Just2Trade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive just2trade review provides an in-depth analysis of a multi-asset broker that has garnered mixed reactions from the trading community. Just2Trade operates as a discount broker. It offers access to various financial instruments including forex, stocks, CFDs, commodities like oil and gold, with support for both MT4 and MT5 trading platforms. The broker serves approximately 155,000 clients and maintains membership in the Securities Investor Protection Corporation (SIPC). It also has additional protection through its clearing firm, COR Clearing, which carries excess SIPC insurance.

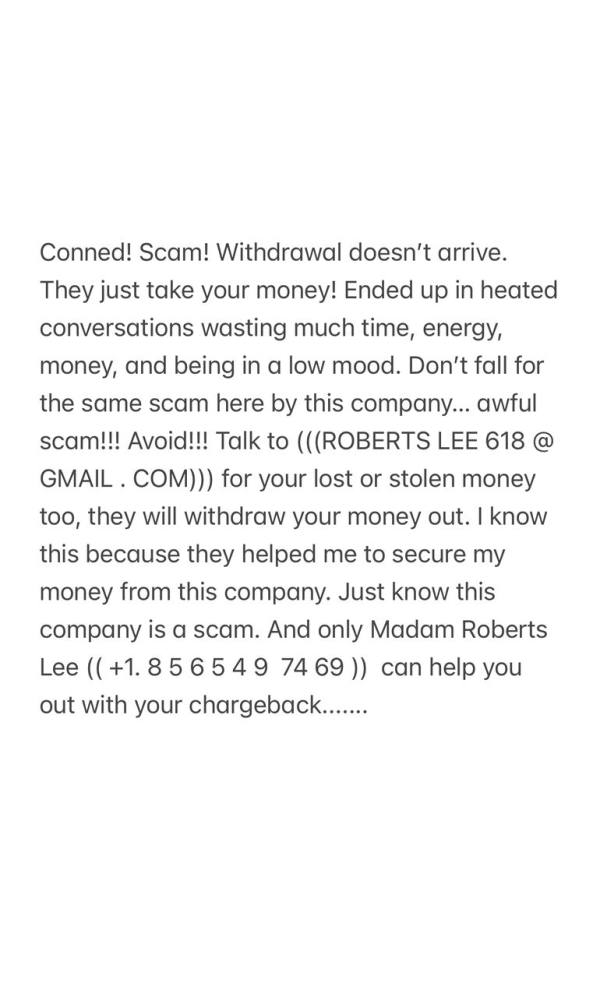

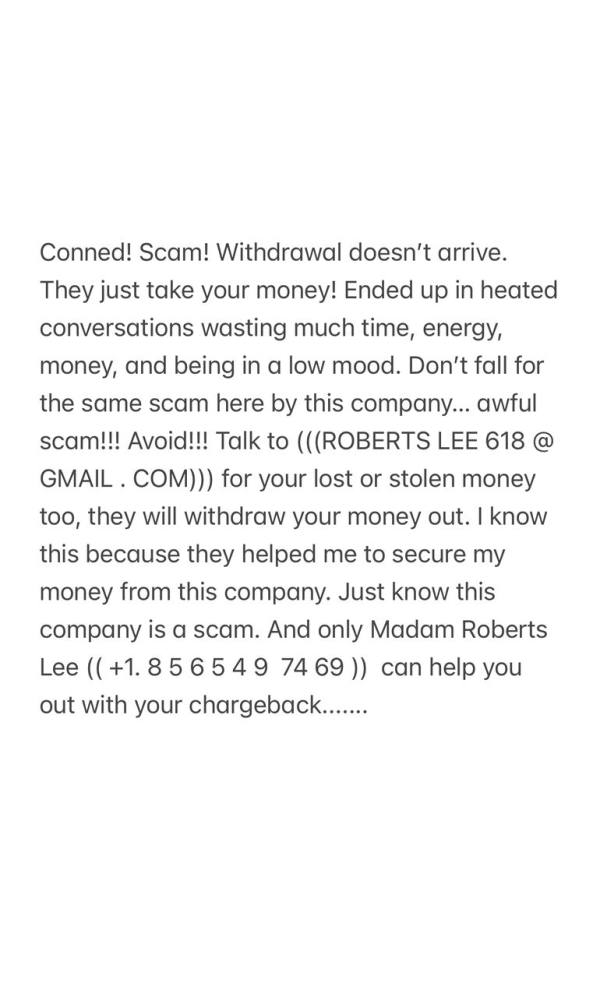

However, user feedback presents a concerning picture. Based on 149 genuine customer reviews, Just2Trade maintains a rating of 2.4 out of 5, with only 32% of reviewers recommending the platform. This low satisfaction rate suggests significant challenges in service delivery and user experience. The broker does offer a competitive commission structure and diverse asset offerings. The platform appears to target active traders seeking multi-asset exposure, particularly those prioritizing low-cost trading over premium service features. While the regulatory framework provides some reassurance regarding fund safety, the consistently poor user ratings indicate potential issues. These problems may include platform reliability, customer support, or overall trading experience that prospective clients should carefully consider.

Important Notice

This review acknowledges that Just2Trade may operate through different regional entities. Each entity is subject to varying regulatory frameworks that can significantly impact user experience and fund security. Traders should verify the specific regulatory status applicable to their jurisdiction before opening an account. The regulatory differences may affect available trading instruments, leverage ratios, client protections, and dispute resolution mechanisms.

Our evaluation methodology combines quantitative data from user feedback platforms, regulatory filings, and direct platform analysis with qualitative assessments based on industry standards. All information presented reflects publicly available data and user testimonials as of the review date. Given the dynamic nature of the forex industry, readers should verify current terms and conditions directly with Just2Trade before making trading decisions.

Rating Framework

The scoring reflects a broker struggling with fundamental service delivery. However, it maintains adequate regulatory compliance and platform infrastructure.

Broker Overview

