OctaFX 2025 Review: Everything You Need to Know

Executive Summary

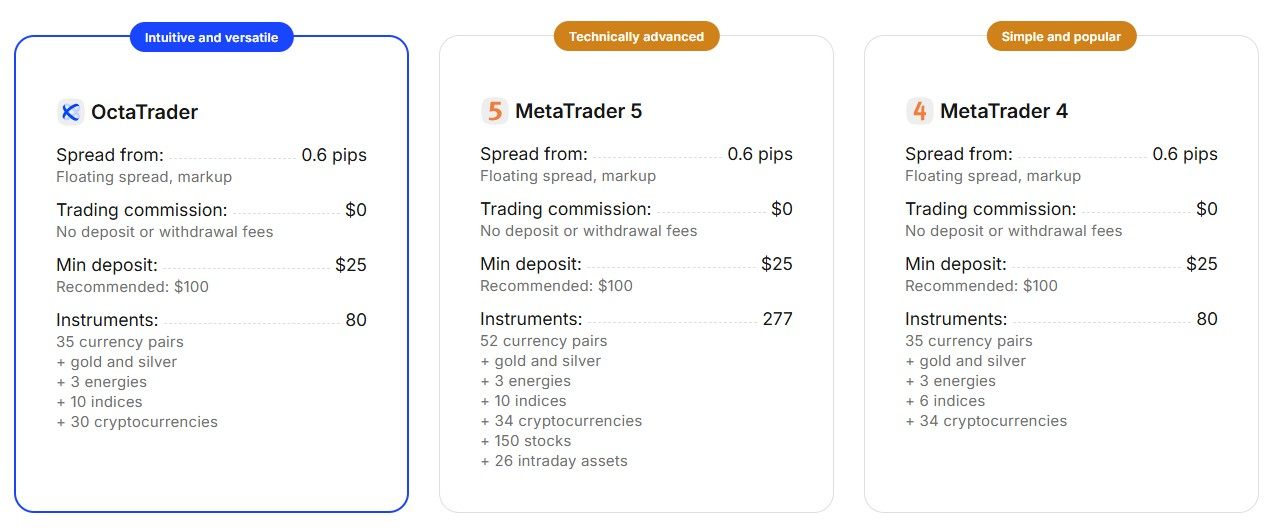

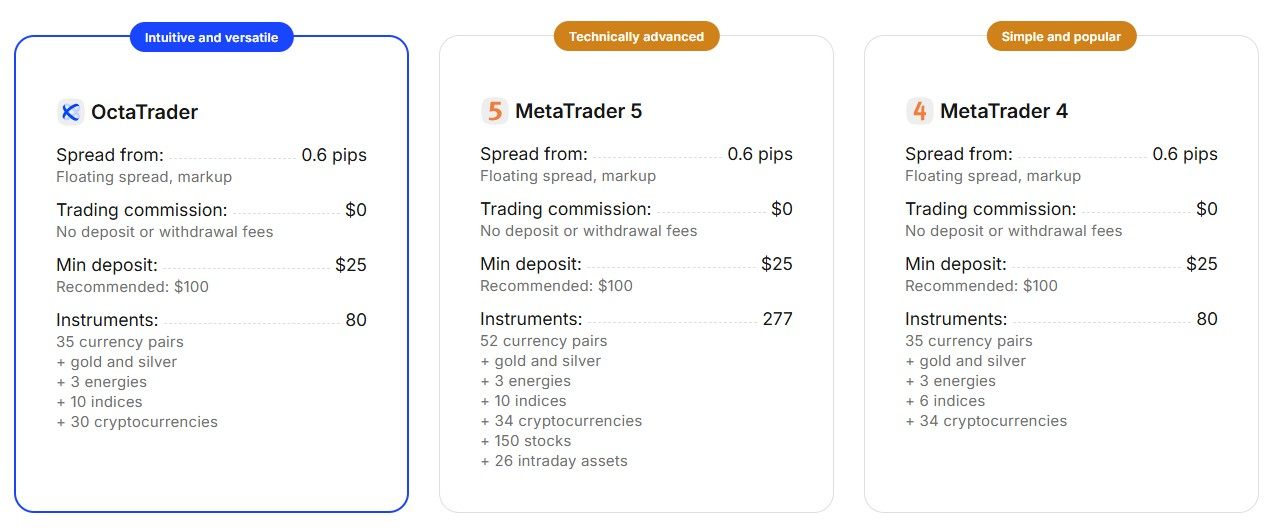

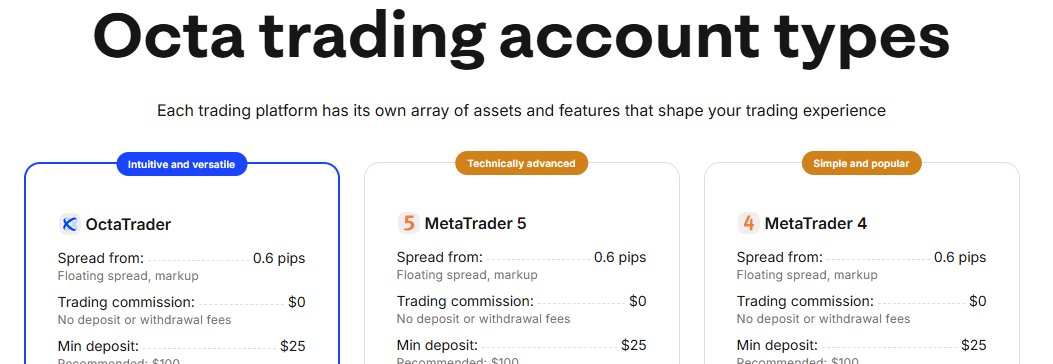

This comprehensive octafx review evaluates one of the market's established forex brokers. It provides traders with essential insights for informed decision-making. OctaFX stands out as a reliable and user-friendly forex broker that has been serving the global trading community since 2011. The platform demonstrates particular strength in accessibility and platform diversity. It offers multiple trading environments including MetaTrader 4, MetaTrader 5, and their proprietary OctaTrader platform.

Key highlights of this broker include exceptionally low barriers to entry with a minimum deposit requirement of just $25. This makes it particularly attractive for newcomers to forex trading. The broker provides competitive spreads starting from 0.8 pips and maintains regulatory oversight through multiple jurisdictions including CySEC, SVGFSA, and FSCA. According to various industry sources, OctaFX has positioned itself effectively within the retail trading space. It particularly appeals to beginner and intermediate traders seeking a comprehensive yet straightforward trading experience.

The broker's commitment to accessibility extends beyond low deposit requirements. It includes a diverse range of tradeable assets spanning forex pairs, commodities, cryptocurrencies, stocks, and indices. User feedback consistently highlights the platform's reliability and user-friendly interface design. This contributes to its growing reputation in the competitive forex brokerage landscape.

Important Disclaimers

Trading with OctaFX involves significant considerations that potential clients should understand before proceeding. The broker operates through different regulatory entities across various jurisdictions. This means protection levels and trading conditions may vary depending on the specific regulatory framework governing individual client relationships. CySEC regulation provides European Union investor protection standards, while SVGFSA and FSCA oversight offers different regulatory frameworks with varying levels of client fund protection.

