BDSwiss 2025 Review: Everything You Need to Know

Summary

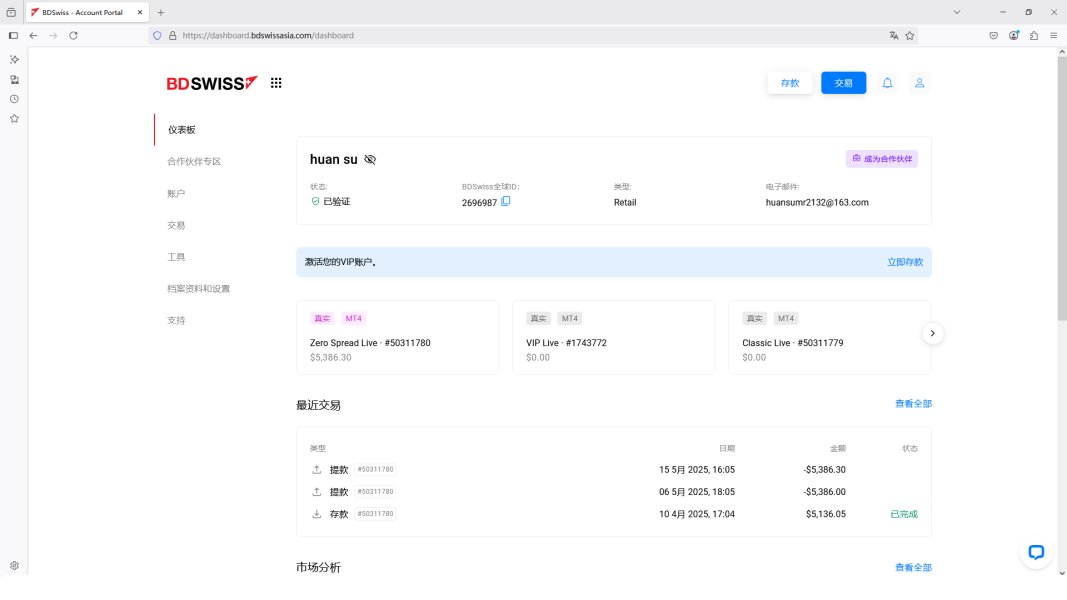

This complete bdswiss review looks at one of the well-known names in the forex trading industry. BDSwiss has built a strong reputation as a trusted forex broker since it started in 2012, helping over 3 million registered clients across 180 countries with a huge trading volume of $84 billion. The broker works under multiple rules including CySEC and NFA, giving traders better security and clear information.

BDSwiss stands out because it offers different trading platforms, including MetaTrader 4, MetaTrader 5, and its own trading apps, plus complete learning resources that help both new and skilled traders. The broker works hard to provide over 50 currency pairs along with various types of investments including stocks, indices, precious metals, and commodities, making it a good choice for traders who want to spread their investments around.

With a trust score of 74/100, BDSwiss shows solid performance in the competitive forex market, though some areas still need work in user experience and service quality. The minimum deposit of $100 makes it easy for regular traders to start, while the high leverage options appeal to those looking for bigger trading chances.

Important Notice

BDSwiss operates through different companies across various locations, and the services, features, and rules may change depending on where you live. This review uses public information and user feedback gathered from multiple sources.

Traders should check the specific rules and available services in their area before opening an account. The rules for forex trading keep changing, and BDSwiss's compliance with CySEC and NFA requirements ensures it follows strict operating standards, though regional differences in service offerings may apply.

Rating Framework

Broker Overview

BDSwiss started in the forex market in 2012, building itself as a major player in the retail trading sector. The company has shown amazing growth over its 13-year history, gathering an impressive client base of 3 million registered users across 180 countries.

This global reach comes with large trading volume figures of $84 billion, showing active user engagement and platform reliability. The broker's business model focuses on providing complete forex and CFD trading services through multiple technology platforms.

BDSwiss has smartly positioned itself to serve different trading preferences by offering both established industry-standard platforms and its own solutions. The company's commitment to following rules has been clear through getting and keeping licenses from respected financial authorities.

BDSwiss operates across multiple asset classes, giving traders access to over 50 currency pairs, stocks, stock indices, precious metals, commodities, and CFDs. This diverse offering helps portfolio diversification strategies and appeals to traders with different risk appetites and market interests.