Just2Trade positions itself as a multi-asset discount broker targeting cost-conscious traders seeking exposure to diverse financial markets. The company has built its business model around providing low-commission trading across multiple asset classes. These include forex pairs, individual stocks, contracts for difference (CFDs), precious metals like gold, and energy commodities such as oil. This broad asset selection aims to attract active traders who prefer consolidating their trading activities under a single platform rather than maintaining multiple brokerage relationships.

The broker's operational framework centers on providing institutional-grade trading platforms. It specifically offers MetaTrader 4 and MetaTrader 5, which are industry-standard platforms trusted by millions of traders worldwide. According to available data from TradingFinder, Just2Trade serves approximately 155,000 clients, indicating a substantial user base despite the mixed reviews. The company's approach emphasizes algorithmic trading capabilities and copy trading functionality. This suggests a focus on more sophisticated trading strategies rather than basic retail forex trading.

From a regulatory standpoint, Just2Trade maintains membership in the Securities Investor Protection Corporation (SIPC). This membership provides standard investor protections. Additionally, the broker benefits from excess SIPC insurance through its clearing partner, COR Clearing, potentially offering enhanced fund protection beyond standard SIPC limits. This regulatory structure suggests the broker operates primarily within the United States regulatory framework. However, specific licensing details across different jurisdictions require individual verification.

Regulatory Status: Just2Trade operates under SIPC membership with additional excess insurance coverage through COR Clearing. This regulatory framework provides standard investor protections, though specific licensing across international jurisdictions remains unclear from available sources.

Deposit and Withdrawal Methods: Information regarding specific deposit and withdrawal options was not detailed in available sources. This requires direct verification with the broker for current payment processing methods and associated fees.

Minimum Deposit Requirements: Specific minimum deposit thresholds were not mentioned in available documentation. This suggests potential variation based on account type or regional requirements.

Promotional Offers: Current bonus structures or promotional campaigns were not referenced in available materials. This indicates either absence of such programs or limited marketing of existing offers.

Available Trading Assets: The platform provides access to forex currency pairs, individual stocks, contracts for difference (CFDs), precious metals including gold, and energy commodities such as oil. This diverse asset selection supports multi-asset trading strategies within a single account structure.

