LiteForex Review 73

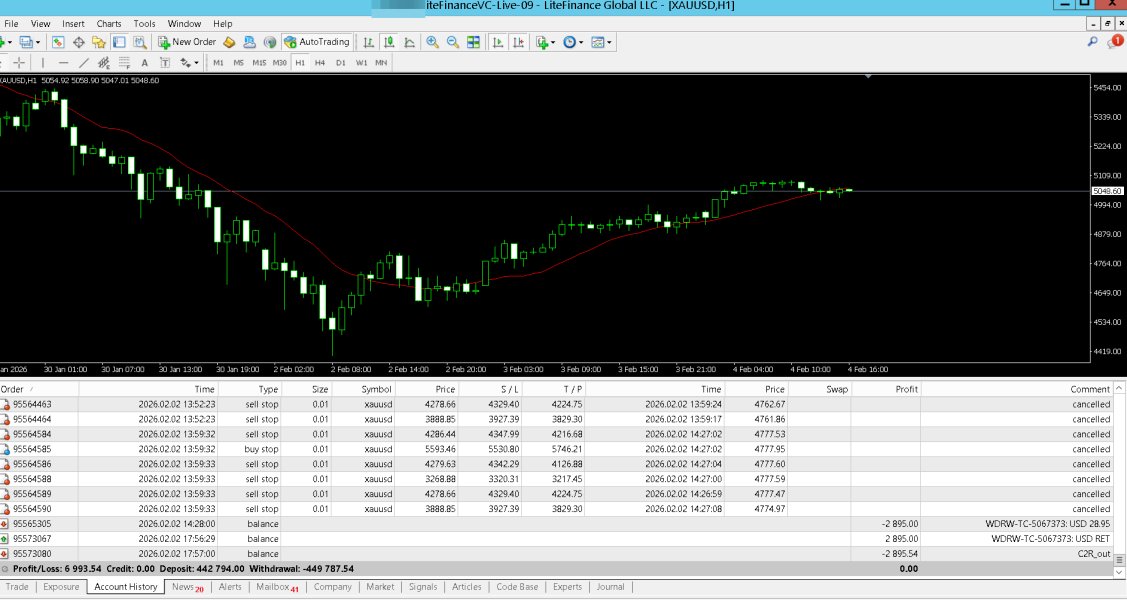

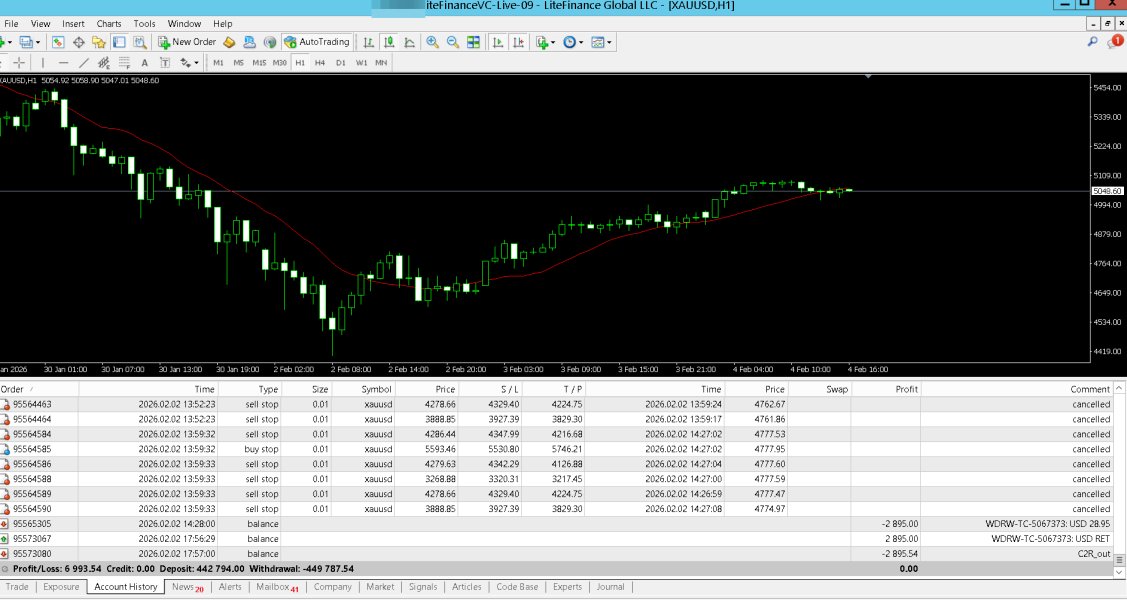

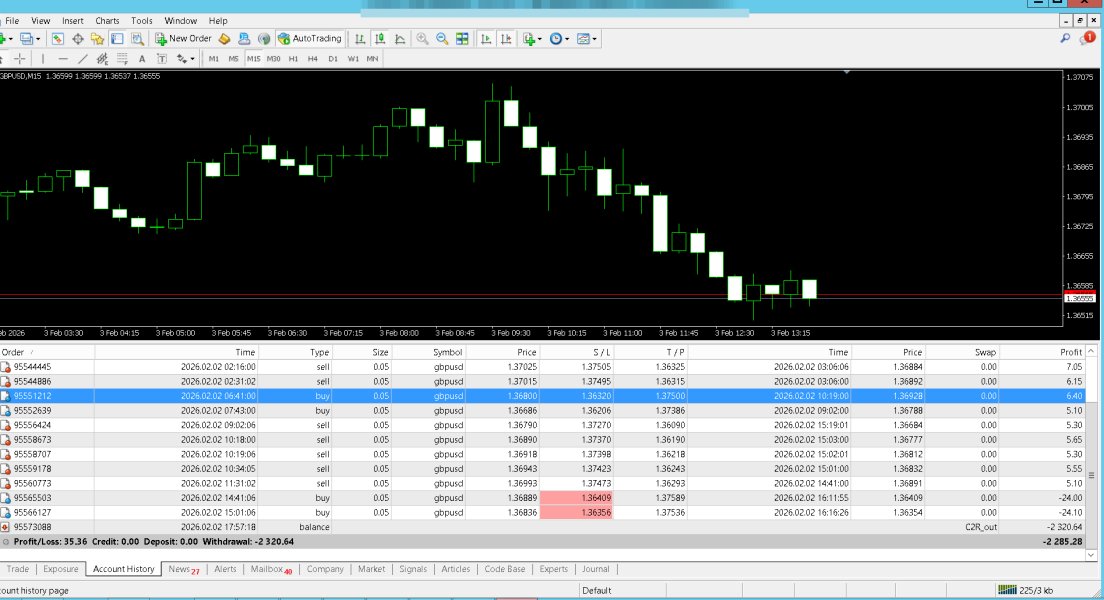

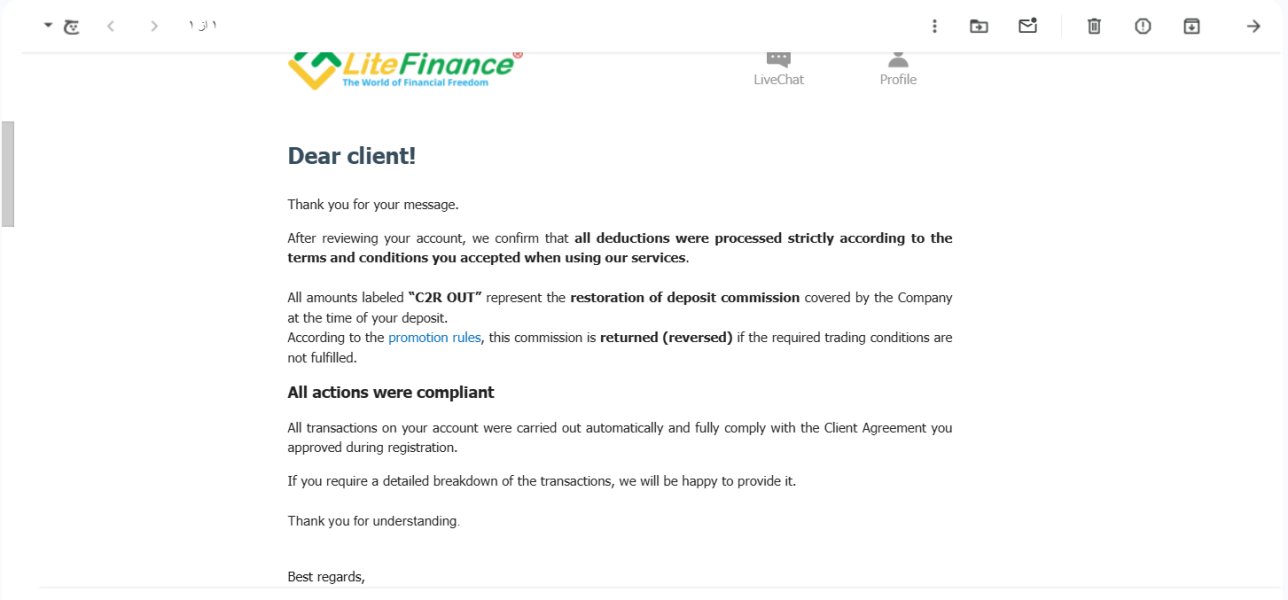

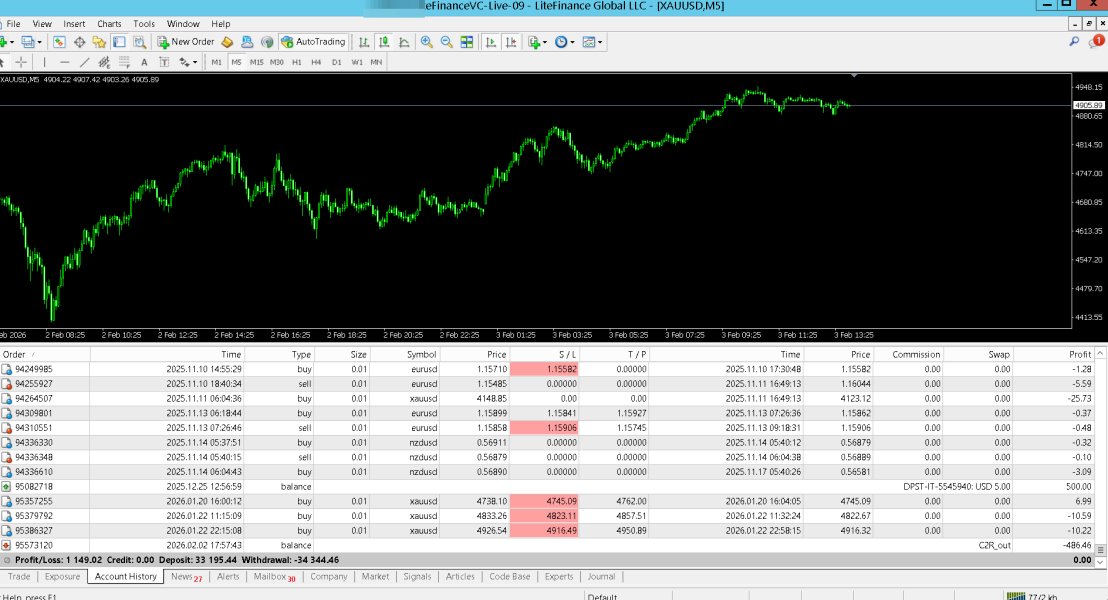

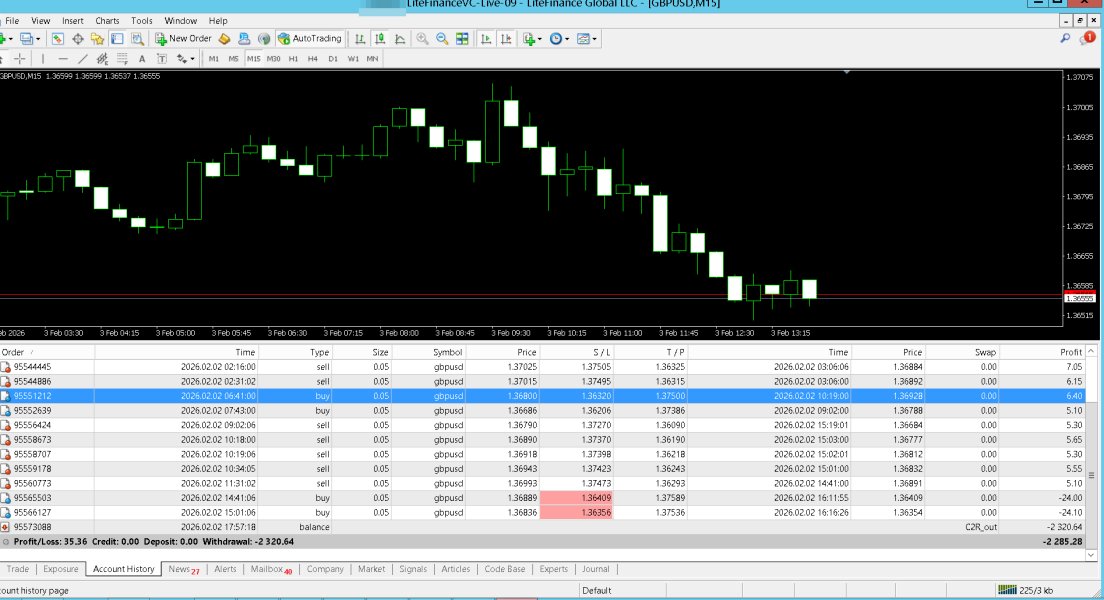

Update Feb 9: Following my previous reports, LiteFinance has partially restored funds to two of my accounts (1***** and 1*****). This action is a clear admission that the 'C2R OUT' deductions were unauthorized and illegal. However, they are still refusing to refund the remaining $139.28 stolen from my other two accounts: Account 1*****: $134.42 (Stolen since 2025/07/11) Account 1*****: $4.86 (Stolen on 2026/02/02) I am attaching evidence showing the restored funds alongside the accounts that are still empty/deducted. It is unacceptable for a broker to settle a fraud case partially. If the deduction was wrong for two accounts, it is wrong for all of them. I will not lower the FRAUD rating until the final $139.28 is fully returned. Traders should beware: this broker only responds when under public pressure and tries to settle with the minimum amount possible."

This platform keeps saying it's "data-based," but it's all just a scam. I've been applying for a withdrawal for almost two weeks, and I haven't seen a penny! I was initially deceived by their promises of "accurate data and three-day withdrawals." I thought