ADSS 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive ADSS review evaluates one of the Middle East's established financial services providers. It offers insights into their trading platform, regulatory standing, and overall service quality. ADSS (ADS Securities) stands as a UAE-regulated forex broker that has maintained a stable presence in the financial markets since its establishment in 2011. The company is headquartered in Abu Dhabi. It operates under the oversight of the Securities and Commodities Authority (SCA), positioning itself as a regulated option for traders in the MENA region.

Two key characteristics distinguish ADSS in the competitive forex landscape. They offer comprehensive multi-asset trading and focus on serving both novice and experienced traders through accessible platform solutions. The broker has developed a reputation for providing diverse trading instruments while maintaining regulatory compliance in their primary jurisdiction.

The platform primarily targets investors seeking exposure to forex and derivatives markets. It particularly appeals to those who value regulatory oversight and regional expertise. According to available information, ADSS has garnered positive feedback from the UAE trading community, with users consistently highlighting the platform's stability and reliability as core strengths.

Important Notice

While ADSS maintains a strong reputation within the MENA region, potential traders should be aware that services and trading conditions may vary significantly across different geographical regions. The regulatory framework and available features discussed in this review primarily reflect the UAE-based operations under SCA supervision.

This ADSS review is based on comprehensive analysis of publicly available information, user feedback, and regulatory documentation current as of 2025. Prospective clients should verify specific terms and conditions directly with ADSS. Trading conditions and available services may be subject to change and regional variations.

Rating Framework

*N/R = Not Rated due to insufficient detailed information

Broker Overview

ADSS was established in 2011 as a financial services company specializing in over-the-counter derivatives and forex spot market trading. Based in Abu Dhabi, the company has positioned itself as a regional leader in providing accessible trading solutions to Middle Eastern investors. The firm's business model centers on offering comprehensive trading services across multiple asset classes. It emphasizes forex and derivatives markets that appeal to both retail and institutional clients.

The company operates as ADS Securities. It maintains its headquarters in the UAE's capital while serving a broader regional client base. Their approach combines traditional financial services with modern trading technology, aiming to bridge the gap between conventional banking and contemporary online trading platforms. This positioning has allowed ADSS to carve out a specific niche within the competitive Middle Eastern financial services landscape.

ADSS operates under the regulatory supervision of the Securities and Commodities Authority (SCA) of the United Arab Emirates. This provides clients with regulatory protection under UAE financial services law. The broker offers multiple asset classes for trading, though specific details about platform types and exact instrument ranges require further verification. Their regulatory standing with the SCA represents a key differentiator in a region where regulatory oversight varies significantly across jurisdictions. This makes this ADSS review particularly relevant for traders prioritizing regulatory compliance.

Regulatory Jurisdiction: ADSS operates under the oversight of the Securities and Commodities Authority (SCA) in the United Arab Emirates. This provides regulatory protection for clients trading within this jurisdiction.