Cost Structure: Just2Trade emphasizes low commission trading. However, specific commission rates, spread information, overnight financing charges, and other fee details were not quantified in available sources. The low-cost positioning suggests competitive pricing relative to industry standards.

Leverage Options: Maximum leverage ratios and margin requirements were not specified in available documentation. These likely vary based on asset class and regulatory jurisdiction.

Platform Selection: The broker supports both MetaTrader 4 and MetaTrader 5 platforms. This provides traders with access to advanced charting tools, automated trading capabilities, and extensive technical analysis resources. Both platforms support algorithmic trading and copy trading functionality.

Geographic Restrictions: Specific country restrictions or availability limitations were not detailed in accessible sources. This requires direct inquiry for regional service availability.

Customer Support Languages: Available customer service languages were not specified in reviewed materials.

This just2trade review highlights several information gaps that potential clients should address through direct broker contact before account opening.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

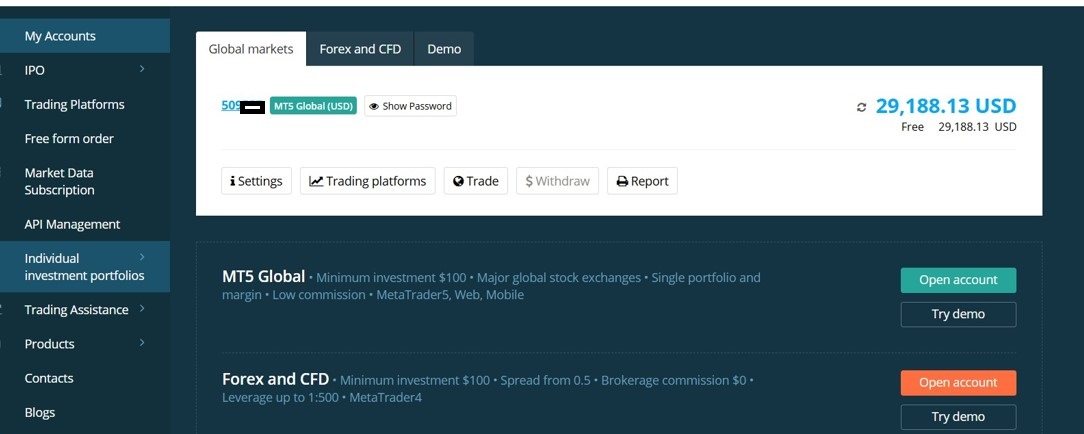

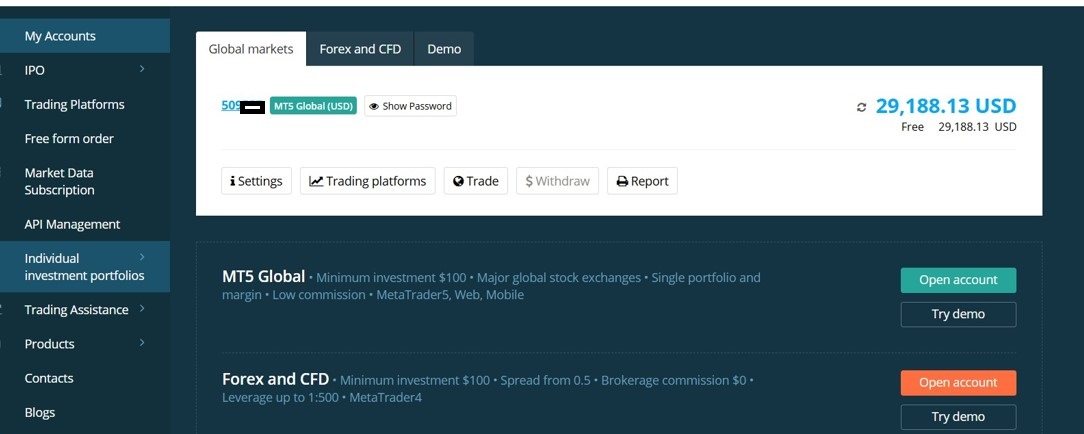

Just2Trade's account conditions receive a below-average rating primarily due to limited transparency regarding account specifications and concerning user feedback. While the broker offers multi-asset trading capabilities, the lack of detailed information about account types, minimum deposit requirements, and specific trading conditions creates uncertainty for potential clients. The 2.4 out of 5 user rating suggests that actual account holders have experienced difficulties with the terms and conditions in practice.

