Executive Summary

This Markets.com review gives you a complete look at this forex and CFD broker for 2025. Markets.com works as a trading platform that offers its own trading software plus the popular MetaTrader 4 and MetaTrader 5 platforms. The broker mainly helps forex and CFD traders, and it features spreads that start from 0 pips as one of its biggest advantages.

Markets.com gets an overall TU rating of 5 out of 10 based on what users say about it. This shows that traders feel neutral about the platform. The broker stands out because it offers many different trading platforms and has competitive spread prices. However, you need to think carefully about several areas, especially the lack of clear regulatory information and account details.

This broker works best for traders with some experience who want flexible platforms and competitive pricing. Markets.com offers over 80 technical chart indicators and multiple platform choices, but potential users should carefully check the limited regulatory information and account details before they decide.

Important Notice

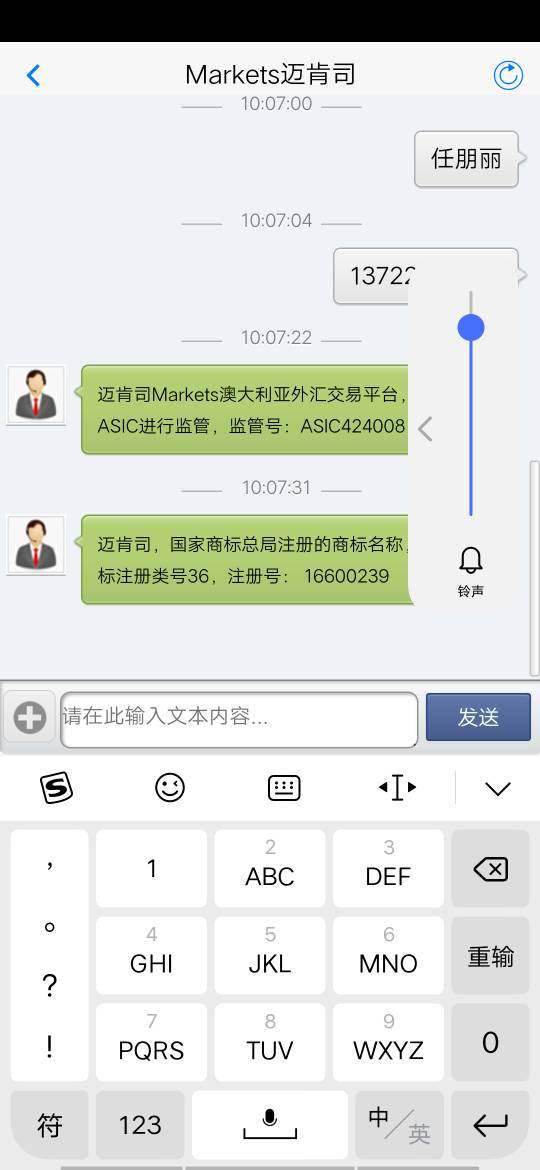

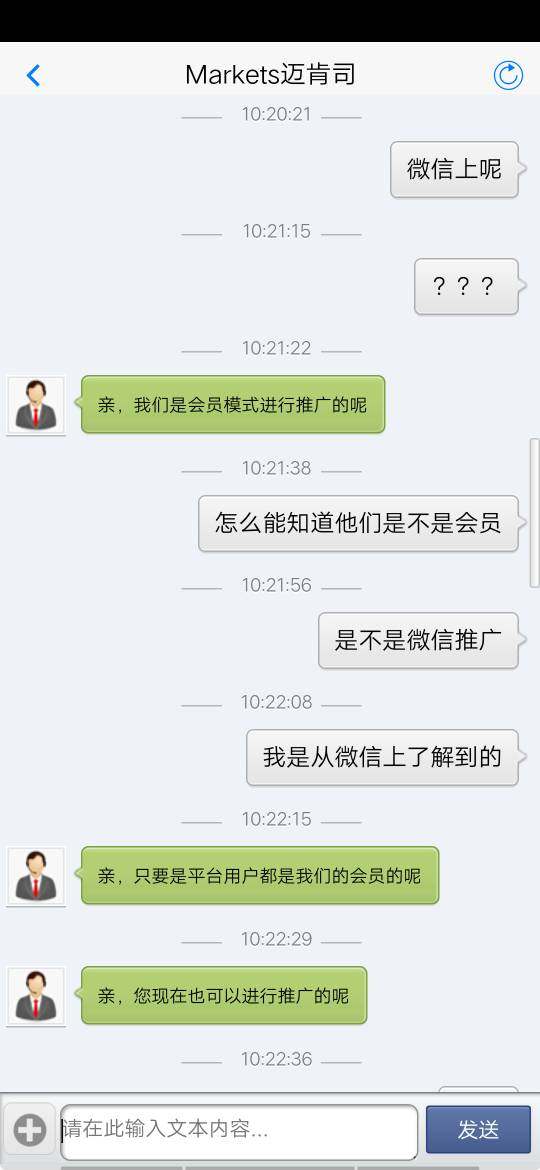

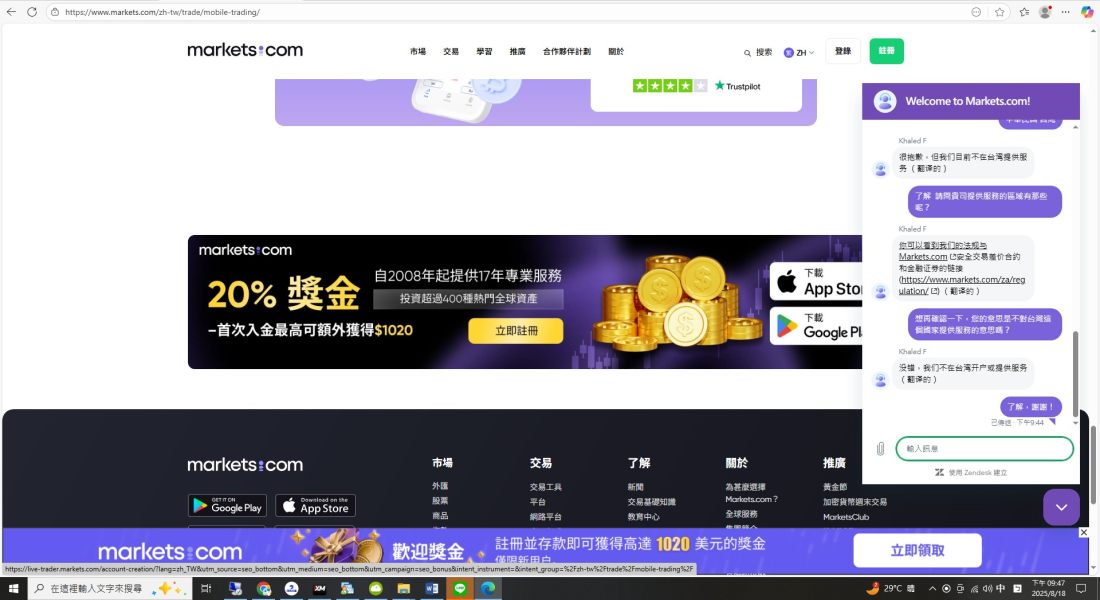

Regional Entity Differences: Traders who might use Markets.com should be careful when choosing this broker because the available sources don't give much regulatory information. Different regional companies may work under different regulatory rules, so traders should check the specific regulatory status that applies to their area.

Review Methodology: This review comes from a complete analysis of user feedback, market research, and available platform information. Our method includes real trader experiences, technical platform analysis, and industry standard comparisons to give you an objective evaluation.

Rating Framework

Broker Overview

Markets.com works as a forex and CFD trading broker, but the available sources don't give clear details about when it started. The company focuses mainly on giving traders complete trading solutions through multiple platform options, and it positions itself in the competitive retail forex market. The broker's business plan centers on giving traders access to various financial tools through both its own platforms and third-party trading platforms.

The platform's main offering includes access to forex markets and contracts for difference (CFDs), supported by their own trading platform plus MetaTrader 4 and MetaTrader 5 integration. This approach with multiple platforms suggests Markets.com wants to help traders with different preferences and experience levels. The broker's focus on providing over 80 technical chart indicators shows it wants to support trading strategies that focus on technical analysis.

Markets.com operates with spreads starting from 0 pips according to available information, which puts the broker in a competitive position within the tight-spread part of the market. However, complete details about the company's regulatory framework, operational history, and specific business licensing stay limited in publicly available sources, so potential users need to do additional research.

