Opofinance 2025 Review: Everything You Need to Know

Executive Summary

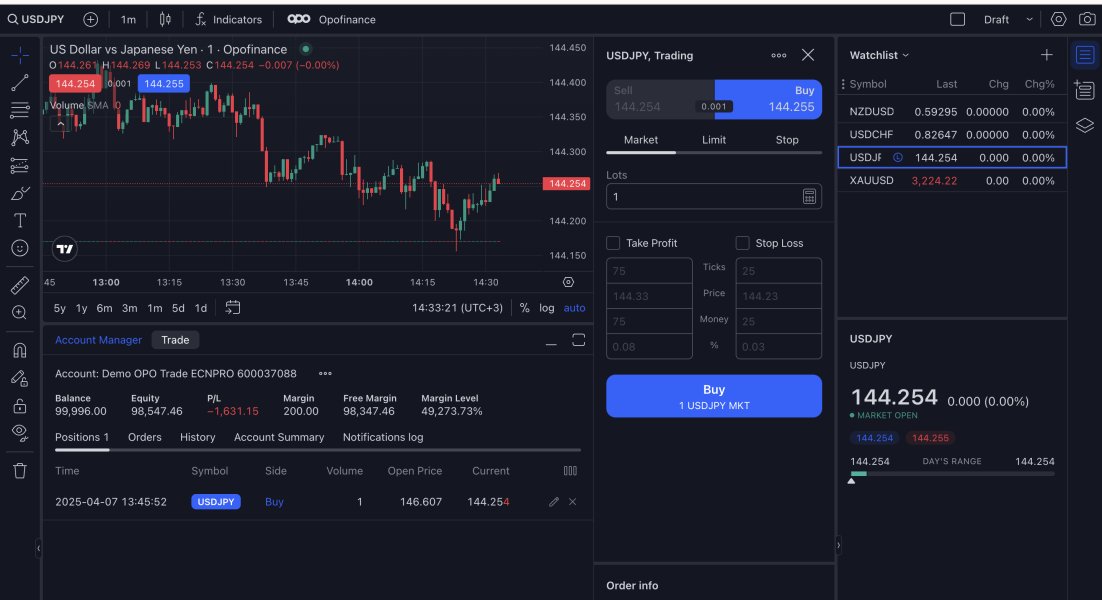

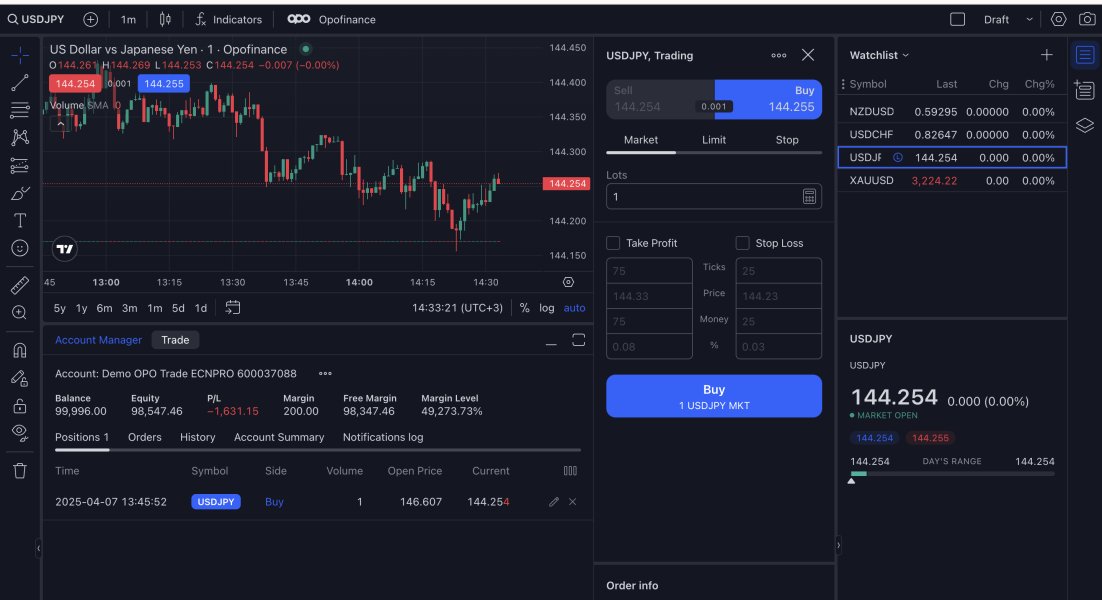

This opofinance review looks at a new online forex broker that started in 2021. Opofinance calls itself a multi-asset trading platform that gives you access to forex, stocks, commodities, and cryptocurrencies through an ECN trading environment. The broker uses the cTrader platform as its main trading system and offers leverage ratios up to 1:500, which makes it appealing to traders who want higher leverage opportunities.

