1. Executive Summary: The Professionals Choice for Trust and Technology

FxPro has, since its inception in 2006, cemented its reputation as a titan of the online brokerage industry. This 2025 review affirms its position as a top-tier choice for serious traders who prioritize unwavering regulatory trust, superior execution quality, and an exceptional range of trading platforms. With its headquarters in London and a global operational footprint, FxPro distinguishes itself through its steadfast commitment to a No Dealing Desk (NDD) execution model, ensuring a transparent trading environment free from the conflicts of interest that plague many competitors.

The brokers regulatory credentials are among the best in the business, holding licenses from multiple top-tier authorities including the FCA (UK), CySEC (Cyprus), FSCA (South Africa), and SCB (Bahamas). This multi-jurisdictional oversight provides unparalleled peace of mind and robust client fund protection. This foundation of trust is complemented by a powerful technological offering. Traders can choose from the complete MetaTrader suite (MT4/MT5), the ECN-focused cTrader platform, and the proprietary FxPro Edge platform, each tailored to different trading styles and tied to specific account types.

While FxPro‘s standard account spreads are competitive but not industry-leading, its raw-spread cTrader platform offers excellent conditions for active traders, with commissions of just $4.5 per side. With a recommended minimum deposit of only $100, access to professional-grade tools is highly accessible. Bolstered by over 100 industry awards and a legacy spanning nearly two decades, FxPro is not just a broker; it’s a financial institution.

For traders in 2025 seeking a reliable, technologically advanced, and highly secure brokerage partner, FxPro remains an unequivocally elite choice.

Overall Rating Framework: 2025

2. Trust and Regulation: A Multi-Jurisdictional Fortress

FxPro‘s commitment to regulation is the cornerstone of its reputation. The broker has strategically secured licenses in multiple top-tier jurisdictions, offering clients a fortress of security and oversight that very few competitors can match. It’s crucial to understand the different entities, as the one you register with determines your leverage and protection level.

Tier-1 Protection: The FCA and CySEC Advantage

For clients in the UK and EEA, FxPro offers the highest level of protection available.

- FCA (Financial Conduct Authority): Considered the gold standard in regulation, the FCA mandates strict adherence to client money rules. Most importantly, clients of FxPro UK Limited are covered by the Financial Services Compensation Scheme (FSCS), which protects deposits up to £85,000 if the broker becomes insolvent.

- CySEC (Cyprus Securities and Exchange Commission): As a key EU regulator, CySEC enforces MiFID II directives. Clients under this entity are protected by the Investor Compensation Fund (ICF), which covers up to €20,000.

Both FCA and CySEC entities enforce Negative Balance Protection and restrict leverage for retail clients to a maximum of 1:30 on major forex pairs.

International Flexibility: The SCB Entity

For most clients outside of the UK/EEA, accounts are opened with FxPro Global Markets Ltd, regulated by the Securities Commission of The Bahamas (SCB).

- Higher Leverage: This entity allows FxPro to offer more competitive leverage, up to 1:200, which is preferred by many experienced global traders.

- Continued Safety: While it doesnt have a state-backed compensation scheme like the FSCS or ICF, FxPro still maintains segregated client fund accounts with major banks and offers Negative Balance Protection to all clients as a company policy, ensuring you can never lose more than your deposit.

This intelligent regulatory structure allows FxPro to offer maximum security where required by law, and flexible trading conditions for the rest of the world, all while maintaining a high baseline of safety.

3. Execution Model: The No Dealing Desk (NDD) Advantage

A core element of FxPro‘s identity is its No Dealing Desk (NDD) execution model. This is a critical feature that builds trust and aligns the broker’s interests with its clients.

What is an NDD Broker?

Unlike a “”Dealing Desk“” or “”Market Maker“” broker that takes the other side of a clients trades (meaning the broker profits when the client loses), an NDD broker acts as an intermediary. FxPro instantly passes client orders to a deep pool of top-tier liquidity providers (major banks and financial institutions).

Why This Matters:

- No Conflict of Interest: FxPro makes its money from trading volumes via the spread or a small commission. They have no financial incentive for their clients to lose money. In fact, they want their clients to be successful and trade more. This eliminates the primary conflict of interest that plagues the industry.

- Transparent Pricing: The prices you see are the aggregated best bid and ask prices from the liquidity pool, with no manipulation from a dealing desk.

