Libertex Review 79

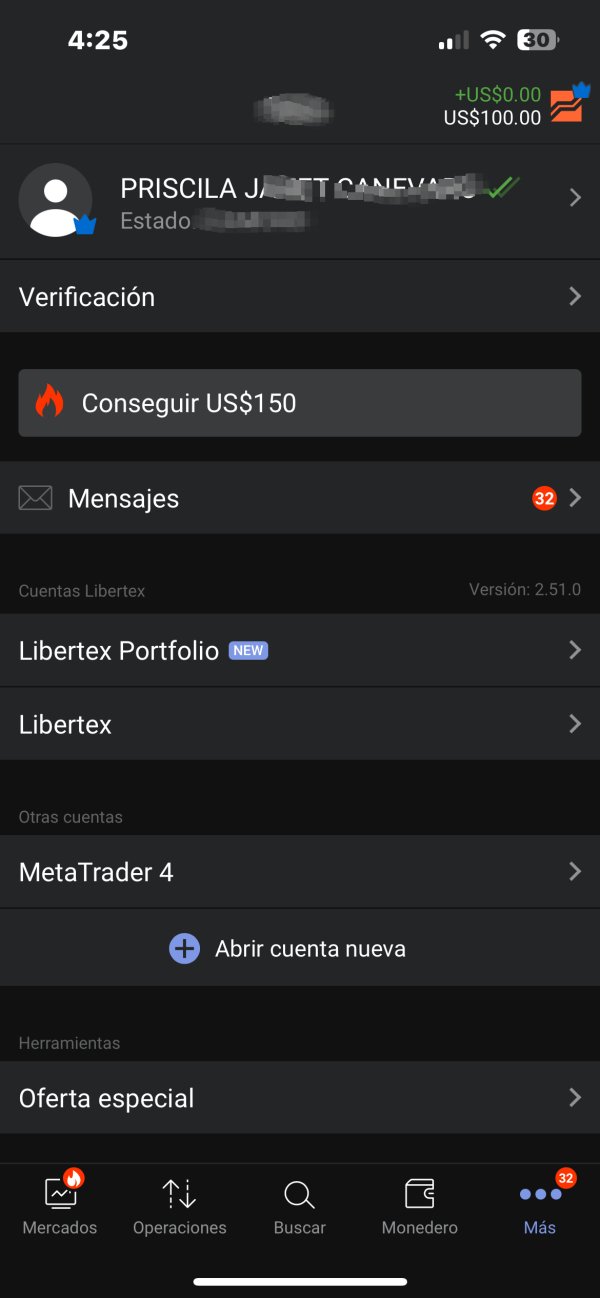

They promised me a $200 real money bonus, which never arrived. It's as if they invited me to appear.

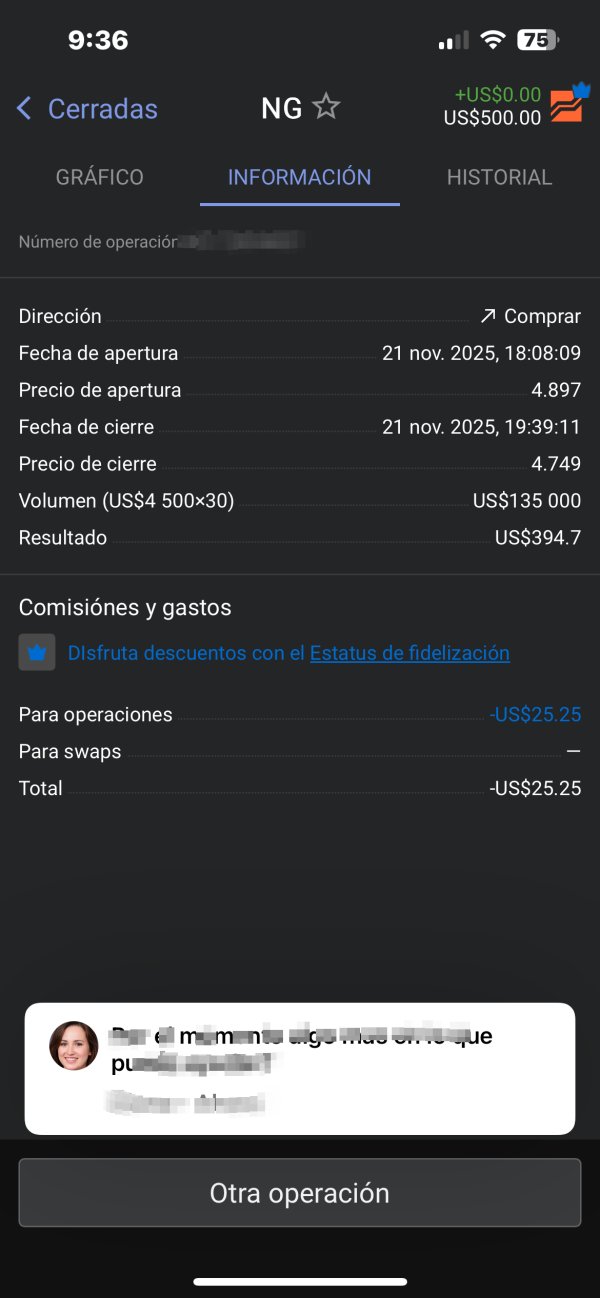

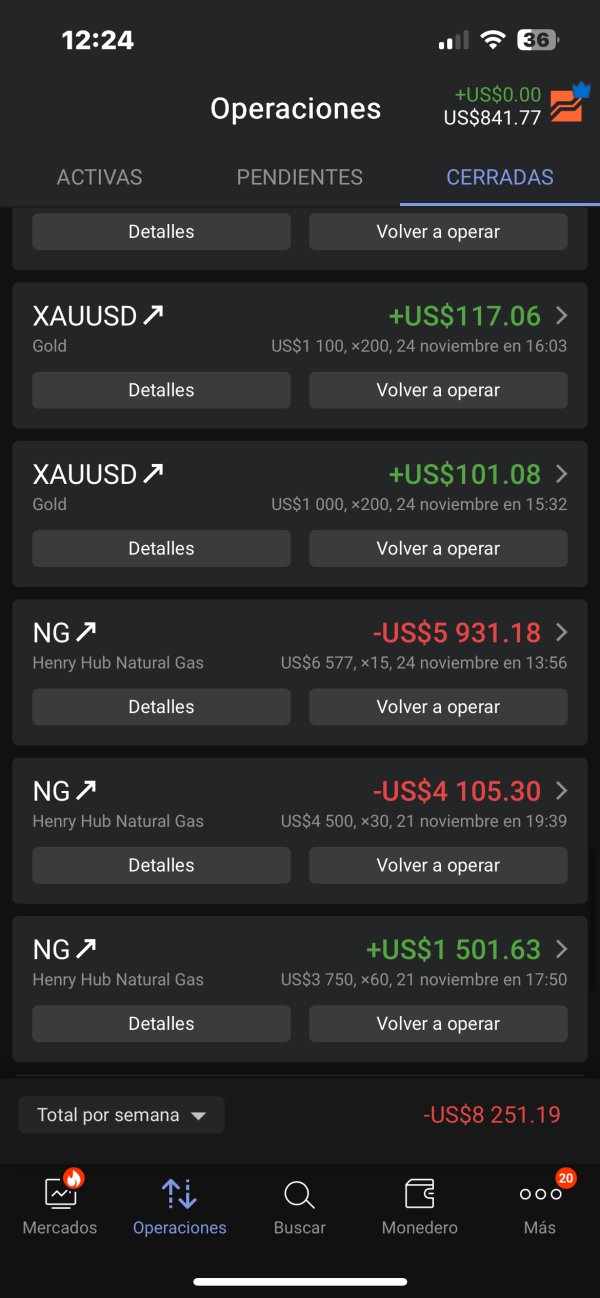

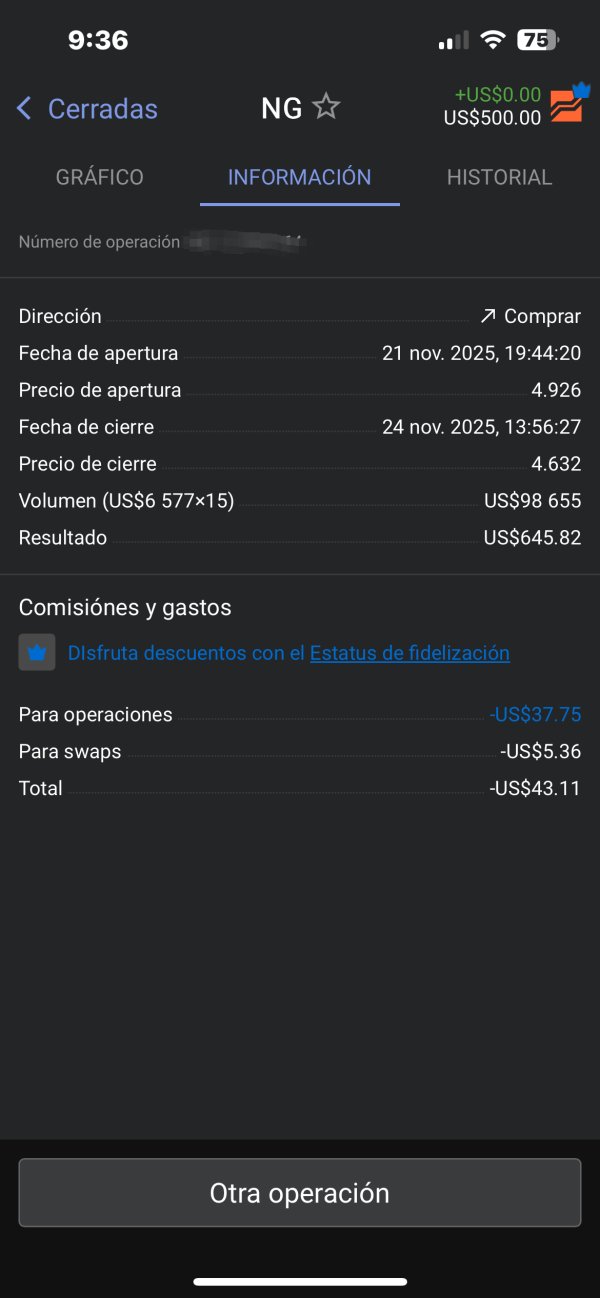

More than 20 days ago, I was scammed and extorted by a Libertex advisor who caused me to lose $10,000 due to a 100% guided trade. After the first loss, he made me take out an urgent loan during the call, guaranteeing that I would recover my capital. Shaking and unable to react, I agreed and lost everything!!!! Libertex still hasn't given me an answer!!!!!

