Regarding the legitimacy of ATFX forex brokers, it provides ASIC, SFC, FCA, CYSEC, SERC, FSCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is ATFX safe?

Pros

Cons

Is ATFX markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

AT GLOBAL MARKETS (AUSTRALIA) PTY LTD

Effective Date: Change Record

2012-05-02Email Address of Licensed Institution:

compliance@atfx.auSharing Status:

No SharingWebsite of Licensed Institution:

https://www.atfx.com/en-au/Expiration Time:

--Address of Licensed Institution:

'GATEWAY' SE 3302 L 33 1 MACQUARIE PL SYDNEY NSW 2000Phone Number of Licensed Institution:

0292472483Licensed Institution Certified Documents:

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

AT Global Financial Services (HK) Limited

Effective Date:

2024-07-22Email Address of Licensed Institution:

info@atghk.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

香港灣仔軒尼詩道303號11樓1103室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Inst Market Making (MM)

Licensed Entity:

AT Global Markets (UK) Limited

Effective Date:

2017-07-11Email Address of Licensed Institution:

compliance.uk@atfx.comSharing Status:

No SharingWebsite of Licensed Institution:

www.atfxconnect.comExpiration Time:

--Address of Licensed Institution:

ATFX Connect 32 Cornhill London City Of London EC3V 3SG UNITED KINGDOMPhone Number of Licensed Institution:

+442039577777Licensed Institution Certified Documents:

CYSEC Forex Execution License (STP) 21

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

ATFX Global Markets (Cy) Ltd

Effective Date:

2015-12-17Email Address of Licensed Institution:

compliance@atfxgm.euSharing Status:

No SharingWebsite of Licensed Institution:

atfxgm.eu, atfx.eu, www.atfxconnect.com/en-eu/Expiration Time:

--Address of Licensed Institution:

Leontiou A Street, Maryvonne Building, Office 204, 3022 Limassol CyprusPhone Number of Licensed Institution:

+357 25 258 774Licensed Institution Certified Documents:

SERC Derivatives Trading License (EP)

Securities and Exchange Regulator of Cambodia

Securities and Exchange Regulator of Cambodia

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ATFX (Cambodia)

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

#House No F220, Oknha Khou Kimbac Avenue, Phum Khtor, Sangkat Prek Leap, Khan Chroy Changvar, Phnom Penh.Phone Number of Licensed Institution:

089 234 285Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

AT GLOBAL MARKETS SA (PTY) LTD

Effective Date: Change Record

2013-11-12Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

OFFICE 1801B, 18TH FLOORPORTSIDE TOWER4 BREE STREET8001Phone Number of Licensed Institution:

+27021 3003117Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

AT Global Markets (SC) Limited

Effective Date:

--Email Address of Licensed Institution:

cs.sc@atfx.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.atfx.comExpiration Time:

--Address of Licensed Institution:

Block B, Room 6, Global Village, Jivan’s Complex, Mont Fleuri, Mahe, SeychellesPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is ATFX A Scam?

Introduction

ATFX is a global online forex and CFD broker that has been operational since 2014. With its headquarters in London, UK, ATFX positions itself as a reliable trading platform for retail and institutional investors, offering a range of financial instruments including forex, commodities, indices, and cryptocurrencies. Given the rapid growth of online trading, it is paramount for traders to carefully evaluate brokers before committing their capital. This is particularly important in the forex market, where the potential for fraud is significant due to the lack of regulation in some jurisdictions.

In this article, we will conduct a thorough investigation into ATFX, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety measures. We will utilize a structured evaluation framework that incorporates both qualitative and quantitative analyses to provide a comprehensive overview of whether ATFX is a legitimate broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most significant factors that determine its legitimacy and safety. ATFX is regulated by several respected authorities, which adds a layer of security for its clients. Below is a summary of ATFX's regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| FCA | 760555 | United Kingdom | Verified |

| CySEC | 285/15 | Cyprus | Verified |

| ASIC | 418036 | Australia | Verified |

| FSC | C118023331 | Mauritius | Verified |

| FSA | SD 093 | Seychelles | Verified |

ATFX's regulation by the Financial Conduct Authority (FCA) in the UK is particularly noteworthy, as the FCA is known for its strict oversight and consumer protection policies. This includes requirements for client fund segregation and participation in compensation schemes, such as the Financial Services Compensation Scheme (FSCS), which protects clients up to £85,000 in the event of broker insolvency.

