Regarding the legitimacy of ThinkMarkets forex brokers, it provides ASIC, FCA, CYSEC, FSCA, FSA, FSA and WikiBit, (also has a graphic survey regarding security).

Is ThinkMarkets safe?

Pros

Cons

Is ThinkMarkets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

TF GLOBAL MARKETS (AUST) PTY LTD

Effective Date: Change Record

2012-09-18Email Address of Licensed Institution:

responsiblemanager@thinkmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.thinkforex.comExpiration Time:

--Address of Licensed Institution:

L 14 333 COLLINS ST MELBOURNE VIC 3000Phone Number of Licensed Institution:

390933400Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

TF Global Markets (UK) Limited

Effective Date:

2015-01-23Email Address of Licensed Institution:

compliance@thinkmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.thinkmarkets.com/ukExpiration Time:

--Address of Licensed Institution:

G07 New Broad Street House 35 New Broad Street London City Of London EC2M 1NH UNITED KINGDOMPhone Number of Licensed Institution:

+4402038295421Licensed Institution Certified Documents:

CYSEC Forex Execution License (STP) 17

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

TF Global Markets (Europe) Ltd

Effective Date:

2013-09-20Email Address of Licensed Institution:

compliance.eu@thinkmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.thinkmarkets.com/europe, www.thinkmarkets.com, www.thinkmarkets.com/eu, https://www.thinkmarkets.com/es/, https://www.thinkmarkets.com/pl, https://www.thinkmarkets.com/de/, https://www.thinkmarkets.com/it/, https://www.thinkmarkets.com/cz/, https://www.thinkmarkets.com/gr/Expiration Time:

--Address of Licensed Institution:

Office 301, 3rd Floor, Pamelva Court (at the corner of Griva Digheni 1 and Anastasi Shoukri 2, Streets), 3105 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 262 143Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

TF GLOBAL MARKETS (SOUTH AFRICA) (PTY) LTD

Effective Date:

2019-02-05Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

THE CAMPUS 57 SLOANE STREET BRYANSTON 2191Phone Number of Licensed Institution:

010 8800273Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

TF Global Markets Int Ltd

Effective Date:

--Email Address of Licensed Institution:

compliance@thinkmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

CT House, Office 9B, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+442038295421, +248 4373952Licensed Institution Certified Documents:

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

あさひマーケッツ株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都港区赤坂二丁目13番1号ルーセント赤坂3階Phone Number of Licensed Institution:

03-3320-7111Licensed Institution Certified Documents:

Is ThinkMarkets A Scam?

Introduction

ThinkMarkets is a global online trading broker established in 2010, offering a wide range of financial instruments, including forex, CFDs, cryptocurrencies, and commodities. With its headquarters in Australia and additional offices in the UK, South Africa, and other regions, ThinkMarkets positions itself as a reputable player in the forex market. Given the complexities and risks associated with forex trading, it is crucial for traders to assess the legitimacy and reliability of their chosen brokers carefully. This article aims to provide a comprehensive evaluation of ThinkMarkets, focusing on its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk profile. The analysis is based on data gathered from multiple credible sources, including regulatory bodies and user reviews, ensuring a balanced perspective on whether ThinkMarkets is a scam or a trustworthy broker.

Regulation and Legitimacy

Regulation is a key factor in determining the safety and reliability of a trading broker. ThinkMarkets is regulated by several top-tier financial authorities, which adds to its credibility. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| FCA | 629628 | UK | Verified |

| ASIC | 424700 | Australia | Verified |

| FSCA | 49835 | South Africa | Verified |

| CySEC | 215/13 | Cyprus | Verified |

| DFSA | N/A | UAE | Verified |

The presence of multiple regulatory licenses from reputable authorities such as the FCA (Financial Conduct Authority) in the UK and ASIC (Australian Securities and Investments Commission) in Australia indicates that ThinkMarkets adheres to strict operational standards and practices. These regulators enforce rules that protect client funds, ensure fair trading practices, and promote transparency.

ThinkMarkets has maintained a strong compliance record since its inception, reflecting its commitment to regulatory requirements. The broker segregates client funds from its operational funds, keeping them in top-tier banks, which enhances the security of client assets. Additionally, regulatory oversight provides a framework for dispute resolution, allowing traders to seek recourse through regulatory channels if issues arise.

Company Background Investigation

ThinkMarkets, originally known as Think Forex, was founded to enhance the trading experience by providing cutting-edge technology and a secure trading environment. Over the years, the broker has expanded its operations globally, establishing a strong presence in various financial markets. The ownership structure of ThinkMarkets is transparent, with its parent company, TF Global Markets Pty Ltd, being registered in Australia and regulated by ASIC.

The management team at ThinkMarkets comprises seasoned professionals with extensive experience in the financial services industry. Their expertise contributes to the broker's strategic direction and operational efficiency. The company's commitment to transparency is evident through its regular publication of financial reports and updates on regulatory compliance.

