Eightcap 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive eightcap review looks at one of Australia's top forex and CFD brokers. The company has gained a lot of attention in the trading community over the past few years. Based on detailed user feedback from over 3,040 Trustpilot reviews, Eightcap has built itself as a trustworthy broker with clear strengths in withdrawal processing and fund security. According to BrokersWay reports, the broker gives access to over 1,000 trading instruments across multiple asset classes. These include forex, cryptocurrency CFDs, indices, commodities, and stock CFDs.

The platform supports standard trading software including MT4, MT5, and TradingView. This makes it a flexible choice for traders who want diverse investment opportunities. User reviews consistently highlight the broker's same-day withdrawal processing abilities, with many traders showing confidence in fund safety. This makes Eightcap especially good for traders who want quick access to their funds and seek a varied trading portfolio across multiple asset classes. The broker's Australian base provides extra regulatory oversight. However, specific regulatory details need more investigation for complete transparency.

Important Notice

This review acknowledges that Eightcap operates across multiple jurisdictions. Services may vary by region due to different regulatory requirements and local restrictions. Traders should verify the specific terms and conditions that apply to their jurisdiction before opening an account. This evaluation is based on detailed analysis of user feedback, industry standards, publicly available market data, and information gathered from multiple financial review platforms. While we work for accuracy, trading conditions and broker policies may change. Potential clients should conduct their own research and consult current terms directly with the broker before making any trading decisions.

Rating Framework

Broker Overview

Eightcap operates as an Australian-based forex and CFD broker. The company has positioned itself as a global provider of online trading services. According to SureshotFX reports, the company specializes in offering complete access to international financial markets through advanced trading platforms. The broker has built its reputation on providing a diverse range of financial instruments while keeping a focus on user experience and fund security. Eightcap's business model centers on offering CFD trading across multiple asset classes. This enables traders to access various markets through a single platform.

The broker stands out through its multi-platform approach. It supports MT4, MT5, and TradingView platforms as confirmed by BrokersWay analysis. This platform diversity caters to different trading preferences and experience levels. Eightcap provides access to over 1,000 trading instruments, spanning forex pairs, cryptocurrency CFDs, stock indices, commodities, and individual stock CFDs. The broker's Australian headquarters suggests following strict financial regulations. However, specific regulatory details require verification through official channels. User feedback consistently emphasizes the broker's reliability in fund management and withdrawal processing. This indicates a business model that puts client satisfaction and operational transparency first.

Regulatory Oversight: While Eightcap operates from Australia, specific regulatory license numbers and oversight details were not fully detailed in available sources. Potential clients should verify current regulatory status directly with the broker.

