effective Date: Change Record

2013-11-08Email Address of Licensed Institution:

contact@credentiainternational.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.credentiainternational.com/Expiration Time:

--Address of Licensed Institution:

C/O CREDENTIA INTERNATIONAL MANAGEMENT LTD 40 CYBERCITY EBENE 2ND FLOOR, THE CATALYST, MauritiusPhone Number of Licensed Institution:

(230) 467 2000, (230) 464 4888Licensed Institution Certified Documents:

Is FXTM A Scam?

Introduction

FXTM, also known as ForexTime, is a global online forex and CFD broker that has been operating since 2011. With a presence in over 150 countries and a strong focus on providing educational resources and trading tools, FXTM has positioned itself as a reputable player in the forex market. However, the complexity and volatility of the forex trading environment necessitate that traders exercise caution and conduct thorough evaluations of brokers before committing their funds. This article aims to provide an objective assessment of FXTM, focusing on its regulatory status, company background, trading conditions, customer fund security, and user experiences. The evaluation is based on a comprehensive review of multiple sources, including regulatory disclosures, customer reviews, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety and legitimacy. FXTM operates under several regulatory authorities, which helps ensure compliance with strict financial standards and protects traders' interests. The following table summarizes FXTM's regulatory information:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA (UK) | 777911 | United Kingdom | Verified |

| CySEC | 185/12 | Cyprus | Verified |

| FSC | C113012295 | Mauritius | Verified |

| CMA | 135 | Kenya | Verified |

| FSCA | 50320 | South Africa | Verified |

FXTMs regulation by the Financial Conduct Authority (FCA) in the UK is particularly noteworthy, as it is a tier-1 regulator known for its stringent standards. This includes requirements for client fund segregation and adherence to investor protection schemes, which can compensate clients up to £85,000 in case of broker insolvency. Additionally, FXTM is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) in South Africa, adding layers of oversight.

However, it is essential to note that FXTM also operates under the Financial Services Commission (FSC) of Mauritius, which is considered a tier-3 regulator. While this provides some level of oversight, it may not offer the same level of protection as tier-1 regulators. Historical compliance records indicate that FXTM has maintained a clean regulatory history, with no significant breaches reported, further enhancing its credibility.

Company Background Investigation

FXTM was founded in 2011 by Andrey Dashin, who has extensive experience in the financial services industry. The company has its headquarters in Mauritius and operates various international offices, including locations in London, Nigeria, and Kenya. FXTM has grown rapidly, acquiring over 1.5 million clients and receiving multiple industry awards for its services.

The management team at FXTM is composed of professionals with diverse backgrounds in finance and trading, contributing to the broker's solid reputation. The company emphasizes transparency and client education, providing a wealth of resources to help traders navigate the complexities of the forex market.

In terms of information disclosure, FXTM maintains a transparent approach, readily providing details about its regulatory status, trading conditions, and fees on its website. This level of transparency is crucial for building trust with clients, as it allows traders to make informed decisions about their trading activities.

Trading Conditions Analysis

FXTM offers a variety of trading accounts, including the Micro, Advantage, and Advantage Plus accounts, each tailored to meet the needs of different traders. The overall fee structure is competitive, although it varies depending on the account type. Below is a summary of the core trading costs associated with FXTM:

| Fee Type | FXTM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0 - 1.5 pips |

| Commission Model | $3.5 per lot (Advantage) | $5.0 - $7.0 per lot |

| Overnight Interest Range | Variable | Variable |

The spread offered by FXTM can be as low as 0.0 pips for the Advantage account, which is highly competitive in the industry. However, the commission structure can vary, with some accounts charging commissions based on trade volume. The overnight interest rates (swap fees) are also competitive, but traders should be aware of the potential costs associated with holding positions overnight.

One area of concern is the inactivity fee that FXTM imposes after six months of inactivity, which can amount to $5 per month. This fee structure may be seen as a drawback for traders who do not actively trade.

Customer Fund Security

The safety of customer funds is paramount in the forex trading industry. FXTM employs several measures to ensure the security of client funds, including:

- Segregation of Funds: FXTM keeps client funds in segregated accounts, separate from the company's operational funds. This practice ensures that client money is protected in the event of insolvency.

- Investor Protection Schemes: Clients of FXTM's UK entity are covered by the Financial Services Compensation Scheme (FSCS), which protects client funds up to £85,000.

