Exante 2025 Review: Everything You Need to Know

Summary

This comprehensive exante review examines a regulated online brokerage that has established itself as a significant player in the global trading landscape. Exante operates under CySEC regulation. The company maintains registration with the FCA's foreign investment firm register, providing traders with access to over 400,000 financial instruments across multiple asset classes. The broker has garnered attention for its direct market access (DMA) trading capabilities and comprehensive range of tradeable assets.

According to available user feedback data, Exante maintains a competitive position in the market with generally positive user sentiment. The platform caters primarily to investors seeking diversified trading opportunities. These traders particularly need sophisticated market access and a broad spectrum of financial instruments. The broker's regulatory compliance and extensive asset coverage make it particularly suitable for professional traders and institutional clients who demand comprehensive market exposure.

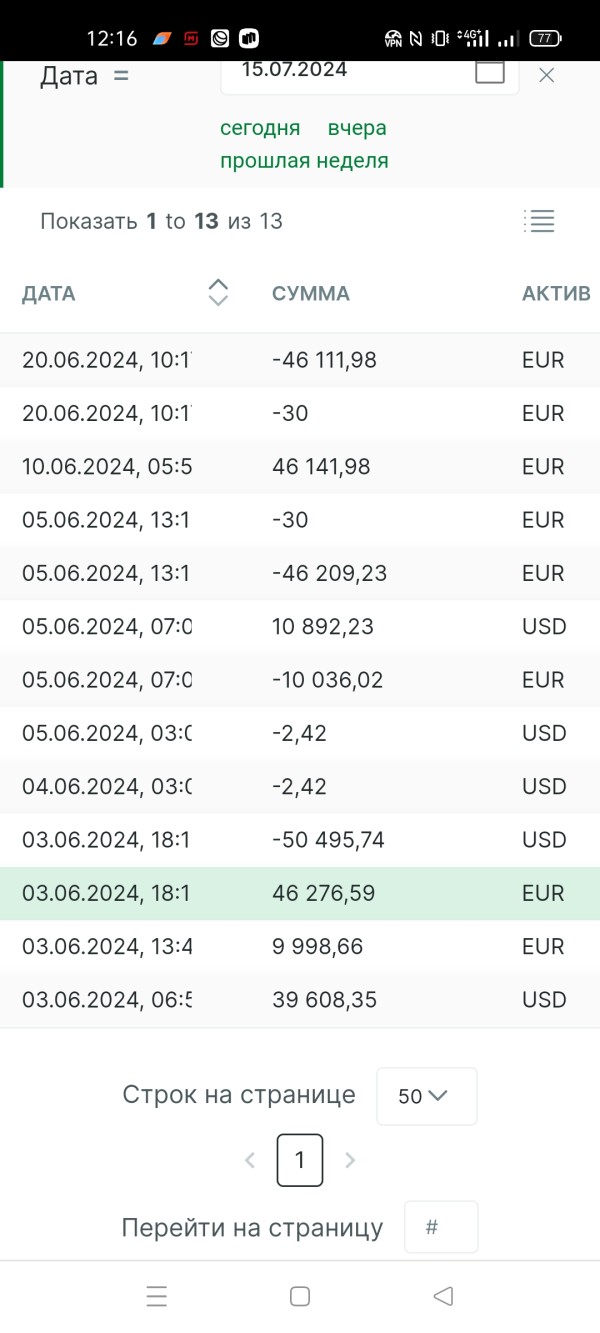

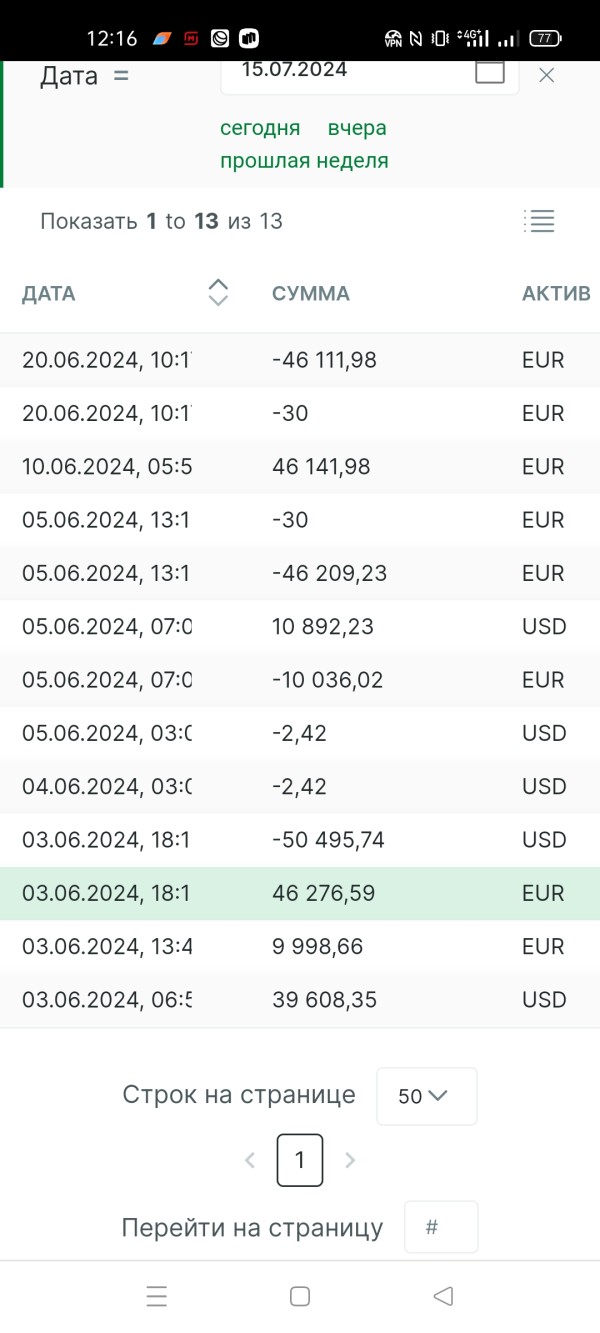

However, potential users should be aware of certain cost considerations, including withdrawal fees of €30 regardless of transaction amount. The broker's fee structure and minimum deposit requirements may influence trader decisions. This is particularly true for smaller retail investors. Overall, Exante presents itself as a well-regulated option for traders prioritizing asset diversity and regulatory compliance over cost optimization.

Important Notice

Exante operates across multiple jurisdictions with different regulatory frameworks that may affect service availability and legal protections for users in various regions. The primary regulatory oversight comes from CySEC (Cyprus Securities and Exchange Commission). The company also maintains registration with the FCA (Financial Conduct Authority) foreign investment firm register. Users should verify the specific regulatory protections and legal frameworks applicable in their jurisdiction before engaging with the platform.

This review is based on publicly available information, regulatory filings, user feedback data, and market analysis as of 2024. Trading involves substantial risk. Past performance does not guarantee future results. Potential users should conduct their own due diligence and consider their risk tolerance before making investment decisions.

Rating Framework

Broker Overview

Exante operates as an online brokerage firm that underwent significant rebranding in early 2022, previously operating under the IdealShape brand name. The company has positioned itself as a provider of direct market access trading services. It caters to both retail and institutional clients seeking comprehensive market exposure. The broker's business model focuses on providing extensive asset coverage rather than competing primarily on cost, which reflects in their fee structure and service offerings.