Regulatory Regions: Available sources don't give detailed information about specific regulatory authorities, so prospective traders need to check applicable regulatory oversight for their area on their own.

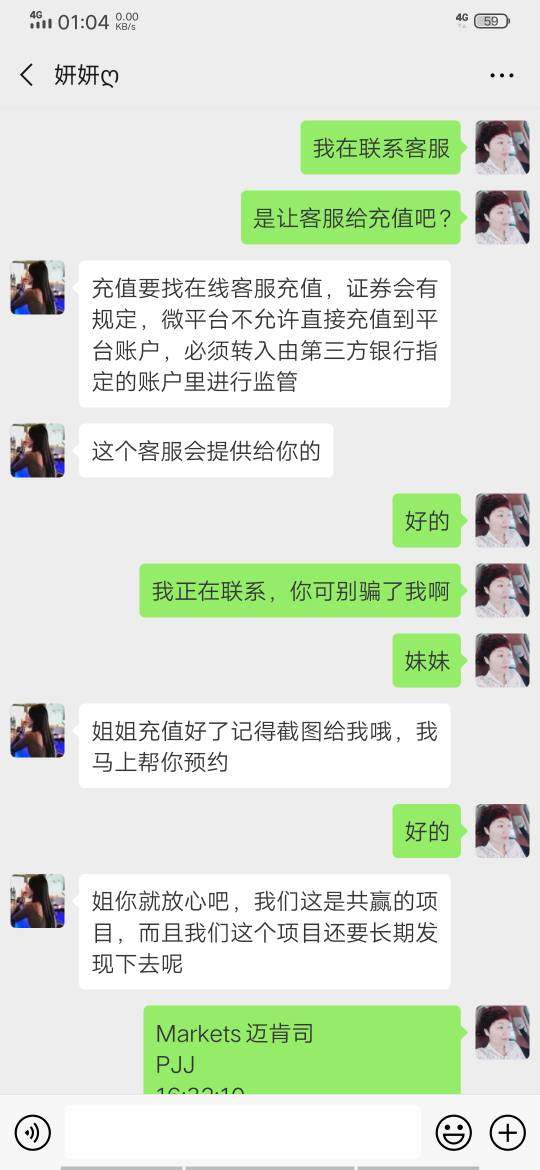

Deposit and Withdrawal Methods: Current available documentation doesn't specify funding and withdrawal options, so you need to contact the broker directly for payment method details.

Minimum Deposit Requirements: Accessible broker information doesn't clearly outline minimum account funding requirements.

Bonus and Promotions: Available materials don't detail current promotional offerings and bonus structures.

Tradeable Assets: Markets.com focuses on forex currency pairs and contracts for difference (CFDs), giving access to major financial markets through these instrument categories.

Cost Structure: The broker advertises spreads starting from 0 pips, but specific commission structures and additional fee details need clarification through direct broker contact. This Markets.com review notes that publicly available materials lack comprehensive fee transparency.

Leverage Ratios: Current source materials don't specify maximum leverage offerings.

Platform Options: Traders can access Markets.com's own trading platform, MetaTrader 4, and MetaTrader 5, which gives flexibility in platform selection.

Regional Restrictions: Available information doesn't detail geographic trading limitations.

Customer Support Languages: Accessible documentation doesn't specify supported customer service languages.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

Markets.com's account conditions show a mixed picture for potential traders. The broker advertises spreads starting from 0 pips, which gives it a competitive advantage in today's market environment, but the lack of detailed information about account types, minimum deposit requirements, and complete fee structures creates uncertainty for prospective users.

The absence of clearly defined account tiers or specialized account offerings limits traders' ability to select appropriate account types based on their experience levels or trading volumes. This Markets.com review identifies the need for better transparency in account specification details, especially regarding commission structures, overnight financing rates, and any additional charges beyond the advertised spreads.

User feedback that indicates an overall rating of 5 suggests neutral satisfaction with account conditions, which means they're neither particularly impressive nor problematic. However, the limited availability of detailed account information may discourage traders who want transparency in their broker selection process. Compared to industry leaders who provide complete account specification details, Markets.com's current approach to account condition disclosure seems insufficient for thorough evaluation.