This evaluation is based on publicly available information, documented user experiences, and analysis of the broker's official offerings as of 2025. Market conditions, regulatory requirements, and broker policies may change. This could potentially affect the accuracy of specific details presented in this review. Prospective traders should verify current terms and conditions directly with OctaFX before making trading decisions. Regulatory differences across jurisdictions may impact available services and protection levels.

Rating Framework

Broker Overview

OctaFX emerged in the forex brokerage landscape in 2011. It established its headquarters in London while building a global service network. The company has positioned itself as a comprehensive online trading service provider, focusing on delivering accessible forex and CFD trading solutions to retail traders worldwide. Over more than a decade of operation, OctaFX has developed a reputation for reliability and user-centric service delivery. This is particularly true among traders seeking straightforward access to international financial markets.

The broker's business model centers on providing multi-asset trading capabilities through advanced technological platforms. OctaFX offers trading services across foreign exchange markets, commodity markets, cryptocurrency markets, equity indices, and individual stock CFDs. This diversified approach allows traders to access various market opportunities through a single brokerage relationship. It streamlines portfolio management and trading execution processes.

According to industry sources, OctaFX operates under a market maker model while maintaining competitive pricing structures. The platform supports MetaTrader 4 and MetaTrader 5, two of the industry's most widely recognized trading platforms, alongside their proprietary OctaTrader solution. This octafx review finds that the broker's regulatory framework spans multiple jurisdictions including Cyprus Securities and Exchange Commission (CySEC), Saint Vincent and the Grenadines Financial Services Authority (SVGFSA), and the Financial Sector Conduct Authority (FSCA) of South Africa. This provides varied regulatory oversight depending on client location and entity structure.