Additionally, ATFX is compliant with the Markets in Financial Instruments Directive (MiFID), which allows it to operate across the European Economic Area (EEA). The presence of multiple regulatory licenses from tier-1 authorities indicates that ATFX adheres to high standards of financial conduct. Historically, ATFX has maintained a clean compliance record without any major regulatory breaches, further solidifying its reputation as a reliable broker.

Company Background Investigation

ATFX was established under the name Positiva Markets (CY) Ltd. before rebranding in 2017. The company has since expanded its operations globally, with offices in various regions including Europe, Asia, and the Middle East. The ownership structure of ATFX includes several subsidiaries, each regulated in their respective jurisdictions, which enhances its operational credibility.

The management team at ATFX comprises professionals with extensive experience in the financial services sector, many of whom have held senior positions in well-known financial institutions. This expertise contributes to the company's strategic direction and operational integrity. Transparency is a key aspect of ATFX's operations; the broker provides detailed information about its services, regulatory compliance, and trading conditions on its website.

ATFX also emphasizes its commitment to client education and support, offering various resources such as webinars, market analysis, and trading strategies. This level of transparency and dedication to client service is indicative of a broker that prioritizes its users' needs and fosters a trustworthy trading environment.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial. ATFX offers competitive trading conditions, but it's essential to dissect its fee structure and any potential hidden costs. The following table outlines the core trading costs associated with ATFX:

| Fee Type | ATFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 0.5 pips | From 0.2 pips |

| Commission Model | $3 per lot (Edge Account) | Varies by broker |

| Overnight Interest Range | Varies | Varies |

ATFX operates on a commission-free model for its standard accounts, which may appeal to beginners. However, the spreads can be higher than the industry average, particularly for its standard account, which starts at 1.2 pips. For more experienced traders, the Edge and Premium accounts offer tighter spreads, but they come with a minimum deposit requirement of $5,000 and $10,000, respectively.

While ATFX does not impose deposit fees, it charges a withdrawal fee of $5 for amounts less than $100, which is not uncommon in the industry. Additionally, the broker has an inactivity fee policy, charging €10 or 20% of the remaining balance after 12 months of inactivity. This fee structure is relatively standard but should be considered by traders who may not be active.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. ATFX employs several measures to ensure the security of its clients' capital. The broker segregates client funds from its operational funds, holding them in accounts with reputable banks such as Barclays. This practice is critical in protecting client assets in the event of financial difficulties faced by the broker.

Furthermore, ATFX offers negative balance protection for retail clients, which means that clients cannot lose more than their deposited amount, even in volatile market conditions. This policy is particularly important in the forex market, where leverage can amplify losses.

The broker's participation in investor compensation schemes, such as the FSCS in the UK and the Investor Compensation Fund in Cyprus, provides an additional layer of security, ensuring that clients can recover a portion of their funds in the unlikely event of broker insolvency.