Markets.com shows strong performance in the tools and resources category, mainly through its offering of over 80 technical chart indicators and multiple platform options. This complete technical analysis toolkit puts the broker in a good position for traders who rely heavily on chart-based trading strategies and technical market analysis.

The availability of MetaTrader 4 and MetaTrader 5 alongside the broker's own platform gives traders flexibility in choosing their preferred trading environment. MetaTrader platforms bring established functionality, extensive customization options, and access to automated trading capabilities through Expert Advisors, while the proprietary platform may offer unique features tailored to Markets.com's specific service offerings.

User feedback about the technical chart capabilities appears positive, with traders appreciating the wide range of analytical tools available. However, information about additional research resources, market analysis, educational materials, and automated trading support stays limited in available sources. The strong technical analysis foundation earns Markets.com a solid rating in this category, though complete research and educational resource details would strengthen the overall offering.

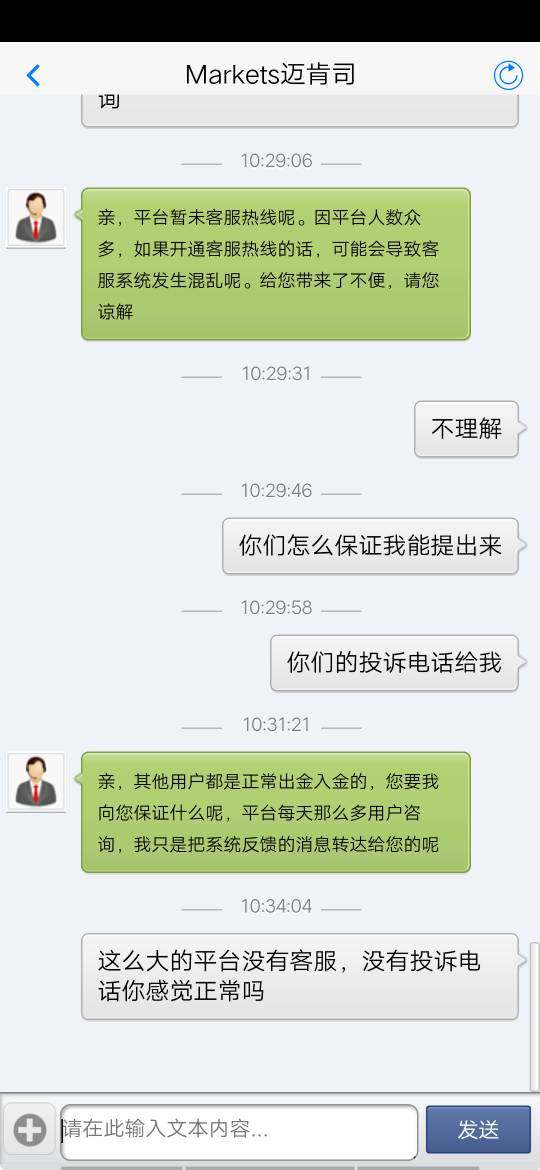

Customer Service and Support Analysis (6/10)

Customer service evaluation for Markets.com relies mainly on indirect indicators because there's limited specific information about support channels, response times, and service quality metrics. The overall user rating of 5 suggests neutral experiences with customer support, which indicates neither exceptional service nor significant service-related complaints.