- Faster, Better Execution: With deep liquidity and advanced order-matching technology, FxPro boasts ultra-fast execution speeds (typically under 14 milliseconds) with a high fill rate and minimal requotes.

- No Restrictions: The NDD model means FxPro places no restrictions on trading styles. Scalping, news trading, and automated strategies (EAs) are all welcome.

This commitment to NDD execution is a powerful testament to FxPros focus on providing a professional and fair trading environment.

4. Platforms & Account Types: A Tailored Trading Experience

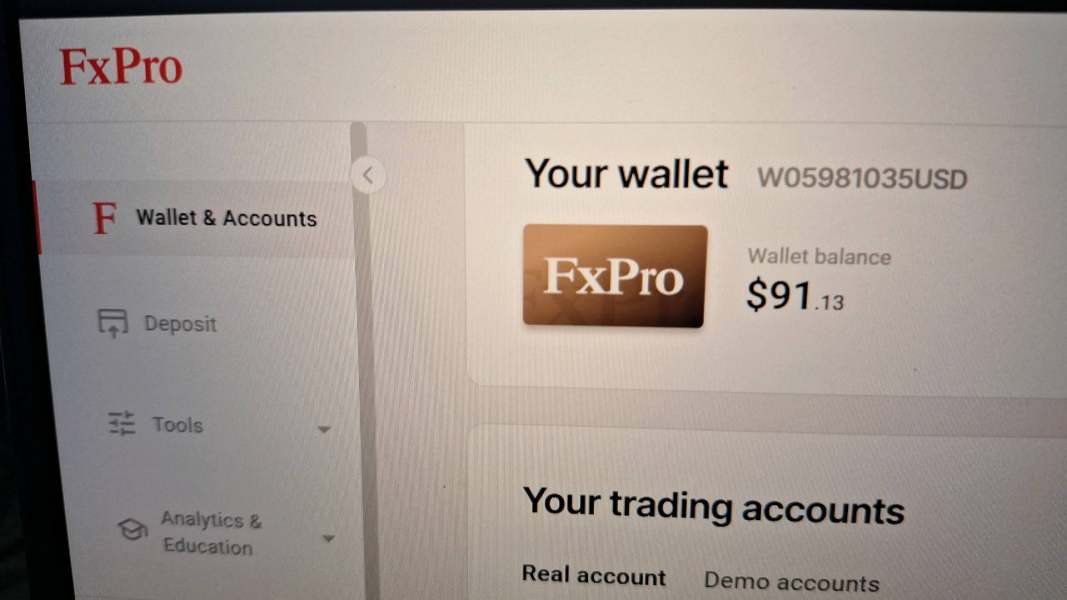

FxPros genius lies in linking its account types directly to its diverse range of trading platforms. This allows traders to choose an entire ecosystem that perfectly matches their strategy and cost preference. The recommended minimum deposit for all accounts is a highly accessible $100.

Cost of Trading Analysis

Lets analyze the real “”all-in“” cost of trading one standard lot of EUR/USD on each platform:

- MT4 Account:

- Typical Spread: ~1.7 pips

- Commission: $0

- Total Cost per Trade: 1.7 pips * $10/pip = ~$17.00

- Verdict: This is higher than many competitors. This account is chosen for its specific MT4 features (like Instant Execution options), not for its cost.

- MT5 Account:

- Typical Spread: ~1.4 pips

- Commission: $0

- Total Cost per Trade: 1.4 pips * $10/pip = ~$14.00

- Verdict: A competitive, standard all-in cost for a high-quality, commission-free account.

- cTrader Account:

- Typical Spread: ~0.3 pips

- Commission: $9.00 ($4.5 per side)

- Total Cost per Trade: (0.3 pips * $10/pip) + $9.00 = $3.00 + $9.00 = ~$12.00

- Verdict: While the $9 commission is slightly higher than some ECN rivals (who charge $6-$7), the all-in cost is still very competitive and provides the transparency of raw spreads. This is the professionals choice within FxPro.