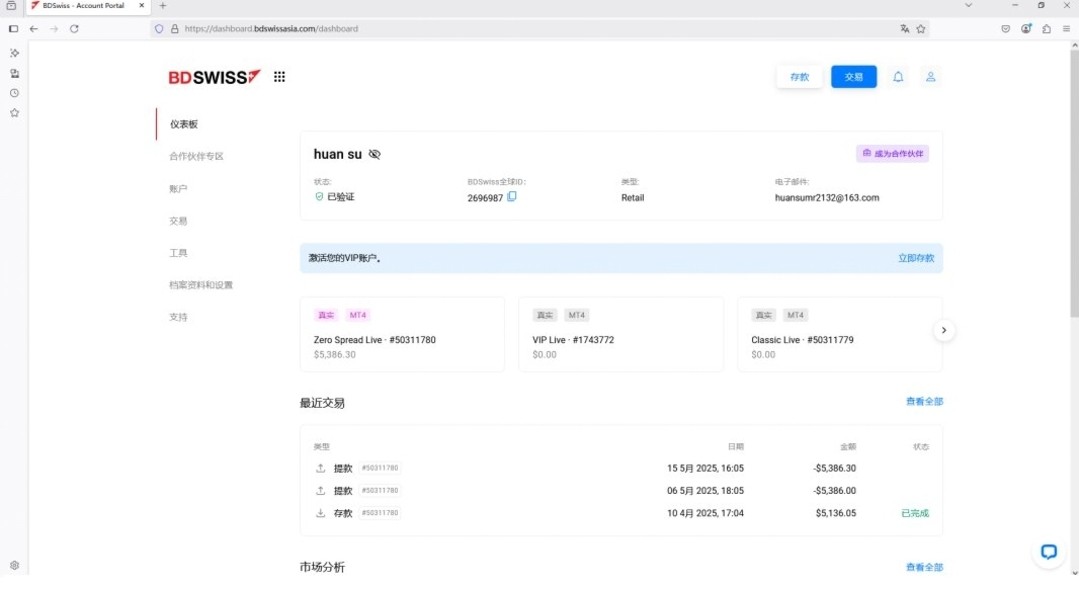

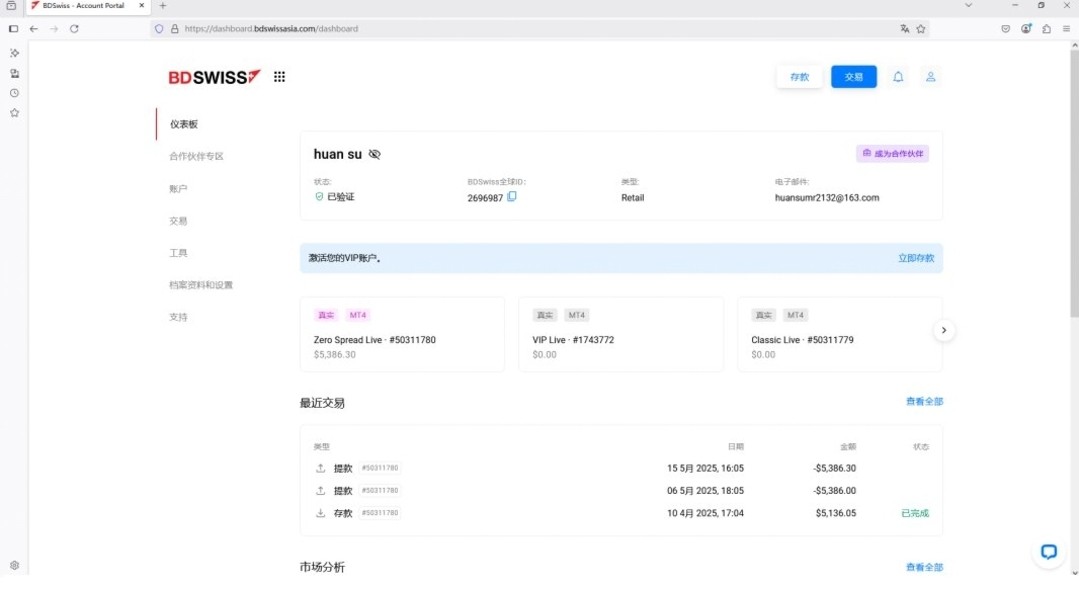

The platform selection includes MetaTrader 4, MetaTrader 5, BDSwiss mobile applications, and BDSwiss Web Trader, ensuring access across different devices and trading preferences. The regulatory framework supporting BDSwiss operations includes oversight from CySEC (Cyprus Securities and Exchange Commission) under license number 199/13 and the National Futures Association (NFA).

These regulatory relationships give clients better protection and ensure following strict operational standards regarding client fund separation, fair trading practices, and transparent business operations.