The absence of clearly communicated account tiers or specialized account features indicates a potentially simplified account structure. This could benefit straightforward traders but may lack the sophistication expected by more advanced users. Without specific information about account opening procedures, verification requirements, or special account functionalities, prospective clients cannot adequately assess whether Just2Trade's account conditions align with their trading objectives.

The low user satisfaction rate of only 32% recommendation suggests that account holders have encountered issues. These may involve either the account opening process, ongoing account management, or the practical application of trading conditions. This concerning feedback pattern indicates that while the broker may offer competitive headline features, the actual account experience may fall short of user expectations.

Given the competitive nature of the forex industry, the lack of detailed account condition information combined with poor user ratings suggests significant problems. This just2trade review scores reflect genuine operational challenges rather than minor service issues.

Just2Trade achieves an average rating for tools and resources. This is primarily supported by its provision of MetaTrader 4 and MetaTrader 5 platforms, which are industry-standard trading environments. These platforms provide comprehensive charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and extensive customization options. The availability of both MT4 and MT5 ensures compatibility with a wide range of trading strategies and user preferences.

The broker's support for algorithmic trading and copy trading functionality adds value for traders interested in automated strategies or social trading approaches. However, beyond the core platform offerings, specific information about proprietary tools, research resources, educational materials, or advanced analytical features was not detailed in available sources. This lack of additional resource information suggests either limited supplementary offerings or inadequate marketing of existing tools.

User feedback regarding tools and resources appears mixed. Some traders appreciate the platform stability and functionality while others express concerns about overall service quality. The absence of detailed information about market research, economic calendars, trading signals, or educational resources indicates potential limitations in supporting trader development and decision-making beyond basic platform functionality.

For active traders prioritizing platform reliability and standard trading tools, Just2Trade appears adequate. However, those seeking comprehensive research resources, educational support, or advanced proprietary tools may find the offering insufficient compared to full-service brokers.

Customer Service and Support Analysis (Score: 5/10)

