IB 2025 Review: Everything You Need to Know

Executive Summary

This ib review gives you a complete look at the Introducing Broker (IB) model in today's trading world. IBs work as middlemen who find and accept orders for futures contracts, forex, commodity options, and swaps, but they don't handle customer money directly. The IB model works really well for client support services and helping new traders get started, which makes it perfect for people who want personal help when trading futures, forex, and commodity options.

Our review shows big gaps in information about specific rules, detailed trading conditions, and complete fee structures. We stay neutral because there isn't enough concrete data about operations, customer feedback, and regulatory compliance details available. IBs provide valuable advice and let qualified floor traders handle the actual trades, but the lack of clear information about specific platforms, account conditions, and regulatory oversight creates problems for potential clients who want detailed operational insights.

The main users seem to be traders who need educational support and personal guidance, especially those new to futures and forex markets who benefit from the advisory relationship IBs provide.

Important Notice

Regional Entity Variations: Different countries may use varying operational models and regulatory requirements for Introducing Brokers. IBs that operate across multiple regions must follow local regulatory frameworks, which can create different service offerings, fee structures, and client protection measures depending on where they operate.

Review Methodology: This evaluation uses publicly available information about the IB model and structure. Areas where specific operational data, regulatory details, or customer feedback metrics aren't available have been clearly marked as "not specified in available sources" to keep our assessment process transparent and accurate.

Rating Framework

Broker Overview

The Introducing Broker model represents a well-established structure within the financial services industry. Individuals or organizations focus on client acquisition and support while partnering with Futures Commission Merchants (FCMs) or Retail Foreign Exchange Dealers (RFEDs) for trade execution and fund custody. IBs must maintain all customer accounts on a fully disclosed basis with their partnering FCMs or RFEDs, which ensures regulatory compliance and client protection.

The IB business model focuses on relationship building and client education. Introducing brokers serve as middlemen who provide advisory services without directly executing trades. This structure lets IBs focus on client development, market education, and ongoing support while using the execution capabilities and regulatory infrastructure of established financial institutions.

IBs typically work across multiple asset classes including futures contracts, forex, commodity options, and swaps. The model works particularly well for clients who value personal guidance and educational support throughout their trading journey. This ib review shows that the introducing broker structure provides a bridge between individual traders and institutional-grade execution services, though specific platform offerings and technological capabilities remain unspecified in available documentation.

Regulatory Oversight: Available sources show that IBs must operate under regulatory frameworks requiring full disclosure of customer accounts with FCMs or RFEDs. Specific regulatory bodies and compliance requirements are not detailed in accessible information.

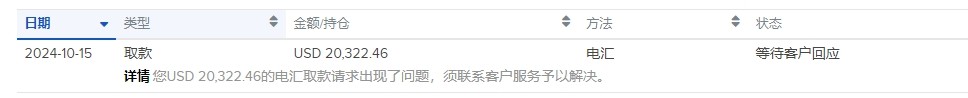

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures are not outlined in available sources. Fund custody is typically handled by the partnering FCM or RFED rather than the IB directly.

Minimum Deposit Requirements: Minimum account funding thresholds are not specified in available documentation. They likely vary based on the partnering institution and account type selected.

Promotional Offerings: Bonus structures and promotional programs are not detailed in accessible sources. Compensation models typically focus on ongoing advisory relationships rather than initial incentives.

Available Assets: Trading opportunities include futures contracts, forex pairs, commodity options, and swaps. Specific instrument availability depends on the partnering FCM or RFED's offerings.

Cost Structure: Fee arrangements, spreads, and commission structures are not detailed in available sources. Pricing is likely determined by the partnering execution firm and the specific IB relationship terms.

Leverage Options: Leverage ratios and margin requirements are not specified in accessible documentation. They are typically governed by the regulatory framework of the partnering FCM or RFED.