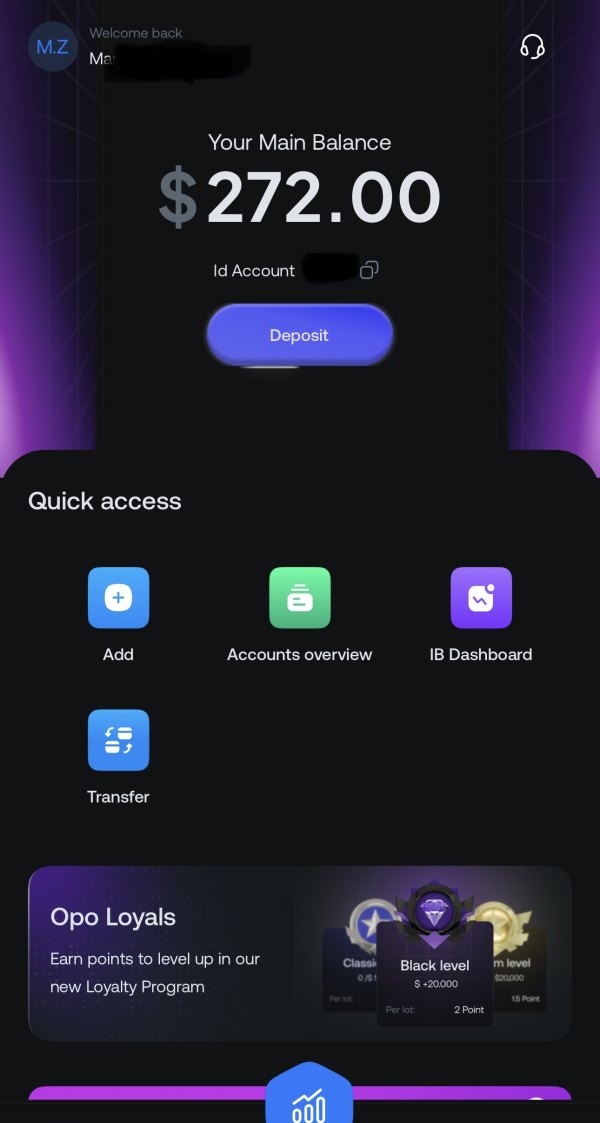

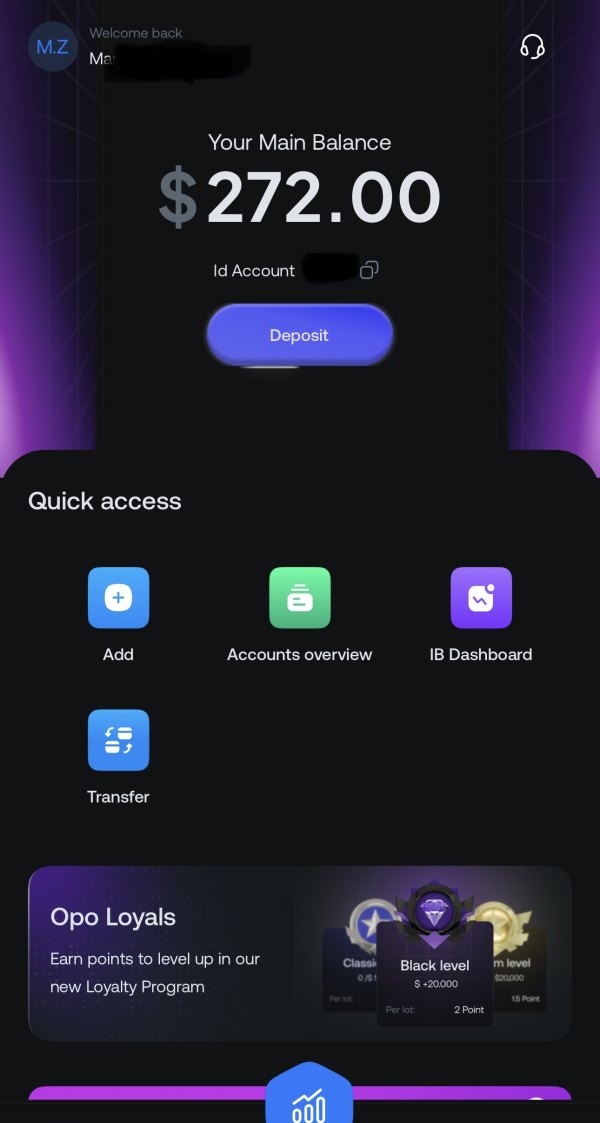

The platform targets both beginner traders and those looking to use high-leverage trading opportunities. With a minimum deposit of $100, Opofinance tries to stay accessible for retail traders while providing professional-grade ECN execution. The broker offers educational resources designed to help retail traders develop their trading skills, though we need to evaluate the depth and quality of these resources more.

However, this review finds several areas of concern, especially about regulatory transparency and complete service documentation. While Opofinance has gotten 167 reviews on Trustpilot, which shows some level of user engagement, the overall assessment remains neutral because there's limited available information about key operational aspects.

Important Disclaimers

Regional Entity Variations: Due to the absence of specific regulatory information in available sources, users should independently assess the risks associated with cross-regional trading activities. Different jurisdictions may offer varying levels of investor protection, and traders should verify the regulatory status applicable to their region before engaging with the platform.

Review Methodology: This evaluation is based on publicly available information and does not incorporate user satisfaction scores or specific complaint analysis. The assessment reflects available data as of 2025 and may not capture all recent developments or changes in the broker's service offerings.

Rating Framework

Broker Overview

Opofinance started in the online trading world in 2021 as a multi-asset broker that wants to serve the growing demand for accessible yet professional trading services. The company has positioned itself as a technology-focused broker that uses the cTrader platform to deliver ECN trading conditions across multiple asset classes. According to available information, the broker's business model centers on providing direct market access while maintaining competitive trading conditions for both new and experienced traders.

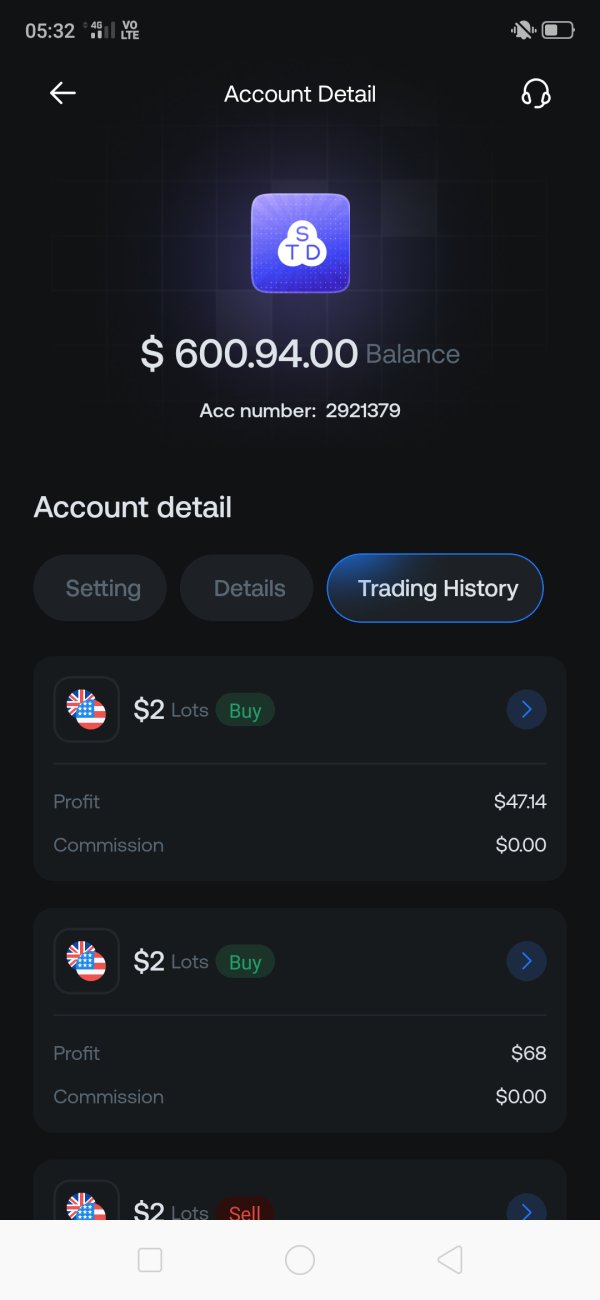

The broker's main offering includes forex pairs, individual stocks, various commodities, and cryptocurrency trading opportunities. This diverse approach reflects the modern trader's need for portfolio diversification within a single trading platform. Opofinance's emphasis on ECN execution suggests a commitment to transparent pricing and reduced conflict of interest between the broker and its clients, though specific execution statistics remain undisclosed in available documentation.

The platform operates mainly through the cTrader ecosystem, which is recognized in the industry for its advanced charting capabilities, algorithmic trading support, and institutional-grade execution infrastructure. This opofinance review notes that while the broker has established its technological foundation, comprehensive information about its operational history, management team, and strategic partnerships remains limited in publicly available sources.