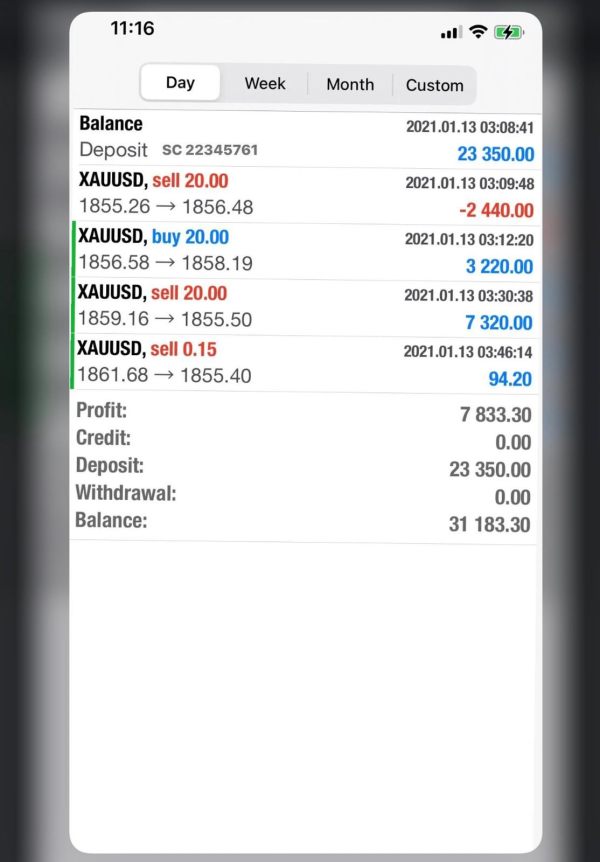

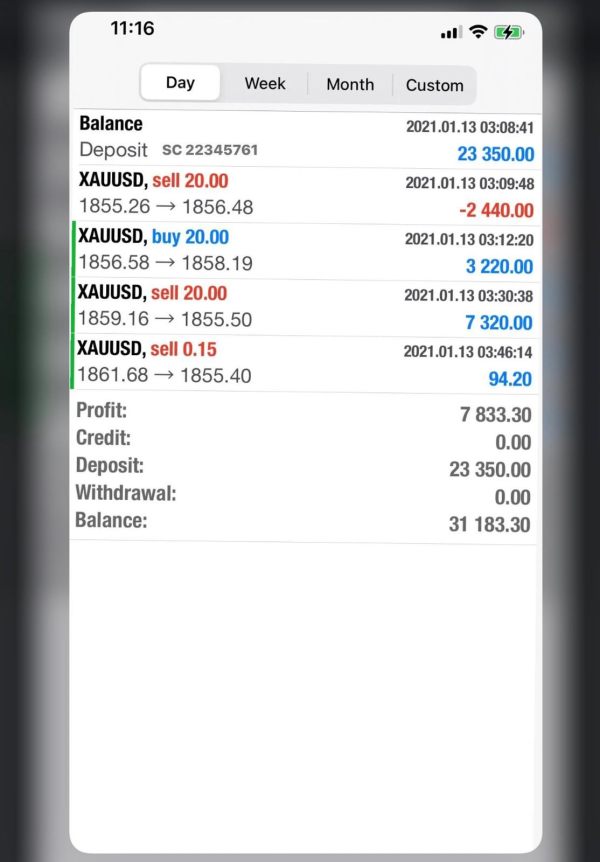

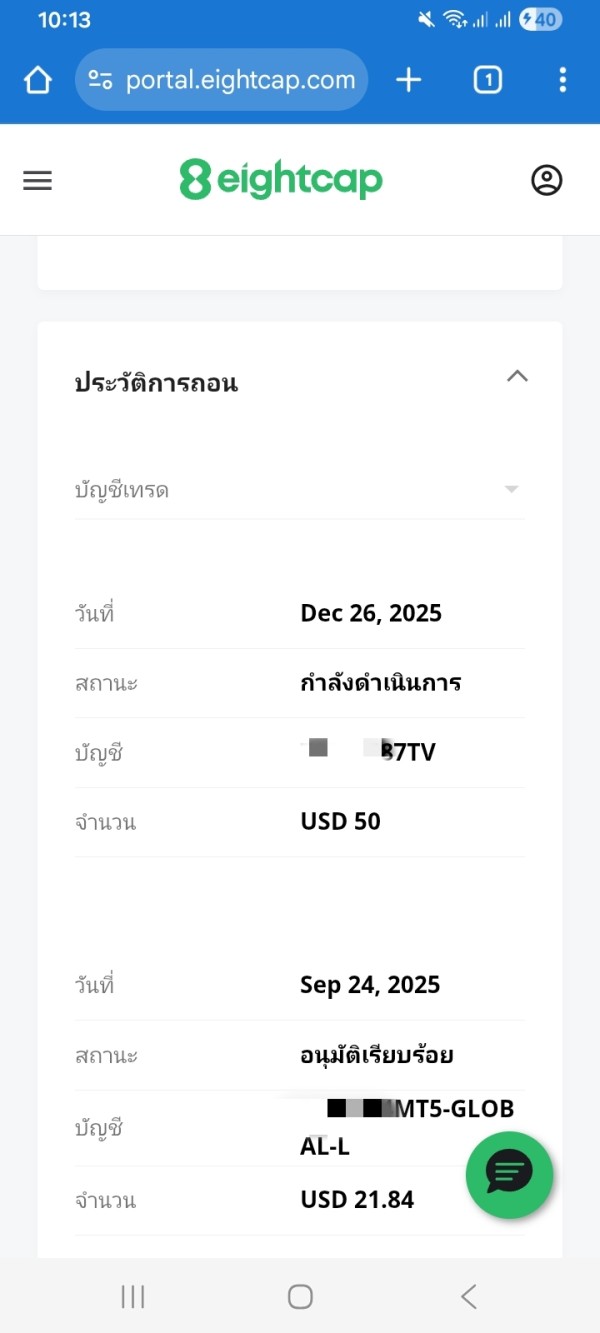

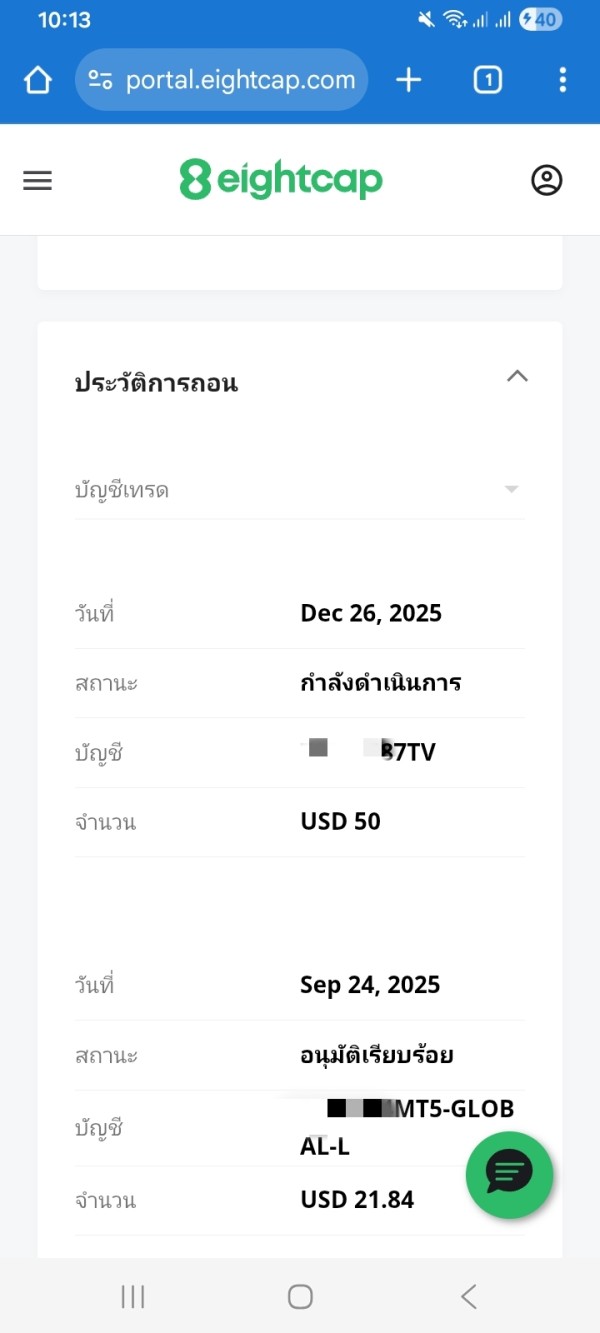

Deposit and Withdrawal Methods: According to user testimonials on Trustpilot, Eightcap processes withdrawals on the same day. This is much faster than many competitors. However, specific payment methods and processing fees require direct confirmation from the broker.

Minimum Deposit Requirements: Exact minimum deposit amounts were not specified in the reviewed sources. This indicates potential variation by account type or region.

Promotional Offers: Current bonus structures and promotional campaigns were not detailed in available materials. This suggests traders should inquire directly about any available incentives.

Available Trading Assets: Eightcap provides complete market access through 1,000+ instruments. These include major and minor forex pairs, cryptocurrency CFDs covering popular digital assets, stock indices from global markets, commodity CFDs including precious metals and energy products, and individual stock CFDs from major exchanges.