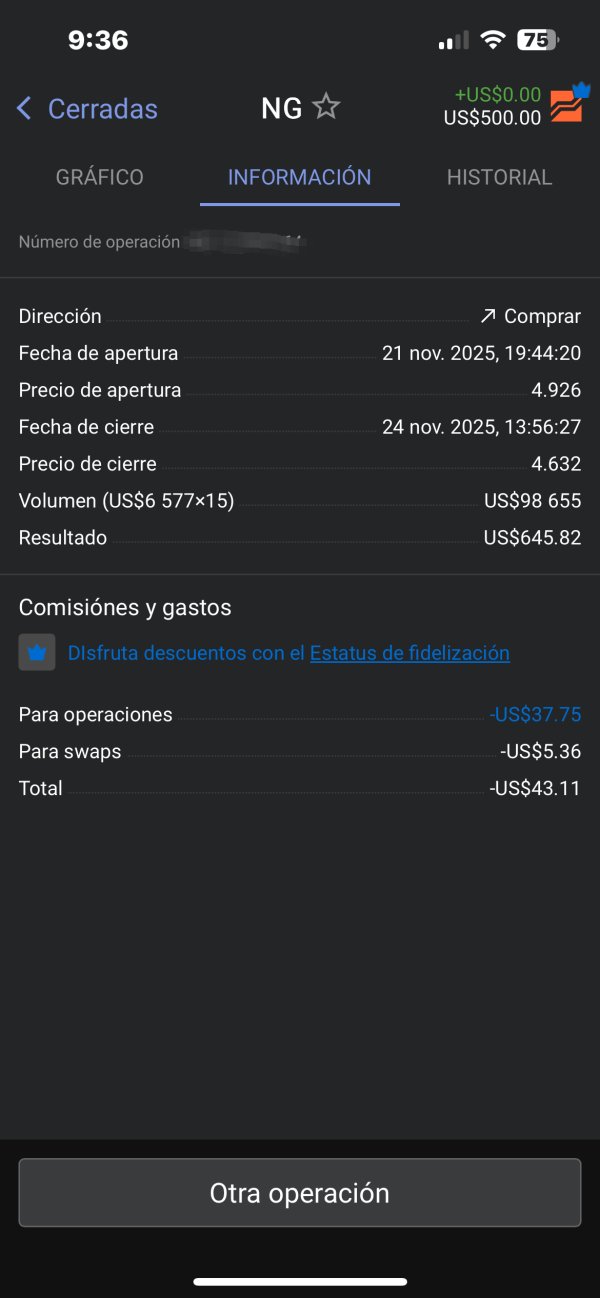

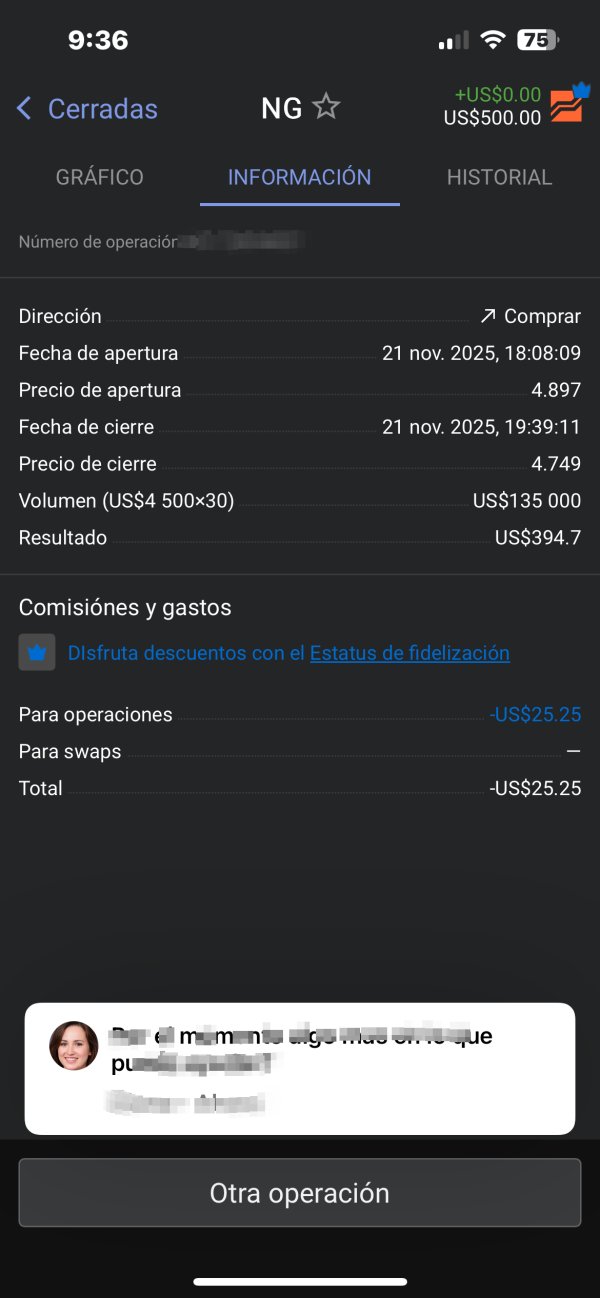

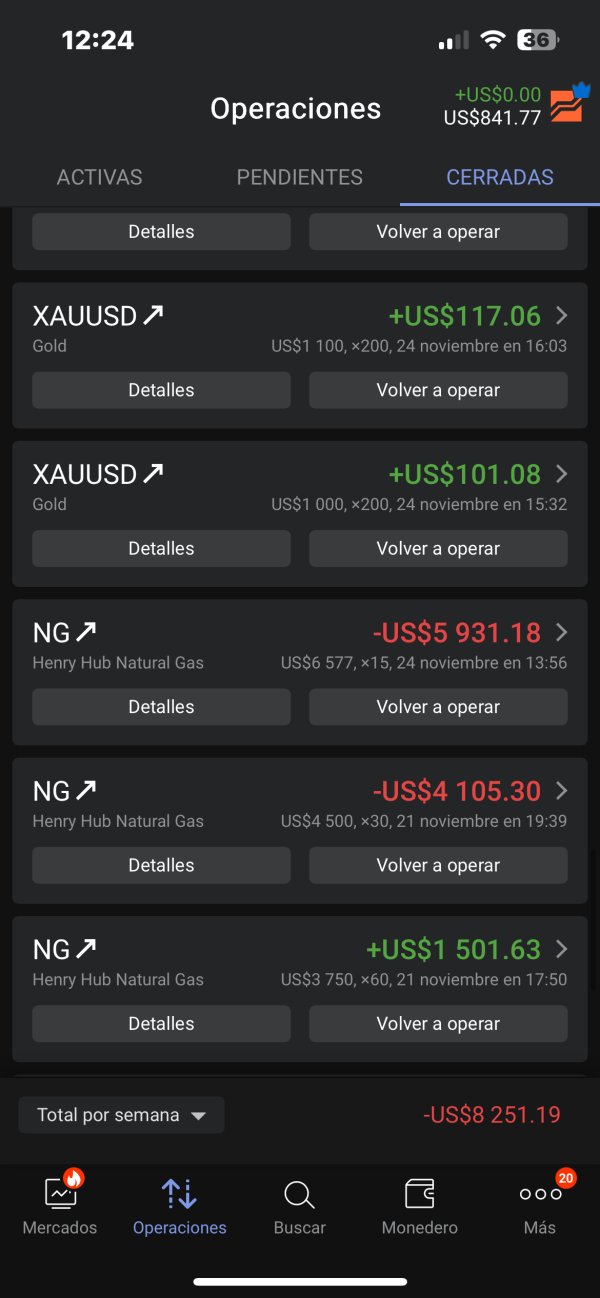

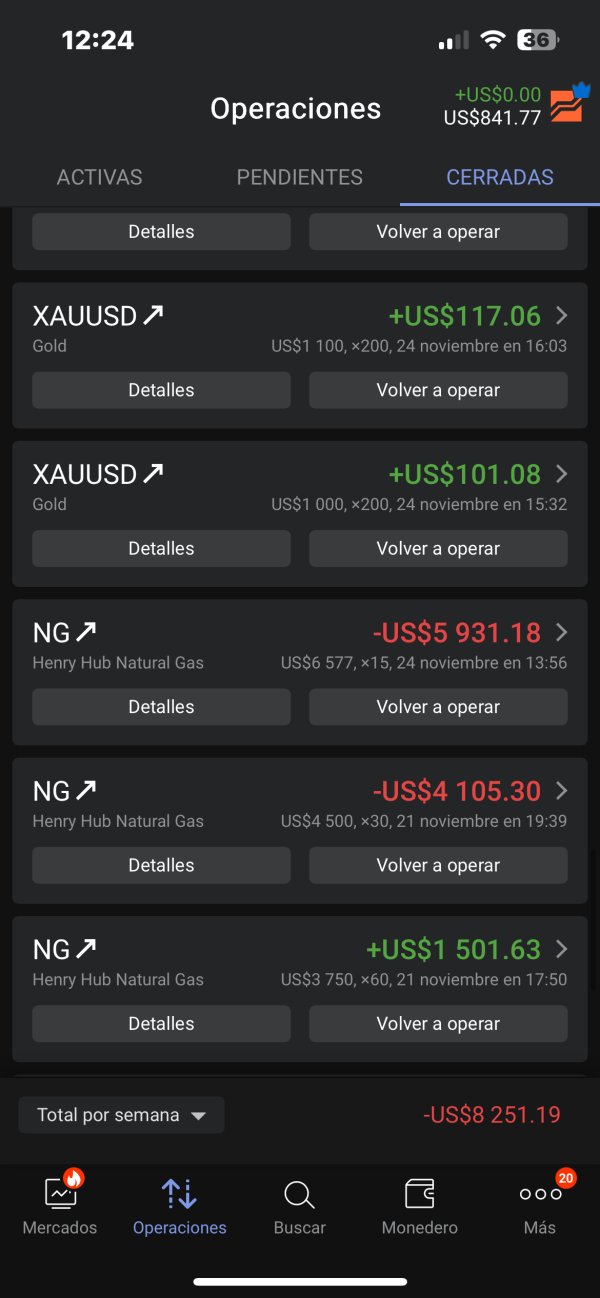

I was scammed in a phone call, they made me lose all my savings, and in desperation, Cristian told me to get the same amount from wherever I could to save the operation, assuring me that I would recover my capital, which was lost 100%, just like the loan! They left me ruined and in debt! I am begging you to investigate the calls from 11/21, and I still have no response! I am desperate!

libertex an application with poor regulation on the charts and in demo it's the same and I think it also has a way to cheat because I have everything fine and it crashes so I wouldn't put my money on this platform and it no longer makes the stop in the trades so no longer I know that mine is for practice but it's not the Broker

