Regarding the legitimacy of Gold Fun Corporation Ltd forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is Gold Fun Corporation Ltd safe?

Pros

Cons

Is Gold Fun Corporation Ltd markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RevokedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

金豐來有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

香港九龍紅磡崇安街18號半島廣場15樓1508室Phone Number of Licensed Institution:

22951889Licensed Institution Certified Documents:

Is Gold Fun Corporation Ltd Safe or Scam?

Introduction

Gold Fun Corporation Ltd is a forex broker that specializes in precious metals trading, particularly gold. Founded in 2016 and based in Hong Kong, it offers a range of services including gold trading, investment, and storage solutions. As the forex market becomes more accessible to individual traders, the need for careful evaluation of brokers has never been more critical. Traders must assess the legitimacy and reliability of brokers to avoid potential scams and ensure the safety of their investments. This article aims to provide a thorough investigation into Gold Fun Corporation Ltd, evaluating its regulatory status, company background, trading conditions, customer safety, and overall reputation in the market. The analysis is based on various online sources, customer reviews, and regulatory information to form a comprehensive view of the broker's credibility.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in assessing its trustworthiness. Gold Fun Corporation Ltd is regulated by the Chinese Gold and Silver Exchange Society (CGSE), which is a recognized authority in Hong Kong. This regulation suggests that the broker adheres to certain operational standards and practices that are essential for protecting investors. Below is a summary of the key regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Chinese Gold and Silver Exchange Society (CGSE) | 064 | Hong Kong | Verified |

The importance of regulation cannot be overstated, as it serves as a safeguard for traders, ensuring that brokers follow ethical practices and maintain transparency. Gold Fun Corporation Ltd's membership in CGSE indicates a level of oversight that can enhance investor confidence. However, it is essential to consider the quality of regulation; while CGSE provides a framework for oversight, it may not be as stringent as other global regulators like the FCA or ASIC. Historically, there have been no major compliance issues reported against Gold Fun, suggesting a relatively stable operational history. Nevertheless, traders should remain vigilant and conduct their own research into the broker's practices and any potential risks associated with trading through them.

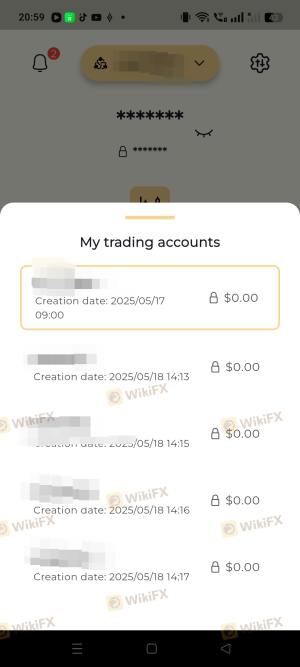

Company Background Investigation

Gold Fun Corporation Ltd has been operational since 2016, focusing primarily on the precious metals sector. The company offers a variety of services, including gold refining, trading, and investment solutions. The ownership structure appears to be private, with specific details about ownership not readily available in public domain sources. This lack of transparency can be a red flag for potential investors; understanding who owns and operates the brokerage is crucial for assessing accountability.

The management team behind Gold Fun consists of professionals with backgrounds in finance and trading, although specific profiles of key personnel are not extensively documented. This raises questions about the depth of experience and expertise within the leadership team. Transparency in management is essential for building trust, and potential investors may want to inquire further about the qualifications and track records of the individuals in charge.

Overall, while Gold Fun Corporation Ltd has established itself in the market, its opacity regarding ownership and management could be a cause for concern. Investors should seek more information about the company's leaders and their experiences in the industry to better understand the broker's reliability.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for any trader looking to maximize their investment potential. Gold Fun Corporation Ltd provides a range of trading options, particularly focused on gold and other precious metals. However, potential clients should be aware of the overall fee structure and any unusual charges that may apply. Below is a comparison of key trading costs:

| Cost Type | Gold Fun Corporation Ltd | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | To be determined | Varies by broker |

| Commission Structure | To be determined | Varies by broker |

| Overnight Interest Range | To be determined | Varies by broker |

While specific figures for Gold Fun's trading costs are not readily available, traders should be cautious of any fees that seem excessive or non-standard compared to industry norms. The presence of hidden fees can significantly impact profitability, and it is essential to clarify all potential costs before engaging with the broker.

Traders should also consider the execution speed and order types available on the platform, as these factors can influence trading outcomes. A broker with high spreads or hidden fees may not be the best choice for active traders looking to capitalize on market movements.

Customer Funds Security

The security of customer funds is a significant concern for any trader. Gold Fun Corporation Ltd claims to implement various measures to safeguard client investments, including segregating client funds from the companys operational funds. This practice is essential for ensuring that client money is protected in the event of the broker facing financial difficulties.

Additionally, the broker provides insured storage options for physical gold holdings, which adds another layer of security for investors. However, the specifics of these security measures, including the extent of fund segregation and the insurance coverage provided, are crucial to understanding the level of protection offered.

Historically, there have been no major incidents reported regarding fund security at Gold Fun, which is a positive sign. Nonetheless, potential clients should inquire directly with the broker about their policies on negative balance protection and how they manage client funds to ensure maximum security.