Detailed Service Analysis

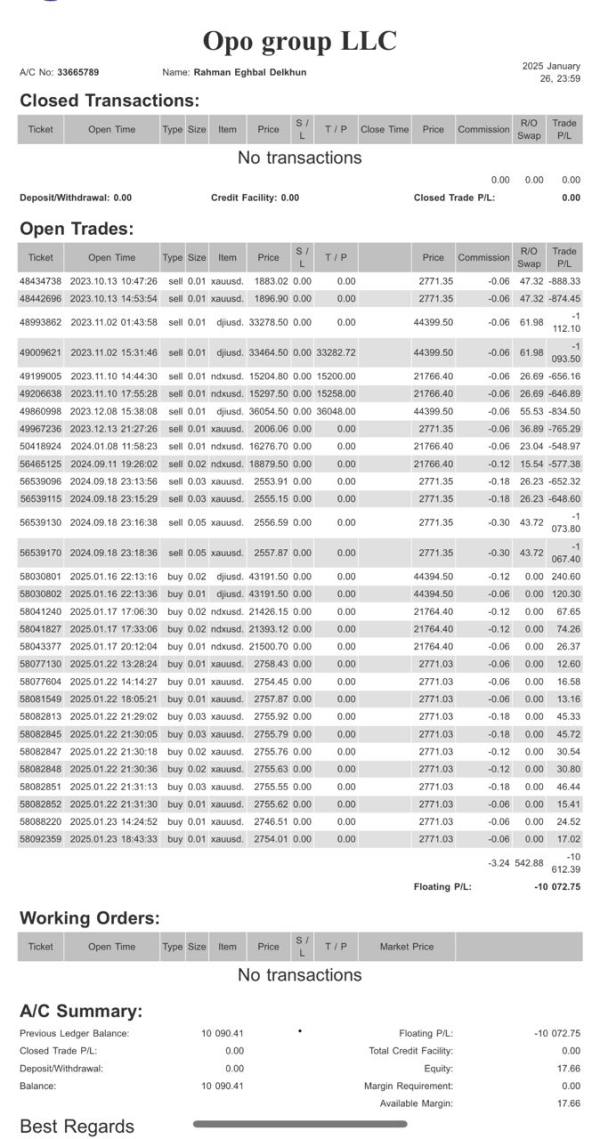

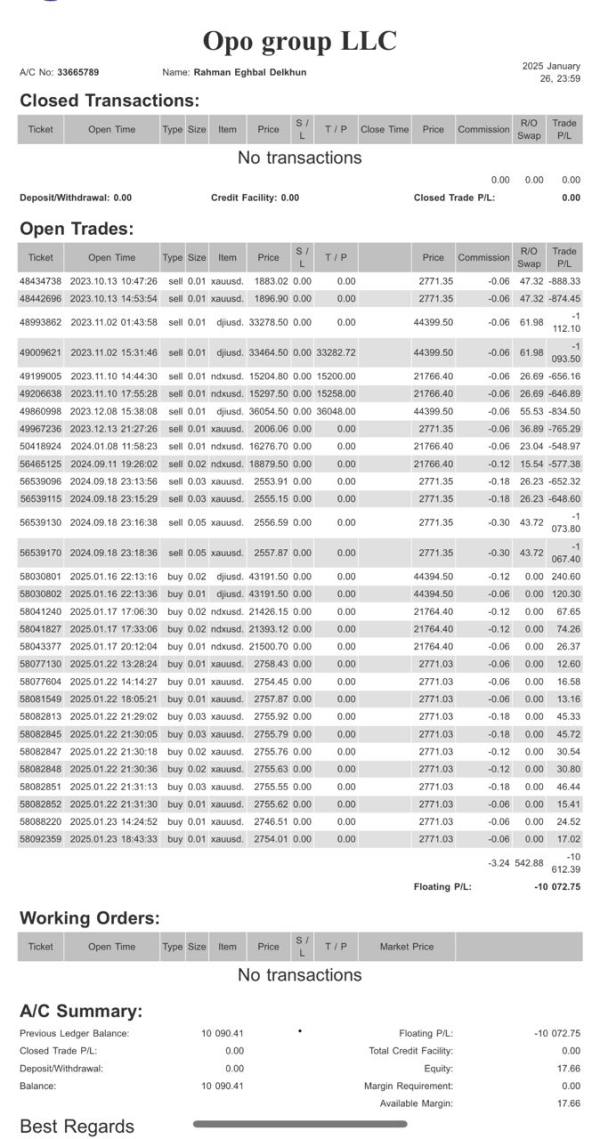

Regulatory Jurisdiction: Available sources do not specify particular regulatory authorities overseeing Opofinance operations, which represents a significant information gap for potential clients seeking regulatory assurance.

Deposit and Withdrawal Methods: Specific funding mechanisms are not detailed in available documentation, though the $100 minimum deposit requirement suggests accessibility for retail traders.

Minimum Deposit Requirements: The broker maintains a $100 minimum deposit threshold, positioning itself competitively for entry-level traders while remaining accessible for account funding.

Promotional Offerings: Current bonus structures and promotional campaigns are not specified in available source materials, indicating either absence of such programs or limited public disclosure.

Available Trading Assets: The platform supports trading across four primary asset categories: foreign exchange pairs, individual equity securities, commodity instruments, and cryptocurrency markets, providing comprehensive market exposure.

Cost Structure: Detailed spread configurations and commission schedules are not explicitly outlined in available information, creating uncertainty about total trading costs for potential clients.