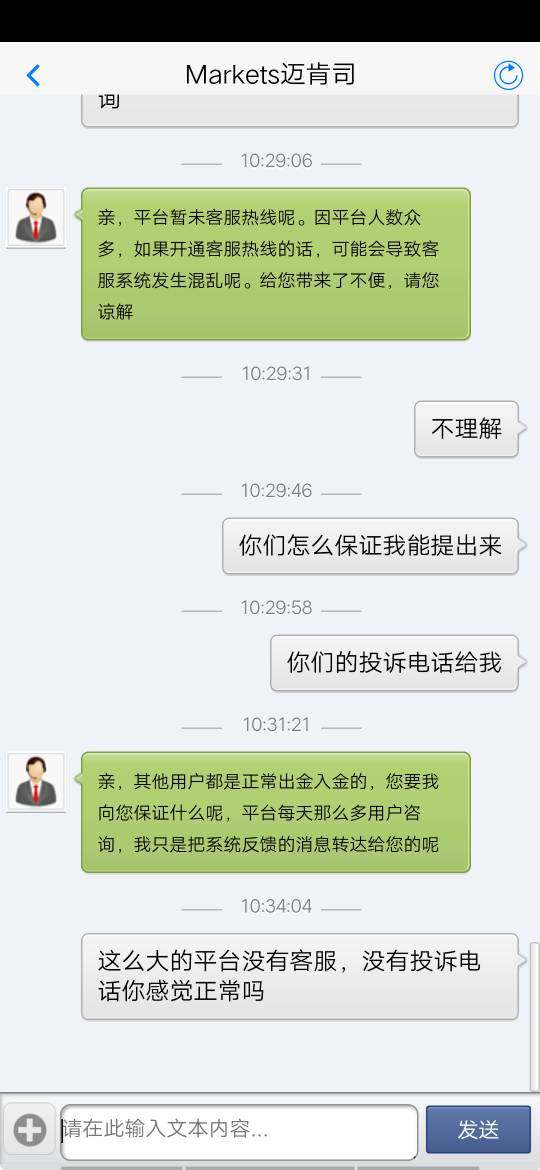

The absence of detailed information about available customer support channels, operating hours, multilingual support capabilities, and typical response timeframes makes comprehensive service evaluation challenging. Professional forex brokers typically provide multiple contact methods including live chat, email support, and telephone assistance with clearly defined service level expectations.

While no specific negative customer service incidents appear in available user feedback, the lack of detailed service information and neutral user ratings suggest room for improvement in support service transparency and potentially service quality. The moderate rating reflects the uncertainty surrounding service capabilities rather than documented service failures, which indicates prospective users should verify support arrangements that meet their specific requirements.

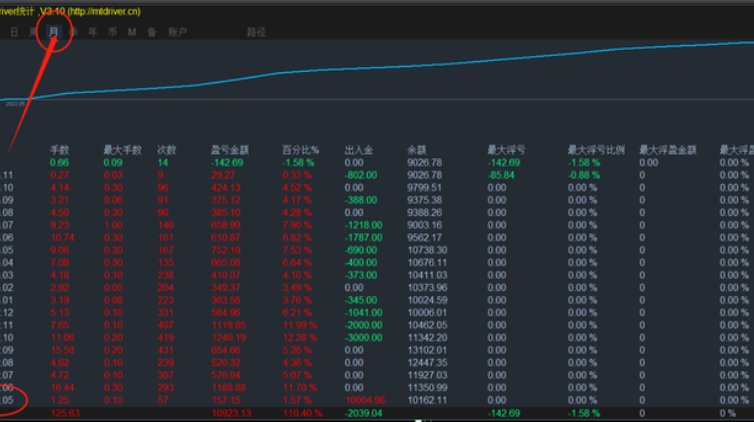

Trading Experience Analysis (7/10)

The trading experience with Markets.com benefits from competitive spread offerings starting from 0 pips and multiple platform availability, contributing to a generally positive trading environment. The combination of proprietary platform features with established MetaTrader 4 and MetaTrader 5 functionality gives traders diverse execution options and interface preferences.

Platform stability and execution quality information stays limited in available sources, though the neutral user rating of 5 suggests adequate performance without significant technical issues or execution problems. The availability of over 80 technical indicators supports comprehensive market analysis directly within the trading environment, which enhances the overall trading experience for technically-oriented traders.

However, specific details about order execution speeds, slippage rates, mobile trading capabilities, and platform uptime statistics are not available in current source materials. This Markets.com review notes that while the fundamental trading infrastructure appears sound based on platform offerings and spread competitiveness, comprehensive execution quality data would provide greater confidence in the overall trading experience assessment.