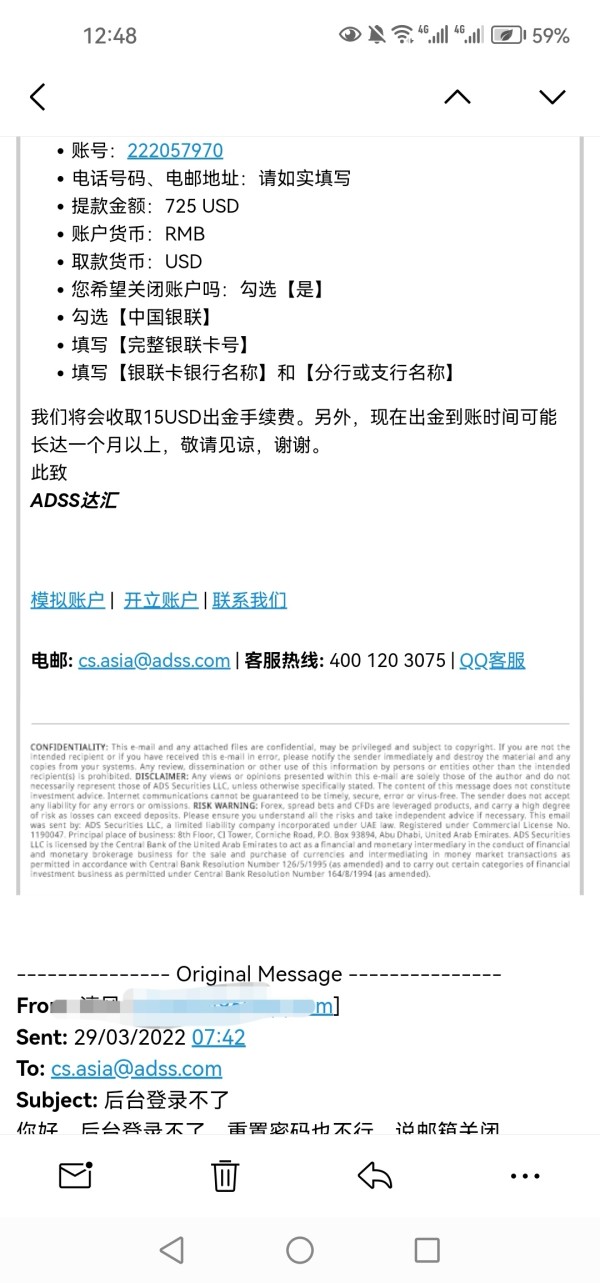

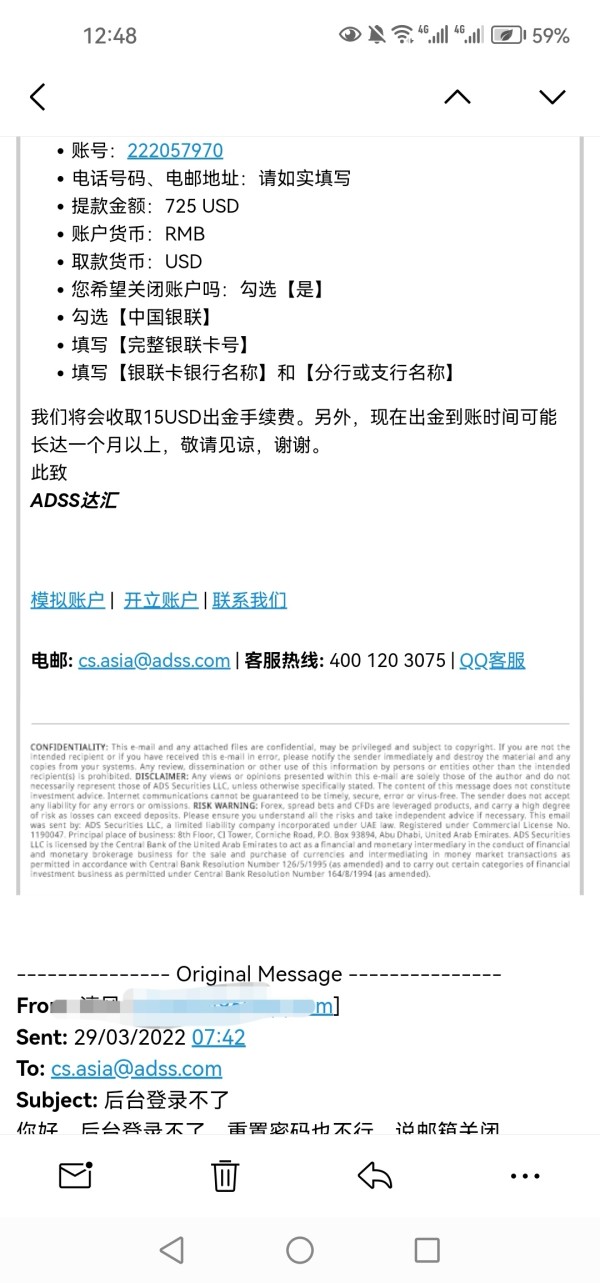

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options is not detailed in current available materials. This would require direct verification with the broker.