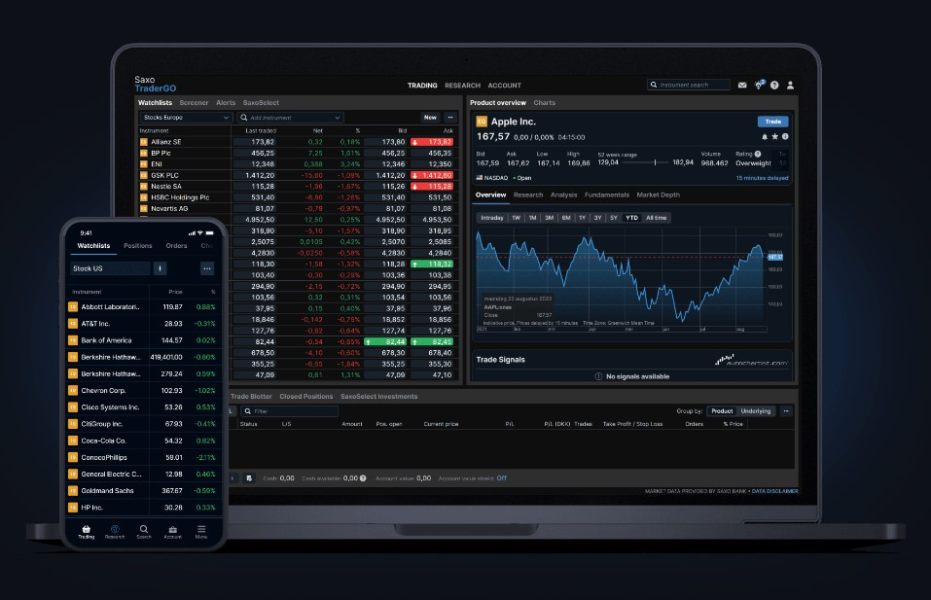

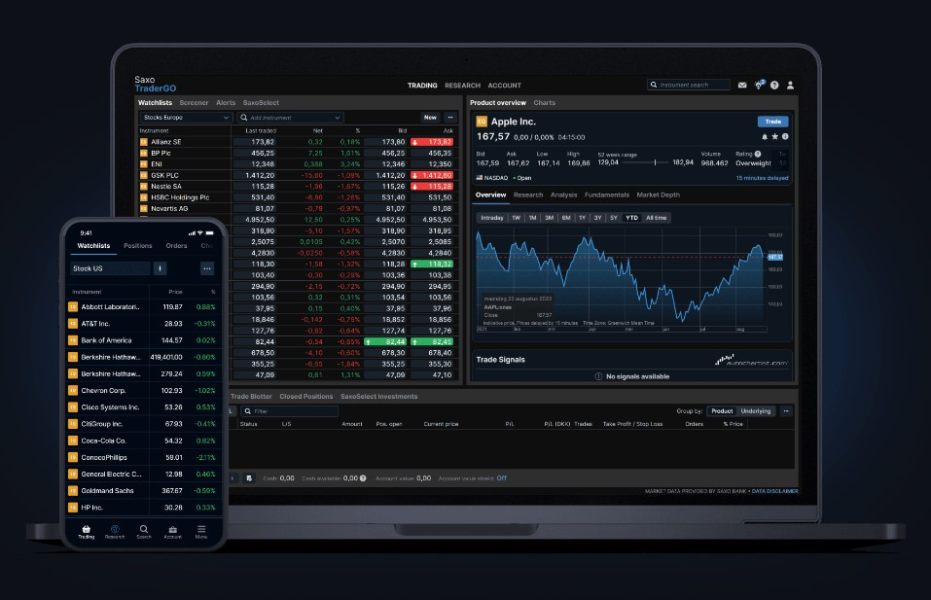

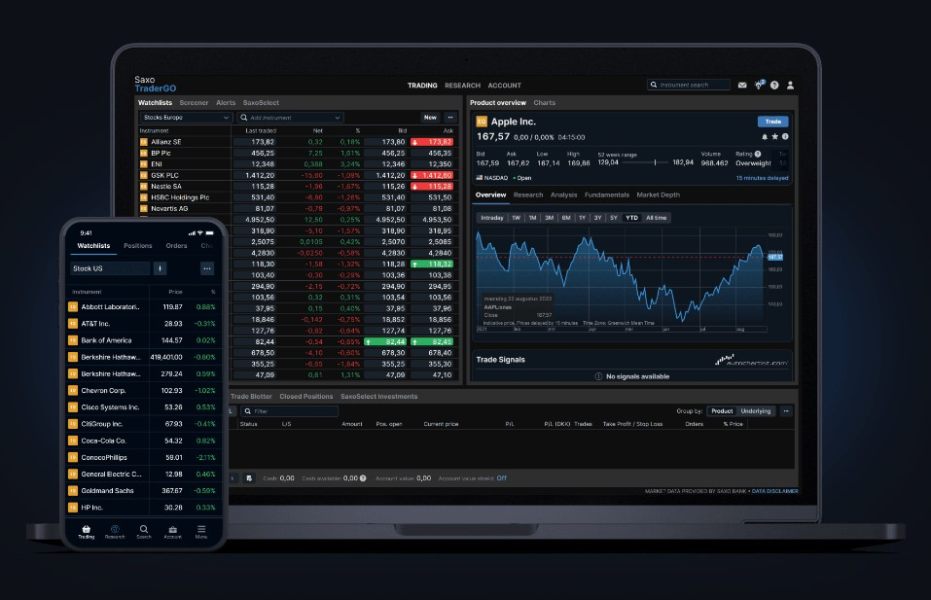

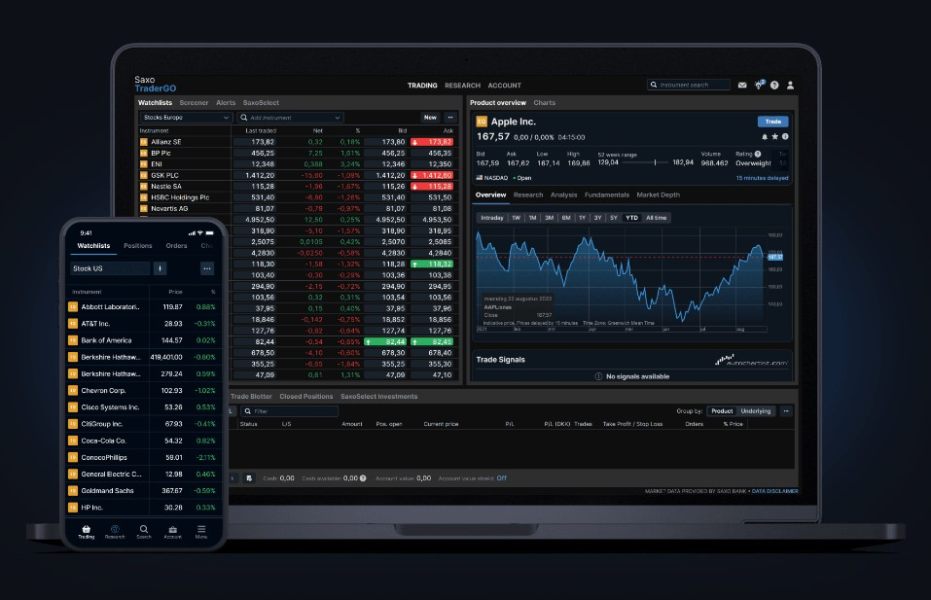

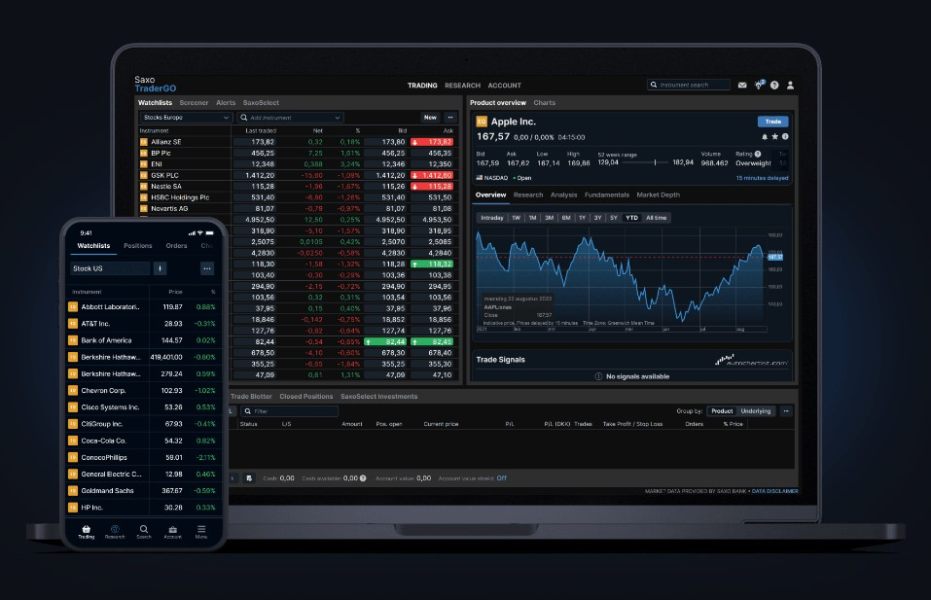

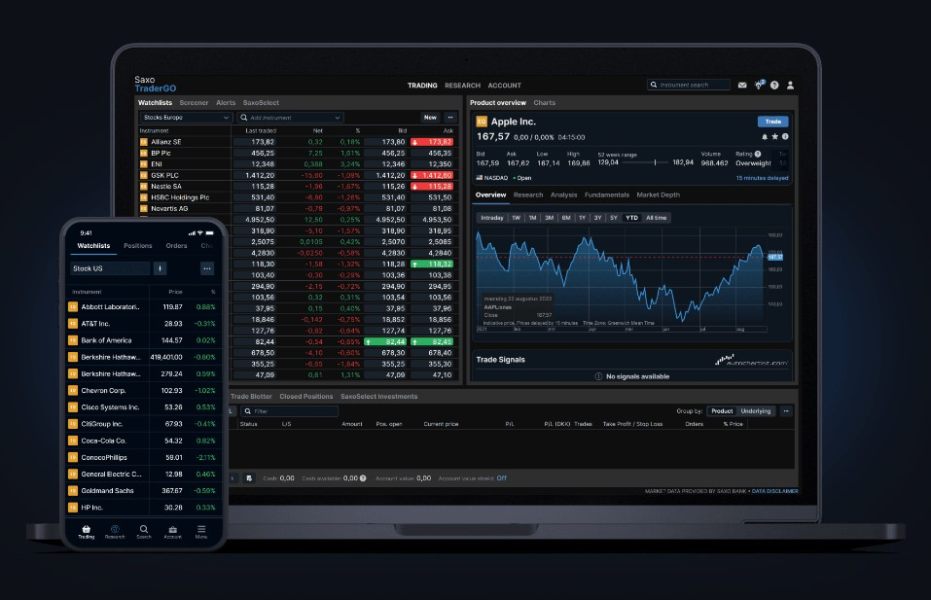

Platform Selection: Specific trading platforms and technological offerings are not detailed in available sources. Technology access is generally provided through the partnering execution firm's infrastructure.

Geographic Restrictions: Regional limitations and availability are not specified in accessible information. Regulatory compliance requirements suggest geographic considerations apply.

Customer Support Languages: Multilingual support capabilities are not detailed in available sources. They likely vary by individual IB and their target market focus.

This ib review reveals significant information gaps in operational specifics, highlighting the need for direct consultation with individual IBs for detailed service information.

Detailed Rating Analysis

Account Conditions Analysis

The available information about account conditions for IBs presents limited specifics about account types, minimum deposit requirements, or detailed terms and conditions. Sources show that IBs must maintain customer accounts with FCMs or RFEDs on a fully disclosed basis, which suggests regulatory oversight of account structures, but specific account categories and their respective features remain unspecified in accessible documentation.

