Regarding the legitimacy of D prime forex brokers, it provides CYSEC, ASIC, ASIC, VFSC, FSA and WikiBit, (also has a graphic survey regarding security).

Is D prime safe?

Pros

Cons

Is D prime markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 6

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Doo Financial Cyprus Limited

Effective Date:

2024-09-02Email Address of Licensed Institution:

info@doofinancial.euSharing Status:

No SharingWebsite of Licensed Institution:

https://www.doofinancial.eu/Expiration Time:

--Address of Licensed Institution:

D. Vrachimis Building, 2A, 59 Agios Athanasios Avenue 4102 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 263 450Licensed Institution Certified Documents:

ASIC Derivatives Trading License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

DOO INSURANCE BROKER AU PTY LTD

Effective Date:

2003-09-19Email Address of Licensed Institution:

bradhowe@ozemail.com.auSharing Status:

No SharingWebsite of Licensed Institution:

www.novuscapital.com.auExpiration Time:

--Address of Licensed Institution:

'TOWER 1' SE 1302 L 13 475 VICTORIA AVE CHATSWOOD NSW 2067Phone Number of Licensed Institution:

0407204611Licensed Institution Certified Documents:

ASIC Derivatives Trading License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

DOO FINANCIAL AUSTRALIA LIMITED

Effective Date: Change Record

2002-10-21Email Address of Licensed Institution:

compliance@doofinancial.com.auSharing Status:

No SharingWebsite of Licensed Institution:

www.doofinancial.com.auExpiration Time:

--Address of Licensed Institution:

'TOWER 1' SE 1302 L 13 475 VICTORIA AVE CHATSWOOD NSW 2067Phone Number of Licensed Institution:

0429266666Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

D PRIME VANUATU LIMITED

Effective Date:

2023-04-17Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Doo Prime (Seychelles) Limited

Effective Date:

--Email Address of Licensed Institution:

compliance@dooprime.scSharing Status:

No SharingWebsite of Licensed Institution:

https://www.dooprime.com, https://www.dooprime.scExpiration Time:

--Address of Licensed Institution:

Office 5, Unit 2, 2nd Floor, Dekk Complex, Plaisance, Mahé, SeychellesPhone Number of Licensed Institution:

+248 4374076Licensed Institution Certified Documents:

Is Doo Prime A Scam?

Introduction

Doo Prime is a multi-regulated online brokerage firm that has established itself in the forex market since its inception in 2014. With a focus on providing access to a wide array of financial instruments, including forex, commodities, and CFDs, Doo Prime aims to cater to both retail and institutional traders. However, as with any financial service provider, it is crucial for traders to approach with caution and conduct thorough evaluations before committing their capital. The forex market is rife with scams and unreliable brokers, making it imperative for traders to assess the legitimacy and reliability of their chosen broker. This article will utilize a comprehensive investigative approach, combining qualitative assessments and quantitative data, to determine whether Doo Prime is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. A well-regulated broker is typically subject to stringent compliance requirements, which serve to protect traders from fraud and malpractice. Doo Prime is regulated by several reputable authorities, including the UK's Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC), which are known for their strict oversight. Below is a summary of Doo Prime's regulatory information:

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| FCA | 833414 | UK | Verified |

| ASIC | 222650 | Australia | Verified |

| SEC | 8-41551 | USA | Verified |

| FSA | SD 090 | Seychelles | Verified |

| FSC | C119023907 | Mauritius | Verified |

| VFSC | 700238 | Vanuatu | Verified |

Doo Prime's regulation by multiple tier-1 authorities enhances its credibility and ensures that client funds are protected. The FCA, for instance, offers a compensation scheme that protects clients up to £85,000 in the event of broker insolvency. However, it is essential to note that some of the regulatory bodies, such as the VFSC, have less stringent requirements, which may raise concerns regarding the broker's operations in those jurisdictions. Overall, Doo Prime's regulatory framework appears robust, but traders should remain vigilant about the varying levels of protection offered by different regulatory bodies.