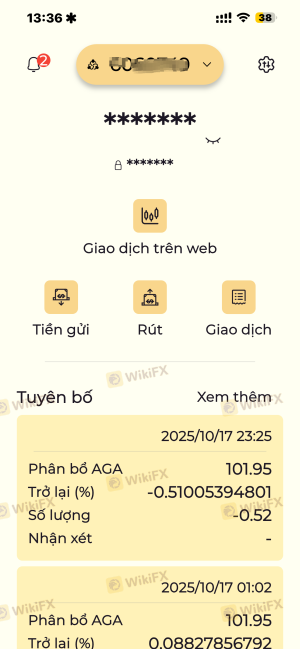

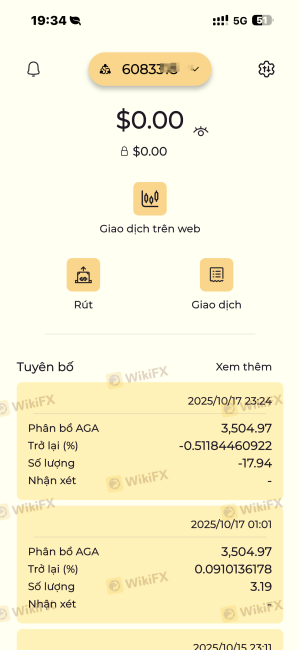

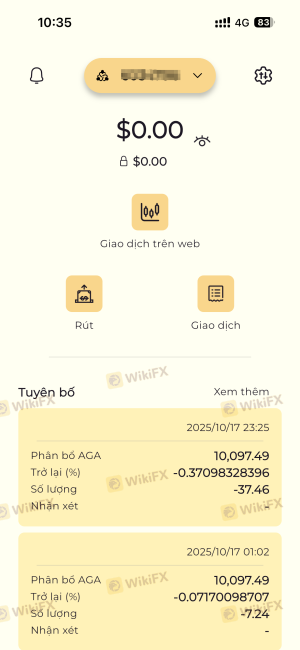

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a brokers reliability. Reviews for Gold Fun Corporation Ltd are mixed, with some users praising the broker for its user-friendly platform and customer service, while others have raised concerns about response times and execution quality. Below is a summary of common complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Slow Customer Support | Medium | Mixed responses |

| Execution Issues | High | Unresolved for some users |

| Fee Transparency | Medium | Needs improvement |

Several users have reported issues with the responsiveness of customer support, particularly during peak trading times. This can be problematic, especially for traders who require immediate assistance. Additionally, execution issues have been noted, which can lead to significant losses if not addressed promptly.

A few case studies illustrate these points: one trader experienced delays in order execution during a volatile market, resulting in a less favorable trade outcome. Another user mentioned that while the platform was easy to navigate, they found it difficult to get clear answers regarding fees, leading to frustration.

Overall, while some clients have had positive experiences, the presence of unresolved complaints suggests that Gold Fun Corporation Ltd may need to improve its customer service and execution reliability.

Platform and Execution

The trading platform provided by Gold Fun Corporation Ltd is reportedly user-friendly, featuring advanced charting tools and real-time market data. However, the performance of the platform in terms of stability and execution quality is crucial for traders. Users have noted varying degrees of success regarding order execution, with some experiencing slippage during high volatility periods.

The execution quality is a critical factor that can influence trading success. If a broker frequently rejects orders or experiences significant slippage, it could indicate underlying issues with their trading infrastructure. Traders should consider these factors before committing to a broker, as they can have a direct impact on profitability.

Risk Assessment

When evaluating the risks associated with Gold Fun Corporation Ltd, it is essential to consider various factors that could affect traders' experiences. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited oversight compared to major regulators |

| Execution Risk | High | Reports of slippage and order rejections |

| Customer Support Risk | Medium | Mixed reviews on responsiveness |

Overall, the risks associated with trading with Gold Fun Corporation Ltd are moderate to high, particularly concerning execution quality and customer support. To mitigate these risks, traders should ensure they have a clear understanding of the broker's policies, maintain open communication with the support team, and consider starting with a smaller investment to gauge the platform's reliability.

Conclusion and Recommendations

In conclusion, while Gold Fun Corporation Ltd presents itself as a legitimate broker with regulatory oversight, there are several areas of concern that potential traders should consider. The mixed customer feedback, execution issues, and lack of transparency regarding fees and management raise red flags that warrant caution.

For traders seeking to invest in precious metals, it is crucial to conduct thorough research and consider alternative options that may offer better customer support and execution reliability. If you are considering trading with Gold Fun, proceed with caution, and consider starting with a smaller investment until you are confident in the broker's capabilities.

For those looking for more reliable alternatives, brokers regulated by major authorities such as the FCA or ASIC may provide a more secure trading environment and better customer service.

Is Gold Fun Corporation Ltd a scam, or is it legit?

The latest exposure and evaluation content of Gold Fun Corporation Ltd brokers.

Gold Fun Corporation Ltd Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Gold Fun Corporation Ltd latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.