I'd invest some money to supplement my family's income, but as soon as I put my money into the platform, they pocketed it! Every time I contact customer service for an explanation, they say, "The data verification failed and I need to resubmit my information," or "The finance department is checking my transactions, so please wait." They can't finish checking for two weeks? It's clear they don't want to pay! Yesterday, I pushed them too hard, and they even said, "There were illegal transactions in my account and my funds were frozen!" I was just trading normally, so how could there be any violations? This is a clear scam!

From confidence to despair, the endless fluidity of the platform and shameless management. After four months of trading, I placed a buy order at 1.2630 for GBP/USD. At that time, the market volatility was stable, but the order was actually executed at 1.2671, with a slippage of 41 pips. Please remember that on legally compliant Thai forex platforms, slippage is generally controlled within 5-10 pips under similar market conditions. Even more shocking was earlier this month when the European Central Bank (ECB) announced its interest rate decision. I set a stop-loss at 142.50 for EUR/JPY to prevent significant losses. However, when the market fluctuated, the stop-loss was actually executed at 143.23, with a slippage of 73 pips. This single order cost me $3,200, which was two months of my savings. This platform, which relies on slippage fraud and lacks integrity, urges all Thai traders to be cautious and not fall victim to the same scam I did!

Last Friday at 9.10 AM, I was staring at the XAU/THB (gold to baht) stock market until 3 AM to analyze nearly 15 days of trading data. It was an opening position of more than 5 lots at the 26,450 point. After clicking and confirming, the platform froze directly. The order status on the screen kept showing "processing" all the time. I frantically clicked refresh, went back and entered the background again, and even restored the phone to factory settings. It took 25 minutes to get back in. When I checked again, the price had surged to 26,720—I could have made a profit of 67,500 baht. But now, not only did I not make a profit, but panic followed, and I ended up adding another 83,000 baht to the losing position. I complained to customer service, and the woman there sounded like a buzzing mosquito, going in circles saying, "At that time, the server was under temporary maintenance, and there was nothing we could do." Maintenance without prior notice? My friend was trading on another platform at the same time, and their entire process went smoothly. This month, I lost nearly 500,000 baht just because of LiteForex's lag and failed orders! LiteForex, you deliberately delay and want us retail traders to suffer.