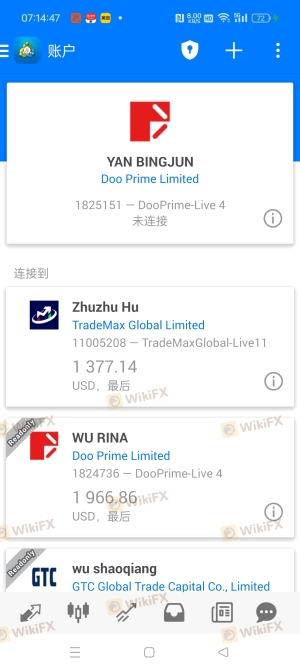

Company Background Investigation

Doo Prime was established in 2014 and is part of the Doo Group, which has a significant presence in the financial services sector. The broker operates under multiple entities, each regulated by different authorities, allowing it to serve a broad clientele across various regions. The management team comprises experienced professionals with backgrounds in finance, technology, and customer service. This diverse expertise contributes to the broker's operational efficiency and client support capabilities.

The company's transparency is reflected in its comprehensive disclosure of regulatory licenses and operational policies. However, some reviews suggest that the broker could improve its communication regarding restrictions on certain jurisdictions, as potential clients have reported difficulties during the registration process. Overall, Doo Prime's background indicates a commitment to providing a secure trading environment, but the level of transparency regarding operational practices could be enhanced.

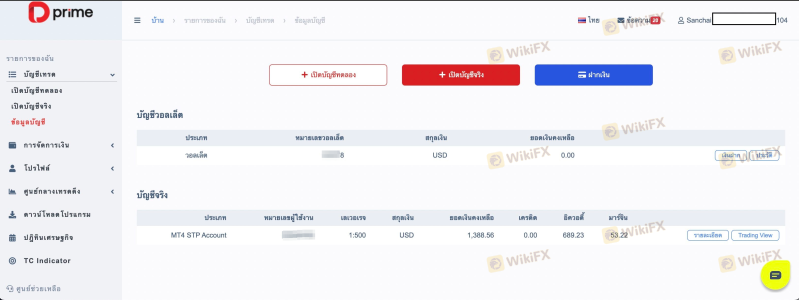

Trading Conditions Analysis

Doo Prime offers a competitive fee structure that appeals to a wide range of traders. The broker provides various account types, including Cent, STP, and ECN accounts, catering to different trading styles and experience levels. Each account type has its own fee structure, with spreads starting as low as 0.0 pips for ECN accounts, while Cent and STP accounts typically have spreads starting from 1 pip. Below is a summary of the core trading costs:

| Fee Type | Doo Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 - 1.0 pips | 1.0 - 2.0 pips |

| Commission Model | $3 - $7 per lot (ECN) | $5 - $10 per lot |

| Overnight Interest Range | Variable | Variable |

While Doo Prime's spreads are competitive, the commission structure for ECN accounts may be a consideration for traders who engage in high-frequency trading. Additionally, the broker does not charge internal fees for deposits and withdrawals, which is a positive aspect compared to many competitors. However, the lack of clarity on certain fees, such as withdrawal fees from third-party providers, may lead to unexpected costs for traders.

Client Fund Security

The security of client funds is paramount in the forex trading environment. Doo Prime implements several measures to ensure the safety of client assets, including segregating client funds from the company's operational funds. These funds are held in reputable banks, such as Barclays, to prevent misuse for business activities. Furthermore, Doo Prime offers negative balance protection, ensuring that traders cannot lose more than their initial deposit, which is crucial given the high leverage options available.

However, Doo Prime does not participate in a compensation scheme like the FCA's Financial Services Compensation Scheme (FSCS), which could be a concern for traders seeking additional layers of protection. Despite this, the broker's commitment to secure fund management and adherence to anti-money laundering (AML) regulations indicates a proactive approach to client safety.

