Regarding the legitimacy of Opofinance forex brokers, it provides FSCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is Opofinance safe?

Pros

Cons

Is Opofinance markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

OPO FINANCE (PTY) LTD

Effective Date:

2025-05-19Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

3 RD FLOOR,34 WHITELEY ROADMELROSE ARCH, GAUTENG2196Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Opo Group Ltd

Effective Date:

--Email Address of Licensed Institution:

support@opofinance.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.opofinance.com, https://www.opoforex.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 9D, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4374099Licensed Institution Certified Documents:

Is Opofinance A Scam?

Introduction

Opofinance is a relatively new player in the forex and CFD trading market, having commenced operations in 2021. It positions itself as a modern broker offering a wide range of financial instruments, including forex, commodities, stocks, and cryptocurrencies. As traders increasingly look for opportunities in the volatile forex market, it's crucial to evaluate the legitimacy and reliability of brokers like Opofinance. With numerous reports of scams and fraudulent activities in the trading industry, traders must exercise caution and conduct thorough research before entrusting their funds to any broker. This article aims to provide an objective analysis of Opofinance, focusing on its regulatory status, company background, trading conditions, customer safety, user experiences, and overall risk assessment.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety and reliability of a trading broker. Opofinance claims to be regulated by the Seychelles Financial Services Authority (FSA) and is also a member of the Financial Commission, which offers some level of investor protection. However, the quality of regulation in offshore jurisdictions like Seychelles is often considered less stringent compared to top-tier regulatory bodies such as the UK's FCA or Australia's ASIC.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 124 | Seychelles | Verified |

| Financial Commission | N/A | Hong Kong | Verified |

The Seychelles FSA allows brokers to operate with minimal oversight, leading to concerns about the level of investor protection it offers. Although Opofinance is insured for up to €20,000 per case through its membership in the Financial Commission, this still falls short compared to the protections offered by more reputable regulators. The lax regulatory environment raises red flags about the broker's accountability and compliance history, making it imperative for traders to weigh these factors carefully.

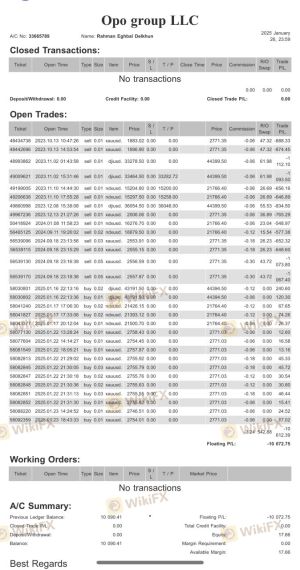

Company Background Investigation

Opofinance is operated by Opo Group Ltd, which is registered in Seychelles. The company has a relatively short history, having been founded in 2021. Its ownership structure and management team details are not extensively disclosed, which can be a cause for concern regarding transparency. A lack of information about the management team can lead to uncertainty about the broker's operational integrity and decision-making processes.

While the website presents a professional image, the minimal disclosure about the company's history and key personnel raises questions about its credibility. Transparency is crucial in building trust with clients, and the absence of clear information can deter potential traders. The company's focus on innovative trading solutions, including the integration of social trading and advanced trading platforms, does not compensate for the lack of transparency regarding its ownership and management.

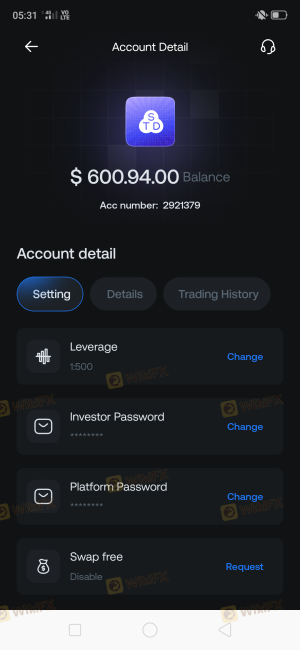

Trading Conditions Analysis

The trading conditions offered by Opofinance are designed to attract a broad range of traders. The broker provides various account types, including Standard, ECN, Social Trade, and ECN Pro accounts. Each account type has different minimum deposit requirements and trading conditions, which can be appealing to both novice and experienced traders. However, the broker's fee structure warrants a closer look.

| Fee Type | Opofinance | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.8 pips | From 1.0 pips |

| Commission Model | $4 - $6 | $2 - $5 |

| Overnight Interest Range | Varies | Varies |

While the spreads are competitive, they are still higher than some industry averages, particularly for the Standard account. Additionally, the commission structure for ECN accounts can add up quickly, making it essential for traders to consider their trading frequency and volume. The overnight interest rates also vary, which can impact long-term trading strategies. Traders should be aware of these costs and assess whether they align with their trading strategies.