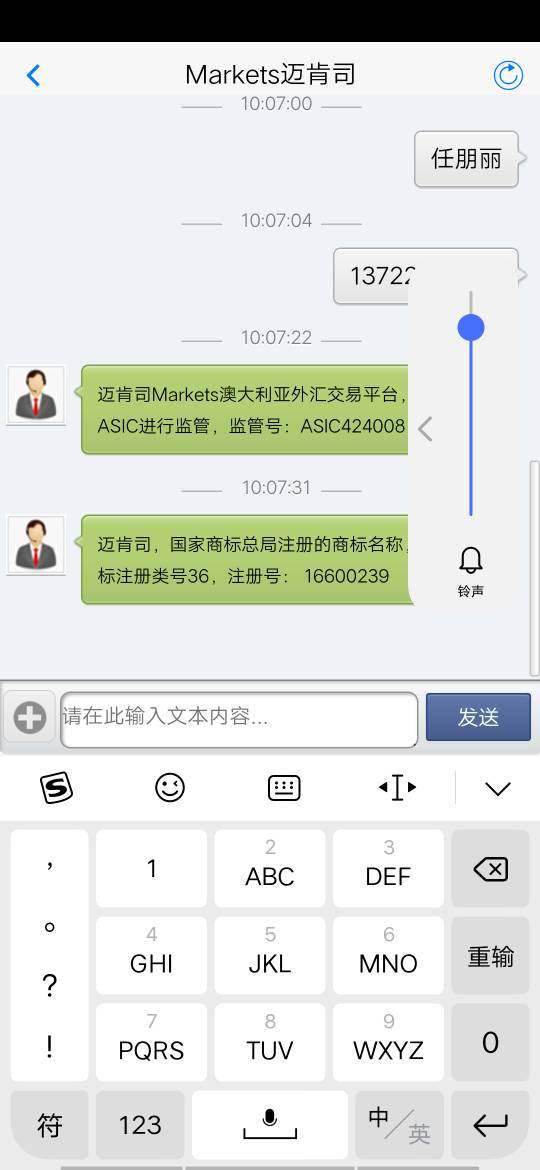

Trustworthiness Analysis (5/10)

Trustworthiness evaluation for Markets.com faces significant challenges because of limited regulatory information in available sources. The absence of specific regulatory authority details, licensing information, and oversight framework details creates uncertainty about the broker's compliance status and consumer protection measures.

Fund safety measures, segregated account policies, investor compensation schemes, and financial reporting transparency are not detailed in accessible materials. These elements typically form the foundation of broker trustworthiness assessment, as they directly impact trader fund security and regulatory compliance verification.

The moderate risk classification mentioned in available sources aligns with the cautious approach recommended for brokers lacking comprehensive regulatory transparency. While no specific negative incidents or regulatory actions appear in current information, the limited regulatory disclosure prevents confident trustworthiness assessment. Prospective traders should independently verify regulatory status and fund protection measures before committing significant trading capital.

User Experience Analysis (6/10)

Overall user experience with Markets.com receives moderate ratings based on the available user feedback score of 5, indicating neutral satisfaction levels among current traders. This suggests the platform meets basic functionality requirements without delivering exceptional user experience elements that would distinguish it significantly from competitors.

Interface design, navigation ease, account registration processes, and fund management experiences are not detailed in available sources, which limits comprehensive user experience evaluation. The availability of multiple trading platforms suggests flexibility in user interface options, potentially accommodating different trader preferences and experience levels.

The absence of specific user complaints in available feedback indicates reasonable operational performance, though the neutral ratings suggest opportunities for user experience enhancement. Typical areas for improvement in broker user experience include streamlined account verification, intuitive platform navigation, comprehensive educational resources, and responsive customer support integration. The moderate rating reflects adequate functionality with potential for enhanced user satisfaction through improved service transparency and platform optimization.

Conclusion

This comprehensive Markets.com review reveals a broker offering competitive trading conditions through multiple platform options and attractive spread pricing, while facing challenges in regulatory transparency and information disclosure. Markets.com appears most suitable for forex and CFD traders seeking platform flexibility and competitive pricing structures, particularly those comfortable with moderate risk profiles.

The broker's primary strengths include diverse trading platform availability, competitive spreads starting from 0 pips, and comprehensive technical analysis tools with over 80 chart indicators. However, significant weaknesses include limited regulatory information disclosure, unclear account condition details, and insufficient transparency regarding customer service capabilities and fund protection measures.

Prospective traders should conduct additional research regarding regulatory status, account specifications, and customer support arrangements before selecting Markets.com as their primary trading platform. While the broker demonstrates adequate functionality for basic trading requirements, the lack of comprehensive information transparency suggests careful evaluation against more established alternatives with clearer regulatory frameworks and service documentation.