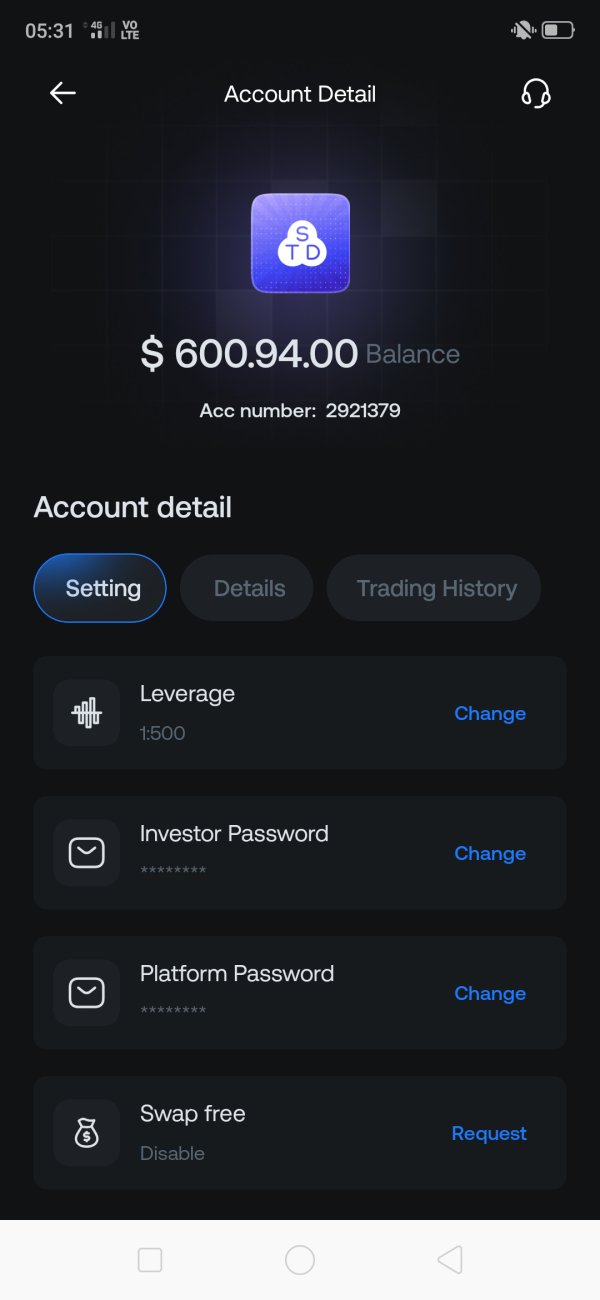

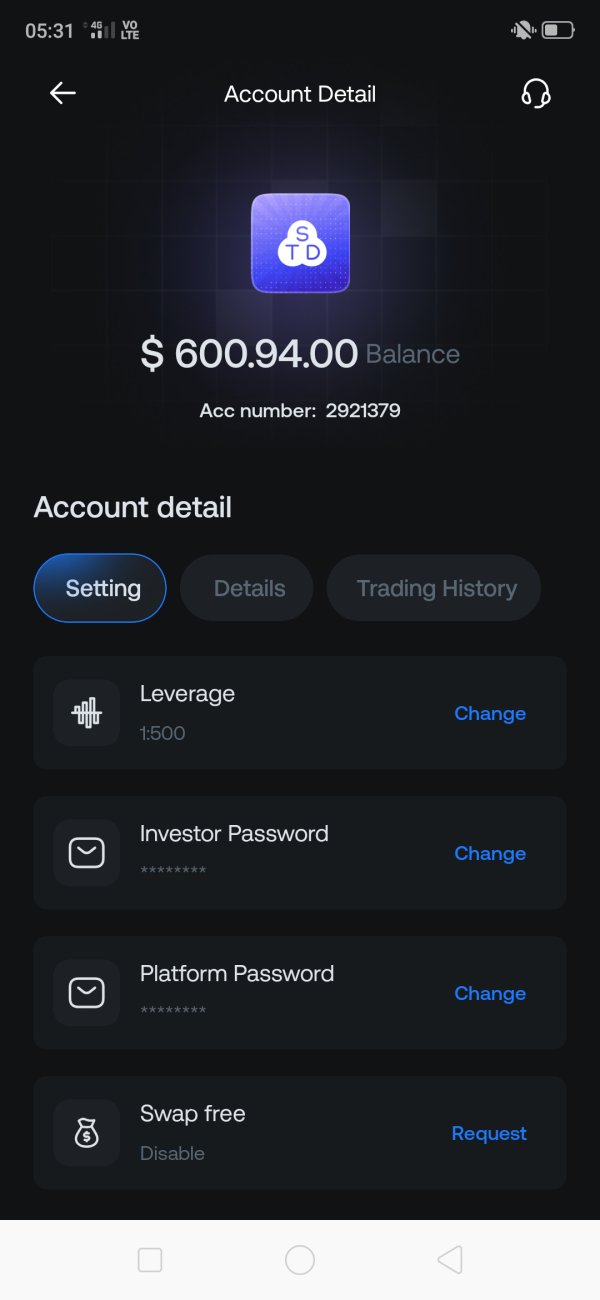

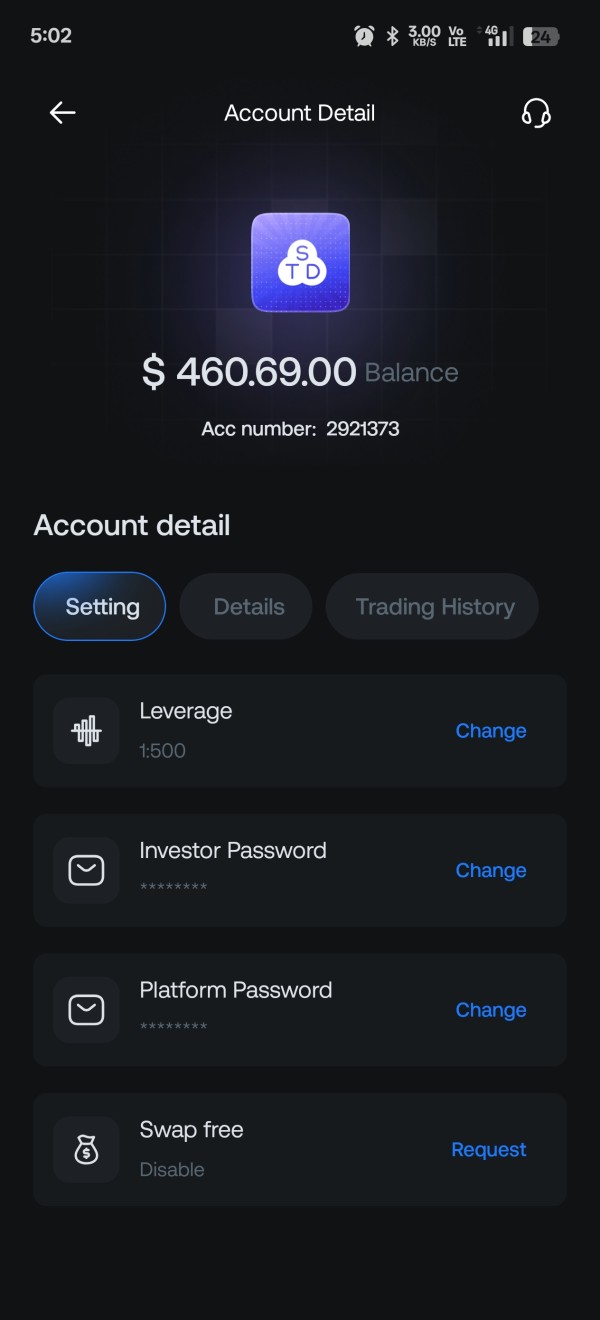

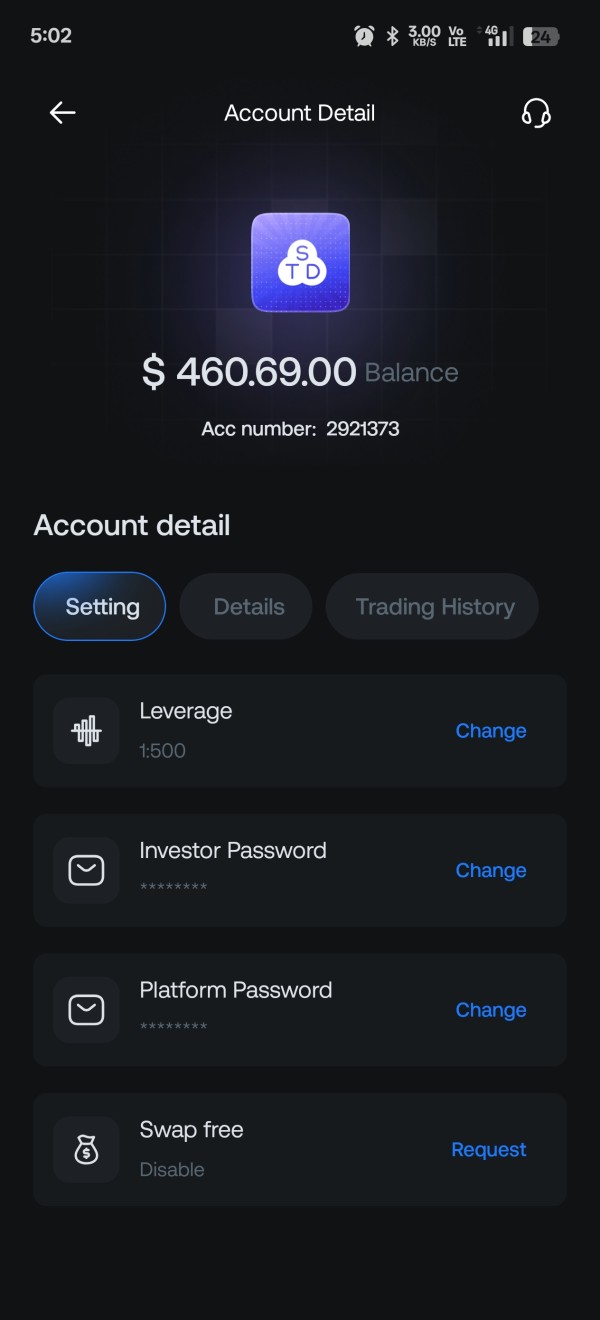

Leverage Capabilities: Maximum leverage extends to 1:500, which exceeds many regulatory limitations in major jurisdictions and appeals to traders seeking amplified market exposure.

Platform Options: The broker exclusively utilizes cTrader-based infrastructure for ECN trading execution, focusing on a single, professional-grade platform rather than multiple options.

Geographic Restrictions: Territory-specific limitations are not documented in available sources, though regulatory compliance likely varies by jurisdiction.

Customer Support Languages: Multilingual support capabilities are not specified in accessible documentation, potentially limiting international client service effectiveness.