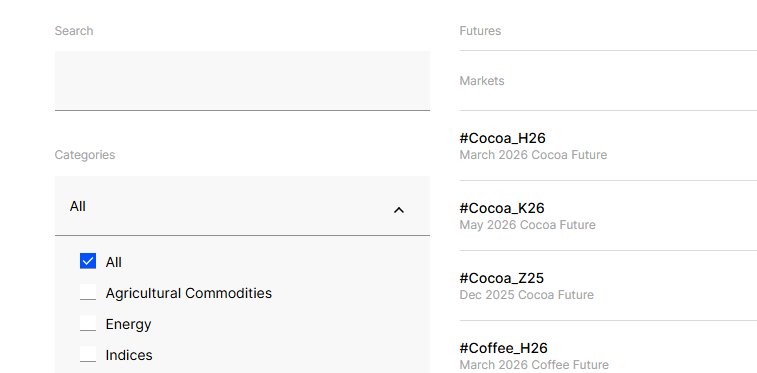

5. Tradable Instruments: A Broad Multi-Asset Portfolio

FxPro provides traders with a comprehensive range of over 2,100 financial instruments across seven asset classes, allowing for excellent portfolio diversification.

- Forex: Over 70 currency pairs, including all majors, minors, and a wide selection of exotics.

- Indices: CFDs on more than 20 of the worlds leading stock indices (e.g., S&P 500, FTSE 100, DAX 40).

- Share CFDs: An enormous selection of over 2,000 global stocks from the US, UK, France, Germany, and more.

- Futures: Trade CFDs on futures contracts for indices, commodities, and energies.

- Metals: A wide range of precious metals including Gold, Silver, and Platinum against various currencies.

- Energies: CFDs on key energy markets like WTI Crude Oil, Brent Crude Oil, and Natural Gas.

- Cryptocurrency CFDs: A solid selection of popular cryptocurrencies like Bitcoin, Ethereum, and Ripple.