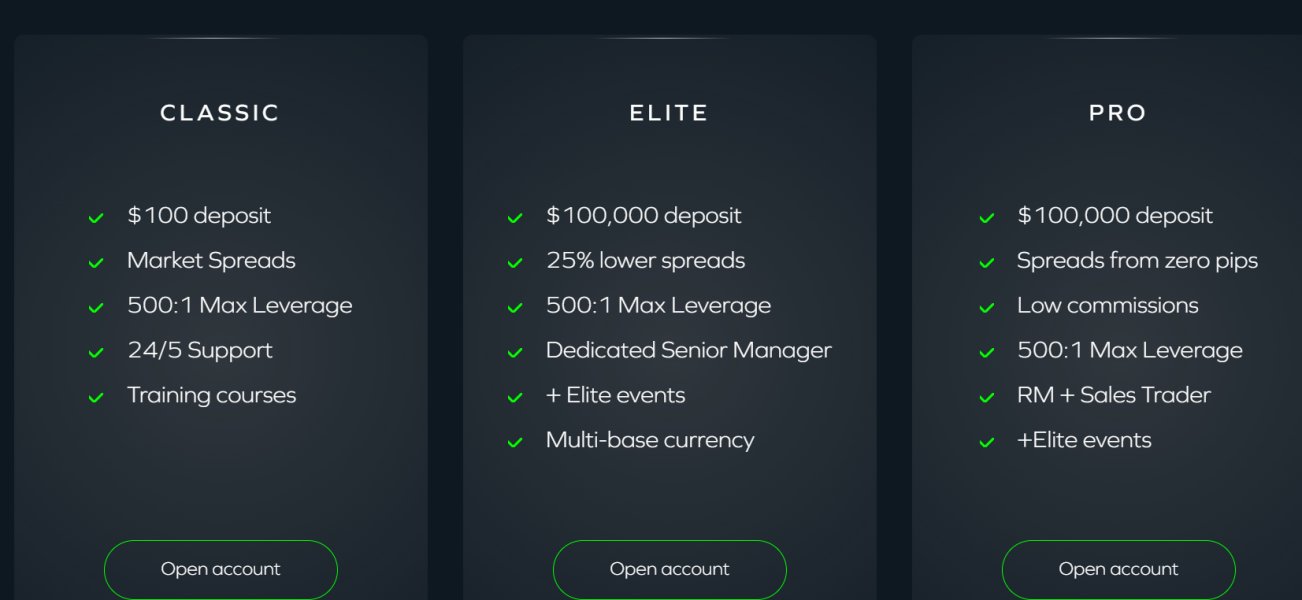

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in available documentation. These should be confirmed directly with ADSS.

Bonus and Promotional Offers: Current promotional structures, welcome bonuses, or ongoing incentive programs are not detailed in accessible materials. These may vary by region and account type.

Tradeable Assets: ADSS offers multiple asset classes for trading, including forex and derivatives. The complete range of available instruments requires further specification from official sources.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not comprehensively available in current materials. This would benefit from direct inquiry.

Leverage Ratios: Specific leverage offerings across different asset classes and account types are not detailed in available sources.

Platform Options: While ADSS provides trading platform access, specific platform types, software options, and technological specifications require further clarification.

Regional Restrictions: Geographic limitations on service availability are not specified in current materials.

Customer Support Languages: Available support languages and regional customer service capabilities are not detailed in accessible documentation.

This ADSS review highlights the need for potential clients to conduct direct due diligence regarding specific trading terms and conditions.