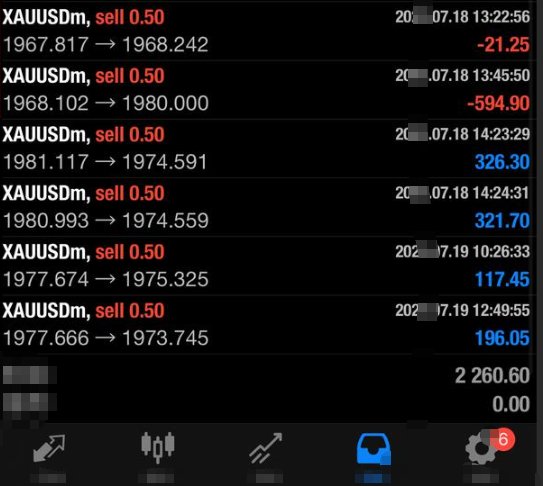

On the night of the June 2025 non-farm payroll report, I traded XAU/USD on LiteForex with a stop-loss at 2,360. When the market hit 2,362, my position was forced closed at 2,325. This 35-point slippage resulted in a loss of RM4,200. Eleven of my 12 stop-loss orders slipped, a whopping 91.7% slippage rate, which perfectly aligns with the "99% stop-loss order slippage" phenomenon I've searched for. Even more disgusting is the profit-stripping scheme. In May, I had a profit of $800 on a long EUR/USD position, but the platform suddenly widened the spread to 18 pips (usually just 1.8 pips), and 30% of my profit was inexplicably deducted during the forced liquidation. A warning to Malaysian traders: Stay away from this platform that exploits low-regulatory licenses to steal your funds. There's no way to protect your hard-earned money!