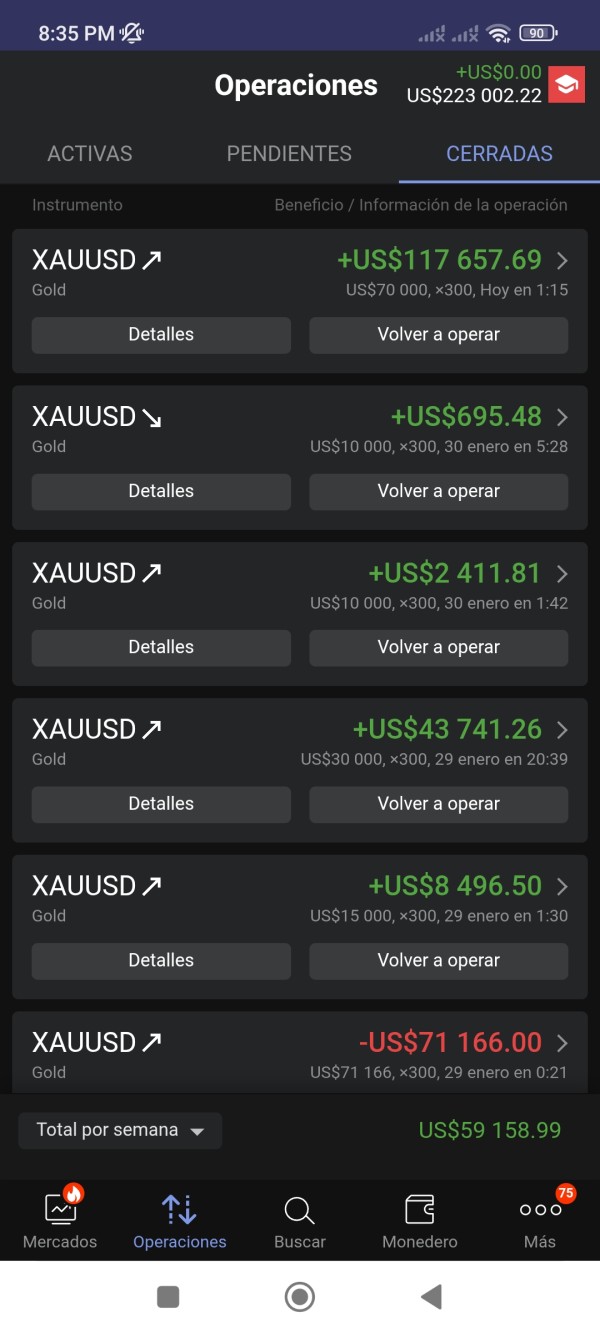

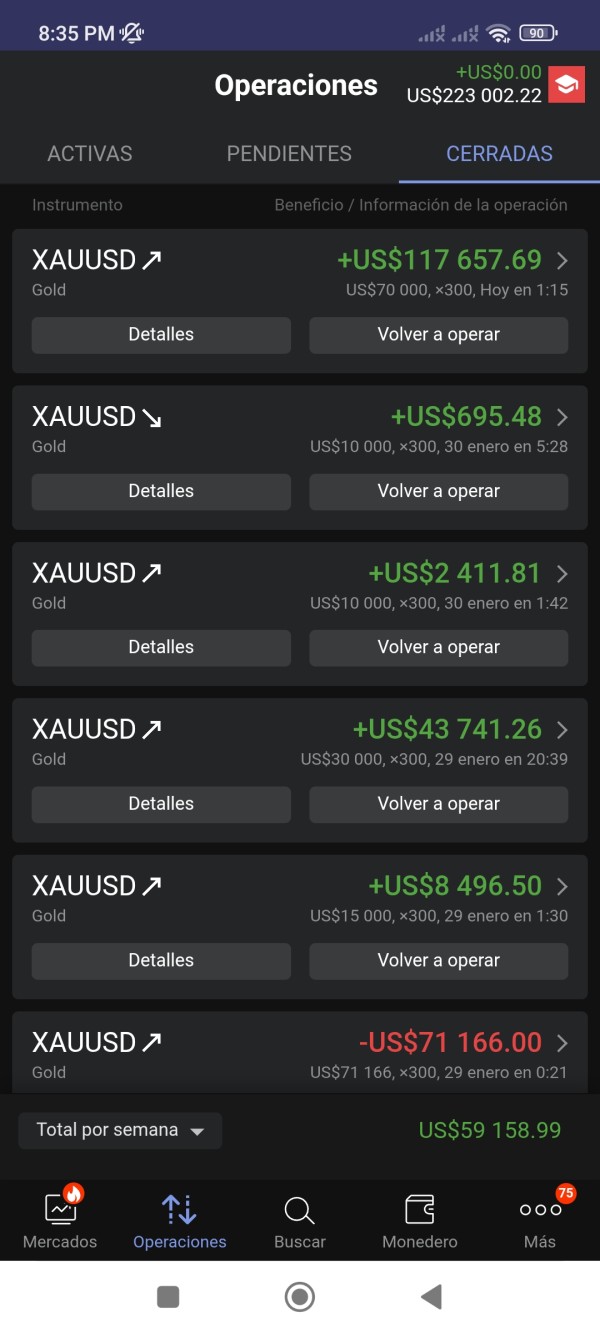

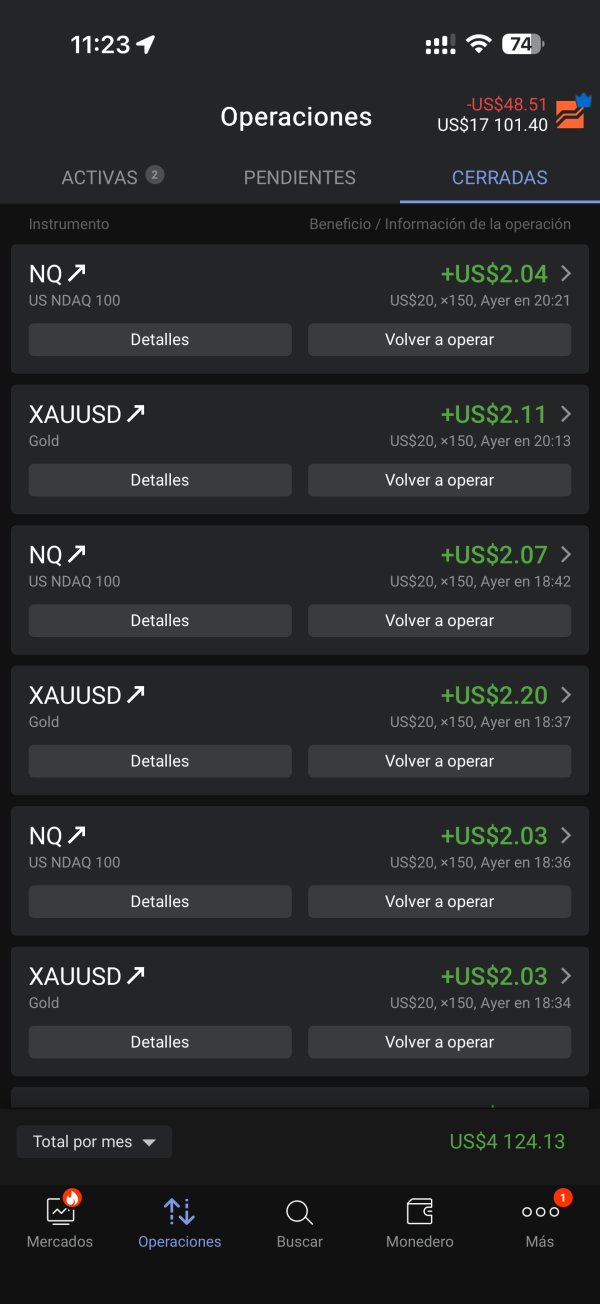

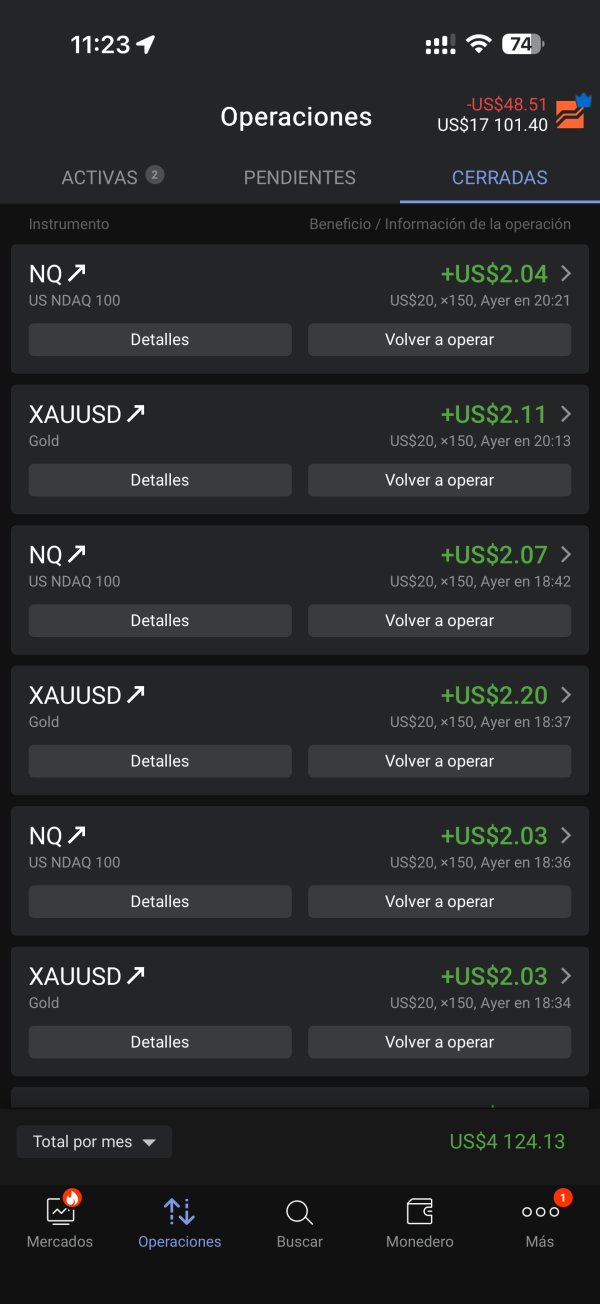

my experience with Libertex has been very good. What happens with the people who comment negatively is because they have no experience in trading and let themselves be guided by people who only earn based on what you deposit or lose, but if you really trade with your knowledge, the platform is excellent and they don't cause problems for withdrawals as they say. It's obvious that there must be an authentication process, but that's a one-time thing because that's security. I think it's good. And on the other hand, if you want to deposit money and have others perform miracles for you, it's difficult. In trading, you must learn