The platform emphasizes its capability to provide access to global markets through a single trading interface. It supports multi-account trading functionality that appeals to professional traders and portfolio managers. According to available information from Trade In Shares, Exante has developed its infrastructure to support sophisticated trading requirements while maintaining regulatory compliance across its operational jurisdictions.

Exante offers trading access to over 400,000 financial instruments spanning multiple asset classes including foreign exchange, contracts for difference (CFDs), and various other financial derivatives. The broker operates under CySEC regulation. It maintains registration with the FCA foreign investment firm register, providing users with regulatory protections under European financial services frameworks. This exante review notes that the broker's focus on asset diversity and regulatory compliance positions it as a comprehensive solution for traders requiring broad market access.

Regulatory Framework: Exante operates under the regulatory oversight of CySEC (Cyprus Securities and Exchange Commission) and maintains registration with the FCA foreign investment firm register. This dual regulatory structure provides users with protections under European financial services regulations.

Deposit and Withdrawal Methods: Specific deposit methods are not detailed in available documentation. The broker implements a €30 withdrawal fee regardless of transaction amount, which may impact cost considerations for smaller traders.

Minimum Deposit Requirements: Minimum deposit thresholds are not explicitly specified in available materials. This requires direct inquiry with the broker for specific account opening requirements.

Promotional Offerings: Current promotional programs and bonus structures are not detailed in available documentation. These would require direct verification with the broker.

Tradeable Assets: The platform provides access to over 400,000 financial instruments across multiple asset classes, including foreign exchange pairs, CFDs, and various derivative products. This represents one of the most comprehensive asset selections in the retail brokerage space.

Cost Structure: The broker implements a €30 withdrawal fee structure. Specific commission rates, spread information, and other trading costs are not detailed in available materials and would require direct inquiry for comprehensive cost analysis.

Leverage Ratios: Specific leverage offerings are not detailed in available documentation. These would require verification based on account type and regulatory jurisdiction.