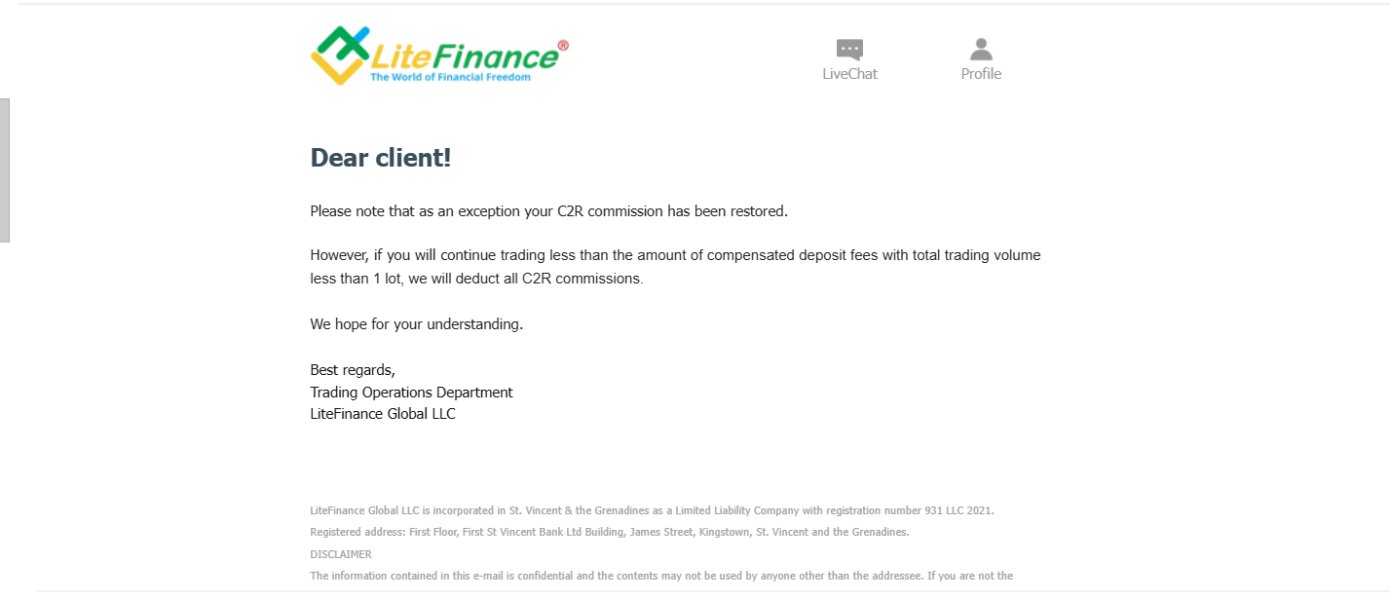

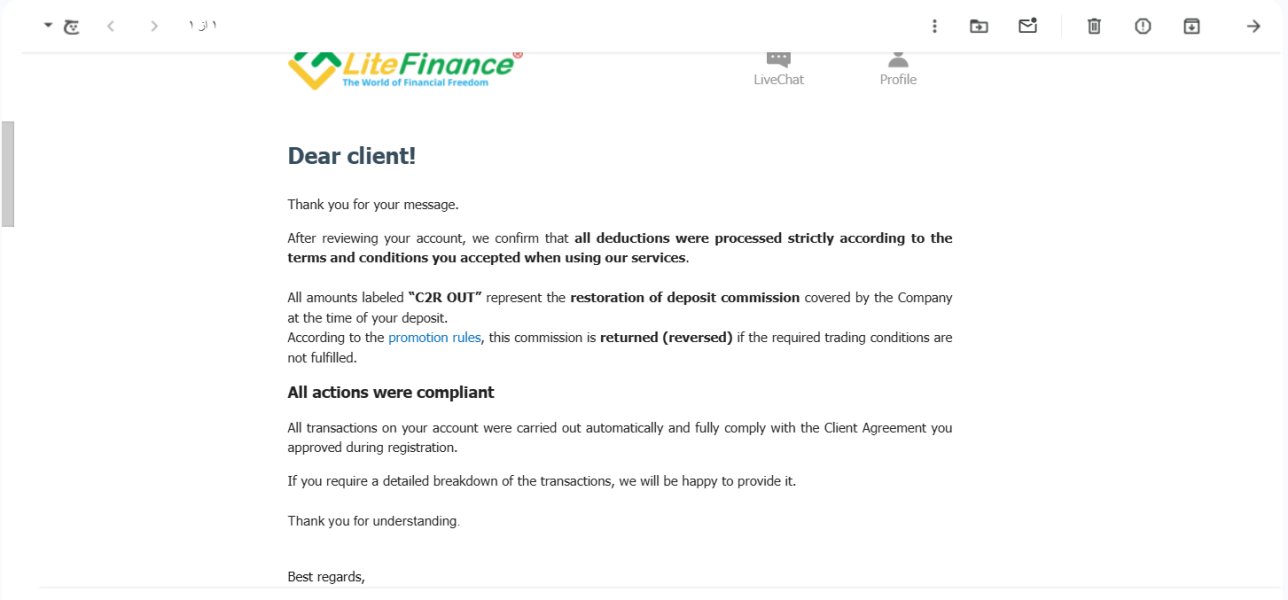

LiteFinance has officially responded to my previous complaint, admitting they seized $193 under the excuse of "Restoration of Commission" (C2R OUT). They are using hidden, unfair terms to justify stealing client capital from accounts . I am attaching their email response as proof of their predatory behavior.

สเปรดพุ่งสูงขึ้น กินเงินต้นไปมาก และอินเทอร์เฟซภาษาไทยก็เต็มไปด้วยบั๊ก ในเดือนพฤษภาคม ขณะที่ผมเทรดคู่เงิน EUR/THB บน LiteForex ผมสังเกตเห็นว่าสเปรดขยายกว้างขึ้นบ่อยครั้งอย่างอธิบายไม่ถูก มันแสดง 2.5 pips ในช่วงเวลาซื้อขายปกติ แต่กลับพุ่งขึ้นทันทีเป็น 15 pips ทันทีที่ผมวางคำสั่งซื้อ ก่อนจะกลับมาเป็นปกติเมื่อปิดสถานะ ในคืนที่มีรายงานการจ้างงานนอกภาคเกษตรกรรมวันที่ 15 ตุลาคม สถานะซื้อ 5 ล็อตของผมถูกปิดลงทันทีเนื่องจากสเปรดขยายกว้างขึ้นอย่างกะทันหันเป็น 30 pips ส่งผลให้ขาดทุน 120,000 บาท ที่แย่กว่านั้นคืออินเทอร์เฟซภาษาไทยเต็มไปด้วยบั๊ก โดยปุ่ม "Stop Loss" เปลี่ยนเป็น "Close" เป็นครั้งคราว โฆษณาของแพลตฟอร์มที่ว่า "สเปรดคงที่" นั้นเป็นเรื่องโกหกโดยสิ้นเชิง ภาพหน้าจอจำนวนมากในฟอรัมผู้ใช้ภาษาไทยพิสูจน์ว่าพวกเขาได้ติดตั้งกับดักสเปรดแบบไดนามิกสำหรับคู่เงินบาทไทย มันน่าหงุดหงิดมาก อย่าเข้ามาใกล้