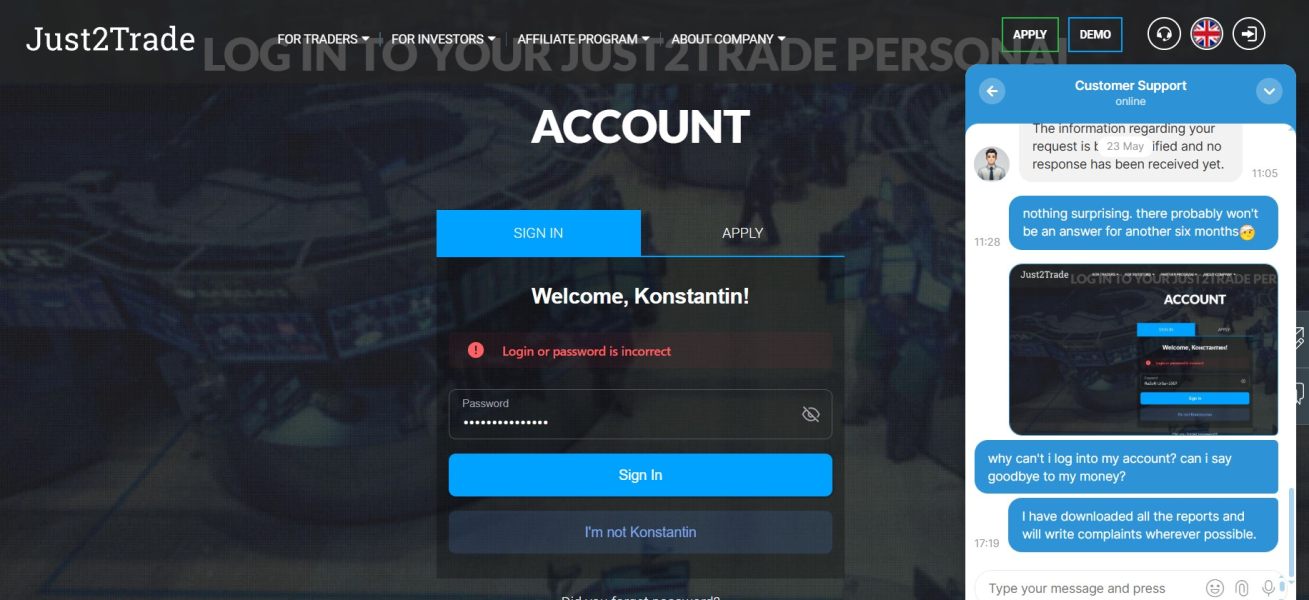

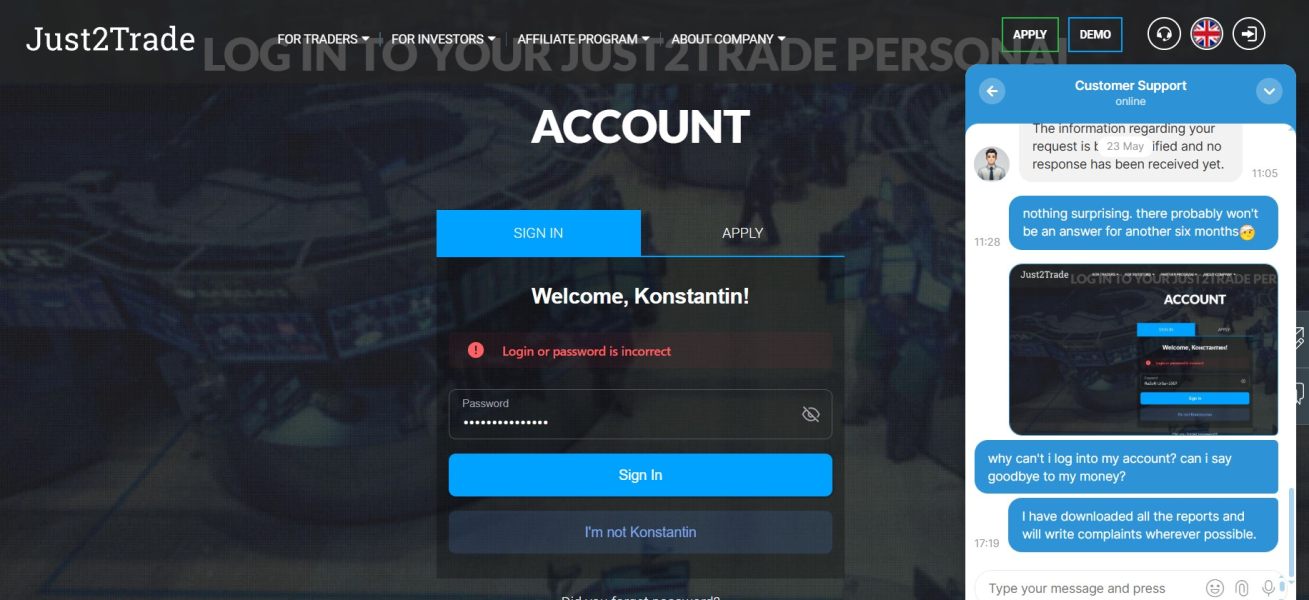

Customer service receives an average rating based on mixed user feedback and limited information about support infrastructure. The 2.4 overall user rating and 32% recommendation rate suggest significant customer service challenges. However, specific details about support channels, response times, or service quality metrics were not provided in available sources.

The absence of detailed information about customer support availability creates uncertainty about the actual support experience. This includes supported languages, operating hours, communication channels (phone, email, live chat), or specialized support for different account types. This information gap itself may indicate limited support infrastructure or inadequate communication about available services.

User reviews suggest inconsistent service experiences. Some clients express satisfaction while others report difficulties with support responsiveness or problem resolution. The low overall satisfaction rate indicates that customer service issues may be systemic rather than isolated incidents. Without specific case studies or detailed feedback analysis, it's difficult to identify particular areas of strength or weakness in the support structure.