Regulatory Framework: OctaFX maintains authorization through three primary regulatory bodies. CySEC oversight provides European Union regulatory standards for eligible clients, while SVGFSA offers offshore regulatory framework options. FSCA regulation covers South African market access and compliance requirements. Each regulatory relationship provides different levels of client protection and operational oversight.

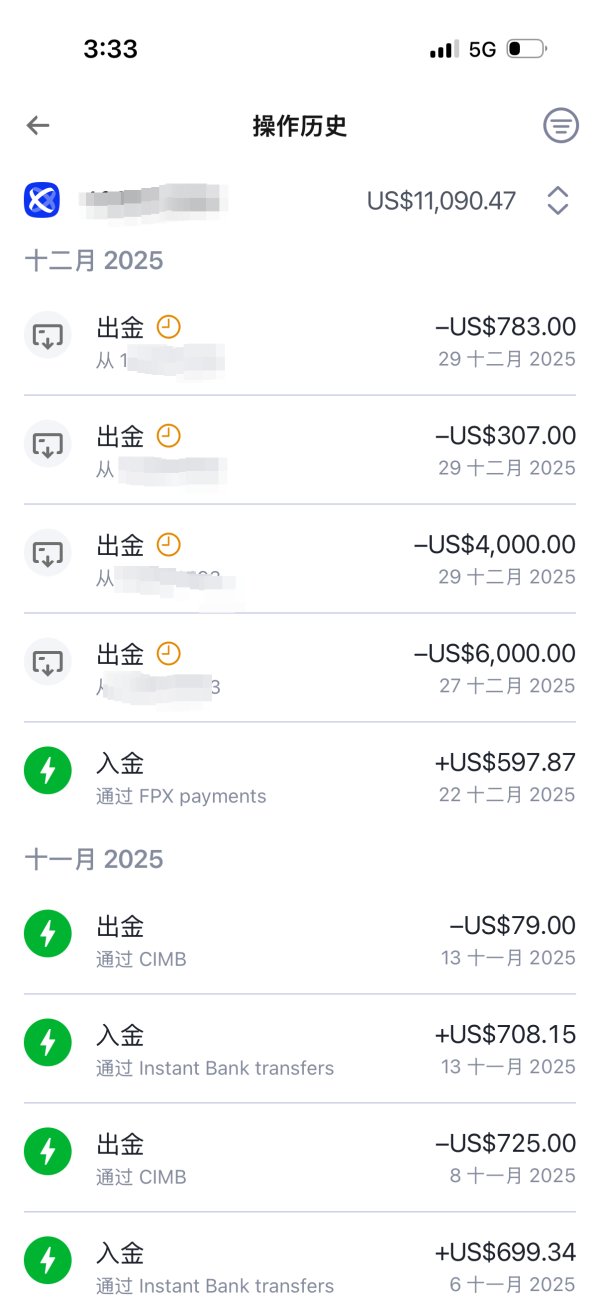

Deposit and Withdrawal Methods: While specific payment method details require verification through current broker documentation, industry standards suggest support for major payment processors, bank transfers, and electronic wallet solutions. Processing times and fees may vary by method and regulatory jurisdiction.

Minimum Deposit Requirements: The broker sets an accessible entry threshold at $25 minimum deposit. This positions it favorably for newcomers to forex trading. This low barrier to entry aligns with the broker's focus on beginner and intermediate trader segments.

Promotional Offerings: Current bonus and promotional structures require verification through official broker channels. These may vary by regulatory jurisdiction and client classification. Industry sources indicate periodic promotional campaigns, though specific terms and availability should be confirmed directly.

Tradeable Assets: OctaFX provides access to foreign exchange pairs covering major, minor, and exotic currency combinations. Commodity trading includes precious metals, energy products, and agricultural futures. Cryptocurrency CFDs cover major digital assets, while equity products include individual stock CFDs and major global indices.

Cost Structure: Spreads begin at 0.8 pips according to available documentation. However, specific spread ranges across different asset classes and account types require verification. Commission structures, swap rates, and additional fees should be confirmed through current broker documentation for accurate cost assessment.