The account opening process appears to involve coordination between the IB and their partnering FCM or RFED. Detailed onboarding procedures, documentation requirements, and timeline expectations are not outlined in available sources. This arrangement potentially provides clients with personal guidance during account establishment, using the IB's advisory role while ensuring regulatory compliance through the partnering institution's infrastructure.

Special account features such as Islamic-compliant trading options, professional trader classifications, or institutional account structures are not detailed in accessible information. The lack of transparent account condition details in this ib review reflects the individualized nature of IB relationships, where specific terms may vary significantly based on the partnering institution and the particular IB's service model.

Without comprehensive account condition data, potential clients must engage directly with IBs to understand available account types, funding requirements, and specific terms applicable to their trading objectives and regulatory status.

The available information provides limited insight into specific trading tools and resources offered through the IB model. Sources emphasize the advisory nature of IB services, but detailed descriptions of analytical tools, charting capabilities, or proprietary research resources are not specified in accessible documentation. The IB structure appears to focus on personal guidance and client education rather than proprietary tool development.

Research and analysis resources available through IBs remain unspecified in available sources. The advisory relationship suggests access to market insights and educational content. The partnership structure with FCMs or RFEDs may provide access to institutional-grade research and analysis tools, but specific offerings are not detailed in accessible information.

Educational resources represent a key component of the IB model. Client education and onboarding are highlighted as primary services. However, specific educational programs, training materials, or certification offerings are not outlined in available documentation, likely varying by individual IB and their expertise areas.

Automated trading support capabilities are not detailed in accessible sources. The IB model traditionally emphasizes personal advisory services over automated execution systems. The delegation of trade execution to floor traders or partnering institutions may limit direct automated trading integration, though specific technological capabilities remain unspecified in available information.

Customer Service and Support Analysis

Customer service represents a fundamental component of the IB model. Client support services are specifically highlighted as a primary function of introducing brokers. However, detailed information about service channels, availability hours, and response time metrics are not specified in accessible documentation, reflecting the individualized nature of IB relationships where service quality may vary significantly between providers.

The advisory nature of IB services suggests personal support approaches. Introducing brokers serve as dedicated points of contact for client inquiries and guidance. This structure potentially provides more direct access to knowledgeable professionals compared to larger institutional brokers, though specific service level commitments are not detailed in available sources.