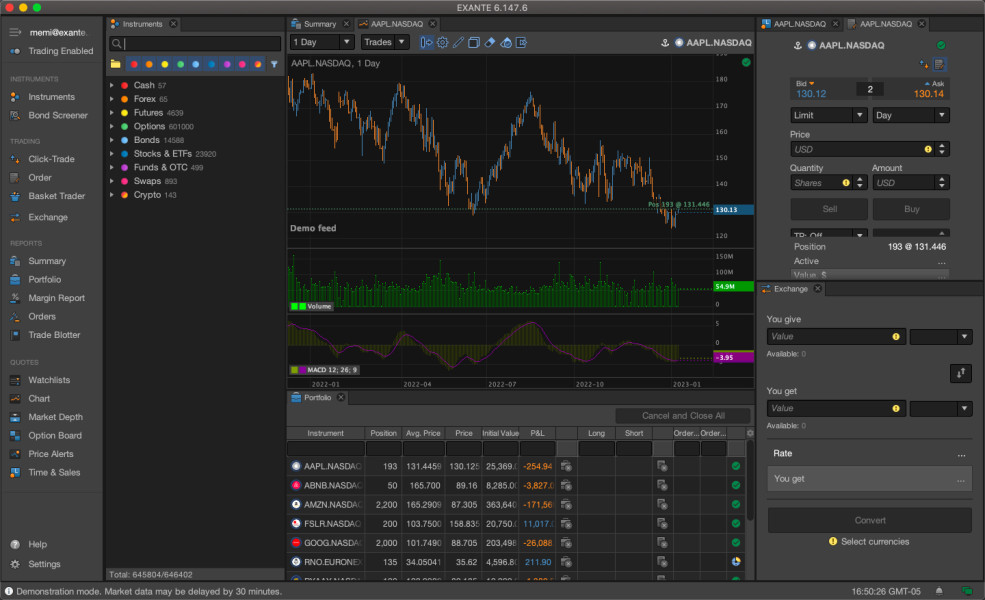

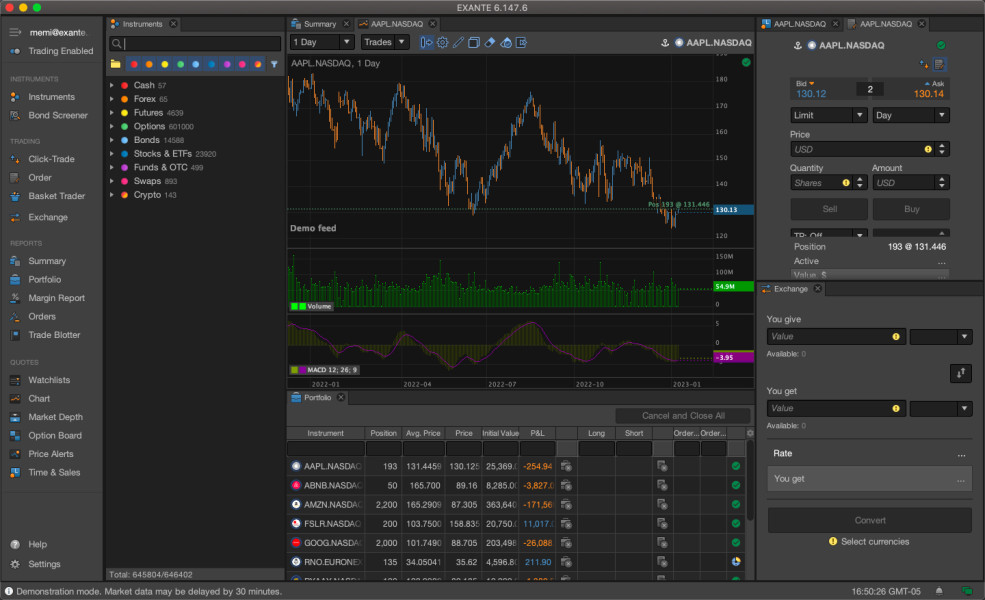

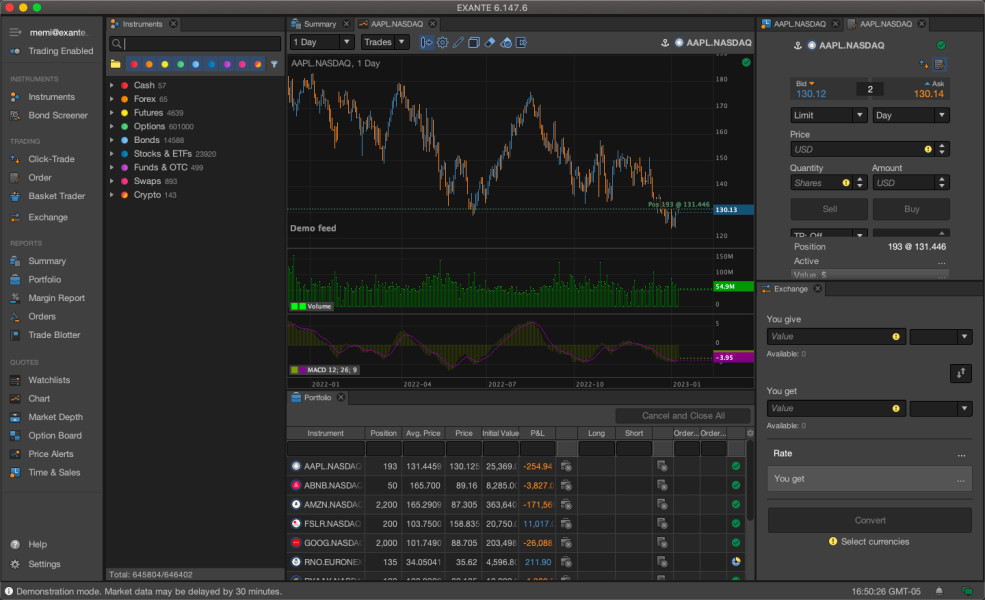

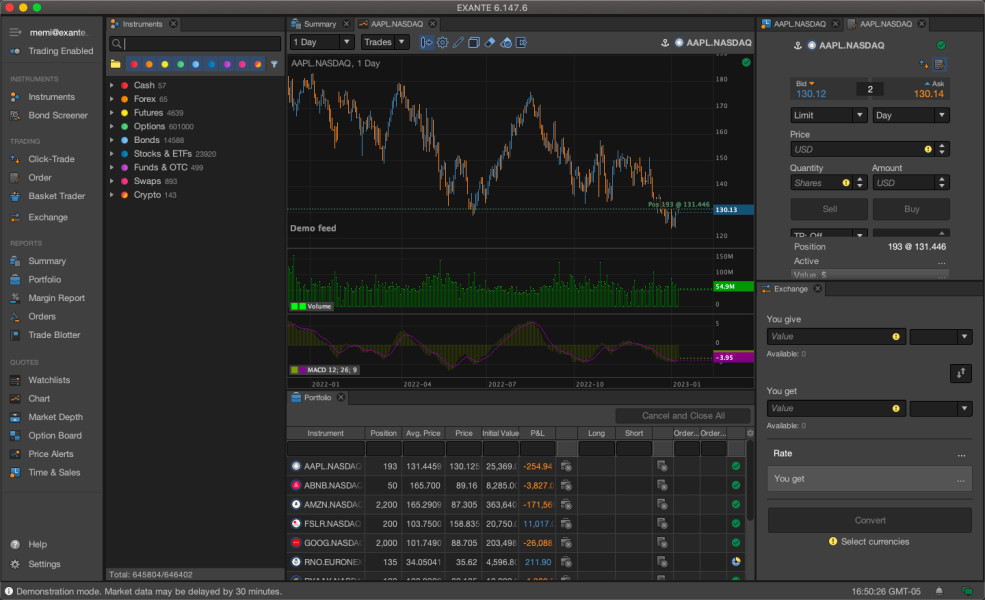

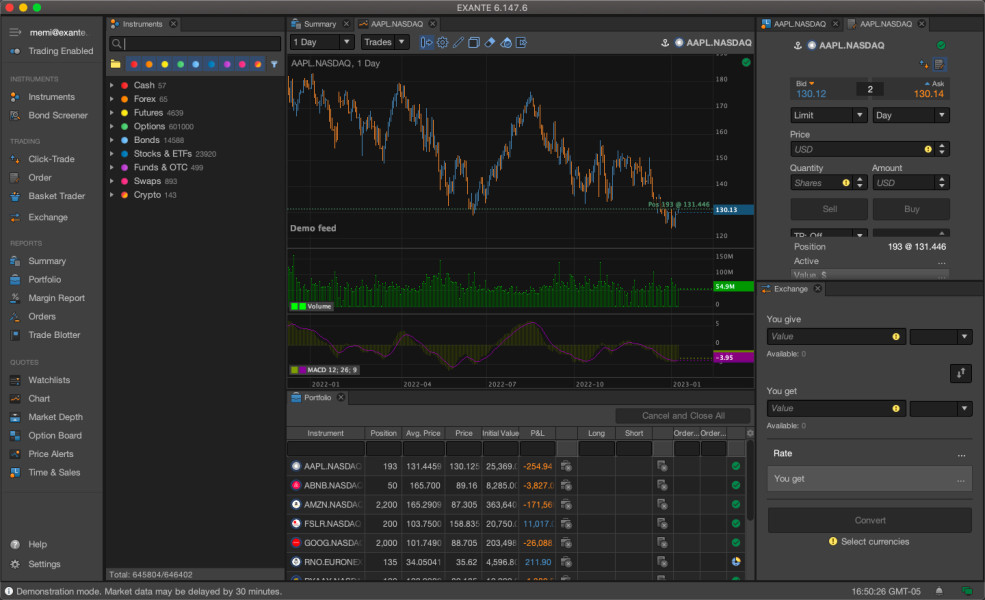

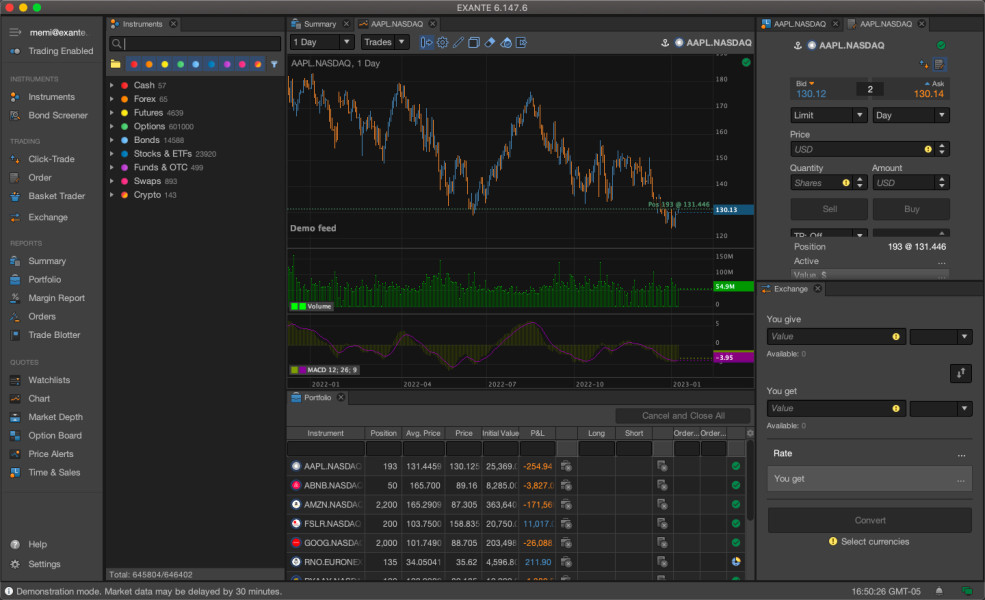

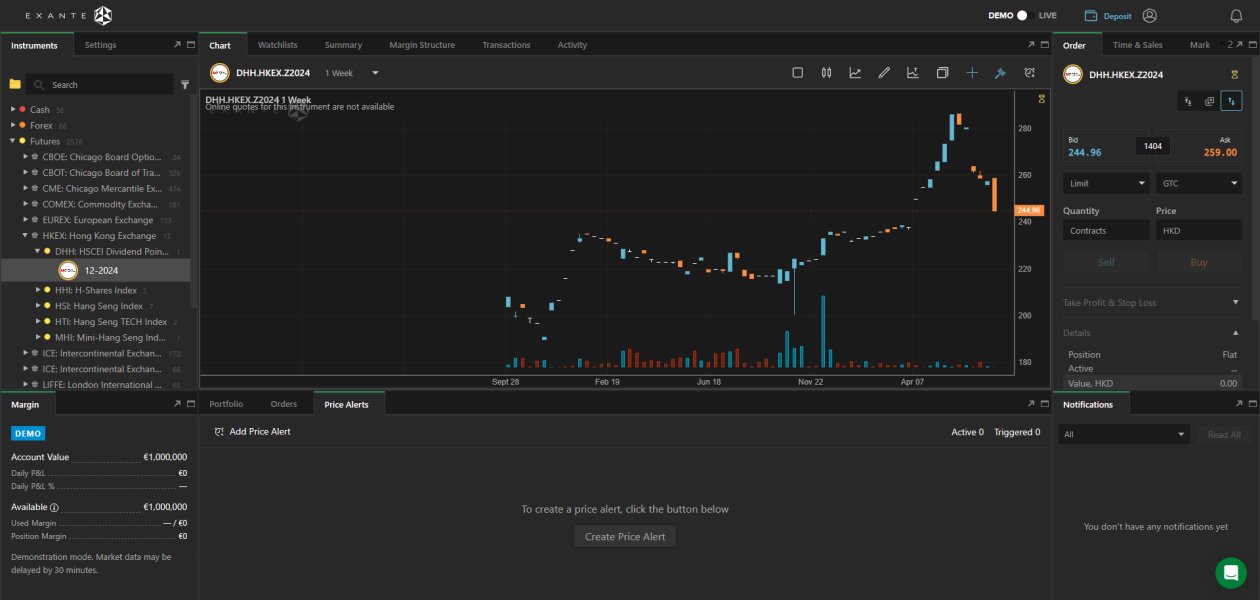

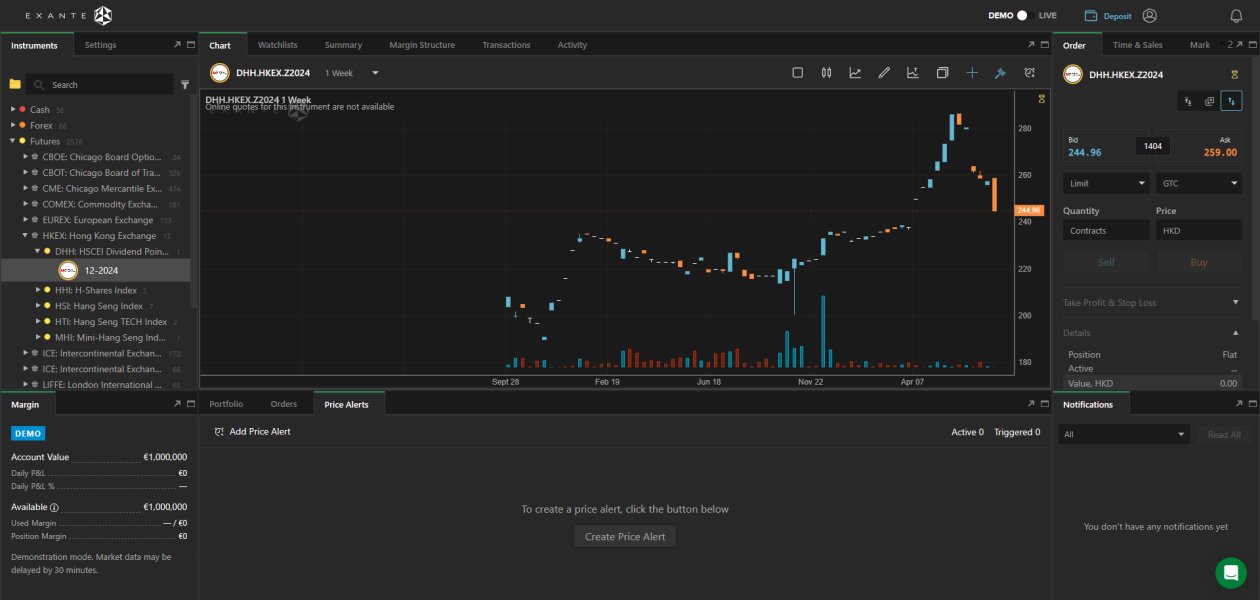

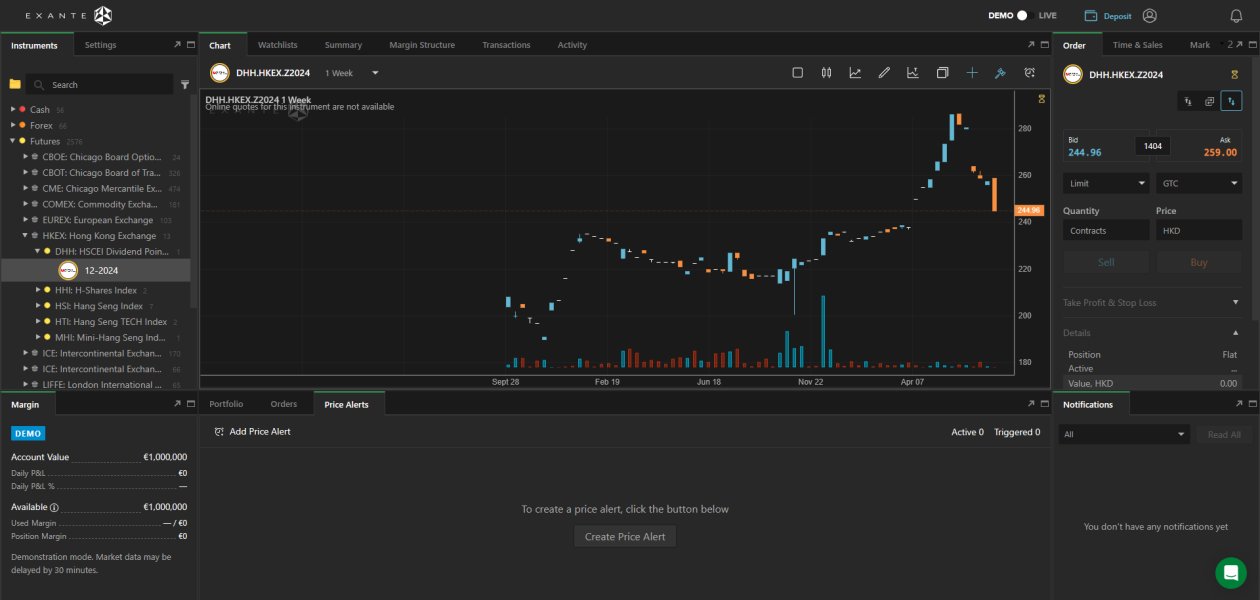

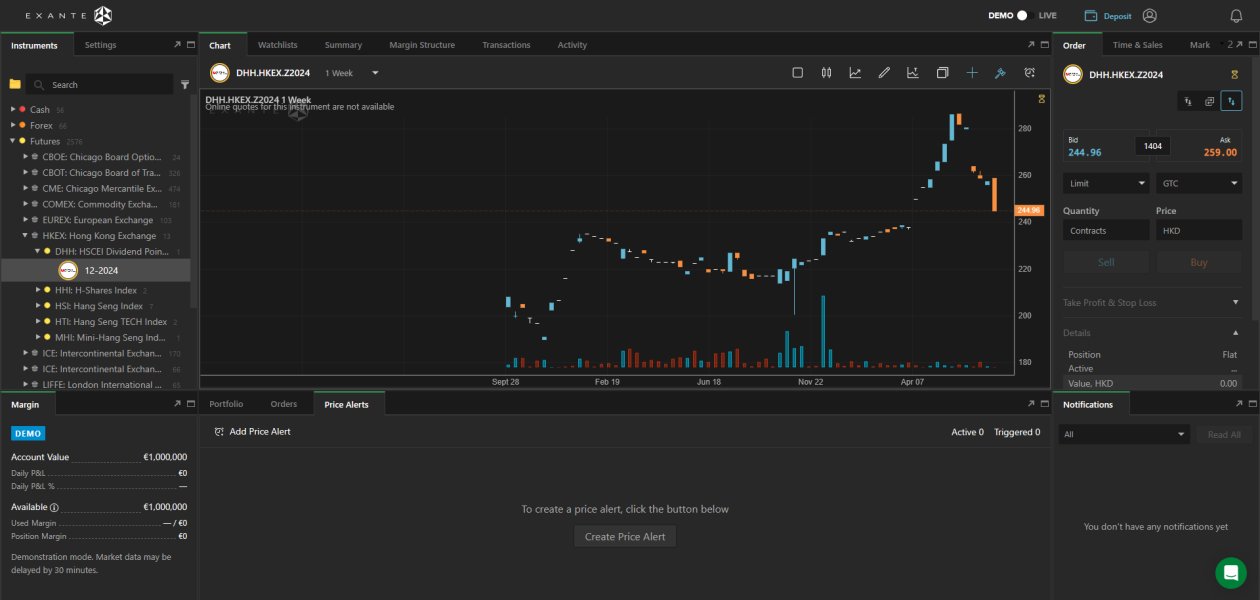

Platform Options: Specific trading platform details are not comprehensively covered in available materials. The broker emphasizes DMA trading capabilities and multi-account functionality.

Geographic Restrictions: Specific geographic limitations are not detailed in available documentation. These would require verification based on regulatory requirements.

Customer Support Languages: The broker primarily offers customer support in English. Additional language options may be available and would require direct verification.

This exante review notes that several key operational details require direct verification with the broker for complete information.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

Exante's account conditions present a mixed picture for potential users. While the broker offers access to an extensive range of financial instruments, the lack of transparent information regarding minimum deposit requirements creates uncertainty for prospective traders. The €30 withdrawal fee, regardless of transaction amount, represents a significant cost consideration. This is particularly true for smaller retail traders who may find this fee structure disproportionate to their trading volumes.