Leverage Provisions: Leverage ratios vary by regulatory jurisdiction and asset class. European clients are subject to ESMA restrictions while other jurisdictions may offer different maximum leverage levels. Specific ratios require verification based on individual client regulatory classification.

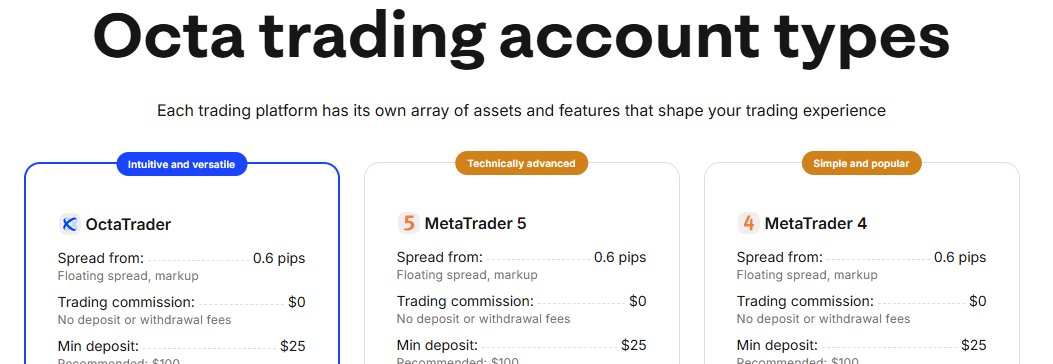

Platform Options: The broker supports MetaTrader 4 and MetaTrader 5 alongside proprietary OctaTrader platform. Each platform offers different feature sets and capabilities. Mobile and web-based versions are available for flexible trading access.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

OctaFX demonstrates competitive account accessibility through its $25 minimum deposit requirement. This is significantly lower than many established brokers in the market. This octafx review finds that such low entry barriers particularly benefit new traders testing live market conditions without substantial capital commitment. The broker's spread structure beginning at 0.8 pips falls within reasonable market ranges. However, comprehensive spread analysis across all asset classes and trading sessions requires additional verification.

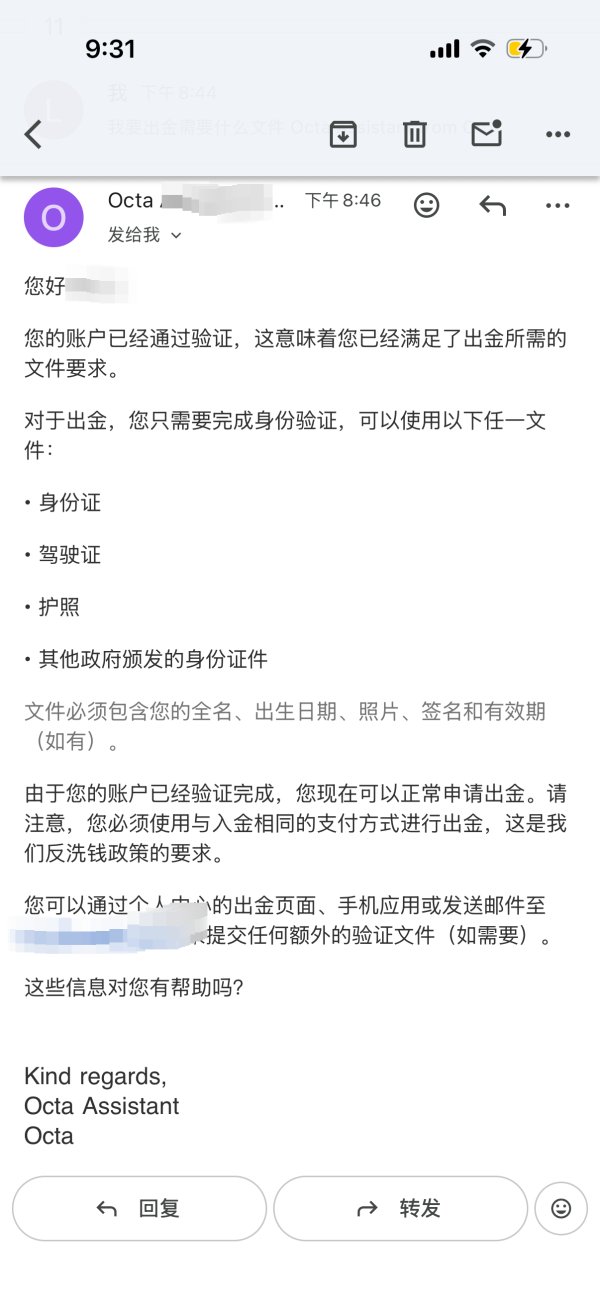

Account opening procedures appear streamlined based on user feedback. Specific documentation requirements and verification timeframes depend on regulatory jurisdiction and client location. The broker reportedly offers multiple account configurations, though detailed specifications regarding account tiers, features, and eligibility criteria need confirmation through official channels.