individually, and for that, there are demo accounts to practice if you are not sure how to trade or what trading to do. But if you do it because others tell you what to do, you are wrong. In general, the platform, the Broker is very good. I have never had problems and I have been trading on it for 8 years. I attach the image, you can see the profits from the last month.

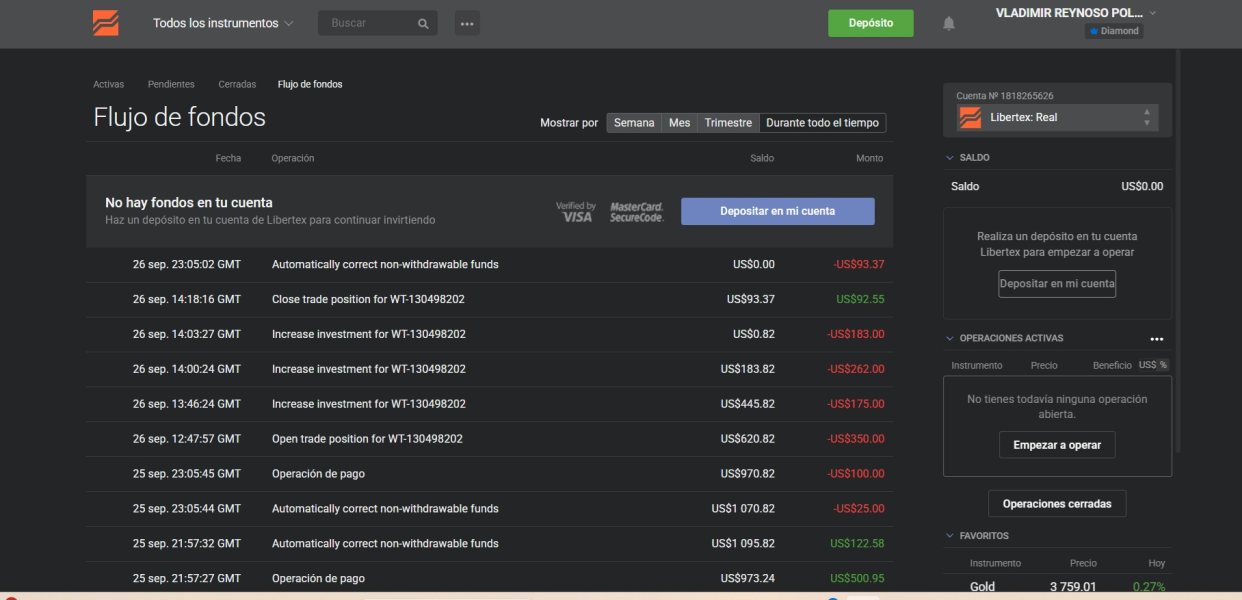

I had a bad experience with that broker. Their advisors harass you with calls, promising you guaranteed returns if you follow their advice, but in the end they lead you to total loss. They earn from what you lose, so be very careful with this. If you don't want to lose your money, don't trust that broker. I am attaching crude oil trades guided by them via telephone and total loss of the account.