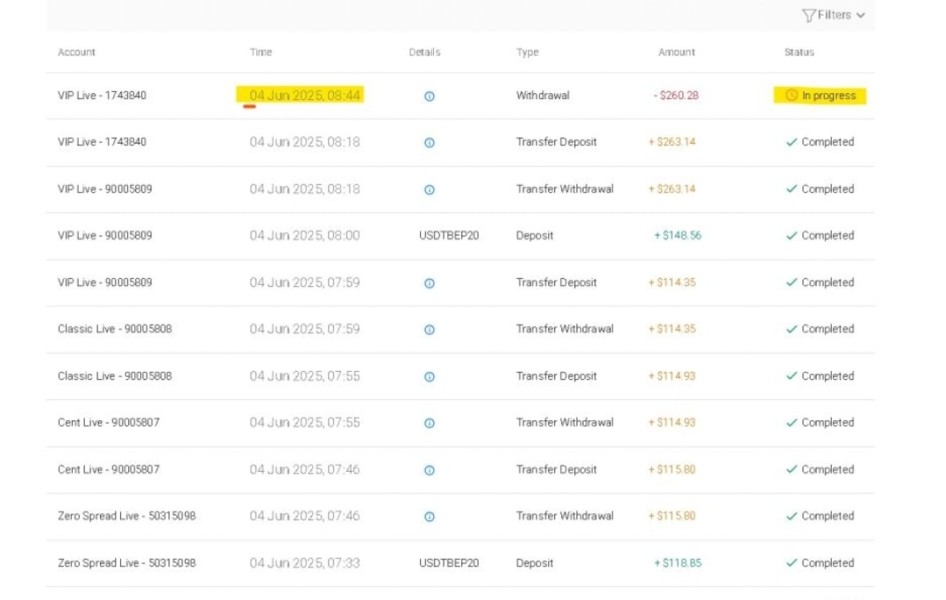

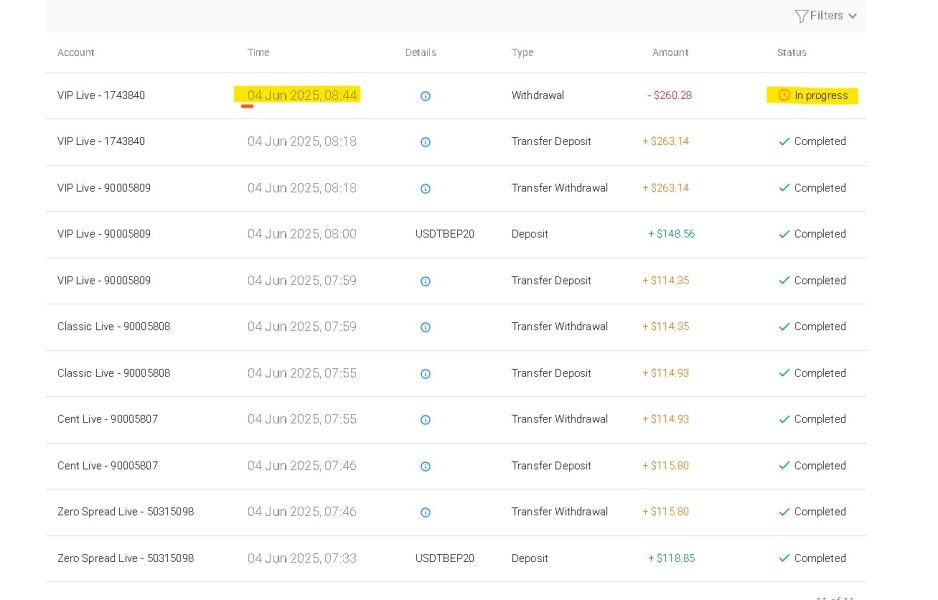

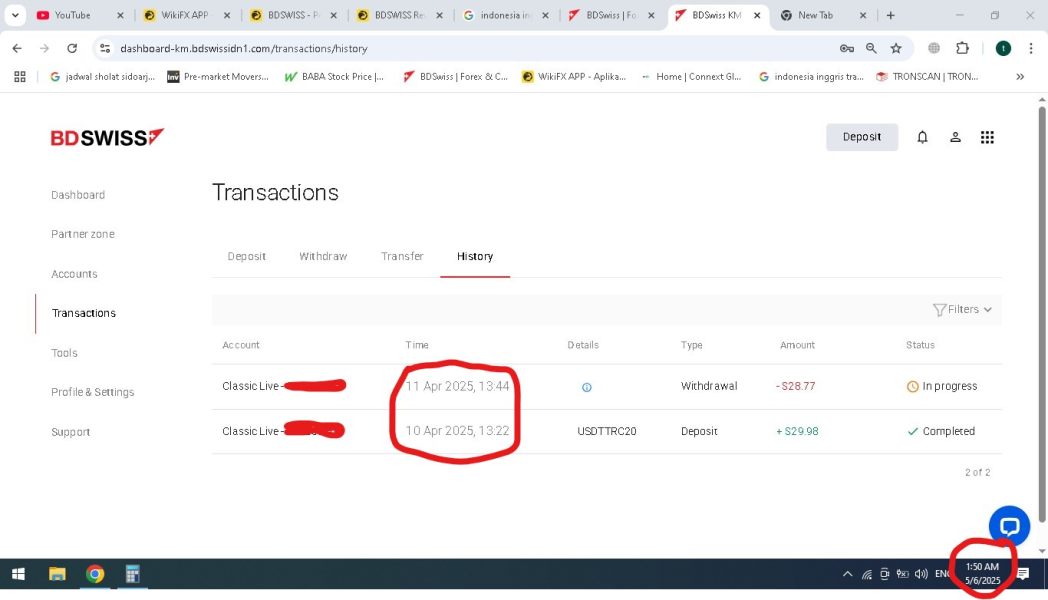

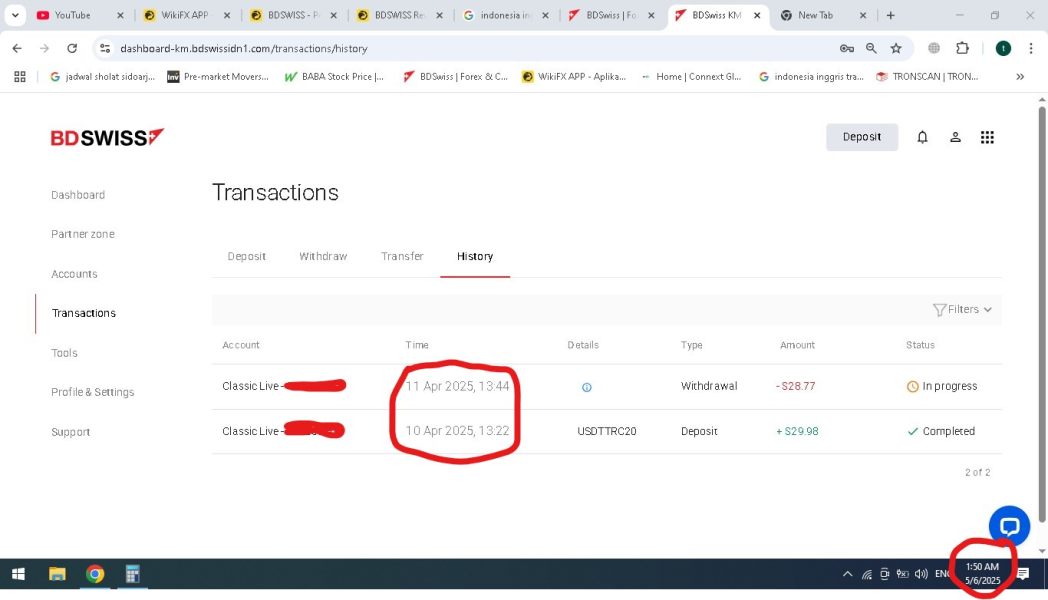

Regulatory Oversight: BDSwiss maintains rule compliance through CySEC and NFA supervision, ensuring client fund protection through separated account structures and following strict operational transparency standards. While specific payment method details were not extensively detailed in available sources, the broker maintains standard industry practices for fund transfers with a minimum deposit requirement of $100.

Minimum Deposit Requirements: The $100 minimum deposit threshold makes BDSwiss accessible to retail traders and beginners seeking to enter the forex market without large initial capital commitments. Specific bonus and promotional information was not detailed in the available source materials, suggesting traders should contact the broker directly for current promotional offerings.

Tradeable Assets: BDSwiss provides access to a complete range of trading instruments including 50+ currency pairs, stocks, stock indices, precious metals, commodities, and CFDs, accommodating diverse trading strategies and market preferences. The broker operates with competitive average spreads, though specific commission structures and detailed fee information require direct inquiry with the broker for current pricing models.

Leverage Options: BDSwiss offers high leverage options suitable for traders with higher risk tolerance, though specific leverage ratios vary by instrument type and regulatory jurisdiction. Multiple platform options including MT4, MT5, and proprietary solutions cater to traders with different technical requirements and experience levels.

Geographic Restrictions: Specific regional limitations were not detailed in available sources, requiring verification based on individual trader locations. Multilingual customer support ensures accessibility for the broker's international client base across 180 countries.

This complete bdswiss review continues with detailed analysis of each evaluation criterion based on available information and user feedback.