Cost Structure: While specific spread and commission details were not fully detailed in reviewed sources, the broker appears to offer competitive pricing structures. Traders should request current pricing schedules for accurate cost analysis.

Leverage Options: Maximum leverage ratios were not specified in available documentation. They likely vary by asset class and regulatory jurisdiction.

Platform Selection: Confirmed support for MetaTrader 4, MetaTrader 5, and TradingView platforms. This provides flexibility for different trading strategies and preferences.

Geographic Restrictions: Specific country restrictions were not detailed in reviewed sources. However, as an Australian broker, services likely comply with local regulatory requirements.

Customer Support Languages: Supported communication languages were not specified in available materials.

This eightcap review section highlights the importance of direct broker consultation for specific trading terms and conditions.

Detailed Rating Analysis

Account Conditions Analysis

Eightcap's account structure remains somewhat unclear based on publicly available information. This impacts the overall rating for this category. While the broker clearly serves a global clientele and maintains operations from Australia, specific details about account tiers, minimum deposit requirements, and account-specific features were not fully outlined in reviewed sources. This lack of transparency makes it challenging for potential clients to make informed decisions about which account type might suit their trading needs.

The account opening process appears smooth based on user feedback. However, specific verification requirements and timeframes were not detailed. The absence of clear information about Islamic account availability, professional account options, or managed account services represents a significant information gap. However, user testimonials suggest that once accounts are established, the operational experience is generally positive. This is particularly true regarding fund management and withdrawal processes.

For a complete eightcap review of account conditions, potential clients should directly contact the broker. They can obtain current terms, minimum deposit requirements, and available account features. The broker's reputation for reliable service suggests that account conditions are competitive. However, lack of public transparency affects the overall assessment.

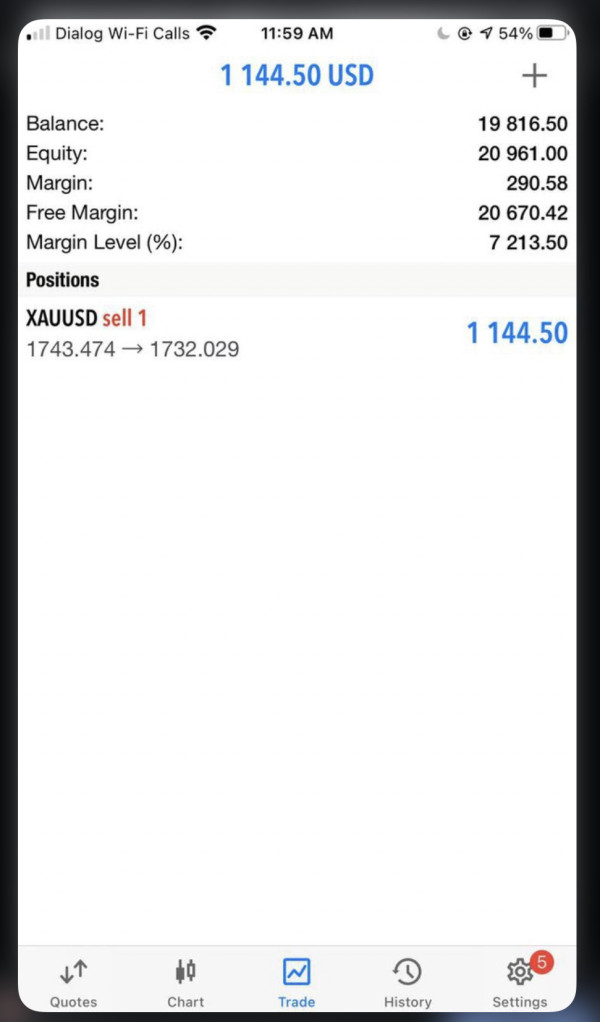

Eightcap excels in providing complete trading tools and resources. This earns a strong rating in this category. According to BrokersWay reports, the broker offers access to over 1,000 trading instruments across multiple asset classes. This represents one of the more extensive offerings in the retail trading space. This breadth includes forex pairs spanning major, minor, and exotic currencies, cryptocurrency CFDs covering leading digital assets, stock indices from global markets, commodity CFDs including precious metals and energy products, and individual stock CFDs.