This opofinance review emphasizes that while basic operational parameters are established, comprehensive service details require direct inquiry with the broker for complete clarity.

Account Conditions Analysis

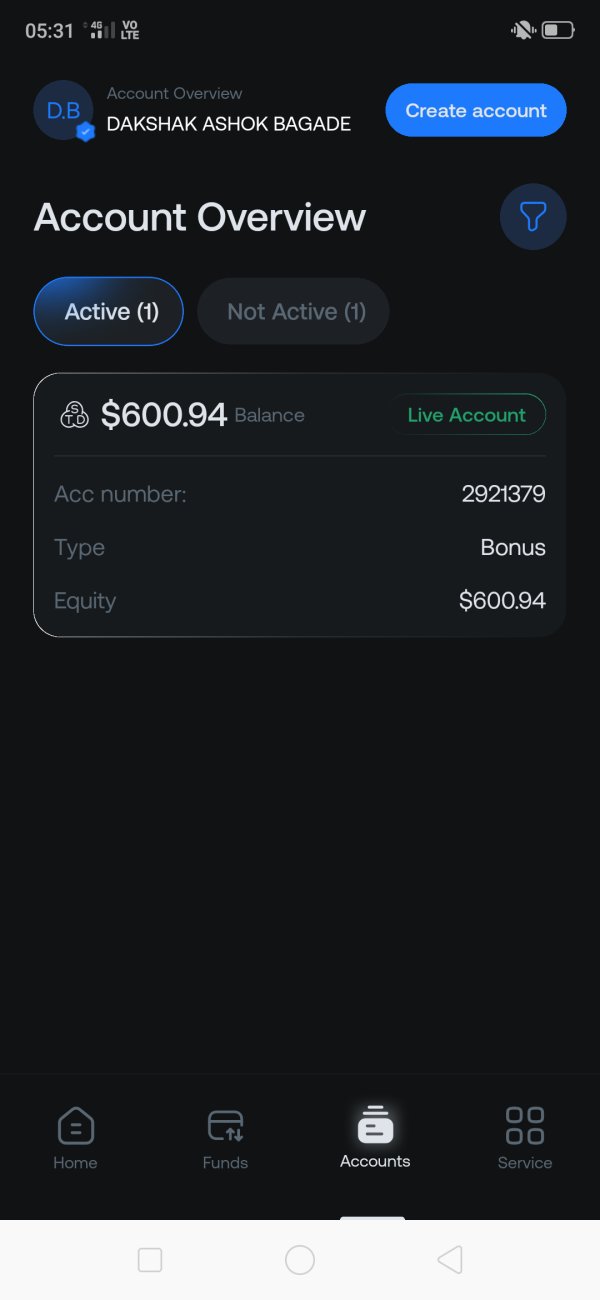

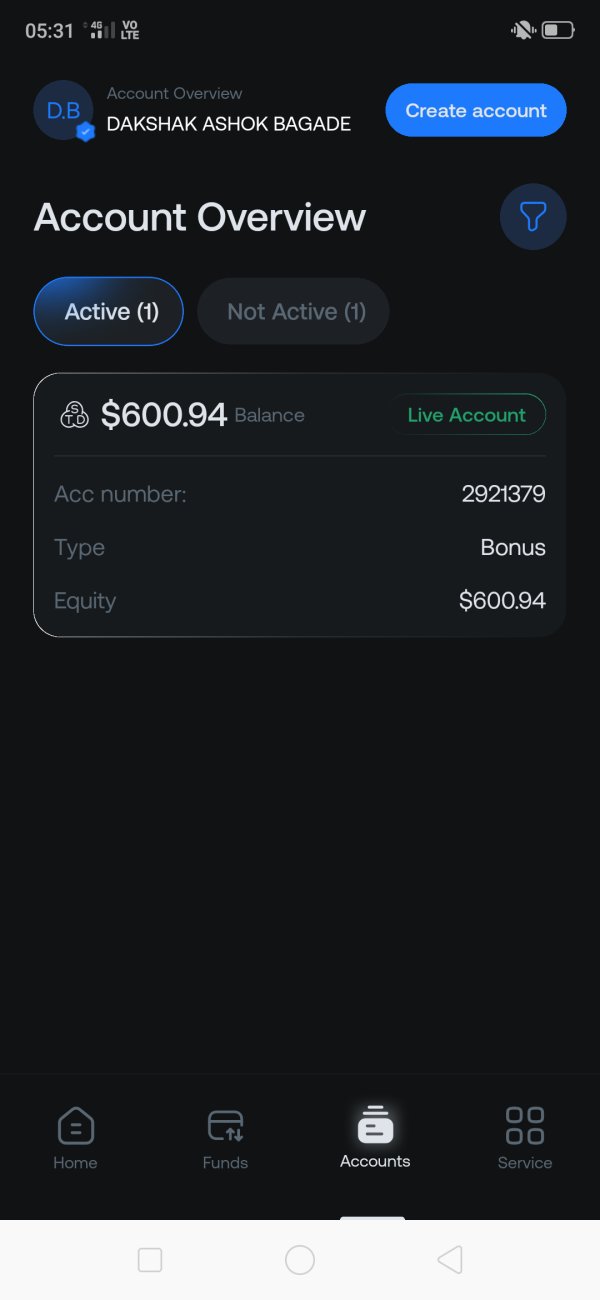

The account structure at Opofinance appears simple, though specific account tier distinctions are not clearly outlined in available documentation. The $100 minimum deposit requirement positions the broker competitively within the retail trading space, making it accessible to beginning traders who may not have substantial initial capital. This threshold is reasonable compared to industry standards and removes significant barriers to entry for new market participants.