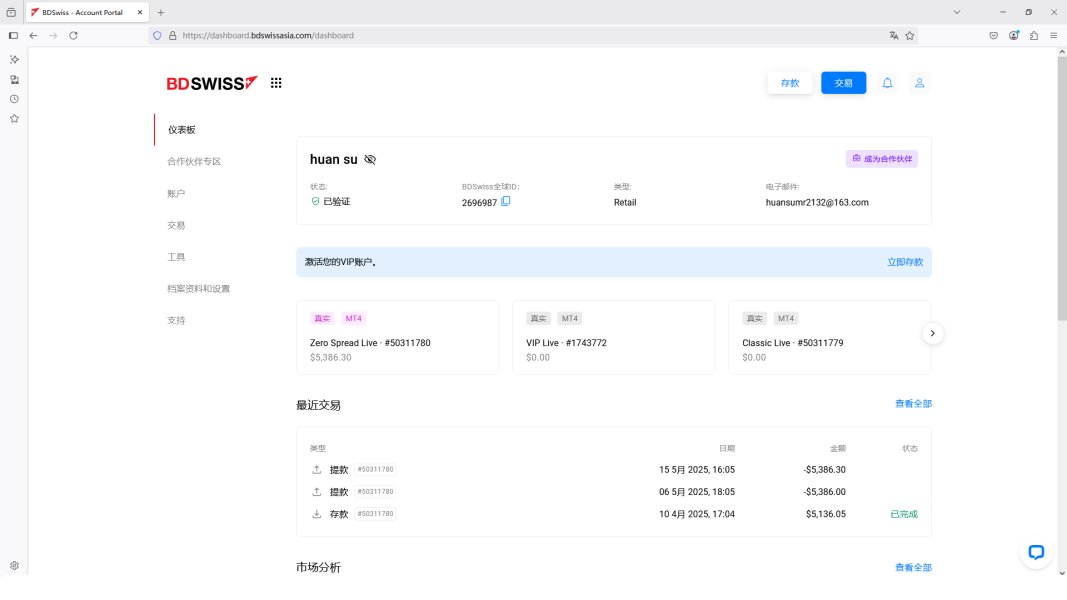

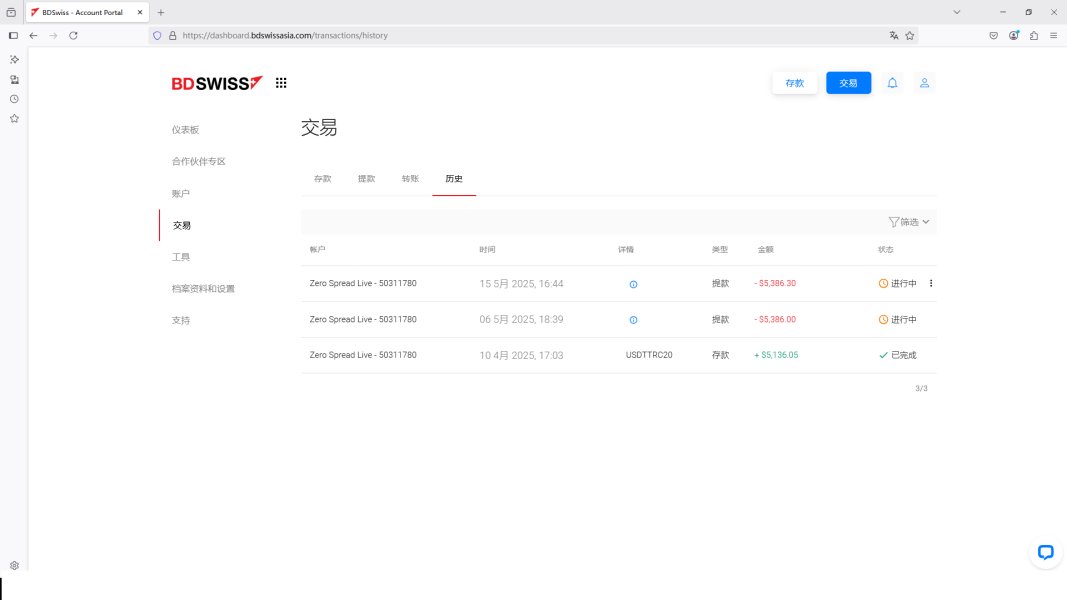

Account Conditions Analysis

BDSwiss shows competitive account conditions with its $100 minimum deposit requirement, making forex trading accessible to retail investors and newcomers to the market. This entry threshold strikes a balance between accessibility and serious trading intent, filtering out casual browsers while remaining achievable for committed traders.

The minimum deposit aligns with industry standards and positions BDSwiss favorably against brokers requiring much higher initial investments. While specific account type variations were not extensively detailed in available sources, the broker's accommodation of 3 million clients across 180 countries suggests flexible account structures designed to meet diverse regulatory requirements and trader preferences.

The account opening process appears streamlined, though specific verification timeframes and documentation requirements would need direct confirmation from the broker. The leverage offerings cater to traders seeking enhanced market exposure, though specific ratios vary by instrument type and regulatory jurisdiction.

This flexibility allows traders to adjust their risk exposure according to their experience level and market outlook. However, the absence of detailed information about specialized account features such as Islamic accounts or professional trader classifications in available sources suggests potential clients should inquire directly about specific account accommodations.

The overall account conditions reflect BDSwiss's positioning as an accessible yet serious trading platform, though the moderate scoring reflects the need for more transparent communication about account variations and specific features. This bdswiss review finds the account conditions suitable for most retail traders while acknowledging room for enhanced clarity in account type differentiation.

BDSwiss excels in platform diversity and educational resource provision, earning strong marks in this evaluation category. The broker's support for both MetaTrader 4 and MetaTrader 5 platforms ensures traders have access to industry-standard tools with complete charting capabilities, technical indicators, and automated trading functionalities.

These platforms are complemented by proprietary BDSwiss mobile applications and web-based trading solutions, providing flexibility across different devices and trading environments. The educational resource portfolio represents a significant strength, featuring webinars, tutorials, and complete learning materials designed to support trader development from beginner to advanced levels.

This educational commitment demonstrates BDSwiss's investment in long-term client success rather than purely transactional relationships. The quality and accessibility of these resources contribute significantly to the broker's value proposition, particularly for developing traders seeking to enhance their market knowledge and trading skills.

Technical analysis tools available through the MetaTrader platforms include extensive indicator libraries, custom indicator support, and advanced charting functionalities. The platforms support automated trading through Expert Advisors (EAs), enabling systematic trading approaches and strategy backtesting capabilities.

Mobile platform functionality ensures traders can monitor positions and execute trades while away from desktop environments. While specific details about proprietary research and market analysis resources were not extensively covered in available sources, the complete platform selection and educational focus position BDSwiss competitively in the tools and resources category.

The combination of established platforms and educational support creates a good environment for trader development and successful trading execution.