The platform selection demonstrates Eightcap's commitment to accommodating different trading preferences. Support for MetaTrader 4 and MetaTrader 5 provides access to advanced charting tools, automated trading capabilities through Expert Advisors, and complete technical analysis features. The inclusion of TradingView integration offers modern charting capabilities and social trading features that appeal to contemporary traders.

While specific details about proprietary research tools, market analysis resources, and educational materials were not extensively covered in available sources, the diversity of trading instruments and platform options suggests a robust trading environment. The broker's focus on providing multiple asset classes through professional-grade platforms indicates a commitment to serving both novice and experienced traders effectively.

Customer Service and Support Analysis

Customer service quality appears to be a relative strength for Eightcap based on user feedback patterns. However, specific operational details were not fully documented in reviewed sources. Trustpilot reviews with over 3,000 user evaluations suggest generally positive customer experiences. This is particularly true regarding responsiveness to withdrawal requests and account management issues.

The speed of withdrawal processing, consistently mentioned as same-day service, indicates efficient back-office operations and customer service coordination. This operational efficiency suggests that customer inquiries related to account management and fund operations receive prompt attention. However, specific details about customer service channels, availability hours, multilingual support options, and average response times were not detailed in available materials.

User testimonials indicate that when issues arise, Eightcap's support team demonstrates competence in resolution. This contributes to the overall trust factor evident in community feedback. The lack of widespread negative reviews regarding customer service suggests adequate support infrastructure. However, complete evaluation requires more detailed operational information about support channels and service level agreements.

Trading Experience Analysis

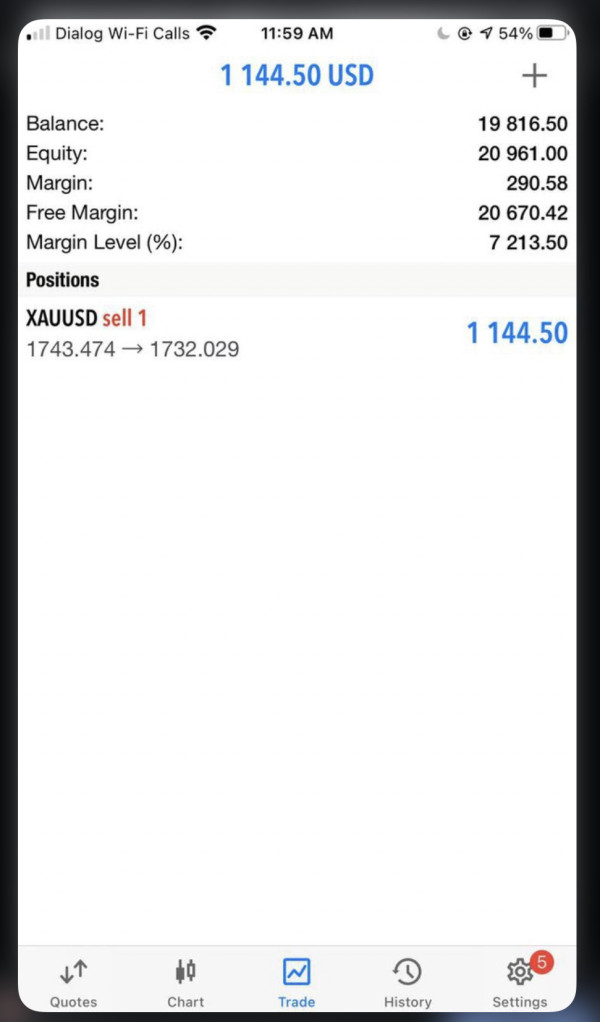

The trading experience at Eightcap appears well-structured based on platform offerings and user feedback. However, specific performance metrics were not detailed in reviewed sources. The broker's support for multiple professional trading platforms including MT4, MT5, and TradingView suggests a commitment to providing robust trading infrastructure. This can accommodate various trading styles and experience levels.