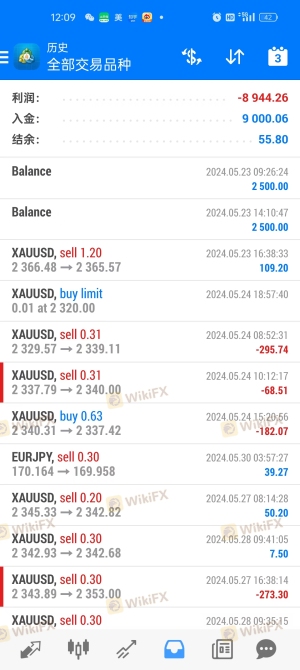

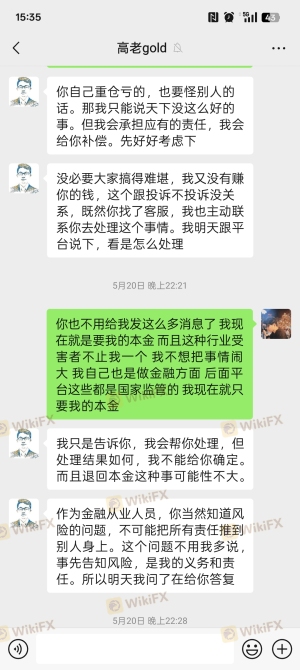

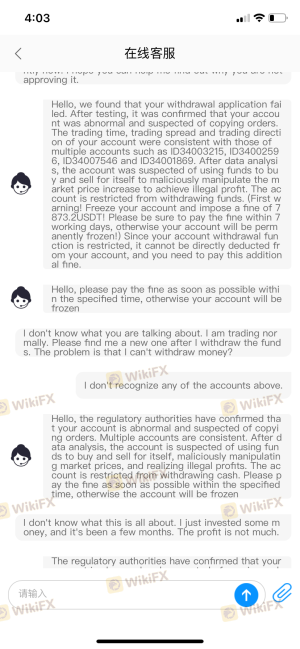

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. ATFX generally receives positive reviews for its customer service and trading conditions. However, like any broker, it is not immune to complaints. Common issues reported by clients include slow withdrawal processing times and difficulties in reaching customer support during peak hours.

The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Generally responsive |

| Customer Support Availability | High | Mixed reviews |

| Account Verification Issues | Low | Usually resolved quickly |

For instance, one common issue involves clients experiencing delays in withdrawals, particularly when using bank transfers. However, ATFX's customer support team is noted for being responsive and helpful in resolving such issues, often providing updates and assistance throughout the process.

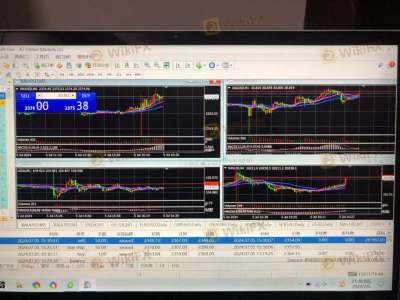

Platform and Trade Execution

ATFX primarily utilizes the MetaTrader 4 (MT4) platform, which is widely regarded for its user-friendly interface and robust trading capabilities. The platform supports various trading tools, including technical indicators and automated trading via Expert Advisors (EAs). User feedback indicates that the platform is stable and efficient, although some users have reported occasional slippage during high volatility periods.

ATFX claims to operate on a Straight Through Processing (STP) model, which minimizes the risk of order manipulation. However, there have been anecdotal reports of execution delays, particularly during major market events. This highlights the importance of evaluating execution quality, as delays can significantly impact trading outcomes.

Risk Assessment

Using ATFX presents various risks, which should be carefully evaluated by potential clients. Below is a summary of key risk areas associated with trading with ATFX:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight |

| Market Risk | High | High volatility in forex trading |

| Operational Risk | Medium | Potential for execution delays |

| Withdrawal Risk | Medium | Occasional delays reported |

To mitigate these risks, traders are advised to employ sound risk management strategies, such as setting stop-loss orders and avoiding over-leveraging. Additionally, conducting thorough research and utilizing demo accounts can help traders familiarize themselves with the platform and trading conditions before committing real capital.

Conclusion and Recommendations

In conclusion, ATFX appears to be a legitimate broker with robust regulatory oversight and a commitment to client safety. The presence of multiple licenses from reputable authorities, combined with effective fund protection measures, indicates that ATFX is a trustworthy option for traders. However, potential clients should be aware of the relatively high spreads on standard accounts and the possibility of withdrawal delays.

For traders seeking a reliable forex broker, ATFX is a viable choice, particularly for those who value regulatory security and a solid trading platform. However, it may be worth considering alternatives such as IG Markets or OANDA, which may offer more competitive trading conditions and a wider range of services.

Ultimately, as with any financial decision, it is essential for traders to conduct their own due diligence and assess their individual trading needs before selecting a broker.

Is ATFX a scam, or is it legit?

The latest exposure and evaluation content of ATFX brokers.

ATFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ATFX latest industry rating score is 7.99, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.99 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.