Detailed Rating Analysis

Account Conditions Analysis

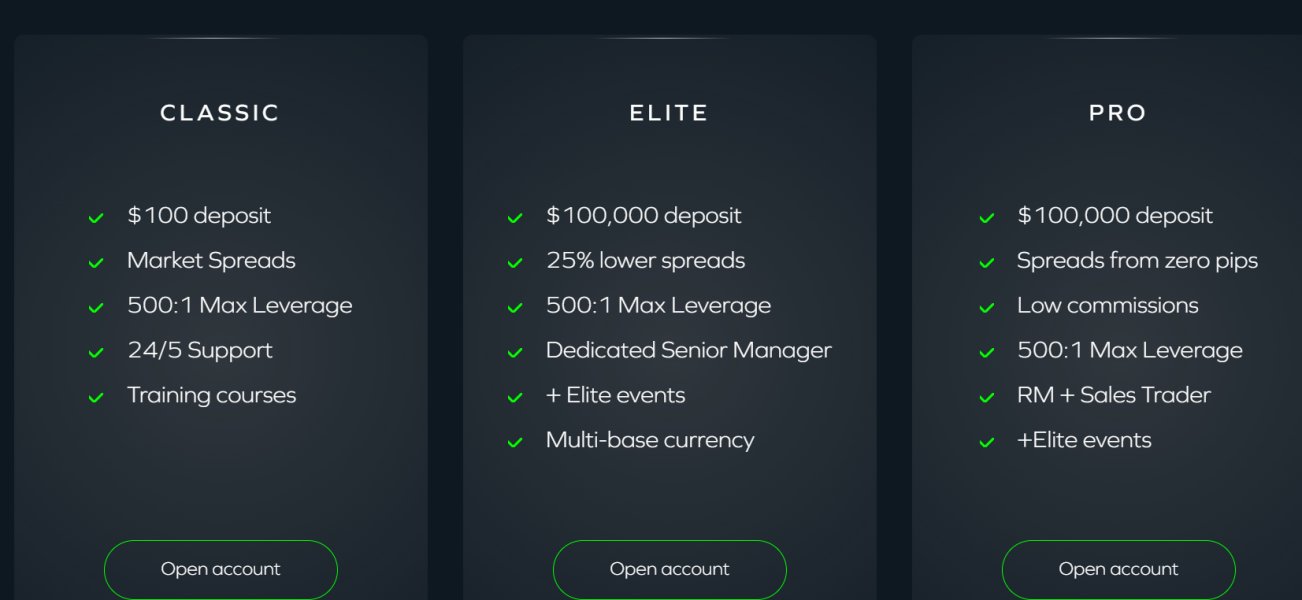

The evaluation of ADSS account conditions faces limitations due to insufficient detailed information in available sources. While the broker operates under SCA regulation, specific account type structures, tier benefits, and qualification requirements are not comprehensively documented in accessible materials. This gap represents a significant consideration for potential traders who require clear understanding of account terms before committing to a platform.

Minimum deposit requirements are not specified in current documentation. These typically serve as a key differentiator among forex brokers. This absence of information makes it challenging to assess the accessibility of ADSS services for traders with varying capital levels. Similarly, account opening procedures, required documentation, and verification timelines are not detailed in available sources.

Special account features are not mentioned in current materials despite the broker's Middle Eastern focus. These include Islamic trading accounts that comply with Sharia principles. This represents a potential oversight given the regional market's requirements for Sharia-compliant trading solutions.

The lack of comprehensive account information in this ADSS review underscores the importance of direct communication with the broker for prospective clients seeking detailed account specifications and terms.

Assessment of ADSS trading tools and resources encounters significant information gaps in available documentation. The specific range of analytical tools, charting capabilities, and technical indicators offered through their platform is not detailed in accessible sources. This limitation prevents a thorough evaluation of the broker's technological offerings compared to industry standards.