Platform stability and execution quality, while not specifically measured in available sources, can be inferred from the generally positive user feedback and the broker's ability to maintain operations across multiple jurisdictions. The diversity of available instruments, exceeding 1,000 trading options, provides ample opportunities for portfolio diversification and strategy implementation across different market conditions.

Mobile trading capabilities, while not specifically detailed, are likely available given the broker's use of industry-standard platforms. These typically include mobile applications. The integration with TradingView particularly suggests modern trading capabilities that appeal to technically-oriented traders who require advanced charting and analysis tools.

This eightcap review section notes that specific execution speed data, slippage statistics, and platform downtime information were not available in reviewed sources. This limits the depth of technical performance assessment.

Trust and Reliability Analysis

Eightcap demonstrates strong performance in trust and reliability metrics. This is primarily evidenced by substantial user feedback and operational consistency. The broker's Trustpilot presence with over 3,040 reviews provides significant insight into user satisfaction levels. There is particular emphasis on fund security and withdrawal reliability. User testimonials consistently highlight confidence in fund safety, suggesting effective client money protection measures.

The broker's Australian operational base provides additional credibility. Australia maintains strict financial services regulations. However, specific regulatory license numbers, client fund segregation details, and insurance coverage information were not fully detailed in available sources. This represents an area where greater transparency would enhance the trust assessment.

Operational reliability is strongly evidenced by consistent user reports of same-day withdrawal processing. This indicates robust financial operations and liquidity management. The absence of significant negative reviews regarding fund access or operational disruptions suggests stable business operations. However, complete assessment of regulatory compliance, financial reporting transparency, and industry certifications requires additional verification through official regulatory channels.

The broker's longevity and continued operations across multiple jurisdictions further support reliability assessments. However, specific founding dates and ownership structure details were not detailed in reviewed sources.

User Experience Analysis

User experience represents a significant strength for Eightcap based on community feedback and operational evidence. The consistently mentioned same-day withdrawal processing creates a positive user experience. This differentiates the broker from competitors who typically require longer processing times. This operational efficiency directly impacts user satisfaction and confidence in the trading relationship.

Platform accessibility through multiple professional trading applications (MT4, MT5, TradingView) suggests accommodation of different user preferences and technical requirements. The diversity of available instruments allows users to pursue various trading strategies without requiring multiple broker relationships. This simplifies portfolio management and operational complexity.

User testimonials indicate general satisfaction with account management processes and fund operations. However, specific details about account opening procedures, verification requirements, and ongoing account maintenance were not fully covered in available sources. The positive sentiment in user reviews suggests that common trading operations proceed smoothly and that users feel their needs are adequately addressed.

Areas for potential improvement, while not specifically identified in available sources, might include enhanced transparency regarding account conditions, more detailed cost structures, and complete educational resources. However, these gaps may simply reflect limited information availability rather than actual service deficiencies.

Conclusion

This comprehensive eightcap review reveals a broker that has successfully built user trust through reliable operations and efficient fund management. Eightcap demonstrates particular strengths in withdrawal processing speed, trading instrument diversity, and overall user satisfaction as evidenced by substantial community feedback. The broker's Australian base and support for professional trading platforms position it well for traders seeking a reliable trading partner with access to diverse financial markets.

Eightcap appears most suitable for traders who put fund security and quick access to their capital first. It also works well for those seeking diversified investment opportunities across multiple asset classes through a single platform. The broker's extensive instrument offering and multi-platform support accommodate both novice traders and experienced professionals with varying strategy requirements.

Key advantages include strong user trust evidenced by positive community feedback, efficient same-day withdrawal processing, and complete access to over 1,000 trading instruments. However, limitations include insufficient transparency regarding account conditions, regulatory details, and specific cost structures. Potential clients should conduct direct research to obtain complete information about trading terms and regulatory compliance before committing to the platform.