The broker's focus on professional and institutional clients is evident in its service structure. This may create barriers for entry-level traders. The absence of clearly defined account tiers or specialized account types in available documentation suggests that potential users need to engage directly with the broker to understand specific account conditions and requirements.

According to information from tradeinshares.com, the broker's fee structure may include high minimum deposit requirements that could deter smaller investors. This approach aligns with the broker's positioning toward professional traders. It may limit accessibility for retail investors seeking lower-barrier entry points.

The exante review assessment reflects the need for greater transparency in account conditions, particularly regarding entry requirements and comprehensive fee structures that would enable traders to make informed decisions about account suitability.

Exante demonstrates significant strength in its tools and resources offering, primarily through its extensive asset coverage of over 400,000 tradeable financial instruments. This comprehensive range provides traders with access to global markets through a single platform interface. It represents one of the most extensive asset selections available in the retail brokerage space.

The broker's multi-account trading functionality caters to professional traders and portfolio managers who require sophisticated account management capabilities. The DMA (Direct Market Access) trading capabilities mentioned in available documentation suggest that the platform provides institutional-grade market access. This is particularly valuable for professional traders requiring direct market connectivity.

However, specific details regarding research and analysis resources, educational materials, and automated trading support are not comprehensively detailed in available documentation. This information gap prevents a complete assessment of the broker's analytical and educational support infrastructure. These could be significant factors for traders relying on broker-provided research and learning resources.

The platform's emphasis on comprehensive market access rather than educational resources suggests a focus on experienced traders who may not require extensive educational support but value broad market exposure and sophisticated trading capabilities.

Customer Service and Support Analysis (8/10)