Research and analysis resources are not comprehensively described in current materials. These often distinguish professional trading platforms. The availability of market commentary, economic calendars, fundamental analysis reports, and real-time news feeds requires direct verification with the broker.

Educational resources represent another area lacking detailed information. The presence or absence of trading tutorials, webinar programs, market education materials, and skill development resources is not documented in available sources. This gap is particularly relevant for novice traders who rely on educational support when selecting a broker.

Automated trading support is not addressed in current documentation. This includes Expert Advisor compatibility, algorithmic trading capabilities, and API access. These features increasingly serve as important considerations for sophisticated traders seeking advanced platform functionality.

Customer Service and Support Analysis

The evaluation of ADSS customer service capabilities faces substantial information limitations in available sources. Specific support channels are not detailed in current documentation. These include live chat availability, phone support hours, email response systems, and help desk accessibility. This absence of information prevents assessment of the broker's commitment to client support infrastructure.

Response time metrics are not documented in accessible materials. These serve as crucial indicators of service quality. The efficiency of problem resolution, support ticket handling, and general inquiry management cannot be evaluated based on available information.

Service quality assessments are not comprehensively available in current sources. These are typically derived from user feedback and satisfaction surveys. While general positive sentiment toward ADSS is noted, specific service quality metrics and detailed user experiences require further investigation.

Multilingual support capabilities are not specified in available documentation. These are particularly relevant given the broker's Middle Eastern focus. The availability of Arabic language support, English proficiency levels, and regional language options would be important considerations for diverse client bases.

Customer service operating hours, timezone coverage, and regional support availability are not detailed in current materials. These represent important gaps for international clients.

Trading Experience Analysis

Analysis of the ADSS trading experience encounters significant information limitations in available sources. Platform stability and execution speed are not specifically documented with performance metrics or user feedback data. These are fundamental components of trading quality. While general positive sentiment exists, detailed technical performance information requires further investigation.

Order execution quality is not detailed in accessible materials. This includes slippage rates, fill ratios, and execution speed statistics. These metrics typically serve as crucial indicators of broker performance but are not available for comprehensive evaluation in this ADSS review.

Platform functionality completeness lacks detailed documentation in current sources. This encompasses charting capabilities, order types, risk management tools, and interface design. The user interface quality, navigation efficiency, and feature accessibility cannot be thoroughly assessed based on available information.

Mobile trading experience is not specifically addressed in current materials. This is increasingly important for modern traders. Mobile app availability, functionality parity with desktop platforms, and mobile-specific features require direct verification.

Trading environment factors are not documented in available sources. These include spread stability during volatile market conditions, server reliability during peak trading hours, and platform performance during major economic announcements.

Trust and Safety Analysis

ADSS demonstrates regulatory compliance through its oversight by the Securities and Commodities Authority (SCA) of the United Arab Emirates. This regulatory framework provides a foundation for client protection and operational standards within the UAE jurisdiction. The SCA regulation represents a significant trust factor for traders operating within or familiar with UAE financial services oversight.

Client fund safety measures are not detailed in available sources. These include segregated account policies, deposit protection schemes, and operational risk management procedures. These safety mechanisms typically serve as crucial trust indicators but require further verification from official documentation.

Company transparency is not comprehensively available in current materials. This includes ownership structure, financial reporting, operational procedures, and corporate governance. Enhanced transparency typically correlates with increased client trust and regulatory compliance.

Industry reputation within the MENA region appears positive based on available information. ADSS has maintained a presence since 2011 and received favorable feedback from regional trading communities. However, specific reputation metrics and industry recognition require further documentation.

Negative incident handling, crisis management procedures, and regulatory compliance history are not detailed in accessible sources. These represent important considerations for comprehensive trust assessment.

User Experience Analysis

Overall user satisfaction with ADSS appears positive based on available information. Users generally recognize the platform as stable and reliable. This positive sentiment represents a valuable indicator of user experience quality, though specific satisfaction metrics and detailed user feedback require further documentation.