- Negative Balance Protection: FXTM offers negative balance protection, ensuring that clients cannot lose more than their account balance, even in volatile market conditions.

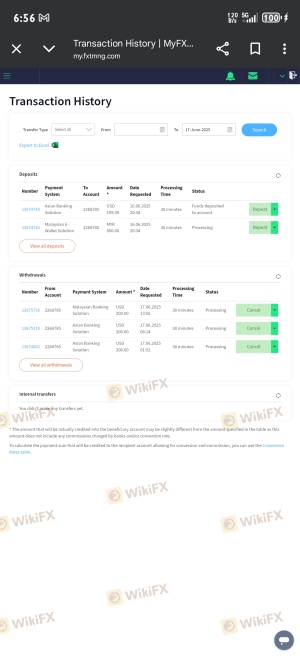

- A trader reported a smooth withdrawal process, receiving funds within the promised timeframe and commending the customer support team for their efficiency.

- Conversely, another trader experienced significant delays in accessing their account and withdrawing funds, leading to frustration and dissatisfaction with the broker's responsiveness.

Despite these robust security measures, there have been occasional reports of withdrawal delays and issues related to account access. However, these incidents appear to be isolated and do not reflect a systemic failure in the broker's security protocols.

Customer Experience and Complaints

Customer feedback is a crucial component of evaluating a broker's reliability. Overall, FXTM has received mixed reviews from users. While many clients praise the broker for its educational resources and responsive customer support, some have reported issues related to withdrawal delays and account access. The following table summarizes common complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

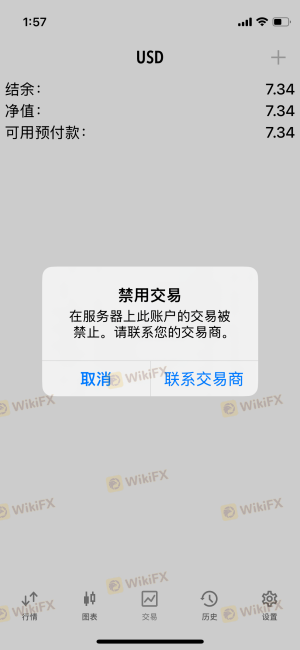

| Withdrawal Delays | Medium | Generally responsive, but some delays reported |

| Account Access Issues | High | Slow response times during peak periods |

| Inactivity Fee Disputes | Low | Clarified in terms and conditions |

Two typical cases illustrate the range of user experiences:

Platform and Trade Execution

FXTM provides access to popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely regarded for their functionality and user-friendly interfaces. The platforms support various trading strategies, including scalping and automated trading.

In terms of order execution, FXTM has been noted for its fast execution speeds. However, some users have reported instances of slippage and requotes, particularly during high volatility periods. Overall, the execution quality is generally considered satisfactory, but traders should remain vigilant during major market events.

Risk Assessment

When considering FXTM as a trading partner, it is essential to assess the associated risks. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight across multiple jurisdictions |

| Operational Risk | Medium | Occasional withdrawal delays and access issues reported |

| Market Risk | High | High leverage can amplify both profits and losses |

| Customer Service Risk | Medium | Mixed reviews on response times and issue resolution |

To mitigate these risks, traders are advised to maintain clear communication with customer support, utilize demo accounts for practice, and implement sound risk management strategies.

Conclusion and Recommendations

In conclusion, FXTM is a well-regulated broker with a solid reputation in the forex market. Its multiple regulatory licenses provide a degree of confidence for traders, and the broker's commitment to client education and support is commendable. While there are some concerns regarding withdrawal delays and customer service responsiveness, these issues appear to be manageable.

For traders considering FXTM, it is essential to weigh the benefits against the potential risks. Beginners may find the broker's educational resources and user-friendly platforms advantageous, while experienced traders can benefit from the competitive spreads and advanced trading tools.

If you are looking for alternatives, consider brokers with strong regulatory backgrounds and positive user feedback, such as IG Group, OANDA, or Forex.com, which also offer robust trading conditions and customer support.

Ultimately, conducting thorough research and remaining vigilant in your trading practices will help ensure a positive trading experience with FXTM or any other broker.

Is FXTM a scam, or is it legit?

The latest exposure and evaluation content of FXTM brokers.

FXTM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXTM latest industry rating score is 6.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.