Response time expectations and service quality metrics are not outlined in accessible information. They likely vary based on individual IB capacity and client relationship management approaches. The partnership structure with FCMs or RFEDs may provide additional support layers for technical and operational inquiries, though specific escalation procedures remain unspecified.

Multilingual support capabilities and service availability across different time zones are not detailed in available sources. Given the global nature of forex and futures markets, individual IBs may offer specialized language support based on their target market focus, but comprehensive service coverage details are not accessible in current documentation.

Trading Experience Analysis

The trading experience through IBs involves a unique structure where trade execution is delegated to qualified floor traders or partnering FCMs/RFEDs rather than being handled directly by the introducing broker. This arrangement potentially provides access to professional execution services while maintaining the advisory relationship with the IB, though specific execution quality metrics are not detailed in available sources.

Platform stability and performance characteristics are not specified in accessible documentation. Technology infrastructure is typically provided by the partnering FCM or RFED rather than the IB directly. This structure may provide access to institutional-grade platforms and execution systems, but specific performance data and reliability metrics remain unspecified in available information.

Order execution quality and speed metrics are not detailed in accessible sources. Execution capabilities depend on the partnering institution's infrastructure and market access. The delegation model may provide benefits of professional execution services, though specific execution statistics and performance comparisons are not available in current documentation.

Mobile trading capabilities and platform functionality details are not specified in available sources. They likely vary based on the technology offerings of the partnering FCM or RFED. The IB's role typically focuses on advisory services rather than platform development, potentially limiting direct influence over technological user experience.

This ib review shows that trading experience quality depends significantly on the capabilities and infrastructure of the partnering institution, with limited specific performance data available for evaluation.

Trust and Security Analysis

Regulatory compliance represents a key component of the IB model. Sources indicate requirements for full disclosure of customer accounts with FCMs or RFEDs. However, specific regulatory bodies, licensing requirements, and oversight mechanisms are not detailed in accessible documentation, limiting the ability to assess comprehensive regulatory compliance and client protection measures.

Fund security arrangements appear to involve segregation through partnering FCMs or RFEDs rather than direct custody by IBs. This potentially provides institutional-level protection for client assets. However, specific investor protection schemes, insurance coverage, and fund segregation details are not outlined in available sources, requiring direct inquiry with individual IBs for security specifics.

Company transparency and operational disclosure levels are not detailed in accessible information. The IB model's individualized nature potentially results in varying transparency standards between different introducing brokers. The partnership structure with regulated FCMs or RFEDs may provide additional oversight layers, though specific transparency requirements remain unspecified.

Industry reputation and track record information are not available in accessible sources. This reflects the diverse nature of the IB landscape where individual providers may have varying experience levels and market standing. The regulatory requirement for partnership with FCMs or RFEDs suggests baseline compliance standards, but specific reputation metrics are not detailed.

User Experience Analysis

Comprehensive user satisfaction data and experience metrics are not available in accessible sources. This limits the ability to assess overall client satisfaction levels with IB services. The personal nature of IB relationships suggests potential for high satisfaction among clients who value advisory support, though specific feedback data and satisfaction surveys are not detailed in available documentation.

Interface design and usability characteristics are not specified in accessible sources. Platform experience typically depends on the technology infrastructure provided by partnering FCMs or RFEDs rather than IB-specific development. This arrangement may provide access to professional-grade interfaces, but specific usability assessments are not available.

Registration and verification processes are not detailed in available sources. They likely involve coordination between the IB and partnering institution for regulatory compliance and account establishment. The advisory nature of IB services may provide personal guidance during onboarding, though specific process timelines and requirements remain unspecified.

Fund management and operational experience details are not outlined in accessible information. Transaction processing is typically handled by partnering FCMs or RFEDs rather than IBs directly. This structure may provide institutional-level operational capabilities, but specific user experience metrics are not available for assessment.

Common user concerns and feedback patterns are not detailed in available sources. This reflects the limited accessibility of comprehensive user experience data for the IB model overall.

Conclusion

This ib review reveals a business model with inherent strengths in personal advisory services and client education. It's particularly suitable for traders seeking guidance in futures, forex, and commodity options markets. However, the evaluation is constrained by significant information gaps regarding specific operational details, regulatory frameworks, and user experience metrics.

The IB model appears most appropriate for traders who prioritize advisory relationships and educational support over direct platform access and self-directed trading. The partnership structure with FCMs or RFEDs potentially provides institutional-level execution and regulatory compliance while maintaining personal service delivery.

Key limitations include the lack of transparent information about fees, trading conditions, specific regulatory oversight, and comprehensive user feedback. Potential clients should conduct direct consultations with individual IBs to obtain detailed operational information and assess suitability for their specific trading requirements and regulatory circumstances.