Customer Funds Safety

The safety of customer funds is paramount when choosing a trading broker. Opofinance claims to implement various safety measures, including segregated accounts to protect client funds. However, the effectiveness of these measures largely depends on the regulatory environment in which the broker operates.

The broker's membership in the Financial Commission provides some level of insurance for traders, but this is limited compared to the protections offered by more reputable regulators. There have been no significant historical issues reported regarding fund safety with Opofinance, but the potential risks associated with offshore brokers cannot be overlooked. Traders should carefully consider the implications of trading with a broker that operates under less stringent regulatory oversight.

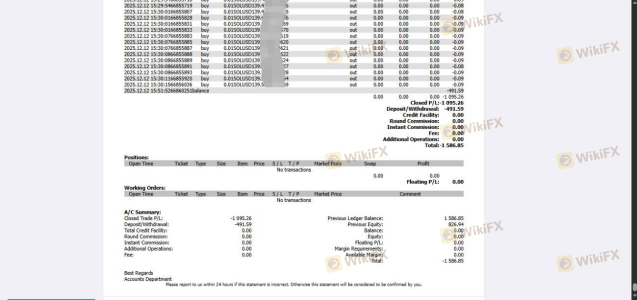

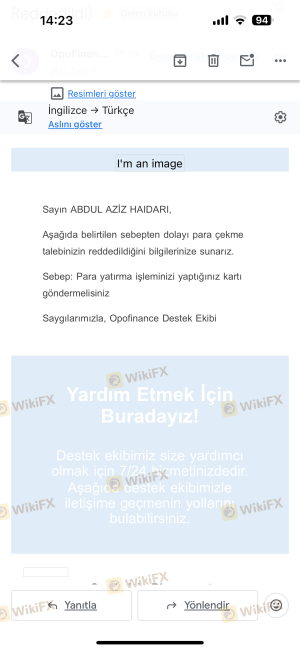

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of Opofinance are mixed, with some traders reporting positive experiences, while others have raised concerns about withdrawal issues and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Poor Customer Support | Medium | Inconsistent |

| High Fees | Low | Addressed |

Common complaints include difficulties in withdrawing funds, which is a significant red flag for any broker. Some users have reported excessive delays or additional withdrawal fees that were not clearly communicated upfront. The quality of customer support has also been criticized, with some users experiencing slow response times.

For instance, one user reported a frustrating experience when attempting to withdraw funds, leading to prolonged communication without resolution. Such issues can indicate deeper operational problems within the brokerage.

Platform and Trade Execution

Opofinance offers the widely-used MetaTrader 4 and 5 platforms, known for their robust features and user-friendly interfaces. However, the quality of trade execution is crucial for a positive trading experience. Reports of slippage and order rejections have surfaced, suggesting that traders may experience difficulties during high volatility periods.

The presence of advanced trading tools and features on the platform does not guarantee that trades will be executed smoothly. Traders should be cautious of any signs of platform manipulation or technical issues that could adversely affect their trading outcomes.

Risk Assessment

Engaging with Opofinance carries inherent risks that traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack investor protection. |

| Withdrawal Risk | Medium | Reports of withdrawal delays and issues. |

| Platform Risk | Medium | Potential for slippage and order rejections. |

To mitigate these risks, traders are advised to start with a demo account to familiarize themselves with the platform and trading conditions. Additionally, they should only invest funds they can afford to lose and consider diversifying their trading portfolio to minimize exposure to any single broker.

Conclusion and Recommendations

In conclusion, while Opofinance presents itself as a modern and innovative trading platform, several concerns regarding its regulatory status, transparency, and customer feedback raise red flags. The offshore regulation from Seychelles and the mixed reviews from users suggest that potential traders should exercise caution.

For traders seeking reliable alternatives, consider brokers regulated by top-tier authorities such as the FCA or ASIC. These brokers typically offer stronger investor protections and a more transparent trading environment. Ultimately, thorough research and due diligence are essential before making any commitments in the forex market.

Is Opofinance a scam, or is it legit?

The latest exposure and evaluation content of Opofinance brokers.

Opofinance Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Opofinance latest industry rating score is 4.74, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.74 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.