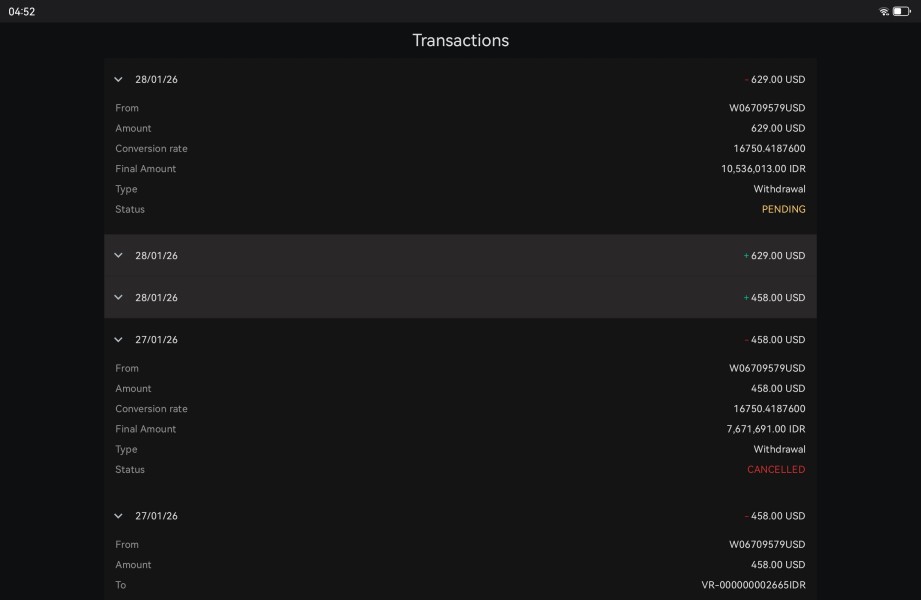

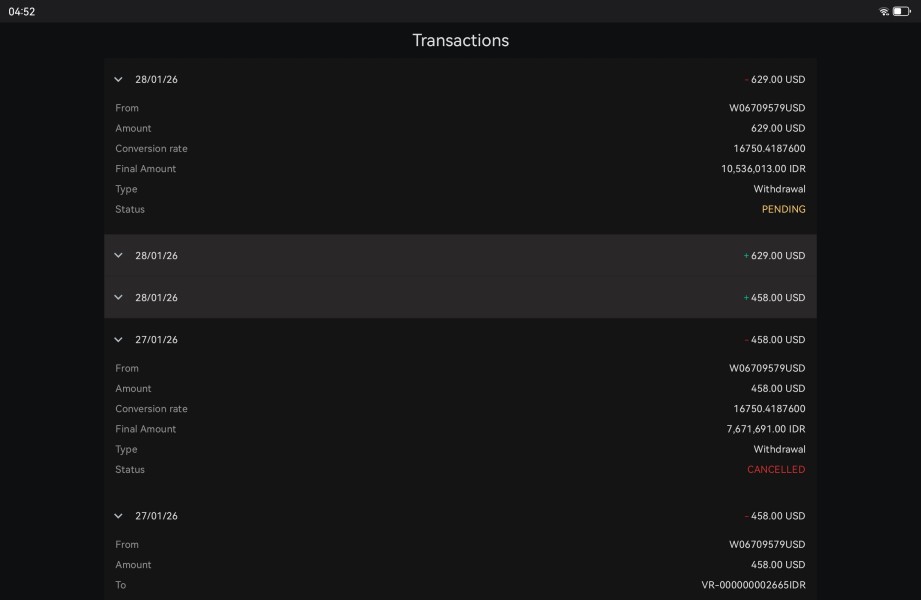

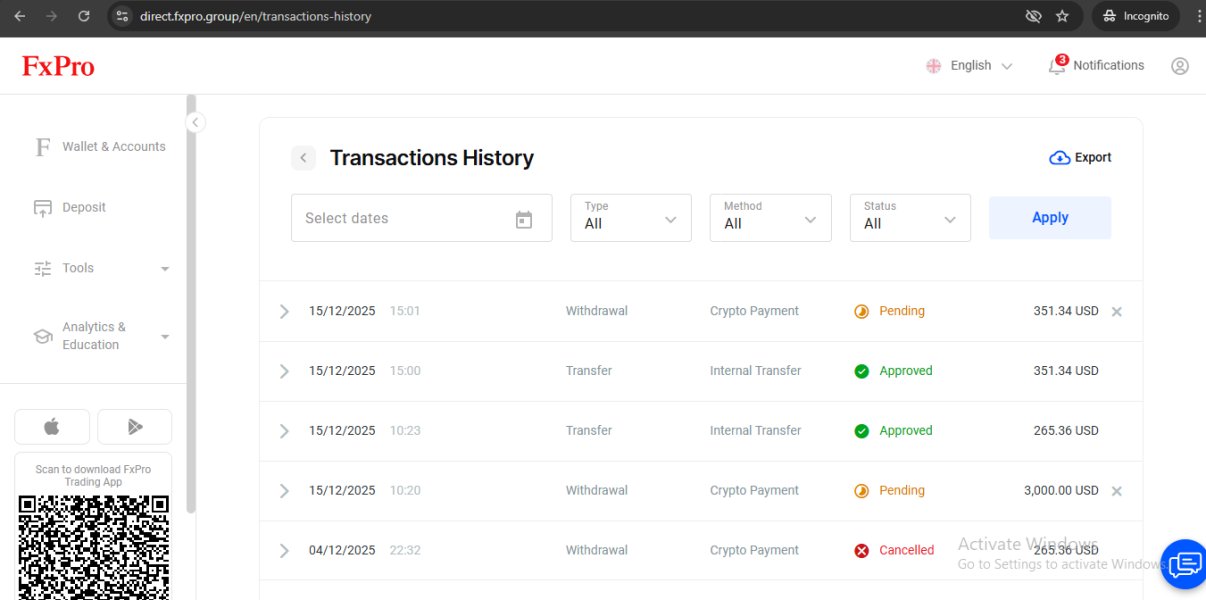

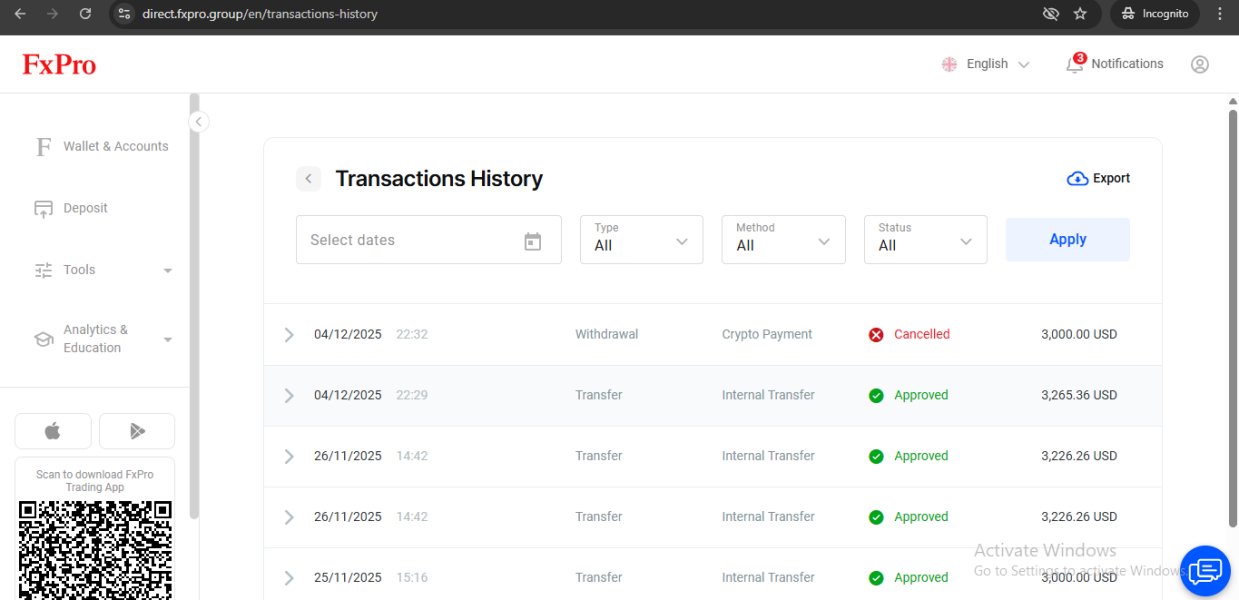

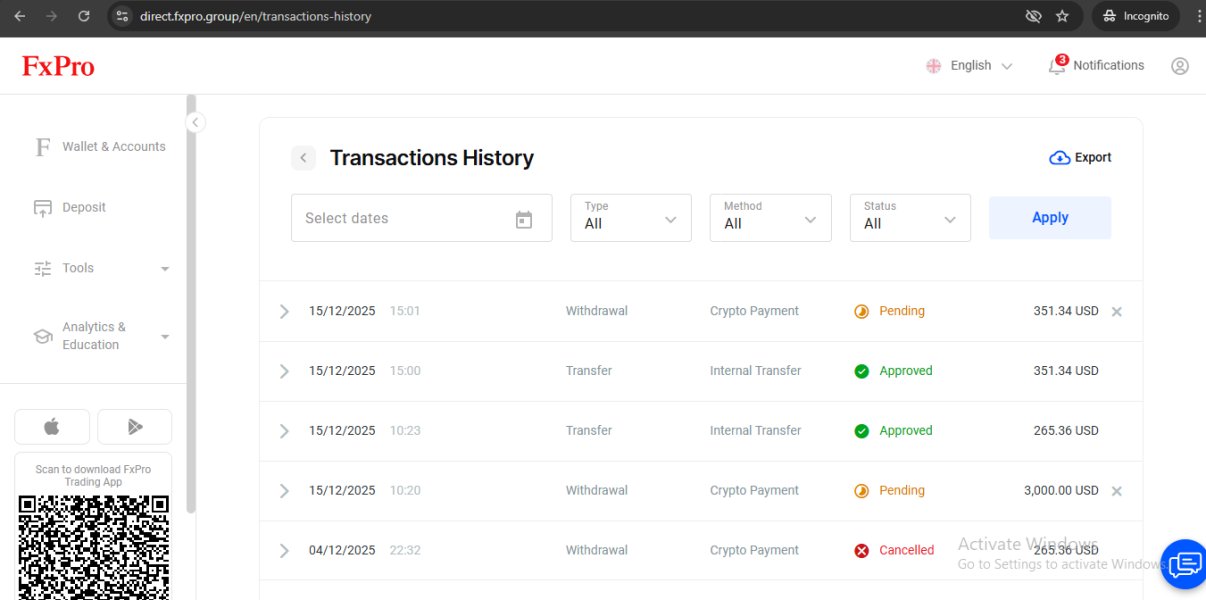

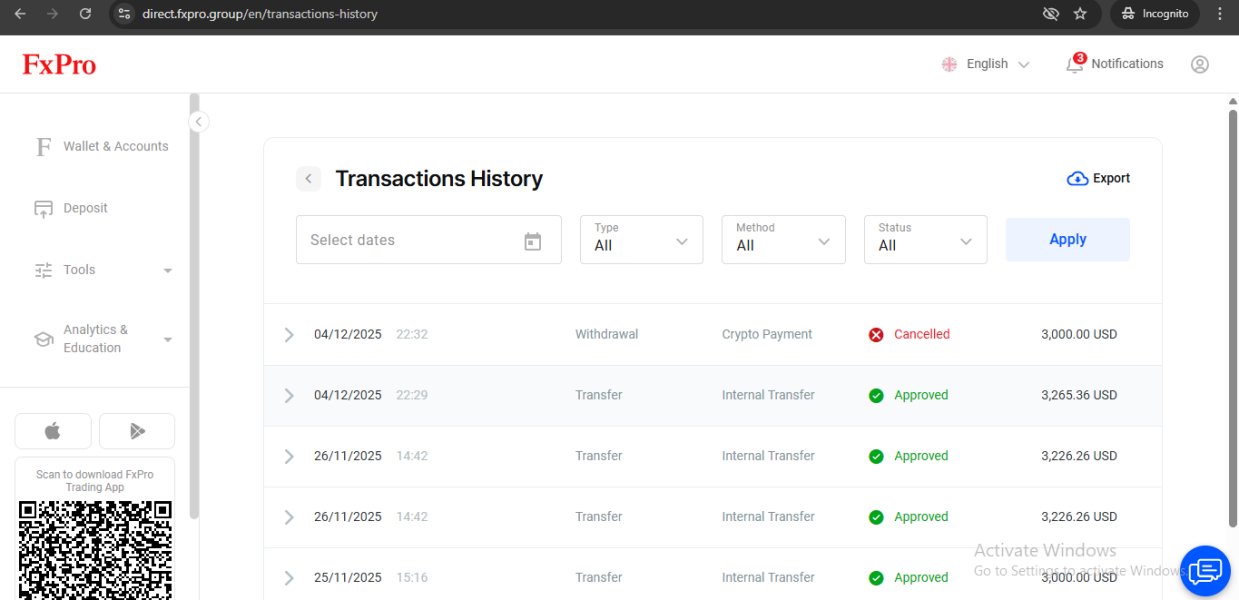

6. Fees, Funding, and Client Services

Non-Trading Fees

FxPro maintains a transparent and fair fee structure that is very client-friendly.

- Deposit & Withdrawal Fees: FxPro charges zero fees for both deposits and withdrawals. This is a significant advantage, as many brokers impose hefty withdrawal charges. (Note: Your payment provider may still charge their own external fees).

- Inactivity Fee: An inactivity fee of $15 is charged after 6 months of no trading activity, followed by a $5 monthly fee. This is a reasonable policy that affects only genuinely dormant accounts.

Funding Methods

The broker offers a wide array of funding options, including:

- Bank Wire Transfer

- Credit/Debit Cards (Visa, Maestro, Mastercard)

- E-Wallets: PayPal, Skrill, Neteller

Customer Support

FxPro offers award-winning customer support that aligns with its professional branding.