Islamic account availability and specific Sharia-compliant trading conditions require direct verification. These services often vary by regulatory entity and jurisdiction. The broker's approach to account management and client onboarding generally receives positive user feedback. This suggests efficient processes and clear communication during account establishment phases.

Platform diversity represents a significant strength in OctaFX's offering. MetaTrader 4, MetaTrader 5, and proprietary OctaTrader provide traders with multiple technological environments. MT4's widespread adoption and familiar interface appeal to traditional forex traders, while MT5's enhanced capabilities support multi-asset trading and advanced order management. The proprietary OctaTrader platform potentially offers unique features tailored to the broker's specific service approach.

Research and analysis resource availability requires verification through current platform access. These services often evolve and may vary by account type or regulatory jurisdiction. Educational content quality and comprehensiveness similarly need assessment through direct platform evaluation. Industry standards suggest basic educational materials for retail-focused brokers.

Automated trading support through Expert Advisors on MetaTrader platforms provides algorithmic trading capabilities for suitable traders. Signal services, market analysis, and third-party tool integration capabilities require verification through current platform documentation and user access levels.

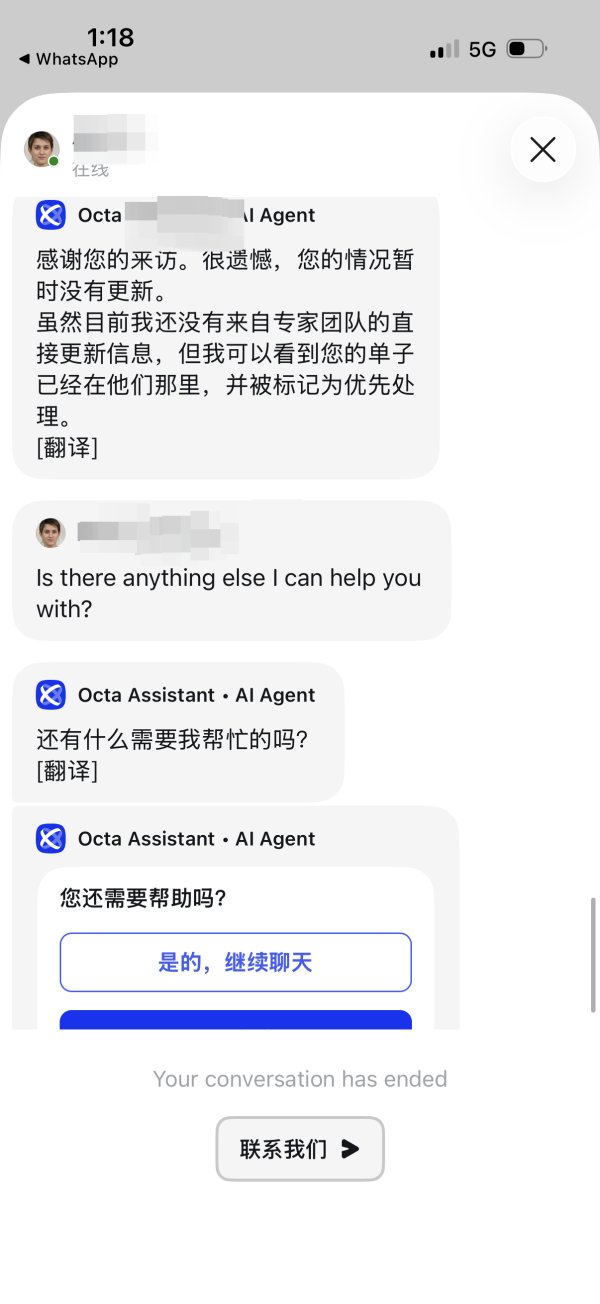

Customer Service and Support Analysis (6/10)

Customer service evaluation proves challenging due to limited detailed information in available sources. This includes specific service metrics, response times, and support channel effectiveness. Industry contact information suggests traditional support channels including telephone and email communication. Live chat availability, support hours, and multi-language capabilities require verification.