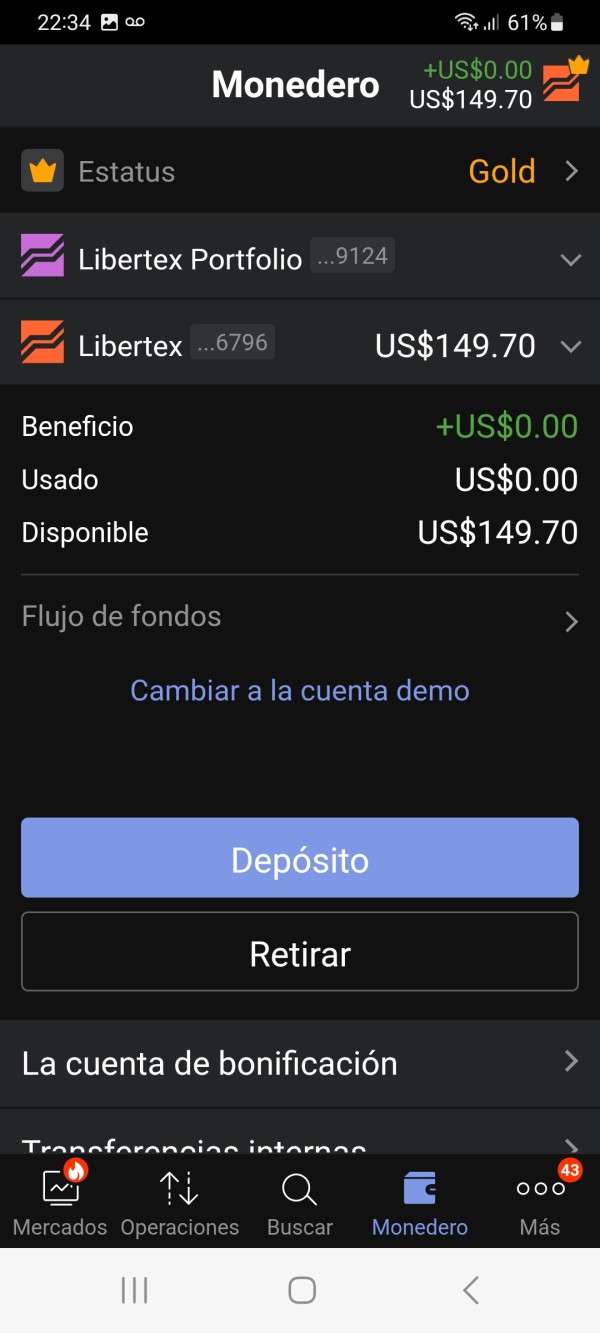

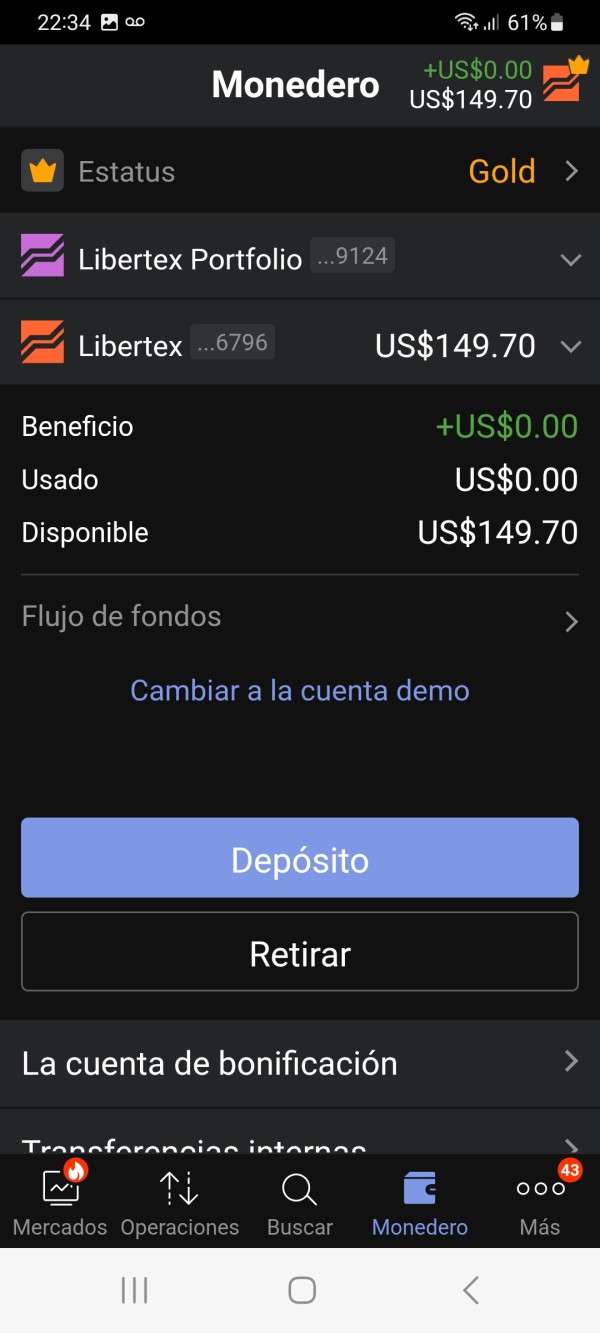

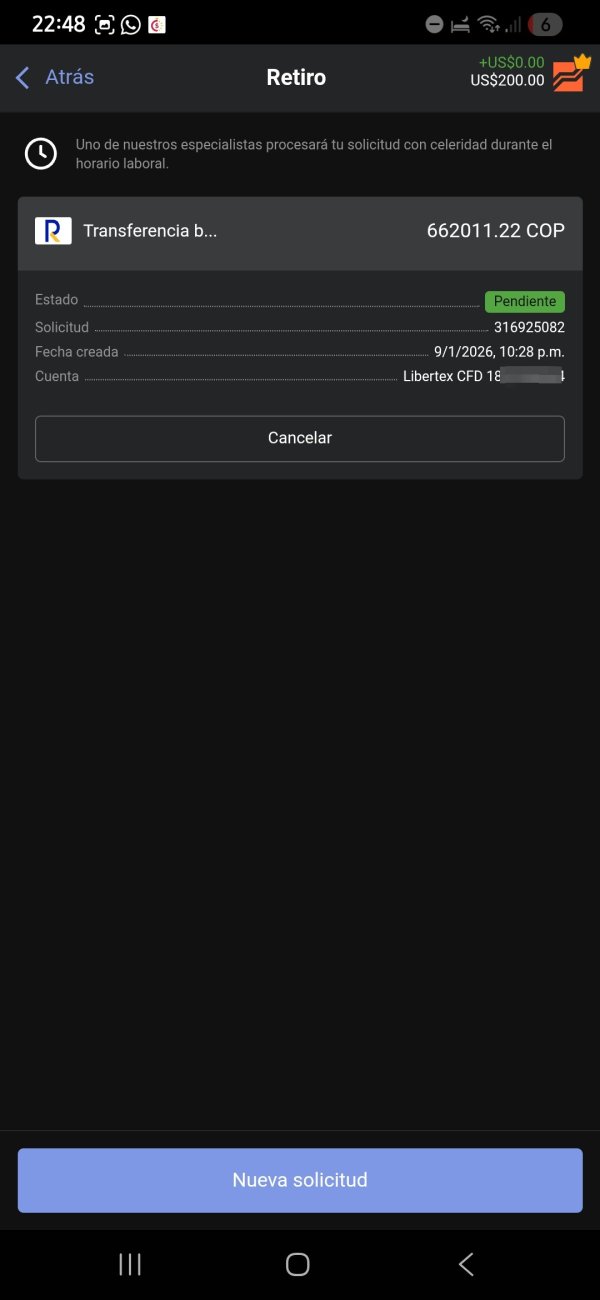

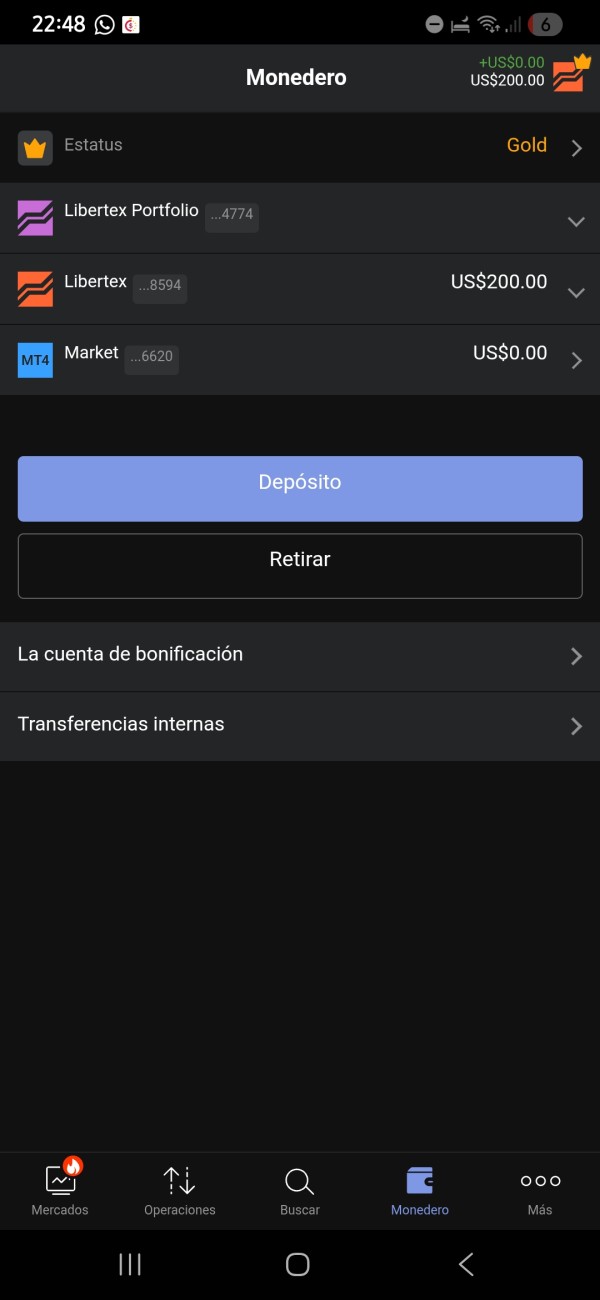

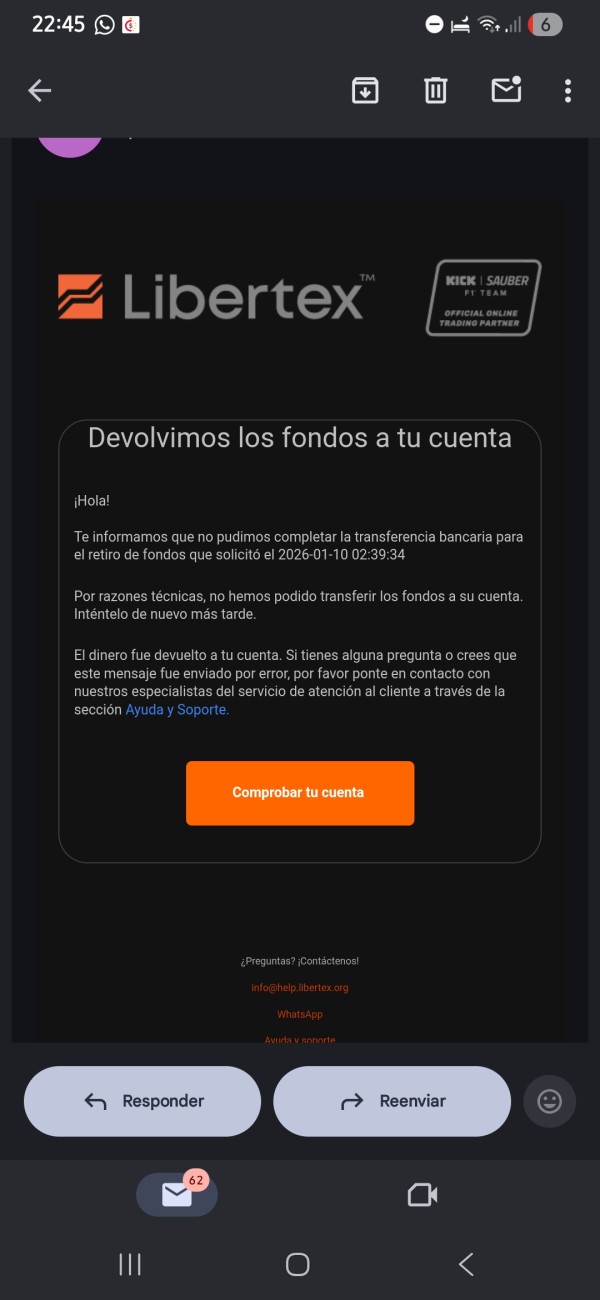

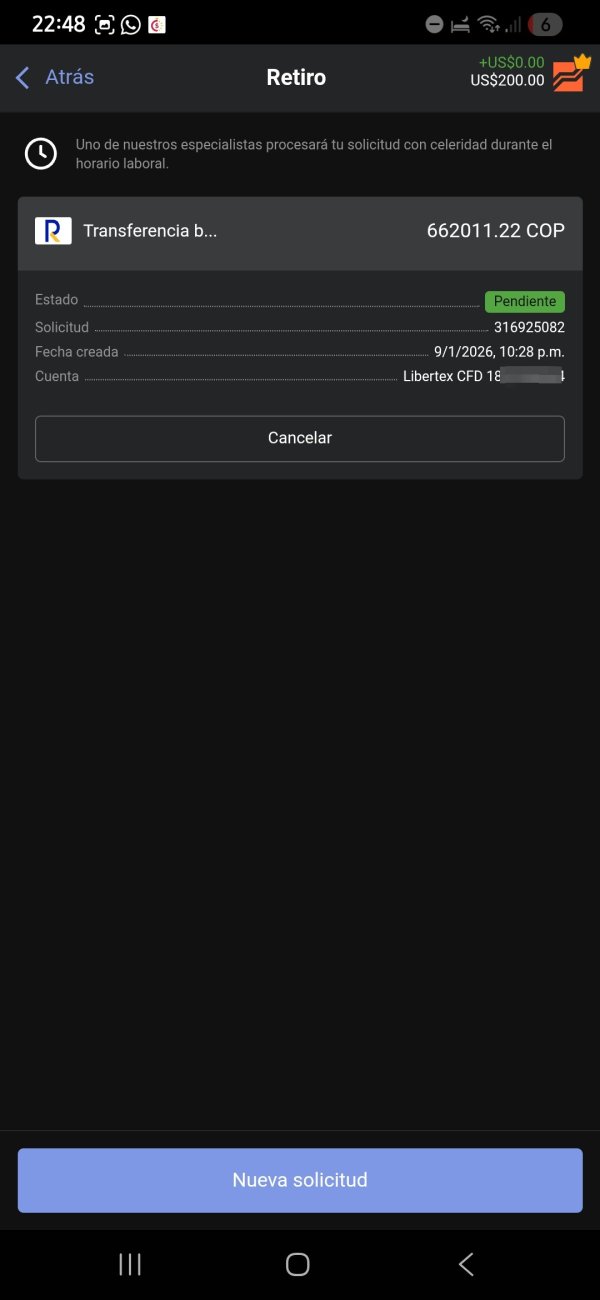

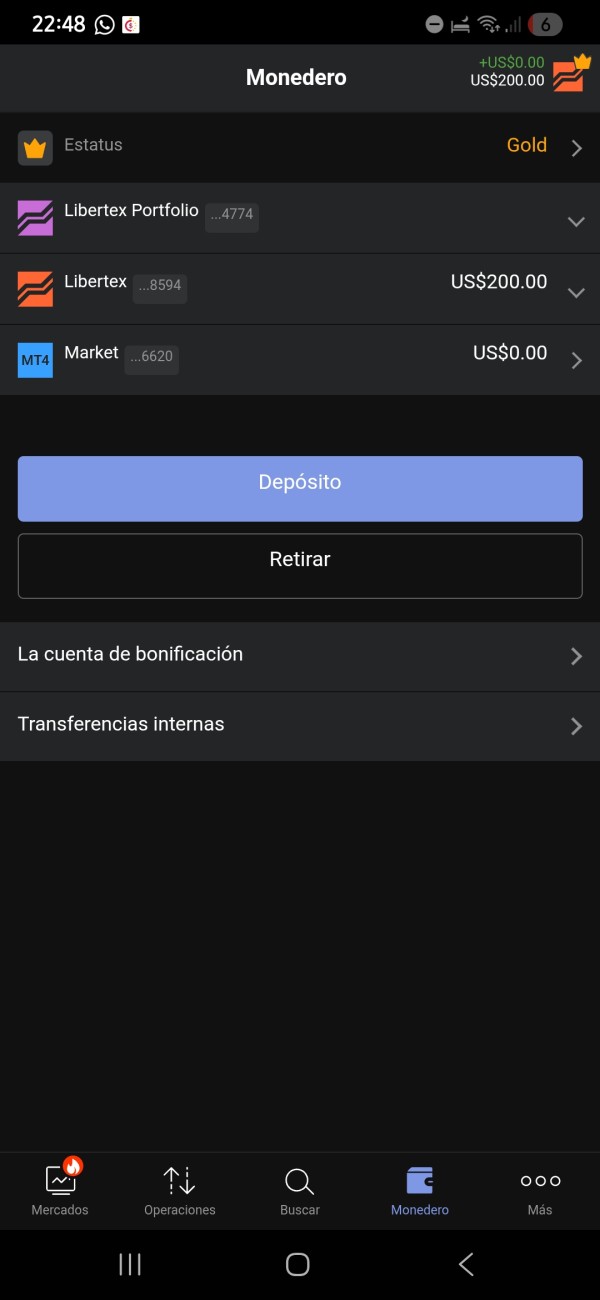

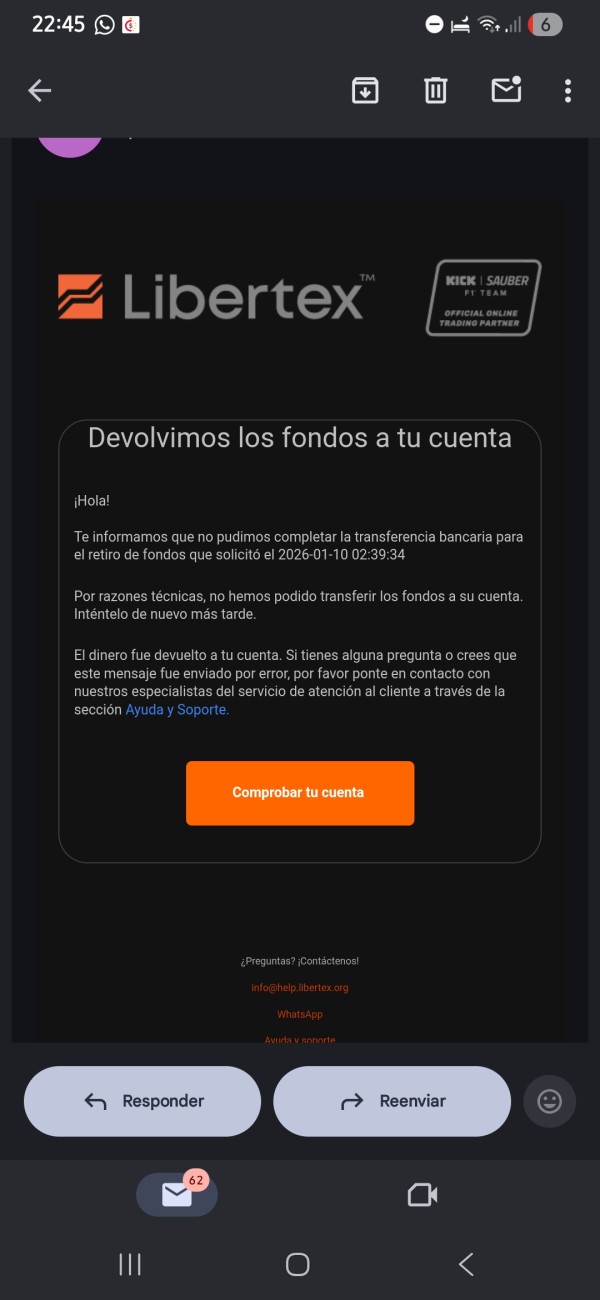

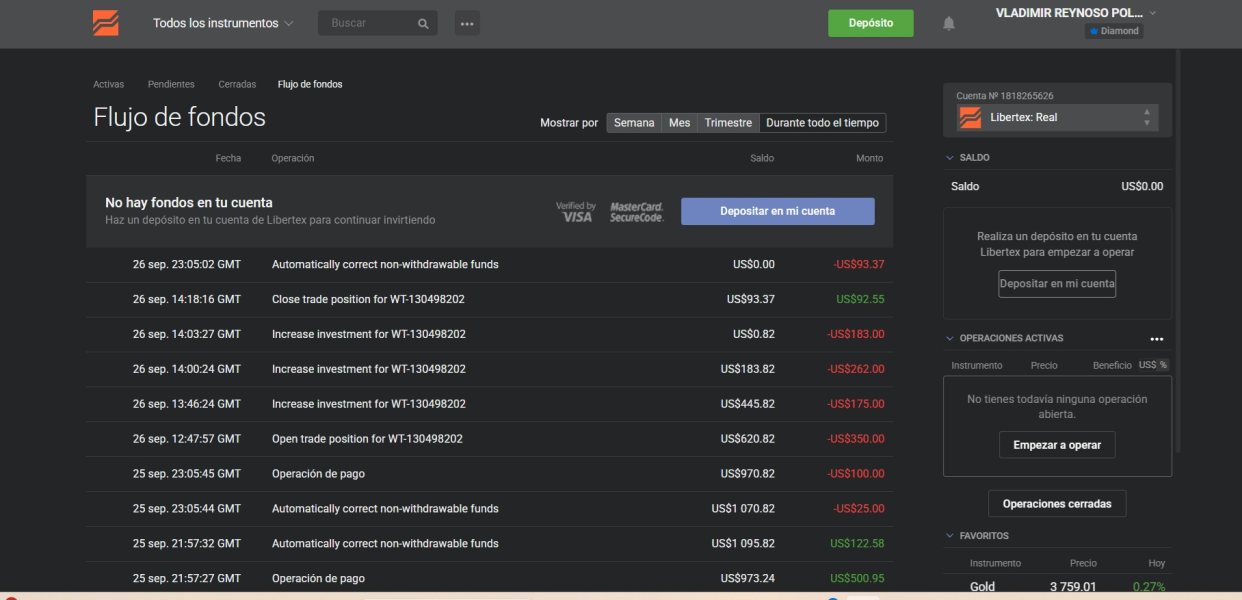