However, the absence of detailed account type specifications raises questions about service differentiation and whether the broker offers specialized accounts for different trading styles or experience levels. Many established brokers provide tiered account structures with varying benefits, spreads, and service levels, but such information is not readily available for Opofinance.

The account opening process details are not fully documented in available sources, which could indicate either a simplified onboarding procedure or insufficient public disclosure of requirements. Modern traders typically expect streamlined digital account opening with clear documentation requirements and reasonable verification timelines.

Regarding specialized account features such as Islamic accounts for Sharia-compliant trading, copy trading accounts, or institutional-grade services, available information does not provide specific details. This opofinance review notes that while the basic account accessibility appears reasonable, the lack of comprehensive account condition information may require direct communication with the broker for complete understanding of available options and their respective features.

Opofinance's technological foundation centers on the cTrader platform, which represents a sophisticated choice for ECN trading execution. cTrader is recognized throughout the industry for its advanced charting capabilities, comprehensive technical analysis tools, and support for algorithmic trading strategies. The platform's Level II pricing transparency and direct market access features align with professional trading requirements and suggest that Opofinance prioritizes execution quality.

The broker's decision to focus exclusively on cTrader rather than offering multiple platform options indicates a specialized approach that may appeal to traders familiar with this ecosystem. cTrader's native support for copy trading, advanced order types, and institutional-grade execution infrastructure provides a solid foundation for diverse trading strategies.

However, available documentation does not detail specific research and analysis resources that Opofinance provides beyond the standard cTrader functionality. Many brokers supplement their platform offerings with proprietary market analysis, economic calendars, trading signals, or third-party research partnerships, but such resources are not explicitly mentioned in accessible sources.

Educational resource availability is mentioned in general terms, with references to materials designed to support retail traders, but the depth, quality, and scope of these educational offerings remain unclear. Comprehensive trader education typically includes webinars, written guides, video tutorials, and market analysis training, though specific details about Opofinance's educational program are not available in current documentation.

Automated trading support through cTrader's cAlgo environment would theoretically be available, but specific information about Opofinance's policies regarding algorithmic trading, expert advisors, or third-party trading systems is not detailed in available sources.

Customer Service and Support Analysis

Customer service infrastructure represents one of the most significant information gaps in this opofinance review. Available documentation does not specify the communication channels through which clients can reach support representatives, whether through live chat, telephone, email, or ticket-based systems. This absence of basic contact information raises concerns about service accessibility and responsiveness.

Response time commitments, service level agreements, and support availability hours are not documented in accessible sources. Modern traders typically expect 24/5 or 24/7 support availability, particularly for platforms serving international markets across multiple time zones. The lack of clear support hour information could indicate limited service availability or insufficient public disclosure of service standards.

Service quality assessments cannot be fully evaluated due to the absence of specific user feedback regarding support interactions in available documentation. While Trustpilot reviews exist for the platform, detailed analysis of customer service experiences is not provided in accessible sources.

Multilingual support capabilities remain unclear, which could significantly impact international client service effectiveness. Brokers serving global markets typically provide support in major languages, but Opofinance's language support scope is not specified in available information.

The absence of documented escalation procedures, complaint resolution processes, or service quality metrics further complicates the assessment of customer service capabilities. Professional brokers typically maintain transparent complaint handling procedures and publish service quality statistics, but such information is not readily available for Opofinance.

Trading Experience Analysis

The trading experience evaluation focuses mainly on the cTrader platform implementation, which generally provides robust performance characteristics. cTrader's ECN infrastructure typically delivers competitive execution speeds and transparent pricing, though specific performance metrics for Opofinance's implementation are not available in documentation.

Order execution quality assessment is limited by the absence of published execution statistics, slippage data, or fill rate information. Professional brokers often provide detailed execution quality reports, but such transparency measures are not evident in available Opofinance documentation. The ECN model suggests minimal conflicts of interest and direct market access, though actual execution quality requires empirical validation through user experience.

Platform functionality completeness benefits from cTrader's comprehensive feature set, including advanced charting, multiple order types, algorithmic trading support, and copy trading capabilities. However, any customizations or additional features specific to Opofinance's implementation are not detailed in available sources.

Mobile trading experience assessment is constrained by limited information about mobile platform availability, functionality, or user interface quality. cTrader typically provides mobile applications, but specific details about Opofinance's mobile trading support are not documented in accessible sources.

Trading environment stability, including spread consistency, server uptime, and platform reliability during high-volatility periods, cannot be thoroughly evaluated due to insufficient performance data in available documentation. This opofinance review notes that while the underlying cTrader technology is generally reliable, broker-specific performance characteristics require direct user experience for accurate assessment.

Trust and Safety Analysis

The trust and safety evaluation reveals significant concerns mainly related to regulatory transparency. Available documentation does not specify regulatory authorities, licensing numbers, or compliance frameworks governing Opofinance operations. This regulatory information gap substantially impacts the trustworthiness assessment, as regulatory oversight provides crucial investor protection and operational standards enforcement.

Fund safety measures, including client fund segregation, deposit insurance, or compensation schemes, are not detailed in accessible sources. Professional brokers typically maintain segregated client accounts and participate in investor compensation programs, but such protections are not explicitly documented for Opofinance.

Corporate transparency regarding financial reporting, ownership structure, or operational metrics is limited in available information. Established brokers often publish annual reports, financial statements, or operational statistics to demonstrate stability and transparency, but such documentation is not readily available for Opofinance.

Industry reputation assessment is constrained by the broker's relatively recent market entry and limited third-party evaluations. While 167 Trustpilot reviews indicate some level of user engagement, comprehensive industry recognition or awards are not documented in available sources.