Interface design and platform usability are not specifically detailed in current materials. User interface quality, navigation efficiency, learning curve considerations, and accessibility features cannot be comprehensively evaluated based on available information.

Registration and account verification processes are not documented in accessible sources. The efficiency of onboarding procedures, required documentation, verification timelines, and account activation processes would benefit from direct investigation.

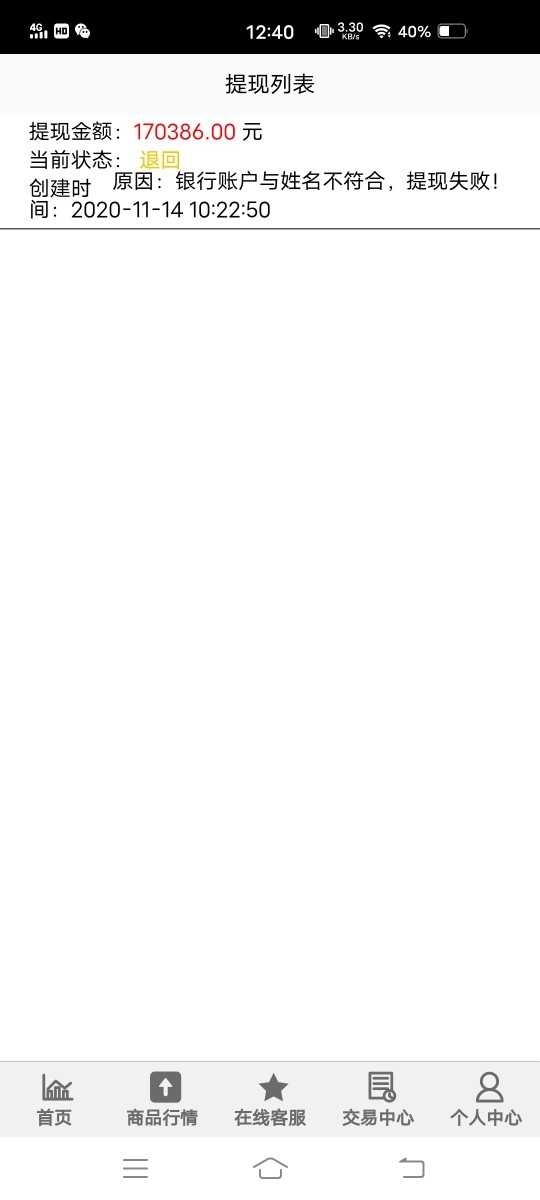

Fund operation experiences are not detailed in current materials. These include deposit processing times, withdrawal efficiency, payment method satisfaction, and transaction fee transparency.

Common user complaints or areas for improvement are not specifically documented in available sources. However, the absence of significant negative feedback in accessible materials suggests reasonable user satisfaction levels.

The user demographic appears to align with investors seeking forex and derivatives trading opportunities. They particularly value regulatory oversight and regional expertise. User feedback consistently emphasizes platform stability as a key strength, though comprehensive user experience data requires further investigation.

Conclusion

This comprehensive ADSS review reveals a UAE-regulated forex broker with established regional presence and positive user sentiment. However, detailed operational information requires further verification. ADSS demonstrates regulatory compliance through SCA oversight and maintains a stable reputation within the MENA trading community since its 2011 establishment.

The broker appears suitable for traders seeking regulated forex and derivatives trading opportunities. It particularly appeals to those prioritizing Middle Eastern regional expertise and regulatory oversight. Both novice and experienced traders may find value in ADSS services, though specific account conditions and platform features require direct verification.

Key strengths include regulatory standing with the UAE's SCA, positive user feedback regarding platform stability, and established regional presence. However, the review identifies significant information gaps regarding specific trading conditions, platform features, and detailed service offerings. Potential clients should address these through direct broker communication before making trading decisions.