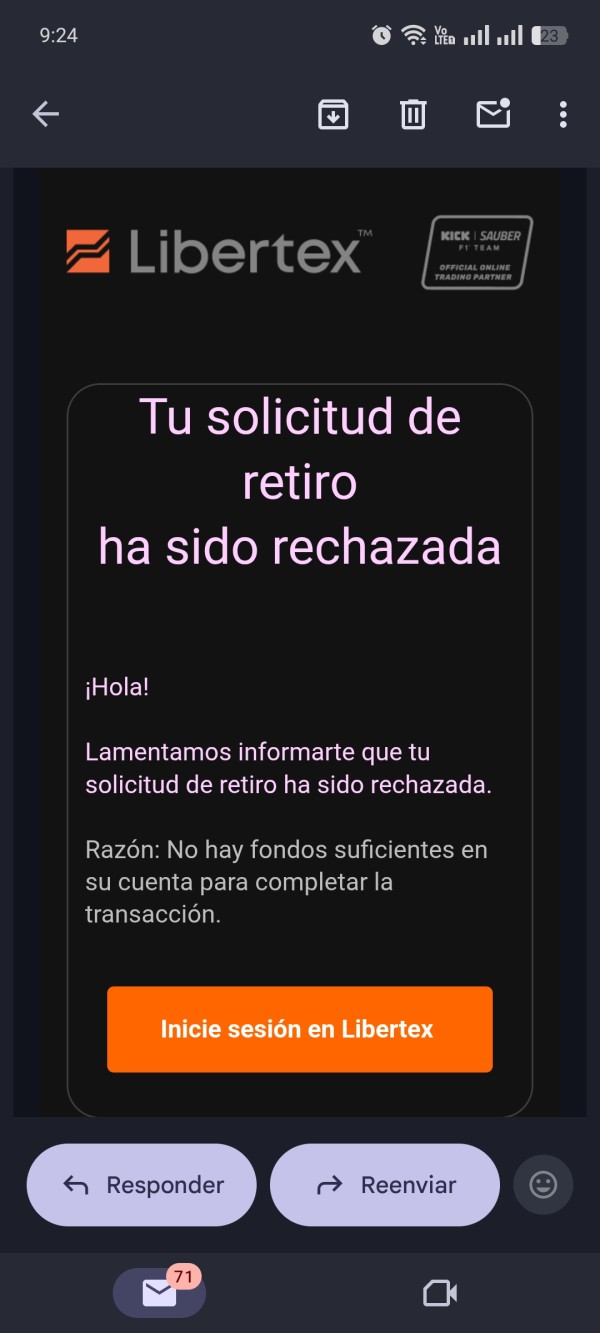

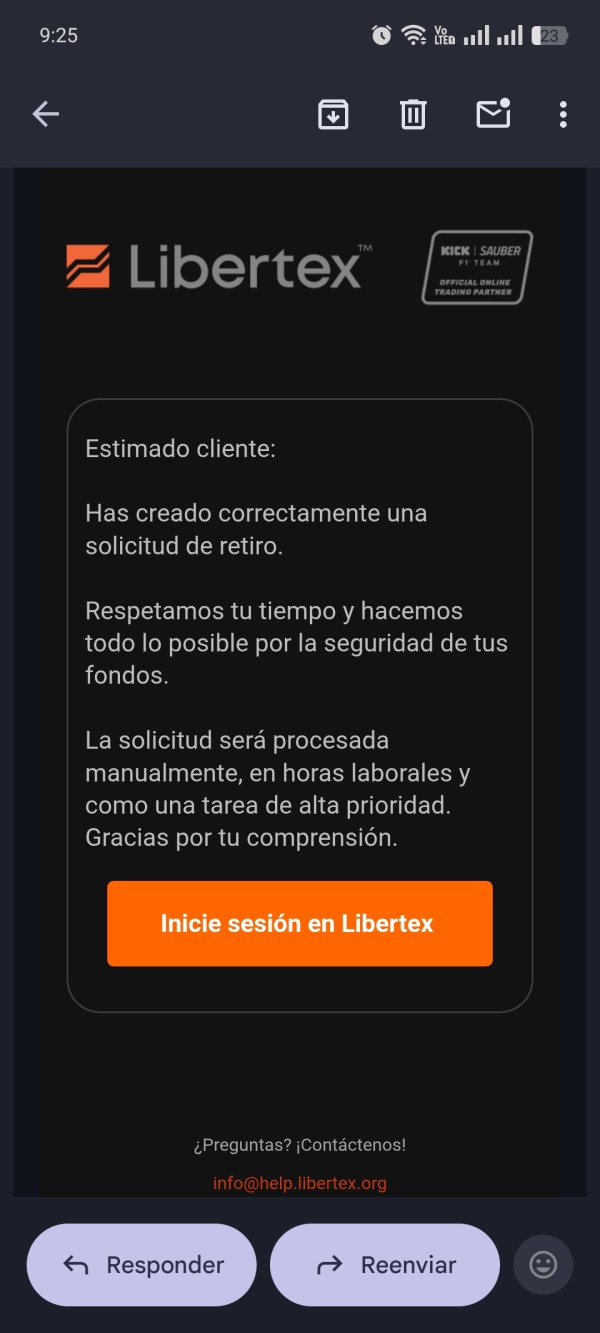

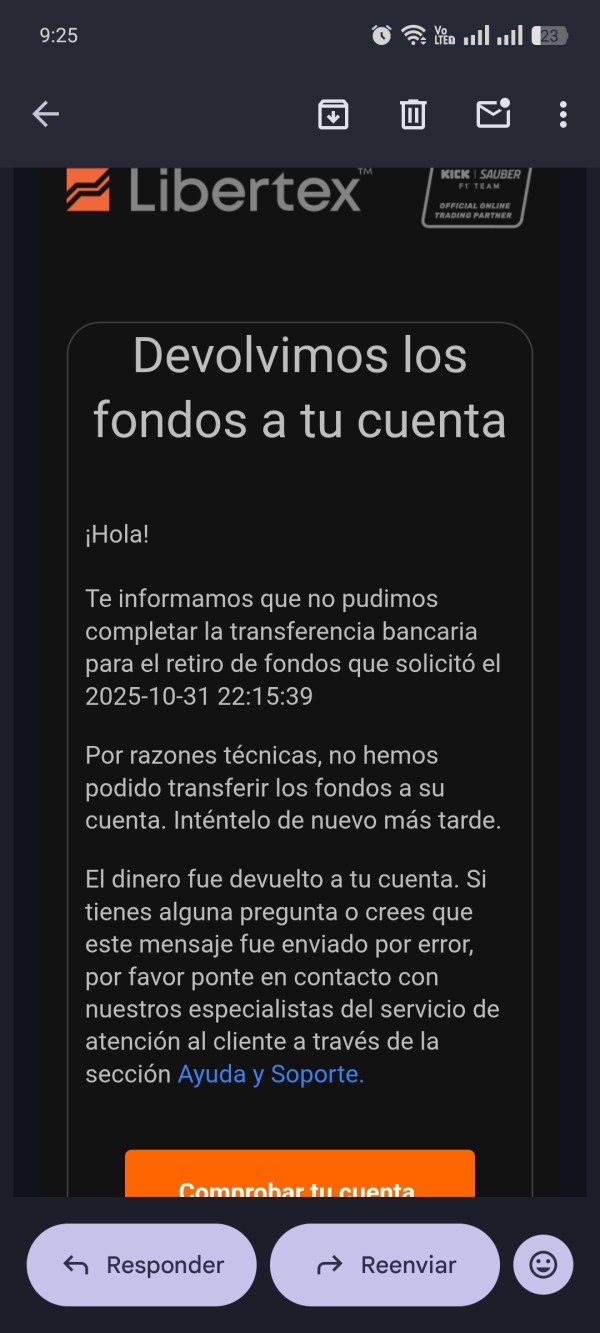

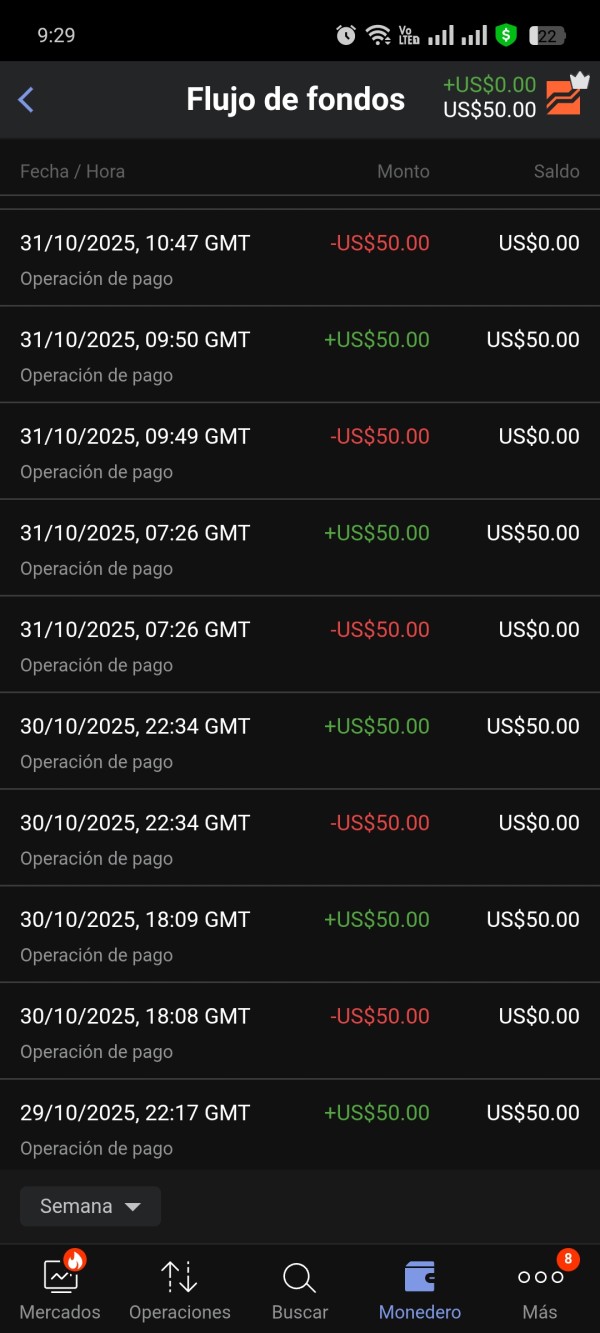

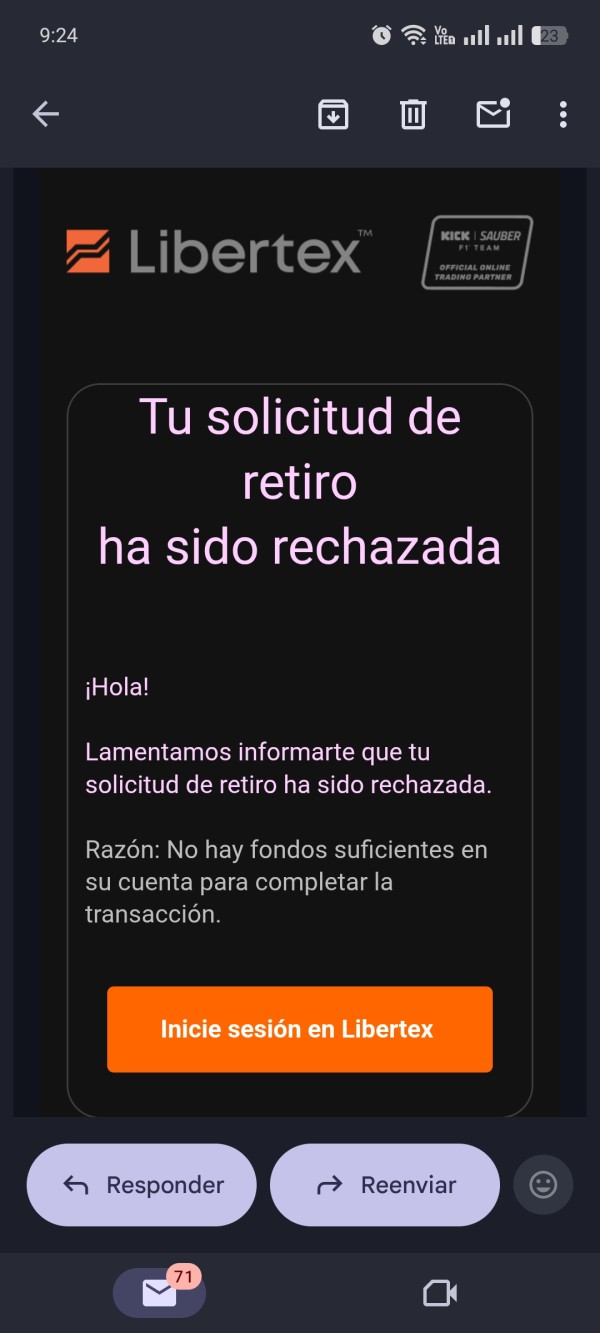

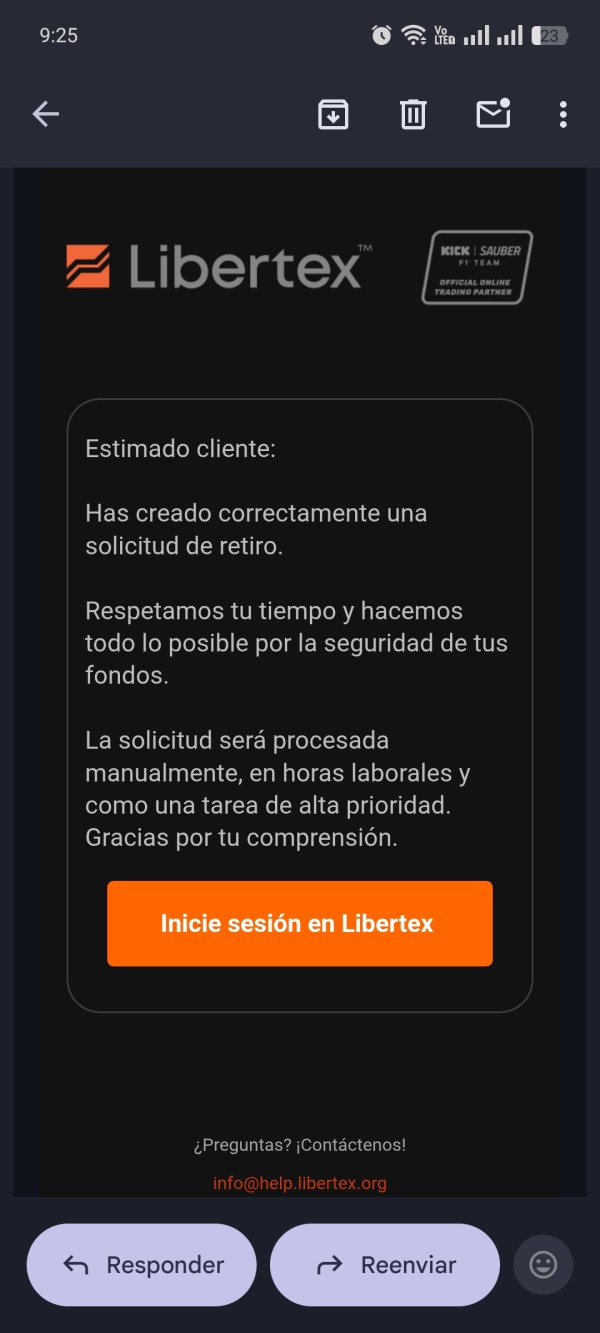

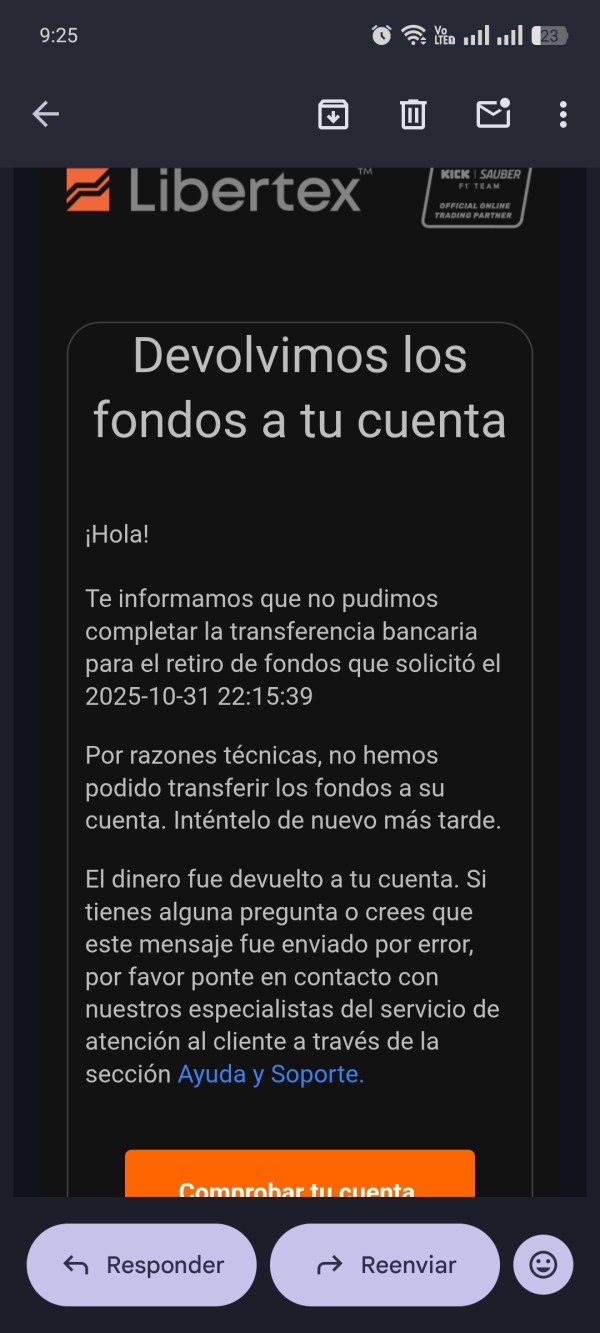

It's super easy to deposit money into the platform, someone would call you and say they will assist you at all times. But once you make the payment, they tell you they will call back the next day and they don't. To withdraw money, you have to make requests, some are accepted and others are rejected but it's always the same story– they claim they are transferring the money to your account and then say it couldn't be done due to technical issues. It's really a terrible platform. In the images, you can see how I loaded the 50 dollars and when I want to withdraw them, the platform behaves as if they’ve already been withdrawn but they return to the account.

I need to withdraw my money and it's not giving me access. I've been trying all day. It's imperative. I need it urgently.