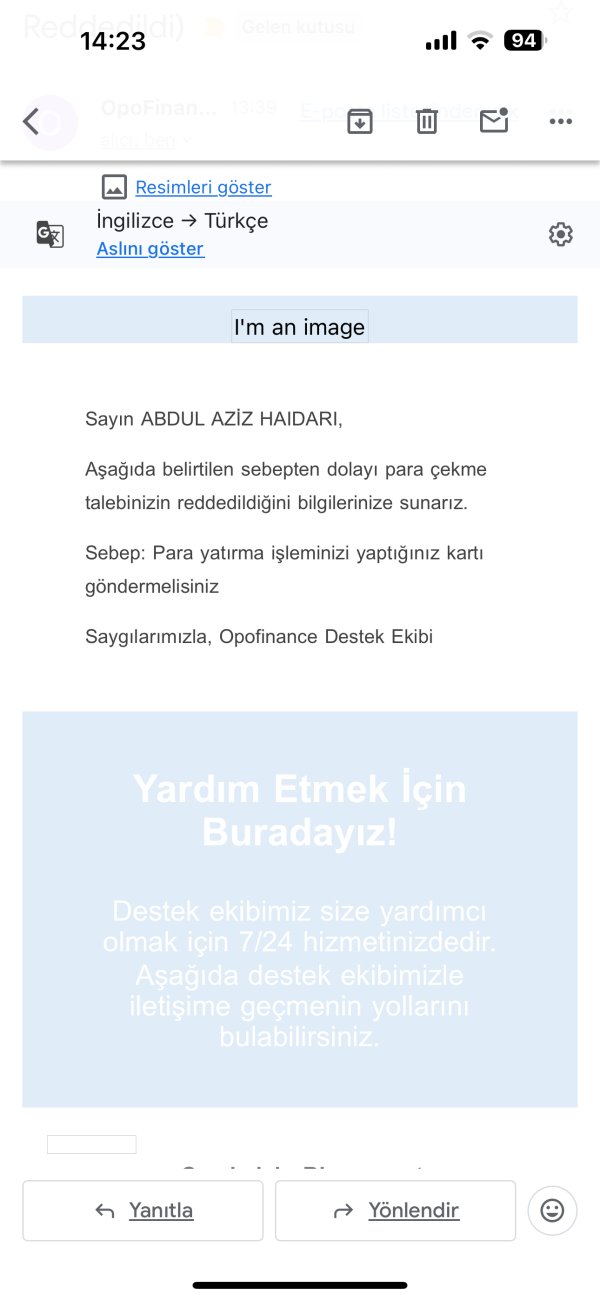

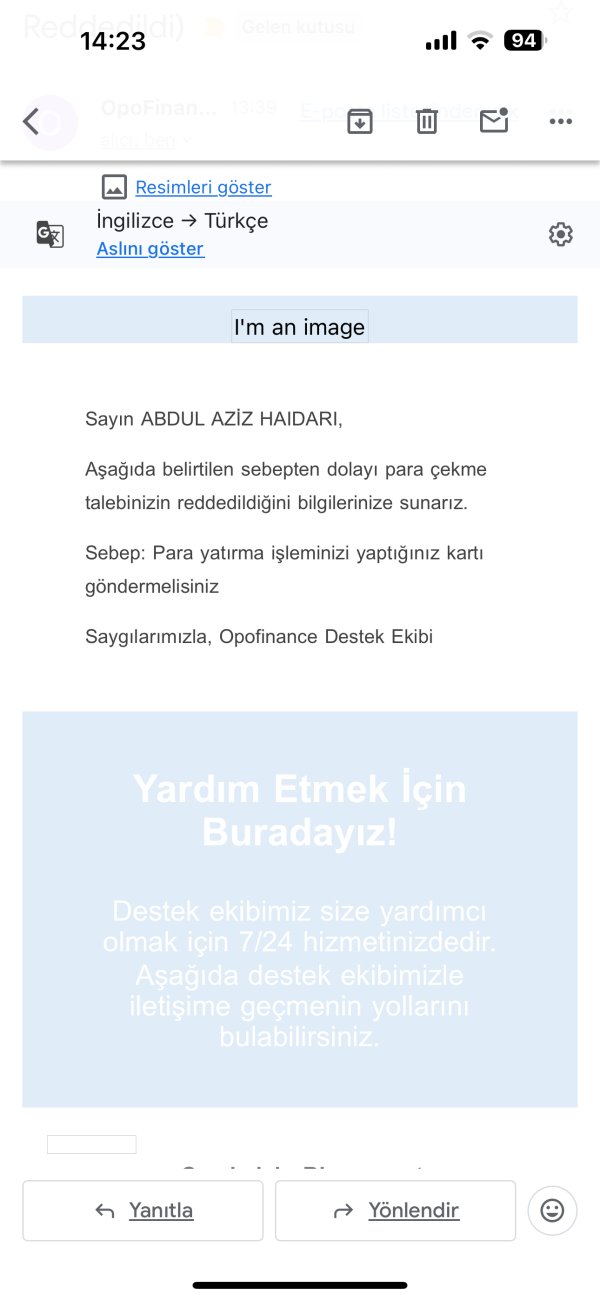

Negative incident handling procedures, dispute resolution mechanisms, or crisis management protocols are not specified in accessible documentation. The absence of clear procedures for handling client complaints or operational issues further impacts the trust assessment.

The combination of limited regulatory information, absent safety measure documentation, and insufficient corporate transparency significantly affects the overall trust and safety rating in this evaluation.

User Experience Analysis

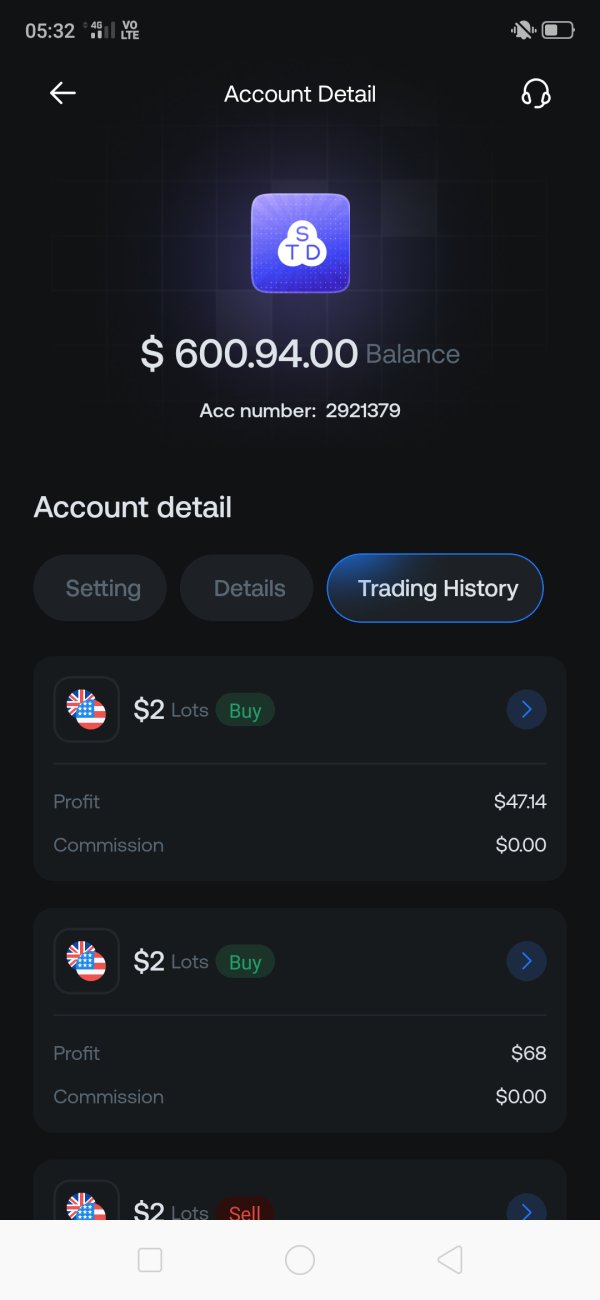

User experience assessment is partially informed by the existence of 167 Trustpilot reviews, indicating active user engagement with the platform. However, specific satisfaction ratings, review sentiment analysis, or detailed user feedback summaries are not provided in available documentation, limiting comprehensive user experience evaluation.

Interface design and usability assessment relies mainly on cTrader's generally positive reputation for user-friendly design and intuitive navigation. The platform's professional-grade interface typically appeals to experienced traders while remaining accessible to newcomers, though specific customizations or enhancements by Opofinance are not detailed.