Service quality assessment depends largely on user experience reports. These appear generally positive though not extensively documented in available sources. Response time benchmarks, issue resolution effectiveness, and technical support capabilities need evaluation through direct testing or comprehensive user feedback analysis.

Multi-language support capabilities and regional service availability likely vary by regulatory jurisdiction and client location. This reflects the broker's international operation structure. Account management services and dedicated support for different account tiers require clarification through official broker documentation.

Trading Experience Analysis (7/10)

User feedback consistently describes OctaFX as providing a reliable and user-friendly trading environment. This suggests stable platform performance and intuitive interface design. Platform stability and execution speed appear satisfactory based on available user reports. However, comprehensive performance metrics including average execution times, slippage rates, and server uptime statistics require verification through detailed testing.

Order execution quality represents a critical factor for trading success. Specific data regarding fill rates, requote frequency, and execution methodology needs confirmation through official documentation or independent testing. The broker's approach to order handling, price feed quality, and market depth transparency should be evaluated through direct platform experience.

Mobile trading capabilities through MetaTrader mobile applications and potential proprietary mobile solutions provide flexibility for active traders. Web-based trading access and cross-platform synchronization capabilities enhance accessibility. Specific feature comparisons across different access methods require detailed evaluation.

This octafx review notes that trading environment assessment ultimately depends on individual trading styles, preferred assets, and specific performance requirements. These may vary significantly among different trader profiles.

Trust and Safety Analysis (8/10)

Regulatory oversight through CySEC, SVGFSA, and FSCA provides multiple layers of compliance and operational standards. Protection levels vary by regulatory framework. CySEC authorization offers European Union investor protection standards including segregated client funds and compensation scheme participation. Other regulatory relationships provide different protection structures.

Industry recognition including the 2023 Asia's Most Reliable Broker award suggests positive peer and client evaluation. Specific award criteria and evaluation methodology should be considered when assessing such recognition. The broker's operational history since 2011 provides substantial track record for evaluation. Specific incident history and regulatory compliance record require verification through regulatory authority databases.

Fund security measures, client money segregation practices, and operational risk management procedures need verification through official documentation and regulatory filing review. The broker's approach to data security, privacy protection, and operational resilience should be evaluated through comprehensive security policy review and implementation assessment.

Transparency regarding company ownership, financial backing, and operational structure contributes to overall trust assessment. Detailed corporate information may require investigation through regulatory filings and official company documentation.

User Experience Analysis (7/10)

Overall user satisfaction appears positive based on available feedback. Users consistently reference user-friendly interface design and accessible trading environment. The broker's positioning toward beginner and intermediate traders suggests intentional focus on simplicity and clarity in user interface design and service delivery.

Registration and account verification processes reportedly proceed smoothly. Specific timeframes and documentation requirements vary by regulatory jurisdiction and client location. User feedback suggests efficient onboarding procedures, though comprehensive process evaluation requires direct experience or detailed user survey analysis.

Platform navigation, feature accessibility, and overall usability receive generally positive user comments. Specific interface design elements and functionality comparisons require hands-on evaluation. The learning curve for new platform users and available guidance resources contribute to overall user experience assessment.

Common user concerns or complaints require identification through comprehensive feedback analysis and support ticket review. Available sources provide limited insight into frequent issues or areas for improvement in the user experience.

Conclusion

This comprehensive octafx review reveals a broker that successfully balances accessibility with regulatory compliance. It makes itself particularly suitable for beginner and intermediate traders seeking reliable market access. OctaFX's strengths lie in its low entry barriers, diverse platform offerings, and multi-jurisdictional regulatory framework. This provides traders with flexible access to various international markets.

The broker's $25 minimum deposit requirement and competitive spreads starting from 0.8 pips create an accessible trading environment. Regulatory oversight through CySEC, SVGFSA, and FSCA provides varied protection levels depending on client jurisdiction. Platform diversity through MT4, MT5, and OctaTrader accommodates different trading preferences and technical requirements.

However, prospective traders should note that detailed information regarding specific service aspects requires verification through direct broker contact and platform testing. This includes commission structures, comprehensive customer service metrics, and detailed platform performance data. The broker's suitability ultimately depends on individual trading requirements, risk tolerance, and preferred regulatory framework. This makes thorough due diligence essential before establishing any trading relationship.