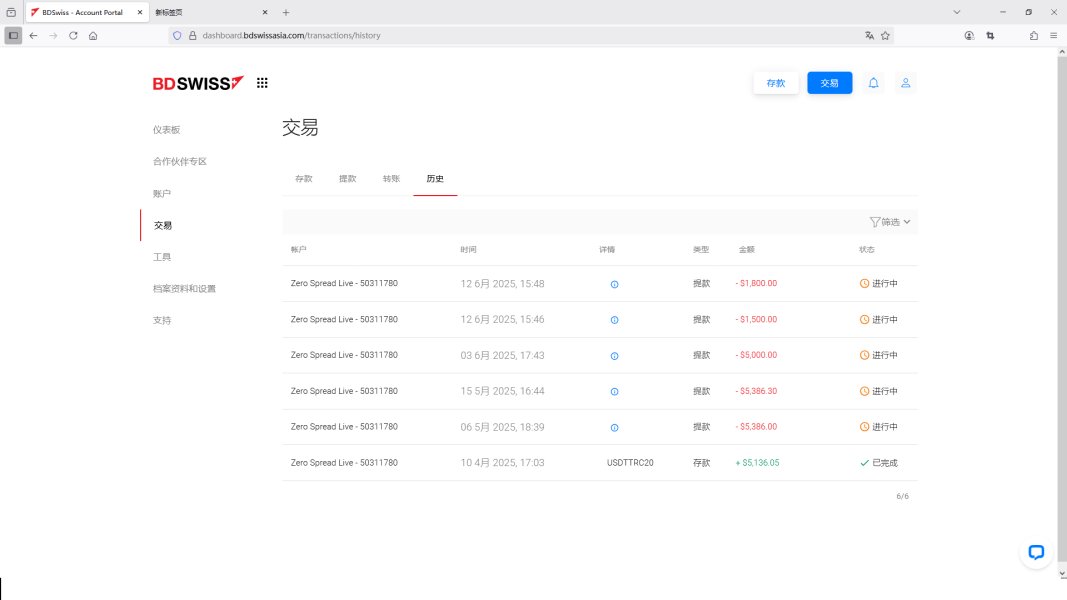

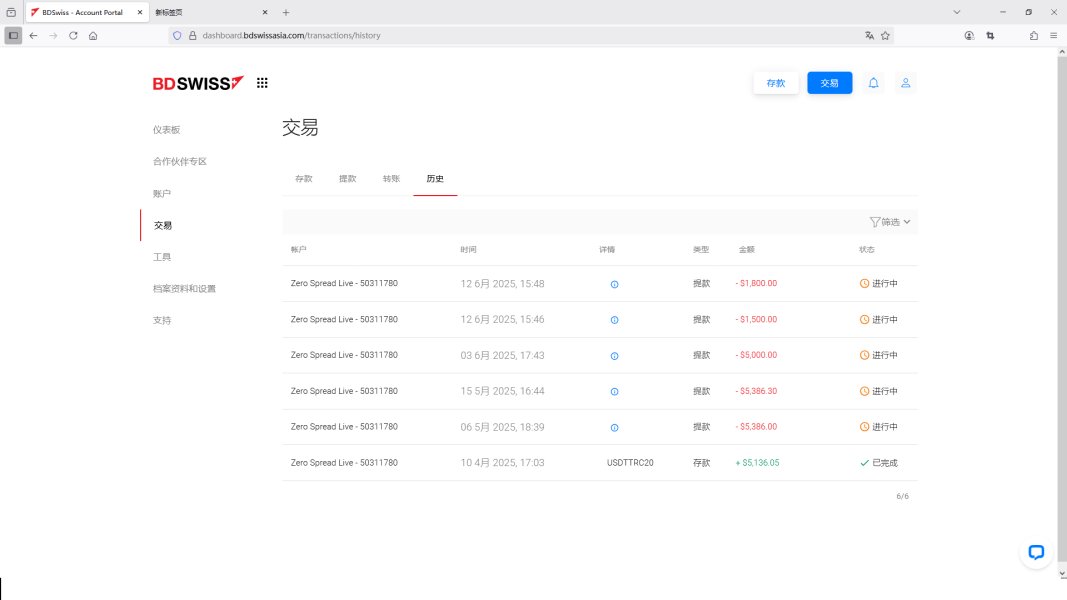

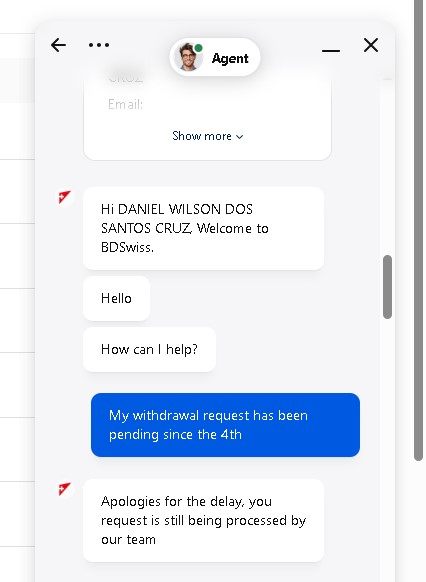

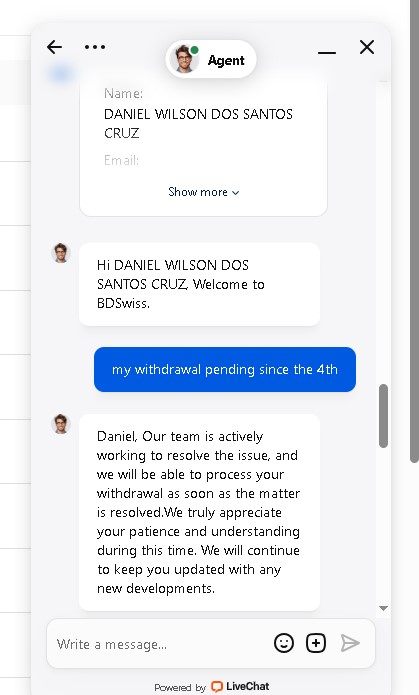

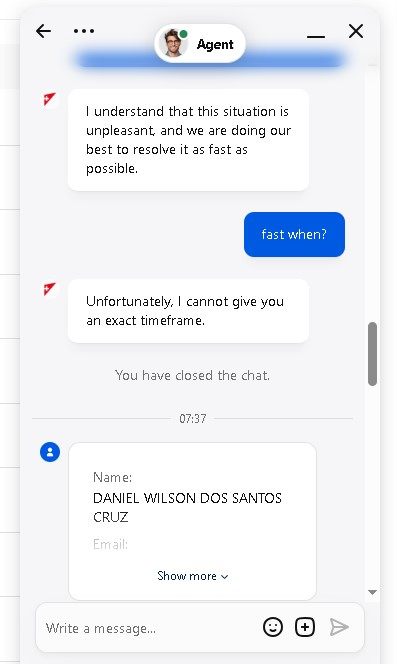

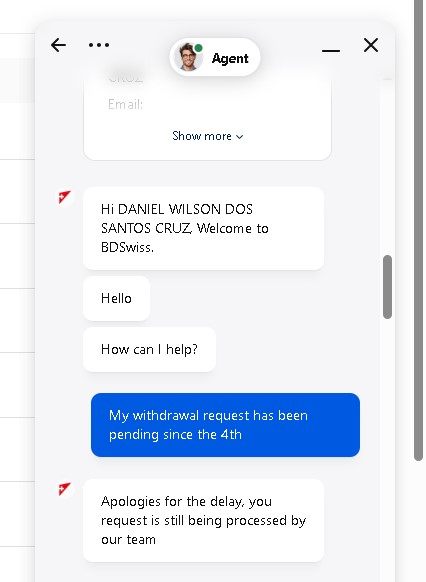

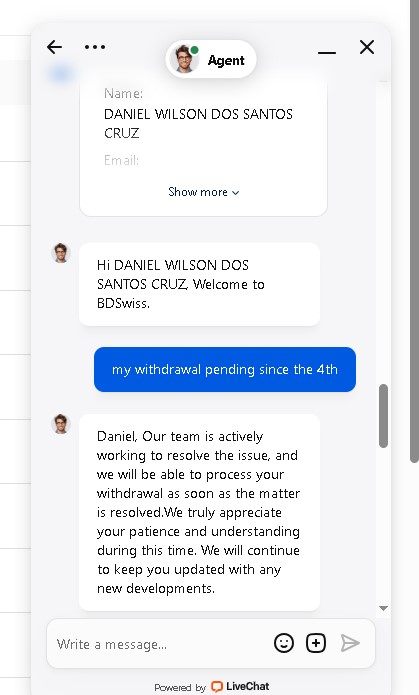

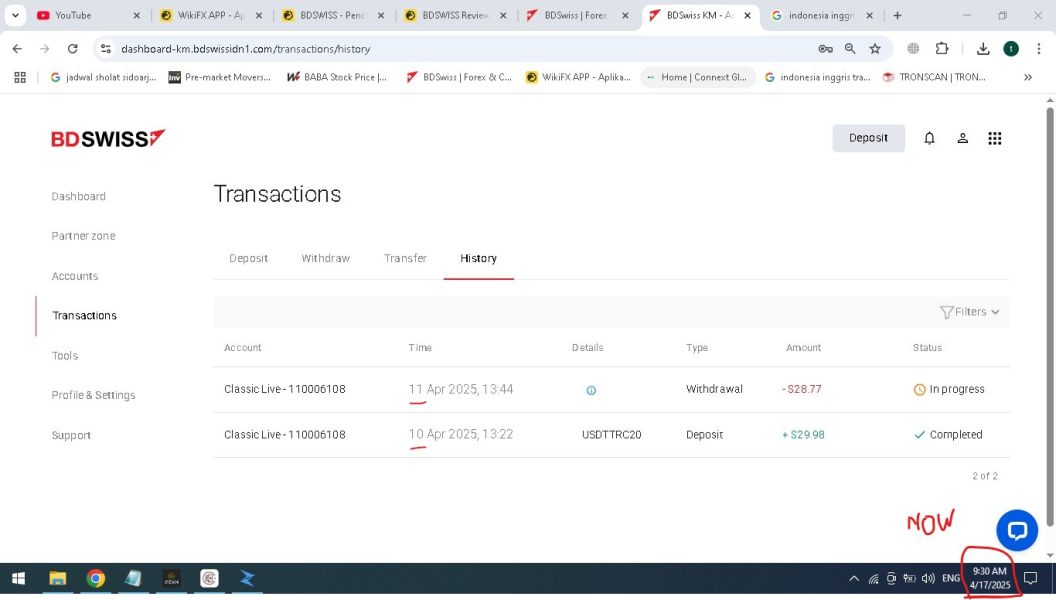

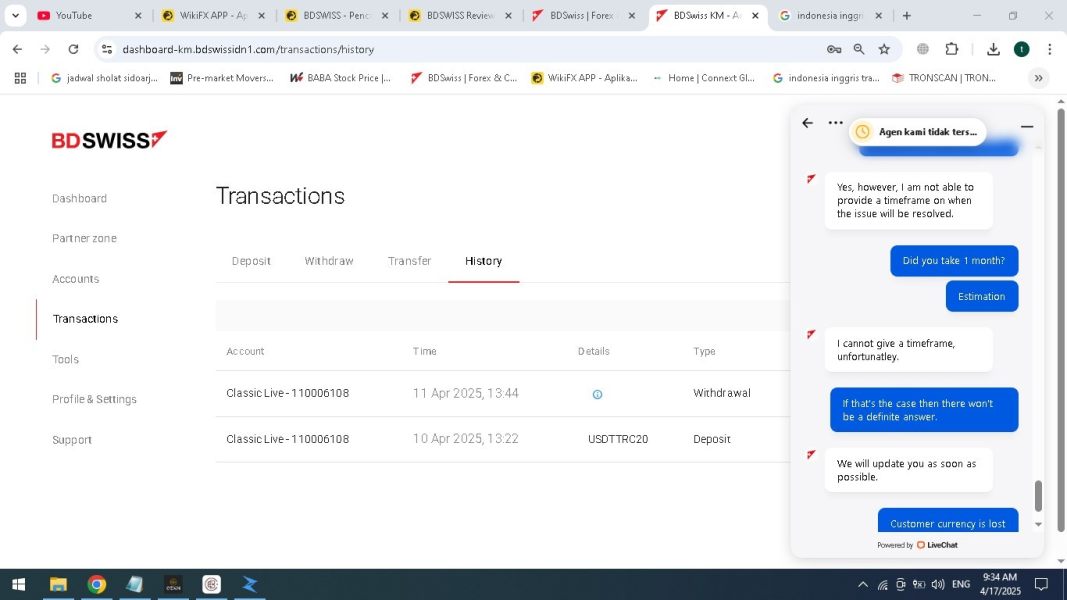

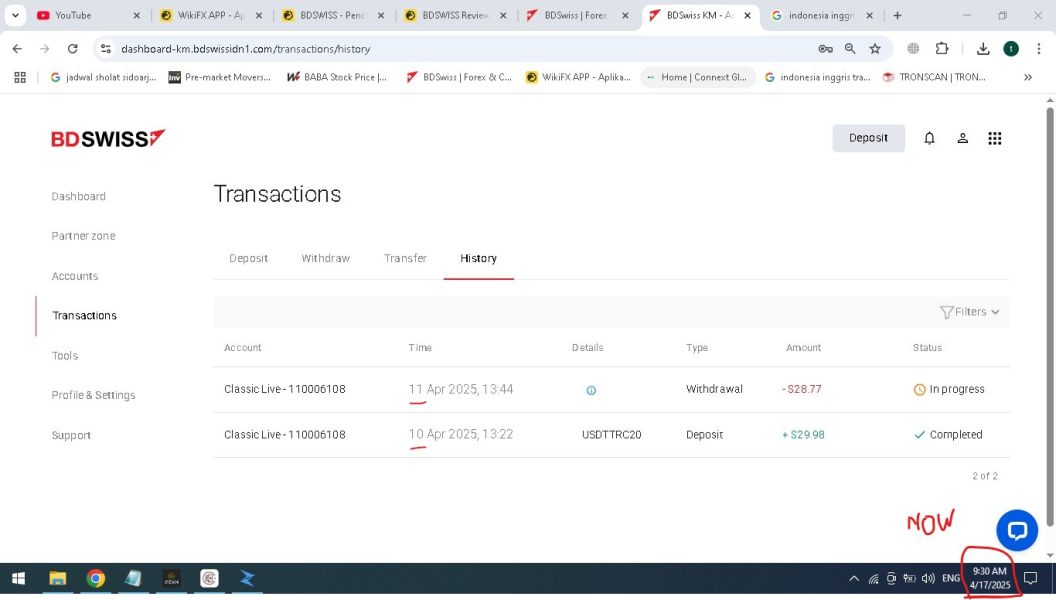

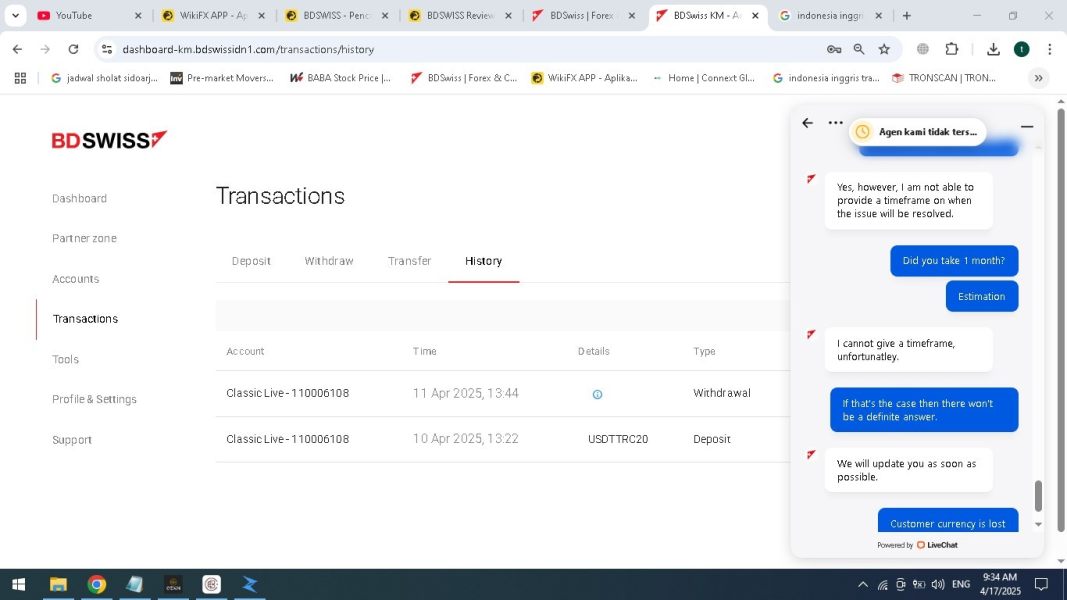

Customer Service and Support Analysis

BDSwiss provides customer support through multiple channels including telephone, email, and live chat, ensuring accessibility across different communication preferences. The 24/5 support schedule covers major trading session hours, providing assistance during peak market activity periods when traders are most likely to require immediate support.

This coverage demonstrates understanding of forex market dynamics and trader needs during active trading periods. Multilingual support capabilities reflect the broker's international client base spanning 180 countries, enabling effective communication across diverse linguistic backgrounds.

This global approach to customer service ensures that language barriers do not impede problem resolution or account management processes. The availability of support in multiple languages represents a significant operational investment that enhances user experience for international clients.

Response time specifics and service quality metrics were not detailed in available sources, limiting the ability to provide complete assessment of support efficiency and effectiveness. User feedback regarding support quality and problem resolution capabilities would provide valuable insights into actual service delivery versus promised service levels.

The absence of specific service level agreements or response time commitments in available information suggests areas for enhanced transparency. The overall customer service framework appears well-structured for international operations, though the moderate scoring reflects the need for more detailed information about service quality metrics and user satisfaction with support interactions.

Effective customer service remains crucial for forex brokers given the time-sensitive nature of trading activities and the importance of rapid problem resolution.