For traders who prioritize responsive customer service and comprehensive support resources, the mixed feedback and limited transparency about support capabilities suggest potential limitations. Just2Trade's service delivery may fall short compared to brokers with established reputation for customer care excellence.

Trading Experience Analysis (Score: 5/10)

The trading experience at Just2Trade receives an average rating. This reflects a mixed performance across key trading metrics. While the broker provides access to industry-standard MT4 and MT5 platforms, which generally offer reliable trading environments, the overall user satisfaction rate of 2.4 out of 5 suggests significant issues with the practical trading experience.

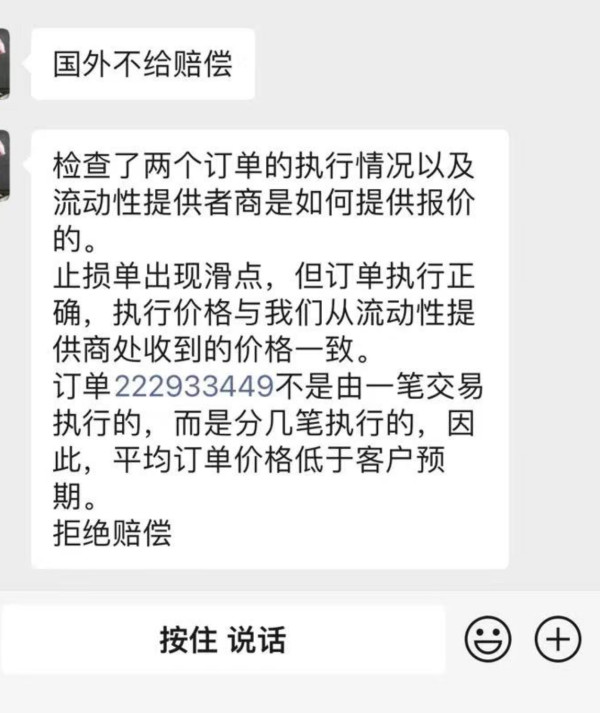

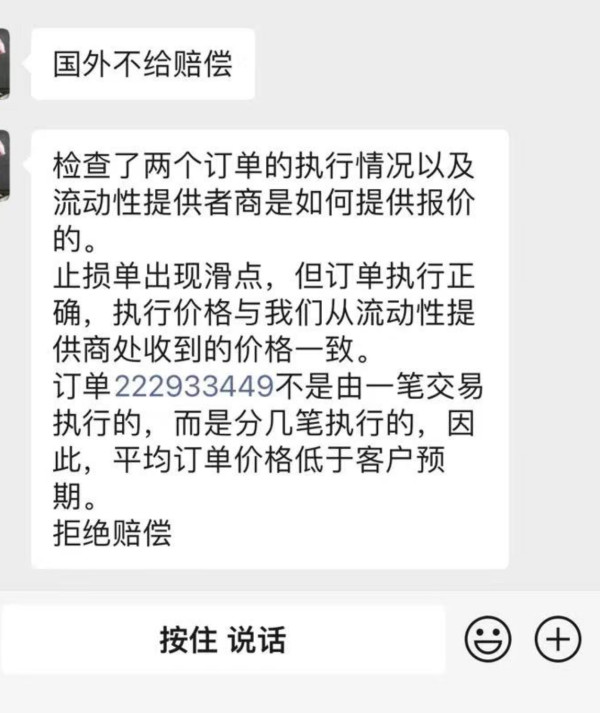

Platform stability and execution quality are critical factors for any trading experience. However, specific information about order execution speeds, slippage rates, requote frequency, or platform uptime was not available in reviewed sources. The low user ratings indicate potential issues in these areas, though without detailed performance metrics, it's challenging to identify specific problem areas. The support for algorithmic trading and copy trading suggests adequate platform functionality for automated strategies.

Mobile trading experience details were not specified in available documentation. This represents a significant information gap given the importance of mobile access for active traders. The absence of information about mobile app features, performance, or user interface quality limits the ability to assess the complete trading experience across different devices.