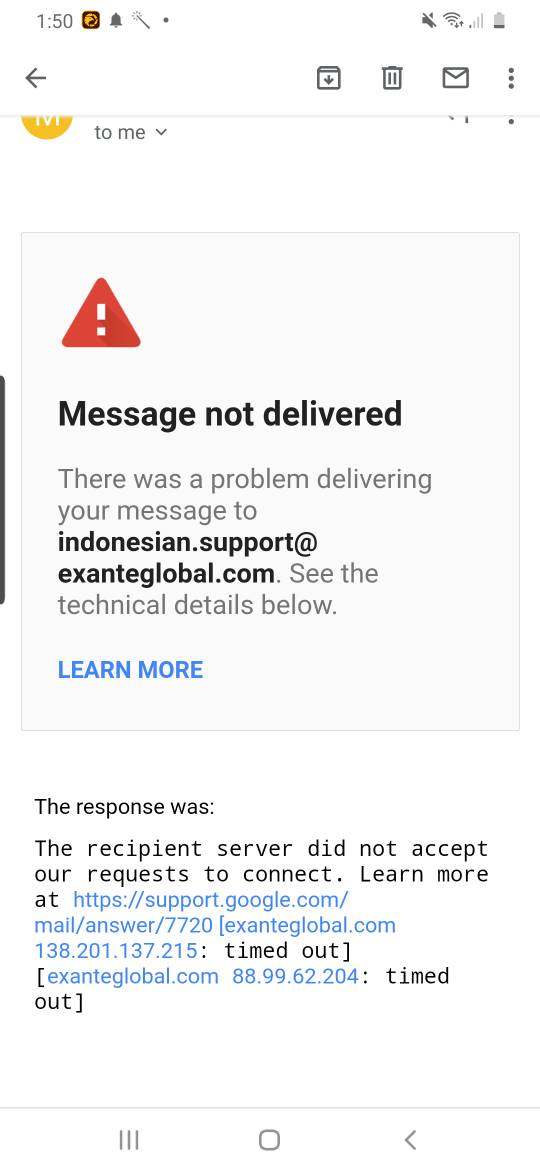

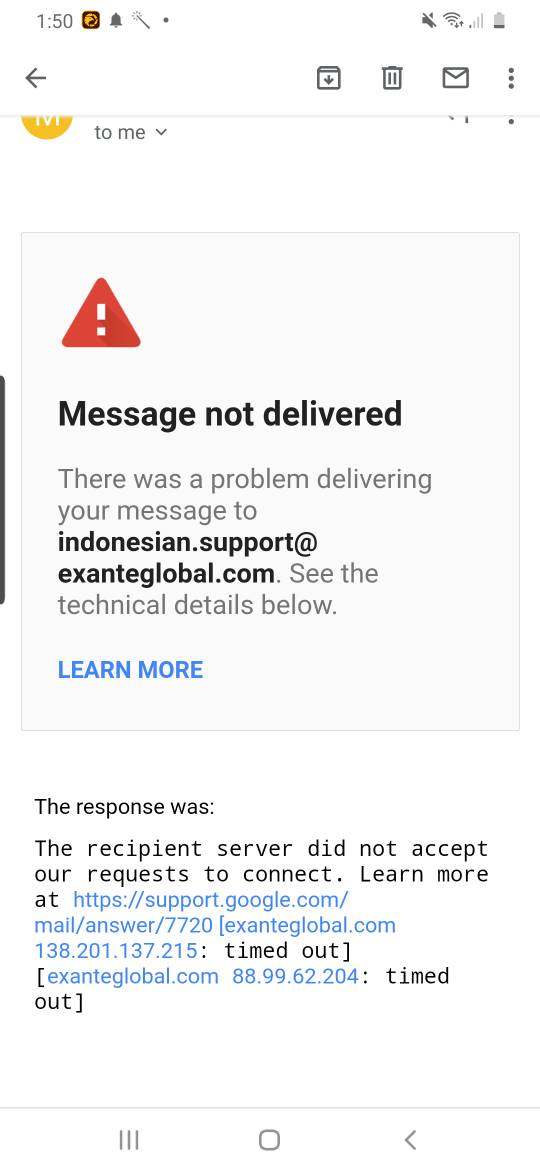

Exante's customer service framework centers on English language support, though the specific channels, availability hours, and response time metrics are not detailed in available documentation. The broker's regulatory compliance under CySEC and FCA registration suggests adherence to customer service standards required by these regulatory frameworks.

User feedback indicates generally positive experiences with the broker's service quality. However, specific case studies or detailed user testimonials are not available in the reviewed materials. The broker's focus on professional and institutional clients suggests that customer service is likely structured to handle sophisticated inquiries and technical support requirements.

The absence of detailed information regarding multi-language support options, 24/7 availability, or specific communication channels represents an area where potential users would need to verify service availability directly with the broker. For international traders, language support and time zone coverage could be significant factors in service satisfaction.

The customer service rating reflects the positive user sentiment while acknowledging the limited detailed information available regarding specific service metrics and support infrastructure capabilities.

Trading Experience Analysis (7/10)

The trading experience evaluation for Exante focuses on the broker's DMA capabilities and extensive asset coverage, though specific platform performance metrics are not detailed in available documentation. The broker's emphasis on direct market access suggests sophisticated order execution capabilities. These would appeal to professional traders requiring institutional-grade market connectivity.

The platform's support for over 400,000 financial instruments indicates robust infrastructure capable of handling diverse trading requirements across multiple asset classes. The multi-account trading functionality suggests that the platform can accommodate complex trading strategies and portfolio management requirements.

However, critical trading experience factors such as platform stability, execution speed, order fill quality, and mobile trading capabilities are not specifically addressed in available materials. These technical performance indicators are crucial for traders evaluating platform suitability. This is particularly true for active trading strategies or time-sensitive market opportunities.

The exante review trading experience assessment reflects the broker's apparent focus on comprehensive market access while noting the need for additional technical performance data to provide a complete evaluation of the trading environment quality.

Trust and Regulation Analysis (9/10)

Exante demonstrates strong regulatory credentials through its CySEC regulation and FCA foreign investment firm registration. This dual regulatory framework provides users with protections under established European financial services regulations. These include client fund segregation requirements and regulatory oversight of business practices.

The CySEC regulation ensures compliance with MiFID II requirements, providing standardized protections for European traders. The FCA registration, while not full authorization, indicates recognition within the UK regulatory framework. It suggests compliance with international regulatory standards.

The broker's regulatory standing represents a significant strength, particularly for traders prioritizing regulatory protection and institutional credibility. The European regulatory framework provides established dispute resolution mechanisms and client protection standards. These enhance user confidence in the broker's operational integrity.

However, specific details regarding client fund insurance, segregation practices, and additional security measures are not comprehensively detailed in available documentation. These operational security details would provide additional assurance regarding client asset protection beyond basic regulatory requirements.

User Experience Analysis (8/10)

User experience evaluation for Exante relies primarily on the broker's comprehensive asset offering and regulatory credibility, though specific interface design and usability details are not available in reviewed materials. The platform's focus on professional traders suggests an interface designed for sophisticated trading requirements. This differs from simplified retail trading experiences.

The multi-account trading functionality indicates platform capabilities that support complex trading strategies and portfolio management. This would appeal to experienced traders requiring advanced account management features. The DMA trading capabilities suggest that the platform provides institutional-grade market access through retail-accessible interfaces.

However, critical user experience factors such as registration process efficiency, account verification procedures, platform navigation, and mobile accessibility are not specifically detailed in available materials. These practical usability factors significantly impact day-to-day trading experiences. They also affect overall platform satisfaction.

The user experience assessment reflects the broker's apparent strength in providing comprehensive market access while acknowledging the need for additional information regarding practical usability and interface design quality to provide a complete user experience evaluation.

Conclusion

This exante review reveals a broker that positions itself as a comprehensive solution for traders seeking extensive market access and regulatory compliance. Exante's strength lies in its vast selection of over 400,000 tradeable instruments and solid regulatory foundation under CySEC oversight with FCA registration. The broker appears well-suited for professional traders and institutional clients who prioritize asset diversity and direct market access capabilities over cost optimization.

However, the broker's fee structure, including the €30 withdrawal fee and potentially high minimum deposit requirements, may present barriers for smaller retail traders. The lack of transparency in key operational details such as specific platform features, comprehensive cost structures, and detailed service specifications represents an area requiring improvement. This affects potential user evaluation.

Exante is most appropriate for experienced traders and institutional clients who require broad market exposure, regulatory compliance, and sophisticated trading capabilities, while traders prioritizing cost efficiency and transparent fee structures may need to carefully evaluate the broker's suitability for their specific requirements.