Registration and verification process convenience cannot be thoroughly evaluated due to limited information about account opening procedures, documentation requirements, or approval timelines. Streamlined onboarding processes significantly impact initial user experience, but such details are not available in accessible sources.

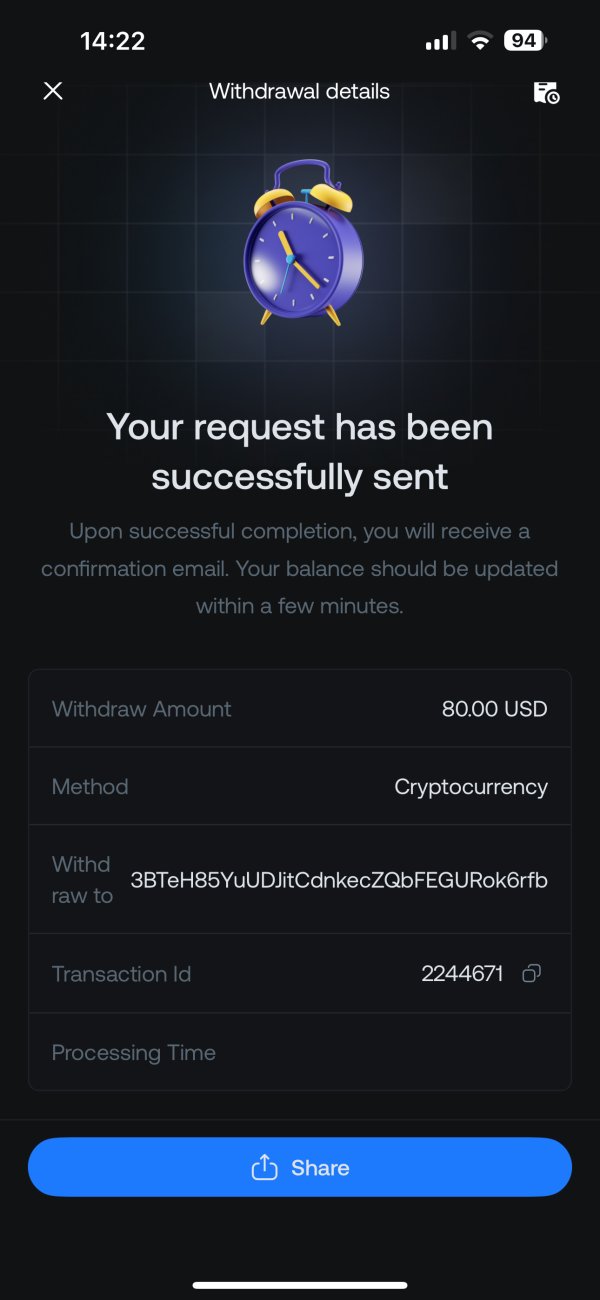

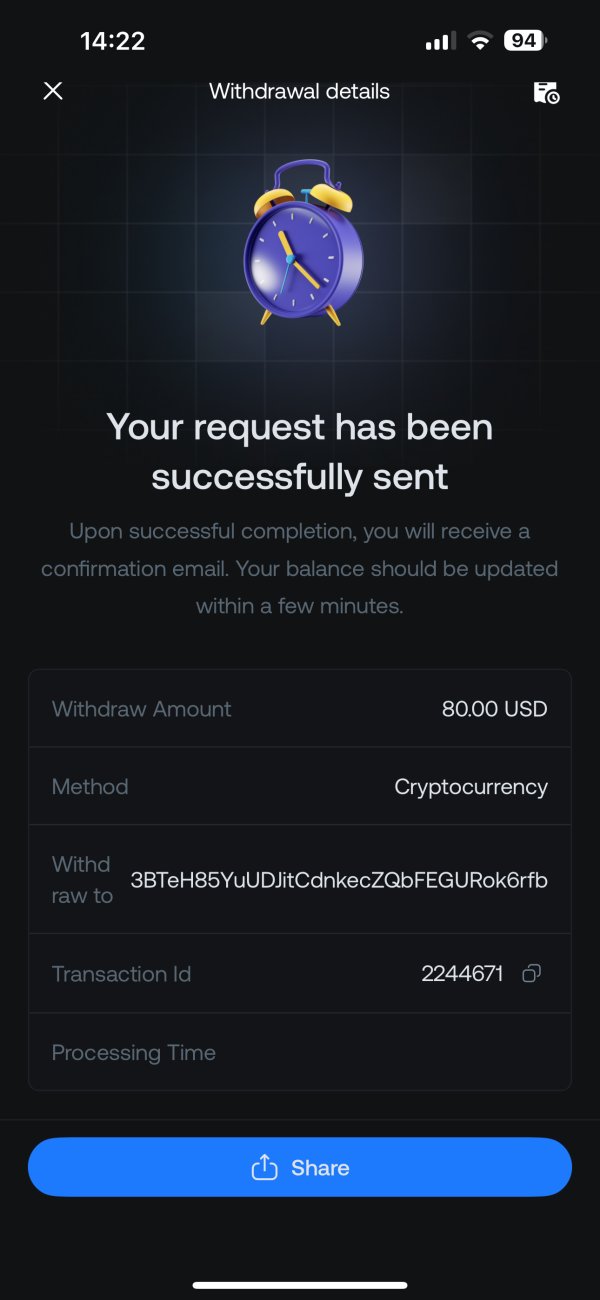

Funding operation experience, including deposit and withdrawal convenience, processing times, and fee structures, remains unclear due to insufficient documentation of payment processing procedures. Efficient fund management significantly influences overall user satisfaction but cannot be adequately assessed with available information.

Common user complaints or satisfaction drivers are not systematically documented in available sources, preventing identification of recurring issues or particularly appreciated features. User experience optimization requires understanding both positive and negative feedback patterns, but such analysis is not possible with current information availability.

The target user profile appears to include beginners attracted by the accessible minimum deposit and traders seeking high leverage opportunities, though comprehensive user demographic analysis is not available in documentation.

Conclusion

This opofinance review presents a mixed assessment of a broker that shows promise in certain areas while raising concerns in others. As a relatively new market entrant established in 2021, Opofinance offers several appealing features including multi-asset trading capabilities, high leverage ratios up to 1:500, and professional-grade ECN execution through the cTrader platform. The accessible $100 minimum deposit requirement makes the platform available to beginning traders, while the ECN infrastructure suggests serious consideration of execution quality.

However, significant information gaps, particularly regarding regulatory oversight and comprehensive service documentation, limit the ability to provide a fully positive assessment. The absence of specific regulatory authority information represents a substantial concern for traders prioritizing safety and compliance. Additionally, limited details about customer service capabilities, specific trading costs, and user experience metrics prevent a complete evaluation of the broker's operational excellence.

Opofinance appears most suitable for traders who prioritize high leverage availability and are comfortable with newer market entrants that may not yet have established comprehensive regulatory documentation or extensive operational transparency. The platform may appeal particularly to experienced traders familiar with cTrader who value ECN execution over extensive educational resources or comprehensive customer service documentation.

Prospective clients should conduct additional due diligence, particularly regarding regulatory status in their jurisdiction and specific service terms, before committing significant capital to the platform.