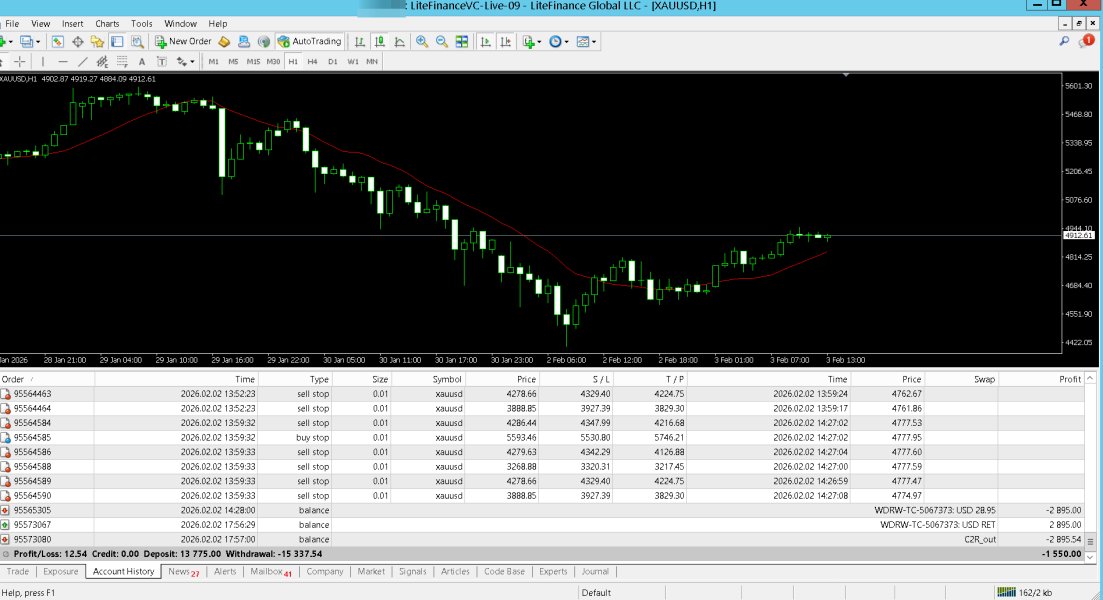

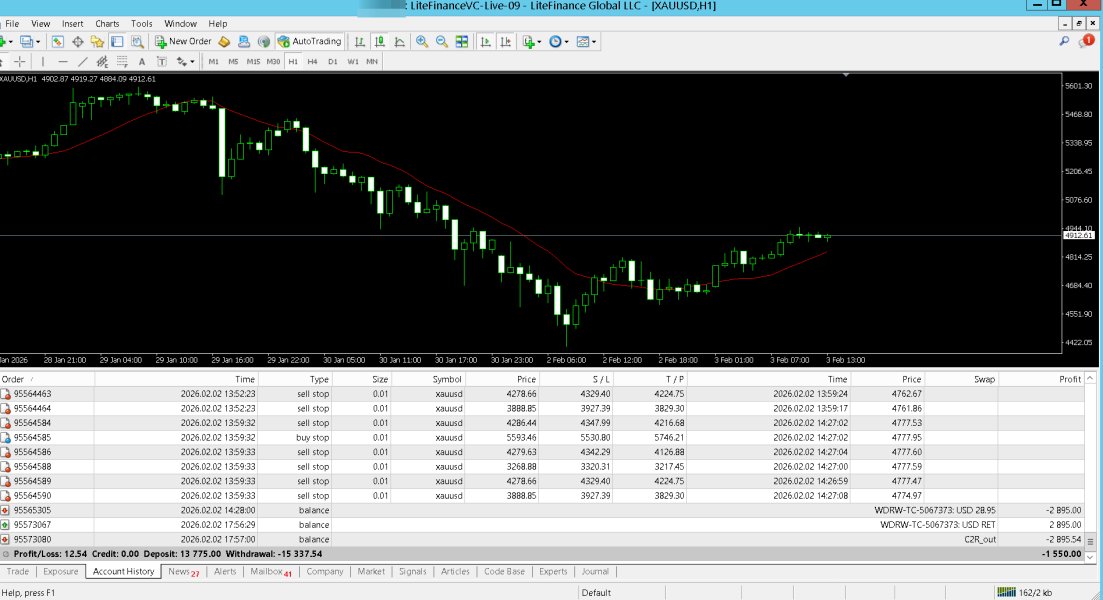

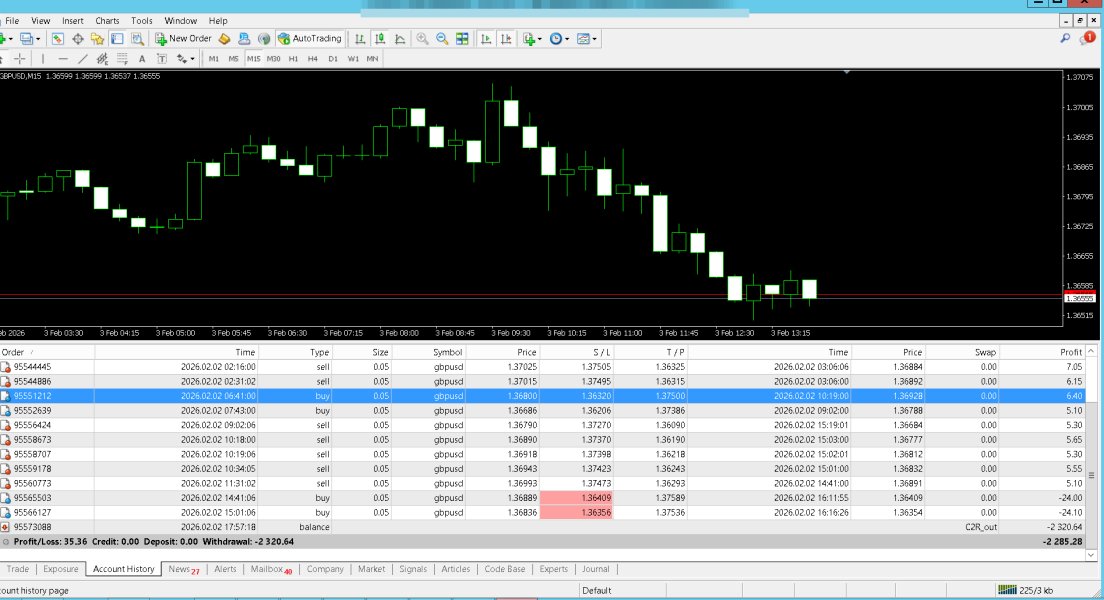

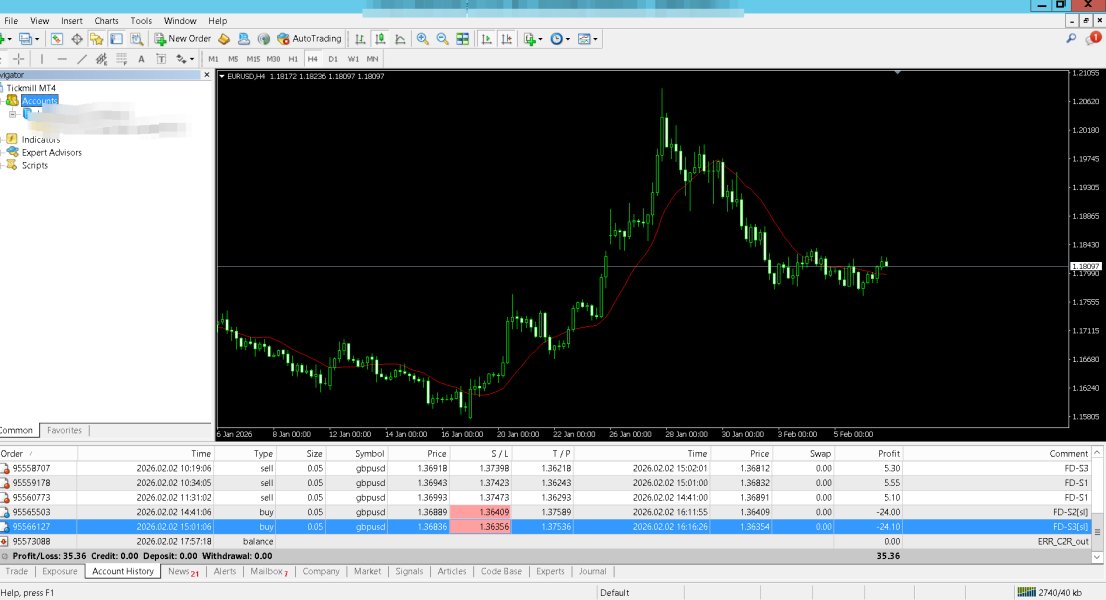

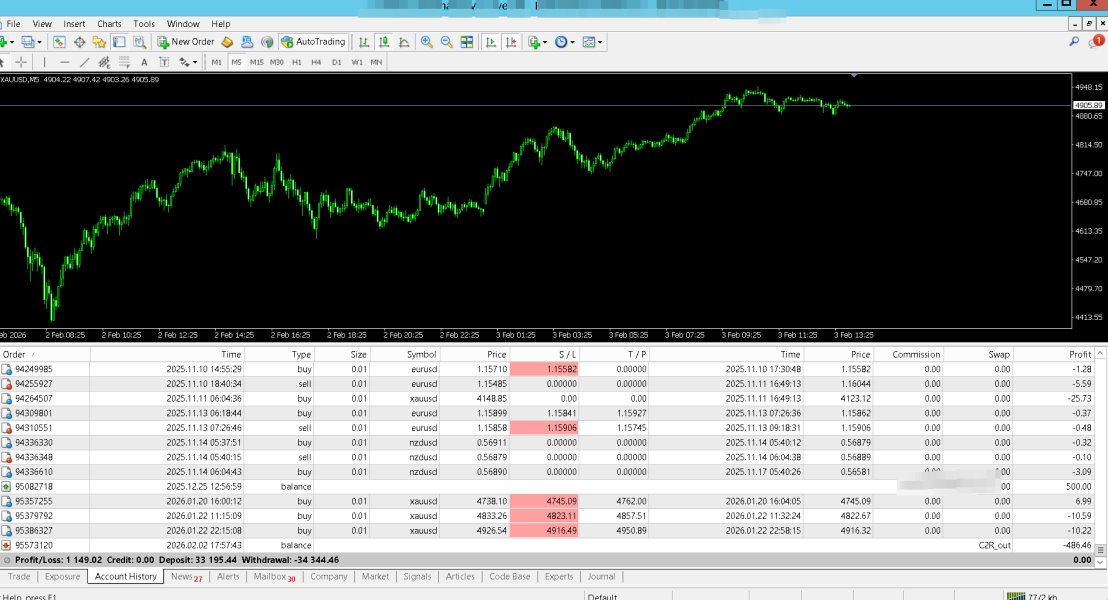

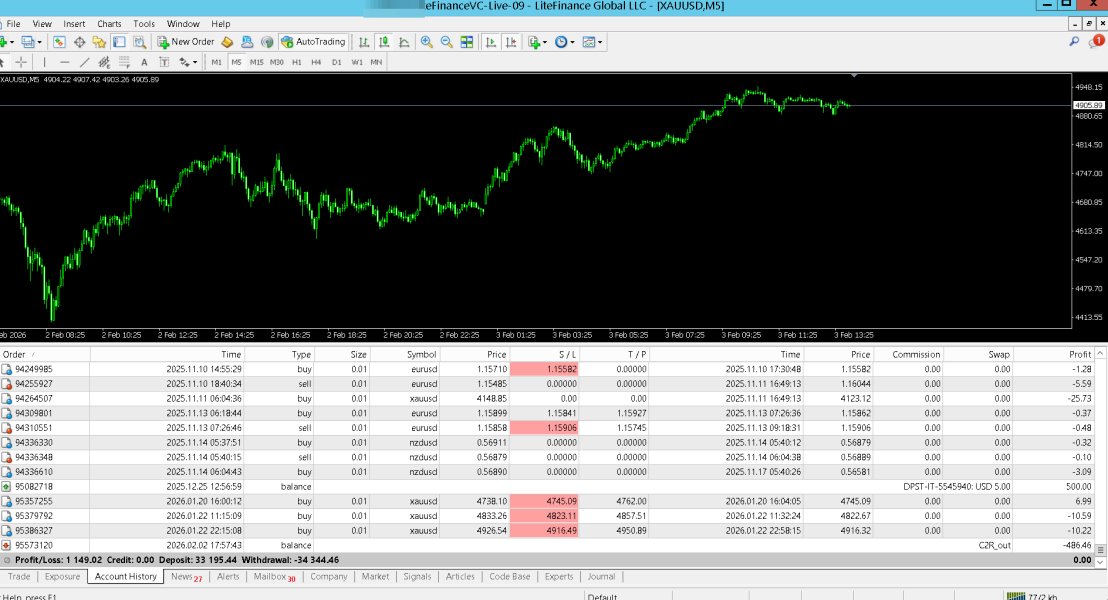

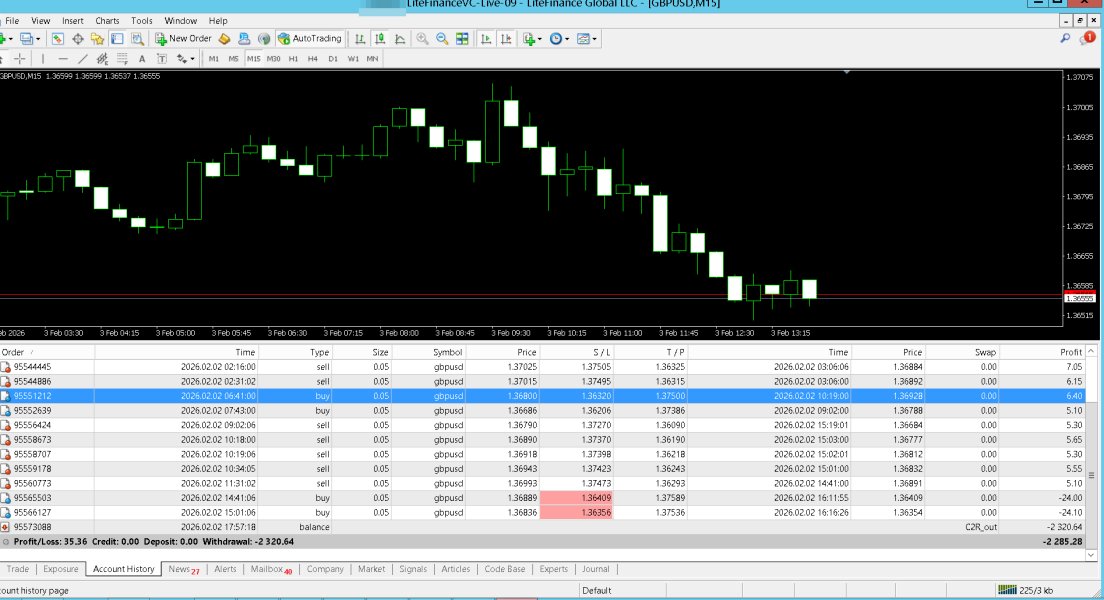

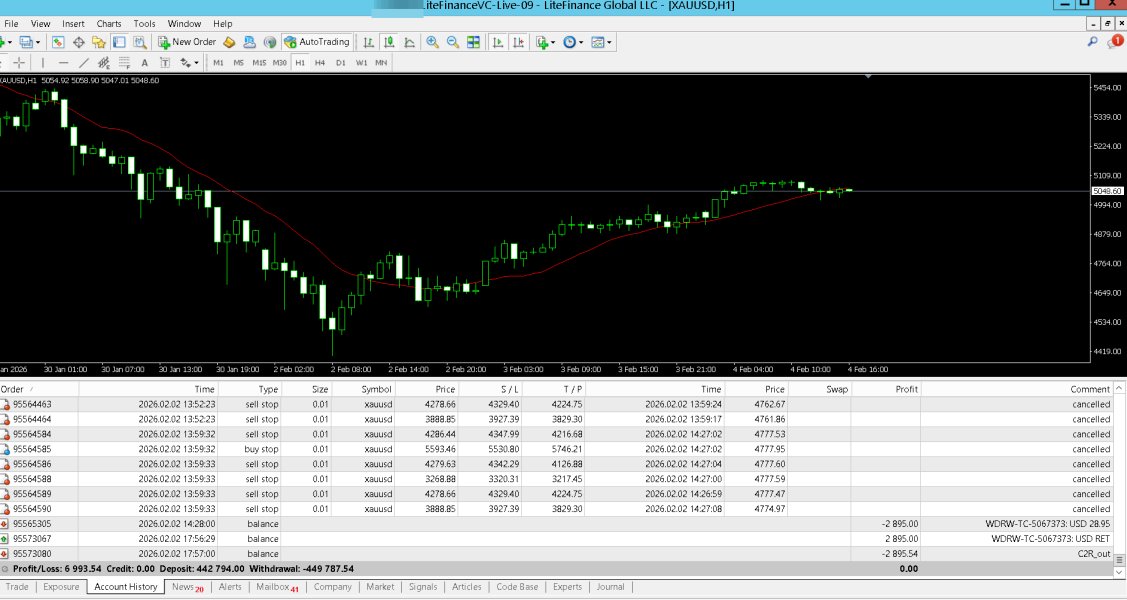

Subject: Systematic Fund Seizure across Multiple Accounts I am reporting a blatant act of fund misappropriation by LiteFinance. I placed a withdrawal request for $28.95 from my account 1****. Not only did they cancel the withdrawal, but they also confiscated the entire amount PLUS the remaining balances in my other linked accounts, 1**** and 1****, totaling $59. The excuse provided was a hidden "1 lot trading" rule that was never disclosed. This is not a commission; it is extortion. Furthermore, this is a recurring issue. Previously, they seized $134 from my balance using the same deceptive tactics and unauthorized "C2R OUT" adjustments. In total, LiteFinance has stolen $193 from me without any legal or contractual basis. I demand the immediate return of my $193. I have all the screenshots as evidence and will not stop until this is resolved.