Customer Experience and Complaints

Customer feedback plays a significant role in evaluating a broker's reliability. Many users report positive experiences with Doo Prime, citing the quality of customer support and the diversity of trading instruments available. However, there are also recurring complaints regarding withdrawal processes and account verification issues. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times reported |

| Account Verification Issues | Medium | Inconsistent communication |

| High Spreads | Low | Generally competitive pricing |

Several users have shared experiences of delays in processing withdrawals, which raises concerns about the broker's operational efficiency. Additionally, some clients have reported difficulties in account verification, particularly when attempting to register from restricted jurisdictions. These issues highlight the importance of thorough communication and timely responses from the broker.

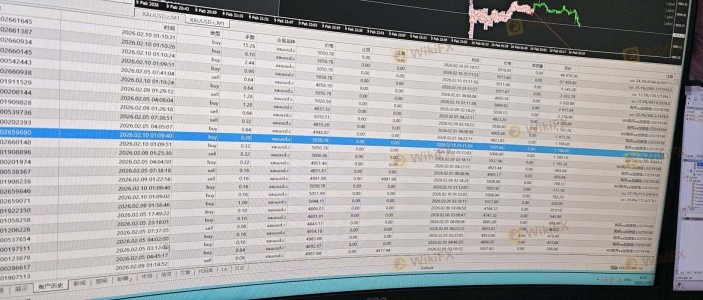

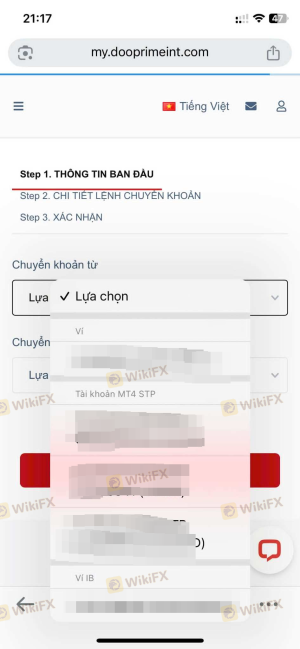

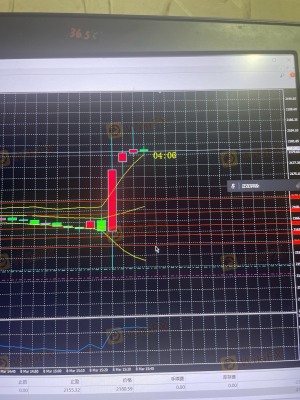

Platform and Execution

Doo Prime offers a range of trading platforms, including the widely recognized MetaTrader 4 and 5, as well as its proprietary platform, Doo Prime Intrade. The platforms are designed to provide a seamless trading experience, with advanced charting tools and fast execution capabilities. However, the quality of order execution can vary, especially during periods of high volatility. Traders have reported instances of slippage and re-quotes, which can impact trading outcomes negatively.

The broker's infrastructure is supported by Equinix data centers, which enhances order execution speed and reliability. Despite this, there have been anecdotal reports of potential platform manipulation, which should be taken into consideration when evaluating the overall trading experience.

Risk Assessment

Using Doo Prime comes with its own set of risks that traders must navigate. While the broker is regulated and offers robust safety measures, the following risk categories should be considered:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Varying levels of regulation across jurisdictions |

| Operational Risk | High | Reports of withdrawal delays and account issues |

| Market Risk | High | High leverage increases potential for significant losses |

To mitigate these risks, traders should conduct thorough research, maintain a diversified portfolio, and utilize risk management strategies such as setting stop-loss orders.

Conclusion and Recommendations

In conclusion, Doo Prime appears to be a legitimate broker with a solid regulatory framework and a commitment to client safety. However, potential traders should be cautious and consider the mixed feedback regarding customer service and withdrawal processes. While there are no clear indications of fraud, the presence of complaints and operational issues warrants careful consideration.

For novice traders or those seeking a reliable broker, exploring alternatives such as IC Markets, Pepperstone, or OANDA may be beneficial, as these brokers have established reputations and offer robust educational resources. Ultimately, traders should assess their individual needs and risk tolerance before making a decision about engaging with Doo Prime or any other brokerage.

Is D prime a scam, or is it legit?

The latest exposure and evaluation content of D prime brokers.

D prime Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

D prime latest industry rating score is 5.08, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.08 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.