The diversity of available trading assets (forex, stocks, CFDs, commodities) provides opportunities for portfolio diversification within a single platform. However, without specific information about spread competitiveness, liquidity provision, or market depth, traders cannot fully evaluate the trading environment quality. This just2trade review indicates that while basic trading functionality appears available, the overall experience may lack the refinement expected by demanding traders.

Trust and Reliability Analysis (Score: 6/10)

Just2Trade's trust and reliability rating reflects adequate regulatory compliance balanced against concerning user feedback. The broker's membership in the Securities Investor Protection Corporation (SIPC) provides standard investor protections. Meanwhile, the additional excess SIPC insurance through COR Clearing offers enhanced fund security beyond basic regulatory requirements. This regulatory framework suggests appropriate safeguards for client funds and basic operational oversight.

The SIPC membership indicates compliance with U.S. regulatory standards for securities brokers. However, specific licensing details for forex operations or international services require verification. The segregated account structure implied by SIPC membership suggests proper client fund handling, which is fundamental for broker trustworthiness. The excess insurance coverage through COR Clearing provides additional reassurance regarding fund protection in adverse scenarios.

However, the consistently low user ratings (2.4 out of 5) and poor recommendation rate (32%) raise concerns about operational reliability and service delivery. While regulatory compliance addresses fund safety, user satisfaction reflects broader operational trustworthiness including platform reliability, service consistency, and overall business conduct. The disconnect between adequate regulatory standing and poor user experience suggests potential issues with day-to-day operations rather than fundamental business integrity.

Company transparency regarding management, financial reporting, industry awards, or public recognition was not evident in available sources. The absence of detailed corporate information or industry accolades may indicate limited market presence or insufficient marketing of positive achievements. This contributes to the mixed trust assessment.

User Experience Analysis (Score: 4/10)

User experience receives a below-average rating based on consistently poor user feedback and limited information about platform usability features. The 2.4 out of 5 user rating from 149 reviews represents a substantial sample size indicating systemic user experience challenges rather than isolated incidents. With only 32% of users recommending Just2Trade, the platform clearly struggles with user satisfaction across multiple touchpoints.

Interface design and platform usability details were not specified in available sources. This limits assessment of the actual user interaction quality. While MT4 and MT5 platforms provide standardized interfaces familiar to most traders, the broker's implementation, customization options, and additional user interface elements significantly impact the overall experience. The absence of information about platform customization, user onboarding processes, or interface improvements suggests limited focus on user experience optimization.

Registration and account verification procedures were not detailed in available documentation. This represents a significant information gap for prospective users evaluating the initial platform experience. Efficient onboarding processes are crucial for positive first impressions, and the lack of information about these procedures may indicate either streamlined processes not requiring detailed explanation or potentially cumbersome procedures not prominently marketed.

Common user complaints appear to center around general platform dissatisfaction. However, specific issues such as platform crashes, slow execution, poor mobile experience, or inadequate customer support were not detailed in available reviews. The consistently low ratings suggest multiple experience touchpoints require improvement to achieve competitive user satisfaction levels.

Conclusion

This comprehensive just2trade review reveals a broker with mixed performance across critical evaluation dimensions. While Just2Trade offers competitive advantages in low-commission trading and diverse asset selection, including forex, stocks, CFDs, and commodities, the consistently poor user satisfaction ratings indicate significant operational challenges that overshadow these benefits.

The broker appears most suitable for cost-conscious traders prioritizing low fees and multi-asset access over premium service features. Active traders comfortable with standard MT4/MT5 platforms and requiring minimal customer support may find value in Just2Trade's offering. However, the 2.4 out of 5 user rating and 32% recommendation rate suggest that most traders experience significant dissatisfaction with the platform.

Key strengths include SIPC membership with excess insurance protection, support for algorithmic and copy trading, and access to industry-standard trading platforms. Primary weaknesses center on poor user experience, limited service transparency, and concerning customer satisfaction metrics. Prospective clients should carefully weigh the cost advantages against the substantial risk of service disappointment indicated by existing user feedback.