Moreover, ThinkMarkets prioritizes customer education and support, offering a wealth of resources to help traders navigate the complexities of the financial markets. This focus on transparency and client education further solidifies ThinkMarkets' reputation as a legitimate broker.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. ThinkMarkets offers competitive trading fees and various account types to cater to different trading styles. Below is a summary of the core trading costs associated with ThinkMarkets:

| Cost Type | ThinkMarkets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 0.0 pips | From 0.2 pips |

| Commission Model | Varies by account type | Varies widely |

| Overnight Interest Range | Varies by position | Varies widely |

ThinkMarkets provides two primary account types: the Standard account and the Think Zero account. The Standard account typically offers commission-free trading with wider spreads, making it suitable for novice traders. In contrast, the Think Zero account is designed for more experienced traders, offering tighter spreads but charging a commission per trade.

While the overall fee structure is competitive, traders should be aware of any potential hidden fees, such as inactivity fees or withdrawal charges, which could impact their trading costs. It is advisable for traders to review the fee schedule carefully and consider their trading frequency to select the most appropriate account type.

Customer Fund Security

The security of customer funds is paramount when choosing a broker. ThinkMarkets implements robust measures to safeguard client assets. The broker segregates client funds from its own operational funds, ensuring that traders' money is protected even in the event of financial difficulties faced by the broker.

In addition to fund segregation, ThinkMarkets offers negative balance protection, which prevents clients from losing more than their initial deposit. This feature is particularly beneficial for traders dealing with high volatility in the forex market.

Historically, ThinkMarkets has not faced significant security issues or controversies related to client funds. The broker's adherence to strict regulatory standards further reinforces its commitment to protecting customer assets.

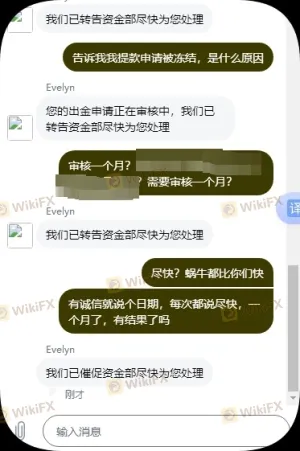

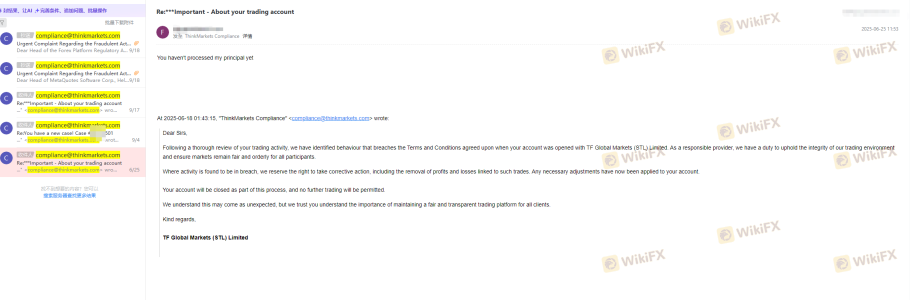

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability. Overall, user reviews of ThinkMarkets are generally positive, highlighting the broker's competitive trading conditions and responsive customer support. However, as with any broker, some complaints have been noted.

Common complaints include issues related to withdrawal processing times and occasional delays in customer service responses. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| Customer Support Response | Moderate | Generally responsive |

| Platform Stability Issues | Low | Ongoing improvements |

One notable case involved a trader experiencing delays in fund withdrawals. The issue was resolved after the trader contacted customer support, which highlights the importance of maintaining open lines of communication with the broker.

Platform and Execution

The trading platforms offered by ThinkMarkets, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the proprietary ThinkTrader platform, are designed to provide a seamless trading experience. Users generally report high levels of satisfaction with the platform's performance, stability, and user interface.

Order execution quality is a critical aspect of trading, and ThinkMarkets has received positive feedback in this area. Traders report minimal slippage and a low rate of rejected orders, indicating that the broker effectively manages order execution. However, as with any trading platform, occasional technical issues can occur, particularly during periods of high market volatility.

Risk Assessment

While ThinkMarkets is a regulated broker with a solid reputation, potential traders should be aware of the inherent risks associated with forex trading. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight |

| Market Risk | High | High volatility in forex markets |

| Operational Risk | Medium | Occasional technical issues |

| Customer Service Risk | Medium | Some complaints about support response |

To mitigate these risks, traders should consider implementing effective risk management strategies, such as setting stop-loss orders and avoiding excessive leverage. Additionally, conducting thorough research and staying informed about market trends can help traders make informed decisions.

Conclusion and Recommendations

In conclusion, ThinkMarkets is not a scam; it is a legitimate broker with multiple regulatory licenses and a solid reputation in the forex market. The broker's commitment to transparency, client fund security, and competitive trading conditions makes it a viable option for traders.

However, potential clients should remain aware of the inherent risks associated with trading and carefully evaluate their individual trading goals and risk tolerance. For novice traders, ThinkMarkets' user-friendly platforms and educational resources can provide valuable support. Experienced traders seeking tighter spreads and lower commissions may find the Think Zero account appealing.

For those looking for alternatives, brokers such as IG, OANDA, or Pepperstone may also be worth considering, as they offer competitive trading conditions and strong regulatory oversight. Ultimately, the decision to trade with ThinkMarkets should be based on a thorough assessment of personal trading needs and preferences.

Is ThinkMarkets a scam, or is it legit?

The latest exposure and evaluation content of ThinkMarkets brokers.

ThinkMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ThinkMarkets latest industry rating score is 7.75, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.75 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.