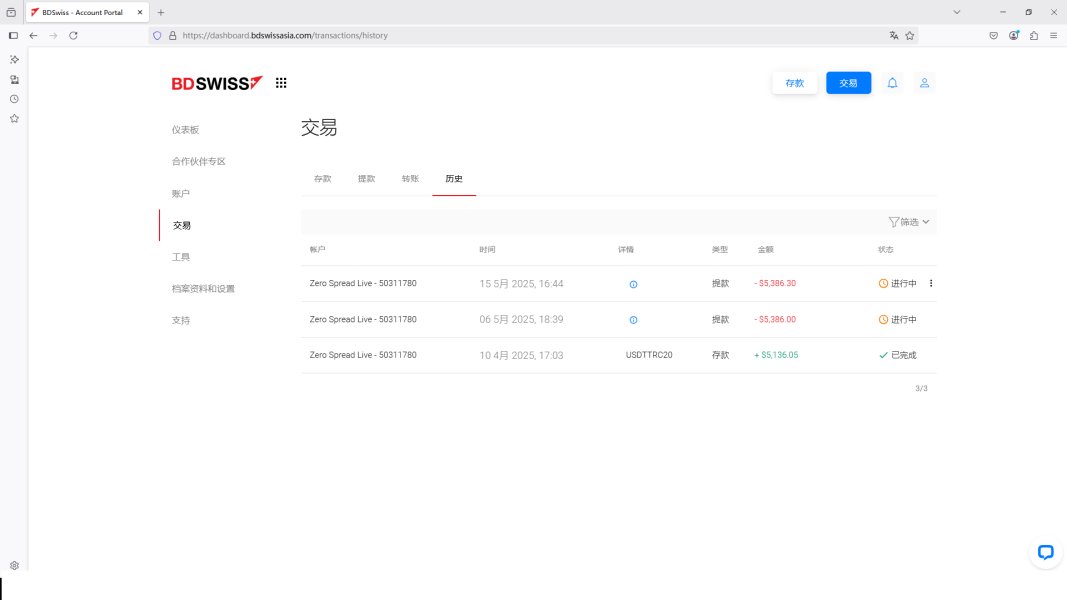

Trading Experience Analysis

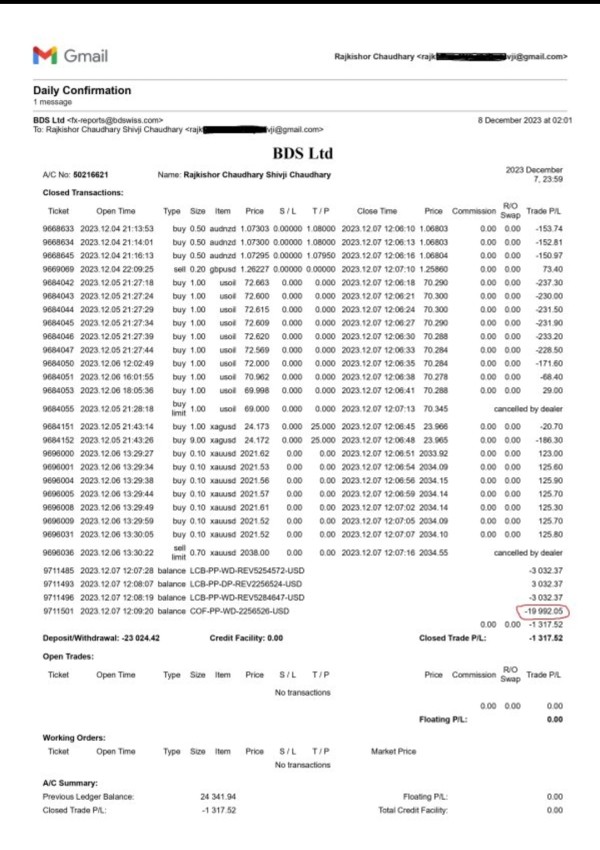

The trading experience with BDSwiss centers around platform stability and execution quality, though specific performance metrics were not extensively detailed in available sources. The broker's support for multiple platforms including MT4, MT5, and proprietary solutions provides traders with familiar interfaces and complete functionality.

Platform stability becomes crucial during volatile market conditions when rapid order execution can significantly impact trading outcomes. The BDSwiss mobile applications receive positive recognition for user-friendly design and functionality, enabling effective position monitoring and trade execution from mobile devices.

Mobile trading capability has become essential in modern forex trading, allowing traders to respond to market developments regardless of location. The quality of mobile platform implementation often reflects a broker's commitment to user experience and technological investment.

Order execution quality, including slippage rates and requote frequency, represents critical factors in trading experience assessment, though specific performance data was not available in reviewed sources. The broker's substantial trading volume of $84 billion suggests active order flow and potentially favorable execution conditions, though individual trader experiences may vary based on account types and market conditions.

The overall trading environment appears good for effective trading activities, supported by established platforms and mobile accessibility. However, the moderate scoring reflects the absence of detailed performance metrics and specific user feedback regarding execution quality.

This bdswiss review acknowledges the importance of actual trading experience data for complete platform assessment.

Trust and Security Analysis

BDSwiss demonstrates strong regulatory credentials through oversight from CySEC (license number 199/13) and NFA, providing clients with enhanced protection and operational transparency. These regulatory relationships ensure following strict standards regarding client fund separation, fair trading practices, and business conduct.

The dual regulatory oversight from respected authorities strengthens the broker's credibility and provides multiple layers of client protection. The broker's 13-year operational history since 2012 establishes a track record of market presence and business continuity.

The accumulation of 3 million registered clients and $84 billion in trading volume indicates sustained business growth and client retention, suggesting operational stability and service reliability. These metrics provide tangible evidence of market acceptance and business viability.

However, specific details about client fund protection mechanisms, insurance coverage, and separated account structures were not extensively detailed in available sources. The absence of information about negative balance protection, compensation schemes, or specific security measures limits complete trust assessment.

Transparency regarding these protective measures would enhance client confidence and regulatory compliance demonstration. The trust score of 74/100 reflects solid but not exceptional performance in trustworthiness metrics, indicating room for improvement in transparency and client protection communication.

While regulatory oversight provides fundamental protection, enhanced disclosure about security measures and client fund protection would strengthen the overall trust profile.

User Experience Analysis

User experience assessment reveals moderate satisfaction levels with a 74/100 trust score, indicating acceptable but improvable service delivery. This scoring suggests that while BDSwiss meets basic operational requirements and provides functional trading services, there remain opportunities for enhancement in user satisfaction and service quality.

The moderate rating reflects the competitive nature of the forex brokerage industry where exceptional user experience increasingly differentiates successful brokers. The broker's accommodation of diverse trader types, from beginners to experienced professionals, demonstrates flexible service delivery designed to meet varying needs and experience levels.

This inclusive approach supports business growth and client development, though specific user experience metrics and satisfaction surveys were not detailed in available sources. Understanding user pain points and satisfaction drivers would provide valuable insights for service improvement initiatives.

Interface design and usability assessments were not comprehensively covered in available information, limiting detailed evaluation of user interaction quality across different platforms and services. The registration and verification process efficiency, fund transfer convenience, and overall platform navigation experience represent critical user experience components requiring direct user feedback for accurate assessment.

The moderate user experience scoring reflects the need for enhanced user feedback collection and service improvement initiatives. While BDSwiss provides functional trading services and maintains regulatory compliance, the competitive forex market demands exceptional user experience for sustained success and client retention.

Conclusion

This complete bdswiss review reveals a regulated forex broker with solid fundamentals and room for growth in user experience delivery. BDSwiss demonstrates strong regulatory compliance through CySEC and NFA oversight, complete platform selection including MT4 and MT5, and extensive educational resources supporting trader development.

The broker's 13-year market presence, 3 million client base, and $84 billion trading volume indicate established market position and operational stability. The broker particularly suits beginning traders seeking educational support and platform variety, as well as experienced traders requiring reliable execution and regulatory protection.

The $100 minimum deposit threshold maintains accessibility while the high leverage options accommodate various risk preferences and trading strategies. Primary strengths include regulatory compliance, platform diversity, educational resources, and international accessibility across 180 countries.

However, areas for improvement encompass user experience enhancement, service quality transparency, and detailed fee structure communication. While BDSwiss provides functional trading services meeting industry standards, the competitive forex market increasingly demands exceptional user experience and service innovation for sustained success.