- Availability: Support is available 24 hours a day, 5 days a week (24/5).

- Channels: Clients can reach the support team via Live Chat, Email, and a dedicated Phone line.

- Quality: The support is multilingual (offered in over 20 languages) and is widely regarded as professional, knowledgeable, and efficient in resolving queries.

7. Final Conclusion: Who is FxPro Best For?

FxPro is not trying to be the cheapest discount broker on the market. Instead, it has focused relentlessly on being one of the most trusted, technologically advanced, and reliable brokers in the world. It has built a service for traders who are serious about their craft and demand a professional environment.

FxPro is the ideal choice for:

- Traders Prioritizing Security: If your number one concern is the safety of your funds and dealing with a heavily regulated, time-tested broker, FxPro is arguably in the top 1% globally.

- Technology Enthusiasts: Traders who want the freedom to choose between MT4, MT5, and cTrader to perfectly match their strategy will find FxPros offering unparalleled.

- Active and Algorithmic Traders: The NDD execution model, fast speeds, and welcoming stance on all trading styles make it a haven for scalpers and EA users, especially on the cTrader platform.

- Professional and Institutional Clients: FxPros deep liquidity and robust infrastructure are built to handle large volumes and sophisticated trading needs.

FxPro may be less suitable for:

- Pure Cost-Minimizers: While its cTrader costs are competitive, traders whose only goal is to find the absolute lowest all-in cost might find brokers with a $6/lot commission to be marginally cheaper.

- Casual Hobbyists: While the $100 minimum deposit makes it accessible, the sheer professionalism and range of platforms might be overwhelming for someone who only trades very infrequently.

In conclusion, FxPro has earned its stellar reputation. It is a financial powerhouse that provides the tools, security, and execution quality that professional traders demand. For anyone serious about trading in 2025, FxPro should be at the very top of their consideration list.